Hello, Vasily Zhdanov is here, in this article we will look at the long-term liabilities of an enterprise. The concept of passive (from the Latin passivus “passive, inactive”) implies part of the book. balance sheet opposite to assets. This part includes all financial sources from which the enterprise’s funds are generated. These, as is customary, are its liabilities and its own (borrowed) capital.

It follows that the liabilities of an enterprise are the sources of its funds, as well as its obligations. Schematically, the composition of the liability can be displayed as follows.

Take our proprietary course on choosing stocks on the stock market → training course

Important! It is generally accepted that the terms “liabilities” and “obligations” are identified in the “borrowed capital” part.

Thus, if assets show the property that an enterprise has, then liabilities reflect the sources of its formation. Liabilities are subject to classification. The following types are distinguished:

- current liabilities, the repayment period of which falls on the next year;

- long-term or long-term debt (eng. long-term debt) – long-term loans and bonds available on the financial market;

- long-term or long-term liabilities (eng. long-term liabilities) – other obligations (for example, to employees, lessors, etc.)

Obligations, in turn, can be systematized according to various criteria. The most common and well-known classification of them is based on urgency. The following obligations are distinguished: short-term (with a period of up to a year) and long-term (with a period of more than a year).

In addition to systematization on this basis, the liabilities of an enterprise are divided into groups depending on who owns them (own capital or borrowed capital). In practice, systematization is also used on a subjective basis, that is, depending on who the company owes something to. Such debts include, for example, salary debt to employees or debt to government agencies and contractors. As for equity capital, it is usually divided into authorized and share capital.

Long-term liabilities in accounting. balance sheet: concept, composition, lines

So, the liability is book. The balance sheet consists of capital, reserves, as well as long-term and short-term liabilities. Long-term (or long-term) liabilities are those obligations that an enterprise must pay off over a period of more than a year. They are reflected in the corresponding lines of the account. balance sheet, which is a key document reflecting the financial condition of the enterprise at the end of a specific period. These include: loans, bank loans, unpaid lease amounts, deferred tax amounts, i.e. different types of debts. On balance sheet lines, long-term liabilities are displayed along with the amount required to repay them. That is, interest, discount, etc. are taken into account and recorded.

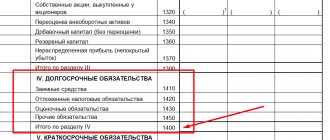

Today, enterprises and other organizations (with the exception of credit institutions) use the new accounting system. balance, approved The Ministry of Finance of the Russian Federation, in particular, by Order No. 66n dated July 2, 2010. It is called form No. 1, and according to OKUD 0710001. The composition of long-term liabilities can be fairly accurately traced along the balance sheet lines. Section No. IV is intended for them, which is called “Long-term obligations”. It consists of 5 lines.

| Section IV book. balance sheet “Long-term liabilities” (line by line) | ||||

| Borrowed funds | Deferred tax. obligated | Estimated liabilities | Other obligations | Total according to sec. IV |

| Page 1410 | Page 1420 | Page 1430 | Page 1450 | Page 1400 |

Each of the named lines is supplemented with the following columns: “Explanations” (column No. 1), the indicator “For __ 20_g.” (gr. No. 4), as well as “As of December 31, 20_.” (gr. No. 4 and 5).

When analyzing the financial condition of an enterprise, long-term accounts payable are divided into 2 parts. One of them should be extinguished before the end of the next 12 months. after the reporting date. The second - after a year following the reporting date.

Passive in book. The balance sheet, in addition to Section IV, includes another Section V. It contains information about the obligations that need to be repaid throughout the year, i.e., in a shorter period. It’s called: “Short-term liabilities”.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Placement of passive liabilities by balance sheet items

Financial management of working capital is a thorough analysis of the movement of current liabilities and assets. This policy is aimed at solving such problems as accelerating turnover in order to increase liquidity, optimizing the formation of assets, and identifying shortages or surpluses of funds.

Due to the fact that current liabilities have different sources of origin, their distribution in the balance sheet is strictly structured. The third section of the balance sheet is entirely devoted to all types of capital (authorized, reserve, additional). Also in this section you can find retained earnings, which remain at the disposal of the company after taxation.

The balance sheet items of the fourth section consist of long-term credit and deferred liabilities. The fifth section of the balance sheet is devoted to accounts payable, which includes tax obligations, accrued wages to employees, debt to suppliers and founders, as well as short-term loans.

Line by line filling out Section IV of the book. balance: main nuances

This section should contain information about all obligations the company has that need to be paid off for a period of more than a year. Data from Section IV, together with other economic indicators from other sections, are used in financial analysis. According to the structure of the section, you will need to fill out 5 lines. It should be taken into account that:

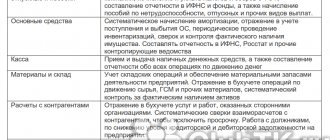

- Page 1410: indicate all credits, borrowings (in cash or in kind) of the enterprise, the term of which exceeds a year. When filling out, use data on the account. 67 (calculation of long-term loans, loans).

- Page 1420 is filled out by those organizations that work using PBU 18/02, approved. by order of the Ministry of Finance of the Russian Federation No. 114n dated November 19, 2002 (as amended in 2015). This Regulation defines the general rules for the formation and disclosure of information on profit calculations for payers of this tax. When filling out this line, you should take account data into account. 77 (regarding deferred tax liabilities) and account. 09 (regarding deferred tax assets). It is necessary to have a loan. account balance 77 was more than the flow rate. account balance 09. Only then the line must be filled out.

- Page 1430: indicate reserves formed according to PBU 8/10, approved. By Order of the Ministry of Finance of the Russian Federation No. 167n dated December 13, 2010 (as amended on April 4, 2015). This Regulation regulates the procedure for displaying estimated and contingent liabilities, including contingent assets, in the accounting of legal entities. Account is used. 96 (about reserves for future expenses regarding obligations with a maturity of more than a year). The credit is written down on the line. balance remaining at 31 Dec.

- Page 1450: other long-term liabilities that are not reflected in the previous lines are indicated here. Data you will need: account. 60, 62, 68, 69, 76 (settlements with suppliers, buyers, taxes, social insurance, debtors, creditors), as well as accounts. 86 (targeted financing).

- Page 1400 is the total amount of the enterprise’s long-term borrowed capital (i.e., the total sum of all previous lines of the section: 1410, 1420, 1430, 1450).

Make a book. The balance sheet is best done using specialized software designed specifically for accounting. If it is compiled independently, then based on the results you should compare the balance sheet of assets and liabilities. If the values are the same, then boo. the balance is correct.

It should be noted that no general standard has been established for long-term liabilities. They can be compared with short-term ones in terms of rational use and volumes. It is quite obvious that a positive motivator is an increase in the share of long-term obligations and a decrease in short-term ones. Accordingly, if there is a choice for an enterprise, the best solution will be one that involves an increase in long-term liabilities.

The impact of current assets on financial stability

The solvency and economic stability of a company are determined by the ratio of the efficiency of asset use and the level of financial risk. Based on such concepts, a business model and working capital management policy are built.

If current liabilities in the form of short-term liabilities remain unchanged against the backdrop of growing assets, this means that the company has acquired financial stability and is able to break-even increase working capital at the expense of its own income.

At the same time, if current liabilities (balance sheet line 610 “Short-term liabilities”) grow against the background of equity and long-term liabilities, then in such a situation one can observe an increase in the liquidity of working capital, but at the same time financial stability and solvency will be reduced.

Ranking and use of liabilities to determine the liquidity of an enterprise

When separating liabilities for the purpose of determining liquidity, they rely on financial sources. As you know, on this basis, liabilities are divided into 4 groups, one of which is long-term liabilities (or P3). A visual systematization of liabilities by maturity is as follows:

- P1 (most urgent obligations).

- P2 (short-term liabilities).

- P3 (long-term liabilities).

- P4 (permanent liabilities).

These groups of liabilities are compared with assets, thus determining whether a particular enterprise is liquid. For your information, assets are also ranked into 4 groups: A1 (the most liquid), A2 (quickly liquid), A3 (slowly liquid), A4 (difficult to liquid). In relation to bu. In the balance sheet, this ranking of assets and liabilities will be as follows.

| Index | Row distribution | Ownership of indicators |

| A1 | Page 1250 + 1240 | |

| A2 | Page 1230 | |

| A3 | Page 1210 + 1220 + 1260 + 12605 | Assets |

| A4 | Page 1100 | |

| P1 | Page 1520 | |

| P2 | Page 1510 + 1540 + 1550 | |

| P3 | Page 1400 | Liabilities |

| P4 | Page 1300 + 1530 + 12605 |

Long-term liabilities (P3) are compared with slowly liquid assets (A3). If as a result it turns out that A3>=P3, then the enterprise is considered liquid and is able to pay long-term obligations. This means that the value of slowly liquid assets must be greater than or equal to the value of long-term liabilities.

All indicators necessary for comparisons are taken from the accounting records. balance. The actual value of P3 is the total of Section IV (p. 1400). A comparison of two values (P3 and A3) is used mostly in accounting analysis. balance sheet to determine its liquidity.

What are current assets

Funds that can be converted into money during one production cycle are called current (current) assets. These include all material assets, inventories, components, accounts receivable, finished products and, of course, cash. Current assets are in constant motion, ensuring continuity of the production process.

Depending on how quickly property assets are converted into money, they are assigned a degree of liquidity. Current balance sheet items are placed as this indicator decreases from higher to lower values.

Answers to frequently asked questions

Question No. 1. What does “total capital” mean? What does it include?

The total capital of an enterprise is its own capital + borrowed capital (i.e., the total amount of all capital that exists and is used in the enterprise). This is the name for the entire liability (balance sheet currency).

Question No. 2: Is the presence of long-term liabilities of an enterprise a positive or negative factor? What should you use to correctly characterize this situation?

They are definitely not a negative factor. Quite the contrary, their presence is actually beneficial for the enterprise, especially in light of inflationary processes. Naturally, provided that they are attracted and used rationally, in moderation and competently.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Moderate working capital management policy

If you analyze moderate business tactics, you will notice that this model occupies an intermediate place among the above. Half of all assets under this policy are occupied by current working capital, which has a moderate period of liquidity. Current liabilities, current liabilities and borrowings are also average.

This model is the safest and most calculated. The likelihood of a risk of decreasing asset liquidity is minimal. The formation of current assets occurs in most cases at the expense of own funds.

Detailed report

The period required to convert a liability into money is usually determined on the basis that everything will be fine. Under normal circumstances, a product made from raw materials, for example, should turn into money within 12 months. Otherwise, the liabilities would certainly be called long-term. This period is also associated with risks. Unfortunately, no one is immune from failure. In this case, the problem with current liabilities will still have to be resolved within 12 months, within the time frame specified in the contract and in the accompanying documentation.

Production is a more complex accounting structure, whatever one may say. However, the main thing is to be careful. Blurred time frames, risks, and unclear points are characteristic of the balance sheet of an enterprise. It is unknown what will happen tomorrow.

An accountant most often does not need access to accompanying documentation, and there is no need to spend extra time on it. It is much easier to operate with the concepts of current liability and long-term liability. All liabilities that raise the question must be isolated and the situation with them will certainly become clearer in the near future. Heads of other departments and the head of the enterprise probably know that it is not necessary to repay some liabilities within a year. It is worth studying the accompanying documentation for such liabilities. In other cases, if there are a lot of liabilities, it is easy to not have time to sum up the results, put the accounting in order, or prepare a report.

(current liabilities) - all obligations to pay cash by a certain date in the near future, including the company's debt to commercial creditors, as well as bank loans and overdrafts.

See working capital.

WORKING CAPITAL

(working capital) - short-term current assets of the company that quickly turn over during the production process. Working capital includes inventories of materials, work in progress and finished goods, accounts receivable (see debtor), cash less short-term current liabilities. An increase in the volume of a firm's activities usually results in an increase in inventories and accounts receivable and thus an increase in working capital requirements. Reducing the time between paying for materials, turning them into final products, selling these products and receiving money from consumers will lead to a decrease in the required working capital.

See also overactivity, cash flow, credit control, inventory control, factoring.

DEBTOR

(

debtor

) (debtor) - an individual or enterprise that owes money to individuals or firms for goods, services or raw materials purchased but not yet paid for (trade credit) or because it borrowed this money from them.

See creditor, debt, credit control, working capital, bad debt.

CURRENT ASSETS

(current assets) - assets such as inventories, money lent to debtors, and cash that the company holds for short-term financing of turnover: the purchase of raw materials and supplies, their processing, the sale of finished products and payment by customers.

See fixed assets, working capital.

MAIN CAPITAL

Fixed assets

) that a firm acquires for long-term use rather than for resale. Fixed capital is used by an enterprise for a long time, and each year, as a rule, part of its original cost is written off (see depreciation, profit) to reflect the decrease in the value of the asset. On the balance sheet, fixed assets are usually stated at the purchase price minus depreciation to date. Some types of fixed assets, such as real estate, tend to appreciate in value (see asset appreciation) and must be revalued periodically to keep their book value in line with market value.

See current assets, reserves.

BALANCE

(balance sheet) - an accounting report on the assets and liabilities of the company on the last day of the operating period. The balance sheet lists all the assets owned by the company, and against them are indicated the company's offsetting liabilities or the claims of those people who provided it with the funds to acquire these assets. Assets are divided into fixed assets (fixed assets) and current assets, while liabilities consist of share capital, long-term borrowings and current liabilities (current liabilities).

ASSETS

(asset) - an object of property owned by an individual or company and having a monetary value. There are three main types of assets:

(a) physical assets - factory buildings and equipment, land, durable consumer goods (cars, washing machines, etc.);

(b) financial assets - cash, bank deposits, shares;

(c) intangible assets - trademarks, etc.

See investment, liquidity, balance sheet, liability.

EXHAUSTABLE ASSET

(wasting asset) - any natural resource, such as coal or oil, which has a finite but indefinite lifespan, depending on the rate of production.

Cm.

PASSIVE

(liabilities) - one of the two sides of the balance sheet, characterizing the sources of capital formation of the company - its own funds and liabilities. Wed. asset .

COMMITMENT

(liability) - the obligation of an individual or company to satisfy the requirements presented to them in relation to property acquired with borrowed funds. A liability is therefore a form of debt, for example a bank overdraft or a building society mortgage.

See asset, balance.

OVERACTIVITY

(overtrading) - expansion by a company of its production and sales volumes without creating additional funds to finance additionally required working capital. At the same time, the company faces liquidity problems and may face a lack of funds for settlements with suppliers.

See cash flow.

CASH FLOW

(cash flow) - money coming into the company from sales and from other sources and spent by the company on payments to suppliers, workers, etc.

You can search for terms and their interpretations on all websites of the School of Economics: