Vacation reserve as an estimated liability

According to PBU 8/2010 “Estimated Liabilities”, organizations must create certain amount-weighted liabilities in their accounting accounts. That is, financial statements must contain not only data on the company’s documented obligations to contractors and third parties, but also information on planned expenses that are inevitable.

For example:

- on future vacations of employees;

- planned tax assessments;

- costs for suppliers in terms of expenses that we know for sure that they will be (for example, if a work completion certificate already exists, but has not yet been signed, so it cannot yet be recorded, although it is known for sure that the director will sign the document will be held next month).

With the advent of this information, the balance sheet becomes the most reliable, since it reflects the most realistic picture of the financial position of the enterprise. Let's take a closer look at what a reserve for vacation pay is.

Each employee, in accordance with labor legislation, is entitled to at least 28 calendar vacation days, and in a number of legally established cases this figure may be higher. Thus, for each reporting date we have vacation days that have not yet been used by employees (it is difficult to imagine an organization in which all employees took 28 vacation days at once). Accordingly, for each reporting date, there are estimated obligations of the company to employees to pay for these days and, as a result, certain obligations to funds to pay insurance premiums.

Who is responsible for reporting this information? In accordance with paragraph 3 of PBU 8/2010, all companies are required to reflect these accruals, with the exception of small enterprises (issuers of securities are not included in such exceptions), which can use a simplified method of accounting. The characteristics of such companies are specified in the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Thus, if a company does not fit the definition of a small business entity, the accrual of valuation reserves becomes mandatory, and the absence of this information on the accounting accounts may be regarded as a violation of the rules for accounting for income and expenses. Responsibility for this comes on two grounds:

- for gross violation of accounting for income and expenses under Art. 120 of the Tax Code of the Russian Federation in the amount of 10,000−30,000 rubles;

- administrative liability applied to officials under Art. 15.11 Code of Administrative Offences.

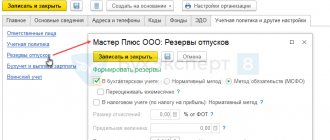

If a company creates a reserve for vacation pay, it is necessary to stipulate this in the accounting policy, as well as the procedure for calculating this reserve.

Why do you need a vacation reserve?

The Labor Code of the Russian Federation provides all employees with the right to annual paid leave. Each employer bears mandatory expenses for:

- vacation pay;

- or monetary compensation for unused days.

Companies and individual entrepreneurs plan vacations for all employees in advance. For this purpose, a special document is drawn up - a vacation schedule. The duration of annual rest for employees is 28 calendar days, but for some categories an extended vacation period is provided (Article 115 of the Labor Code of the Russian Federation). Compensation for vacation days not used by the employee is paid upon dismissal.

Calculate the period and amount of compensation using the online calculator on our portal.

Therefore, the organization needs a reserve of money from which not only vacation pay or compensation will be paid, but also contributions to extra-budgetary funds. Such a stock is created in the current period and used in the future. For example, the creation of a reserve for vacation pay for 2021 was formed in 2021. And in the current one, employers will reserve money for 2022.

ConsultantPlus experts examined the creation and restoration of a reserve for vacation pay in tax accounting. Use these instructions for free.

to read.

Reflection of the vacation reserve in accounting

The calculation and reflection of the vacation reserve in accounting must be carried out at each reporting date. According to current legal requirements, the balance sheet is compiled once a year - that is, December 31 will be the reporting date.

However, it is more accurate and correct (primarily for management accounting) to form vacation reserves on a monthly basis, since this type of reserve depends on the number of employees and vacations taken - and these values can change very often. It should be understood that monthly reserve calculation is labor-intensive. The organization needs to independently determine the desired frequency of settlements and record it in its accounting policies.

In accounting, account 96 is intended to reflect such information. All planned costs of the company are accumulated on it, including vacation pay. In this case, a separate sub-account is opened for each type of expense.

Let's consider typical transactions for the accrual and write-off of reserves in correspondence with the account. 96:

| Account Dt | Account name | Kt account | Contents of operation |

| 08 | Fixed assets | ||

| 20 | Primary production | 96.01 “Reserve for payment of employee vacations” | A reserve for employee leave has been accrued (accounts are selected depending on the department in which the employee works) |

| 23 | Auxiliary production | ||

| 26 | General expenses | ||

| 44 | Selling expenses | ||

| Other expense accounts of the company, which account for salary expenses | |||

| 96.01 | Reserve for employee vacation pay | 70 “Labor expenses” | Vacation pay accrued at the expense of the created reserve |

| 69 “Settlements with extra-budgetary funds” | Insurance premiums accrued from the reserve | ||

As you can see, the reserve is always accrued to the same accounts as employee salaries. Insurance premiums are calculated according to the same principle, but in correspondence with the reserve account, and not with accounts for settlements with extra-budgetary funds.

The balance of account 96 when generating periodic reporting is reflected in the liability side of the balance sheet. Line 1540 “Estimated Liabilities” is intended for this purpose.

Please note: if reserves in an organization are created only in accounting, then the base for calculating income tax is not reduced, and temporary tax differences arise, in accordance with PBU 18/02. If the accounting policy for tax accounting states that this reserve is taken into account when calculating income tax, the right appears to create it in the manner specified in Art. 324.1 Tax Code of the Russian Federation.

Creating a reserve for tax purposes is a voluntary matter, depending only on the decision of the business entity.

Reserve inventory

As of December 31, take an inventory of the reserve for vacation pay created in accounting and tax accounting. This is the requirement of paragraph 3.50 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated June 13, 1995 No. 49, and paragraph 3 of Article 324.1 of the Tax Code of the Russian Federation.

During the inventory, compare the actual amount of vacation expenses incurred in the current year with the actual amount of contributions to the reserve.

If it turns out that the amount of the accrued reserve is less than the amount of actual expenses for vacation pay, include the difference in the current expenses for vacation pay. This rule is established in paragraph 3 of clause 3 of Article 324.1 of the Tax Code of the Russian Federation.

Make an entry in accounting:

Debit 20 (23, 25, 26, 29, 44) Credit 96 subaccount “Estimated liability for vacation pay”

– an additional reserve has been accrued for the amount of excess of actual expenses for vacation pay over the reserve amount.

An example of additional accrual of reserves to actual expenses for vacation pay

LLC "Torgovaya" created a reserve for vacation pay in accounting and tax accounting.

At the end of the year, the accountant conducted an inventory, as a result of which he revealed the following:

- actual deductions to the reserve were made in the amount of 490,584 rubles;

- the accrued amount of vacation pay, taking into account contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases, amounted to 510,000 rubles.

The amount of the reserve is less than the amount of actual expenses for paying vacation pay (including insurance contributions) by 19,416 rubles. (490,584 rubles – 510,000 rubles).

At the end of the year, the organization’s accountant added the reserve to the actual expenses for vacation pay. He made the following entries in accounting:

Debit 44 Credit 96 subaccount “Estimated obligation to pay for vacations” - 19,416 rubles. – an additional reserve has been accrued for the amount of excess of actual expenses for vacation pay (including insurance premiums) over the reserve amount.

When calculating income tax, the accountant took into account 19,416 rubles in expenses.

If it turns out that the amount of the accrued reserve is greater than the amount of actual expenses for vacation pay, the procedure for accounting for the difference depends on whether the organization will create a reserve for vacation pay next year or not.

The organization may not make changes to the accounting policy and continue to create a reserve for vacation pay (using the same methodology). In this case, part of the reserve that was underused in the current year can be transferred to the next year.

For this:

- determine which employees did not use vacation (part of it) for the current year;

- determine the exact number of vacation days not used by such employees for the current year;

- Calculate the average daily earnings of such employees.

Then, for each employee, calculate how much of the reserve can be carried over to the next year. To do this, determine the estimated amount of vacation pay for vacation not used by the employee in the current year:

| Estimated amount of vacation pay for vacation not used by the employee in the current year | = | The actual number of vacation days not used by the employee in the current year | × | Average daily earnings of an employee | + | The amount of contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases related to calculated vacation pay |

Sum up the results for each employee. You will receive a total reserve amount that can be carried forward to the next year. If a decision is made to transfer the reserve, add it to the reserve for vacation pay for the coming year.

Compare the estimated amount of vacation pay for vacation unused by employees this year with the balance of the reserve. If this amount exceeds the actual reserve balance at the end of the year, include the excess amount in labor costs. If the amount of the calculated reserve for unused vacation is less than the actual balance of the reserve at the end of the year, then include the negative difference in non-operating income.

This procedure is established by paragraph 4 of Article 324.1 of the Tax Code of the Russian Federation.

When forming an accounting policy for the next year, the organization has the right to refuse to create a reserve. In this case, include the entire amount of the underutilized reserve as of December 31 of the current year in non-operating income for the current year. This rule is established by paragraph 5 of Article 324.1 of the Tax Code of the Russian Federation.

And in the case when the organization carries over the balance of the reserve to the next year, and when the reserve is not created in the next year, reflect the amount of the underused reserve for vacation pay in accounting as part of other income:

Debit 96 subaccount “Estimated liability for vacation pay” Credit 91

– the amount of the reserve for vacation pay for the excess difference is reflected in other income.

If the organization carries over the balance of the reserve to the next year, include in other income only the amount of excess of the balance of the reserve over the amount of the reserve in terms of unused vacation. If the organization does not plan to create a reserve for vacation pay next year, then include the balance of the reserve at the end of the year in other income in full.

This accounting procedure follows from the provisions of paragraph 23 of PBU 8/2010.

An example of transferring part of the reserve for vacation pay to the next year

In 2015, Torgovaya LLC created a reserve for vacation pay in accounting and tax accounting. The organization is not changing the reserve formation methodology in 2021.

According to inventory data in 2015:

- actual deductions to the reserve were made in the amount of 540,128 rubles;

- the accrued amount of vacation pay, taking into account mandatory insurance contributions, amounted to 500,000 rubles.

Thus, the amount of the accrued reserve is greater than the amount of actual expenses for vacation pay by 40,128 rubles. (540,128 rubles – 500,000 rubles).

In 2015, only manager A.S. was not granted leave. Kondratiev. The accountant calculated the amount of the reserve relating to unused vacation as follows.

For January–December 2015, Kondratyev received a salary of 276,000 rubles. There were no other payments to the employee during this period. The billing period has been fully worked out.

Kondratiev’s average daily earnings are 784.98 rubles/day. (RUB 276,000: 12 months: 29.3 days/month). Accordingly, the amount of vacation pay as of December 31, 2015 is: 784.98 rubles/day. × 28 days = 21979.44 rub.

Contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases: RUB 21,979.44. × (22% + 2.9% + 5.1% + 0.2%) = RUB 6,637.79

The amount of the reserve for unused vacation is equal to: RUB 21,979.44. + 6637.79 rub. = 28,617.23 rub.

The difference between the amount of the unused reserve for 2015 and the amount of the reserve calculated based on the days of unused vacation is: RUB 40,128. – 28,617.23 rub. = 11,510.77 rub.

When calculating income tax, the accountant included 1,900 rubles. included in non-operating income in 2015. He made an entry in accounting:

Debit 96 subaccount “Estimated obligation to pay for vacations” Credit 91 – 11,510.77 rubles. – the excess difference for 2015 in the amount of the reserve for vacation pay is reflected in other income.

Reserve for vacation pay in the amount of RUB 28,617.23. The accountant postponed it to 2021.

An example of accounting for the difference in the amount of the reserve for vacation pay during capital construction. The created reserve turned out to be greater than actual payments to employees

Alpha LLC is building a new building for its own needs. Expenses directly related to its construction are included in capital investments (account 08). In particular, a reserve for vacation pay was created in accounting and tax accounting - 1,500,000 rubles.

The accountant reflected this operation as follows:

Debit 08 Credit 96 subaccount “Estimated obligation to pay for vacations” - 1,500,000 rubles. – deductions were made to the reserve for vacation pay from the salaries of employees involved in capital construction.

At the time of commissioning of the building, Alpha’s accountant, in accordance with the requirement of paragraph 23 of PBU 8/2010, recalculated all estimated indicators that are associated with this event (including the amount of the reserve for vacation pay). According to the inventory data, it was revealed that the amount of the reserve determined at the time of commissioning of the building is less than the figure calculated earlier and should be 1,200,000 rubles.

Thus, the difference between contributions to the reserve and its size at the time of commissioning of the facility (accounted for in account 96) was:

– 300,000 rub. (RUB 1,500,000 – RUB 1,200,000).

The accountant took the specified amount into account as part of the organization’s other income in accordance with paragraph 22 of PBU 8/2010:

Debit 96 subaccount “Estimated obligation to pay for vacations” Credit 91 – 300,000 rubles. – the excess difference in the amount of the reserve for vacation pay is reflected in other income.

Situation: what to do if the amount of vacation pay actually paid was less than the formed reserve for vacation pay? Deductions to the reserve are made from capital investments in fixed assets. This year the facility was put into operation.

The answer to this question depends on the reason for the difference.

There are two options:

1. The reserve itself was incorrectly formed, or deductions for it were incorrectly made at the expense of capital investments.

2. The reserve was formed correctly, but actual payments actually turned out to be less than expected.

In the first case, adjust the initial cost of the fixed asset and accrued depreciation to the excess amount. At the same time, write off this amount as other expenses.

Let us explain why this should be done. The initial cost of a fixed asset is formed from the actual costs of its acquisition, construction and production. That is, from capital investments (account 08, clause 8 of PBU 6/01). If, at the time of commissioning, capital investments also included the costs of creating a reserve for vacation pay, which were determined to be excessive as a result of the inventory, then the initial cost was overstated.

The identified error must be corrected. After all, it turns out that the organization applied the norm incorrectly. This follows from the provisions of paragraphs 3 and 4 of PBU 22/2010. If the cost of the fixed asset is not adjusted, the organization faces administrative liability.

Errors that are discovered before the end of the year, as in the situation under consideration, should be corrected in the month in which they were discovered. This instruction is contained in paragraph 5 of PBU 22/2010.

Reflect the initial cost correction as follows:

Debit 01 Credit 08

– the initial cost of the fixed asset was reduced by the amount of the identified error.

Accrued depreciation also needs to be adjusted, since it was calculated based on an inflated initial cost:

Debit 20 (23, 25, 44...) Credit 02

– adjustment of accrued depreciation for fixed assets in the amount of the identified error.

At the same time, exclude the excess amount from capital investments. You can do this with the following wiring:

Debit 91 Credit 08

– reflects the write-off of contributions erroneously attributed to capital investments to the reserve for vacation pay.

In the second case, there is no need to adjust the original cost and depreciation.

The fact is that actual payments for vacations, which subsequently turned out to be less than the created reserve, cannot be considered an error. After all, at the time the reserve was formed, its size was determined correctly - based on the time actually worked by employees. There is no need to correct such inaccuracies. This follows from the provisions of paragraph 8 of paragraph 2 of PBU 22/2010.

The difference that arose due to the fact that the created reserve turned out to be more than actual expenses is attributed to other income (clause 22 of PBU 8/2010).

In accounting, write off the excess difference as other income as follows:

Debit 96 subaccount “Estimated liability for vacation pay” Credit 91

– the amount of the reserve for vacation pay for the excess difference is reflected in other income.

An example of reflecting adjustments to the initial cost of a fixed asset in accounting. Deductions for the formation of a reserve for vacation pay were taken into account in it erroneously

Alpha LLC independently builds a building for its own needs. Construction continues from January to September.

Due to capital investments, 5,500,000 rubles were spent on the construction of the building. The accountant reflected them with the corresponding entries:

Debit 08-3 Credit 10 (23, 25, 26, 60, 70, 76...) – RUB 5,500,000. – reflects the costs associated with creating an object and bringing it to a state suitable for use.

The following employees were employed in construction:

- 100 people – from January to July;

- 70 people – from August to September.

Therefore, the accountant made deductions to pay them vacation pay from capital investments - 200,000 rubles each. monthly (based on days actually worked). From January to September, the accountant made the following monthly entries:

Debit 08-3 Credit 96 subaccount “Estimated obligation to pay for vacations” - 200,000 rubles. – deductions were made to the reserve to pay for vacations of employees involved in capital construction.

Also, every month until October, the accountant deducted 100,000 rubles to create a reserve to pay for vacations of employees (50 people) engaged in the main production:

Debit 20 Credit 96 subaccount “Estimated obligation to pay for vacations” - 100,000 rubles. – deductions were made to the reserve to pay for vacations of employees engaged in the main production.

In September, construction was completed and the building was put into operation, all necessary rights to it were registered. The accountant made the following entry:

Debit 01 subaccount “Fixed asset in operation” Credit 08-3 – RUB 7,300,000. (RUB 5,500,000 + RUB 200,000 × 9 months) – a fixed asset created on an economic basis was accepted for accounting and put into operation at its original cost.

The useful life of the building was determined to be 20 years (240 months). Starting in October, the accountant began depreciating the object. According to the accounting policy - linear method. To do this, the accountant first determined the annual depreciation rate for the object: – 5% (1: 20 years × 100).

And then he calculated the amount of monthly depreciation of the building: - 30,416.67 rubles. (5% × RUB 7,300,000: 12 months).

The accountant reflected the calculation of depreciation in accounting as follows: Debit 20 Credit 02 – 30,416.67 rubles. – depreciation has been accrued on fixed assets used in the main production.

Starting from October, when all employees were employed in the main production, the accountant created a reserve for vacation pay entirely from the costs of the main production (300,000 rubles per month based on the days actually worked):

Debit 20 Credit 96 subaccount “Estimated obligation to pay for vacations” - 300,000 rubles. – deductions were made to the reserve to pay for vacations of employees engaged in the main production.

Thus, at the end of the year, the total amount of contributions to the reserve was: - RUB 3,600,000. (RUB 200,000 × 9 months + RUB 100,000 × 9 months + RUB 300,000 × 3 months).

On December 31, the accountant took inventory of the organization’s income and expenses, including the correspondence of the reserve for vacation pay and actual payments to employees. It was revealed:

- that from August to September some of the people previously employed in construction were transferred to the main production. That is, deductions for the formation of a reserve to pay for vacations at the expense of capital investments were overestimated. Instead of 200,000, it was necessary to deduct 140,000 rubles. The remaining 60,000 rubles. had to be attributed to the costs of main production;

- actual payments to employees turned out to be less than the created reserve - RUB 3,400,000.

In order to correct the error associated with inflated deductions due to capital investments, the accountant determined its size:

– 120,000 rub. (RUB 60,000 × 2 months).

The accountant adjusted the initial cost of the fixed asset by this amount by issuing an accounting certificate in December, and reflected this in accounting as follows:

Debit 01 Credit 08-3 – 120,000 rub. – the initial cost of the fixed asset was reduced by the amount of the identified error.

Thus, the initial cost of the building should be:

– 7,180,000 rub. (RUB 7,300,000 – RUB 120,000).

Taking into account the adjustment of the original cost, the accountant also adjusted the depreciation accrued from October to December.

To do this, he first determined how much monthly depreciation should be:

– RUB 29,916.67 (5% × RUB 7,180,000: 12 months).

That is, you need to adjust depreciation by: – 1500 rubles. (3 months × (RUB 30,416.67 – RUB 29,916.67)).

The accountant reflected the adjustment as follows:

Debit 20 Credit 02 – 1500 rub. – the accrued depreciation on the fixed asset was adjusted in the amount of the identified error.

At the same time, the accountant wrote off part of the adjusted initial cost from capital investments to other expenses, taking into account that there was no work in progress at the end of the year:

Debit 91 Credit 08-3 – 120,000 rub. – the excess difference determined during the inventory of the reserve for vacation pay is excluded from the composition of capital investments.

In addition, the accountant reflected the write-off of the excessively formed reserve:

Debit 96 subaccount “Reserve for vacation pay” Credit 91 – 200,000 rubles. (RUB 3,600,000 – RUB 3,400,000) – the amount of the reserve for vacation pay for the excess difference is reflected in other income.

Methodology for calculating the amount of reserve for vacation pay

Since the formula used to calculate the amount of the reserve is not defined by law, each company determines it independently. In this case, the developed method should be fixed in the accounting policy.

Any estimated liability should be as close as possible to a reliable monetary estimate of future expenses. The reserve should be determined on the basis of existing facts of the organization's economic activity, and the calculation should be based on accumulated work experience and, possibly, some expert opinions. That is, calculations must be supported by documents and be extremely justified.

Thus, to justify the amount of the accrued reserve for vacation pay, the organization must have:

- A method for calculating a reserve established in the accounting policy that would provide a reliable estimate of expenses for this item.

- Developed primary document to reflect the calculated reserve (certificate, for example). It is worth attaching a primary document, the information on which was used in the calculation (time sheet, pay slip, etc.).

There are several ways to calculate the reserve for vacation pay. First, let's look at one of them, which is fairly accurate - it is based on the actual number of unused vacation days and the average daily earnings of employees:

- First, you should break down all employees by department to determine which cost accounts are used (20–26, 44, etc.).

- It is necessary to have information on the number of vacation days entitled to each employee. If you have automated accounting, collecting this information is not difficult. These days should be summed up for each employee group.

- We calculate the average daily earnings (ADE) of workers for each group. To do this, you must first divide all employee salaries for the past selected period (month, quarter) by the number of calendar days in this period, and then by the number of employees in the group. Visually, this formula looks like this:

Employee SDZ = Salary / DN / K,

Where:

ZP - salary for the period,

DN - calendar days of the period,

K is the number of employees in the group (or the company as a whole).

Calendar and working days should not be confused, since the number of vacation days is always counted in calendar days - therefore, earnings for calculating vacation pay should also be counted in calendar days.

The final point is to calculate the amount of the reserve itself (do not forget to calculate insurance premiums from this reserve). The final reserve amount will be calculated using the following formula:

Reserve = (employee SDZ × K × DNO) (employee SDZ × K × DNO) × Cst,

Where:

DNO - days of unused vacation,

Cst - the total rate of insurance premiums in%.

The most accurate way to calculate the reserve is to calculate it individually for each employee. In this case, the amount of the reserve will consist of the amount of obligations to each employee. However, if the number of employees in the company is large, this process will be quite labor-intensive.

Who creates

Accounting regulations stipulate who is obliged to create a vacation reserve - this is the responsibility of not only government organizations, but also all legal entities. An exception is made only for organizations that maintain simplified accounting. For commercial organizations and non-profit organizations, the responsibilities are prescribed:

- in paragraph 3 of PBU 8/2010;

- Articles 4 and 5 402-FZ dated 06.12.2011.

Budgetary institutions form reserves according to the Federal Accounting Standards, approved by Order of the Ministry of Finance No. 124n dated May 30, 2018 “Reserves. Disclosure of Contingent Liabilities and Contingent Assets.”

An example of calculating and reflecting the vacation reserve in the accounting accounts

This is an example of the above method of calculating the reserve - based on average earnings. Below you will see examples for other reservation options.

Example

reflected in the accounting policy that the reserve for vacation pay is formed quarterly. To calculate wages and insurance premiums, account 44 “Distribution costs” is used; in total, the company employs 20 people. The company has no grounds for applying reduced or increased insurance premiums (the total rate of insurance premiums is 30.2%). As of March 31, the data for the quarter is as follows:

- number of days of unused vacation - 134;

- for the 1st quarter, the amount of accrued wages amounted to 678,000 rubles;

- there are 91 days in the quarter.

- Let's calculate the reserve as of 03/31/20XX:

SDZ = 678,000 / 91 / 20 = 372.53 rubles.

The reserve amount is 372.53 × 134 × 20,372.53 × 134 × 20 × 30.2% = 998,380.40 301,510.88 = RUB 1,299,891.28.

Postings:

Dt 44 “Sales expenses” Kt 96.01 “Vacation reserve” - RUB 998,380.40.

Dt 44 “Sales expenses” Kt 96.01 “Vacation reserve” - RUB 301,510.88.

- Let’s add a few more data to this example to understand how the vacation reserve is adjusted:

- as of 03/31/20XX, a reserve for vacation and insurance premiums was accrued in the amount of RUB 1,299,891.28;

- in the 2nd quarter, the amount of accrued vacation pay and insurance contributions from them amounted to 140,900 rubles;

- the number of unused vacation days at the end of the 2nd quarter is 120 days;

- wages for the 2nd quarter and the number of employees remained the same as in the previous period.

Thus, as of 06/30/20XX, the amount of the unused reserve amount is equal to 1,299,891.28 - 140,900 = 1,158,991.28 rubles.

Reserve amount as of 06/30/20XX:

SDZ = 678,000 /91 / 20 = 372.53 rubles.

The reserve amount is 372.53 × 120 × 20,372.53 × 120 × 20 × 30.2% = 894,072,270,009.74 = RUB 1,164,081.74.

Amount for contributions to the reserve as of the end of the 2nd quarter:

1,164,081.74 (calculated reserve) - 1,158,991.28 (reserve balance, balance in account 96) = 5,090.46 rubles.

If the amount of the reserve on the account. 96 exceeded the calculated amount at the end of the quarter, the reserve should have been reduced. In our case, it is necessary to make an additional accrual posting.

Postings:

Dt 44 Kt 96.01 - 5,090.46 rub.

Method 1: personalized calculation

If an organization decides to calculate the vacation stock for each employee, the following formula is used:

RO = K × ZP,

Where:

- RO - vacation reserve;

- K - the balance of rest days not used by the employee;

- Salary is his average daily earnings.

IMPORTANT!

In all three cases, all data is taken on the day of calculation.

You also need to determine the amount of reserve to pay insurance premiums. The formula used for this is:

Рсв = К × ЗП × С,

Where:

- RSV - reserve of expenses for insurance premiums;

- C is the rate of insurance premiums.

Having summed up both obtained values, we get the amount that is reserved to pay for the vacation.

Other ways to calculate reserves

As already noted, the algorithm for calculating the amount of the reserve is prescribed in the accounting policy, this is due to the fact that PBU 8/2010 does not contain formulas and methods that allow obtaining the value of the reserve.

In addition to the above method, in practice, you can also use one of the following amounts to calculate the reserve:

- wage fund (hereinafter referred to as OT);

- vacation pay paid for the calendar year preceding the year for which the reserve is created (standard method).

The procedure for calculating the reserve amount is carried out in the following steps:

- determination of the average daily wage fund or vacation pay;

- formation of a reserve.

Let's look at examples of using each of these methods.

Example 1

Molniya LLC's accounting policy reflects the creation of a reserve for vacation pay for the year 20XX based on labor costs. The organization uses the following formula to calculate the reserve:

(FROM insurance premiums) / 28 × 2.33,

where 28 is the number of vacation days per year for each employee;

2.33 - number of vacation days for 1 month worked.

The reserve is formed at the end of each month. The reserve does not include payments to employees who have not worked for a full month. The reserve amount at the end of 2021 is 0 rubles. The OT values for 2021 are presented in column 2 of Table 1. Insurance premiums - 30.2% (including contributions for injuries).

Table 1. Reserve calculation

| Month | FROM | Insurance premiums (OT × 30.2%) | Reserve (FROM insurance premiums) / 28 × 2.33 |

| 1 | 2 | 3 | 4 |

| January 20XX | 100 000 | 30 200 | 10 835 |

| February 20XX | 110 000 | 33 220 | 11 918 |

| March 20XX | 120 000 | 36 240 | 13 001 |

| April 20XX | 100 000 | 30 200 | 10 835 |

| May 20XX | 130 000 | 39 260 | 14 085 |

| June 20XX | 90 000 | 27 180 | 9 751 |

| July 20XX | 108 000 | 32 616 | 11 701 |

| August 20XX | 111 000 | 33 522 | 12 026 |

| September 20XX | 120 000 | 36 240 | 13 001 |

| October 20XX | 100 000 | 30 200 | 10 835 |

| November 20XX | 101 000 | 30 502 | 10 943 |

| December 20XX | 100 000 | 30 200 | 10 835 |

| Total | 1 290 000 | 389 580 | 139 765 |

At the end of each month, Molniya LLC will reflect in the accounting the accrual of the reserve for the year 20XX: Dt 26 (44.20) Kt 96 in the amount from column 4, i.e. as of 01/31/20XX - 10,835, as of 02/28/20XX - 11,918 , as of 03/31/20XX - 13,001, etc.

The reserve amounts are reflected in the balance sheet as part of the indicators in line 1540 “Reserves for future expenses.”

Example 2

LLC "Molniya" in its accounting policy recorded the creation of a reserve once a year, based on the payment of vacations of the previous year. According to accounting data, these expenses are 960,000 rubles.

Reserve calculation:

Insurance premiums = 960,000 × 30.2% = 289,920 rubles.

Reserve = 960,000 289,920 = 1,249,920 rubles.

Calculation example using method 2

Let's consider another option for creating a reserve for vacations in accounting and tax accounting with an example of calculation in 2021. Let's say that employees of an institution have accumulated 450 days of vacation, and the average daily salary is 1,500 rubles.

The additional amount will be 1500 rubles. × 450 days = 675,000.

The total rate is 30.2%, so the amount to pay insurance premiums = 675,000 × 0.302 = 203,850.

Total required to reserve 675,000 + 203,850 = 878,850.

What is the impact of the new standard?

The federal standard “Payments to personnel” was approved by order of the Ministry of Finance of the Russian Federation dated November 15, 2019 No. 184n for use in government and local governments, governing bodies of state extra-budgetary funds, recipients of budget funds, state and municipal autonomous and budgetary institutions. In accordance with it, two groups of payments were allocated for the public sector: current and deferred. How are they different?

Current payments always have a certain deadline, are characterized by a specific size, and the object of their accounting is a separate monetary obligation. But the object of deferred payments is a separate obligation to an individual, the amount of which must be calculated by assessing the obligations for an indefinite period of validity.

These include:

- payment of basic and additional holidays to employees for hours worked;

- compensation for unused vacation upon dismissal of an employee or upon application;

- insurance premiums accrued for the above items.

To evaluate deferred payments, it is necessary to create a reserve, which can be created using the following algorithm:

- Fix the selected calculation method in the accounting policy.

- Determine in personnel production the amount of unused vacation for all employees.

- Calculate the average salary for the entire institution or the average daily earnings for each employee.

- Calculate the reserve using the selected method.

There are only three methods for calculating the reserve: for the institution as a whole, for categories of employees and for an individual employee. A detailed description of each of these methods can be found in the letter of the Ministry of Finance of the Russian Federation dated May 20, 2015 No. 02-07-07/28998.

Why is it calmer and more reliable with PROGRAMS 93 LLC than with regular employees?

- You work with a team. The work of each specialist is checked by competent specialists; you do not need to understand the issue yourself.

- Our problems don't become yours. There is no need to organize a workplace for an employee, pay him sick leave and vacations. You won’t even notice that someone from the team is sick - another specialist will immediately replace him!

- We have experts of different profiles. We take a comprehensive approach to accounting and can optimize the work of an entire department.

Call the phone number listed on the website or fill out the feedback form so that we can guide you on the exact cost, choose the best solution and tell you how to start cooperation!

Option 3: helps to avoid the difference between accounting and tax accounting

To avoid discrepancies between accounting and tax accounting, the organization decides to form an estimated liability in tax accounting and approves in its accounting policies a calculation methodology similar to that established in Article 324.1 of the Tax Code of the Russian Federation. It consists in the following.

Deductions are made every month and are determined by the formula:

Calculate the percentage of deductions using the formula:

At the end of the year, the amount of the generated estimated liability must be inventoried. To do this, the cost of non-vacation days on the last day of the year is determined. The amount received is compared with the actual amount of the estimated liability at the end of the year.

Example.

Another example of calculating the reserve for vacation pay in 2021: Company LLC employs 10 people. The average salary as of December 31, 2020 was 20,000 rubles. For January, the amount of accrued wages amounted to 200,000 rubles.

| Index | Calculation | Result |

| Projected average daily earnings | 971,66 | |

| Forecasted average daily income for calculating vacation pay | 682,59 | |

| Estimated amount of vacation pay for 2021 | 191 125,20 | |

| Insurance premiums | 57 719,81 | |

| Estimated amount of labor costs in 2021 | 2 205 668,20 | |

| Insurance premiums | 666 111,80 | |

| Percentage of deductions | 8,67 % | |

| Deduction to the reserve for January 2021 | 22 576,68 |

Calculation example using method 3

Let the data for employee categories at the beginning of the year be as follows:

- for management personnel: rest of vacation days - 300 calendar days, average daily earnings - 2000.00 rubles.

- for business personnel: remaining days - 200 calendar days, average daily earnings - 1200.00 rubles.

Reserve amount = 2000 rub. × 300 days + 1200 rub. × 200 days = 840,000.

The total rate is 30.2%, therefore, the amount to pay insurance premiums = 840,000 × 0.302 = 253,680.

A total of 840,000 + 253,680 = 1,093,680 should be reserved.

How to reflect in accounting

In budget accounting, the accrual of financial reserves and all other operations with it are reflected in special postings. We have prepared an example of how the vacation reserve is formed in a table with accounting entries for budget accounting:

| Contents of operation | accounting entry | |

| Debit | Credit | |

| Formation | ||

| For vacation pay | KRB.1.401.20.211 | KRB.1.401.60.211 |

| For insurance premiums | KRB.1.401.20.213 | KRB.1.401.60.213 |

| Accrued expenses | ||

| For vacation pay | KRB.1.401.60.211 | KRB.1.302.11.730 |

| For payment of insurance premiums | KRB.1.401.60.213 | KRB.1.303.00.730 |

| Refinement upwards (downwards using the “red reversal” method) | ||

| For vacation pay | KRB.1.401.20.211 | KRB.1.401.60.211 |

| For payment of insurance premiums | KRB.1.401.20.213 | KRB.1.401.60.213 |

What is an estimated liability?

Provisions are an existing obligation of an enterprise that has an uncertain amount or deadline. If available, a reserve must be created.

If the indicator does not appear in the reporting, this will lead to an overstatement of net profit. For this reason, financial statements will not provide objective information about the position of the enterprise. All this can lead to negative consequences: an increase in dividends and a deterioration in the financial condition of the organization.

Are provisions for doubtful debts classified as provisions?

Estimated liabilities differ significantly from other provisions. Let's look at examples:

- The company plans to repair equipment; this will require funds. A reserve of estimated liabilities will not be created for them, since repair work is not the responsibility of the organization. The company may change its mind about carrying out repairs.

- The reserve also does not need to be organized in the presence of ordinary obligations. The company ordered the goods. The products arrived, but the company did not pay for the contractor’s services. In this case, a reserve for estimated liabilities will not be created, since the existing debt is payable. It does not correspond to an important feature of an estimated liability - uncertainty of the amount and timing. In this example, the company knows how much money it owes and when it needs to be repaid.

- Estimated liabilities and estimated provisions differ. The latter represent an adjustment to the balance sheet indicators of assets associated with the receipt of new information. Valuation reserves are created in the presence of doubtful debts, a decrease in the value of inventories, and a decrease in prices for financial deposits. These indicators are not reflected in the balance sheet. The indicators under consideration will be recorded in the liability side of the balance sheet.

- Provisions that are created on the basis of undistributed earnings will also not be classified as provisions.

Difficulties often arise when fixing OO. To prevent errors, it is important to distinguish an estimated liability from other types of provisions.

Are estimated liabilities reflected in tax accounting ?