Covering letter for the updated calculation of form 6-personal income tax - all about taxes

It is not always possible for even an experienced accountant to fill out 6-NDFL without a single mistake the first time. Unfortunately, they are difficult to avoid, and sometimes you become aware of them after sending the documentation to the tax office. In such a situation, the only way out is to adjust the 6-NDFL.

In what cases does adjustment not help?

There are a number of errors due to which it is subsequently necessary to urgently begin filling out the adjustment document. But there are also errors that cannot be corrected with the help of clarification. These include an incorrectly entered TIN, INFS code, and an error in specifying the period for which the form is filled out.

All these shortcomings are in fact serious errors, due to which the INFS will refuse to accept the primary report submitted to it. In this case, it is important for the employer to remember the reporting deadline. If there is the slightest delay in transferring documents to the tax office, a fine may be imposed on him.

For what errors is a clarification submitted for 6-NDFL?

In other cases, errors identified in the form can be corrected by clarification on 6-NDFL. It is worth noting that it will be better for the reporting person if all the shortcomings are identified by himself rather than later by the tax authorities. The reason for this is Art. 126 NK. It talks about the fine that must be assessed to the reporting person for providing false information.

You will have to fill out and send a corrective report to the tax office if the following errors were made in the main form 6-NDFL:

- Checkpoint . Such an error is not critical, so the Federal Tax Service will accept such a document. But care should be taken to provide updated information in a timely manner.

- OKTMO . A document from the Federal Tax Service Inspectorate may receive a document regarding its clarification only if this code is not included in the territory under the supervision of the Federal Tax Service Inspectorate. But if the specified code turns out to be within the scope of the INFS, then the reporting person expects an accrual that will be carried out by the INFS according to the previously incorrectly indicated OKTMO.

- If the company has separate divisions that are registered with one Federal Tax Service. Reporting should be completed for each division in a separate form. If information about all divisions located on the territory of one Federal Tax Service Inspectorate is provided in a single document, correction of the error is possible only through correction documents.

- Incorrectly reflected rates and providing them in undivided form . Information on different rates must be provided in different sheets of the report.

- The number of persons to whom certain types of payments were made by the company . As well as the withholding of taxes from them, which should have been carried out and transferred to the tax office within the time allocated for this. If such errors are identified, you should be prepared for claims that will definitely be brought by the Federal Tax Service due to inconsistency of the information included in the report.

Special situations and penalties

These include several types:

- If you mistakenly enter OKTMO , which is assigned to the territory under the supervision of the Federal Tax Service, to which the document was transferred, you should first take care of eliminating the possibility of accrual of the amount on it. To do this, using an erroneously entered code, a clarification with zero values is filled in. This measure allows you to cancel a previously entered erroneous code. Then it is advisable to also submit a letter to the Federal Tax Service Inspectorate, which should contain an explanation containing the reason for canceling the previously submitted report. At the same time, you should also try to submit the report with the OKTMO code entered correctly. Any delay in transmitting this document will result in a fine.

- In the event of an error manifested in combining information that must be divided into special divisions, the clarification is completed only in relation to the previously sent report. To other departments, reports are submitted in the primary version. The reports must be submitted on time; failure to comply with the deadline will result in a fine.

- Erroneous use of the right to fail to submit reports . This situation arises when an employer during a certain period does not have employees for whom income was previously paid, and he decides to exercise the right not to provide 6-NDFL. But for some reason, he lost sight of some types of accruals that were made during the reporting period. The reporting subsequently submitted by him will be primary. If the document is submitted after the allotted period, the employer will be required to pay a fine. You can insure yourself against such a nuisance by filing zero reports. In this case, the reporting will be accepted by the tax authorities, and if previously unaccounted income is identified, you can safely send an updated document.

When an adjustment is completed

The updated document has no differences from filling out the primary 6-NDFL. The whole point of the document is that the previously specified data is provided again, but in the correct form.

https://www..com/watch?v=FFU5tJ4EtDY

But when the 6-personal income tax adjustment must be submitted, how can you ensure that there is no penalty for the error? You need to detect the error yourself in a timely manner - before it is detected in the INFS. If, before checking a document with an error, a clarifying document is submitted to the INFS, the employer will be able to avoid punishment.

Excellent video about the updated adjustment declaration:

Source:

Sample explanation to the tax office for 6-NDFL

The employer, according to clause 2 of Art. 230 of the Tax Code of the Russian Federation, is obliged to submit a report in form 6-NDFL to the Federal Tax Service. If, for some reason, the employer did not provide the tax office with a calculation in Form 6-NDFL or errors were identified in the calculation, then he must provide an explanation to the tax office.

In what cases are explanations drawn up for the tax office regarding 6-personal income tax?

In the explanation, it is necessary to indicate an explanation of the reason for non-submission of reports or errors made in the provided calculation of 6-NDFL. Otherwise, the employer may be held accountable for failure to submit this report (clause 1.2 of Article 126 of the Tax Code of the Russian Federation) or seize the current accounts (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

Employers who, for any reason, did not start operations or ceased operations in the year preceding the reporting period are exempt from filing a report in Form 6-NDFL. Such employers do not have the data to fill out the form, but it is better for them to provide explanations to the tax office in order to avoid penalties.

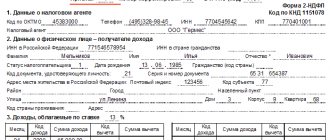

The explanatory note is addressed to the head of the tax office. There is no strict form for drawing up an explanatory note to form 6-NDFL. The text of the explanatory note is drawn up arbitrarily, which reflects the reason why the employer did not submit a report in Form 6-NDFL for the reporting period or an explanation of the errors identified in the report.

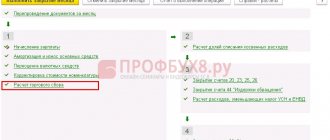

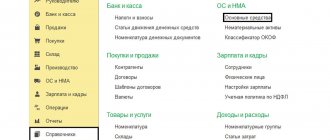

Get 267 video lessons on 1C for free:

Further, the explanatory note is drawn up on letterhead, which reflects the basic data (full name, TIN, legal address, contact information), registered, signed by the head of the organization and certified with a seal.

You can submit an explanatory note to the tax office in different ways, for example:

- in electronic form via telecommunication channels (TCS);

- by mail (it is advisable to keep a copy of the explanatory note);

- take it to the tax office by hand or via courier.

The most common situations when an employer needs to provide an explanatory note are:

- inevitable document;

- explanations for the zero report;

- explanations of identified errors in the report;

- discrepancy in performance;

- discrepancy between the dates indicated in lines 100, 110 and 120;

- deadline for submitting the report and so on.

If a tax inspector identifies an error in the report, the employer can submit corrective reporting within five working days, in accordance with clause 3 of Art.

88 of the Tax Code of the Russian Federation, therefore, the employer is not obliged to present an explanatory note.

If the employer does not submit a corrective report or explanatory note within the specified period, then he may be fined 5,000.00 rubles, according to Art. 129.01 Tax Code of the Russian Federation.

In the case of a zero report, the tax office is obliged to accept such a report on the basis of letter No. BS-4-11/7928 of the Federal Tax Service of Russia dated May 4, 2016.

Sample explanations on 6-NDFL for the tax office

Let's take a closer look at the most common cases of explanations to the tax office regarding the calculation of 6-NDFL with samples of filling out:

- organizations that did not start operations in the reporting period:

- detection of errors in indicators in the calculation of 6-NDFL:

Source:

Explanation to the tax office regarding 6-NDFL: how to explain the discrepancies

The organization often receives requests from the tax office to provide explanations of discrepancies in the calculation of 6-NDFL. There are different situations when data inconsistencies, errors or inaccuracies may arise. Let's take a closer look at how to write an explanation to the tax office regarding 6-NDFL in 2021 if you find discrepancies and how to explain them.

Tax inspectors reconcile 6-NDFL as part of a desk audit. The report indicators are checked according to control ratios (Letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] ). If there are discrepancies, the Federal Tax Service will request clarification or clarification. Submit your updated calculation if there really is an error. Otherwise, explain the reasons for the discrepancy in the letter.

Download a detailed example of filling out 6-NDFL>>>

Urgent news for all payroll accountants: the Ministry of Finance insists on personal income tax and contributions from accountable amounts. Read more in the Russian Tax Courier magazine.

Explanations on contradictions in 6-NDFL, which are not an error>>>

Letter to the tax office stating that there is no obligation to submit 6-NDFL>>>

How to write an explanation to the tax office regarding 6-NDFL in case of mistakes made

To draw up an explanatory note to the Federal Tax Service regarding 6-NDFL, you do not need to use any specific form; it does not exist. Everything is done in free form, but following several rules:

- The letter to the tax office must contain all the main details of the company (TIN, KPP, OGRN);

- Full name of the enterprise;

- Address at the place of registration and telephone number;

- Registration number, date of compilation, manager’s signature and seal (if any);

- In the explanatory note, briefly state the essence of the error and an explanation for it.

Below we will present to your attention samples of explanations to the tax office for 6-NDFL for frequently encountered situations.

Reason #1. How to explain discrepancies if tax has not been paid (error in payments, late transfer)

Inspectors may request clarification if the amount of the transferred tax does not correspond to the data in the payer’s personal card.

This may be an incorrect KBK, tax details, etc. In this case, it is necessary to clarify the payment by submitting an application and writing an explanation to the tax office under 6-NDFL for the tax not transferred on time:

explanations for incorrectly specified KBK>>>

Important ! If the OKTMO or checkpoint was indicated incorrectly, then you need to submit an updated calculation.

In addition, the tax may indeed not have been paid or paid later due to various circumstances, for example, there were no funds in the current account, then use the following template for explanations for 6-NDFL:

Download an explanation template for non-payment of personal income tax>>>

Reason #2. Incorrect dates in lines 100,110,120: preparing explanations for the tax office

Inspectors will request clarification if dates in the report in Section 2 are incorrect. However, in practice this means submitting an updated calculation. This is due to the fact that incorrectly indicated dates will be included in the settlement card and mutual settlements with the organization will be incorrect.

Source: https://nalogmak.ru/drugoe/soprovoditelnoe-pismo-k-utochnennomu-raschetu-formy-6-ndfl-vse-o-nalogah.html

Filling out an explanation to the tax office for 6-personal income tax - sample

Tax inspectors are quite actively checking reporting on the new Form 6-NDFL, regularly reconciling report indicators against certain control ratios.

Moreover, if any discrepancies are discovered during the inspection, then the company will be asked to provide appropriate explanations or updated declarations.

In this case, in order to avoid any penalties and other administrative measures, entrepreneurs must know how to correctly fill out a sample explanation to the tax office for 6-NDFL and what needs to be taken into account in the process of completing this paper.

What it is

Personal income tax reporting is optional documentation only if the company has not transferred wages to its employees during the current reporting period.

In accordance with the provisions of the Tax Code, the relevant information must be submitted by employers who calculate and withhold the corresponding tax from their employees.

The lack of information for calculating personal income tax and, accordingly, filing reports in Form 6-NDFL is a completely understandable and justified phenomenon if during the reporting period:

- the company's work has not yet begun;

- the company ceased to exist during the year preceding the reporting year;

- the company is engaged in seasonal work, the deadline for which has not yet arrived;

- The company's staff includes only the executive director, who performs his duties without any remuneration.

It is highly recommended to promptly notify the authorized persons of the Tax Service about all these circumstances by sending an explanatory note or submitting zero reporting, so that in the future they will not have any unnecessary questions and they will not impose appropriate fines.

Starting in 2021, the list of responsibilities of tax agents has expanded significantly, and every quarter it is necessary to submit reports prepared on form 6-NDFL.

As soon as it is sent to the inspectorate, tax officials immediately begin to study it, and this is done within the limits of desk control and in the appropriate premises of the Tax Service.

In other words, in this case there is no need for the mandatory presence of a company representative.

During the process of conducting such an audit, the inspection specialist may ask various questions, and only the relevant tax agent can give explanations on them.

It is best, of course, in such a situation to predict such a course of events, and if any error is discovered, it is best to immediately submit the necessary explanations to 6-NDFL in order to clarify the position of the company, as well as its reputation as a conscientious agent performing the duties assigned to it obligations.

In case of zero reporting, there is no need to submit any documents to the Tax Service, but in this case, the control authorities may in any case inquire as to why the calculation was not submitted, and in such a situation it is best to provide an explanatory document. Moreover, in some situations it is best to take the initiative to write such a letter yourself.

Sample explanation to the tax office for 6 personal income tax

Important Disclaimers

Depending on the circumstances, you need to approach the reporting procedure differently, since each individual situation has its own peculiarities of document preparation, as well as the need for certain response measures.

Main reasons

First of all, tax officials can detect arrears by comparing the amounts in the reporting with those that were actually transferred to the budget and indicated on the payment card.

In other words, if the tax authorities report arrears, this may indicate that the tax filers paid less in taxes compared to what was indicated in the filed reports.

In this case, the amounts that must be transferred to the budget are prescribed in the terms of Section 2 140.

To do this, it is best to request from authorized persons the appropriate statement of calculations, which will indicate the amount of personal income tax paid.

Initially, the accrual indicators are compared with the calculation of 6-NDFL, after which the payment is compared with the actual documentation.

The company may also be charged a penalty if the tax is not paid on time. At the tax office, the timeliness of tax assessment is carried out by comparing the dates written in line 120 and the date when the actual payment of the tax amount to the budget was registered.

Inevitable Document

After passing f. 6-NDFL, tax authorities study it without the presence of a company specialist. The tax inspector often has questions about the submitted document, or the company itself has discovered errors and inaccuracies in the report that has already been submitted.

It becomes inevitable to write a letter of explanation for the calculation of personal income tax.

The form of the explanation and its content are not regulated by either instructions or regulatory documents. There are also no methodological instructions. Therefore, an employee of the enterprise, most likely an accountant, has to independently generate the text.

It is necessary to write the explanation in such a way that the tax office no longer has any questions. You need to approach the formation of the text of a document from approximately the same positions as the motivation in the tax audit process.

Since 2021, the range of responsibilities of tax agents has expanded dramatically. Every quarter you have to submit reports on form 6-NDFL. As soon as it arrives at the inspectorate, tax officials immediately begin to study it. Moreover, this happens within the framework of desk control, on the premises of the Federal Tax Service. That is, the presence of a representative of the company that submitted the next payment is not expected.

The problem is that during such an audit, the inspection specialist, while studying your reporting, may have questions about filling it out. And only a tax agent can remove them.

But it’s better to be able to predict such situations.

When, for example, due to an error in 6 personal income tax, explanations to the tax office could immediately clarify the company’s position and its reputation as a conscientious tax agent.

We will talk about the most common such situations below and along the way we will give an example of explanations to the tax office regarding 6 personal income tax. The form and content of this calculation appendix are not regulated in any way by law. Therefore, freedom of creativity is already your trump card. But I think that the approach to this document should be approximately the same when giving explanations as part of a tax audit.

When can tax authorities request clarification?

Information about personal income tax comes to the tax authorities from various sources.

First of all, this is the reporting of the employer itself, submitted in forms 2-NDFL and 6-NDFL. An individual also submits income tax information to the tax office if he submits a declaration in Form 3-NDFL. Filing a declaration is not the responsibility of all individuals, but in fact it is submitted in many cases - when selling property, if you need to receive a tax deduction, for the income of an individual entrepreneur, etc.

Inspectors analyze the amounts of tax revenue, comparing them with reporting data. If any discrepancies are detected between data from different sources, tax authorities may request clarification from the taxpayer (clause 3 of Article 88 of the Tax Code of the Russian Federation).

The taxpayer is required to provide an explanation within 5 days. For violation of this period, a fine of 5,000 rubles may be collected from him, and in case of repeated violation within a year - 20,000 rubles. (Article 129.1 of the Tax Code of the Russian Federation).

Filling out an explanation to the tax office for 6-personal income tax - sample - State Collection Info

Explanation to the tax office regarding 6-NDFL - a sample of its preparation is in our article. It is not a mandatory document, but it can save a person who does not submit this report due to lack of data from possible undesirable consequences.

When you need explanations for 6-NDFL

How to prepare an explanatory note for 6-NDFL

Results

When you need explanations for 6-NDFL

It is advisable to submit an explanation to the tax office regarding 6-NDFL in a situation where the employer has no reason to submit this report. You can not submit it if there are no employees who received income payments during the corresponding reporting period (quarter, half-year, 9 months, year).

The Tax Code of the Russian Federation (clause 2 of Article 230) directly assigns the obligation to submit Form 6-NDFL to the employer who calculates and withholds personal income tax.

Therefore, the absence of data to fill out this form automatically removes the obligation to submit it.

However, in order to avoid misunderstandings, it is better to inform the tax authorities about this circumstance, since they have nowhere else to obtain such information.

If, according to the Federal Tax Service, income payments could have taken place, then for the employer there will be not only the risk of being held liable for failure to submit a 6-NDFL report (clause 1.2 of Article 126 of the Tax Code of the Russian Federation), but also the danger of blocking the current account (clause 3.2 of Article 76 Tax Code of the Russian Federation).

For more information about sanctions related to 6-NDFL, read the material “The amount of the fine for late submission of the 6-NDFL report .

At the same time, the absence of data for inclusion in the report may be quite justified for persons:

- have not started activities;

- ceased operations in the year preceding the reporting year;

- carrying out seasonal work occurring in the middle of the reporting year.

But in each specific case, it is better to take proactive steps (submit zero reports or give written explanations on the current situation) than to create uncertainty that will raise questions from the tax office and may lead to an undesirable reaction.

Submission of a report with zero indicators, which the Federal Tax Service has no right to refuse to accept (letter of the Federal Tax Service of Russia dated 04.05.

A zero report submitted on time can simply be clarified, and this will make it possible to avoid a fine for failure to submit reports, which will inevitably arise if a report was not submitted on time, and a report with income data later than the deadline will be submitted as a primary one.

For more information about zero reporting and reporting options for income arising in different periods of the year, read the article “Do I need to submit zero reporting 6-NDFL?” .

How to prepare an explanatory note for 6-NDFL

The explanatory note is drawn up on the letter form of the employer, containing basic information about him:

- Name;

- TIN;

- address;

- telephones.

The letter is addressed to the relevant tax authority, registered with an originating number and date, signed by the head of the employer and certified with a seal.

The text part of the letter sets out in free form the circumstances due to which the employer is not required to submit a 6-NDFL report for the specified reporting period.

A sample version of the explanation for 6-NDFL can be seen on our website.

You can submit such a letter to the Federal Tax Service in any available way:

- by TKS, having previously scanned it;

- via mail, leaving a copy of the letter for yourself;

- in person, bringing with you 2 copies of the document in order to receive a mark on its acceptance on the second one.

Results

An explanatory note containing information about the reasons for failure to submit reports in Form 6-NDFL is recommended to be submitted to the Federal Tax Service if there is no basis for submitting such a report. This will help avoid unnecessary questions from the tax office and eliminate possible misunderstandings.

Source:

Explanation to the tax office regarding 6-NDFL - sample writing

In the course of any business activity, a company has a number of questions regarding filling out reports, nuances when filling out, etc. Perhaps a controversial situation has arisen in your organization, and now you need to explain it to tax inspectors.

Let us give an example and a sample explanation to the tax office regarding 6-NDFL.

Under what circumstances is an explanation required?

When filling out form 6-NDFL and sending it to the tax office, the data is verified. Based on the reconciled data, tax authorities determine when the organization paid the tax, whether it happened legally or late.

First of all, pay attention to lines 070 and 120. One indicates the amount of income tax, the other, 120, the date of payment to the state treasury.

All information is verified automatically. In what case will the tax authorities demand an explanation?

- If the tax withheld is more than paid to the budget.

- Income tax was not paid.

Having found discrepancies, tax authorities demand clarification. To do this, the organization needs to write an explanatory statement in free form.

How to write an explanatory note to the tax office

An explanatory note is written in free form with the obligatory indication of all details. Let us give example No. 1, in which the accrual does not correspond to the income tax withheld from it.

Let's consider the option when income taxes were withheld before the payment of wages. When operating a company, it may be confusing when to report income tax on line 070.

If you enter all the withheld tax into line 070 at once, it will coincide with line 040 of the calculated tax.

After the tax authorities clarify that in line 070 you need to fill in only the amount that was withheld from the employees, the information is corrected.

Withholding should be reflected on the last day of the month (BS-4-11/9194). When correcting the amounts in the 6-NDFL report, lines 070 and 040 will no longer converge.

And now the Federal Tax Service began to demand an explanation of why this happened. This means that in the explanatory note the tax authorities will need to indicate that there are no inaccuracies. The amounts themselves in lines 070 and 040 cannot coincide. Line 070 included amounts that were withheld from employees after payroll.

The explanatory note to the tax authority will need to specifically describe why these amounts should diverge. If a note is made that there are no errors, the tax inspector will require a second explanation. It is necessary to specifically make all the calculations and give examples of the differences, only then will it be possible to satisfy the requirements of the BUT.

See also general points about explanatory notes to the inspection in this interesting video:

Why does the tax office ask for explanatory notes?

The requirement of tax authorities to provide explanatory notes on filling out 6-NDFL is possible in different situations. It can be:

- Errors in details when filling out reports.

- Arithmetic errors when calculating salaries and taxes.

- Incorrectness in checkpoint or OKMO.

- Incorrect BCC when paying income tax.

- Incorrect dates in the second section of form 6-NDFL.

In any case, you will have to provide an explanation to the tax office. It is important to correctly draw up an explanatory note, attaching all the necessary documents. This will partially protect the company from additional penalties and interest.

Any mistake when filling out reporting documents will create a lot of questions for the company. Even a simple spelling error may not only require writing an explanation, but also trigger a fine of 500 rubles. Therefore, care and accuracy when filling out documents is an important factor.

Source:

Explanation to the tax office for 6 personal income tax sample

Working on reporting forms requires attention and preliminary study of the calculation algorithm. When it is performed for the first time, it is difficult to do everything perfectly and avoid mistakes. The human factor on the part of the inspection organization also has an impact.

If inaccuracies are discovered, there is no way to avoid providing an explanation to the tax office for 6 personal income tax, a sample of which is shown below.

Explanation as an inevitable document

After passing f. 6-NDFL, tax authorities study it without the presence of a company specialist. The tax inspector often has questions about the submitted document, or the company itself has discovered errors and inaccuracies in the report that has already been submitted.

It becomes inevitable to write a letter of explanation for the calculation of personal income tax.

The form of the explanation and its content are not regulated by either instructions or regulatory documents. There are also no methodological instructions. Therefore, an employee of the enterprise, most likely an accountant, has to independently generate the text.

Source: https://pravospb812.ru/nds/zapolnyaem-poyasnenie-v-nalogovuyu-po-6-ndfl-obrazets.html

What does a sample explanation to the tax office for 6-NDFL look like?

Tax inspectors are quite actively checking reporting on the new Form 6-NDFL, regularly reconciling report indicators against certain control ratios.

Moreover, if any discrepancies are discovered during the inspection, then the company will be asked to provide appropriate explanations or updated declarations.

In this case, in order to avoid any penalties and other administrative measures, entrepreneurs must know how to correctly fill out a sample explanation to the tax office for 6-NDFL and what needs to be taken into account in the process of completing this paper.

Design features

Starting in 2021, the list of responsibilities of tax agents has expanded significantly, and every quarter it is necessary to submit reports prepared on form 6-NDFL.

As soon as it is sent to the inspectorate, tax officials immediately begin to study it, and this is done within the limits of desk control and in the appropriate premises of the Tax Service.

In other words, in this case there is no need for the mandatory presence of a company representative.

During the process of conducting such an audit, the inspection specialist may ask various questions, and only the relevant tax agent can give explanations on them.

It is best, of course, in such a situation to predict such a course of events, and if any error is discovered, it is best to immediately submit the necessary explanations to 6-NDFL in order to clarify the position of the company, as well as its reputation as a conscientious agent performing the duties assigned to it obligations.

In case of zero reporting, there is no need to submit any documents to the Tax Service, but in this case, the control authorities may in any case inquire as to why the calculation was not submitted, and in such a situation it is best to provide an explanatory document. Moreover, in some situations it is best to take the initiative to write such a letter yourself.

Sample explanation to the tax office for 6 personal income tax

When comments are needed

Submission of an explanation to the tax office is required if the employer does not have grounds for filing reports in Form 6-NDFL. The absence of this reporting is provided for in the absence of employees who did not receive any payment during the relevant reporting period.

The Tax Code directly stipulates that tax agents have the obligation to submit documentation if they are involved in the calculation and withholding of the corresponding tax.

Thus, if any data in this regard is missing, then in this case there is no obligation to submit 6-NDFL, but it is best to inform the tax authorities in advance, since this information cannot be obtained by them in any other way.

If, according to the Tax Service, payment of profits could have occurred, then in this case authorized employees can not only impose administrative liability on authorized persons, but also completely block the current account.

Zero readings

Quite often, a situation occurs when, if there are zero quarterly indicators, in any case it is not possible to simply confine oneself to sending an explanatory note, and reporting in Form 6-NDFL is required.

In such a situation, you need to do the following:

- if the amounts were paid only in the first quarter, then in this case in the future you need to submit reports throughout the year, indicating all this information;

- if the amounts were paid in the second quarter, then in this case, instead of filing reports for the first three months, the tax authorities may receive an explanatory note, while for half a year, nine months and a year full reports will need to be submitted;

- if payments occurred during the third quarter, then in this case, accordingly, reporting will be submitted only for six months and nine months;

- When making payments during the last quarter, quarterly reports are in principle not required to be submitted, and you will only need to submit annual reports to the tax authorities.

The peculiarity is that submitting reports with zero indicators in some situations may indeed be appropriate if it is possible to prepare updated reports at this period of time, which will already indicate information on the payment of income. In this case, the timely sent zero declaration can be supplemented with updated documentation, and it will be presented as primary.

Sample how to write explanations to the tax office regarding 6-NDFL

After receiving a request to send clarifications, you will need to respond to this request within five working days.

Today, failure to comply with this requirement involves the imposition of administrative liability, and in particular, taxpayers may be fined 5,000 rubles, and if they are ignored again, the amount of the fine will increase to 20,000 rubles.

If a typo was found in the reporting, then in this case you will need to submit an explanation indicating the following points:

- Full name and position of the person to whom the document is submitted;

- full name of the company that sends the reports;

- TIN, OGRN and KPP of the organization;

- indication of the number of the document in which the requirement to provide this paper was indicated;

- providing an explanation of why the error occurred in the documentation and how it was corrected.

- the initials of the person drawing up the document and his personal signature.

Exactly the same information must be indicated if tax officials find any discrepancies between the information specified in the certificates.

Are you late paying your taxes? We'll have to explain to the tax authorities why. Otherwise - fine

Tax officials want an explanation as to why the tax was not paid on time. If you do not answer, a fine will be imposed. Accountants are at a loss as to what to answer? “Sorry, we accidentally”?

They told in the “Red Corner of an Accountant”.

“I’m at a loss... In February, the client received a request for clarification, with the wording:

“During the tax audit, it was revealed that the tax agent did not comply with the deadlines for the transfer of personal income tax, reflected in the submitted calculation of the amounts of personal income tax calculated and withheld by the tax agent. Within 5 working days from the date of receipt of this Requirement, it is necessary to provide clarifications or make appropriate corrections.”

And now the Act has arrived:

» within the period specified in the request for explanations, explanations or an updated calculation were not provided, thereby committing a guilty unlawful act, for which clause 1 of Art. 129.1 of the Code provides for tax liability of 10,000 rubles.”

What kind of demand should I have presented? I’m sorry that I didn’t pay my taxes on time, I won’t do this again?”

In the comments they write possible answers to this:

“It was necessary to write: Response to Demand No. ... from ... we inform: “Sorry, we won’t do this again, we repent generously, there is no loss to the budget, we hit you with our foreheads, your slaves.”

Someone also received a similar act from the tax authorities:

“It’s cruel, and they flew to me and talked to the Federal Tax Service, they said it’s not necessary. You have to answer some crap, otherwise they’ll charge you 10K.”

Someone suggests simply stating in the answer how it all happened, without being sarcastic:

“We clarify that the withheld personal income tax for the *** quarter of 2021 was transferred in violation of the deadlines established by the Tax Code of the Russian Federation. As of **.**.2021, there is no personal income tax arrears. The arrears of withheld tax have been repaid in full. Something like this".

Here's a more detailed comment:

“We must always send at least something in response. I got myself into trouble with this twice last year. Once they sent me that the type of simplified tax system (not income, but D-R) did not correspond. I was dumbfounded, got through to the inspector, worked with her for a long time - they asked for the previous inspection, where the notification had once been submitted, etc. - but everything is over the phone...

It turned out that they were right, we submitted another declaration. And six months later, 5 thousand arrived for failure to respond to that Demand. I went to the debriefing and asked to at least reduce the fine. But it all came down to the fact that we didn’t answer them in writing.

And recently a lengthy decision came, why we can’t reduce this fine and say, 5 thousand. It's a shame, there are no words.

Secondly, a small company received a request about some contractors with whom it had no relationship. And also reporting, Covid... I asked the general director... so far the answer is, well, no and no... And then as many as 10 thousand arrived... Since they didn’t write anything to them then.”

Nevertheless, a demand is a demand, and it must be answered.

invites you to a free webinar “ Criminal liability for tax crimes ”. It will take place on May 19, starting at 11:00 Moscow time.