The concept of equity turnover ratio

Own capital is included in the liabilities of a commercial organization. Own capital includes:

- initially formed capital (authorized, share capital);

- capital created for reservation (reserve);

- capital created for additional payments and insurance (additional);

- capital created from the remaining net profit (retained earnings).

The equity turnover ratio a (Kob.sk) is one of the indicators for analyzing the financial stability of a commercial organization, showing the number of turnover of the company’s equity capital during the reporting period.

10. Criteria for the insolvency of an enterprise.

The Law “On Insolvency (Bankruptcy)” dated October 26, 2002 No. 127-FZ provides a definition of bankruptcy.

Insolvency (bankruptcy) is the inability of the debtor, recognized by an arbitration court or declared by the debtor, to fully satisfy the claims of creditors for monetary obligations and to fulfill the obligation to make mandatory payments.

According to the Methodological Regulations, the assessment of the unsatisfactory balance sheet structure is carried out on the basis of three indicators:

- Current ratio;

- Own funds ratio;

- The coefficient of restoration (loss) of solvency.

We calculated the coefficients of current solvency and equity security when determining solvency indicators. The solvency restoration coefficient is calculated for a period of 6 months, and the solvency loss coefficient is calculated for a period of 3 months. If the coefficient takes a value of <1, this indicates that the company has no real opportunity to restore solvency in the near future.

,

where Kv is the solvency restoration coefficient;

ΔKt.l – change in the current liquidity ratio for the period under study;

Kt.l.k.g. – current liquidity ratio at the end of the period under study;

Formula for calculating the equity turnover ratio on the balance sheet

Kob.sk = Revenue (line 2110) form No. 2 / ((line 1300 BB of the beginning period + line 1300 BB of the end period))/2

Thus, equity capital turnover ratio of revenue (turnover) to the average equity capital in the reporting period. As a rule, for the reporting period for the purpose of analyzing the indicator under study, the reporting year is taken.

Calculation example:

in 2021, sold products worth 162,092 thousand rubles. The company’s equity capital at the beginning of 2021 was 75,000 thousand rubles, and at the end of the year, due to positive profits, it increased to 79,000 rubles. Then:

Cob.sk = 162,092 / ((75,000 + 79,000))/2 = 2.1 revolutions.

Thus, during the analyzed period, the equity capital in Alt-Master LLC made 2.1 turns

[flat_ab id=”5"]

Analysis of enterprise profit.

The analysis of the enterprise's profit is carried out on the basis of Form 2 “Profit and Loss Statement” (Table 8).

Table 8

Table 8

Gains and losses report

| Index | During the reporting period | For the same period of the previous year | Deviation | share in % of revenue in the reporting period | share in % of revenue in the previous period | Level deviation | |

| Name | code | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Income and expenses from ordinary activities | |||||||

| Revenue (net) from the sale of goods, products, works, services (less value added tax, excise taxes and similar mandatory payments) | 010 | 84046 | 38454 | 45592 | 100 | 100 | 0 |

| Cost of goods, products, works, services sold | 020 | -74260 | -44781 | -29479 | 88.36 | 116.45 | -28.09 |

| Gross profit | 029 | 9786 | -6327 | 16113 | 11.64 | 16.45 | -4.81 |

| Administrative expenses | 040 | -10269 | -18010 | 7741 | 12.22 | 46.84 | -34.62 |

| Profit, loss from sales | 050 | -483 | -24337 | 23854 | 0.57 | 63.29 | -62.72 |

| Other income and expenses | |||||||

| Percentage to be paid | 070 | -2094 | 0 | -2094 | 2.49 | 0.00 | 2.49 |

| Other income | 090 | 22307 | 41561 | -19254 | 26.54 | 108.08 | -81.54 |

| other expenses | 100 | -18912 | -16732 | -2180 | 22.50 | 43.51 | -21.01 |

| Profit (loss) before tax | 140 | 818 | 492 | 326 | 0.97 | 1.28 | -0.31 |

| Current income tax | 150 | -363 | -410 | 47 | 0.43 | 1.07 | -0.64 |

| Net profit (loss) of the reporting period | 190 | 455 | 82 | 373 | 0.54 | 0.21 | 0.33 |

Conclusion:

During the reporting period, profit increased.

9. Calculation and assessment of indicators characterizing the profitability / profitability / of the enterprise.

Profitability is one of the main qualitative indicators of production efficiency at an enterprise, characterizing the level of return on costs and the degree of use of funds in the process of production and sale of products (works, services). The profitability of an enterprise shows the degree of profitability of its activities.

- Return on sales shows how much profit is generated per unit of product sold.

Ррр = (Sales profit/Sales revenue) x 100%.

Rpr = -0.57

Rpr = -63.29

Conclusion:

Return on sales has decreased. Sales profitability decreased, i.e. How many rubles do you need to sell products for to get 1 ruble of profit? The dynamics of product sales prices decreased, the level of production costs increased.

- Accounting profitability from ordinary activities shows the level of profit after taxes.

Rbukh = (Profit from ordinary activities/Sales revenue) x 100%.

Rbukh at start = 0

Rbuh on the line. = 0

Conclusion:

There is no profit from ordinary activities.

- Net profitability shows how much net profit is generated per unit of revenue.

CR = (Net Profit/Sales Revenue) x 100%.

| CR at the beginning | =0.54 |

| CR at the end | =0.21 |

Conclusion:

The return on total capital has decreased, i.e. the amount of net profit per unit of revenue decreased.

- Economic profitability shows the efficiency of using all the assets of the enterprise.

ER = (Net profit/Average asset value) x 100%.

| ER to the beginning = | 0.09 |

| ER at the end = | 0.02 |

Conclusion:

the efficiency of the entire property of the enterprise has decreased.

- Return on equity shows the efficiency of using the company's equity capital.

Rsk = (Net profit/Avg. cost of equity capital) x 100%.

| R S.K to the beginning | =16.90 |

| R S.K at the end | =2.60 |

Conclusion:

The efficiency of using equity capital is not profitable. The coefficient has decreased, i.e. the efficiency of using funds belonging to the owners of the enterprise has decreased.

Factors influencing changes in equity capital turnover

Factors of equity capital turnover

- An increase (+) in revenue is a factor equity capital turnover

- A decrease (-) in revenue is a factor equity capital turnover

- An increase (+) in the average amount of equity capital is a factor in reducing equity capital turnover .

- a decrease (-) in the average amount of equity capital is a factor in increasing equity capital turnover .

The equity turnover ratio may take a negative value if the enterprise has a high amount of uncovered loss (line 1370 of the balance sheet). As a result, when calculating, a negative value is formed on line 1300 “Section III” of the balance sheet and, accordingly: Revenue / Equity capital (with the “-“ sign) = Turnover ratio with the “-“ sign

If the indicator under study in the company at the end of the year is “0” , then this means that the enterprise simply does not carry out activities - i.e. no sales revenue. The enterprise cannot have its own capital, since its level is normatively fixed for various organizations: for example, for an LLC - 10 thousand rubles.

What is equity on the balance sheet

Equity on the balance sheet represents the totality of funds at the disposal of the company. This is one of the key indicators that gives an idea of the company's performance.

What is equity?

Own capital can be determined in two ways:

- The net assets of the company are determined. In particular, you need to take into account only assets without taking into account liabilities (debts, etc.).

- A set of values that form equity capital.

Let's consider the features of these methods.

First method

Under the first method, equity is the combination of net assets and retained earnings. The admissibility of using this method is confirmed by the presence of a number of relevant regulations. For example, paragraph 3 of Article 35 of Federal Law No. 208 “On JSC” dated December 26, 1995 states that instead of determining net assets, one’s capital is calculated. Paragraph 29 of Order No. 208 of the Ministry of Agriculture dated January 20, 2005 states that the concept of net assets corresponds to the concept of equity capital.

Second method (as directed by the Ministry of Finance)

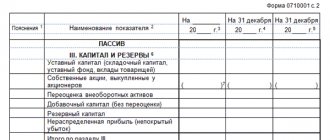

The second method assumes that equity includes these values:

- Authorized capital. Formed upon registration of a company. It is formed from the contributions of the founders.

- Extra capital. Appears when the founders of the entity invest funds in the company in excess of their share in the management company. It can also be formed through income from the issue, revaluation of non-current assets, and retained earnings.

- Reserve fund. It represents funds set aside by the company intended to cover losses in the event of an emergency.

- Retained earnings. Represents the balance of funds formed after paying all tax payments and covering other obligations. This also includes the balances of special funds, if the company has them.

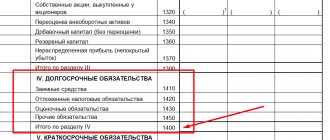

Own capital also includes shares of the company purchased from the auctioneer. The parameters necessary for calculations are contained in lines 1310-1370 of the balance sheet.

FOR YOUR INFORMATION! Which method is better to use? It all depends on the specific circumstances, business practices in a particular environment. For example, the desired method may be recommended by investors, banks and other interested parties.

Payment options

Let's consider formulas for calculation using various methods.

Traditional method

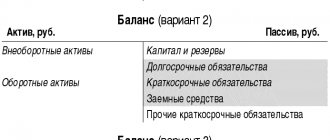

The traditional method is characterized by increased simplicity, and therefore it is popular in calculations. Let us recall that within the framework of this method, equity capital is identical to the size of net assets. To determine it, just look at the value of line 1300.

That is, the formula will be as follows: Own capital = Line 1300.

Obviously, an accountant can find out the value of equity within one minute.

Calculations according to the Ministry of Finance

The calculation can be carried out on the basis of Order of the Ministry of Finance No. 84n dated August 28, 2014. This order states that equity includes all assets except liabilities. These indicators are used in calculations:

- Line 1400 (debts with a repayment period of 12 months or more).

- Line 1500 (short-term debts).

- Page 1600 (assets).

Calculations are carried out in accordance with this procedure:

- The values from lines 1400 and 1500 are added together.

- The credit indicators of account 98 (free receipt of property, etc.) are subtracted from the resulting value.

- The balance on DT account 75 is subtracted from the indicator on line 1600.

- From the value obtained in step 3, the result of the calculations from the second point is subtracted.

This calculation algorithm is more complex, but it gives more accurate results.

Optimal amount of equity capital

Simply calculating your net worth is not enough. It is also necessary to correctly decipher the calculation results. What should you pay attention to? First, you need to make sure that the net asset value is positive. If the indicator is negative, this indicates a high credit load. That is, the company has few assets and many liabilities that are not covered by these assets.

During the analysis process, it is recommended to determine the average annual amount of equity capital. The following formula is used for this:

Average equity capital = (SC at the beginning of the year + SC at the end of the year) / 2.

All the necessary information can be taken from the balance sheet.

A good sign is that the amount of equity capital exceeds the size of the authorized capital. It indicates the investment attractiveness of the company. It is equity capital in sufficient size that is evidence of the success of the business model. If the size of net assets is less than the size of the authorized capital, then the LLC will be liquidated on the basis of paragraph 4 of Article 90 of the Civil Code of the Russian Federation.

Return on equity

Return on equity reflects the efficiency of the business, the degree of return from the work of the money in circulation. To put it simply, profitability gives an idea of how much profit each ruble of a company's capital brings in. This indicator reflects the success of maintaining the return on capital at a normal level. The better this indicator, the more attractive the company will be to investors.

The return on equity ratio can be determined using this formula:

PE / SK * 100.

The formula uses these values:

- PE – net profit.

- SK – own capital.

To clarify the calculation result, it is recommended to use the average annual value of equity capital.

Profitability can also be determined based on reporting documentation. In particular, you will need values from the balance sheet and income statement lines. The formula for calculations will be:

Line 2400 / line 1300 * 100.

What profitability will be optimal? Usually a ratio of 10-12% is considered normal. However, it is relevant for developed countries. If there is high inflation in the state, then the normal value will be 20%. A negative sign is a negative indicator.

Equity turnover

Equity capital turnover reflects the intensity of use of one's funds and business activity. It is an indicator of the productivity of a firm's resource management. It indicates the number of revolutions needed to pay invoices. Turnover indicates these aspects of the company’s activities:

- The degree of effectiveness of the product sales system.

- Subject's dependence on borrowed funds.

- Finance activity.

Turnover is determined by this formula:

Line 2110 / 0.5 * (line 1300 at the beginning of the period + line 1300 at the end of the period).

It is recommended to analyze the indicator over time. If it increases, this indicates an increase in the efficiency of product sales.

Return on equity capital - value

This indicator characterizes various aspects of activity:

- from a commercial point of view, it reflects either a surplus of sales or a lack of sales;

- from financial – the rate of turnover of invested capital;

- from economic – the activity of funds at risk of the investor.

If the level of sales significantly exceeds the amount of invested capital, this entails an increase in credit resources. There is a limit beyond which creditors begin to participate more actively in the business than the owners of the company. In this case, the ratio of liabilities to equity will increase, the risk of creditors will also increase, and the company will be in serious difficulties due to a decrease in income or a downward trend in prices.

On the contrary, a low indicator means the inactivity of part of one's own funds. In this case, the equity capital turnover ratio indicates the need to invest equity in another more suitable source of income.

Return on Capital Employed (ROCE)

Return on Capital Employed

(Return on Capital Employed, ROCE) is an analytical business indicator of the return on capital - both own and from attracted investments. Using the ROCE indicator, you can evaluate the effectiveness of a company's operational management, regardless of the sources of financing for its activities. Synonyms: return on capital employed; return on invested capital; return on capital attracted; return on equity; return on invested capital. The economic essence of the return on capital employed ratio is that you can compare the calculated profitability ratio with other types of business if the question arises about the feasibility of investing funds.

Standard value of the return on capital employed ratio

This indicator has no regulatory significance, but investors usually compare it with the average loan rate. If a company's ROCE is higher than the average borrowing rate, the business may be considered a potential investment. Otherwise, expanding the business by attracting additional borrowed capital will lead to a deterioration in financial condition, a drop in profits or losses. If the ROCE ratio decreases, it means:

- Own capital increases (as well as debt obligations).

- Asset turnover decreases.

If the ROCE ratio increases, we can conclude that:

- The profit of the enterprise increases.

- Financial leverage increases.

This ratio is compared to return on equity (ROE), with the difference that when calculating the return on capital employed ratio, earnings before interest and taxes are used, and the company's debts are taken into account along with shareholders' equity. If the company does not have preferred shares (long-term liabilities) and there are no obligations to pay dividends, then the value of ROCE = ROE. The relationship between ROCE and ROE shows the impact of the financing structure on capitalization and business risks: how effectively external financing is used to increase dividends, as well as how high the risks of the company and shareholders are when using external financing.

How to calculate ROCE

There are several methods for calculating the coefficient: 1) ROCE = (Net Income - Preferred Dividends) / Total Stockholder Equity Net Income - net profit Preferred Dividends - dividends on preferred shares Equity - the amount of ordinary share capital. 2) ROCE = Earnings before interest and tax (EBIT) / capital employed (raised capital). 3) ROCE = 2 * NP / CEbeg + CEend NP (net profit) – net profit; CE (capital employed) – attracted capital at the beginning and end of the period.

Benefits of Using ROCE for Financial Analysis

1) Analysis of the return on invested capital indicator serves as a guide in making important investment decisions, for example, on conducting an additional issue of shares or regarding the dividend policy of the enterprise. 2) This indicator acts as a guideline for assessing the feasibility of a company raising borrowed funds. If the interest on the loan is higher than the ROCE ratio, it means that the organization will not be able to effectively use the loan and earn the interest on it. 3) A high ROCE is a fact of efficient use of capital in the long term, and as a result, the generation of additional value for shareholders. 4) Used to compare the performance of different types of businesses and to evaluate whether the company generates enough profits to justify the cost of raising capital.

This is a preliminary encyclopedic article on this topic. You can contribute to the development of the project by improving and expanding the text of the publication in accordance with the rules of the project. You can find the user manual here

Where to look for the ROE indicator and which services publish it

The formula for return on equity ratio is not that complicated, so it is quite possible to calculate the indicator yourself. Moreover, the financial statements of companies are open to everyone.

But for the convenience of investors, specialized portals have been created, where not only the final figure is calculated, but also a full analysis is carried out. Like, for example, on the site gurufocus.com.

You can also use finance.yahoo.com. Information on each company is presented there, and Return On Equity is located in the Statistics tab.

I also recommend reading:

Unemployment rate as an economic indicator

What does the unemployment rate tell investors?

Among the Russian-language services, you can use, for example, the same smartlab.ru. Finding profitability indicators for large companies, especially foreign ones, is not difficult. The situation with small Russian enterprises is much more problematic. In such situations, you should make calculations yourself and find data from the company’s financial statements. For calculations, you need to take the indicator of equity capital and net profit of the enterprise at the beginning of the reporting period.

Explanation of the indicator

The equity turnover indicator (Equity Turnover) is an indicator of business activity that demonstrates the effectiveness of the company’s equity capital management. The ratio is calculated as the ratio of revenue (net income) to the average annual amount of equity capital. A high value of the indicator indicates the efficient use of owners' capital. The value of the coefficient indicates how many goods and services were sold for each ruble of funds raised from the owners.