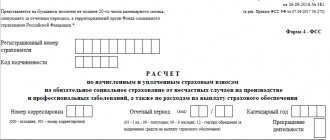

Firms and individual entrepreneurs using hired labor, from the report for 9 months of 2017, are required to submit quarterly to the Social Insurance Fund a form showing the procedure for calculating contributions for insurance against accidents and injuries, as well as a number of related information. The legally approved instructions for filling out the 4-FSS in 2021, which can be found in the public domain on the websites of information and legal systems and more, will help prevent errors in the report. Having received the necessary information, fund employees check the correctness of the calculation and the completeness of the payments made.

Who submits Form 4-FSS for 2018 and when?

Form 4-FSS displays information about accrued and paid “accidental” contributions at work. It is submitted at the end of each quarter to the territorial office of the Social Insurance Fund by all employers:

- LLC and JSC;

- Individual entrepreneur with hired employees;

- private practitioners paying remuneration to citizens subject to compulsory social insurance.

If no activity was carried out and wages were not paid to hired employees, then:

- LLCs are required to submit a zero calculation;

- Individual entrepreneurs registered as policyholders submit a report with zero indicators;

- Individual entrepreneurs without registration with the Social Insurance Fund and without employees do not report on injuries.

Individual entrepreneurs without hired employees have the right to register with the Social Insurance Fund on a voluntary basis and pay insurance premiums for themselves.

In this case, you do not need to submit any reports. Form 4-FSS was approved by FSS Order No. 381 dated September 26, 2016. It was not updated in the 4th quarter of 2021. 4-FSS in a convenient Excel format can be found here.

Policyholders have the right to submit a calculation on paper or electronically, provided that the average number of personnel for the past year was 25 people or less. If this indicator has been exceeded, the employer has only one option available: electronic via telecommunication channels (TCS).

The legislation establishes 2 deadlines for submitting the 4-FSS report:

- before the 20th day of the month following the reporting month - on paper;

- until the 25th – in electronic format.

Thus, for 2021 it is necessary to report no later than 01/18/2019 (since 01/20/2019 falls on a Sunday) on paper and 01/25/2019 - according to the TCS.

The legislation on “unfortunate” contributions does not provide for the postponement of the deadline for submitting 4-FSS to the next closest working day if it falls on a non-working date. Therefore, we recommend that you report on paper in advance.

Basic information about the annual 4-FSS is presented in the diagram:

Reporting for the Social Insurance Fund, which transferred to the Federal Tax Service in 2021

The 2021 FSS reporting update suggests that part of the responsibility for collecting funds is shifting to the tax services. This is the main calculation for insurance premiums, which is submitted quarterly. At the beginning of the next year, you need to provide a final document for the entire previous period. This includes maternity contributions.

For the 2021 FSS reports submitted to the Federal Tax Service, the update also concerns the submission deadlines: now they must be submitted by the 30th, regardless of the submission method. On paper, as before, only enterprises that employ no more than 25 people can provide everything.

The new form was approved in October 2021. On the website of the tax authorities there are instructions for filling out; for 2021 the required pages of the FSS report are also listed. It will be necessary to submit in April (the deadline has been postponed to May 2 due to the weekend), July and October.

Are there sanctions for late reporting?

If the report is submitted later than the established deadline, the policyholder will face a fine of 5% of the unpaid premiums for the last quarter for each overdue month (full and incomplete), but not more than 30% of the established amount. If the report is not submitted, but insurance premiums have been paid or not accrued, the minimum amount of sanctions will be 1 thousand rubles.

We recommend that you do not leave the payment until the last day, since the social insurance fund has the right to refuse to accept it. The grounds for such a refusal are listed in clause 16 of the FSS Administrative Regulations, approved. by order of the Ministry of Labor of the Russian Federation dated March 20, 2017 No. 288n:

- The calculation is presented on a form different from that established by Order of the Social Insurance Fund dated September 26, 2016 No. 381.

- The report is submitted by an unauthorized person.

- The electronic report file is signed with an invalid enhanced digital signature.

Possible sanctions

Please note that you must remember to donate 4-FSS to the fund. Otherwise, for its absence you will have to pay a fine of at least 1000 rubles (Clause 1, Article 26.30 of Law No. 125-FZ). In general, it will amount to 5% of the amount of contributions payable for January – March 2021, but not more than 30% of it.

In addition, most likely, the manager/employees of the enterprise who are responsible for the generation and submission of the reports in question will also face an administrative fine. They will have to fork out an amount of 300 to 500 rubles (Part 2 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation). But this fine is not imposed on entrepreneurs.

Algorithm for filling out form 4-FSS for the 4th quarter of 2021

Form 4-FSS consists of a title page and 6 tables. However, not every employer should complete them all. Some of them are issued only if information is available.

| Sheet of form 4-FSS | Must be included in the report | Tables to be filled in if information is available |

| Title page | + | |

| Table 1 – calculation of the base for “unfortunate” insurance premiums | + | |

| Table 1.1 – data on employees sent to another organization (agency labor) | + | |

| Table 2 – calculation of injuries | + | |

| Table 3 – benefits paid in connection with industrial accidents | + | |

| Table 4 – number of victims in an industrial accident | + | |

| Table 5 – data on special assessment of working conditions | + |

Let's consider a step-by-step algorithm for filling out form 4-FSS using the example of a small company.

Example

Design Studio “Elite” LLC employs 4 people. When filling out the 4-FSS annual report, the accountant found out that she only needed to fill out the required sheets, since there were no insured events in 2021.

The accountant began processing the calculation with the title page. Let's look at the features of filling it out.

General requirements

The procedure for filling out 4-FSS established by the supervisory authority determines a number of mandatory requirements for the document. Those who fill out information about the organization on paper should carefully read them.

In the case of working with an electronic document format, a special program will indicate that the fields are filled in incorrectly and will even check the compliance of the indicators in order to ensure that they are correct.

When submitting a calculation on paper, you can fill it out first on a computer or manually, but in this case you need to remember the following rules:

- You can only use a fountain pen or ballpoint pen;

- The ink color must be blue or black (the use of other colors is not allowed);

- Information must be entered strictly in block letters.

In the lines and columns, space is reserved for only 1 indicator; it is strictly prohibited to enter several in them. If some information is missing, then you cannot leave the column empty - you need to put a dash in it.

Error correction

Knowing the general rules for entering information, some policyholders do not remember how to fill out 4-FSS in case of errors. In such cases, it is strictly prohibited to use concealer or other similar products. If you find an error/clip, proceed as follows:

- the erroneous meaning must be crossed out;

- indicate the correct parameter next to it;

- near the adjusted value, the employer himself, acting as the policyholder, or his representative/authorized person puts his signature (in the same ink that the document itself is filled out);

- The date of amendments to the document is indicated, and not the date of submission of the report.

If an individual entrepreneur or organization has a seal, then she also needs to endorse the corrections.

Filling sequence

If the policyholder has recently opened an enterprise and is submitting reports for the first time, he may have a completely natural question about how to fill out form 4-FSS. You need to follow the established rules. It is better to enter information in this order:

- transfer all information about the organization to the title page;

- from the title page to the remaining pages, transfer the values for the fields “policyholder registration number” and “subordination code” (they will be the same for the organization) - in electronic format they are usually placed on other sheets automatically;

- fill out all mandatory tables and additional ones if data is available;

- check the received parameters;

- after entering all the information and carefully checking, make continuous numbering of all pages (1, 2, and so on), entering the appropriate values in the “page” field;

- indicate on all pages the date of preparation of the document, as well as the signature of the employer or his authorized/responsible person.

Please note : there is no “page” field on the title page, but this particular sheet will be the first, and for subsequent ones 2, 3, and so on are entered.

This algorithm will help you avoid getting confused and do everything correctly. But before entering information, you also need to familiarize yourself with the rules for filling out all components of the report.

Let's sum it up

Form 4-FSS is submitted at the end of each quarter by all employers to the territorial Social Insurance Fund no later than the 20th day following the reporting month, on paper and before the 25th day - in electronic form. Based on the results of the 4th quarter of 2021, it is necessary to submit a report by 01/18/2019 on paper and by 01/25/2019 by TCS. Since 01/20/2019 falls on a weekend, we recommend that you do not delay submitting the report until 01/21/2019, since there is no official clarification on the possibility of postponing the deadline.

The 4-FSS report records the amount of insurance premiums for injuries, as well as payments related to industrial accidents. The calculation is filled out with a cumulative total from the beginning of the year and broken down by month.

The order of filling out the pages

The most difficult thing for policyholders is directly filling out the tables and title page of the document. Therefore, when entering information into 4-FSS, the filling sample will help you avoid many mistakes. However, it is recommended to further independently study the rules for drawing up the document, and only then proceed to enter the parameters.

Title page

By and large, the title page is detailed information about the organization or individual entrepreneur acting as the insured. To enter information, you can take a notification from the Social Insurance Fund and constituent documents. This will make it easier to find information. On the first page you will need to enter the following information:

- Registration number of the policyholder.

- Subordination code. It consists of 5 digits (put down in accordance with the place of current registration of the policyholder).

- Correction number. If the report is submitted for the first time, it will correspond to the code “000”. If an adjustment report is already submitted, then it will have the number 001, 002, and so on - depending on the number of adjustment reports. Moreover, if an adjustment is provided after a long period of time, then it is filled out on the form that was in force during the reporting period. For example, for the 1st half of 2017 you need to submit reports that are still unchanged.

- Reporting period. Consists of two columns of 2 cells each. In the first two, you need to indicate the reporting period (3 months - 03, 1st half of the year - 06, 9 months - 09, year - 12). The second two cells are filled in only when the policyholder applies to the supervisory authority for the allocation of funds to pay premiums. That is, if the company has currently applied for security 2 times, then 02 is entered.

- Calendar year. Moreover, it does not refer to the moment of filling, but to the year in which the reporting period falls.

- Information about the organization (full name or full name for an individual entrepreneur or an ordinary individual, INN, KPP, OGRN, registration address). INN and OGRN may have fewer characters than they are allocated in the cells; in this case, you need to put zeros in the extra fields at the beginning.

- OKVED code. The main activity code is entered in accordance with the current classifier. Dashes are placed in the remaining empty cells.

- Contact number. Only numbers are indicated, without any brackets or signs. This could be a landline or mobile phone.

The termination field is not left blank. If the organization is liquidated, then the letter “l” is entered, otherwise a dash is added. For budgetary organizations, a separate column is provided to indicate financing (from 1 to 4); for simple enterprises, a dash is placed.

The following is information about working employees, namely:

- average payroll number (how it is calculated for 4-FSS, read more in the article);

- number of employees with disabilities;

- number of workers with hazardous working conditions.

At the end of the title page information about the person providing the report is indicated. First, the status is indicated in the form of a number from 1 to 3. For the policyholder, the corresponding number is 1. Additionally, you need to indicate the full name of the head of the company or individual entrepreneur, affix the date and signature. The stamp is affixed if available.

Be careful : the date of the document must correspond to the date of applying to the FSS or sending the information by mail.

The data on the provision of the report must be left blank; they will be filled in by a specialist from the supervisory authority when accepting the documents.

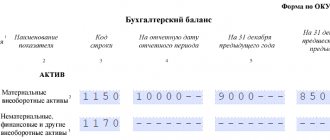

Table 1

Table 1 indicates the amounts subject to payment of insurance premiums and those not requiring such payments (monthly and for the reporting period in total), as well as the conditions for calculating insurance premiums, namely:

- established insurance rate;

- discounts or allowances, if any;

- final fare taking into account individual discounts and surcharges.

For rows 1, 2, 3, and 4, column 3 is calculated as the sum of the values in columns 4, 5, and 6 if the calculations are for 1 quarter. Line 3 is calculated by subtracting the values from line 1 from the values in line 2.

table 2

To fill out the second table, you will need accounting information. To calculate monthly insurance premium amounts, you need to multiply the values from line 3 in table 1 (in the corresponding month) by the established tariff from line 9.

To indicate the amounts of insurance premiums paid, payment documents will also be required (their dates and numbers are indicated).

Tables 3, 4 and 5

Tables 3 and 4 are filled out only when insured events occur at the enterprise during the reporting period. If there were none, you can exclude this sheet from the report completely.

Table 5 is mandatory. The features of entering information into it are described in detail in the article Filling out Table 5 of Form 4-FSS.

New reporting regulations

On 09/08/2019, Order No. 265 of 05/22/2019 of the Social Insurance Fund of the Russian Federation came into force, which introduced a new procedure for submitting reports 4-FSS - administrative regulations for the provision of public services for the acceptance of documents serving as the basis for the calculation and payment (transfer) of insurance premiums, and documents confirming the correctness of calculation and timely payment (transfer) of insurance premiums.

The previous regulations, approved by orders of the Ministry of Labor No. 288n dated March 20, 2017 and No. 774n dated November 8, 2017, which guided employers, have become invalid. They were canceled by Order of the Ministry of Labor No. 361n dated May 28, 2019.

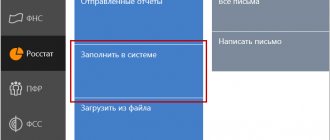

Most of the rules for providing Form 4-FSS have been preserved. Employers have the right to submit papers in person, by mail and through the MFC. For those who have switched to electronic reporting, it is possible to submit information using the State Services website.

The terms within which the Fund’s employees provide the service are separately specified:

- If accepted in person, documents will be accepted on the day they are received;

- when applying through the MFC - on the day of submission of papers;

- when applying through the State Services portal - no later than 1 business day following the day of receipt.

If documents are submitted on a weekend or non-working holiday, they will be accepted on the first working day. In this regard, we recommend that you do not leave reporting until the last few days: you may not be able to make it in time.

Pay special attention to the list of documents that the FSS now requires. Since the acceptance of documents has become a public service, the employer, in addition to the reports themselves and documents confirming the correct calculation of insurance premiums, will need to fill out a special application for their acceptance.

Application form to the Social Insurance Fund for receiving reporting services (must be submitted along with the report)

Please note: such an application must be submitted every time you submit Form 4-FSS and documents confirming the legality and completeness of the accrual and timely payment (transfer) of insurance premiums (see clause 19, part 2, article 17 of Law No. 125-FZ ). Since it is possible to submit reports to any territorial branch of the Social Insurance Fund, without reference to the place of registration of the policyholder, carefully fill out the header of the application and correctly indicate which territorial branch you want to submit documents to.

The number of sheets sent to the Fund varies depending on the quarter. Be sure to also control what data you enter in the appropriate field, especially if you report online and the program does not independently count the number of prepared pages.