6 conditions for transferring debt under an assignment agreement

- The debtor's consent is not required.

- The seller or buyer notifies the debtor of the assignment of the claim.

- The buyer of the debt receives principal and interest.

- Claims for alimony and compensation for damage to health cannot be transferred.

- The parties confirm the transfer of debt by signing the agreement.

- The execution of the assignment agreement depends on the execution of the main transaction.

Let's take an example: transfer of rent debt. The lease agreement is registered with the territorial department of Rosreestr. This means that an agreement on the assignment of rent arrears is submitted for registration.

Without registration, the agreement has no legal force (clause 3 of Article 433 of the Civil Code).

4 problems associated with the transfer of debt under an assignment agreement

- The buyer bought the debt, but there is no basis for making a claim.

The Arbitration Court of the West Siberian District invalidated the agreement under which the debt was sold under an assignment agreement (Resolution dated September 23, 2015, case No. A45-684/2014).

Grounds for refusal:

- there is no evidence that the coal was delivered to the debtor;

- there is no confirmation of payments for coal;

- the debtor's consent to replace the creditor was not received.

- The creditor has ceded the right to claim the debt free of charge.

Donation and assignment are different transactions. Comply with the requirement of Article 423 of the Civil Code of the Russian Federation. Specify in the agreement how much the buyer must pay the seller for the assignment of the claim.

- The parties included in the agreement a condition prohibiting a change of creditor.

The Arbitration Court of the West Siberian District declared the transfer of debt invalid. Reason: the terms of the agreement prohibit changing the creditor.

- The parties do not comply with the form of the transaction.

The Arbitration Court of the North Caucasus District explained that the pledge agreement for a share in an LLC is certified by a notary (Resolution dated October 13, 2015, case No. A32-20473/2013). If the parties have not certified the share pledge agreement with a notary, the agreement becomes invalid. Often a debt transfer agreement is concluded between legal entities and individuals.

Notice of assignment of rights

The seller or buyer of the debt sends a notice to the debtor. If the parties forget to send the notice, problems arise. The buyer of the debt does not receive the right to demand performance.

The notice may be signed by the buyer, the seller of the debt, or both parties.

Information specified in the notification:

- what right is being transferred;

- who is the new creditor?

The law does not regulate how a notice of assignment of a claim is drawn up. Practice shows that disputes arise if the parties do not indicate in the contract the basis for the assignment. We advise you not to give reasons to challenge the transaction. Indicate in the notice the basis for the assignment of the right.

The seller transfers to the buyer the agreement, which is the basis for the debt. Provides information that affects the fulfillment of the obligation.

List of documents that the assignor transfers:

- agreement;

- additional agreements;

- invoices;

- acceptance certificates;

- invoices.

Counterclaim and set-off

In accordance with the information letter of the Supreme Arbitration Court of the Russian Federation, after filing a claim against a citizen who has the right to claim offset, he can exercise his right to offset only through a counterclaim.

That is, the entry of the case into court entails the loss by the debtor of the opportunity to terminate the obligation through a unilateral extrajudicial statement of set-off.

The Arbitration Procedure Code of the Russian Federation establishes that the defendant, before the arbitration court of the first instance issues a judicial act that concludes the consideration of the case on the merits, has the opportunity to present its claim to the plaintiff for consideration in parallel with the original one.

In other words, if the plaintiff is an assignee, then the counterclaim must be brought against the assignee. But in court practice, this approach often raises questions.

For example, the debtor's counterclaim to the original creditor may not be related to the obligation for which the assignment of rights was made. This circumstance is acceptable, in accordance with the information letter of the Supreme Arbitration Court of the Russian Federation.

Thus, the debtor has the right to set off against the claim of the new creditor his counterclaim against the original creditor arising from any other obligation.

Lawyers at Argument Law Firm note that in fact the legislator placed on the new creditor the risk of circumstances arising, the existence of which at the time of the assignment he objectively did not know and should not have known. However, practice shows that despite the fact that the assignee who filed a claim against the debtor may not even know about the assignor’s existing debt to the debtor and may not have any evidence on this issue, he will be brought as a defendant in the debtor’s counterclaim aimed at offset .

Registration of assignment of rights in court

Business partners often violate the terms of agreements. Creditors are faced with the fact that the debtor ignores the writ of execution and the court decision.

Instructions on how to formalize the transfer of debt under an assignment agreement in court:

- Receive a decision and writ of execution.

- Find an organization willing to buy the debt.

- Draw up an agreement.

- Notify the debtor.

- Submit an application to the arbitration court to change the party in the case. Attach to the application an agreement and confirmation of notification to the debtor.

- Obtain a court ruling.

- Submit the ruling and writ of execution to the bailiff service.

Two errors in the assignment agreement:

- the transaction price is not indicated;

- the transaction value in the agreement has been reduced.

Tax authorities will not leave mistakes unnoticed. We advise you to play it safe and argue your position.

Draw up a memo before the transfer of ownership.

The memo explains:

- transaction price;

- reasons for the assignment of rights;

- collection problems;

- cash investments to repay debt;

- losses associated with debt collection under a loan agreement.

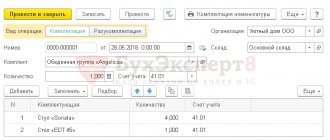

Assignment agreement: postings to the assignee

For clarity, let's look at the postings under the assignment agreement for all parties to the transaction using an example.

Example

Les LLC shipped lumber worth RUB 118,125 to Novaga LLC, including 20% VAT of RUB 19,687.50. The cost of lumber was 85,100 rubles.

Les LLC entered into an assignment agreement with Kotel LLC. The contract amount was 97,125 rubles, incl. VAT RUB 16,187.50 Kotel LLC consulted with auditors on the preparation of the assignment agreement, paying 5,000 rubles for the consultation. Kotel LLC transferred 97,125 rubles, incl. VAT, to the account of Les LLC.

The assignor reflects the transaction as follows.

| Accounting entries under the assignment agreement with the assignor | Sum | the name of the operation |

| Dt 62 Kt 90.1 | 118 125 | Lumber shipped |

| Dt 90.3 Kt 68.2 | 19 687,50 | VAT charged |

| Dt 90.2 Kt 41 | 85 100 | We write off the cost |

| Dt 90.9 Kt 99 | 15 005,93 | We reflect the profit on the transaction |

| Dt 76 Kt 91.1 | 97 125 | Assignment under an assignment agreement |

| Dt 91.2 Kt 62 | 118 125 | We write off accounts receivable |

| Dt 99 Kt 91.9 | 21 000 | Loss on sale of debt |

| Dt 51 Kt 76 | 97 125 | Payment received from Kotel LLC |

We also recommend that you read our article “Sale of accounts receivable – postings”.

The assignee takes into account the receivables acquired under the assignment agreement as a financial investment.

In the amount of actual costs incurred when purchasing receivables, and therefore in the initial cost of such an investment, you can take into account not only the amount of the debt itself, but also the following expenses (clauses 8, 9 of PBU 19/02, approved by order of the Ministry of Finance dated December 10, 2002 No. 126n):

- information, intermediary services;

- any other costs incurred during the acquisition of assets (financial investments).

Continuation of the example

| Accounting entries under the assignment agreement with the assignee | Sum | the name of the operation |

| Dt 58 Kt 60 (76) | 97 125 | Purchase of receivables |

| Dt 58 Kt 60 (76) | 5 000 | Costs for auditors taken into account |

| Dt 60 (76) Kt 51 | 97 125 | Funds were transferred to the assignor |

| Dt 51 Kt 91.1 | 118 125 | The debtor transferred the money to the assignee |

| Dt 91.2 Kt 58 | 102 125 | All expenses under the assignment agreement are reflected |

| Dt 91.2 Kt 68.2 | 2 666,67 | VAT charged on income (118 125–102 125) × 20 / 120 |

| Dt 91.9 Kt 99 | 13 559,32 | Profit from assignment agreement |

In accordance with clause 7 of PBU 9/99 “Income of the organization” (hereinafter referred to as PBU 9/99), other income is, in particular, proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods. Taking into account the above, we believe that income from the assignment of receivables by the assignor is recognized in his accounting as other income.

We invite you to read: Loan agreement between individuals citizens of different countries

According to the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Instructions), account 91 “Other income and expenses” is intended to summarize information on other income of the reporting period.

Receipts associated with the sale and other write-off of fixed assets and other assets other than cash in Russian currency, products, goods are reflected in the credit of account 91 in correspondence with the accounts for settlements or cash. Settlements with the assignee under the agreement for the assignment of claims, based on the Instructions, should be made using account 76 “Settlements with various debtors and creditors.”

Other income will be determined in the amount calculated based on the price of the assignment of the claim, determined in the agreement with the assignee, and on the date of this transaction (for example, on the date of signing the act of assignment of the claim) (clause 6, clause 10.1, 12, 16 PBU 9/ 99, part 3, article 9, parts 1, 3, article 10 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”).

At the same time, the organization incurs expenses associated with the implementation of claims, which should be considered as other expenses (clause 11 of PBU 10/99 “Organization expenses”), reflected in the debit of account 91 (Instructions). In this case, the write-off (disposal) of receivables under the service agreement should be reflected in the accounting accounts.

Debit 76, subaccount “Settlements under the assignment agreement” Credit 91, subaccount “Other income” - income from the assignment of the claim is recognized (the amount under the assignment agreement);

Debit 91, subaccount “Other expenses” Credit 62 - the receivables of organization “B”, formed as a result of the execution of the service agreement, are written off;

Debit 66 (67) Credit 76, subaccount “Settlements under the assignment agreement” - the mutual claims of organization “A” and organization “B” - the lender - were offset. The basis is an act of mutual settlement drawn up by the parties, or an application by one of the parties to carry out such a netting.

Since the claim in this case is assigned at a price equal to the amount of the assigned debt, organization “A” does not experience profit or loss from this operation (it is not reflected in accounting).

Clause 3 of PBU 19/02 “Accounting for Financial Investments” (hereinafter referred to as PBU 19/02) provides that receivables acquired on the basis of an assignment agreement are taken into account from the assignee as part of the organization’s financial investments. According to the Instructions, an account is intended to summarize information about the availability and movement of financial investments

We invite you to read: LLC bankruptcy: application, liquidation, procedure and consequences

At the same time, in order to accept assets for accounting as financial investments, it is necessary to simultaneously fulfill the conditions listed in paragraph 2 of PBU 19/02, one of which is the ability to bring economic benefits (income) to the organization in the future in the form of interest, dividends or their increase value (in the form of the difference between the sale (redemption) price of a financial investment and its purchase value as a result of its exchange, use in repaying the organization’s obligations, an increase in the current market value, etc.).

Obviously, in the case of acquiring receivables at a price equal to the amount of this debt, the assignee does not receive economic benefits in the form of the difference between the price of acquiring the debt and the amount due from the debtor.

Under such circumstances, to take into account the acquired debt, instead of account 58 “Financial investments”, we consider it appropriate to use account 76 “Settlements with various debtors and creditors”.

Let us note that, based on clause 2 of PBU 19/02, an interest-free loan also does not fall under the definition of a financial investment. In this case, it is also advisable to reflect the amount of funds transferred to the borrower in the debit of account 76 “Settlements with various debtors and creditors” in a separate sub-account, and not in account 58 “Financial investments”.

Debit 76, subaccount “Acquired debt” Credit 76 “Settlements under an assignment agreement” - the right of claim against debtor “B” was acquired;

Credit 76, subaccount “Settlements under the assignment agreement” Debit 76, subaccount “Provided loans” - the mutual claims of organizations “A” and “B” were offset.

Debit 51 Credit 76, subaccount “Acquired debt” - funds received from debtor “B”.

— Encyclopedia of solutions. Settlement of mutual claims.

Prepared answer:

Legal Consulting Service Expert

GARANT Lazareva Irina

The answer has passed quality control

December 13, 2021

What is a debt assignment agreement?

With the help of an assignment agreement, the debt or part of the debt and the right to interest are transferred. The company will avoid legal disputes and claims from tax authorities if it draws up the contract correctly.

The assignment agreement and debt transfer have pitfalls. Lawyers from the website “33 Yurista.ru” will competently draw up an agreement, notify the debtor of the assignment of the claim, and explain the intricacies of taxation. They will clarify how the purchase of debt is formalized under an assignment agreement. You can (online) without registration.

If the company is involved in litigation, lawyers will evaluate the prospects of the case. Analyze the client’s position, collect evidence and protect interests in court.

Assignment after filing a counterclaim during legal proceedings

The situation is different if the debtor presented his claim to the original creditor before the assignment.

Judicial practice explains this matter as follows.

If the defendant has not filed an opposing claim against the assignor, then, regardless of whether the assignment took place before the initiation of the criminal case or after, he must present counterclaims against the assignee.

If he has already brought a claim against the assignor, then the defendant is still the assignor. Thus, in the latter situation, there is the possibility of simultaneous consideration of the initial and counterclaims with different subject composition, which will end in mutual settlement.

Lawyers at the law office summarize that these decisions confirm that, regardless of the moment of origin of the assignment - before a dispute arises in court or during the process, the debtor retains its legal right to offset. In other words, he will not be infringed on his rights, regardless of who the counterclaim is brought against.

However, a very common situation is when the court considers the debtor’s counterclaim not against the assignor, but against the assignee. In this situation, it is not entirely clear how the assignee can defend against the claim. Let's try to understand this issue by determining whether the penalty presented for offset should be indisputable.