Pay taxes in a few clicks!

Pay taxes, fees and submit reports without leaving your home!

The service will remind you of all reports. Try for free

In order to make the payment correctly, legal entities and entrepreneurs using the simplified tax system must know the budget classification codes (BCC), which are used when filling out reports and when paying taxes, contributions, penalties and fines. They can change at any time, so always check that the codes are up to date before using them.

In the article we will tell you what the KBK is, how to use them and which KBK for the simplified tax system to use in 2021 and 2021.

According to Article 346.21 of the Tax Code of the Russian Federation, entrepreneurs must pay tax according to the simplified tax system to the Federal Tax Service inspectorate at the location of the organization or, if it is an individual entrepreneur, at the place of residence.

Advance payments for this tax are paid quarterly - in April, July and October, until the 25th day of each month inclusive. The balance of the tax under the simplified tax system must be paid next year - before March 31 (organizations) and April 30 (individual entrepreneurs).

In order to make payments in accordance with all standards, legal entities and entrepreneurs using the simplified tax system must know the budget classification codes that are used when filling out reports and when paying taxes, contributions, penalties and fines.

What is KBK and why is it used?

KBK (budget classification code) is a combination of numbers that indicates the purpose of the payment received by the Federal Tax Service.

Based on this number, funds contributed by an individual entrepreneur or legal entity are sent to the appropriate budget item.

Assigning the simplified tax system to KBK simplifies the control of receipts and planning of funds.

The code consists of 20 digits, which, in a group or individually, convey information about the purpose of the payment.

- The initial three digits represent the organ code.

- The next number indicates the transfer group - tax payment, free transfer and others.

- Then the third two digits indicate the tax code - on profit, on property and others.

- Based on the next five numbers, the article and subitem of the payment are determined.

- After that, two numbers indicate where the amount was paid - to the regional, federal budget or in favor of the Social Insurance Fund or Pension Fund.

- The next four digits indicate the purpose of the payment - tax contribution, payment of a fine or penalty.

- The final three numbers determine the type of transfer - tax, from property, etc.

These indicators are divided into 4 blocks:

- administrator block (code numbers 1-3);

- income block (numbers 4-13);

- program (numbers 14-17);

- classifying (numbers 18-20).

It is necessary to check the relevance of the codes annually, as they may change. Specifying an incorrect number will result in the tax received by the Federal Tax Service not being displayed.

This entails sanctions in the form of penalties and fines.

Important: if the simplified tax system was specified incorrectly when filling out the KBK documents, you will need to send a letter to the tax service with a request to transfer funds. If the amount has not been credited, the payment is repeated.

back to menu ↑

What are the consequences of an incorrect KBK in a payment order?

The absence or incorrect indication of the code may result in the payment being among the unknown. The responsibility for indicating the correct BCC lies with the taxpayer, since the codes are enshrined in law. Of course, all these “movements” take time, and tax payment deadlines will not be met. As a result, you will face penalties and/or a fine.

If you indicated the wrong code, but the payment was received by the budget, send an application to the Federal Tax Service to clarify the payment. The tax authority will recalculate penalties for the period from the date of payment until the payment is clarified. In Art. 45 clause 4 of the Tax Code of the Russian Federation specifies two types of errors in which the payment will not be counted: an incorrect treasury account number or an error in the name of the recipient bank. In this case, a different procedure for correctly determining the payment applies.

Where to find the required KBK

It is hardly possible to remember all the required budget classification codes.

To make it easier to fill out documents when making payments, special reference books are provided. The information in them is updated annually in accordance with legislative amendments.

Every accountant has such a KBK directory. Before filling out the forms, check the values indicated there for the “Income minus expenses” mode.

If you don’t have a reference book at hand, but have access to the Internet, you should go to the official website of the tax service www.nalog.ru. It displays complete and up-to-date information for 2017.

The KBK simplified tax system will need to be indicated on payment orders when transferring quarterly advance payments and transfers to the Pension Fund. In order for the amount paid to the Federal Tax Service to be received as intended, the code must be entered correctly.

back to menu ↑

Settlement transactions for payment of social insurance contributions

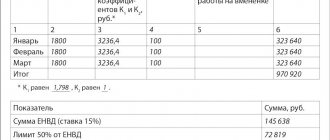

The presence of hired employees obliges the entrepreneur to pay social insurance contributions. In this case, the amount of the “imputed” tax is also reduced by the amount of deductions made, but in no case more than 50% of its value.

Note! In 2021, the BCC for settlement transactions related to the transfer of contributions to the Social Insurance Fund in terms of social insurance for disability and in connection with maternity was changed. These changes are also associated with the transfer of these contributions to the jurisdiction of the tax authorities. The BCCs for social insurance contributions against accidents have not been changed, since they are still controlled by the social insurance authorities.

Individual entrepreneurs do not have tax obligations regarding the payment of social insurance contributions for themselves on UTII. However, if desired, an entrepreneur can draw up an agreement with the Social Insurance Fund for their subsequent payment - 2.9% of the minimum wage. This type of insurance will allow you to receive Social Security benefits, for example, in the case of maternity.

What are the features of calculating and paying taxes according to the simplified tax system?

The rate under the “Income minus expenses” mode is 15%. In the regions, its size can fluctuate between 5-15%, which is associated with the use of differentiated tax rates.

To correctly determine the tax base and calculate the tax contribution, a ledger is kept to record incoming and outgoing transactions. It can be maintained manually or electronically.

The main difficulty for an accountant of an LLC or individual entrepreneur working under the “Income minus expenses” regime is recognizing the legitimacy of expenses.

This is necessary to correctly determine the tax base. If it is underestimated, an additional fee will be charged and fines will be imposed.

Important: if an enterprise suffers a loss based on the results of the previous tax quarter, the tax base in the current tax period can be reduced by the amount of this loss.

Cash receipts are calculated using the cash method: after funds are credited to the current account or to the cash desk of an LLC or individual entrepreneur, they can be indicated in the income item.

As for expenses, before making them, you need to prove their economic justification.

To classify the amount spent as an expense, two conditions must be met.

- Costs must be documented. The expense item includes amounts for concluded contracts and advance reports. The payment document is filled out in accordance with legal requirements and company rules.

- Only amounts paid for profit can be considered expenses. In addition, if the company has paid for the goods, its cost can be taken into account after it is delivered to the warehouse.

Important: funds spent on advertising are recognized as expenses only in an amount not exceeding 1% of the amount of cash receipts.

back to menu ↑

Concept of dividends

The profit received by the enterprise after taxation can be distributed among the participants of the company.

Dividends recognize not only income from the distribution of remaining profits received by the participant, but also other similar payments to the participants (letter of the Ministry of Finance of the Russian Federation dated May 14, 2015 No. 03-03-10/27550). Dividends are also recognized as receipts outside the Russian Federation, recognized as such by the legislation of other countries (Clause 1, Article 43 of the Tax Code of the Russian Federation). Read about the conditions under which dividends are distributed in an LLC in this article.

For information about the specifics of calculating dividends for organizations that use a special regime, read the article “Procedure for calculating dividends under the simplified tax system.”

When are payments made?

Based on Articles 346.19 and 346.21 of the Tax Code of the Russian Federation, advance payments under the simplified tax system “Income minus expenses” are transferred until the 25th day of the month following the reporting quarter. As for the payment of the single tax according to the data for the past year, the deadlines differ:

- for individual entrepreneurs - until April 30 of the year following the reporting year;

- for LLC – until March 31.

When an enterprise stops operating under the simplified tax system “Income minus expenses” before the end of the calendar year (currently 2017), the tax contribution is transferred within the time limits specified for the incomplete period.

When the payment date falls on a non-working day, the amount is paid on the business day closest to that date. This procedure is determined by paragraph 7 of Article 6.1 of the Tax Code of the Russian Federation.

back to menu ↑

Budget classification codes 2021 for individual entrepreneurs on UTII

We bring to your attention the 2021 BCC for an individual entrepreneur on UTII:

| Payment type | What do we pay? | KBK |

| UTII | UTII tax | 182 1 0500 110 |

| Penya | 182 1 0500 110 | |

| Interest | 182 1 0500 110 | |

| Fine | 182 1 0500 110 | |

| Contributions to the Pension Fund | Pension contributions for your employees | 182 1 0210 160 |

| Pension contributions from an entrepreneur’s annual income of less than RUB 300,000. | 182 1 0210 160 | |

| Pension contributions from the entrepreneur’s annual income of more than 300,000 rubles. | 182 1 0210 160 | |

| Contributions to the Compulsory Medical Insurance Fund | Health insurance premiums for your employees | 182 1 0213 160 |

| Self-employment health insurance contributions | 182 1 0213 160 | |

| Contributions to the Social Insurance Fund | Insurance premiums for temporary disability and in connection with maternity for its employees | 182 1 0210 160 |

| Insurance premiums for temporary disability and in connection with maternity of the entrepreneur for himself (is voluntary) | 393 1 1700 180 | |

| Insurance premiums for accidents and injuries for their employees | 393 1 0200 160 |

What is the difference in payments according to the simplified tax system?

The KBK simplified tax system is different for a single contribution under the “Income minus expenses” regime and when paying the minimum tax. The latter is charged in the following two cases:

- the tax on the difference between income and expenses turned out to be less than the minimum payment;

- According to the results of the year, the enterprise's expenses exceeded its income.

The deadlines within which the minimum tax must be paid without the accrual of penalties do not differ from the deadlines for paying the single tax. The tax period is also a calendar year, currently 2016.

If the enterprise is liquidated or no longer applies the simplified tax system “Income minus expenses”, this period is counted from the beginning of the year until the date of liquidation or until the day the preferential regime is applied.

If an organization has switched to another tax scheme, the minimum tax will be calculated based on the results of the previous reporting period.

Important: the minimum tax is 1% of cash receipts.

back to menu ↑

Who pays the trading fee

Now let's talk about who pays the trading fee. The fact is that this obligation is not established for all organizations and entrepreneurs who trade in Moscow. There is a direct dependence on the tax regime applied by the seller. This payment is required only on the general (OSNO) and simplified (USN) taxation systems. The trade tax does not apply to the PSN and Unified Agricultural Tax regimes.

What is the result? Organizations cannot work on the PSN, and only agricultural producers and fishing enterprises (as well as those who provide them with certain services) have the right to use the Unified Agricultural Tax. This means that only individual entrepreneurs who have issued a patent for retail trade can be exempt from paying TC in Moscow.

Free tax consultation

Which KBK simplified tax system to indicate when filling out documentation in 2017

In the process of processing payment orders, the KBK simplified tax system is entered on the basis of the data presented in the order of the Ministry of Finance dated July 1, 2013 No. 65n (as amended on December 25, 2015 No. 215n).

For the single tax under the “Income minus expenses” regime and for the minimum tax, different codes are entered. Some BCCs of the simplified tax system have penalties and fines.

Important: advance payments are made according to the “Income minus expenses” mode. However, if at the end of 2021 the level of income falls under the minimum tax, it must be paid, but advance payments made are deducted from the amount.

It is important to correctly enter the KBK of the simplified tax system when preparing documentation for the Federal Tax Service. Then the deposited amount will go to its destination.

Accurate information on codes for 2021 can be obtained from regulatory documents or on the tax service website.

back to menu ↑