Components of an enterprise's equity

In the Russian economic and legal tradition, equity capital (hereinafter referred to as SC) is usually defined as a set of the following main components:

- authorized capital (as well as its analogues: share capital, represented by contributions of partners, mutual funds, etc.);

- additional capital;

- reserve capital;

- amounts corresponding to those spent on repurchasing shares;

- retained earnings.

There are other interpretations of the concept of equity. But from an accounting point of view, the concept we have presented can be characterized as the most holistic and adapted to practice. Moreover, the formal right to adhere to it was given to us by the legislator. Clause 66 of Order No. 34n of the Ministry of Finance of Russia dated July 29, 1998 states that the structure of the insurance company takes into account authorized, additional, reserve capital, retained earnings, as well as other reserves, which, in principle, can include amounts corresponding to those transferred for shares.

consider the features of accounting for an organization's equity capital by consistently studying the nuances of accounting for its individual components.

Let's start with the authorized capital.

THE PROCESS OF FORMING OWN CAPITAL IN MODERN CONDITIONS

The article allows us to assess the significance and stages of formation of organizations' own capital in modern conditions of economic development.

Key words: capital, profit, resources, source, owner.

Everyone knows that today any organization cannot exist without capital, that is, without the potential that allows it to function and develop. Capital is divided into own and borrowed capital. Borrowed capital is divided into long-term (maturity period more than 12 months) and short-term (maturity period less than 12 months).

Borrowed capital is borrowed funds (credits and borrowings), as well as accounts payable. By attracting capital from outside and guaranteeing payment of this capital to creditors, the organization expands its activities and operates in the market. Accounts payable include: settlements with suppliers, settlements with customers regarding advances received, settlements with personnel for wages, settlements with the budget and extra-budget, etc.

As for equity capital, it is necessary to provide the composition and stages of its formation. When registering an organization, every manager must understand the fact that without capital there is no chance of opening a profitable enterprise.

Based on the economic definition of capital, it should be noted that equity includes: authorized capital, reserve capital, additional capital and retained earnings.

Let us consider in detail each of the elements of equity capital.

Reserve capital is capital that allows the formation of enterprise reserves, or a reserve of resources that can be used to avoid incurring expenses or losses.

The second element of equity capital is additional capital. Additional capital is capital that is formed as a result of the revaluation of non-current assets. Overestimation may be

- either a markdown or an additional valuation. The moment of determining what exactly will happen - an additional valuation or a markdown - depends on the market value of a particular non-current asset that is being assessed [3].

The third element of equity is the organization's retained earnings.

Retained earnings can be accumulated over a certain period of time, or can be an element of the reporting year. As for the retained earnings of the reporting year, this type of profit cannot be called a source of equity capital, since in fact there are economic indicators that can adjust the amounts of retained earnings of the reporting year.

It is worth noting that when analyzing the process of forming retained earnings of the reporting year, one can notice that this profit is formed in several stages:

– gross profit as the difference between revenue and cost;

- revenue from sales

— as the difference between gross profit and administrative and commercial expenses;

– profit before tax

- as the sum between profit from sales and the balance of other income and expenses.

And only the fourth stage generates net profit for the reporting period. The process is expressed as the difference between profit before tax and income tax, the rate of which is determined by the Tax Code of the Russian Federation and is 20% of profit before tax.

In the equity capital system, the main indicator and often the most complex is the authorized capital.

Authorized capital is funds or property contributed by the founders when registering an LLC. In accordance with paragraph 1 of Art. 14 Federal Law No. 14-FZ “On LLC”, the authorized capital of an LLC determines the minimum amount of its property, guaranteeing the interests of its creditors, and is made up of the nominal value of the shares of its participants.

Regarding the contribution to the authorized capital, we can say that the contribution by the founders can be made by various property [2]:

– funds to the current account, confirmed by a bank statement;

– current assets - supporting documents of the organization on the acceptance of this property;

– non-current assets - supporting documents on the acceptance of this property.

It is worth noting that the founders can be both individuals and legal entities. There can be one founder as the founder of the organization; if such a situation arises, then the contribution is made individually.

Also, when assessing the formation of equity capital, it is necessary to highlight problematic issues that arise during its formation:

– imperfection of regulatory regulation, which creates many controversial issues and makes capital formation difficult for the organization;

– reflection of the process of formation of equity capital in full and in full;

– reflection of equity capital in the financial statements of the organization;

– targeted use of the organization’s own capital.

When considering this issue, you must also pay attention to the importance of equity capital and the consequences of the illegality of its formation.

Analyzing the structure of the organization’s equity capital, as well as the sources of its formation, taking into account the process of assessing the dynamics, makes it possible to identify certain problematic issues in the sphere of functioning of a particular organization.

If there is insufficient reserve, there may be losses and the occurrence of any emergency situations that negatively affect the activities of the organization.

We can also highlight such a problem as insufficiency of equity capital and own sources of financing economic activities. When analyzing the balance sheet, it can be noted that if accounts payable exceed equity, analysts draw conclusions that the enterprise is operating inefficiently. In other words, the company has a low level of financial independence.

Persons who are interested in obtaining the greatest economic benefits can be considered as sources of financial resources, that is, the capital of the organization. In this regard, financial control over compliance with the economic interests of all its participants is important. The main source of information on which control is carried out is the financial statements of the organization.

Poor information to the owner about the real state of affairs of the organization threatens bankruptcy, as well as a lack of expected profits and benefits or direct losses.

The only way the owner can exercise financial control of the organization is through annual financial statements certified by an auditor with an opinion on its quality and suitability for exercising financial control.

To improve the financial condition of the organization, as well as improve the process of formation and distribution of equity capital, the following ways are used:

— reduction of production duration due to the introduction of the latest technologies and process automation;

– improving the organization of logistics for the uninterrupted supply of necessary material resources and reducing the time that capital remains in reserves;

– acceleration of the process of shipment of products and execution of settlement documents;

– reducing the time spent in accounts receivable;

– creation of a reserve fund, as well as improvement of its accounting and reflection in the balance sheet.

Bibliography

1. Civil Code of the Russian Federation [Electronic resource] // SPS “Consultant Plus”

2. Own capital / Burmistrova L.M. // Finance. - 2013. - No. 4. - 32 p.

3. The process of forming the authorized capital /Gavrilova A.N.// Finance. - 2014. - No. 1. - 21 p.

4. Organization of enterprise activities /Knysh M.I// Economics. - 2013. - No. 5. - 65 p..

Accounting for authorized capital as part of equity

The considered component of the insurance company is one of the main sources of the formation of the company’s property assets.

Authorized capital and similar business categories perform 3 main functions:

- investment (the corresponding amount of funds is allocated for the acquisition of various non-current assets, fixed assets, etc.);

- reserve (authorized capital is one of the main security resources of the company in credit and contractual legal relations);

- communication and partnership (through the distribution of shares in the authorized capital, control over the business of individual entities is established).

Accounting for the authorized capital is carried out using synthetic account 80, which is included in the chart of accounts approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

This synthetic account belongs to the passive category: a decrease in the authorized capital is recorded as a debit of the account, an increase - as a credit. It is often used in correspondence with another synthetic account - 75, also approved by law.

Capital and reserve accounting

Aubakir L.V.

KSTU

Topic 11 Accounting for capital and reserves

Plan

11.1 The procedure for forming the authorized capital and its accounting

11.2 Share capital, the procedure for its formation and changes

11.3 Accounting for retained earnings (uncovered loss)

11.4 Accounting for the formation and use of reserve capital

11.1 The procedure for forming the authorized capital and its accounting

Capital is the assets of a business minus all liabilities.

Capital can be divided into subclasses. For example, in a joint stock company, funds contributed by shareholders, retained earnings, reserves, which represent allocations of retained earnings.

Sometimes the creation of reserves is required by charter or law to provide additional protection to the enterprise and its creditors from the impact of losses.

The amount that determines equity on the balance sheet depends on the valuation of assets and liabilities.

Authorized capital is the start-up capital that a business entity needs for production activities in order to receive further income.

Authorized capital is the main indicator characterizing the size and condition of the enterprise. It is reflected in the amount specified in the constituent documents, as the totality of the founders’ contributions. The amount of the authorized capital remains unchanged throughout the entire activity of the enterprise and can only be changed in exceptional cases. Changing the authorized capital is associated with the procedure for re-registration of its value in the constituent documents and re-registration of the enterprise. The decision to change the size of the authorized capital is made in the manner prescribed by law.

The accounts of Section 5 “Capital and Reserves” are intended to summarize and record information about the state and movement of the authorized capital of the entity.

Subsection 5000 “Authorized capital” includes three groups of accounts: 5010 “Preferred shares”, 5020 “Common shares” and 5030 “Deposits and shares”.

The balance of the accounts of subsection 5000 must correspond to the amount of the authorized capital recorded in the constituent documents of the enterprise, if the enterprise has fully formed its authorized capital.

To account for the debt of the founders on contributions to the authorized capital, a counter-regulating account 5110 “Unpaid capital” is intended, the debit of which reflects the amount of the authorized capital that must be contributed by its founders in correspondence with the accounts of subsection 5000 “Authorized capital”. The actual amounts received from the founders' deposits are reflected in the debit of the accounts for cash, inventories, fixed assets and other assets from the credit of account 5110 “Unpaid capital”.

11.2 Share capital, the procedure for its formation and changes

Joint-stock companies keep records of their own shares purchased from shareholders for the purpose of further withdrawal from circulation on account 5210 “Repurchased own equity instruments.” On the debit side, the accounts reflect the cost of repurchased own shares in correspondence with the cash accounting accounts, and on the credit side, the withdrawal of shares from circulation in correspondence with the accounts of groups 5010 “Preferred Shares”, 5020 “Common Shares” and 5030 “Deposits and Shares”.

Share premium refers to the amounts received by a joint stock company as a result of the sale of its own shares at a price higher than their nominal value. The share premium is recorded on account 5310 of the same name, the credit of which shows the amount of sale of own shares in correspondence with the debit of cash accounting accounts - upon receipt of proceeds from the sale of own shares; accounts receivable - upon presentation of invoices. The amount of additional paid-in capital can be used for the consumption needs of the joint-stock company.

11.3 Accounting for retained earnings (uncovered loss)

In organizations, another type of equity capital arises - retained earnings (uncovered loss). Retained earnings represent the part of equity that has not been distributed among shareholders as dividends and income to participants in business partnerships. Retained earnings can be used to pay dividends and income to partnership participants, as well as to create reserve capital in accordance with the constituent documents.

Accounting for retained earnings (uncovered loss) is kept in the accounts of subsection 5500 “Retained earnings (uncovered loss)”,

Accounting for retained earnings (uncovered loss) of the reporting year is kept on account 5510 “Retained earnings (uncovered loss) of the reporting year,” which is intended to summarize information about the presence and movement of amounts of retained earnings or uncovered losses that arose in the reporting year. The main account is passive, but it can also be active for an unprofitable enterprise.

Retained earnings can increase from year to year, representing growth in equity.

Funds from the revaluation of fixed assets and long-term investments that remained in the accounts of subsection 5400 “Reserves” are used to increase retained earnings.

Financial results of previous years are reflected in account 5520 “Retained earnings (loss) of previous years.”

11.4 Accounting for the formation and use of reserve capital

In accordance with current legislation and constituent documents, business entities can form reserve capital. The source of reserve capital formation is retained earnings.

Reserve capital is used to cover expenses provided for by the tax code, that is, to cover losses from business activities, to repay bonds of a joint-stock company and accrue dividends, as well as to repurchase shares of a joint-stock company.

Reserve capital is accounted for in the accounts of subsection 5410 “Reserve capital established by constituent documents.” The credit of the account reflects the amount of contributions to reserve capital from retained earnings of the reporting year, and the debit shows the use of reserve capital funds.

In addition to the reserve capital established by the constituent documents, the enterprise can create other reserves. To account for reserves for the revaluation of fixed assets, intangible assets, and financial investments, the corresponding accounts are opened in groups 5420 “Reserves for revaluation”, 5430 “Reserves for the revaluation of intangible assets”, 5440 “Reserves for the revaluation of financial assets available for sale”.

Correspondence accounts for capital and reserves

| Contents of operation | Account correspondence | |

| Debit | Credit | |

| 1. Registered authorized capital of JSC and LLP | 5110 | 5030 |

| 2. The founders paid off their debt in cash at the cash desk | 1010 | 5110 |

| 3. Shares were sold to shareholders at a price higher than their par value (reflect the amount of share premium) | 1010 | 5310 |

| 4. The cost of fixed assets increased as a result of revaluation | 2410 | 5420 |

| 5. The amount of accumulated depreciation of fixed assets was adjusted as a result of the revaluation of fixed assets | 5420 | 2420 |

| 6. Reserve capital has been formed within the amounts approved by the constituent documents at the expense of retained earnings of the reporting year | 5510 | 5410 |

| 7. Reserve capital was used to cover last year’s losses | 5410 | 5520 |

| 8. Income written off at the end of the reporting period | Section 6 accounts | 5610 |

| 9. Expenses written off at the end of the reporting period | 5610 | section 7 accounts |

| 10. Dividends on shares were accrued from retained earnings | 5510 | 3030 |

Basic literature [1-9]

Further reading [1-15]

Test tasks for SRS

- Concept and elements of capital.

- The procedure for forming the authorized capital and its accounting.

- Share capital, the procedure for its formation and changes

- Unpaid capital.

- Accounting for retained earnings (uncovered losses).

- Accounting for the formation and use of reserve capital.

Accounting for authorized capital: use of subaccounts

In the process of accounting for equity capital, it may be necessary to use a number of additional subaccounts on accounts 75 and 80.

These include:

- subaccount 80.01, which records information about certain movements of the authorized capital;

- subaccount 80.02, which records the value of subscribed shares;

- subaccount 80.03, on which experts advise recording the amount of funds contributed by the founders of the company.

To fully reflect transactions to increase the authorized capital, it is recommended to use an additional subaccount 75.01. For example, in correspondence with subaccount 80.01.

How do loans and credits differ from each other?

This is the question that most often arises among accounting employees.

A loan can only be obtained from a bank or other credit organization, i.e. an organization that has the right to carry out certain banking operations on the basis of a license from the Central Bank of the Russian Federation. The loan can be received from any individual or legal entity in accordance with Art. 807, 819 of the Civil Code of the Russian Federation.

It is worth noting that until June 1, 2018, the loan agreement was considered concluded at the moment of transfer of money to the borrower. After 06/01/2018, it can be considered concluded at the time of its signing (by analogy with loan agreements).

There are no fundamental differences in terms of reflecting the transactions under consideration in accounting and tax accounting in terms of the type of loan or credit agreement.

Postings when replenishing the authorized capital from property, shares and profits

The authorized capital can be formed not only by crediting funds, but also by various property in respect of which the founders have made a valuation.

If we are talking about replenishing the authorized capital with the help of property, then to reflect such transactions in the registers, debit entries of such synthetic accounts, such as, for example, 08, 10, 41, can be used in correspondence with the credit of the above-mentioned subaccount 75.01.

The authorized capital can be replenished from external resources. Their acquisition can be facilitated by the issue of shares (for JSC) or work to attract additional portfolio investments (for LLC). Moreover, from an accounting point of view, all such operations are almost identical and are recorded using the posting: Dt 75.01 Kt 80.

The authorized capital of the company can also be replenished from retained earnings. For this, wiring is used: Dt 84 Kt 80.

Postings when reducing the authorized capital

The authorized capital of a company can be reduced, for example, as a result of transactions for the sale of shares concluded by the founders. Accounting for these procedures can be carried out using entries such as: Dt 80 Kt 75, if we are talking about reducing the value of shares of the authorized capital (for example, if 1 of the founders goes out of business). The debit of account 75 can also correspond with the credit of such accounts as 51 or 91, if the disposal of property that forms the authorized capital is expected.

Let us now consider how equity capital is accounted for in the context of the next component - additional capital.

Accounting for additional capital in the structure of own capital: main accounts and subaccounts

This component of the insurance system reflects the increase in the value of non-current assets due to the revaluation of fixed assets, emission procedures, or, for example, due to an increase in the price of assets due to market reasons (in particular, if the assets are represented by real estate, which has increased in price). It can be noted that non-profit organizations can consider various allocations from the budget as additional capital.

Additional capital can be considered an increase in the value of the authorized capital due to changes in exchange rates. For example, if the authorized capital is denominated in dollars and it has become much more expensive, then its revaluation may be accompanied by the subsequent allocation of the increased amount in rubles as additional capital.

The main synthetic account on which additional capital is kept is 83.

A number of additional subaccounts can be opened for him:

- 83.01, which is used in entries recording an increase in additional capital due to the revaluation of fixed assets;

- 83.02, which is used in entries recording an increase in additional capital due to emission procedures;

- 83.03, which is used in other scenarios for increasing additional capital.

It is noteworthy that in the structure of the balance sheet form, approved in the Russian Federation by law (by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n), separate accounting of indicators for additional capital, as well as those corresponding to the revaluation of non-current assets, is assumed, despite the fact that in order to reflect transactions on both The components of the company's capital use 1 and the same synthetic account - 83. We will look at this aspect in more detail a little later.

Let us give examples of entries that can be used when accounting for additional capital.

Benchmarks and predictive model

Now about the system of performance benchmarks for analyzing the state of working capital at the enterprise.

There are many of them, let’s just name the main ones.

| 1. | Current assets turnover ratio |

| 2. | Turnover period of current assets |

| 3. | The period of turnover of stocks of raw materials, supplies and other similar assets |

| 4. | Sales receivables turnover period by accounting breakdown |

| 5. | Turnover period for advances received on sales by accounting breakdown |

| 6. | Period of turnover of accounts payable to suppliers and contractors by accounting breakdown |

| 7. | Share of overdue accounts payable in the total volume of accounts payable |

| 8. | Share of overdue accounts receivable |

| 9. | Share of non-liquid inventories |

Let's talk about each one separately.

1. The turnover ratio of current assets is the number of turnovers that current assets make during the analyzed period.

Cob.ac. = (Income for the period) / (Current assets at the end of the period)

2. The turnover period of current assets is the duration of one turnover that current assets make, in days.

Pob.ac. = (Current assets at the end of the period * Duration of the reporting period) / (Income for the period)

3. The turnover period for inventories of raw materials, materials and other similar assets shows how many days on average they are completely written off into production.

Sub.record = (Inventories at the end of the period * Duration of the reporting period) / (Written off to production for the period)

4. The sales receivables turnover period shows how many days, on average, receivables are repaid.

Pob.dz.= (Accounts receivable at the end of the period * Duration of the reporting period) / (Revenue for the period)

5. The turnover period for advances received on sales shows how many days later, on average, advances received are offset.

Inc. = (Advances received at the end of the period * Duration of the reporting period) / (Income for the period)

In addition to calculating the turnover of accounts receivable and advances received on sales, these indicators can be assessed in various sections - by type of activity or product group, by group of counterparties, etc.

6. The turnover period for accounts payable to suppliers and contractors shows how many days on average the accounts payable are repaid.

Ext.cz = (Accounts payable at the end of the period * Duration of the reporting period) / (Costs for the period)

In addition to calculating accounts payable turnover, this indicator is assessed separately in the context of debt for operating and investment activities.

7. The share of overdue accounts payable in the total volume of accounts payable shows the degree of timeliness of payment to suppliers for products supplied or services provided.

The calculation of this indicator is especially significant when implementing an aggressive working capital management policy, because a high proportion of overdue accounts payable carries the risk of having to repay a significant amount of obligations simultaneously.

K pr.kz.= (Overdue accounts payable at the end of the period) / (Accounts payable at the end of the period)

8. The share of overdue accounts receivable - shows the degree to which customers pay on time for products supplied or services provided. It is necessary to monitor this indicator and respond promptly when a positive value occurs.

To pr.dz.= (Overdue receivables at the end of the period)/(Receivables at the end of the period)

9. The share of illiquid inventories is an indicator that affects the liquidity of the company. This ratio is especially important to control when implementing a conservative net working capital management policy.

To non-liquid inventory = (Volume of non-liquid inventories at the end of the period) / (Volume of inventories at the end of the period)

Indicators of turnover of current assets and their individual elements, as well as the quality of debt have a direct impact on the level of liquidity. In this case, a distinction is made between the liquidity of assets and the liquidity of the company.

Asset liquidity refers to the ability of assets to quickly be involved in cash circulation. Any asset item has a different level of liquidity. The most liquid are cash and cash equivalents, as well as short-term financial investments. Inventories and non-current assets have minimal liquidity.

Company liquidity is the sufficiency of the funds available to the company to carry out its operating, investing and financial activities. In other words, a company’s liquidity is its ability to pay its obligations on time and in full.

To assess the level of liquidity, companies usually use the following indicators:

- Current ratio - represents the ratio of current assets to short-term liabilities:

To current liquid = (Current assets) / (Current liabilities)

- quick liquidity ratio - represents the ratio of current assets, excluding inventories and VAT, to short-term liabilities:

For urgent liquidation = (Current assets - Inventories - VAT) / (Current liabilities)

- absolute liquidity ratio - gives a more accurate assessment of the organization’s solvency at the time of its assessment and represents the ratio of the most liquid assets to the amount of short-term liabilities:

To absolute liquid = (Cash and cash equivalents) / (Current liabilities)

Each of the above indicators of the effectiveness of working capital management must be considered in dynamics (over several past periods) and management decisions must be made based on trends in their change.

The general view of calculation tables for monitoring can be as follows:

The first group is values for past periods, for example, for the last two years, quarterly.

The second group is the current period, deviation from the forecast value, assessment of the trend of change.

The third group is the expected (forecast) or planned values of indicators for future periods. This could be a quarter, a year, etc.

Postings for accounting for additional capital

So, one of the options for increasing additional capital is the revaluation of fixed assets. This procedure is carried out using wiring: Dt 01 Kt 83.

Another option for replenishing additional capital is issuing shares. It involves the use of the following set of transactions:

- Dt 51 Kt 75.01 (it records the receipt by the company of funds for shares at the original price);

- Dt 75.01 Kt 83 (used when the value of shares increases, as a result of which the volume of additional capital increases).

Now let's look at a series of entries on the debit of account 83:

- Dt 83 Kt 01 - used when repaying amounts corresponding to a decrease in the value of non-current assets upon revaluation;

- Dt 83 Kt 80 - reflects the transfer of additional capital to authorized capital;

- Dt 83 Kt 75 - used when distributing additional capital between the owners of the company during the liquidation of a legal entity.

Next, we will study the nuances of accounting for reserve capital.

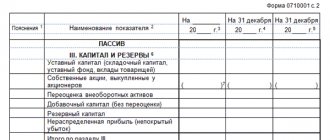

Equity as part of the balance sheet

When organizing accounting for an organization's equity capital, it is necessary to take into account the specifics of using this information in financial statements. It was noted above that all equity capital is divided into authorized, additional, reserve, retained earnings, and the amount of shares purchased from the co-owner.

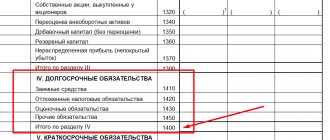

It is this structure that is reflected in the third section of the balance sheet, approved by order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. Based on the balance sheet, the company's total equity can be calculated by adding the following lines:

- 1310 - authorized capital;

- 1320 - size of purchased shares;

- 1340 and 1350 - components of additional capital;

- 1360 - reserve fund;

- 1370 - retained earnings.

Data in the balance sheet on lines 1310, 1320, 1360 and 1370 are determined based on the balances of accounts 80 (credit), 81 (debit), 82 (credit) and 84 (depending on the final financial result of the debit or credit) respectively.

Some difficulties may arise when preparing lines 1340 and 1350 in Form No. 1. The first reflects the results of the revaluation of non-current assets, the second - additional capital formed from other sources. Although the revaluation of fixed assets is by definition included in the additional fund, legislators require it to be taken into account separately in the balance sheet.

At the same time, this accounting option does not create any insoluble difficulties, since for these purposes a separate subaccount is applied to account 83 “Additional capital”. To determine the amount that needs to be entered into line 1350, you need to subtract the data from the subaccount that takes into account the results of the revaluation from the total final balance of account 83.

The total amount of equity is determined in the balance sheet on page 1300 by adding all the lines of section 3.

***

Correct accounting of an enterprise's equity capital presupposes knowledge of its structure and the features of how all its constituent elements are reflected in the accounts. When accounting, it is necessary to separately record the authorized, additional, reserve capital, the amount of repurchased shares and retained earnings. In particular, additional capital, due to the specifics of its formation from different sources, requires separate accounting for each of them. For these purposes, it is necessary to open specialized analytical sub-accounts for most accounts intended for accumulating information on changes in capital.

Retained earnings, in addition to increasing the amount of equity capital, can be used to cover losses of both current and previous periods. In this case, postings are made within one account 84, but using different subaccounts.

Of no small importance is the correct reflection of data on the state of capital in the balance sheet. For these purposes, data based on the results of the accounts of their components at the end of the period are used. In this case, additional capital is also reflected in two parts: formed through the revaluation of non-current assets and from other possible sources. Thus, knowing all the nuances listed above, a specialist will easily reflect the movement of equity capital on the accounting accounts and provide reliable information to all interested users of the statements.

Similar articles

- Own capital - what is this line on the balance sheet?

- Ways to increase net assets by founders

- The procedure for forming additional capital

- Statement of changes in capital - sample filling

- Accounting for equity

Reserve capital as a component of equity capital

Reserve capital is used as a source to cover the company's losses, as well as to fulfill the company's obligations in cases where fixed assets are insufficient. The charters of commercial organizations usually do not provide for other scenarios for using reserve capital. Reserve capital is formed, as a rule, from retained earnings, as well as personal contributions from the founders of the company.

The main synthetic account, which takes into account the considered component of the insurance system, is 82, which belongs to the category of passive.

Replenishment of reserve capital from retained earnings is documented by the entry: Dt 84 Kt 82. In turn, if this resource is replenished through personal contributions of the company’s founders, the entry is used: Dt 75 Kt 82.

Let's also consider the entries corresponding to certain methods of spending reserve capital. For example, if reserves are used to compensate for the company’s losses, then the following entry is used: Dt 82 Kt 84. If they are spent on paying off obligations, a different correspondence is used: Dt 82 Kt 66.

Concept of equity

Capital is the basis for the creation and development of an organization.

In the course of the company’s economic activities, he ensures the interests of staff, owners and the state. Each company has a certain capital, which represents the totality of cash and other funds necessary for the implementation of business activities. Depending on the ownership of a particular organization, funds are divided into own or borrowed (Fig. 1). Own capital is the source of the formation of the company's property and belongs to the liability side of the balance sheet.

Definition 1

Equity capital is formed from the funds of the organization's owners. Equity is the value of all the company's funds owned by it and used to form a share of assets. With this capital, a business entity can operate without any obstacles when making transactions. The amount of equity capital depends on the financial performance of the company. The profit received accordingly increases equity capital, and the loss decreases. The amount of equity is defined as the difference between the value of all assets of the organization and its liabilities.

Finished works on a similar topic

- Course work Accounting for equity capital 440 rub.

- Abstract Accounting for equity 250 rub.

- Test work Accounting for equity capital 190 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Own capital is formed and replenished from the following sources:

- funds (money or property) invested by the owners of the organization during its establishment (authorized capital, share capital, authorized capital);

- net profit of previous years and the reporting year minus income paid from it and dividends to the founders;

- gratuitous contributions from founders or other individuals and legal entities;

- targeted financing invested on an irrevocable basis.

Example 1

Authorized capital and net profit are the main sources of equity capital formation. The increase in the organization's equity capital is ensured by successful financial and economic activities, due to the net profit of the reporting years.

The company's own capital has the following components (Fig. 1):

- authorized capital (share capital, authorized capital);

- Extra capital;

- reserve capital, other reserves;

- retained earnings.

Have questions about this topic? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Picture 1.

The amount of the authorized capital is indicated in the charter or constituent documents. This amount can only be changed in accordance with the results of the enterprise’s activities over the past year and as a result of changes in data in the company’s constituent documents. The share capital (authorized capital, authorized fund) of an organization indicates the minimum amount of the company's property, which guarantees the interests of creditors. Own funds should not be less than the declared authorized capital.

Equity capital is a source of funds that are used by an organization to achieve various goals.

Own funds have two main components: capital invested by the owners in the enterprise, that is, invested, and capital created in addition to what was initially advanced by the owners, that is, accumulated. Invested funds are formed by preferred and common shares. Additional paid capital and funds received free of charge are also included. Accumulated funds are formed in the process of distributing the net profit of the enterprise. Thus, equity capital, such as the equity capital of a bank or trading company, will vary depending on the performance of the firm.

If the organization has no obligations to creditors, i.e. accounts payable, then the value of the total property (assets) of the organization is equal to the amount of equity capital. If the organization has liabilities, then its equity capital will be equal to the amount of assets minus the amount of liabilities. Therefore, the amount of equity capital is also called net assets. The value of the enterprise's net assets is assessed in a certain order, the basis of which is the data of the annual balance sheet.

Retained earnings as a component of equity

The next component of the insurance company is retained earnings. This resource actually reflects how successful the company is from a commercial point of view. At the same time, it can also take negative values - in this case, this indicator will be called the uncovered loss.

In order to reflect the amounts of retained earnings, it is necessary to use the main synthetic account 84.

The key feature of this account is that no entries are made to it during the reporting year. In fact, the accountant works with it immediately before submitting reports, for example, a balance sheet, using another synthetic account - 99, on which profits and losses are recorded. The profit recorded on it must be transferred to account 84 at the end of the year by posting: Dt 99 Kt 84.

Retained earnings as a source of business financing

Let's consider how accounting is carried out for transactions that reflect the practical use of such a component of the insurance system as retained earnings.

This financial resource can be used, for example, to pay dividends. This operation corresponds to the wiring: Dt 84 Kt 75.

Another option for using retained earnings is to pay the company’s employees. When carrying out the relevant transactions, it is necessary to use the posting: Dt 84 Kt 70.

Retained earnings can be used as a resource to cover losses recorded in previous years of business. In this case, the transaction is carried out within the same account - 84, and therefore, in order to correctly reflect this operation, the accountant needs to open a number of additional sub-accounts. For example, 84.01, which records retained earnings or losses from previous years, as well as 84.02, which reflects current retained earnings. The posting recording the coverage of losses may look like this: Dt 84.02 Kt 84.01.

Nuances of accounting for shares purchased from shareholders

Another component of equity capital is the amounts corresponding to transactions for the company’s repurchase of shares from other owners. The corresponding transactions should be recorded in the debit of account 81 (in the amounts of actual costs) in correspondence with the credit of the accounts on which transactions corresponding to the type of transaction are recorded (for example, 50 - if funds for shares were paid through the cash register, 51 - if shares were paid through a current account ).

In turn, it may be necessary to reflect transactions on the credit of account 81. This is possible if, for example, the authorized capital of the company is reduced by an amount corresponding to the par value of the shares. This operation is documented by posting: Dt 80 Kt 81.