In what cases is part-time work established?

Art. The Labor Code of the Russian Federation allows for the possibility of reducing hours according to the work schedule. The employer is obliged to reach an agreement with the employee to reduce the working day if the request is made by:

- pregnant employee;

- one of the parents raising a child under 14 years of age or a disabled child under 18 years of age (also established for a guardian or trustee);

- an employee who provided a medical report on the need to care for a sick family member.

In other cases, the employee must obtain the consent of the organization’s management. The duration of the part-time work regime is indicated in the additional agreement to the employment contract.

At the initiative of the employer, part-time work can be introduced for a period of up to 6 months (Article of the Labor Code of the Russian Federation), under the following circumstances:

- there has been a change in organizational or technological conditions;

- there is a possibility of mass layoffs of employees (the consent of the trade union is required if there is such a body).

Cancellation of the regime earlier than the date announced by the employer is agreed upon with the trade union.

Three happy days: what threatens the reduction of the working week

The idea of reducing the working week from five to four days continues to excite the minds of Russian officials. The Ministry of Labor is already ready to consider the proposal. Experts believe that it is preferable to shorten the working week by increasing the working day to 10 hours. Then Russians will not lose in wages. Other experts insist that before moving on to a four-day week, it is necessary to increase labor productivity. Otherwise, this could be a blow to the country's economy.

The Ministry of Labor will consider proposals to switch to a four-day working week, if they are voiced, said the head of the department, Anton Kotyakov. The minister did not comment to journalists on the proposal to introduce a four-day working week in Russia. He noted that readiness to consider the proposal does not mean that the ministry agrees with it.

Any proposals from social partners are always discussed in the ministry. If a social partner comes up with some kind of initiative, we cannot ignore it ,” explained the official, quoted by RIA Novosti.

One can only guess who Kotyakov had in mind when talking about a “social partner.” The transition to a four-day working week was previously allowed by Deputy Chairman of the Russian Security Council Dmitry Medvedev. In April, he proposed conducting an experiment with the transition to such a work schedule. According to him, the process can be started small - shortened by an hour, two, three, so that the reform is not abrupt, but step-by-step. This method will help avoid spikes in unemployment, he believes.

For the first time, Medvedev announced the possibility of switching to a “four-day week” due to technological progress in the summer of 2021 in Geneva. Then he instructed the Ministry of Labor to study this issue.

Sergey Lantyukhov/NEWS.ru

The idea of a four-day work week is not new. In the spring of 2018, New Zealand decided to test how shortening the working week would affect labor productivity. The investment company Perpetual Guardian transferred 240 employees to a four-day work week while maintaining the same wages. In total, the number of working hours decreased from 37.5 to 30. And it turned out that the company’s productivity and production volumes did not decrease. Many countries have begun to study the New Zealand experience. For example, Microsoft tried the idea of a four-day workweek before the pandemic with promising results. The company said labor productivity increased by 40%.

In 2019, 15% of more than 2,700 U.S. companies and organizations offered employees a four-day workweek, up from 12% in 2021, according to a report from the Society for Human Resource Management. However, there was no decrease in income.

Labor productivity does not directly depend on the number of working days; this factor has only an indirect effect, explains Inna Baranova, dean of the Faculty of Management at Synergy University. In a number of countries, for example in the Netherlands, Germany or Austria, the number of working days, including holidays, is less than in Russia, but labor productivity is higher. This indicator depends on targets, the number of staffing positions and the effectiveness of performing certain tasks, Baranova points out.

According to the expert, in order for Russians not to lose wages, the number of workdays can be reduced by increasing the length of the working day.

«

According to the Labor Code, the working week in Russia should not exceed 40 hours. However, the law does not stipulate how many days a week people should work. In fact, most Russians work more than eight hours a day. Many people are late at work for two to three hours because they have a number of tasks to complete. If we switch to a four-day working week and increase the workday, then citizens will still work out their weekly norm of 40 hours. Their income will not decrease from this. In this case, to switch to a four-day work week, you won’t even have to change the corresponding article in the Labor Code.

Inna Baranova

Dean of the Faculty of Management at Synergy University

To maintain labor productivity during the transition to a shorter workweek, it is important to prescribe the quality of working hours and key performance indicators for employees. If employees meet KPIs or exceed these indicators, their income will either not change or even grow, the expert believes. An option is to introduce shift work and a staggered schedule for staff. According to the expert, all this will allow a painless transition to a four-day working week, while maintaining labor efficiency.

According to Georgiy Ostapkovich, director of the Center for Market Research at the ISSEK National Research University Higher School of Economics, a four-day working week can be afforded by countries with initially high labor productivity, which Russia, alas, is not one of. Moreover, in this case we may not be talking about a four-day week as such, but about a reduced working time fund. For example, in France it is 35 hours a week, in Belgium - 32 hours. In Germany, the working time fund is 30% less than in Russia, and labor productivity is 2.5 times higher, the economist points out.

It is possible to make a decision and reduce working hours, but this will hit the country’s economy and lead to a reduction in GDP, Ostapkovich warns.

It should be remembered that 30–40% of the domestic economy is occupied by continuous cycle industries. This is, for example, the entire mining industry - oil, gas, coal - manufacturing industry, metallurgy, food industry, almost all agriculture, transport. For them there is neither May 1 nor January 1. And all these are large industries that occupy a large volume in the structure of GDP.

Georgy Ostapkovich

Director of the Center for Market Research at the Higher School of Economics

Georgy Ostapkovichhse.ru

Why is work efficiency low in Russia? The point is not at all the laziness of Russian workers, but a weak technological base. High depreciation of fixed assets does not allow increasing labor productivity, the economist explains. Therefore, before seriously considering the problem of switching to a four-day working week, Russia must make a “technological breakthrough.”

The degree of depreciation of fixed assets by economic sectors in 2021 was 49.7%, and the average age of machinery and equipment available at the end of the year by economic sectors was 11.5 years. All these indicators have a steady upward trend, that is, a deterioration of the situation, agrees the associate professor of the basic department of the Chamber of Commerce and Industry of the Russian Federation “Development of Human Capital” of the Russian Economic University. G. V. Plekhanova Farida Mirzabalayeva.

On the one hand, we are raising the retirement age, investing in retraining for pre-retirees, trying to regulate the migration flow and somehow protect the national market. On the other hand, we dream of reducing working hours, maintaining the level of wages, self-development, and increasing job satisfaction. The wishes are kind and attractive, but where to get the money?

Farida Mirzabalayeva

Associate Professor of the basic department of the Chamber of Commerce and Industry of the Russian Federation "Development of Human Capital" of the Russian Economic University. G. V. Plekhanova

According to the expert, the level of labor productivity is demonstrated in fragments and is not even considered in dynamics over a long period. It is necessary to technologically update the economy, create highly productive jobs, and reduce dependence on imports, Mirzabalayeva lists.

...And we are talking about the transition to a four-day working week in the context of the country’s aging and declining population ,” the expert is indignant.

Economists also point out that from 70% to 90% of Russians overwork, and overtime is not always paid for by employers. Why would the latter suddenly pay for four working days as if they were five? The problem must be studied from a professional and qualification perspective. If it is relatively easy to calculate the overtime of construction workers, taxi drivers, and sales workers, then with specialists and engineering workers, scientists, and teachers, the situation is more complicated, argues Mirzabalayeva. Russians still have the opportunity to work four days by agreement with employers, if the specifics of the work and the desires of the workers themselves coincide. Only in this case they receive a salary for the time worked and the work performed, the expert says.

unsplash.com

According to her, the income of those working on a four-day shift will definitely decrease. People will be forced to look for additional income on the side. And the bet that a more “rested” employee will do the job more “productively” is also very controversial. Anna Korenevskaya, Associate Professor at the Faculty of Economics of RUDN University, recalls how during the pandemic, not everyone was able to independently organize an effective work regime at home (on the contrary, Russians declared overtime), highlight the boundaries of working and free time and spend this free time with benefits for health, self-development and etc.

If the bet on productivity does not win, we end up reducing wages and optimizing the number of jobs. A logical question is: maybe it’s not a matter of days and it’s worth reducing the number of working hours? And here we can speculate. The freed up time cannot be summed up and turned into additional hours in the day. These will be the same hours for the journey home, the evening and less productive part of the day for personal affairs - rush hour will simply shift to an earlier time.

Anna Korenevskaya

Associate Professor, Faculty of Economics, RUDN University

And again, not everyone knows how to make good use of their free time, and for many it will just be extra hours waiting for the next working day, Korenevskaya believes. If the process of reducing working hours were not connected with the income of the population, it would have been resolved much faster. After all, the most important (but far from the only) question is the relationship between hours and money.

In other words, there are still too many problems and pitfalls for a four-day work week. And until government agencies find solutions for at least half of them, it would probably be naive to seriously consider this idea.

The most interesting things are in our Yandex.Zen channel

subscribe

Remuneration for part-time work

Working hours can be reduced in different ways. There are:

- part-time work – reducing the duration of one shift (instead of 8 hours, the employee works less, for example, 6 hours)

- part-time work week – reducing the number of trips to work (instead of 5 working days, the employee works, for example, only 3 days a week).

The payment procedure for part-time work is prescribed in the company’s local documents (Salary Regulations, employment contract). To avoid conflicts with employees, it is recommended that the supplementary agreement detail the calculation of earnings, indicate not only the amount of the salary, but also the calculation procedure (in proportion to the time worked or as a percentage of the salary), especially if a non-piece-rate system is used.

Salary payment for part-time work

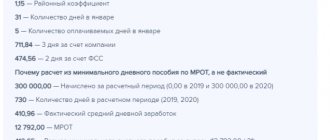

Under the salary system, wages are calculated in proportion to the time worked. Since a part-time employee will work less than the norm, the amount accrued for receipt will be lower than the official salary. Let's give an example of calculating earnings based on salary.

Example

At Fregat LLC, storekeeper M.A. Ivanova. established from July 1, 2020 part-time - 6 hours. The company operates on a 40-hour work week. The storekeeper's salary for a full-time job is 26,400 rubles. The month was worked in full (22 working days).

How Ivanova’s salary for July was calculated:

- determined the time worked according to the timesheet (22 working days x 6 hours = 132 hours);

- for the calculation, we took the standard hours according to the July 2021 production calendar - 176 hours;

- calculated Ivanova’s salary for July based on the standard hours and actual time worked:

26400 rub. : 176 hours x 132 hours = 19800 rub.

Payment at an hourly rate

For part-time work, hourly wages are calculated based on hours worked. The number of hours worked is recorded in the timesheet. Earnings are determined by multiplying the hourly rate by the number of hours actually worked.

Example

Milling machine operator Smirnov has an hourly tariff rate of 170 rubles. He was established part-time working hours from July 1, 2021 - 4 hours a day. The number of hours worked according to the July report card is 88.

Smirnov’s monthly earnings will be:

170 rub. x 88 hours = 14960 rub.

Payment under the piecework system

For pieceworkers, the amount of earnings depends only on the amount of work performed. Accrual is made at rates established by the enterprise. The procedure for calculating earnings does not change due to the fact that the employee worked less time.

Example

For each part processed by a turner, the price is set at 80 rubles. In June 2021, turner Polyvanov turned 470 parts while working part-time.

Polyvanov’s earnings for June 2021 will be:

470 children x 80 rub. = 37600 rub.

Overtime work

In case of part-time work, an employee will be subject to overtime hours if he has actually worked more time than specified in the employment contract (additional agreement). In this case, he must receive an additional payment (Article 152 of the Labor Code of the Russian Federation):

- at one and a half times the rate for the first 2 hours worked in excess of the norm;

- double the amount for the remaining hours of overtime work.

Overtime work should not exceed 4 hours for 2 consecutive days and 120 hours per year, incl. and for those who work part-time (Article of the Labor Code of the Russian Federation).

Example

The salary of an estimator according to the staffing schedule is 40,000 rubles. Estimator Rastov has a part-time working day of 6 hours. On one day in July 2021, instead of 6 hours, the employee, by order of his superiors, worked 7 hours. How will Rastov’s salary be calculated if the standard working time according to the July calendar is 176 hours, working days in July is 22.

Rastov actually worked out:

22 working days x 6 hours. + 1 hour = 133 hours, of which 132 hours were worked according to the norm and 1 hour was overtime.

Payment for the first 2 hours of overtime is due at one and a half times the rate, so Rastov’s salary for July will be:

(40,000 rubles: 176 hours x 132 hours) + (40,000: 176 hours x 1.5 x 1 hour) = 29999.64 + 340.91 = 30340.55 rubles.

What salary should be indicated in the employment contract?

The article of the Labor Code of the Russian Federation states that in case of part-time work, the employee’s salary is proportional to the time worked or the amount of work performed. This wording does not allow us to make an unambiguous conclusion about what salary should be specified in the employment contract - the full salary or the amount calculated based on the days or hours actually worked.

Experts disagree. Some believe that the employment contract should indicate the amount that the employee would be paid if they were working full time. Here you should indicate his personal schedule and make the following reservation: “Wages are calculated in proportion to the time worked.” So, if the full salary is, for example, 30,000 rubles, then this exact amount should appear in the employment contract. Further, it should be noted that the employee works four hours daily (20 hours per week) and receives a salary in proportion to the time worked. It is assumed that a person, based on this information, will independently calculate the final amount of his salary (15,000 rubles).

Calculate your salary and benefits taking into account the increase in the minimum wage from 2021 Calculate for free

But there is another point of view, according to which the employment contract should stipulate not the full, but an already reduced salary. Proponents of this approach refer to the article of the Labor Code of the Russian Federation. It states that the employment contract must contain the conditions for remuneration of the employee. Therefore, it is necessary to indicate information that relates specifically to this employee. And if he works part-time, then the employment contract must contain a salary calculated based on his personal work schedule. With this design option, the employee is freed from the need to calculate his own salary, because the employer did it for him. As for the full salary, this is a general indicator that is reflected in the staffing table and other documents related to the company as a whole.

Officials are coming to similar conclusions. In particular, Ivan Shklovets, Deputy Head of the Federal Service for Labor and Employment, commented on this topic. He explained that if an employee works at 0.5 rate, and the salary according to the staffing table is 15,000 rubles, then the employment contract must indicate a salary of 7,500 rubles.

Labor inspectors think the same way. There were cases when inspectors recorded a violation if the employment contract stated a full salary for incomplete working hours. According to the logic of the controllers, such conditions mean that the employer is obliged to pay the employee the full salary for the partial number of hours worked, according to the employee’s schedule. And since the employee actually received less, the employer must pay him up to his full salary.

Considering the above, as well as the fact that most labor disputes are decided by judges not in favor of employers, it is better to draw up an employment contract as follows. Indicate that the employee is assigned such and such a partial number of working hours or days and the corresponding reduced salary. At the same time, the full number of hours and days, as well as the full salary, must be reflected in the local regulations of the organization.

Draw up local acts using ready-made templates and prepare all personnel reports

Daily salary payment

The company can pay for part-time work daily, but the payment procedure itself will still be tied to either the time worked or the volume generated.

When making daily calculations, the employer may have difficulties with taxation, and here's why:

- an individual’s salary is recognized as income on the last day of the month for which it is accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated December 15, 2017 No. 03-04-06/84250);

- Personal income tax on wages is also calculated at the moment the wage is recognized as income, withheld when it is paid to the employee, and transferred to the budget no later than the next working day after the day of payment; amounts received by an individual before the end of the billing month are considered advances, personal income tax on which cannot be calculated before the end of the month (letter of the Federal Tax Service dated May 26, 2014 No. BS-4-11 / [email protected] );

- Tax can be withheld only at the end of the month from the next payment, but the next payment may not be enough for tax (according to Article 138 of the Labor Code of the Russian Federation, no more than 20% can be withheld from each salary, and in certain cases 50% of income), then further calculation will become more complicated.

If an employee resigns before the employer withholds the entire amount of personal income tax from him, the employer will have to inform him of the impossibility of withholding tax by sending a 2-NDFL certificate with sign “2” to the Federal Tax Service.

To avoid such difficulties, you can pay the employee daily earnings minus personal income tax, and transfer the tax to the budget on the last day of the month (or immediately after the first payment in the next month).

Insurance premiums calculated from daily earnings are transferred within the usual time frame - no later than the 15th day of the month following the billing month.

Minimum payout amount

According to Article 133 of the Labor Code, if an employee has fully worked the time established by the employment agreement, the amount of his remuneration should not be lower than the minimum wage (minimum wage). For example, in 2021 this figure in Moscow is 17,561 rubles. Under working conditions at a rate of ½, wages cannot be less than 8,780.50 rubles, that is, in proportion to the established minimum:

Salary = 17,561*0.5 = 8,780.50 rubles

Calculation example No. 2. The Podsolnushko farm in the Krasnodar Territory had two employees in 2021: tractor driver Klyuev and driver Petrov. Klyuev is employed full-time and his salary is 11,000 rubles, Petrov works at a rate of ½ and his salary is 5,000 rubles. We will determine whether these payments in the prescribed amount do not violate labor laws.

The minimum wage in the Krasnodar region in 2021 was 10,366 rubles. Klyuev’s salary exceeds this value, and therefore management does not violate his rights. But in relation to Petrov, their actions are illegal, since his rate is ½, then the amount of payment should not be less than 5,183 rubles.

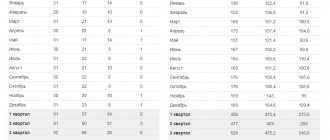

It is worth remembering that the minimum wage in different regions is set individually. The table shows how the indicators differ. It all depends on the different levels of inflation in different regions and on the established cost of living. Wages for part-time work may be less than the minimum wage, but only in proportion to the rate.

| Region | Minimum wage size in 2021 |

| Bryansk region | 7,500 rubles |

| Murmansk region | 13,650 rubles |

| Tyumen region | 7,700 rubles |

| Moscow | 17,300 rubles |

Is it possible to pay less than the minimum wage for part-time work?

The Labor Code of the Russian Federation prohibits paying wages less than the minimum wage if the standard time has been worked in full and the specified amount of work has been completed (Article 133 of the Labor Code of the Russian Federation).

In a part-time mode, the number of hours of work will be below the norm, therefore the remuneration for work may be less than the minimum wage in the appropriate proportion. However, it should be borne in mind that the amount of remuneration for part-time work, when converted to full-time work, should not be lower than the minimum wage level established in the relevant constituent entity of the Russian Federation.

Payment methods, procedure and calculation formula

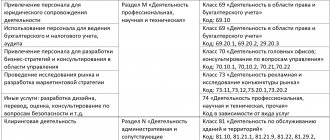

To learn how to correctly calculate the amount of payments, you need to clearly understand how a certain type of salary is calculated.

| Forms of payment | Calculation procedure |

| Time-based | Depends only on the amount of time worked, the amount of products produced does not affect this form of payment |

| Piecework | The calculation procedure is inversely proportional to the previous form. Payments are made only for the amount of work done, regardless of the time spent on it. |

In addition, the salary can be divided into:

Main:

- salary or piece income;

- bonuses for a job well done;

- other surcharges.

Additional:

- payment for required vacation and sick leave in case of incapacity for work;

- reimbursement of expenses incurred in connection with travel, accommodation and meals (for example, during business trips);

- bonus payments that are not part of the main employment agreement.

The established calculation formulas are applied depending on the forms of remuneration:

- For piecework wages, the following calculation is used: Salary = cost of production specified in the contract * volume of products produced for the period + accrued bonuses + other additional payments – income tax – other deductions.

- Time-based payment is calculated using the formula: Salary = salary amount / total number of working days * number of days actually worked + bonus amount - personal income tax - withheld amounts . Read also the article: → “Calculating salaries for employees (piecework, temporary payment, calculation example).”

The above formulas are relevant when the employment contract states that the terms of employment are part-time and the employee has worked the required hours.

Payroll calculation for part-time work

When an employee has not fully worked the required hours, the calculation algorithm will be different:

| Period | Formula |

| Calculation for less than a month | Salary for an incomplete month = the value obtained by calculation using the formula for the standard calculation of payments due / number of working days for a certain period * number of days actually worked. |

| Calculation for the day worked | Wages for one day = value obtained by calculation using the formula / number of working days in the period. |

| Calculation for the year worked | Average salary per day = amount of salary for the year / number of months / 29.3. |

| Calculation of wages with a vacation break | Wages, if there was a vacation in the billing period = employee’s salary / total number of working days in the period * number of days actually worked in the month. |

Calculation of wages at a salary rate at a rate of ½ or ¼:

- Salary at ½ rate = salary at full rate*0.5

- Salary at ¼ rate = salary at full rate *0.25

Calculation example No. 1. Employee Kovalev A.A. drawn up under an employment contract, rate - ½, from November 11, 2016 to the position of equipment sales manager. The full salary for this position is 25,000, according to the staffing table. Calculate wages for less than a month.

First you need to determine the number of working days and weekends that fell in November:

- workers - 21 days;

- weekend - 9 days.

From November 11 to November 30, the employee worked 14 days. Next, the calculation is carried out according to the formula: 25,000 / 21 * 14 = 16,666.67 rubles - wages for the period from November 11 to November 30. The rate of Kovalev A.A is ½, accordingly the amount of payment will be:

Salary for November = 16,666.67*0.5=8,333.34 rubles

Under piecework conditions, the calculation is much simpler. It is enough to know the amount of payment per unit of production and the quantity of goods sold.