Individual entrepreneurs are people too and have the same right to sick pay as everyone else. However, they receive payment only in one case: if they voluntarily registered with the social insurance fund and paid mandatory contributions there for at least a year. After all, it is the Social Insurance Fund that issues benefits to individual entrepreneurs, unlike hired employees, for whom the employer partially pays.

How can an individual entrepreneur register with the Social Insurance Fund? What is the amount of mandatory payments to the department? How to apply for sick leave and receive compensation for temporary disability? Read about all this below.

We need an agreement with the FSS

If an entrepreneur intends to receive payments for sick leave or maternity leave, then he must enter into an agreement with the Social Insurance Fund.

This is easy to do - you just need to submit an application. Don't forget to take a set of necessary documentation with you when you visit the Foundation. This:

- Passport

- OGRNIP (main state registration number of an individual entrepreneur)

- TIN

- Extract from the Unified State Register of Individual Entrepreneurs

After concluding the contract, you will need to begin paying insurance premiums and maintaining reports on them. That is, in fact, the entrepreneur takes out insurance for himself.

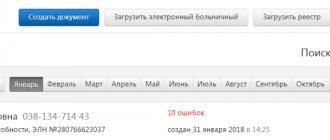

As for reporting, it is submitted in the FSS-4 form no later than the 15th day of the reporting period. Payment of contributions can occur no later than December 31 of the current year. If these conditions are not met, the individual entrepreneur will be deprived of the opportunity to receive government benefits.

How to register with the Social Insurance Fund

This procedure is quite simple. You need to provide the FSS with a set of documents specified in Order of the Ministry of Labor of the Russian Federation dated February 25, 2014 N 108N. It includes:

- identity document

- TIN

- extract from OGRNIP

- registration application

Documents can be submitted to the FSS in person by the individual entrepreneur, regardless of place of residence, by mail, at the MFC or through the government services portal.

If documents are submitted through the public services portal, individual entrepreneurs receive the result in the form of an electronic document, which is signed with an enhanced qualified electronic signature of an official of the territorial body of the Social Insurance Fund.

If an individual entrepreneur submits documents in person or by mail, then he receives the result in the form of a postal item - depending on the method of receipt indicated in the application.

Conducting business according to the law. Services for individual entrepreneurs and LLCs

Details

Registration and issuance of the relevant notification is carried out within three working days from the date the territorial body of the fund receives all the necessary documents.

If the individual insured changes his place of residence, then he needs to submit an application for registration in connection with the change of residence and a copy of the passport confirming the change of residence.

To deregister from the FSS, you need to fill out an application for deregistration.

How to fill out a sick leave certificate for an individual entrepreneur

- Step No. 1. We go to the clinic at your place of residence and get a certificate from a doctor who confirms that you are feeling unwell and because of which you cannot work.

- Step No. 2. Fill out an application for payment of sick leave. Payment under this application will have to come to the individual entrepreneur’s bank account.

- Step No. 3. Make copies of the receipt for payment of insurance premiums. That is, we confirm with receipts that you really paid for everything on time.

- Step No. 4. We take the package of collected documents along with receipts to the social insurance fund.

Is it profitable for an individual entrepreneur without employees to register with the Social Insurance Fund?

By voluntarily participating in OSS for disability and maternity, individual entrepreneurs without employees must pay insurance contributions to the Social Insurance Fund in a fixed amount. This fixed amount is equal to the cost of an insurance year. The calculation rules are defined in Part 3 of Art. 4.5 of the Federal Law of December 29, 2006 No. 255-FZ.

The cost of an insurance year is determined by the formula:

Minimum wage x insurance premium rate x 12

The following details are taken into account when calculating:

- The minimum wage is established by federal law at the beginning of the financial year for which insurance premiums are paid. Federal Law No. 481-FZ dated December 25, 2018 established that from January 1, 2021, the minimum wage amount is 11,280 rubles. per month.

- The rate of insurance premiums for OSS in case of temporary disability and in connection with maternity is specified in paragraphs. 2 p. 2 art. 425 Tax Code of the Russian Federation. It is 2.9%.

- The financial year is the calendar year from January 1 to December 31.

Taking into account the established values, the cost of the insurance year should be calculated as follows:

11,280.00 x 2.9% x 12 = RUB 3,925.44

So, 3,925.44 rubles. - the amount of insurance premiums that an individual entrepreneur needs to transfer to the Social Insurance Fund if he enters into voluntary legal relations with him under the Social Insurance Fund.

Sample receipt for payment of insurance premiums

Sample payment order

If you are an individual entrepreneur who is voluntarily registered with the Social Insurance Fund, and at the same time an employee, then in case of illness you will receive disability benefits both as an individual entrepreneur and at your place of work.

Adviсe

Filling out a sick leave certificate has several nuances that are important to know in advance, otherwise you risk filling it out incorrectly. And then you will have to waste time and nerves filling it out again.

- You can only write on the form with a black gel pen.

- Write only in block capital letters, no cursive.

- Letters must be exclusively inside the cell. You can’t even touch the boundaries of the cells, let alone go beyond them.

- Any corrections in the sheet will put an end to this option, you will have to fill it out all over again.

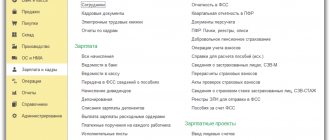

How to record contributions and payments

In expenses for the simplified tax system “Income minus expenses” and for OSNO, only mandatory fixed contributions and an additional contribution for income over 300,000 rubles can be taken into account. Voluntary contributions to the Social Insurance Fund and Pension Fund cannot be included in expenses to reduce the tax base.

do not need to be included in the tax base , because they are not related to business activities. From benefits that are subject to personal income tax, the Social Insurance Fund will independently deduct tax and transfer it to the budget.

In the online accounting My Business, contributions are calculated automatically - the entrepreneur cannot make a mistake when calculating and saves a lot of time. And until the end of the year there is a 50% discount!

How to calculate the amount of sick leave payment for individual entrepreneurs

There are several factors that influence the amount of payments. The first is the total length of service of an individual entrepreneur. Accordingly, the longer the experience, the more money will be transferred to your current account. Moreover, the length of service coefficient applies to the calculation.

So, for example, if your activity as an entrepreneur has been ongoing for less than five years, then the benefit will not be paid in full, but only in the amount of sixty percent. Five to eight years of experience already raises the bar. In this case you will receive eighty percent. And one hundred percent payment can be expected only after working as an individual entrepreneur for more than eight years.

The second factor influencing the amount of payment is the minimum wage, which is established by the state. 6203 rubles is the current minimum wage. But, for example, after July 2021, the minimum wage will be at 7,800 rubles.

For better or worse, the amount of compensation payments does not depend on the income and expenses of an individual entrepreneur.

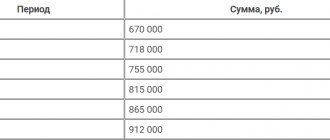

Pension

Entrepreneurs pay contributions to pension insurance and can . They accumulate pension points, just like employees. True, it will be much slower, so the pension will be small.

The fact is that individual entrepreneurs pay minimal contributions. Compare: from an employee’s salary of 30 thousand rubles, his employer will pay a pension contribution of 22% every month, which is 6,600 rubles. It will run up 79,200 per year. Small businesses pay at reduced rates, but even there they will run up 53,467 rubles per year. The higher the salary, the more contributions. And an individual entrepreneur with the same income for the whole of 2021 will pay pension contributions of only 32,448 rubles, plus 1% on income over 300,000 rubles - that’s another 600 rubles, a total of 33,048 rubles.

In 2021, in order to receive even the minimum pension, you need to have at least 11 years of insurance experience and 18.6 points. In 2024 it will be 15 years and 30 points.

The exact amount of your pension depends on how many pension points you have accumulated and how many more you accumulate. And this, in turn, depends on income and insurance coverage.

You can increase the number of points if you transfer more than what is required under the voluntary insurance agreement to the Pension Fund. Then the future pension will be greater.

If you apply the NAP regime, that is, you work as a self-employed individual entrepreneur, pension points do not accumulate, because Self-employed people do not pay contributions. In this case, you will be able to receive a pension only if you have accumulated or have already accumulated the required length of service and points at another place of employment. To accumulate points, you can make voluntary contributions to the Pension Fund directly from the “My Tax” application.

Calculation of sick pay for individual entrepreneurs

To ultimately understand how much you will be paid for sick leave, you need to use the formula:

Benefit amount = (minimum wage * 24/730) * percentage of work experience for which insurance premiums were paid * number of days of sick leave validity

It would seem that everything is clear, but let’s give an example:

Conditions: an individual entrepreneur went on sick leave and stayed there for 7 days. Moreover, he has 6 years of experience.

Calculation:

(6203 * 24/730) * 0,8 * 7

Answer: for a week on sick leave, an entrepreneur receives 1,142 rubles.

IP volunteers

To be eligible to receive benefits from the Social Insurance Fund, an entrepreneur must register there as an insurer, voluntarily entering into legal relations under compulsory social insurance.

To do this, you must fill out the appropriate application.

Within 3 working days, the FSS assigns a registration number and subordination code to the applying citizen, and also generates a notification of registration. By voluntarily registering with the Social Insurance Fund, an individual entrepreneur acquires the right to receive insurance coverage, subject to the payment of insurance premiums for the calendar year preceding the calendar year in which the insured event occurred.

Insurance contributions to the Social Insurance Fund

An equally interesting question, because you will need to pay regularly. And as for the size of these contributions, the income of the entrepreneur is already important here. If the annual income does not exceed the amount of 300 thousand rubles, then the following formula is applied:

Minimum wage*0.026*12 = 1935 rubles.

As we can see, with such a contribution, registration of illness will be beneficial only if the entrepreneur is ill for at least two weeks.

The question is logical. How useful is sick leave in reality then? If you, as an entrepreneur, decide to be sick for two weeks just to win the difference between the annual contribution and the payment, then it is extremely doubtful. After all, during these two weeks, what will be the total cost of business downtime? You are behind schedule, slowing down the work process - for most Russian entrepreneurs this is completely unacceptable.

As we can see, being sick in our country is unprofitable, even if you are an individual entrepreneur.

If the entrepreneur pays only fixed contributions

For employees, employers must pay insurance premiums for 4 types of compulsory insurance. That is why employees can receive pensions, sick leave and maternity leave.

An individual entrepreneur has only two types of mandatory insurance contributions:

- pension (from which the future pension of the individual entrepreneur is formed);

- medical (they go towards medical care).

An individual entrepreneur who pays only mandatory contributions can count on free medical care, a small pension and minimal payments upon the birth of a child. But there will be no sick leave, for this you only need to additionally conclude a voluntary insurance agreement with the Social Insurance Fund and pay contributions, more on this below.

Child care benefits for individual entrepreneurs

The government has slightly different views regarding female entrepreneurs. And benefits, for example, maternity benefits, are formed based on a fixed rate, and not calculated using a formula. So, for those who regularly paid contributions, for one hundred and forty days of maternity leave there is a payment in the amount of 27,455 rubles.

There is also an increase in the amount if complications arise or several children are born. And if a female entrepreneur registers with an antenatal clinic before the twelfth week of pregnancy, she will be able to receive another one-time payment in the amount of 544 rubles.

Here, as we see, the situation with the profitability of payments is not so sad. Especially, for example, if a spouse is absent. Indeed, in this case, the opportunity to receive any income is temporarily deprived.

As you can see, filing a sick leave to receive payments from the Social Insurance Fund has its own subtleties, which every entrepreneur should think carefully about before actually filing a sick leave. Of course, there are cases when sick leave will be the only solution, and first of all, we are talking about the inability to receive income from other sources.

Benefit

For individual entrepreneurs the average earnings , on the basis of which benefits are calculated, are assumed to be equal to the minimum wage established on the day the insured event occurred.

The average daily earnings for calculating benefits are determined by dividing the minimum wage established on the day the insured event occurred by the number of calendar days of each calendar month on which the insured event occurred.

Example:

In November 2021, a female individual entrepreneur, being 5 months pregnant, wrote an application to the Social Insurance Fund, registered as an insurer and paid contributions in the amount of 3,302.17 rubles.In January 2021, she received sick leave for 140 days from 01/11/2019 to 05/30/2019. The minimum wage at the start of maternity leave is 11,280 rubles.

| Month | Calendar days of the month | Days due for payment | Average daily earnings | Benefit amount |

| January 2019 | 31 | 21 | 363,87 | 7641,27 |

| February 2019 | 28 | 28 | 402,86 | 11280,08 |

| March 2019 | 31 | 31 | 363,87 | 11279,97 |

| April 2019 | 30 | 30 | 376,00 | 11280,00 |

| May 2019 | 31 | 30 | 363,87 | 10916,10 |

| Total | X | 140 | X | 52397,42 |

Thus, having paid 3.3 thousand rubles in December 2021, already in January 2021 a pregnant individual entrepreneur will receive 52 thousand rubles from the Social Insurance Fund.