Who must submit a report on Form 1-T and when?

Officials determined that only small businesses are exempt from the need to submit this statistical report. All other organizations must report to statistics.

Any organization has the opportunity to independently check whether it needs to submit this report. This can be done on the official website of Rosstat (note that the previous website address does not work; our link will take you to the current page). To do this, you must enter the OKPO, INN or OGRN of the organization. If you still need to take it, you should do it before January 21, 2021. After this date, statistical authorities will begin to apply penalties to latecomers.

Separately, it should be noted that if an organization has separate divisions (branches), then the 1-T report is filled out and submitted both separately for each of such divisions and for the entire organization as a whole. It is important to understand that in this case, by a separate unit, officials understand any territorially separate unit from the organization, at or from the location of which economic activity is carried out at equipped stationary workplaces. Whether such a unit is registered as separate or not does not play a role in this case. The report should be submitted to the territorial statistical authorities at the location of each of them.

In addition, bankrupt organizations in respect of which bankruptcy proceedings have already been opened are not exempt from the obligation to submit this report. The legislation allows not to submit this form only after the complete liquidation of such a legal entity.

Generating and sending reports to Rosstat

The report is created using the algorithm presented below.

First of all, you need to go to the main window of the service and select the “Rosstat” , then “Fill in the system”:

Select a report form from the list offered by the system:

To select a form, you can use the search bar - it is performed by the name of the report or OKUD.

In the window that opens, select “Edit” . A report form will open for you to fill out. To familiarize yourself with the approved procedure for filling out the report, click on the icon with a question mark.

Enter data into the reporting form:

To move to the next section of the document, use the “Next” , and to return to the previous section, use the “Back” .

After entering all the data, select the “Save and Close” .

To check and send a document, you must select the “Send” tab:

Control of the content of the form will start automatically. If the report contains errors, a list of them will be displayed on a separate page:

- If there are any errors. To make corrections, you need to open the form, correct errors and run the check. To open a report line that contains an error, you need to select a link with a description of the error or select a bookmark "Edit report":

To print or save a document in printable PDF format, you must select a bookmark “Print the report on a form”. - If there are no errors. You need to select the “Proceed to Send” , and then “Sign and Send” . Certify the document with an electronic signature and submit it to the territorial body of state statistics (TOGS).

The reporting is transferred to the server of the electronic reporting operator and stored in the list of transmitted reports ( Rosstat → Sent reports ).

Documents received after sending reporting forms

No later than one business day after sending the reporting forms, the service user receives the following documents:

- “Confirmation of date of dispatch” - serves as confirmation of the fact of transmission of the report and records the time of sending. Signed with an electronic signature on the part of the recipient and the sender.

- “Notice of receipt” - generated upon receipt of the statistical reporting form by Rosstat.

The time of sending the reporting form is taken into account according to the time zone of the region where the TOGS is located.

No later than two working days the user receives:

- “Notification of acceptance for processing” means that the document has successfully passed verification and was accepted by the statistics body.

- “Error Notification” or “Format Mismatch Notification” means that the document did not pass the review due to detected errors. The violations should be corrected and the document sent to Rosstat again.

The statistical reporting form is considered accepted if the following documents are received:

- "Confirmation of dispatch date";

- “Notification of acceptance for processing”.

Sample of filling out the 1-T statistics form

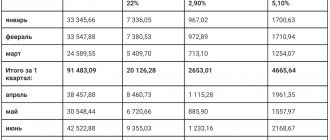

Before you start filling out the document itself, you need to remember that it contains such an indicator as the average number of employees. It can be calculated using the standard formula:

The sum of the average number of employees for all months of the reporting year, divided by 12.

In this case, the average number of employees per month is calculated as follows:

The sum of the payroll number of employees for each calendar day of the month, from the 1st to the 30th or 31st (for February - on the 28th or 29th), including holidays (non-working days) and weekends, divided by the number of calendar days of the month.

Form 1-T: filling rules

Statistics require filling out this document based on data as of December 31, 2021. The title page is easy to fill out. It should have:

- full name of the organization and a short name in brackets next to it;

- legal address of the legal entity, indicating the subject of the Russian Federation and the index;

- the actual address of the organization, if it does not coincide with the legal one,

- OPKO code assigned by Rosstat.

In section 1 you should indicate the numerical values:

- the average number of employees of the organization, broken down by industry;

- the wage fund of these workers;

- social benefits fund for these employees;

- fund for payments to external part-time workers.

The number of employees must take into account all persons working on the basis of employment contracts, including those performing temporary or seasonal work, as well as the owners of the organization if they receive a salary. The average headcount traditionally does not include external part-time workers, persons with whom civil contracts have been concluded, employees on maternity leave, and employees on study leave.

Who is required to report?

The following are subject to continuous surveillance:

- Organizations that, at the end of 2021, were listed in the register of small and medium-sized enterprises (SMEs) in the “microenterprise” or “small enterprise” category.

- Anyone who had the status of an individual entrepreneur at the end of 2021 (regardless of being a small business).

Receive a fresh extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs with the signature of the Federal Tax Service Send an application

According to Rosstat order No. 469 dated August 17, 2020, respondents must fill out one of two reports:

- Form No. 1-entrepreneur “Information on the activities of an individual entrepreneur for 2021” is intended for individual entrepreneurs.

- for organizations from the category “micro- and small enterprises” - form No. MP-SP “Information on the main performance indicators of a small enterprise for 2021.”

Fill out and submit “MP-SP” and “1-Entrepreneur” for free via the Internet

The forms of statistical reports differ from the usual tax returns - they are more like questionnaires. Kontur.Elba cannot know all the data requested by Rosstat, so you need to answer the questions yourself. The following instructions will help you give correct answers.

Self-test

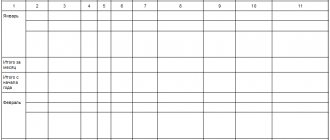

In order to check the correctness of its completion, department specialists prepared control ratios. They are shown in the table:

| No. | Data control |

| 1 | sum of lines from 02 to 13 = line 01 in columns 4, 5, 6, 7 |

| 2 | line 14 column 4 and 6 = 0 |

| 3 | line 15 = sum of lines 01 and 14 in columns 4, 5, 6, 7 |

| 4 | line 14 <= line 15 according to columns 5 and 7 |

| 5 | line 01 <= line 15 in columns 5 and 7 |

Instructions for entrepreneurs

Title page

Form No. 1-entrepreneur has a title page and three sections. "Kontur.Elba" will automatically fill in the basic details of the taxpayer on the title page, all that remains is to enter the missing ones.

REFERENCE

When filling out the form, you need to select the Rosstat branch where the report will be sent. Not all branches will appear in the drop-down list, but only the most suitable ones. But, if you start entering the desired department number, it will still be found, even if it is not in the short list.

Section 1. General information

The first question asks if the individual entrepreneur did not work and did not receive income in 2021. Question 1.2 should be answered “Yes” if in 2020 the individual entrepreneur worked as an employee of another entrepreneur or organization. The answer to question 1.3 indicates the number of months of work.

REFERENCE

If in any month an individual entrepreneur worked at least one day, take into account this month along with the months worked in full. For example, you have a seasonal job: from May to September you rent out bicycles - 5 months. But, if the rental opened on the last day of April and closed in the first days of October, indicate 7 months.

When answering question 2, you need to enter the actual address where the main activity is carried out.

In question 3, you need to find out about all the taxation systems that the individual entrepreneur applied in 2021.

The answer to question 4 indicates the number of employees, partners, and contributing family members.

Section 2. Key performance indicators

In the fifth question, you need to indicate whether paid services were provided to the population. If the work was carried out only with legal entities, Fr.

When answering question 6, you should click “Add line”, select the type of activity from the drop-down list and indicate the amount of income for it.

ATTENTION

Fill in amounts in thousands of rubles with one decimal place. If the revenue from bicycle rental in 2021 was 1,240,570 rubles, then write 1240.6 in the form.

Section 3. Fixed assets (funds) and investments in fixed capital

In the seventh question, “Yes” is indicated if there are fixed assets, and in question 7.3 their total cost in thousands of rubles is indicated. Question 7.4 notes the cost of constructing, renovating, or purchasing new fixed assets in 2021.

The eighth question asks the number of vehicles used for cargo transportation. Both your own and rented vehicles are taken into account.

Fill out and submit the “1‑entrepreneur” form through “Kontur.Elba”

Unified system of classification and coding of economic information

Official statistics use a unified system for classifying and coding economic data. Examples are:

- Classification by economic sectors;

- Classification of types of economic activities;

- Classification of financial transactions;

- Classification of goods and services;

- Classification of liabilities and assets of an enterprise;

- Classification of taxes and other fees;

- Classification of expenses of government bodies;

- Classification of administrative forms of ownership, etc.

The main objectives of the unified classification and coding system:

- Creation of favorable conditions for the formation of a unified information environment on the territory of the Russian Federation;

- Systematization of data in accordance with unified classification rules, their application in forecasting the social and economic development of the state;

- Information support in the field of taxation, social insurance, licensing, real estate transactions, etc.;

- Promotion of cooperation and specialization in the production field;

- Streamlining the certification and standardization of manufactured goods and services provided;

- Promoting intersectoral exchange of information resources;

- Ensuring compatibility of information resources and information systems;

- Harmonization of a unified classification and coding system with regional and international standards and classifications.

What are statistics codes for?

You will need knowledge of statistics codes in the following cases:

- opening a bank account;

- submission of tax and accounting reports;

- filling out payment orders and payment receipts;

- submission of statistical reporting (Gosstat);

- carrying out export-import operations;

- changing the place of registration of an individual entrepreneur or the location of an organization (legal address);

- when opening a branch of the organization;

- changing the full name of the individual entrepreneur or the name of the legal entity;