The Russian Ministry of Finance and Rostrud are confident that an employment contract with the director, the sole founder of the company, cannot be concluded, since there are no labor relations. However, the Russian Ministry of Health and Social Development, foundations and judges have a different opinion.

As a rule, an employment contract with the head of a company does not cause difficulties. Moreover, Chapter 43 of the Labor Code is dedicated to it.

However, everything is not so simple if the company has a single participant and he also becomes the director. It's all about a clause in the Labor Code. It says that the norms of Chapter 43 “Features of labor regulation of the head of an organization” do not apply to cases when the head of the company is the only participant (founder), member of the organization, owner of its property (Article 273 of the Labor Code of the Russian Federation). From this we can conclude that the relationship between the company and its director, the only participant, is not labor.

An employment contract is not concluded if the relationship is not employment

This unchanged position was taken by Rostrud (letters of Rostrud dated 03/06/2013 No. 177-6-1, dated 12/28/2006 No. 2262-6-1).

He pointed out that it is impossible to conclude an agreement with oneself, since the signing of an employment contract by the same person on behalf of the employee and on behalf of the employer is not allowed. It was also stated that the parties to the labor relationship are the employee and the employer. An employee is an individual who has entered into an employment relationship with an employer. An employer is an individual or legal entity (organization) that has entered into an employment relationship with an employee. An employment contract is an agreement between an employer and an employee, that is, a bilateral act. If one of the parties to the employment contract is absent, it cannot be concluded. Thus, labor legislation does not apply to the relations of the sole participant of the company with the company established by him. As Rostrud points out, the only participant in the company in this situation must, by his decision, assume the functions of the sole executive body - director, general director, president, etc. Management activities in this case are carried out without concluding any contract, including an employment contract.

Other departments were not so categorical and changed their position over time.

Thus, the Ministry of Health and Social Development of Russia in its letter (letter of the Ministry of Health and Social Development of Russia dated August 18, 2009 No. 22-2-3199) fully shares the above point of view of Rostrud.

She was also supported by the Social Insurance Fund of the Russian Federation, pointing out that cases when the head of an organization is the sole owner of its property are not regulated by labor legislation (letter of the Federal Social Insurance Fund of Russia dated June 27, 2005 No. 02-18/06-5674).

However, both departments subsequently took the opposite position.

Is it possible to make a deal with yourself?

— Any contract is an agreement between two or more persons to establish, change or terminate rights and obligations.

Therefore, there must be at least two persons entering into an agreement. Anna Vorobey Legal Advisor, Center for Legal Solutions, LLC "YurSpektr"

If you are a representative of one party to a transaction and at the same time a representative of the second party, then we can say that you entered into the transaction in relation to yourself personally.

The conclusion of an agreement by the same individual acting on behalf of different business entities is prohibited.

An employment contract can be concluded if the employment relationship

Changing their position, employees of the FSS of Russia and the Ministry of Health and Social Development of Russia cited the following arguments (letter of the FSS of Russia dated December 21, 2009 No. 02-09/07-2598P; order of the Ministry of Health and Social Development of Russia dated June 8, 2010 No. 428n). The Labor Code does not contain rules prohibiting the application of its general provisions to labor relations when the employee and the employer are one person. Labor relations that arise as a result of election, appointment to a position or confirmation in a position are characterized as labor relations on the basis of an employment contract (Article 16 of the Labor Code of the Russian Federation). The relationship of the manager with the organization, where he is the only participant, meets all the characteristics of labor relations (Article 15 of the Labor Code of the Russian Federation):

- are based on an agreement between the employee and the employer;

- the employee personally performs his or her job function;

- work is carried out for a fee;

- the employee has a specific specialty or profession according to the staffing table;

- The parties to the agreement are subject to labor regulations.

At the same time, the said manager is subject to all social guarantees and has the right to temporary disability and maternity benefits.

It should be noted that the departments changed their point of view under the influence of uniform judicial practice, which is steadily developing in favor of the fact that it is necessary to conclude an employment contract with the director - the only participant (determination of the Supreme Arbitration Court of the Russian Federation dated 06/05/2009 No. 6362/09 in case No. A51-6093 /2008,20-161; Resolution of the Eighteenth AAS dated March 18, 2014 No. 18AP-1388/14 in case No. A76-15808/2013 (by decision of the RF Armed Forces dated November 28, 2014 No. 309-KG14-4819, transfer for review was denied), Ninth AAS dated 05/26/2010 No. 09AP-10226/2010, AS DVO dated 12/09/2014 No. F03-5420/14, FAS DVO dated 10/19/2010 No. F03-6886/2010; appeal rulings of the Krasnoyarsk Regional Court dated 08/20/2014 in the case No. 33-8058/2014, Moscow Regional Court dated 02/07/2013 in case No. 33-2788/2013).

An interesting point of view was expressed by the Supreme Court of the Russian Federation (determination of the Supreme Court of the Russian Federation of February 28, 2014 No. 41-KG13-37): if between a company and its manager, who is the only participant (founder) of this organization and the owner of its property, the relationship is formalized by an employment contract, for the specified manager is subject to the general provisions of the Labor Code.

That is, the form in this case determines the content: if an employment contract is concluded, it means that the employment relationship has developed.

The relationship is labor, but formalized by the decision of the participant

It would seem that there has been some clarity on this issue.

Rostrud remained in the minority. The courts, the Federal Social Insurance Fund of Russia and the Ministry of Health and Social Development of Russia support the idea of the necessity and legality of an employment contract. And then the Ministry of Finance of Russia unexpectedly issued a letter (letter of the Ministry of Finance of Russia dated March 15, 2016 No. 03-11-11/14234), where it fully reproduced the position of Rostrud, which is as follows: The Labor Code stipulates that an employment contract involves two parties: the employee and the employer . If one of the parties to the employment contract is absent, it cannot be concluded. If the head of the organization is its only founder, that is, one of the parties to the employment contract is absent, the employment contract cannot be concluded. In this regard, employees of the financial department proposed to accrue dividends quarterly, subject to personal income tax.

The opinion seems to the author controversial from a legal point of view, since in this case it is absolutely groundless to talk about the absence of one of the parties to the employment contract. Both sides are present: on the employer’s side - the company, that is, a legal entity, on the employee’s side - an individual.

It is also quite obvious to the author that it is impossible to equate an LLC, consisting of a single participant - an individual, and this individual himself. These are different persons from the point of view of law, they have different legal status, rights and obligations, legal capacity, taxation. This is evidenced by the norms of the Civil Code, the Tax Code and judicial practice. For example, when considering one of the cases, the judges (appeal ruling of the Chelyabinsk Regional Court dated November 27, 2014 in case No. 11-12571/2014) rightly indicated that concluding an employment contract with oneself in this situation does not occur, since the contract is concluded between a legal entity and an individual, that is, different subjects of legal relations.

Excluding the possibility of applying the general provisions of labor legislation to the relationship between a legal entity and its director, who is the only participant in the company, violates the rights provided for by the Constitution of the Russian Federation: to freely dispose of one’s ability to work, to choose the type of activity and profession, the right to remuneration for work and paid annual leave, and also for social security by age (Articles 37, 39 of the Constitution of the Russian Federation).

What is especially strange is that the Ministry of Finance of Russia in its letter (letter of the Ministry of Finance of Russia dated March 15, 2016 No. 03-11-11/14234) referred to the ruling of the Supreme Arbitration Court of the Russian Federation (determination of the Supreme Arbitration Court of the Russian Federation dated June 5, 2009 No. 6362/09 in case No. A51- 6093/2008, 20-161). However, in this judicial act, although the court came to the conclusion that an employment contract with the director - the sole founder may not be concluded, it also indicated that the relationship in this case is labor, the director is an employee in relation to the company, and therefore it is subject to the norms of the Labor Code and compulsory insurance. And most importantly, the definition does not prohibit the conclusion of an employment contract in the case we are considering. Although the court came to the conclusion that labor relations in this situation are formalized by the participant’s decision to appoint a director (Article 39 of Federal Law No. 14-FZ of 02/08/1998).

If local tax authorities perceive the letter from the Russian Ministry of Finance as a direct guide to action and consider only the payment of dividends, but not the calculation of salaries to the director, to be legal in this situation, then we may encounter tax authorities refusing to recognize the salary of the director - the only participant - as a legal and justified expense.

At the same time, the author believes that this situation is still unlikely, since taxation remains the same: it doesn’t matter whether the payment is quarterly or monthly, 13 percent of personal income tax is still paid on it (Articles 210, 214, paragraph 1 of Article 224 of the Tax Code of the Russian Federation) .

And if wages are paid, the budget not only did not suffer, but also received personal income tax earlier than if you follow the position of the Russian Ministry of Finance. At the same time, the dividend option proposed by the financial department can be used, because the participant has the right to dividends, and they are also not subject to insurance contributions. When paying dividends to a company participant, such amounts will not be related to the existence of labor relations with the company or relations within the framework of civil contracts, the subject of which is, among other things, the performance of work or the provision of services, which means that these amounts will not be subject to insurance contributions ( Part 1, Article 7 of the Federal Law of July 24, 2009 No. 212-FZ; Clause 1 of Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ; Letters of the FSS of Russia dated December 18, 2012 No. 15-03-11/08- 16893, dated November 17, 2011 No. 14-03-11/08-13985). At the same time, only paying dividends without paying salaries can also be dangerous, since funds may consider this a way to avoid contributions and reclassify these payments as wages.

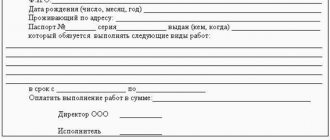

Sample documents:

- Employment contract with a remote worker

- Employment contract with the director of the LLC

- Fixed-term employment contract with a seasonal worker (filling sample)

- Fixed-term employment contract with a minor employee

- Employment contract with part-time worker

- Employment contract with a programmer

- Employment contract with a dentist

- Employment contract with an accountant

- Employment contract at the main place of work

- General employment contract

- Entry in the work book about dismissal

Due to the wide range of issues considered, our company has developed an “internal request analyst” system. After receiving a request for consultation, the system automatically distributes applications among lawyers for further processing.

On our website you can find sample documents, as well as consult with a specialist using the “call a lawyer” form on the main page, or “request for consultation” in the “CONTACTS” section.

To speed up communication with a specialist, call: 8 (495) 151-29-09, 8 (929) 985 98 65 or write: [email protected]

We will be happy to help you!

Lack of an employment contract is punishable by a fine

If in the described situation you do not conclude an employment contract, the state labor inspectorate may consider this an administrative offense and prosecute you for violating labor legislation (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Responsibility may be as follows: a warning or the imposition of an administrative fine on officials in the amount of 1,000 to 5,000 rubles, a fine on legal entities - from 30,000 to 50,000 rubles. And the courts confirm this, pointing out that from the Labor Code (Article 11, 273 of the Labor Code of the Russian Federation) it follows that the person appointed to the position of director of the company is its employee, and the relationship between the company and the director as an employee is regulated by labor law. At the same time, the Labor Code does not contain rules prohibiting the application of the general provisions of the Code to labor relations when there is a coincidence of an employee and an employer in one person (decision of the Primorsky Regional Court of September 22, 2015 in case No. 21-1087/2015).

The absence of an employment contract will increase income tax

The organization has the right to take into account expenses associated with the payment of wages to employees when forming the tax base (clause 1 of Article 255 of the Tax Code of the Russian Federation).

However, remunerations accrued to managers and employees, but not provided for in the employment contract, do not reduce taxable profit (clause 21, article 270 of the Tax Code of the Russian Federation). Therefore, in order to take into account payments in favor of the sole founder, they must be provided for in the employment contract. Formally, the legality of accounting for wage expenses can be confirmed even if the employment contract is not concluded in writing. After all, as the author has already pointed out, as a result of the appointment to the position of a manager, labor relations arise between him and the organization. At the same time, this approach may cause claims from tax authorities during an audit, and its legality will have to be defended in court. What can be recommended to the director - the only participant in such a confusing situation among conflicting opinions? Since it is obvious that the advantages of having an employment contract in the situation under consideration are much greater than the disadvantages, in the author’s opinion, the following options are possible:

- draw up an employment contract, calculate and pay wages based on the fact that all judicial practice, the Ministry of Health and Social Development of Russia, the Federal Social Insurance Fund of Russia and the labor inspectorate support this option;

- draw up an employment contract and receive part of the funds as wages, as well as accrue and pay dividends to yourself as a member of the company. Both of these options are reasonable, legal and justified. In addition, they will help you save on insurance premiums.

Important!

The Russian Ministry of Finance believes that if the head of an organization is its only founder, that is, one of the parties to the employment contract is absent, the employment contract cannot be concluded.

Magazine "Actual Accounting"

If there are several founders

In this case, the algorithm of actions is the same as in the case of a single founder, with the only difference that the appointee does not sign the minutes of the decision of the meeting of the founders of the company and the order appointing himself to the position.

| Solution #1 meetings of founders Limited Liability Company "Vector" Moscow May 02, 2021 We, the founders of Vector LLC (TIN 1236547801, KPP 111111111, OGRN 2222222222222, legal address: Moscow, Shirokaya St. 15-1):

owning equal shares (50%) of the authorized capital, with a nominal value of 10,000 (ten thousand) rubles, DECIDED: appoint Ivan Ivanovich Ivanov to the position of General Director of the company, Russian Federation citizen passport 45 07 125356, issued on March 18, 2007 by the passport and visa service of the Ministry of Internal Affairs of the city of Moscow, division code 550-031, registered at the address: Moscow, Kotelnicheskaya embankment, 15-2, from 02.05 .2020. Founders of Vector LLC Petrov /Petrov P. P./ Ivanov /Ivanov I. I./ |

employment contract with the director of an LLC with two founders