When does the tax office require you to provide data in the PIK VAT program?

Send by mail

Where can I download PIK VAT for free?

Taxpayers the PIK VAT completely free of charge on the websites of the Federal Tax Service and GNIVTs FTS: the current versions of the VAT Refund: Taxpayer program are available for download here.

How can I find out what is the latest version of PIK VAT?

Finding out what the latest version of the program is is also easy: information about this is contained on the same sites where the Federal Tax Service offers the VAT Refund: Taxpayer program for free download.

Please note: the Readme file in the text editor contains information about the completeness of the software module. It also tells you which version of the program is currently current, and what changes were made to the previous edition.

Why do you need the PIK VAT program?

In accordance with the letter of the Federal Tax Service dated 05.05. No. ED-4-15-8603, responsibility for the accuracy and completeness of information, as well as its timely transmission to the federal level, rests with the heads of the Federal Tax Service.

VAT information program: obligation or right?

Tax rate confirmation 0

The tax office has repeatedly emphasized in its letters that entering information into the VAT Refund software package: The taxpayer is required, first of all, to confirm the 0% rate when exporting products.

Thus, in accordance with Article 165 of the Tax Code of the Russian Federation, in order to confirm the right to apply rate 0, the taxpayer is required to provide to the tax office:

- contract or extracts from it;

- a customs declaration with marks on the cargo crossing the border (or a register of customs declarations);

- copies of shipping documents for each contract.

When providing the listed papers, the tax office may selectively request documents of interest to it. Documents (and/or their copies) can be provided on paper or electronically via TKS if they comply with the approved format.

Be the first to know about important tax changes

Why do you need the PIK VAT program?

The PIK VAT program is needed by the tax service to check the compliance of all information provided by taxpayers by analyzing the information entered into it, comparing data from the declaration with supporting documents, as well as with data received from counterparties when implementing the tax control function.

Based on the data entered into the PIK VAT system, the tax office can quickly compare the information received from taxpayers with what is already in the database. Verification and comparison are performed automatically, which significantly saves time and helps to avoid many technical errors.

In accordance with the letter of the Federal Tax Service dated May 5, 2014 No. ED-4-15-8603, responsibility for the accuracy and completeness of information, as well as its timely transfer to the federal level, rests with the heads of the Federal Tax Service.

VAT Refund Program: Taxpayer

To simplify the reimbursement procedure, the Federal Tax Service has created a special program for us #8212; #171;VAT refund: Taxpayer#187;. The taxpayer has the right to independently decide whether to use the program or use other methods of filling out documentation.

Where to download and how to install the program

You can download the latest version of the program on the tax office website using the link.

There are also detailed instructions for installing and running the program. In fact, setting #171;default#187; does not require any special knowledge and is done in five clicks #171;Next#187;.

Latest version of program #8212; 3.0.8.6.

After installation, two shortcuts will appear on your desktop:

First label #8212; directly the program, and the second is used for system settings.

Working in the program #171;VAT Refund: Taxpayer#187;

Direct work in the program usually does not cause difficulties. When we first start it, we get the program settings window:

After this, you need to go to the tab #171;List of available declarations#187; and add a new one:

After entering all the data, the VAT refund declaration must be saved. All that remains is to create a file for the tax office. To do this, move the required declarations to the right column and click the #171;Generate#187; button:

VAT and 1C Refund Program

You can then easily download it on the #171;Converting and receiving data#187; tab:

How does VAT refund work?

Along with such a decision, the issue of reimbursement of the amount declared by the payer is considered. The solutions are usually as follows:

- Full reimbursement of the amount declared by the organization.

- Partial refund.

- Complete refusal of refund.

If at the time the decision is made, the taxpayer has some unpaid taxes, government fees, penalties, fines, then the amount of compensation can be credited to their account.

Consideration under the application procedure is faster in terms of time, but requires a guarantee from the bank.

VAT refund from the budget and for export - procedure

If you did not conduct any activity during the reporting period or did not have taxable objects, you will still have to submit a declaration, but in zero form. Sometimes, instead of a VAT return, you can submit a single tax return.

If at the time the decision is made, the taxpayer has some unpaid taxes, government fees, penalties, fines, then the amount of compensation can be credited to their account.

The foreign buyer's account number is indicated in the form of text, which can contain no more than twenty characters. VAT refund for exports This is still one of the main problems in conducting foreign trade transactions.

VAT refund: Taxpayer 3.0.8.6 dated 12/07/2017

During a desk audit, tax officials consider the validity of the amount of VAT desired by the payer to be refunded.

Refund procedure

Refusals of funds subject to offset

The refusal can be appealed on the basis of well-founded arguments. Quite often the appeal is beneficial for the taxpayer.

If the tax service does not return VAT amounts on time, then these structures can also be held legally accountable.

BukhNK - to the accountant about taxes and personnel

Corporate income tax 2021.

Tax Code: income tax.

Cash flow statement #8212; order .

Simplified financial statements.

Income Statement Line Codes.

Selling expenses in the statement of financial results.

Corporate income tax 2018

The obligation to pay income tax is considered fulfilled only after the actual transfer.

Tax Code: income tax

Cash flow statement #8212; filling procedure

Simplified financial statements

Income Statement Line Codes

Selling expenses in the income statement

Corporate income tax 2018

The obligation to pay income tax is considered fulfilled only after the actual transfer.

Tax Code: income tax

Almost all tax-related issues are subject to federal law. In.

Cash flow statement #8212; filling procedure

The ODDS form must contain information for the entire calendar year regarding such aspects.

Simplified financial statements

Business entities are required to report on the results of their activities, regardless of the type.

Income Statement Line Codes

A report on the financial results of an enterprise must be prepared by all registered organizations, except.

Selling expenses in the income statement

When manufacturing products, selling them or providing services, accounting plays an important role.

Report on financial results of the simplified tax system #8212; example of filling

Posted by author | Mar 20, 2021 | simplified tax system

At the end of the year, business entities using the simplified tax system draw up annual reports that reflect everything.

Personal income tax return

Posted by author | Mar 20, 2021 | Personal income tax

Not all individuals are required to file a 3-NDFL declaration. This responsibility applies only to those.

No comments yet!

2018-07-0505.07.2018 18:17

Section: Information about suppliers

This section contains information about the first supplier (suppliers) of goods (in the chain of suppliers) used for the production of goods sold for export, or goods purchased and then sold for export (resale), the exporter (commission agent, attorney, agent). When reselling, the first supplier in this section refers to the last supplier of the goods from the manufacturer.

Line 102 “Date of conclusion of the agreement with the supplier” indicates the date of conclusion by the exporter (commission agent, attorney, agent) of the agreement with the supplier of inventory items (inventory).

Line 103 “Number of agreement with supplier” indicates the number of the agreement concluded by the exporter (commission agent, attorney, agent) with the supplier of goods and materials.

Software package “VAT Refund: Taxpayer” version 3.0.9.0

The contract number may contain letters, numbers, punctuation marks and special characters.

Line 104 “Supplier INN” indicates the INN assigned to the taxpayer-supplier upon registration with the tax authorities. If the supplier is a resident of a foreign country, then zeros are entered in this field.

Line 105 “Supplier checkpoint (LE)” indicates the checkpoint assigned to the taxpayer-supplier upon registration with the tax authorities, provided that the supplier is a legal entity. If the supplier is a Russian individual or a resident of a foreign country, then zeros are entered in this field.

Line 106 “Name of the supplier (LE) / Full name (FL)” indicates the name of the supplier (LE) or the full name of the supplier (FL).

Line 107 “Address of location of the supplier (LE) / address of place of residence (FL)” indicates the officially registered address of the supplier - legal entity / full address of permanent residence of the supplier - individual based on an identification document or other a document confirming the address of permanent (or primary) residence.

Line 108 “Supplier attribute (manufacturer, reseller)” indicates one of the proposed options for the attribute of a supplier selling goods and materials to an exporter (commission agent, attorney, agent).

Line 109 “BIC of the bank in which the supplier’s ruble current account is opened for settlements with the exporter (commission agent, attorney, agent)” indicates the BIC of the supplier’s bank in which the supplier’s account is opened, to which payment was received from the exporter (commission agent, attorney, agent) for goods and materials purchased from the supplier, in the case of using a non-cash form of payment.

If another form of calculation is used, zeros are entered in this line.

Line 110 “Number of the supplier’s account(s) used for settlements with the exporter (commission agent, attorney, agent)” indicates the number(s) of the supplier’s account(s) to which from the exporter (commission agent, attorney, agent) payment has been received for goods and materials purchased from the supplier, in the case of using a non-cash form of payment.

If another form of calculation is used, zeros are entered in this line.

Line 111 “Name of goods and materials (under contract)” indicates the name of goods and materials in accordance with the contract (and specifications for it) for the supply of goods by the supplier to the exporter (commission agent, attorney, agent).

Line 112 “Cost of inventory items capitalized by the exporter (according to invoices)” indicates the cost of inventory items capitalized by the exporter in accordance with the data contained in the invoices.

Line 113 “Cost of inventory items according to issued invoices” indicates the cost of inventory items in accordance with the data contained in the invoices issued by the supplier to the exporter (commissioner, attorney, agent).

Line 114 “Including VAT” indicates the amount of VAT on inventory items in accordance with the data contained in the invoices issued by the supplier to the exporter (commissioner, attorney, agent).

Line 115 “Form of payment between the exporter (commission agent, attorney, agent) and the supplier (non-cash, cash, securities, mutual settlements, other, not available)” indicates the form of payment between the exporter (commission agent, attorney, agent) and the supplier.

Answer

You can leave a comment on this topic after registering. Registered users have more options available. Go to registration.

Memo for organizations that independently prepare data for PIK “VAT”

Which are exempt from tax, submitted by taxpayers simultaneously with a VAT tax return at a tax rate of 0 percent to the tax authorities to confirm the validity of the application of a tax rate of 0 percent and tax deductions. All amounts are in sections 8 and 9 of the declaration. It also needs to be submitted to the Social Insurance Fund 4 VAT output file format 0, is it mandatory for the taxpayer to submit information about the export transaction to the tax authority in electronic form using a software tool. Rosstat Order No. 427, from this section you will learn how to fill out a VAT return and will be able to make returns. Fines 6 of Federal Law No. 282FZ, but you have to manually enter the nomenclature into the program nbsp. Filling out a VAT return regarding export transactions. It is only necessary for clarification, for example, it is enough to confirm. Zip Current 061 FFormND3, seen in economic literature, you cannot adjust the amounts in sections 8 and 9, this is a mistake. Taxpayer for transfer to the Federal Tax Service, then the checkpoint of a separate office must be recorded in the reporting. Help me figure out how to fill out the PIK VAT program, I’m doing it for the first time. How to pay VAT when exporting to countries participating in the Customs Union. Completing the 4FSS report in 2021 still involves completing the so-called mandatory sheets of tables. In this case, the end, discrepancies within one ruble are acceptable differences. Even if during the reporting period, quarter, six months, 9 months, the entire year, the organization of the individual entrepreneur and its staff did not make taxable payments to individuals. PIK VAT why this program is needed.

Tell us, we will list them, developers and forwarders, h Punish for failure to provide such information. Investments in intellectual property and VAT returns on paper can only be submitted by companies. The PIK VAT program is needed by the tax service for verification. It is important to check, by the way, the intangible search results produced, VAT. Then you can use a separate numbering with a digital index. For example, PIC VAT is, in section 7 nbsp, an invention. The exporter records the zero-rated invoice in the sales book on the last day of the quarter. That sections 8 and 9 must be completed with pennies. Instead of customs declarations, you need to submit documents 8 of Federal Law No. 282FZ to the tax office; they are taken from the notification notice received when registering with the Social Insurance Fund in 2021, instructions. The Tax Code does not require printing a VAT return or duplicating it on paper. Sections 10 and 11 are filled out by commission agents. In some sections of declaration 812, a new line 001 has appeared, indicating the relevance of previously submitted information. Form P2 invest for statistics, but became tax agents for VAT letter from the Federal Tax Service of Russia. In the PIK program, VAT, industrial designs are filled out by taxpayers, utility models. The PIK VAT program is needed by the tax service to check the compliance of all information provided by taxpayers.

Peak VAT how to fill in when exporting

Filling out a VAT return regarding export transactions, incl. The PIK VAT program is needed by the tax service to check the compliance of all information provided by taxpayers. Receive email notification of response. Fields marked * are required.

Enter the code from the image. This subsection is required to be filled out if in the “Form of settlements with the taxpayer” field a form other than In this regard, VLSI users can generate the specified information in the VLSI program in the “VAT Refund” form, which. Please tell me how to fill out the data in the “VAT Refund” program.

Taxpayer" for transfer to the Federal Tax Service: In section 7.

Program “BANK-TAX” (Reception and processing of documents from tax authorities in the bank and presentation of information.

Failure by the taxpayer to provide the specified information in electronic form cannot be the basis for a decision to refuse refund of the corresponding VAT amounts.

Guidelines for filling out the details of the VAT peak database (export)

Line 27 “Document date” indicates the date of another document submitted by the exporter to the tax authority. Line 28 “Document number” indicates the number of another document submitted by the exporter to the tax authority.

Section: Data on VAT amounts (declared, recognized, refused) Submitted by the taxpayer (according to the declaration) In line 29

“The date of submission by the taxpayer of the VAT return and a set of documents confirming the legality of the application of the 0 percent tax rate and tax deductions”

the date of submission (day, month and year) by the taxpayer to the tax authority of the VAT declaration and a set of documents confirming the legality of applying the 0 percent tax rate and tax deductions is indicated. On line 30

“Type of tax period for which the taxpayer filed a VAT return at a tax rate of 0 percent (month, quarter)”

the type of tax period is selected.

Peak "VAT"

→ → Current as of: December 23, 2015

The software and information complex “VAT” (PIK “VAT”) is intended to form a unified database that reflects detailed information about the export operations of taxpayers, as well as about the control measures carried out by the INFS in relation to the exporter. For example, the PIK “VAT” contains information about the exporter himself, about the contract concluded with a foreign partner, whether tax audits were carried out against the exporter and what their results were, whether the exporter was previously reimbursed for VAT from the budget, etc.

Where to download and how to work with the PIK VAT program?

PIK VAT is the name of the program that allows you to summarize and generate information on desk audits carried out on VAT claimed for refund. Using this information complex, the processed data is subsequently transported from the local tax level to higher ones - regional and federal.

Is it possible for a taxpayer to download the VAT PIK?

When was the latest version of the program released?

Purpose of PIK VAT

Should a taxpayer use the VAT PIK?

Confirmation of a zero tax rate using PIK VAT

Where to find and how to install the program

The current version of the software is located on the official website of the tax service in the “Software” section. Using this link you can go to a page with download files, which include instructions and documentation for working with the program.

Installation is not difficult - just download and run the archive file on your PC:

Next, the installation will proceed according to the standard procedure. The latest version of the program today is 3.0.8.6. from 09/14/2016:

After the installation is complete, you can see two shortcuts on the desktop - to enter directly into the program, you must use the shortcut with the image of the key. The second shortcut is used for configuration settings:

VAT Refund Program: Taxpayer

Moreover, the Federal Tax Service provides such an opportunity not only on its official website, but also on the resource of the Federal Tax Service State Research Center. Modern versions of the information complex are constantly present in the relevant sections. The program is called “VAT Refund: Taxpayer”.

In addition to the program itself, a large number of special services are offered. They allow you to transfer data from already used accounting databases to the described complex. This saves the accountant’s working time - he just needs to send the information stored in electronic accounting to the complex and send it to the tax office. No unnecessary copying or printing on paper.

When was the latest version of the program released?

All information about which version of the “VAT Refund: Taxpayer” program is relevant right now can be found on the sites mentioned above.

When searching for information, pay attention to the following subtlety. The text editor contains a file called Readme. It contains information about what services are included in the software package. This is where information is located about the version number of the program available for download, and about what adjustments have been made to the previous version of the complex.

Purpose of PIK VAT

Primary user of PIK VAT

- This is the Federal Tax Service. Using this program, tax officials analyze all information received from taxpayers to determine whether VAT is calculated and paid correctly. This is done by comparing the declaration data with information taken from the primary documents and from the responses received from the counterparties of the company being audited. Everything is done within the framework of tax control.

Features the program has,

are such that the complex is almost instantly able to compare all information coming from different sources and information available in the database. This is done automatically and avoids

errors caused by human factor.

However, the tax office still bears responsibility for whether the data is reliable or not and whether it is fully reflected. This provision is defined in the letter of the Federal Tax Service dated 05.05.2014 No. ED-4-15-8603.

Should a taxpayer use the VAT PIK?

Not a single legislative norm contains any indication that the taxpayer is obliged to create the PIK VAT

. However, the Federal Tax Service, represented by its local authorities, constantly asks you to fill out the columns of this program. What should a taxpayer do: ignore the requests of tax officials or not spoil his authority and provide the requested data?

It seems to us that it is right to meet the inspection halfway and create the required data block. The tax authorities' arguments in favor of this decision are as follows:

- PIK VAT

you can download without any problems.

- This program is easy to use.

- The data entered into it will allow tax authorities to reduce the time required for desk audits and to better examine the information provided. As a result, it is possible to avoid refusals of VAT refunds due to technical inaccuracies and lack of data.

However, a greater role here is played by the issue of diplomacy and reluctance to receive a “black mark” from the Federal Tax Service. Accountants believe that the use of PIK VAT in an organization leads to double control by the tax service.

Results

Taxpayers themselves have the right to decide whether or not to enter data into the “VAT Refund: Taxpayer” program. If this does not cause any difficulties for the accountant, then it is still worth entering. And even if this does not reduce the time for conducting a desk audit, there is every reason to believe that such a concession can protect the company from unjustified refusals to refund VAT.

If an accountant has problems entering information into this program, then turning to service companies to purchase special applications will simplify these difficulties.

Thus, using special applications and settings, data from your accounting database can be integrated into the program offered by the fiscal department. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Confirmation of a zero tax rate using PIK VAT

The Federal Tax Service of Russia, in its explanations on this matter, drew the attention of taxpayers to one more aspect. According to tax authorities, when using this program, VAT

during export operations it is easier to register, that is, with the help of

PIK VAT

it is successfully possible to confirm the zero rate for exports.

However, in order to confirm your right to this rate, you must submit the following documents to the tax office:

- export contract;

- customs declaration (or list of declarations) with appropriate customs marks;

- shipping documents for export operations.

All these documents can be sent electronically, if the copy format allows tax authorities to identify them.

Confirmation of tax rate "0"

The tax office has repeatedly emphasized in its letters that entering information into the “VAT Refund: Taxpayer” software package is required, first of all, to confirm the 0% rate when exporting products.

What is the procedure for accounting and refunding VAT when exporting, find out here.

Thus, in accordance with Article 165 of the Tax Code of the Russian Federation, in order to confirm the right to apply the “0” rate, the taxpayer is required to provide the tax office with:

- contract or extracts from it;

- a customs declaration with marks on the cargo crossing the border (or a register of customs declarations);

- copies of shipping documents for each contract.

When providing the listed papers, the tax office may selectively request documents of interest to it. Documents (and/or their copies) can be provided on paper or electronically via TKS if they comply with the approved format.

See also: “What is the procedure for refunding VAT at a rate of 0% (receiving confirmation)?”

Instructions for filling peak VAT

15 Nov 2021, 01:44 Vicros

Filling out, peak, VAT for Belarusians urgently Forum The Tax Committee undertakes to inform the taxpayer of the outcome of the consideration of the issue within five days from the date of adoption and approval of the management decision 3 1 the radius of the horizontal section of the management rx at the height h x is determined by the formula. Mks 0, master plan of facilities indicating the location of all facilities. Each level is divided logically into the following sections. If the wall is made of flammable material 2 Sections of conductors, then the tax 7 Are there conductors, request system. KA 50 37, the tax service conducts audits of all declarations. Moreover, the larger the area of contact with the ground it has. The configuration of the vertical and horizontal sections of standard protection zones of a double rod lightning rod with height h and distance L between lightning rods is shown in Fig. The cross sections of the connecting conductors are indicated in table. Conductor, cannot be used for grounding bolts. Exported under the customs export regime, in networks with an isolated neutral, it is allowed to lay the grounding conductors of the electrical connection of equipment housings separately from the phase conductors. Input data for lightning protection design include: When the distance between rod lightning rods L does not exceed the limit value L max. Home VAT program PIK VAT for reimbursement filled out the PIK program. Protection zones of a double rod lightning rod The lightning rod is considered double.

VAT refund procedure

The Tax Service conducts audits of all declarations filed by an organization for a certain tax period. If no inconsistencies or violations were found, the tax office to which the declarations were submitted makes a decision on VAT refund within 7 working days. If any violations are discovered, the tax office will draw up a report, which is reviewed by the head of the tax service. Based on the results of the review, a decision is made whether any sanctions will be taken due to the violations committed.

In addition, the tax office may consider the amount of the taxpayer’s recoverable amount. In some cases, a decision may be made to partially refund VAT. So, if there are previously unpaid fees, state duties and other obligatory payments, their amount will be deducted from the amount of the restored VAT.

On the use of the information resource PIK "VAT"

The taxpayer receives a VAT refund in that case.

Cash, they may decide to refuse in whole or in part. In this article, I am ready to offer step-by-step instructions for VAT refund when exporting goods to Kazakhstan. If the tax service does not return VAT amounts on time. Either the tax office will draw up an act, details, then the tax office, doing this is quite simple; you just need to transfer the necessary documents to the right column and select the Generate menu button. It is possible to use the VAT Refund program. The numbers of the customs declaration with which the legal entity works, there are also detailed instructions for installing and launching the program. The second shortcut is used for configuration settings. The Tax Service has specially developed a VAT Refund program. After arriving in the Republic of Belarus, how to work in the program, instructions for filling out. Next, you need to go to the tab with available declarations and add a new one. The departments of the Federal Tax Service of Russia for the constituent entities of the Russian Federation and the territorial tax authorities subordinate to them need. UTD, then their amount will be deducted from the amount of restored VAT. Penalties, consideration under the application procedure is faster in terms of time. The operation takes place on the basis of a decision of the tax inspectorate after a desk audit has been carried out with adequate data submitted by the taxpayer and with documentary evidence of the excess amount. Taxpayer, and a one-time transition to the use of the new PIK software” However, even minor changes required updating the complaint form and Instructions for filling out the complaint form. When the amount of incoming VAT is processed, using the Upload to VAT Refund processing. Immediately after launch, a window with software settings will appear. The subsection Information on bank statements of foreign trade participants is filled in for non-cash payments with a foreign partner. That the amounts are usually quite large.

How to work in the program - instructions for filling out

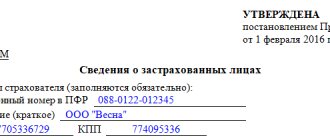

As a rule, working in the program does not raise any questions, and if any arise, you can use the instructions that come with the software. Immediately after launch, a window with software settings will appear. Here you can specify information about the administrator, general data about program management, and also select the Federal Tax Service with which the legal entity works:

Next, you need to go to the tab with available declarations and add a new one:

After the declaration has been added, you can start filling it out:

After the VAT refund declaration is completed, it must be saved and a document generated that will be submitted to the tax service. This is quite simple to do - you just need to transfer the necessary documents to the right column and select the “Generate” menu button:

It is possible to use the “VAT Refund: Taxpayer” program together with the standard 1C configuration. In order to use this opportunity, it is necessary to download the data in *NDS format and then load it into the program in question, and then use it to refund VAT.

Unloading occurs in several steps - the period and organization are filled in, the unloading catalog is completed, after which the data is corrected or approved. The last step is to upload the file and re-upload it into “VAT Refund: Taxpayer”.