Assignment to a collection agency

The sale by banks of problem loans to debt firms became the subject of a dispute between Rospotrebnadzor and the Supreme Arbitration Court of the Russian Federation. Rospotrebnadzor indicated that the assignment of a problematic contract is a violation of consumer rights if the receiving party is not a banking organization.

The Supreme Arbitration Court of the Russian Federation adhered to the opposite solution to the issue, according to which such actions do not contradict relevant legislative norms and do not require the prior consent of the borrower.

The Supreme Court of the Russian Federation provided clarity by pointing out that the transfer of claims to non-banking organizations actually violates consumer rights. The legality of the transfer will not raise doubts if the agreement contains an appropriate clause or condition indicating the likelihood of the bank committing such actions.

Since the publication of the decision of the highest court, credit organizations began to use this amendment to their advantage. Now in any loan agreement there is a clause, the content of which indicates the bank’s right to assign (sell) the rights of claim under all concluded agreements to credit and other organizations, or third parties.

By other organizations and third parties we mean collection agencies, so the borrower, by signing agreements, actually gives his consent to a possible assignment by a unilateral decision of the bank.

After the assignment has been made, we can talk about a violation not only of consumer rights, but also about the disclosure of personal information, in particular, credit history, level of solvency, events under the transferred (sold agreement).

Violations are expressed as follows:

- the bank received the borrower’s consent not to transfer the agreement to third parties, but did not provide for the possibility of re-transfer of obligations - the collection agency can buy and sell borrowers’ debts again;

- The majority of collection agency employees are not professional collectors or lawyers, but ordinary hired employees who are given access to personal information about each borrower.

That is why assignment is considered not as a legal preference of a lender who has decided to get rid of a complex contract or client, but as a set of actions that infringe on the consumer rights of borrowers. It is extremely rare that an assignment is completed without serious violations.

Legal consequences of assignment

The main dispute between the judicial and control authorities concerned the participation of a collection agency as a receiving (third) party. Against the backdrop of numerous violations that took place before the adoption of amendments to industry legislation, this development of events did not bode well for the borrower. Therefore, the mechanism and conditions of the transfer were also regulated by law.

So, in accordance with the disposition of Art. 382 of the Civil Code of the Russian Federation, any borrower whose obligations are transferred to a third party must be liable for them in the same amount and on the same principle as before the transfer. The new lender does not have the right to change the terms of the agreement in the direction of actual worsening of the borrower’s situation. It is not allowed to increase the interest rate, charge penalties, or charge commissions unless they are expressly provided for in the body of the agreement.

The borrower has the right to raise objections against the new lender that occurred before the transfer of rights under the agreement. By accepting the rights under the agreement, the new lender simultaneously undertakes to resolve all disagreements with the borrower that were unresolved at the time of transfer (Article 386 of the Civil Code of the Russian Federation). All existing security measures, such as pledge and surety, are retained after the assignment.

: The assignment is considered completed from the moment the borrower receives the appropriate notice from the former lender. The fact of sending documents is equivalent to due notification. After receiving supporting documents, the borrower fulfills its previous obligations in relation to the new lender.

How is debt assignment carried out?

Here it is necessary to take into account that not every problem debt can be assigned to a third party. In order to transfer or sell claims on a debt, the debt itself must not be bad. That is, even a professional collection agency will not accept obligations if nothing can be done about them legally.

In this regard, credit and microfinance organizations do not constantly cooperate with any one collection agency that buys up all their problem debts. As a rule, an electronic auction is opened in which several applicants participate in the purchase of receivables. The more favorable the terms of the contract are for the buyer, the more expensive this contract will cost him.

In practice, the sale occurs as follows: the creditor puts the contract (obligations) up for auction at a nominal price - up to 40% of the total debt. And the indicated 40% is considered a very large value, since under most contracts the rights of claim are transferred for 1-10% of the total debt.

After acquiring the right of claim, the new creditor notifies its client of this in a documented manner. The legislator planned to stop the accrual of interest until the borrower received notification of a change of lender, but so far nothing has changed in this direction - interest, including penalty interest, is accrued without such a stop.

about the author

Evgeniy Nikitin Higher education majoring in Journalism at Lobachevsky University. For more than 4 years he worked with individuals at NBD Bank and Volga-Credit. Has experience working in newspapers and television in Nizhny Novgorod. She is an analyst of banking products and services. Professional journalist and copywriter in the financial environment [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

The situation in detail

The nature of the formation of debt is that one subject transfers some valuable item for temporary disposal to another. For example, money, real estate, goods or even intangible assets. Until the recipient returns the value to the creditor, he is in debt. Moreover, not only organizations, but also private businessmen and citizens can act as lenders and recipients.

The creditor, having not received repayment of the debt, takes legal methods of collection. If the actions do not produce any result and the debtor does not repay the loan, then it is allowed to sell the debt to a third party. This procedure is called debt assignment.

But not only the creditor can waive his obligations in favor of a third party. The debtor also has the right to transfer his obligations to another citizen or third-party company. The procedure is called debt transfer; it is, in essence, replacing the debtor with a new defendant for debt obligations. Each type of assignment or transfer of rights to debt has its own characteristics.

Comments: 18

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Evgeny Nikitin

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Lisa

05/24/2021 at 16:06 The bank sued me, and a little more than six months later, it transferred my debt to collectors. This was in 2021. But the bank is still collecting money from me, although I called the bank, they told me, you don’t owe us anything, they are now taking care of your business... So I can’t understand why the bank continues to collect money if they sold my debt

Reply ↓ Anna Popovich

05/24/2021 at 16:58Dear Lisa, contact the bank in writing - if the debt was assigned, then the creditor should have changed.

Reply ↓

05/13/2021 at 15:23

I took out a car on credit and the court ordered me to pay off the debt. The writ of execution was with the bailiffs, but they closed it under Article 46. Now I find out that a court has been appointed to assign the rights of the bank to which the debt is owed to a collection agency. What to do? What to refer to in court?

Reply ↓

- Anna Popovich

05/13/2021 at 23:15

Dear Maria, returning the writ of execution to the claimant is not an obstacle to re-presenting the writ of execution for execution.

Reply ↓

05/12/2021 at 01:58

Is it possible to assign a non-overdue loan?

Reply ↓

- Anna Popovich

05/12/2021 at 14:52

Dear client, yes, assignment is possible.

Reply ↓

04/26/2021 at 16:21

Good afternoon, tell me, what if a loan was taken out in 2021, then the full amount was not paid and two years later the loan was assigned. But during this time the bank did not notify of any actions or debts. How might the situation turn?

Reply ↓

- Anna Popovich

04/26/2021 at 18:19

Dear Ekaterina, you should have been notified about the change of creditor, but in essence, this does not matter, since the debt remains with you in any case. The assignment of the right of claim does not relieve you of the obligation to pay the loan balance, interest and penalties. If you do not voluntarily repay the debt, it will be forcibly collected.

Reply ↓

04/21/2021 at 16:04

Hello. And if I haven’t paid the loan for five years and can’t figure out where it went, the credit history says assignment. I want to know how I can find where it went, I call the bank, they don’t know anything, I’m not registered with them, I call debt collection and they say they closed the case and transferred it back to the bank, in short. Will they ask me for this loan in the future?

Reply ↓

- Anna Popovich

04/21/2021 at 16:27

Dear Dmitry, upon assignment, the bank must send you a bank notification within 30 days after the sale of the debt. In addition, the letter must contain complete information about the organization to which the debt was sold. Contact the bank in writing and wait for a response, after which you can talk about tactics for further action.

Reply ↓

Dmitry

04/21/2021 at 16:54

There were no letters. And I took out this loan from Trans-Credit Bank, then they merged with VTB. After that, I called VTB Bank to find out about the debt, and after I gave my passport details, they told me that the details were incorrect.

Reply ↓

04/21/2021 at 17:14

And this loan was sold in 2021 and no one asked me about this loan in so many years. Will they resume?

Reply ↓

Anna Popovich

04/21/2021 at 07:13 pm

Dmitry, contact VTB, the statute of limitations on the loan has objectively expired.

Reply ↓

03/27/2021 at 16:08

Good afternoon. The BKI says that the loan has been written off. The reason for closure is assignment of rights. But at the same time I did not receive any notifications. The bank called and they couldn’t give me information about this loan. But individual repayment conditions apply for others. Is there such a development option that it was not sold to other organizations, but the bank simply wrote it off???

Reply ↓

- Anna Popovich

03/27/2021 at 17:04

Dear Arman, this is unlikely, banks do not write off debts. We recommend that you contact the bank in writing and receive an answer regarding a specific debt; the bank cannot fail to provide such data.

Reply ↓

02/01/2021 at 20:41

This is not the case when what is not prohibited is permitted. The loan agreement MUST contain an agreement to permit the assignment of claims to third parties. Read the laws carefully.

Reply ↓

01/21/2021 at 18:30

Hello. Tell me, if the bank’s license was revoked, the unpaid loans were transferred to the DIA Group. which subsequently assigned them to the collection agency Questor, how legal are the latter’s demands to repay the entire debt at once?

Reply ↓

- Anna Popovich

01/21/2021 at 19:24

Dear Olga, the legality of the requirements depends on the terms of the loan agreement and the length of the delay. As a general rule, the creditor has the right to demand repayment of the entire amount and change the deadline for fulfilling obligations to repay the principal debt and pay interest for using the loan.

Reply ↓

How to transfer a loan debt to a third legal entity with the consent of the lender

Currently, obtaining loans by individuals has become an easily accessible procedure, since credit organizations are developing more and more new credit products with attractive lending conditions, thereby “tempting” citizens to enter into a new credit experience, improving their living conditions, making repairs, buying new cars or expensive telephones. And mortgage loans

today they are one of the most desirable credit products of Russians, as they allow, firstly, to solve the housing problem, and, secondly, due to the long loan term (from 10 to 25 years) they have an affordable monthly payment, which in today's difficult situation, in the context of increasingly shrinking jobs and taking into account the difficulty of finding decent work, it is very important.

Statistical information

In 2021, there is a noticeable increase in loans issued. The number of citizens who came to take out a loan from banks in 2018 increased by 22% compared to 2021.

What are the reasons for the increase in credit activity of Russians? The main reason is lower interest rates. People are more likely to take out loans for vacations; approximately every fifth smartphone was purchased with credit money.

And here are the statistics on the issuance of mortgage loans: in 2018, the issuance of mortgage loans amounted to almost 1.08 million loans. The average size of mortgage loans is 1.87 million rubles. According to statistics, almost 32% of mortgage loans issued are in Moscow, the Moscow region, St. Petersburg and the Tyumen region.

But “long” loans, which start out as joy, can gradually turn into a heavy burden, which over time becomes unbearable. The borrower often begins to realize from the second year of payments that he is no longer able to fulfill the obligations taken on the loan, because paying monthly payments is a significant burden on both the family budget and the budget of a non-family person. Moreover, not every borrower initially wants to see the “economics” of a mortgage loan, and this “economics” is very tough - if you do not repay the loan early and pay according to the annuity payment, then by the end of, for example, a twenty-five-year loan term, the borrower will have paid the cost of at least two more apartments.

If the borrower repays at least small amounts of the loan ahead of schedule, without reducing the monthly payment, but shortening the loan term, then the economics of this approach will bear fruit - the ratio between the amount of interest and the amount of principal in the annuity payment will be reduced, which, of course, , will lead to both a reduction in the loan term and will lead to savings for the borrower in the future.

Of course, the obligations assumed under loan agreements, as Art. 309 of the Civil Code of the Russian Federation must be executed properly; the normal and natural basis for termination of an obligation is its fulfillment, which occurs subject to the parties meeting certain requirements.

However, often the difficulties of repaying the loan become unbearable for the borrower. In this case, you need to think about whether there are additional ways to terminate obligations other than their proper execution?

These methods include: compensation, set-off, matching of debtor and creditor in one person, debt forgiveness.

What to do when a borrower cannot cope with loan obligations?

The Civil Code provides for two types of change of persons in an obligation: transfer of the rights of the creditor to another person, that is, replacement of the creditor, and transfer of debt - replacement of the debtor (Chapter 24 of the Civil Code of the Russian Federation).

Every borrower, from the moment of signing a loan agreement, should know that if it is impossible to fulfill the contractual conditions under the loan agreement, it is possible to ease or even completely relieve the burden of loan obligations, but this will also deprive the borrower of the apartment for the purchase of which he took out his loan, namely :

- transfer of debt to a third party (replacement of the debtor), which is formalized by an Agreement on transfer of debt to a third party, under which all obligations to pay the debt of the borrower-debtor (assignor) are transferred to a third party (assignee), while obligations under the loan do not terminate and remain without changes;

- transfer of a mortgaged apartment pledged by a credit institution under a compensation agreement with the credit institution;

- negotiate with the credit institution (sign the appropriate agreement) for the “withdrawal” of the apartment from collateral with its subsequent sale by the borrower and repayment of the entire amount of debt (loan body, interest, fines under the terms of the agreement).

Also, the borrower should know that if he fails to fulfill the contractual terms of the loan agreement, the credit institution can transfer the rights under the loan to another person, that is, carry out an operation to assign the rights to claim the debt under the loan agreement, and the assignment can also be made to specialized collection agencies, who are already professionally engaged in “knocking out” debts.

Of course, in all cases the rights of both new and previous creditors and debtors must be respected. Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 21, 2021 No. 54 “On some issues of application of the provisions of Chapter 24 of the Civil Code of the Russian Federation on the change of persons in an obligation on the basis of a transaction” is aimed at ensuring the protection of their rights. The most important clarifications of the Court are given in the article.

Procedure for transferring credit debt

What is the procedure for transferring credit debt? How difficult is it for the borrower and what risks does it entail?

According to the law, the transfer of debt is carried out (§ 2 of Chapter 24 of the Civil Code of the Russian Federation) with the consent of the creditor by agreement between the original debtor and the new debtor.

In obligations related to business activities, the transfer of debt can also be made by agreement between the creditor and the new debtor, who assumes the obligations of the original debtor (clause 1 of Article 391 of the Civil Code of the Russian Federation).

Three parties take part in the procedure for transferring a credit debt: the borrower, the creditor and the third party to whom the debt will be transferred, that is, the person who will assume the borrower’s obligations.

The third party is carefully checked by the bank, just like any other new borrower, which means that the credit institution must be provided with a full package of documents indicating that the person to whom the borrower’s debt will be transferred is able to cope with new obligations, that is, he has a place of work, has an official income confirmed by a 2-NDFL certificate, and an age that allows him to work for a number of years that provides the opportunity to cope with the new responsibilities assigned to him.

When the transfer of debt is properly executed, the debtor is replaced, and all demands for the fulfillment of obligations are sent to the creditor to the successor of the debt. The debt transfer scheme is simple and logically understandable: a tripartite agreement is concluded between the creditor, the debtor and the person accepting the obligation to pay the loan.

In this case, the creditor sends his notice of consent to the transfer of debt to the old and new debtors, indicating the main parameters of the agreement (the amount of the loan balance, the loan repayment period, the date of the monthly payment, the interest rate), as well as the basis for the transfer of debt (the name of the document on the basis of which the debt, document number, date of document is translated).

However, as practice shows, performing the procedure for assigning loan debt and registering it to a new person is a complex and time-consuming process, which has its own characteristics and requires certain knowledge.

Each such case is considered by the credit institution individually, taking into account various circumstances. This article discusses in detail the entire procedure for transferring debt to a third party.

Obtaining bank consent

In order to transfer a debt to a third party, as noted above, it is necessary to obtain the consent of the bank. In this case, the only case when the bank’s consent is not required is the transfer of debt upon entry into inheritance rights. In all other cases, the borrower must obtain permission from the bank.

The law does not establish the form of an application for obtaining the consent of the creditor, nor does the law determine the form of the consent of the creditor. But credit institutions are among those organizations that have formalized all internal procedures, developed packages of documents for all areas of the credit institution’s activities, and also operate a very strict internal control system. Therefore, when a debtor approaches a bank with an application to transfer a debt to a third party, bank employees will offer to fill out the application forms established by the bank, however, applications drawn up in free form are also accepted.

The main thing is that the application for the bank to transfer the debt contains all the essential information determined by the rules of business turnover:

- To – Legal name of the credit institution, address, full name of the official;

- From whom – full name of the applicant-debtor, address, passport details, TIN;

- Subject of the application - Date of agreement, agreement number, amount of principal and interest;

- To whom - full name of the third party - the new creditor, address, passport details, TIN;

- Signatures of the parties.

Copies of documents of the third party to whom the debtor wants to transfer the debt should be attached to the application for debt transfer.

Of course, in order to most likely obtain consent to transfer the debt, the list of documents that must be provided to a third party must be clarified with the bank, but, as a rule, it coincides with those collected by the borrower. All documents are submitted personally by the person accepting the loan obligations.

Please note that until a positive decision is received, the borrower is obliged to continue fulfilling his obligations to pay loan obligations and regularly make monthly payments.

The conditions under which the debt is transferred to a third party are specified separately in the agreement between the old and new borrower.

Transfer of consumer credit

A consumer loan can be transferred through an agreement on the fulfillment of obligations. In this case, with the consent of the lender, an agreement on the fulfillment of obligations under the loan agreement is drawn up by a notary.

After the agreement is formalized, the loan agreement does not change and formally the former person remains the borrower, therefore, if the payment obligations are not fulfilled, the bank will make claims against the former borrower. Therefore, in order to avoid unpleasant situations, it is better to carry out a complete transfer to a third party.

Transfer of loan with guarantors

Large loans are usually secured by guarantees.

Thus, to complete a transaction, the borrower must obtain not only the consent of the bank, but also the consent of the guarantors to provide a guarantee for the loan with the new borrower.

This must be done because, in accordance with paragraph 2 of Art. 367 of the Civil Code of the Russian Federation, the guarantee agreement is terminated when the debtor changes.

If the consent of the guarantors is not obtained, the borrower will need to find new guarantors and submit a request to the bank to change the guarantors under the agreement. And only after receiving the bank’s consent to change the guarantors will it be possible to continue formalizing the debt transfer agreement.

Features of transferring debt with collateral

The situation is more complicated with “long-term” loans, which are issued by credit institutions for the purchase of a car or apartment. In these cases, obtaining a loan is not possible without collateral (a collateralized car or apartment).

How can you transfer a debt if there is a bank encumbrance?

Several options are possible:

1) Transfer of debt by agreement:

The borrower is looking for a buyer for the property who will be willing to accept the existing loan agreement and replace the borrower in it.

After receiving the bank's consent, a contract for the purchase and sale of property is concluded between the parties with its subsequent re-registration. The agreement specifies both the full value of the property and the part that will be paid in accordance with the agreement, as well as the procedure for transferring rights. The collateral property may remain the same, but it is possible, with the consent of the bank, to provide a new collateral.

2) Applying for a new loan and closing the current one

The borrower is looking for a buyer who will take a loan, and the borrower’s loan agreement will be closed using the funds received.

At the same time, a purchase and sale agreement is drawn up indicating on what basis the transfer of ownership occurs.

However, despite all the simplicity, finding a buyer for collateral property is very difficult.

The bank refused to transfer the debt. What to do?

If the bank does not provide the opportunity to transfer the loan debt to a third party, you can try to transfer the debt on the basis of a guarantee. The new borrower is designated as a guarantor for the loan.

The old borrower notarizes his obligations to his guarantor and, if required, provides appropriate guarantees. After registration, the borrower sends a letter to the bank in which he reports that he is unable to repay the loan and transfers his payment obligations to the guarantor.

Of course, in this situation there are risks for each participant. The guarantor may stop paying the loan and all penalties will be levied on the borrower. In turn, the Borrower may waive his warranty obligations to the guarantor, and both parties will have to prove their case in court.

Therefore, it is advisable to carry out all procedures for transferring debt through a bank.

Termination of loan obligations under a compensation agreement

Let's consider other ways to terminate a loan obligation if it is impossible to fulfill it.

If the Borrower cannot fulfill the loan obligations assumed under the mortgage agreement, then banks can, in accordance with clause 1 of Art. 349 Civil Code of the Russian Federation, clause 1, art. 55 of the Federal Law of July 16, 1998 No. 102-FZ “On Mortgage (Pledge) of Real Estate” satisfy their claims to the Borrower for a loan from the value of the mortgaged real estate.

Satisfaction of the mortgagee's claim is allowed without going to court, but only on the basis of a notarized agreement between the mortgagee (bank) and the mortgagor (Borrower), concluded after the grounds for foreclosure on the subject of the pledge (subject of the mortgage) arise.

At the same time, such an agreement may be declared invalid by the judicial authorities upon the claim of a person whose rights are violated by such an agreement.

The borrower needs to know that current legislation does not provide for the possibility of transferring the property that is the subject of the pledge to the ownership of the pledgee (bank). Any agreements providing for such transfer are void, with the exception of those that can be qualified as compensation or novation of an obligation secured by a pledge.

(paragraph 46 of the joint resolution of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Arbitration Court of the Russian Federation dated 01.07.1996 N 6/8 “On some issues related to the application of part one of the Civil Code of the Russian Federation”).

Article 409 of the Civil Code of the Russian Federation stipulates that, by agreement of the parties, the obligation can be terminated by providing compensation in exchange for execution (payment of money, transfer of property, etc.).

In this case, the amount, terms and procedure for providing compensation are established by the parties.

The meaning of compensation is that instead of the subject of performance originally specified in the obligation, another subject of performance is provided. Compensation is a payment for refusal to perform specified in the original obligation, a means of freeing the debtor from the need to perform the original performance.

A compensation agreement is a direct expression of the will of the parties to terminate the existing obligation between them and to refuse to fulfill the original obligation.

If the compensation agreement is not fulfilled within the period specified by the parties, the creditor has the right to demand the fulfillment of the original obligation and the application of liability measures to the debtor in connection with its failure (fines, penalties, penalties).

If in the compensation agreement the parties provided for the right of the debtor, in return for fulfilling the obligation under the contract, to provide compensation within a certain period of time, then the creditor actually granted the debtor a delay in fulfilling the original obligation. Taking into account the above, the creditor has no right to demand fulfillment of the initial obligation before the expiration of the period established by the parties for the provision of compensation.

I would like to note that the compensation agreement between the borrower and the lender, of course, will solve the borrower’s problems with his loan debt, however, the market value of an apartment pledged, for example, may exceed the borrower’s current debt, unpaid penalties and fines under the agreement, but the borrower, having shed his current obligations to the creditor, he will not be able to take advantage of this difference.

Therefore, we can advise the borrower to try to negotiate with the bank to remove the encumbrance from the apartment, which is pledged by the bank, for the purpose of its subsequent sale and repayment of the loan debt.

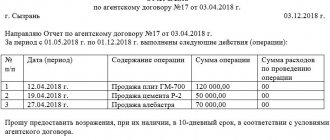

Assignment of rights to claim debt under a loan

If the borrower fails to fulfill the contractual terms of the loan agreement, the credit institution may transfer the rights under the loan to a third party, that is, carry out an operation to assign the rights to claim the debt under the loan agreement.

The assignment of a claim (§ 1 of Chapter 24 of the Civil Code of the Russian Federation) means the transfer of rights belonging on the basis of an obligation to the original creditor (assignor) to a new creditor (assignee) under an agreement (clause 1 of Article 382, clause 1 of Article 388 of the Civil Code of the Russian Federation ).

So, the assignment of rights to claim debt under a loan agreement is called an assignment. Simply put, it is the sale of debt. An agreement is concluded between a credit institution and a third party, according to which the third party assumes the debt of the borrower.

Today, the most common option for assigning rights to claim debt under a loan agreement is transferring the debt to collection companies. Collection companies work on a percentage of the transaction and collect debt from the borrower on their own.

In general, an assignment implies that the borrower must agree to it. But in modern conditions, credit organizations easily circumvent this requirement by initially including assignment terms in the loan agreement. By signing this condition, the borrower automatically agrees to its implementation. This means that the assignment of rights to claim debt under the loan agreement will be carried out on legal terms.

However, when assigning a debt claim to organizations or an individual without a license, it is necessary to obtain the consent of the debtor, otherwise the procedure may be declared invalid.

The conclusion of an assignment agreement and the entire procedure for assigning rights is regulated by the Civil Code of the Russian Federation. In accordance with his explanations, a credit institution is not obliged to agree with the borrower on the transfer of debt to third parties. Such a decision can be appealed in court only if the loan agreement provides otherwise.

In the case where a claim is assigned under a transaction that requires state registration, the assignment agreement itself must also be registered (clause 2 of Article 389 of the Civil Code of the Russian Federation). This means that it is from the moment of registration that it is considered concluded for third parties (clause 3 of Article 433 of the Civil Code of the Russian Federation). However, the absence of registration of the agreement does not entail any negative consequences for the debtor, who was notified in writing by the assignor of the assignment of the claim and on this basis provided performance to the assignee (clause 2 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 21, 2021 No. 54).

As a general rule, a new creditor may receive fewer rights than the original one had - in the event of an assignment of the right of claim in part (clauses 2-3 of Article 384 of the Civil Code of the Russian Federation).

The original creditor has no right to cede to him more rights than he himself has. However, the volume of rights of the assignee may still increase - due to its special legal status, for example, if it is subject to the provisions of the Law of the Russian Federation of February 7, 1992 No. 2300-1 “On the Protection of Consumer Rights,” the Supreme Court considers (paragraph 2 clause 4 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 21, 2021 No. 54).

In what cases does a credit institution assign the right of claim under a loan agreement?

- Firstly, when all possibilities to motivate the debtor to make payment have been exhausted

. Most often, debts for which there is no collateral and payment for which has not been received for more than 12 months are sold. That is, we are talking about completely hopeless debt.

- Secondly, the principal debt on the loan (the body of the loan) has been paid, but the interest has not been repaid, and the borrower refuses to pay it.

- Third, the credit institution is in a state of bankruptcy, liquidation

and seeks to obtain funds to correct the situation as quickly as possible, which is why it sells off debt.

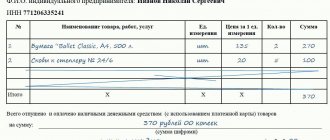

The debt sale procedure is as follows:

- The debt seller collects information about your assets and income.

- All documentation is submitted for analysis to a licensed collection agency, whose specialists study the authenticity of the documents and the legality of the creditor’s claims.

- An analysis of recovery prospects is being carried out. This takes about 3 - 4 weeks.

- A decision is made and the price for which a third party is willing to buy the debt is announced.

- If a credit institution is ready to sell debts for this amount, an assignment agreement is drawn up.

- The debtor is sent a written notice of the change of creditor and documents confirming the conclusion of the assignment agreement.

- The debtor makes payments to the new creditor.

Consequences for the borrower

If you look from the position of an ordinary borrower, then the assignment of rights of claim for him only means a change of creditor. The amount of debt remains the same, as does the procedure for fulfilling obligations. These points remain unchanged unless the borrower and the new lender agree to change the terms of debt repayment.

The borrower may require proof from the lender that the assignment has been made. The proof will be the seal of the new creditor on the assignment agreement. If this document is not provided by the credit institution, then the borrower is not required to make payments.

At the same time, it is worth remembering the following:

- the new creditor buys out the problem debt at a reduced cost, so making at least a small profit for the old creditor will be a favorable option, and this allows the borrower to independently buy back his debt in a much smaller amount than the accumulated debt on the debt;

- You can negotiate the most lenient repayment terms with the new lender.

But the consequences for a borrower who has ceased to fulfill his loan obligations, and the credit institution has assigned the rights of claim under his loan agreement to a collection agency, can disrupt the calm way of life of the borrower-debtor.

Questions about the legality of the assignment of credit debts to an organization that does not have a banking license are closed, namely:

- arbitration courts have established that the assignment of the right to claim a debt to a third party who is not a credit institution does not contradict the law;

- The Supreme Court clarified that, in accordance with the law “On the Protection of Consumer Rights,” the bank does not have the right to transfer the right of claim under a loan agreement with a consumer (individual) to a person who does not have a license to carry out banking activities, unless otherwise provided by law or an agreement containing this condition, which was agreed upon by the parties at its conclusion

(Paragraph 51 of the Supreme Court Resolution No. 17 of June 28, 2012 “On the consideration by courts of civil cases in disputes regarding the protection of consumer rights”).

Therefore, if the loan agreement provides for the bank’s ability to assign the debt to a person who does not have the status of a credit organization, and the credit dossier does not contain consent from the borrower for this operation, then the court may recognize the assignment agreement as void (according to paragraph 2 of Article 388 of the Civil Code of the Russian Federation, Article 26 “Banking secrecy” of the Federal Law of December 2, 1990 No. 395-1 “On Banks and Banking Activities”).

In conclusion, it is worth noting that in 2021, Federal Law No. 230-FZ was adopted “On the protection of the rights and legitimate interests of individuals when carrying out activities to repay overdue debts and on amendments to the Federal Law “On microfinance activities and microfinance organizations” dated June 03, 2021, which sets boundaries for the activities of collection agencies and describes point by point the methods by which agencies can collect debts, including from individual borrowers.

Source: Press, financial and reference system “Financial Director”