Inventory is a check of the presence and condition of an organization's property . The property includes:

- fixed assets;

- financial investments;

- inventory;

- intangible assets;

- cash;

- other property

Financial obligations include:

- accounts payable, accounts receivable;

- credits, loans;

- reserves

The main regulatory documents governing the procedure and rules for conducting inventories are:

- Order of the Ministry of Finance of the Russian Federation No. 49 dated June 13, 1995 (as amended on November 8, 2010) “On approval of the Methodological Guidelines for the Inventory of Property and Financial Liabilities”;

- Order of the Ministry of Finance of Russia No. 34n dated July 29, 1998 (as amended on April 11, 2021) “On approval of the Regulations on accounting and financial reporting in the Russian Federation”;

- PBU 4/99;

- Federal Law “On Accounting” No. 402-FZ dated December 6, 2011

Justification for mandatory inventory

An indication of the obligation to carry out an inventory before drawing up annual financial statements is contained in two main regulatory documents for accounting:

- Law “On Accounting” dated December 6, 2011 No. 402-FZ (clause 3 of Article 11);

- PBU for accounting and accounting, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n (clause 27).

Carrying out an inventory is mandatory for all organizations, regardless of their legal form and the applied tax regime.

The purpose of this event is to ensure the reliability of accounting data and financial statements (clause 26 of the PBU on accounting and accounting). The procedure for its implementation is determined by the Methodological Guidelines for the Inventory of Property and Financial Liabilities (approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49).

Recognition of loss.

According to paragraph 15 of the Federal Accounting Standards “Impairment of Assets”, an impairment loss on an asset is recognized in accounting when its residual value at the annual reporting date exceeds its fair value less the costs of disposal of such an asset. Once an impairment loss on an asset is recognized at the annual reporting date, it is recognized as a lump sum expense for the reporting period.

That is, identifying an impairment loss and recognizing it will now be one of the results of the inventory!

However, the application of these provisions of the standard gives rise to a difficult situation. On the one hand, an asset impairment loss is recognized as a lump sum as part of the expenses of the reporting period. That is, at the end of the year, “in one fell swoop,” expenses for the reporting period will be increased by the amount of impairment losses. In other words, the institution’s expenses at the end of the year will increase “out of thin air.” On the other hand, the question arises of covering such losses. How will these costs be covered? What will be the source of funding?

For example, last year, by Decree of the Government of the Russian Federation dated September 13, 2017 No. 1101, changes were made to the procedure for forming state assignments. Now the state task must take into account the annual amount of planned (calculated) depreciation for particularly valuable movable property (VTsDI) used in the process of providing public services. That is, depreciation of fixed assets is financed, but there is no impairment loss yet. Although the loss itself, according to the Federal Accounting Standard “Impairment of Assets,” the Ministry of Finance already proposes to reflect in accounting.

The resolution of this situation should probably be reflected in the regulations of the Government of the Russian Federation and the Ministry of Finance. It can be assumed that changes will be made to the procedure for forming state assignments by the Government of the Russian Federation, taking into account the provisions of federal standards. It is possible that the impairment loss will somehow be taken into account in the subsidy for the government task.

What to Inventory

The following are subject to inventory (clause 1, article 11 of law No. 402-FZ, clauses 1.2, 1.3 of the Guidelines):

- All property (assets) of the organization, regardless of its location. These are fixed assets, intangible assets, financial investments, inventories, finished products, goods, other inventories, cash and other financial assets, including accounts receivable. An inventory is also taken of property that does not belong to the organization, but is located in it (in custody, on lease, in processing), as well as property that is not taken into account for any reason.

- All financial liabilities (accounts payable, bank loans, loans and reserves).

About the need to carry out an inventory of property accounted for off-balance sheet, read the material “Is it possible to carry out an inventory for off-balance sheet accounts? ”

EXPLANATIONS from ConsultantPlus: During the inventory of fixed assets, it is necessary to check not only the presence of the objects themselves, but also their technical and (or) operational characteristics, as well as identify unused objects and the reasons why they are not used. Inventory of fixed assets has other features. They are related to the frequency of its conduct before the preparation of annual financial statements. Find out more about the nuances of conducting an inventory in the K+ legal reference system by receiving trial demo access. It's free.

Accounting for fixed assets for public sector employees: what has changed since 2021

One of the most important differences lies in the very interpretation of the term “fixed assets”. From January 1, 2021, this concept includes not just material objects, but material values that are assets. This means that in addition to the standard requirements for an object, a new one appears - to have useful potential. This means that the object can be used to perform state (municipal) functions or provide services, pay off obligations, or exchange for other assets. An object can be accepted for accounting as a fixed asset only if its initial cost is reliably estimated.

There are few significant differences in the definition of the accounting unit and the procedure for accepting fixed assets for accounting. It is worth mentioning that the FSB introduces the concept of “OS complex”, that is, it allows objects with an equal useful life and insignificant cost to be considered as an inventory unit.

Inventory period

An inventory should be carried out before preparing annual reports. The specific timing of its implementation can be fixed in the accounting policy (clause 4 of PBU 1/2008 “Accounting policy of the organization”, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n).

In this case it is possible:

- not to take inventory of property for which the inventory was carried out in October - December of the reporting year;

- inventory fixed assets once every 3 years, and library collections - once every 5 years;

- organizations of the Far North - to conduct an inventory of goods, raw materials and supplies during the period of their lowest balances.

Such rules are established in clause 1.5 of the Guidelines.

The Ministry of Finance postponed the application of federal accounting standards

The Russian Ministry of Finance issued order No. 85n dated June 7, 2021, which approved a new program for the development of federal accounting standards for 2021-2021. The previous program for 2021-2021 has become invalid. In fact, officials have revised the timing of the entry into force of key federal accounting standards.

Let us recall that accounting standardization presupposes the existence of legislative acts that make compliance with standards mandatory for accountants of various organizations. First of all, federal accounting standards will become mandatory for organizations and institutions of the public sector. Commercial organizations will also have to be guided by them in order not to deviate from uniform accounting and reporting requirements.

Inventory procedure

The inventory procedure requires compliance with a certain sequence of actions.

Step 1. Create an inventory commission

To carry out an inventory, a permanent inventory commission is created in the organization, and in case of a large volume of work, working inventory commissions are created to simultaneously carry out an inventory of property and financial obligations (clause 2.2 of the Methodological Instructions).

The commission should include representatives of the administration, accounting employees, other specialists (engineers, economists, technicians), and may also include representatives of the internal audit service or independent audit organizations.

Its personnel are approved by the head of the organization (clause 2.3 of the Guidelines).

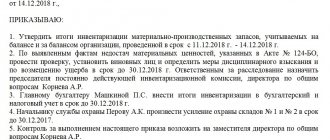

Step 2. Issue an order to conduct an inventory

The inventory order specifies:

- specific timing of inventory;

- the reason for the conduct (in this case, preparation of annual financial statements);

- composition of the inventory commission.

This order is registered in the book of control over the implementation of orders for inventory (clause 2.3 of the Methodological Instructions).

For an example of an inventory order dedicated to a separate component of the objects being inventoried, see the article “Order for an inventory of receivables - sample” .

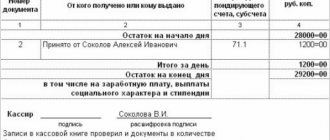

Step 3. Determine the balance of property at the beginning of the inventory according to accounting data

Before the start of the inspection, the inventory commission must receive the latest incoming and outgoing documents or reports on the movement of material assets and funds at the time of inventory (clause 2.4 of the Methodological Instructions). They are endorsed by the chairman of the commission with the indication: “Before inventory on “__________” (date).” Based on these documents, accounting determines the balance of property at the beginning of the inventory according to accounting data.

Receipts are taken from financially responsible persons stating that by the beginning of the inventory, all expenditure and receipt documents for the property were handed over to the accounting department or transferred to the commission, all valuables received under their responsibility were capitalized, and those disposed of were written off as expenses. Similar receipts must be taken from persons who have accountable amounts for the acquisition or powers of attorney to receive property.

Step 4. The actual inventory

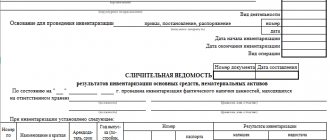

During the inventory, the commission identifies the actual presence of property, as well as the reality of the recorded financial obligations, information about which is recorded in inventory lists or inventory reports, drawn up in at least two copies (clauses 2.5–2.7 of the Methodological Instructions).

The inspection must be carried out in the presence of the financially responsible person. This requirement is provided for in clause 2.8 of the Guidelines.

Read more about inventory procedures in the following materials:

- “Procedure for conducting an inventory of fixed assets”;

- "Inventory of inventories";

- “Inventory of receivables and payables”;

- “Inventory of settlements with accountable persons (nuances)”.

Step 5. Registration of inventory results

The results of the inventory are summarized in the statement of results identified by the inventory (clause 5.6 of the Guidelines). They must be taken into account in the annual financial statements (clause 5.5 of the Guidelines).

In this case, the identified surplus property is accepted for accounting with the recognition of other income, and the missing property is written off as a shortage.

Read about the generated corrective entries in the article “Reflection of inventory results in accounting .

conclusions

Carrying out control of the movement of material assets and funds in the form of a periodic inventory, despite some complexity of the process, is an effective tool for an objective assessment of the company’s assets and making competent decisions by the company’s management.

In addition, despite the fact that Russian legislation does not provide for direct liability for insufficient correct maintenance of inventory records, nevertheless, in a number of cases that lead to the discovery of facts of gross violation of financial reporting (for example, during a tax audit), measures may be taken against violators punishments.

This punishment can be applied within the framework of the Administrative Code of the Russian Federation (Article 15.11) with appropriate sanctions in the form of fines for guilty officials.

Results

An inventory of property and liabilities before drawing up annual reporting is a mandatory procedure, since it allows you to check the correctness of accounting data and make the necessary adjustments to accounting if inconsistencies are identified.

It is carried out within a certain time frame and in compliance with certain rules, including taking into account the features inherent in the inventory processes of each of the components of the inventory mass. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to reflect in accounting

Surpluses of fixed assets are reflected as part of other income; entries when a shortage is identified will depend on the presence or absence of the perpetrators.

Postings if there is excess:

Postings when a shortage is detected:

- Dt 01/disposal Kt 01 – the initial cost of fixed assets is written off.

- Dt 02 Kt 01/disposal – depreciation is written off.

- Dt 94 Kt 01/disposal - the residual value of fixed assets is attributed to shortages.

- Dt 73/2 Kt 94 - the amount of the object at the residual value is attributed to the guilty parties.

- Dt 50, 51, 70 Kt 73/2 - the shortage is withheld from the salary, repaid to the cashier or to the current account.

- Dt 91/2 Kt 94 - if the culprit is not identified, the shortage is included in other expenses. The posting is made on the date of receipt of the relevant documents from government agencies (Article 265-2(5) of the Tax Code of the Russian Federation).

In tax accounting, the cost of surplus fixed assets is included in non-operating income, while shortages of fixed assets are considered non-operating expenses. The shortfall contributed by the culprit is reflected as non-operating income.

When writing off the shortage, it is necessary to restore the VAT on the fixed asset, since the object is not in production. Input VAT is restored in accordance with the amount of the residual value.

Source

2021 Federal Accounting Standards for Public Sector Organizations

The standard introduces a new concept of “fair value”. It corresponds to the price at which ownership of the asset is transferred between independent parties to the transaction. Accounting items that need to be measured at fair value, and the cases in which it is used, will be established in the standards dedicated to these items.

According to the program, ten standards must be in effect from January 1, 2021. However, the entry into force of three of them was planned to be postponed from 2021 to 2021: the Russian Ministry of Finance prepared a draft order to introduce appropriate changes to the program.

A fixed asset is not an asset: how to account for it according to FAS

To approve the write-off to the completed act on the write-off of non-financial assets f. 0504104, signed by the commission on receipt and disposal of assets, attach the necessary package of documents and transfer them to the founder.

Please note: previously the statement of discrepancies based on inventory results f. 0504092 was filled out only if surpluses and shortages were detected. From 2021, it must be filled out if, during the inventory, the commission identified fixed assets that do not meet the conditions of the asset.

Accounting entries for fixed assets in budgetary organizations

Fixed assets are recorded in accounting registers at their original cost. It includes the costs of purchasing and constructing facilities, consulting services, delivery and other costs required to bring the facility into a state of readiness for operation, taking into account the VAT charged. Accounting in budget accounting accounts is carried out in rubles and kopecks.

Example. The budgetary institution paid for and purchased equipment worth 236,000 rubles from budget funding. (of which 36,000 rubles are VAT) Delivery costs incurred by the transport organization amounted to 11,800 rubles. (VAT – 1800 rub.). The equipment has been put into operation.

Inventory form 2021 in a budgetary institution changes

Changes in accounting from January 1, 2021 affected the rules for recording transactions aimed at attracting resources by non-credit financial institutions. The adjustments were reinforced by updated industry standard text. The essence of the changes is that now non-credit financial organizations are allowed not to include non-essential other costs in the base for calculating the effective interest rate. These expenses can be recognized at a time as a component of commission expenses (Instruction of the Bank of Russia dated August 14, 2021 No. 4495-U).

We recommend reading: How to fill out Form 14001 if there is an error in the address

Every year, before the annual reporting, carry out a mandatory inventory of all accounting items, including those on the off-balance sheet. Do this between October 1st and December 31st. An audit is needed to confirm the accuracy of the annual reporting data. Inventory is also required when an institution:

Inventory in a budgetary institution in 2021 with new standards

In 2021, almost all existing budget accounting instructions were adjusted. Officials have once again adjusted the procedure for generating budget classification codes to reflect income and expense transactions. Innovations also affected the current Unified Chart of Accounts. Since January 2021, new accounting accounts have been added to the UPS, the names of some old ones have been changed, and some have been completely excluded.

Before carrying out an inventory in a budgetary institution, it is necessary to decide on the objects that will be subject to inspection. In this case, the audit can be complete (absolutely all assets of the organization are rewritten and counted) or selective (a specific area of accounting is analyzed).