Reasons for changing the general director of an LLC

The head of the LLC, or rather its sole executive body (general director), is elected at the general meeting of the company's participants. The term of office of the general director is specified in the company's charter.

The reasons for changing the director of an LLC may include the following:

- expiration of his term of office;

- the manager’s own desire to leave his post;

- common decision of the parties;

- death of a leader;

- election of a new leader.

These grounds are independent and do not depend on the effectiveness of the manager. The last reason is a special circumstance that is subject to assessment by other LLC management bodies and business owners. The grounds for changing the director in this case coincide with the grounds for dismissing an employee at the initiative of the employer, provided for by the Labor Code of the Russian Federation (Part 1 of Article 81 of the Labor Code of the Russian Federation). In particular, company participants may decide to change the general director if he:

- systematically violates his labor duties (Part 5 of Article 81 of the Labor Code of the Russian Federation);

- violated a trade secret (clause “c”, clause 6, part 1, article 81 of the Labor Code of the Russian Federation);

- committed actions that provide grounds for loss of trust in him by other bodies of the LLC (Clause 7, Part 1, Article 81 of the Labor Code of the Russian Federation);

- made a decision that resulted in damage to society (clause 9, part 1, article 81 of the Labor Code of the Russian Federation).

- removal from office of the head of the organization - the debtor, can be carried out in accordance with the legislation on insolvency (bankruptcy)

- other grounds provided for in the employment contract

These are just examples of the actions of the director, which may be followed by his change. The general director is, first and foremost, an employee of the company, so his neglect of his job responsibilities may become the basis for hiring a new employee for this position.

For greater convenience, we will break down the procedure for replacing the current general director of an LLC into a series of sequential steps.

Changing the governing bodies of a non-profit organization

Another type of changes in non-profit organizations are changes made to the structure of governing bodies or a change in the name of the governing bodies of the NPO.

Let's consider this form of non-profit organization as a foundation. In accordance with current legislation, the structure of management bodies in the fund is as follows: the council (presidium) is the highest management body, the director (chairman, president) is the sole executive body and the board of trustees is the supervisory body. The law stipulates that the highest management body cannot be called the Management Board. But this was not always the case, and at the moment there are funds where the highest governing body is the Board. If such a Fund makes changes to the charter, it will necessarily have to change the name of the supreme management body of the fund, for example, to the council or presidium.

In accordance with the Federal Law “On Charitable Activities and Volunteering (Volunteering)” dated August 11, 1995 N 135-FZ, a control and audit body must be formed in a charitable foundation - an auditor or an audit commission.

Previously, there was a practice that the Ministry of Justice would not allow the registration of charitable foundations without an auditor. However, now, if changes are made to a charitable foundation, the Ministry of Justice writes refusals due to the absence of such a position as an auditor in the Charter.

Therefore, when making any changes to the Charter of a charitable foundation and the absence in the Charter of such a position as an auditor or an audit commission, it is necessary to make changes to the Charter of the fund and provide for the presence of an audit body in the new version of the Charter. Please note that the auditor cannot be a member of other management bodies of the Fund.

A similar situation occurred with associations. The legislation does not specifically mention that an audit body must be formed in the association. The Civil Code states that in associations or unions a sole executive body (chairman, president, etc.) is formed and permanent collegial executive bodies (council, board, presidium, etc.) can be formed. However, now the Ministry of Justice writes refusals in the absence of the position of Auditor in the Charter of the Association, referring to Article 65.3 of the Civil Code of the Russian Federation, according to which the competence of the highest body of the corporation includes the election of the control and audit body of the corporation. Since the association is a corporate organization, according to the Ministry of Justice, it must also form an audit commission or elect an auditor.

That is why, if changes are made to the charter of the association in the absence of such a body as an auditor, it must be included in the new edition of the charter of the Association, and also do not forget to elect a person to this position and reflect this in the minutes of the supreme governing body.

Changes may be made to the structure of the governing bodies of an NPO in connection with the expansion of the activities of a non-profit organization, due to an increase in the number of employees, members of the NPO, an increase in the number of events held and programs and projects being implemented. Let's take, for example, such a form of NPO as an association. The minimum set of governing bodies is a general meeting of members and a sole executive body. To form such a structure of governing bodies, only two founders are enough. But in the course of the association’s work, the need often arises to form a collegial executive body in order to “unload” the general meeting of the association members and the sole executive body and transfer those powers that are not the exclusive competence of the supreme management body. Also, part of the powers of the head of the association may be transferred to the collegial executive body. If previously the sole executive body of the association was responsible for accepting members, expelling members of the association and maintaining the register of association members, now these powers can be transferred to the collegial executive body. However, do not forget that when forming a new body, you must immediately elect persons to its composition. In the association, all governing bodies are formed only from among the members of the association ; accordingly, these persons must be included in the members of the association.

Required documents

Let us immediately make a reservation that some of them, for example, form P14001, will have to be certified by a notary, with the exception of electronic filing using an enhanced qualified signature of the applicant. Only the current manager can do this, since only he has the necessary powers.

The complete list of required information will look like this:

- form P14001 certified by a notary;

- extract from the Unified State Register of Legal Entities (fresh, no more than 5 days). Sometimes notaries themselves receive them online. It is worth clarifying, when planning a visit to a notary, whether he will need an extract from the Unified State Register of Legal Entities or whether he will upload it himself;

- certificate of state registration of LLC;

- certificate of registration with the tax office;

- a decision (protocol) confirming the authority of the manager; in addition, an order to take office and an employment contract may be needed;

- manager's passport.

It is better to check the list of documents that will allow you to witness a signature on an application for amendments to the register of legal entities directly from a notary. Sometimes their requirements are slightly different from each other.

How to submit

All pages are folded in order of designation and numbered .

The documents are taken by the applicant (in this case, the new director) to the notary for witnessing of the signature.

The notary copies the completed document.

A completed application can be submitted to the registration authorities in several ways:

- personally by the applicant or his representative (by proxy) to the tax office;

- the applicant or his representative to the multifunctional center (MFC);

- by registered mail with a list of enclosed papers;

- an electronic document drawn up according to certain rules on the website of the Federal Tax Service through a special service for submitting documents for registration (a digital signature of the applicant or notary is required).

If a new director has joined the organization, these changes must be declared on form P14001 within three days from the time they occurred or a decision was made about their necessity.

If this deadline is not met, under Article 14.25 of the Code of Administrative Offenses of the Russian Federation, you can receive a fine of 5,000 rubles or a warning.

When changing the surname of the founder or director, with rare exceptions, filing P14001 is no longer required .

Step-by-step instructions for changing the CEO of a company

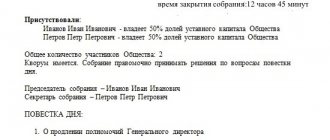

The first step is to convene a general meeting of LLC participants and make a decision to change the director. Such a decision is made by a majority vote of the participants, unless the charter provides for a different procedure, and is documented in minutes. If the LLC has one founder, the decision is made by him alone. The decision must indicate:

- the basis for the change of director;

- specifics of releasing a director from office (for example, payment of benefits, if provided for by the charter);

- details of the new director.

Second step:

Obtaining an extract from the Unified State Register of Legal Entities from the tax office

To prepare documents and subsequently certify the signature of the general director, it is necessary to order an extract from the Unified State Register of Legal Entities from the tax office. The notary will require you to provide an extract from the Unified State Register of Legal Entities, the statute of limitations of which is no older than 10-30 calendar days.

In order to order an extract, you must pay a state fee of 400 rubles for an urgent extract, or 200 rubles for a non-urgent one, and provide a pre-filled application for an extract. An urgent statement is provided the next day after submitting an application; a non-urgent statement is provided a week later. Absolutely any company employee or individual can order an extract, even without a power of attorney. If the general director of the company personally orders an extract, then you do not have to pay the state fee, but in this case the extract will be provided as if it were not urgent, only a week after submitting the application. Therefore, ordering an urgent extract will be much more convenient.

Third step:

Preparation of documents for changing the head of the company

Necessary documents for registering a change of manager with the tax office

- It is necessary to fill out an application on form P14001. The application does not need to be stapled and sewn with threads, as this will be done by the notary after it is certified;

- It is necessary to prepare minutes of the meeting of the founders of the company on the change of the general director (in the case of 2 or more founders in the company);

- It is necessary to prepare a decision of the sole founder of the company on changing the general director (in the case of the only founder in the company);

- Order on the appointment of a new general director.

Fourth step:

applying to the tax authority with an application to make changes to the information in the register of legal entities. This must be done no later than three days after the new manager takes office, otherwise the company faces a fine under Art. 14.25 of the Code of Administrative Offenses of the Russian Federation in the amount of 5 thousand rubles. After this, the tax inspector issues a receipt of receipt of the documents, and changes are registered within 5 working days.

Fifth step: Notify the bank. The bank must record the signature of the new manager, as well as all his personal data. The notice period is not established by law. But it is in the best interests of the business to notify the bank immediately after the shift. Most often, it is the general director who has the right to sign payment documents. Therefore, from the moment of termination of the powers of the previous manager, it will be impossible to carry out banking transactions. If an early change occurs, then until notification, the bank will carry out transactions in accordance with the current card. To make changes, you must present the bank with documents confirming the change of manager:

- decision to change the director;

- extract from the register of legal entities;

- passport of the new manager;

- order for his appointment.

Step six – There is no need to renegotiate contracts with counterparties.

Moreover, notifying counterparties about a change in the head of the company is not a mandatory procedure, except in cases where this notification is indicated in the concluded agreement. But in order to avoid possible informational and documentary misunderstandings, it is worth sending out to counterparties a notice of this change in free form. There is no need to sign additional agreements with counterparties in connection with the change of the general director. A change of director is not a change in the details of a legal entity. This is simply a change of authorized representative. It is worth writing and sending out this kind of document only after the fact of the dismissal of the old general director and the assumption of the position of a new one has already been fixed in the Unified State Register of Legal Entities.

Entering information about the second head of the NPO

During state registration of a non-profit organization, a sufficient number of founders is not always recruited to form the desired structure of governing bodies. Therefore, it is necessary to create NPOs with a minimum set of management bodies, that is, with the structure of management bodies that is required by law.

After state registration of a non-profit organization as a legal entity, it can begin activities provided for by the charter of the NPO. In the course of implementing the activities of the Organization, for example, new members may be admitted to corporate organizations. Thus, the organization develops and “grows”. Due to the increased volume of work, it is increasingly difficult for the current manager to fulfill his duties, so it may be necessary to create the position of a second sole executive body.

If there is a need to create the position of another manager, you must understand that the corresponding changes must be registered in the manner prescribed by law. Such changes are registered by the Ministry of Justice. First, you need to decide what the position of one of its leaders will be called. As a rule, a Vice President is appointed if there is a President, or a Director if there is a Chairman.

To enter information about an additional manager into a non-profit organization, it is necessary to prepare a protocol or decision of the highest management body, an application in the form P13001, P14001 and a new version of the charter of the non-profit organization. The minutes of the highest management body indicate the decision to create a sole executive body of the organization and who will be appointed to this position. Let me remind you that in corporate organizations (public organizations, associations, bar associations) all management bodies are formed from members of the Organization, including the sole executive management body.

It is necessary to determine whether the new sole executive body will act on behalf of the legal entity without a power of attorney or under a power of attorney. If the manager acts by proxy, then information about this person is not entered , which means that an application in form P14001 is not required to be filled out. Information about such a manager is indicated in the protocol. If a person acts without a power of attorney, then information about the sole executive body is also indicated in the application on Form 14001.

In any case, it is necessary to amend the charter of a non-profit organization , which should indicate the procedure for the formation and term of office of the sole executive body, as well as the competence of the head.

Competence must be divided between two managers. For example, the competence of the President of the Association includes the following:

- acts on behalf of the Association without a power of attorney, including representing its interests and making transactions;

- issues powers of attorney for the right of representation on behalf of the Association, including powers of attorney with the right of substitution;

- opens and closes bank accounts of the Association;

- carries out general management of all activities of the Association;

- carries out general management of the activities of committees, commissions, sections, associations and working groups created by the Association;

- approves the rules, procedures and other internal documents of the Association, with the exception of documents, the approval of which is referred by this Charter to the competence of the General Meeting of Members;

- carries out admission of members to the Association in the manner determined by the General Meeting of Members of the Association;

- carries out the exclusion of members from the membership of the Association, in the manner determined by the General Meeting of Members of the Association;

- maintains a register of members of the Association;

- within the limits of its competence, makes decisions and issues orders, orders and other acts on the activities of the Association, binding on members and staff of the Association;

- disposes of the property of the Association within the limits established by the General Meeting of Members of the Association, this Charter and the current legislation of the Russian Federation.

- on behalf of the Association interacts with government authorities, local governments, government, commercial and non-profit Russian, foreign and international organizations and citizens;

- manages the international activities of the Association;

- makes claims and lawsuits against Russian and foreign legal entities and citizens on behalf of the Association;

- annually reports to the General Meeting of Members of the Association on the results of its activities;

- exercises other powers that are not within the competence of other bodies of the Association.

Then it is within the competence of the Vice-President of the same Association that he:

- acts without a power of attorney on behalf of the Association, including representing its interests and making transactions;

- issues powers of attorney for the right of representation on behalf of the Association, including powers of attorney with the right of substitution;

- opens and closes bank accounts of the Association;

- represents the Association in government bodies, local governments, state, commercial and non-profit Russian, foreign and international organizations on the development of the statutory goals of the Association;

- maintains direct contacts and connections with commercial, non-profit and other organizations that support the goals of the Association, enters into relevant agreements, participates in congresses, symposia, conferences, forums, exhibitions and events;

- considers current issues related to the activities of the Association;

- prepares materials, projects and proposals on the implementation and development of the statutory goals of the Association;

- conducts congresses, conferences, seminars, round tables, discussions in accordance with the purposes for which the Association was created;

- makes decisions and issues orders, orders and other acts on the activities of the Association, binding on members and staff of the Association;

- provides the General Meeting of Members with a report on the results of its activities.

Sample of filling out form P14001

The application form was approved by Order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/ [email protected] , the document consists of 51 sheets. For different cases of changes in LLC registration information, different sheets are filled out.

The rules for filling out P14001 when changing the director are similar to the rules for filling out form P11001: only capital letters; can be filled out manually in black ink or on a computer in Courier New font 18 points high; printing on only one side of the sheet, etc. You can find out all the requirements for filling out in full in the Federal Tax Service order No. ММВ-7-6/ [email protected]

Which sheets of form P14001 should I fill out when changing directors? Total 8 pages:

- title page, where information about the organization is indicated;

- sheet K - page 1 (for the former director);

- sheet K - pages 1 and 2 (for the new director);

- sheet P – all 4 pages (information about the applicant).

Since the application is sequentially numbered, the first page will be the title page, page 1 of sheet K with the data of the former director is assigned the number 002, etc. Blank pages of form P14001 are not submitted to the tax office.

Who applies for a change of director - the old or new director? On the one hand, information about the new director has not yet been entered into the Unified State Register of Legal Entities, on the other hand, the previous director has already been deprived of his powers. About 10 years ago, there was a practice of signing an application by the old director as a person whose information was included in the state register (letter of the Federal Tax Service dated October 26, 2004 N 09-0-10/4223). Later, by decision of the Supreme Arbitration Court of the Russian Federation dated May 29, 2006 N 2817/06, this provision was declared invalid, as inconsistent with the Law “On LLC”.

Moreover, the courts have repeatedly emphasized that the powers of the former leader terminate from the moment the corresponding decision of the participants is made (for example, the decision of the Supreme Arbitration Court of the Russian Federation dated September 23, 2013 No. VAS-12966/13). Based on this, the application in form P14001 can only be signed by a new director; the previous director no longer has any relation to the LLC.

Change of OKVED

When registering an organization, the application must indicate the type of activity in accordance with the All-Russian Classification of Types of Economic Activities (OKVED) in accordance with which the activity will be carried out. Which must meet the following requirements:

- must comply with the goals of the non-profit organization, which are provided for by its constituent documents;

- should not be prohibited by the legislation of the Russian Federation.

In the future, an already registered organization may need to change its main type of activity or add and (or) exclude an additional type of activity. To do this, you will need to carry out the procedure for state registration of changes in the Unified State Register of Legal Entities.

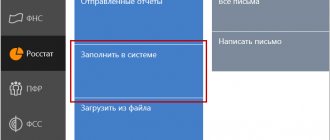

To register changes you will need:

• Draw up a protocol (decision) which will reflect the types of economic activities that are introduced and (or) liquidated (drawn up in 2 (two) copies);

• Fill out the application according to the form; to change OKVED, form P14001 is suitable (if you do not need to make changes to the organization’s Charter); if, when changing OKVED, you need to make changes to the organization’s charter, then you need to choose form P13001. (drawn up in 2 (two) copies, one of which is certified by a notary, and the other is signed by the manager);

• The Charter (if changes are made to it) is drawn up in 3 (three) copies;

• Power of attorney (if the procedure for registering changes is not performed by the manager).

After everything is prepared, the above set of documents is submitted to the appropriate department of the Ministry of Justice. Registration of changes by NPOs according to the law takes 1.5 months.

It must be remembered that in this type of change a mistake is often made when choosing the application form.

Accounting support

Zero 1500 rub. Activity 3500 rub. Activities + Salary 5000 rub.

• Personal accountant • Possibly remotely • 12 years of experience • 1000+ NGOs • All forms • Grants

Call your accountant right away

*The cost in Moscow and Moscow Region, St. Petersburg and Leningrad region is respectively: 2000, 5000, 7000 rubles

Order a consultation

Changes in the Unified State Register of Legal Entities when the head changes

By virtue of the provisions of Article 40 of Federal Law No. 14, the director of an LLC is vested with public functions and the right to represent the company in external relations. In this regard, counterparties and competent authorities must know in advance and from open sources which person has the right to represent the organization, sign powers of attorney, contracts, etc. This issue is resolved by recording the data of the head of the company in the Unified State Register of Legal Entities. To do this, the following must be recorded:

- initials of the company director;

- his passport details;

- Taxpayer Identification Number (if available).

Accordingly, when changing the director of the company, it is necessary to notify the tax office at the place of registration of the LLC within 3 days from the date of appointment of the new director.

Notification form No. R14001 is unified and approved by the order of the NSF of the Russian Federation “On approval...” dated January 25, 2012 No. ММВ-7-6/ [email protected] This application is signed by the new director and notarized.

A change of director does not entail the need to make changes to the constituent documents, therefore filing an application in form P14001 when replacing a director is not subject to a fee (Article 333.33 of the Tax Code of the Russian Federation).

Changing the name of the NPO

Changing the name of a non-profit organization is not uncommon, and there can be many reasons for changing the name. The name may change for various reasons, for example, due to the fact that it does not correspond to its type of activity or it simply contains grammatical errors.

If you decide to change the name, you need to remember that it must comply with current legislation. At the moment, the name of an NPO must contain two parts: the first is the name of the organization itself, the second is an indication of its organizational and legal form.

You also need to remember that there are several nuances that require compliance, namely:

- The name must be written only in Russian (in addition, the name may be in a foreign language);

- The name of the organization should not contain any foreign words;

- The use of words such as “Russian Federation”, phrases derived from them and the names of Russian government agencies requires special permission.

Sample act of acceptance and transfer of documents

A mandatory procedure when changing a director is the transfer from the old director to the new director of the constituent and other documents of the company for which the director is responsible. The volume of transferred documentation may vary depending on the size of the company and the performance of other functions (personnel, legal, financial) by the director of the LLC. In addition to the documentation itself, the organization's forms, seals, stamps, keys to safes, passwords, etc. must be transferred. The document confirming the fact of transfer and recording the list of transferred papers is the acceptance certificate.

My personal recommendations

- Between the former and the new manager it is necessary to draw up an act of acceptance and transfer of documents according to the inventory. This act must be notarized.

- Today I recommend notarizing the decision or minutes of the meeting of participants (founders) on changing the sole executive body. In different regions, these registration steps take place differently. Somewhere today, notarization may not be required. Check with your registration authority.

You may be interested in the article - Step-by-step instructions for changing the founder (participant) of an LLC in 2020

@garant_ooo

Sample additional agreement when changing the director of an LLC

In addition to the tax authorities, the new head of the company must also notify the banks in which the company’s accounts are opened, as well as counterparties with whom the organization has contractual relations.

Another question that often arises among practitioners when replacing a manager is the need to renew existing contracts or make changes to them in terms of replacing a representative (signatory).

The current regulations do not clearly regulate this issue. Current practice shows that the director of a company signs contracts representing the interests of the legal entity, and not his own.

The latter means that a change of director is not a mandatory basis for renewing existing contracts or making adjustments to them. Nevertheless, an additional agreement in the event of a change of manager can be drawn up (for example, if there is such a wish on the part of the counterparty or a direct indication in the contract with him).

What happens if you don’t notify the bank about the change of general director

It is necessary to send a letter notifying about a change of director because the current founders bear administrative and even criminal liability for failure to notify of such changes. So, you need to visit the bank to change the signature on the company cards.

New bank cards are subject to mandatory certification. Today, banks independently provide notary services, so signature confirmation is very fast. It is also required to obtain a new electronic key when changing the director’s last name. If the bank was not notified and the signature was not changed, and if a new electronic key was not received, all financial transactions will be carried out on behalf of the inactive head of the company, which can lead to various troubles.

The time limit for notifying the bank is not established by law. But until the financial institution is informed about the change of general director, it will carry out settlement transactions on the basis of the issued card. If you have various suspicions about possible fraud by the old manager, you need to send a covering letter to the bank with a request to stop conducting any transactions on the old accounts. This document must be signed by the new general director, attaching a copy of the protocol on his appointment to the position of head of the enterprise.

List of necessary documents provided to the bank when replacing the general director of an enterprise to obtain a new card:

- old bank card;

- minutes of the general meeting on the appointment of a new director;

- passport and TIN of the new owner of the company;

- extract from the Unified State Register of Legal Entities;

- certificate of entry into the Unified State Register of Legal Entities regarding the change of director;

- OGRN code.

Decision of the LLC participants to change the director

If the company has more than one founder, then a general meeting of participants should be convened. Ideally, when a planned general meeting has already been scheduled in the near future. However, if such a meeting has not been scheduled, then the participant must send a request to the director to convene an extraordinary meeting (Clause 2, Article 35 of the LLC Law). If the director refuses to convene a meeting, then any of the participants with more than 10 percent of the share can gather all the founders independently (Clause 4, Article 35 of the LLC Law).

Minutes must be kept at the meeting, in which the question of changing the general director should be raised. The deadline for drawing up a protocol for an LLC is not specified by law. For the decision to dismiss a manager to be valid, more than 50 percent of the participants must vote positively on each item on the agenda (termination of powers of the general director and appointment of a new one). The charter may establish other decisions at meetings.

The protocol must include:

- termination of powers of the former general director of the LLC: his full name. and TIN (if available);

- appointment of a new general director, his full name and full passport data;

- the term of termination of the powers of the current director and the start date of the powers of the new one (the term of office is usually fixed in the organization’s charter);

This information will help when you subsequently contact the tax service to register changes.

The fact that a decision was made by the general meeting of founders and the list of those who appeared must be notarized. The general meeting has the right to provide for another method of confirmation (without the participation of a notary), enshrining it in the charter or unanimously adopting an appropriate decision. Such a unanimous decision, in turn, must be notarized. This norm is valid only to certify the decision of the founders to change the general director, which was made later than December 25, 2019 (clause 3 of article 67.1 of the Civil Code of the Russian Federation, clause 2 of the “Review of judicial practice on certain issues of application of legislation on business companies dated December 25, 2019”), clause 1 of the FNP letter dated January 15, 2020 No. 121/03-16-3, Ruling of the Supreme Court of the Russian Federation dated December 30, 2019 No. 306-ES19-25147 in case No. A72-7041/2018).