General principles for forming the 1st section of the form

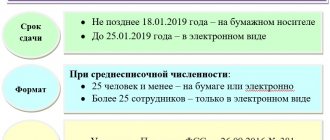

Starting with reporting for the 1st quarter of 2021, a new form 6-NDFL is used (approved by order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected] ).

This form is radically different from the previous one: sections 1 and 2 have changed their purpose, and accordingly, the content of all lines of the report has changed. You can read more about all changes in form 6-NDFL from 2021 in the Review from ConsultantPlus, having received trial access to the system. It's free.

In the previous form 6-NDFL, approved. By order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] , line 140 was intended to reflect information about the amount of withheld tax to be transferred to the budget on a certain date.

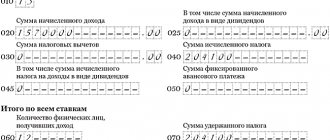

From the 1st quarter of 2021, line 022 is intended for this, which is an integral part of the information blocks that form the 1st section of 6-NDFL. Each block is intended to include in the report information about the deadline for transferring personal income tax to the budget. The structure of the block consists of lines with serial numbering from 021 to 022. Data is posted into the block in a certain sequence:

- first, line 021 indicates the day no later than which the personal income tax shown on line 022 (formerly page 140) must be transferred to the budget (taking into account the norms of Article 226 of the Tax Code of the Russian Federation);

- after that, in line 022 (previously page 140), you must indicate the amount of tax withheld from the payment for which the block is being filled out.

Thus, the indicator for line 022 is interconnected with the characteristics of filling out other lines in each specific report.

ConsultantPlus experts have prepared step-by-step instructions for filling out the new form 6-NDFL. You can get trial access to K+ for free.

Completing the second section

The structure of the second part of the document includes serial numbering from 100 to 140 to provide all the necessary data about the individual.

All information is included in the reporting in a certain sequence:

- the date of payment of income to the employee is indicated (page 100);

- the actual amount of remuneration is entered in field 130;

- in cell 110 the day on which tax funds were withheld must be entered (data from field 130);

- line 140 is necessary to indicate in it information regarding the amount of tax that was withheld from the employee’s salary;

- in field 120 indicate the deadline for transferring funds to the budget.

How to form line 140 if there were payments at different tax rates

Lines 021 and 022 in 6-NDFL are formed without subdividing the summary totals into income and tax withheld at different rates. This is explained in the letter of the Federal Tax Service dated April 27, 2016 No. BS-4-11/7663. Thus, if in one payment (for example, salary) personal income tax was withheld at different rates, in the 2nd section of the report for such payment one block will be formed with combined information about the entire amount of the payment on line 021 and the entire amount of personal income tax withheld on line 022 .

NOTE! Section 2 of 6-NDFL is filled out for each applicable personal income tax rate separately, i.e. the number of sheets required to fill out section 2 may exceed the number of sheets on which the information for section 1 will fit. Federal Tax Service in letter No. BS-4-11 /7663 additionally explains what to do with “extra” report sheets that are formed due to different approaches to filling out sections of the form. In the blank blocks of the 1st section you need to put dashes, including on line 022 (previously p. 140).

Read more about the filling procedure in the article “ How to correctly fill out section 2 in the calculation of 6-NDFL?” .

What is reflected in line 140 in the 6-NDFL report for 2021

Next, let's look at filling out line 140 in 6-NDFL for 2021 using the most common situations as an example.

Filling out 6-NDFL quickly and without errors in the “My Business” online service

The service will remind you of deadlines, take into account all the nuances of filling out, generate, check and send reports.

Get free access

When personal income tax was withheld at several rates

When different rates are applied, the report indicates the entire tax amount, excluding rates. That is, when filling out section two, we focus not on tax rates, but on the dates of receipt of income and tax withholding. This procedure is confirmed by letter of the Federal Tax Service dated April 27, 2016 No. BS-4-11/7663.

Important!

The first section of the 6-NDFL report is filled out separately for each rate.

When the salary was given in installments

If the employee’s salary is paid in parts and on different dates, then the amounts are displayed in section 2 of the report in different blocks. This is enshrined in Appendix 2 to the order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

Simply put, in 6-NDFL, as many lines as 140 are formed, as there were payments. Please note that the amount of tax reflected on line 140 must necessarily correspond to the amount of income indicated on line 130.

When wages are accrued but not issued

Important!

If an employer accrues income in one reporting period and makes payments in another, then this operation is reflected in the reporting period in which it was completed.

Let's explain with an example

:

Salaries were calculated in June and paid in July. In this case, 1 section is completed

report 6-NDFL, and

section 2 remains blank

, in accordance with the letter of the Federal Tax Service dated February 12, 2016 No. BS-3-11 / [email protected] That is, the lines of section 2 reflect the amounts and dates of the actual payment of income to the employee.

When income is issued to a foreigner

If you employ a foreigner, then when calculating tax on his income, you need to take into account the following nuances:

- if a foreigner does not require a patent, line 140 is filled out according to the general rules;

- if the amount of the patent exceeds the amount of calculated personal income tax, the amount of income of the foreign worker is reflected in line 130, and “0” in line 140;

- if the amount of the patent is less than the calculated personal income tax, line 130 still reflects the amount of income, and line 140 shows the difference between the amount of the patent and the income tax.

When it is impossible to withhold income tax

If the employer cannot withhold income tax from employees, then in line 140

"0" is filled in.

When the total income on lines 140 does not match in line 070

The generalized amount of withheld personal income tax is reflected in line 070 and is calculated on an accrual basis. Line 140 includes the amount of tax withheld only for the last three months, i.e. based on the results of the reporting period.

It turns out that the values on line 070 and line 140 can coincide in the 1st quarter (according to the new rules, equality of the amounts on line 070 and line 140 is not a prerequisite). The values of the lines in the following periods will not match, since line 070 will include data for half a year, with the next report for 9 months, and line 140 will reflect the amount only for the last quarter.

Be careful:

when an employee’s wages are calculated in March and paid in April,

the income tax for March, reflected in line 140, will appear in the report for the half-year

, and not for the first quarter. In this case, the values on lines 070 and 140 will not coincide in the report for the first quarter.

Download form 6-NDFL doc xls pdf

When line 140 in 6-NDFL is “0”

A similar situation arises when income is accrued, but personal income tax is not withheld.

Let's look at the possible reasons:

- The deduction is greater than or equal to the amount of income tax

If the base for calculating tax is “0”, no tax is charged. The base for calculating personal income tax is zero (clause 3 of Article 210 of the Tax Code) when the amount of tax deductions is greater than taxable income.

- The patent covered the tax

If a foreign worker has a fixed advance payment (patent) that is greater than calculated in the corresponding personal income tax period, then in fact only 1 section is completed for it:

Nuances of reflecting a foreign worker’s patent

If, when calculating the tax of a foreign employee, payments made by him under a patent are taken into account, the procedure for forming 6-NDFL has its own characteristics.

If payments under a patent exceed the amount of tax that the tax agent must withhold, all settlements with such an employee will actually be reflected in the 2nd section of the report:

- 110 - amount of income (accrued);

- 140 each - the estimated amount of personal income tax from charges in favor of a foreigner on a patent;

- 150 each - the amount to reduce the accrued tax due to fixed payments.

In the 1st section, the only (essentially reference) information will be the indication of the date of transfer and the amount of payment from the tax agent by a foreign individual:

- by 021 - 00.00.0000;

- for 022 - 0.

NOTE! It is possible that the amount of payments under a patent is not sufficient to cover the amount of personal income tax payable. Then the agent’s taxable portion of the income appears. In this case, according to the above logic, according to section 1, personal income tax is formed for withholding and additional payment by the tax agent (the difference between lines 140 and 150). Then, on line 021 of the 1st section, payment dates for this difference should appear (according to the norms of Articles 223, 226 and 6.1 of the Tax Code). And on line 022 there will no longer be 0, but the amount of tax to be withheld and transferred to the budget by the employer.

How to generate data for section 1 if there were several payments for one accrual

If the income was paid in several amounts on different dates, then each such payment is shown separately in 6-NDFL (a separate block is filled out). This follows from the filling requirements approved by Appendix 2 to the order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

Therefore, if several payments were made for one accrual on different days, the report will include as many lines 022 as there were payments. In this case, the value for each line will be calculated based on the amount of the partial payment.

What to put in line 022 (formerly line 140) if income has been accrued, but payment has not yet taken place

In cases where the income has not yet been paid in fact, in relation to such amounts and the personal income tax on them, section 2 of the report should be completed, and section 1 should not be completed. This is implied by the filling requirements and is confirmed by explanations from the Federal Tax Service (see letter from the Federal Tax Service dated February 12, 2016 No. BS-3-11 / [email protected] ).

Consequently, in relation to the tax on income that has not yet been paid upon the fact, line 022 (formerly page 140) of the report is not filled in (as well as the other lines of section 1, which would correspond to it if filled out).

What information does lines 130 and 140 of the 6-NDFL declaration contain?

In lines 130 and 140 of section 2 of form 6-NDFL, information about the total income of the company’s employees is recorded. In this case, the amount excluding withheld taxes is placed in line 130, and the entire tax deducted from this income is entered in line 140.

In the reporting process, it is necessary to remember that the amount of employee income for the month entered in line 130 will correspond to the amount of actually accrued income only if it is completely tax-free. This point is explained in more detail in the Letter of the Federal Tax Service of Russia dated December 15, 2016 No. BS-4–11/ [email protected]

Results

Line 022 (formerly page 140) of the 1st section of 6-NDFL is intended to indicate data on the amount of tax actually withheld to be transferred to the budget on the date specified in page 021.

Read our articles about filling out other report lines:

- “Procedure for filling out line 190 (formerly line 090) of form 6-NDFL”;

- “Line 130 in 6-NDFL - what is included there and how to fill it out?”

An example of filling can be found here.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Let's sum it up

- Line 140, located in Section 2 of form 6-NDFL, is included in the set of lines 100-140, issued for each income payment, and reflects the amount of tax withheld from taxpayers on this payment.

- Tax data for line 140 should be taken from tax registers, since the calculation of tax withholdings is carried out individually for each payer and is not amenable to arithmetical control in aggregate figures.

- The set of lines 100-140 under certain conditions may be missing in the current report, despite the presence of income accruals or payments. A number of situations result in zeros being shown on line 140 (as well as lines 110 and 120).