According to paragraph 5 of Art. 346.25 of the Tax Code of the Russian Federation, the amounts of VAT calculated and paid by the taxpayer from the amounts of prepayment received before the transition to the simplified tax system are subject to deduction in the last tax period preceding the month of transition to the simplified tax system, in the presence of documents indicating the return of tax amounts by the buyer. How to correctly understand and apply this norm when switching to the simplified tax system in 2021? Does an enterprise that has switched to the simplified tax system have the right to pay VAT at 1/3 or must pay the entire amount immediately before the date of submission of the declaration for the fourth quarter (by January 25)?

A little theory. How to switch to simplified

To have an idea of how to switch to the simplified tax system, you need to remember the following: the conditions for switching to the simplified tax system require submitting a corresponding notification to the tax office at your location (residence). This must be done no later than December 31 or within 30 days from the date of state registration. This notice should include the following information:

- planned object of taxation (all income or income that remains after deducting the expenses allowed by the Tax Code of the Russian Federation);

- residual value of fixed assets calculated as of October 1 of the current year;

- total income for 9 months of current income.

The transition from OSNO to simplified tax system in 2019-2020, as before, is carried out on the basis of a notification in form 26.2-1. The transition from the OSN to the simplified tax system involves choosing one of two bases for taxation with a single tax. This can be either all income received or income less expenses incurred. Accordingly, in these two cases there will be different rates for the single tax. If all income is taken as a basis, you will have to pay a single tax on it at a rate of 6% (subjects of the Russian Federation can reduce the rate to 1%). When the base for the single tax is net income, it is paid in the amount of 5 to 15% (the rate also depends on the specific region of the Russian Federation).

Restoration of VAT on inventories

Organizations using the simplified tax system are not recognized as payers of value added tax, with the exception of value added tax payable when importing goods into the customs territory of the Russian Federation ( clause 2 of article 346.11 of the Tax Code Russian Federation ).

Clause 1 of Article 171 of the Tax Code of the Russian Federation determines that the taxpayer has the right to reduce the total amount of VAT calculated in accordance with Article 166 of the Tax Code of the Russian Federation by the tax deductions established by Article 171 of the Tax Code of the Russian Federation.

When purchasing goods (work, services), including fixed assets and intangible assets, by persons who are not VAT taxpayers, the VAT amounts presented to the buyer are taken into account by him in the cost of such goods (work, services), including fixed assets and intangible assets assets ( clause 3, clause 2, article 170 of the Tax Code of the Russian Federation ).

If the taxpayer accepts the specified amounts of VAT for deduction or reimbursement in the manner prescribed by Chapter 21 of the Tax Code of the Russian Federation , the corresponding amounts of VAT are subject to restoration and payment to the budget.

Based on the above provisions of Chapter 21 of the Tax Code of the Russian Federation, the Ministry of Finance of Russia and the Federal Tax Service of Russia conclude that it is necessary to restore and pay to the budget the amounts of VAT previously accepted for deduction on goods (work, services) used in production activities after the organization’s transition to the simplified tax system.

Cases when it is necessary to restore VAT

- If the company has made an advance payment to the seller, it can deduct the VAT paid as part of the advance payment.

- If the company transferred an advance payment to the seller, accepted VAT for deduction, and then terminated the contract (the seller returned the advance payment).

- After the purchase, the cost of the product decreased. VAT is restored in the amount of the difference between the tax amounts.

- Purchased products, on which VAT had already been deducted, began to be used in transactions taxed at a 0% rate.

- The company received a government subsidy to reimburse the costs of paying for purchased goods. The tax is restored during the period of provision of the subsidy.

- The company began to use the purchased property in transactions not subject to VAT.

Recovering VAT on fixed assets

For the same reasons, an organization, when switching to a special simplified tax system regime, must restore VAT on fixed assets, which was previously declared for deduction ( clause 8 of article 145 , clauses 1 , 2 , 6 , 7, clause 3 of article 170 , p. 3 Article 171.1 of the Tax Code of the Russian Federation ).

In general, the amount of “input” VAT on fixed assets, which was previously presented for deduction from the budget, is restored in proportion to the residual value of the fixed assets ( clause 3 of Article 170 of the Tax Code of the Russian Federation ) according to the following formula:

Amount of VAT to be restored = VAT previously accepted for deduction on fixed assets X Residual value of fixed assets / Initial cost of fixed assets

In this case, the calculation of the amount of tax subject to restoration on depreciable property is made taking into account the residual value of such property, formed according to accounting data.

Write-off of incoming VAT

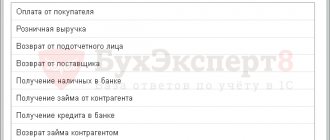

For those goods that were purchased for subsequent resale, expenses are taken into account as they are sold. This means that the tax must be written off in the period in which the goods were sold.

The amount of input VAT is determined by calculation.

Input VAT amount = cost of goods sold * VAT rate

However, there is another opinion on this matter: simplified organizations should include input tax as an expense item as they are paid. This means that you don’t have to wait for them to be written off. However, if you do this, you may have disagreements with the tax authorities.

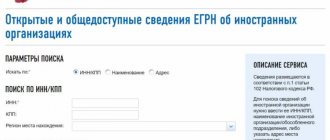

It is worth remembering that a simplified company can only take VAT into account as an expense if it has invoices from suppliers. This requirement was expressed by the Federal Tax Service of Russia in one of its letters. However, the court believes that the requirement is not entirely legal, since the invoice can only serve as the basis for tax deduction. Also, the Tax Code does not have a special list for simplifiers, which determines the list of documents suitable for confirming expenses.

It follows that input VAT can be taken into account in expenses even in cases where there is no invoice from the supplier. The main thing is that the VAT amount is presented in the total cost of goods and is also paid to the supplier. A payment order can be presented as documentary evidence.

The period of restoration of VAT, previously legally claimed for deduction, on fixed assets and inventory balances

Restoration of VAT amounts paid to suppliers of materials, goods and fixed assets and previously legally accepted for deduction is made in the last tax period before the transition to the simplified tax system.

In the situation under consideration, in December of the current period, the organization must make an entry on the credit of account 68 “Calculations for taxes and duties” in correspondence with account 19 “Value added tax on acquired assets” (Instructions for using the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n ).

The procedure for accounting for VAT previously legally claimed for deduction on fixed assets and inventory balances

Based on clause 6 of the Accounting Regulations “Accounting for Inventories” PBU 5/01, approved by Order of the Ministry of Finance of Russia dated 06/09/2001 N 44n, clause 8 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved By Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n , the amounts of VAT restored for payment are included, respectively, in the actual cost of materials and in the initial cost of fixed assets by entries on the credit of account 19 in correspondence with accounts 10 “Materials”, 01 “Fixed assets”.

At the same time, the restored amount of VAT is not included in the cost of goods, but is taken into account as part of other expenses in accordance with Art. 264 Tax Code of the Russian Federation. Thus, with a change in the taxation system, it is necessary to restore the VAT previously claimed for deduction on fixed assets to the balances of inventories.

It should also be remembered that VAT is restored at the rate that was in effect at the time of acquisition of this or that property.

When switching to the simplified tax system, expenses take into account the paid cost of the remaining raw materials, supplies, work in progress and finished products ( Letter of the Ministry of Finance dated October 30, 2009 N 03-11-06/2/233 ).

But the cost of goods on the simplified tax system is written off only upon sale ( clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation ).

The residual value of fixed assets is written off in a special manner ( clause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation ).

Example.

The organization has decided to switch to a simplified taxation system starting next year.

As of December 31 of the current year, materials worth 40,000 rubles are listed on the organization’s balance sheet. and goods worth 60,000 rubles, as well as fixed assets purchased in the current year.

The initial cost of the fixed asset is 500,000 rubles. (without VAT). The residual value of the fixed asset at the end of the current year was 250,000 rubles.

When purchasing a fixed asset, VAT was declared deductible at a rate of 20% in the amount of 100,000 rubles.

Then the amount of VAT subject to restoration in the fourth quarter of the current year will be equal to 50,000 rubles. (RUB 100,000 x RUB 250,000 / RUB 500,000).

In the accounting of the organization, the restoration of VAT accepted for deduction when purchasing materials and fixed assets, in connection with the transition to a simplified taxation system, should be reflected as follows:

| Contents of operations | Debit | Credit | Sum, rub. | Primary document |

| In December of this year | ||||

| Reinstated for payment in budget VAT amount with residual value fixed assets | 19 “VAT on the acquisition of fixed assets” | 68/VAT | 50 000 | Accounting certificate-calculation |

| Reinstated for payment in budget VAT amount with cost of materials (40 000×20%) | 19 “VAT on purchased inventories” | 68/VAT | 8 000 | Accounting reference-calculation |

| Reinstated for payment in budget VAT amount with cost of goods (60 000×20%) | 91-2 | 68/VAT | 12 000 | Accounting reference-calculation |

| For the restored amount VAT increased initial cost fixed assets | 01 | 19 “VAT on the acquisition of fixed assets” | 50 000 | Inventory object registration card fixed assets |

| For the restored amount VAT increased actual cost of materials | 10 | 19 “VAT on purchased inventories” | 20 000 | Card inventory accounting |

Amount of income

In order for a company to switch to the simplified tax system, it must meet the following limit.

The amount of income for nine months of the year preceding the transition to the simplified system should not exceed 15,000,000 rubles.

This rule does not apply to individual entrepreneurs (Letter of the Ministry of Finance of Russia dated May 7, 2007 N 03-11-05/96).

Firms and entrepreneurs working on the simplified tax system need to constantly monitor the amount of revenue. Otherwise, they may lose the right to use the simplified procedure.

This will happen if the amount of annual income exceeds 20,000,000 rubles.

Income is determined in accordance with Art. 248 of the Tax Code. They consist of income from sales (less VAT) and non-operating income. If for certain types of activity (for example, retail trade or transport tax), then you must calculate the income limit for the “simplified tax” for activities taxed under the general tax regime, i.e., income that is received from activities on UTII, take in calculation is not necessary (clause 4 of article 346.12 of the Tax Code of the Russian Federation).

Both amounts of the maximum allowable income must be adjusted by the deflator coefficient. We will tell you how to do this below.

How to use the deflator factor

The deflator coefficient is annually approved by the Russian Ministry of Economic Development by order.

For 2009, it is set at 1.538 (Order No. 395 of November 12, 2008).

In paragraph 2 of Art. 346.12 of the Tax Code states: “the amount of the maximum amount of income of an organization... is subject to indexation by a deflator coefficient established annually for each subsequent calendar year... as well as by deflator coefficients that were applied in accordance with this paragraph earlier.”

This means that the amounts are 15,000,000 and 20,000,000 rubles. must be consistently multiplied by all deflator coefficients starting from 2006. However, the Russian Ministry of Finance indicates that income limits need to be adjusted only once - by the deflator coefficient, which is approved for a given year. According to financiers, in the current coefficient, the Ministry of Economic Development has already taken into account all the coefficients for previous years (Letters of the Ministry of Finance of Russia dated April 11, 2008 N 03-11-04/2/70, dated January 31, 2008 N 03-11-04/2 /22).

Thus, when switching to the simplified tax system from 2010, the company’s income for the nine months of 2009 should not exceed RUB 23,070,000. (RUB 15,000,000 x 1,538).

In order not to lose the right to use the simplified tax system, income in the reporting period should not exceed 30,760,000 rubles. (RUB 20,000,000 x 1,538).

Starting from the quarter in which the excess occurred, you will have to pay traditional taxes.

Errors after switching to special mode

To conclude the article, let’s look at examples of violations after the transition to a special regime:

After the transition to the simplified tax system, payments received from buyers for goods, works, services sold on the simplified tax system were included in income

Based on paragraph 1 of Article 346.25 of the Tax Code of the Russian Federation , organizations that, before the transition to a simplified taxation system when calculating corporate income tax, used the accrual method, when transitioning to the simplified tax system, follow the following rules:

— on the date of transition to the simplified tax system, the tax base includes amounts of funds received before the transition to the simplified tax system in payment under contracts, the execution of which the taxpayer carries out after the transition to the simplified tax system ( subparagraph 1 of paragraph 1 of Article 346.25 of the Tax Code of the Russian Federation ).

At the same time subparagraph 3 of paragraph 1 of Article 346.25 Code of the Russian Federation provides that funds received after the transition to the simplified tax system are not included in the tax base if, according to the rules of tax accounting using the accrual method, these amounts were included in income when calculating the tax base for corporate income tax .

Thus, after switching to the simplified tax system, do not count payments received from buyers for goods, works, services sold on the simplified tax system as income.

Example.

The organization, within the framework of the simplified tax system, shipped goods to the buyer, payment for which will be received by the organization after the transition to the simplified tax system.

Since, on the basis of paragraph 1 of Article 271 of the Tax Code of the Russian Federation , the organization took into account the income from the sale of these goods as part of the application of the OSN, when receiving payment for the goods from the buyer, funds from their sale are not included in the tax base for the “simplified” tax.

How to issue invoices

Before switching to special The company's regime should calculate how profitable it is not to pay VAT. It is worth considering that tax exemption is not an advantage in all cases. For example, organizations that pay VAT are interested in deducting input VAT from the budget. But by purchasing something from a simplified company, they are deprived of this opportunity. This is due to the fact that simplifiers do not pay VAT, and, therefore, cannot issue invoices. Therefore, general-regime organizations do not like to cooperate with simplified organizations. It follows from this that it is beneficial to use the simplification only for those engaged in retail trade. For their buyers, crediting input VAT is not a problem.

However, the legislation does not prohibit simplifiers from issuing invoices. The special regime officers do this so as not to lose their clients from the general regime.

After the transition to the simplified tax system, interest received under loan agreements was included in income

As part of the application of the SOS, the organization issued an interest-bearing loan to another organization.

According to the general rule of paragraph 6 of Article 250 of the Tax Code of the Russian Federation, the creditor company located on the OSN reflects interest due from the borrower as part of its non-operating income at the end of each month of the corresponding reporting (tax) period, regardless of the date (terms) of their payment, provided for by the contract. Consequently, the organization has already taken such non-operating income into account in its income while still on the OSN.

Having received such interest from the borrower under the simplified tax system, she should not take these funds into account in the tax base under the simplified tax system.

A similar conclusion is confirmed by Letter of the Federal Tax Service of Russia dated August 14, 2015 N GD-4-3/ 14371 “On sending clarifications on certain issues of creating reserves for doubtful debts by microfinance organizations.”