Concept and types of tax benefits

Tax benefits are a more favorable regime for transferring obligatory payments to the budget compared to the “standard” one. Benefits can be provided in different ways:

- Exclusion from taxation of certain objects.

- Complete exemption from certain taxes.

- Reducing the tax base.

- Reduced tax rates.

- Deferment or installment payment.

Tax benefits cannot be established individually for a specific individual or legal entity (clause 1 of article 56 of the Tax Code of the Russian Federation). Also, benefits should not depend on nationality, religion, citizenship or source of capital (clause 2 of article 3 of the Tax Code of the Russian Federation).

Who sets tax breaks?

The tax system in the Russian Federation consists of three levels: federal, regional and local. Each of them may be subject to certain preferences.

At the federal level, preferential treatment is determined only by the Tax Code of the Russian Federation. At the regional and local levels, benefits can be established by the Tax Code of the Russian Federation or regulations of constituent entities of the Russian Federation or municipalities.

Also at the “lower” levels a combined option is possible. In this case, the Tax Code of the Russian Federation determines the “framework” conditions for the application of benefits, and regional or local authorities specify them.

For example, for personal property tax, a basic reduced rate has been established for residential real estate - up to 0.1%. And local authorities have the right to set their own rates for this category of objects in the range from 0% to 0.3%. The tax burden in this case may vary depending on the value of the object, its category or location (Article 406 of the Tax Code of the Russian Federation).

Withdrawal of individual objects from taxation

First of all, this category of benefits is applied to mandatory payments that are levied on owners of material objects: property tax, land tax or transport tax.

For example, cultural heritage sites are not subject to corporate property tax, and transport tax does not apply to low-power vehicles (up to 100 hp) equipped for use by the disabled.

But the allocation of non-taxable objects is also possible for “current” taxes. The company as a whole may be a VAT payer, but at the same time engage in the sale of certain goods or services exempt from this tax (Article 149 of the Tax Code of the Russian Federation).

Such exempt categories include, for example, medicine, passenger transport or cultural and artistic services. To apply this benefit, a businessman must keep separate records for taxable and non-taxable activities.

Types of tax benefits

Let us consider in detail the types of tax benefits.

Tax deductions

The Tax Code prescribes the classification of benefits that are available to individuals.

Tax deductions are benefits that provide the opportunity not to pay tax on an amount that is allocated for established purposes. But this applies under one condition - this amount must be paid. The meaning of this is that the subject pays the needs of a certain category, followed by the provision of supporting documents, which exempts the person from paying on the income of individuals within a certain amount.

Tax deductions are divided into the following types:

- Standard - intended for absolutely all citizens who have taxable income and who have children. The deduction is carried out monthly, and its size depends on the status of the children (whether the child has a disability) and whether the family has many children.

- Social – intended for expenses that were used for treatment, education, insurance and pension purposes. The conditions for this type of deduction imply a limitation to a certain amount.

- Property - occurs if a citizen is engaged in the sale or purchase of housing, real estate or a car. In the case of purchasing housing, the taxpayer has the right to a refund of the tax paid on the purchase.

Preferential loan: program

If a sale of real estate was made, the subject is exempt from tax payment for the income that was received in connection with the sale. To receive this type of deduction, you must comply with all the conditions provided for in the Tax Code.

For property

For any property owned by an individual, the tax code requires a mandatory state contribution. Property tax applies to the following categories:

- Premises fee. Any premises owned by a person are subject to tax. But if an individual has a state-provided status, he is exempt from mandatory contributions. Sometimes there are cases when the size of the premises does not allow it to be considered as an object of taxation.

- Car tax. This type of tax contribution is set at the regional level. However, federal legislation establishes an amount that the state contribution should not exceed. An individual may not pay for property if he has the right to do so, or if the vehicle does not meet the established characteristics.

- State land tax. A plot of land owned by a subject is also subject to tax. However, people belonging to certain preferential categories may not pay contributions if all necessary conditions are met.

Such benefits are provided both on a permanent basis and temporarily.

Benefits for land tax and transport services

Land benefits are provided for the following categories of citizens:

- disabled people of the first and second groups;

- disabled since childhood;

- heroes of labor and heroes of Russia;

- Knights of the Order of Glory;

- veterans and disabled people of the Great Patriotic War;

- liquidators of the accident at the Chernobyl nuclear power plant.

To apply for this type of benefit, you need to contact the civil service of your city.

All of the above categories are subject to transport taxation, and this also includes pensioners whose cars have an engine power of up to 150 horsepower.

Complete exemption from certain mandatory payments

One of the common options that allows a businessman to get rid of several mandatory payments at once is the use of special tax regimes.

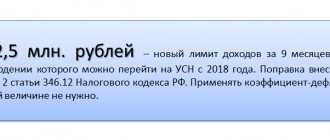

"Simplified", UTII, unified agricultural tax and the patent system allow, in general, not to pay income tax, VAT and property tax. To switch to these regimes, a businessman must meet certain criteria: composition of founders, type of activity, revenue, number of staff, etc.

However, it would be more correct to talk here not about the abolition of these payments to the budget, but about their replacement with one “special” tax. Although in most cases it is more profitable than “general” ones, the fiscal burden still remains.

But for some categories of taxpayers, it is possible to cancel certain taxes without any replacement payments, for example:

- Residents of the Skolkovo project may not pay income tax for 10 years (Article 246.1 of the Tax Code of the Russian Federation).

- Representatives of “micro-businesses” with revenues of up to 2 million rubles can receive a VAT exemption. per quarter, as well as the already mentioned Skolkovo residents and participants in other innovation programs (Articles 145, 145.1 of the Tax Code of the Russian Federation).

- Residents of free economic zones do not pay land tax for five years after purchasing a plot in the territory of the FEZ (clause 9, clause 1, article 395 of the Tax Code of the Russian Federation).

When do you have to pay personal income tax?

Income tax applies to all residents of Russia without exception. Of course, from salaries, and official ones, a certain amount in the amount of 13 percent of the salary is withheld every month in favor of the authorities. Last year's rate was exactly the same. And the principle of providing discounts also remains the same. Tax is also payable if:

- Entry into inheritance.

- Selling a car or real estate.

- Receipt of real estate or movable property by deed of gift.

- Performing one-time work or services and receiving any profit from such activities.

In simple terms, any receipt of profit through official sources must be declared and tax paid on the amount. Payers can be not only individuals and residents of Russia, but also non-residents who receive income in our country.

Reducing the tax base (tax deductions)

The application of this benefit is associated with the exclusion of certain amounts from the tax base.

For example, the income of an individual, which is subject to personal income tax, can be reduced by various “socially significant” expenses of the taxpayer: purchasing housing, training, treatment, etc. (Article 219 of the Tax Code of the Russian Federation). In addition, the law also provides for fixed deductions for personal income tax, which the employer must apply to certain categories: employees with children, veterans, disabled people, etc. (Article 218 of the Tax Code of the Russian Federation).

The use of accelerated depreciation can be considered a kind of “deduction” for income tax. In this case, a businessman has the opportunity to write off the costs of purchasing fixed assets much faster than in the standard mode - the acceleration factor can reach 3 (Article 259.3 of the Tax Code of the Russian Federation). The condition for accelerated write-off is, for example, an increased intensity of use of fixed assets, or their acquisition on lease.

Who gets the benefit? How to get a discount when paying taxes in 2021

Since the beginning of this year, amendments have been made to the legislation that directly affected the salaries of ordinary Russians. So, until this time, the rate was 13 percent in any case and regardless of the type of place of work or wages. But the tax base at the moment will be considered the total income of a resident - income from business activities, profit from the sale of property, salaries and inheritance received. Therefore, if the amount exceeds 512 thousand rubles, then the rate is already equal to 23 percent of income tax.

Benefits are given in several cases:

- Construction of a private house.

- Buying a car or apartment.

- Purchasing a voluntary insurance policy.

- Donations to religious communities.

- Education or treatment of children or parents.

- Charitable contributions.

- Registration of a mortgage.

- Voluntary pension insurance.

It is worth noting that since 2013, a legal provision has been in force according to which the following categories of residents are exempt from tax:

- Income from received plots of land in favor of authorities or residential premises.

- One-time government assistance for starting farmers.

- Recipients of assistance for children in relation to funds allocated from regional budgets.

- Recipients of grants, subsidies for the development or opening of a farm.

The tax agent issues a refund of the tax already paid. The agent is quite often the head of the enterprise or the employer. A taxpayer who claims to receive discounts is required to write an application. Then the boss is obliged to review the application within ten days and organize a tax refund. He is immediately able to issue a written refusal, which indicates the mandatory reasons.

Standard deductions for children are:

- To parents.

- Guardians or adoptive parents.

- To adoptive parents.

- One of the parents or guardians.

If you want to use discounts, you must contact the accounting department of the enterprise where the applicant works, or the Federal Tax Service at your place of residence. The 2021 income tax credit for children is available from the moment the child is born until the child turns 18 years old. If the child was a full-time student, the period for using the discount can be extended until the child turns 24 years old.

In 2021, the amount of personal income tax benefits for children will be:

- The first one is 1.4 thousand rubles.

- The second – 1.4 thousand rubles.

- Third - 3 thousand rubles.

- Disabled child – 3 thousand rubles.

The discount can be used until the amount of income from the beginning of the deduction begins to exceed 280 thousand rubles. If a Russian wants to apply for a deduction, then he must bring a birth certificate, a salary certificate for the previous year and a certificate from an educational institution. We will also add an application for benefits and a declaration of income to this list.

Reduced tax rates

For most mandatory payments, it is possible to apply reduced tax rates. The benefit in this case may be related to the category of the payer or the type of taxable object, for example:

- For income tax, preferential rates (from 5% to 13.5%) are applied to participants in free economic zones (Article 284 of the Tax Code of the Russian Federation).

- For VAT, a reduced 10% rate is used for the sale of certain groups of goods and services: food, children's clothing, medicines, passenger transportation, etc. (Clause 2 of Article 164 of the Tax Code of the Russian Federation).

In addition to reduced tax rates, there is also a benefit in the form of a zero rate, for example:

- For VAT when exporting goods or services (clause 1 of Article 164 of the Tax Code of the Russian Federation).

- On income tax for social organizations: medical, educational, cultural (Article 284.1, 284.5 of the Tax Code of the Russian Federation).

- According to the simplified tax system and the patent system - for two years for newly registered individual entrepreneurs (law of December 29, 2014 No. 477-FZ).

If a businessman is entitled to a zero rate, then he actually does not pay the corresponding mandatory payment. However, this benefit should be distinguished from the full tax exemption discussed above.

A businessman using a 0% rate must submit returns and also fulfill other taxpayer obligations. For example, for VAT this is the preparation of invoices and maintaining books of sales and purchases.

Postponement of payment deadline

Payment of mandatory payments at a later date can be implemented in two ways.

- Deferment or installment plan (Article 64 of the Tax Code of the Russian Federation).

A businessman can pay the tax later or in installments, for example, in the event of force majeure (natural disaster) or in the event of a threat of bankruptcy. The deferment period can range from one to three years.

- Investment tax credit (Articles 66, 67 of the Tax Code of the Russian Federation).

This form of support is provided to businessmen whose activities are especially important for the state. These are, for example, innovative companies, defense contractors, or residents of territorial development zones.

The term of the tax credit can range from one to ten years. Unlike installment plans, in this case you will have to pay for using budget money. True, it is not very expensive: the interest rate should not exceed 0.75 of the current Central Bank refinancing rate.

Are benefits always needed?

Unlike paying taxes itself, applying benefits is a right, not an obligation. The taxpayer has the right to completely refuse the preferences assigned to him or to suspend their use for a while, taking into account the specifics of calculating a specific payment (clause 2 of Article 56 of the Tax Code of the Russian Federation).

It would seem - why give up the benefits provided by law? However, such situations do happen.

Suppose a small enterprise switched to one of the special regimes and stopped paying VAT. In this case, the company may lose some of its clients - VAT payers, or will be forced to provide significant discounts. The loss in this case is sometimes comparable to the resulting tax savings.

Also, individuals do not always take advantage of social deductions for personal income tax (for example, for treatment). People who do not have the appropriate knowledge often turn to consultants to prepare documents for deduction. And if the amount of expenses is small, then the tax savings may be comparable to the consultant’s fee.

Social benefits for personal income tax

In addition to the standard benefit, there is also a social benefit. Citizens can also use it once a year. The following persons can receive it:

- Single mother and father.

- Afghans.

- Parents who have a disabled child.

The size of the reduction in the income tax base for parents is about 2,000 rubles. As for the participants in the war in Afghanistan, it is equal to 500 rubles. The benefit also applies to treatment of children and parents. And sometimes in foreign clinics. However, here documents are required that are ready to confirm expenses: checks, receipts, contracts with a medical institution. Discounts for parents for children with disabilities of group 1 or from childhood are given in the form that the tax base reduces the amount of income, which cannot exceed three times the minimum salary.

Want to know how to earn over 450% per annum in the stock market?

Get a free course on investing in high-yield instruments that brought in more than $1 million in 2021.

I, Andrey Abrechko, an investment expert with 12 years of experience and the founder of the Academy of High Profit Investments, invite you to take part in my free course, where you will learn:

— which instruments are the most profitable in 2021;

— what are IPOs and SPACs and how to start making money on them from 100% per annum;

I will analyze my real case, where I will show with a clear example how I managed to make more than 450% per annum for 2020.

The course consists of 5 small lessons that will be sent to you via Telegram and you can watch them at any convenient time.

Follow the link and start free training