The other day it became known that Rostrud finally approved 107 checklists.

From January 1, 2021, when conducting scheduled inspections of certain categories of employers, inspectors will begin to use checklists (checklists), and from July 1, 2021, such checklists will be applied to all employers. Let us recall that recently, during routine inspections of employers, a risk-based approach has been used, in which the form, duration and frequency of control activities are determined by the risk category to which the employer is assigned.

How are risk categories and hazard classes established in relation to organizations and individual entrepreneurs? What are the requirements for the content of checklists? What services are recommended for employers by Rostrud for self-monitoring? The answers to these and other questions are in the presented article.

Regulatory basis for the formation of a plan for inspections of GIT

When preparing control action plans, territorial bodies of Rostrud are required to be guided by the following regulations:

- Law “On the Protection of Rights...” dated December 26, 2008 No. 294-FZ (hereinafter referred to as Law 294-FZ).

- Rules for the preparation of annual inspection plans by supervisory authorities, approved. Decree of the Government of the Russian Federation dated June 30, 2010 No. 489 (hereinafter referred to as the Rules for the Preparation of Plans).

- Regulations on federal state supervision of compliance with labor legislation (approved by Decree of the Government of the Russian Federation dated September 1, 2012 No. 875) (hereinafter referred to as the Regulations on FGN for labor).

- Administrative regulations for the performance by Rostrud of the function of supervising compliance with labor legislation (approved by order of the Ministry of Labor dated October 30, 2012 No. 354n) (hereinafter referred to as the Administrative Regulations).

- Methodological recommendations for planning GIT control activities in the constituent entities of the Russian Federation (approved by order of Rostrud dated October 28, 2010 No. 455) (hereinafter referred to as the Methodological Recommendations).

HOW TO CHECK

How will employers be checked in 2021?

When conducting scheduled inspections of all employers - legal entities and individual entrepreneurs - state labor inspectors use checklists (checklists) from July 1, 2021, and when conducting scheduled inspections of employers classified as moderate risk - from January 1, 2021 (actually from February 4, 2021). The subject of a routine inspection of all employers is limited to the list of questions included in the checklists.

Among all supervisory authorities, Rostrud has the largest number of checklists - 107 (for comparison: Rosprirodnadzor has 7, Rospotrebnadzor and the Ministry of Emergency Situations have 3 each, Rosreestr has 1). In the near future there will be even more of them - Rostrud has prepared a draft order[6] approving another 28 checklists. Among them are issues related to the financial responsibility of the employee, the organization of vocational education and advanced training, as well as compliance with labor protection requirements in the coal industry.

How to prepare for the test?

Based on clause 7 of the general requirements for the development and approval of checklists (checklists), approved by Decree of the Government of the Russian Federation of February 13, 2017 No. 177, questions from the checklists can be used for self-testing. And by letter dated 03/07/2018 No. 837-TZ, Rostrud sent Methodological recommendations for employers on voluntary internal control (self-control) of compliance with labor legislation and other regulatory legal acts containing labor law norms.

Not everything is so simple with regard to the unambiguous answers to the questions posed in the checklists. Here are some examples:

What specific checklists will they be used to check? How many inspectors will there be? What should be included in the inspection order?

In practice, when carrying out scheduled inspections of the State Tax Inspectorate for the majority of inspected organizations, on average, the first 36–37 checklists on the list plus checklist No. 100 are used.

Occupational safety checklists will be used depending on the specifics of the organization’s activities. Some of the questions specified in the checklists are used if the employer has a corresponding type of economic activity according to the Federal Tax Service, real estate and equipment on which this type of work is carried out, professions and positions in the staffing table performing this type of work. In some regions, there has already been a tendency for employers to en masse apply to the Federal Tax Service to exclude additional OKVED regulations.

The order to conduct an inspection must indicate specific numbers of checklists that will be used when conducting a scheduled inspection in relation to a specific employer.

Note!

Indicating all checklists in an inspection order is unacceptable and may negatively affect the transparency of supervisory activities.

In addition, the order may indicate several officials. As a rule, this is a labor protection inspector and a legal inspector. The number of inspectors is actually limited only by the numerical composition of the corresponding territorial body of Rostrud. And if the inspector, due to temporary disability, being on vacation, business trip, dismissal or other valid reasons, was unable to come out for the inspection, then appropriate changes are made to the inspection order, formalized by order.

Recently, orders also contain a QR code, which contains an encrypted link to the website of the Unified Register of Inspections. By dialing the inspection account number specified in the checklist or scanning the QR code, you can subsequently familiarize yourself with the results of the inspection, view information about the execution of the order and find out whether the perpetrators have been brought to administrative responsibility.

What documents should the organization receive after the audit?

Upon completion of the inspection, the employer will receive an inspection report with copies of the completed checklists attached.

If violations are discovered - also an order to eliminate violations of labor legislation, and if violations are identified in terms of labor safety training - an order to remove from work persons who have not received training in safe methods and techniques for performing work, instructions on labor protection, in accordance with the established procedure, on-the-job training and testing of knowledge of labor protection requirements.

How will the checklist and inspection report be filled out during an inspection?

By law, checklists include lists of questions affecting the most significant mandatory requirements of labor legislation and other regulatory legal acts containing labor law standards imposed on employers.

The columns “Inspection Account Number” and “Date of Entry into the Unified Register of Inspections” of the checklist must be filled in, for example: No. 0018000xxxxxx dated 02/08/2018.

According to Part 11.5 of Art. 9 of Federal Law No. 294, the checklist is filled out based on the results of the inspection and is attached to the inspection report. However, the article does not specify which one.

According to clause 61 of the Administrative Regulations, the inspection report is drawn up by an authorized official of the territorial body of Rostrud immediately after its completion in two copies having equal legal force, one of which, with copies of the attachments, is handed over to the authorized representatives of the person being inspected against a receipt for familiarization.

The original check sheet is attached to the inspection report kept by the labor inspector, and copies of the check sheets are attached to the inspection report handed to the employer (his representative)[7].

Is it possible to receive an inspection report and checklist in electronic form?

The regulations on the type of federal state control (supervision) provide for the possibility of issuing checklists in the form of an electronic document signed with an enhanced qualified electronic signature in accordance with the Federal Law “On Electronic Signatures” (clause 5 of the Government of the Russian Federation of 02/13/2017 No. 177 “On approval general requirements for the development and approval of checklists (checklists)."

However, the Regulations on federal state supervision of compliance with labor legislation and other regulatory legal acts containing labor law standards[8] do not currently provide for the possibility of issuing a checklist in the form of an electronic document. The employer, even if desired, will not be able to receive an inspection report in the form of an electronic document[9], since it is impossible to attach a verification sheet on paper to the act in the form of an electronic document.

Does the inspection report specify the number of employees against whom violations were identified?

The questions formulated in the checklists vary according to the number of subjects. For example, checklist No. 2 asks questions in relation to the employee, and checklist No. 22 asks questions in relation to employees. The situation is similar with regard to the employment contract.

However, the act (if a violation is identified) will indicate that a similar violation of the requirements of the regulatory legal act was committed, for example, in relation to 5 employees indicating their names, so there are no difficulties in this.

Are checklists used as evidence in an administrative offense case?

Yes, they are used. As an example, we can cite the resolution in the case of an administrative offense dated March 28, 2018 No. 80/5-186/2018, issued by the magistrate of the judicial district No. 80 of the Oktyabrsky district of the city of Kirov, in which checklists are given as evidence of violations of labor protection requirements . Since the person brought to administrative responsibility did not dispute the essence of the alleged violations under Part 1 of Art. 5.27.1 of the Code of Administrative Offenses of the Russian Federation, the court applied an administrative penalty in the form of a warning.

Is it possible to appeal the order?

It will become more difficult to appeal against orders issued based on the results of a scheduled inspection carried out using checklists, since they are issued in the event of an obvious violation of labor legislation, and the answers to the questions posed in the checklists unambiguously (and therefore obviously) must indicate the presence of or no violation.

A separate layer of court decisions will be formed by appealing the results of inspections using checklists regarding compliance with labor protection requirements, since some of the checklists contain references to documents that are advisory and not mandatory, for example, Resolution of the Ministry of Labor of Russia dated December 17, 2002 No. 80 “On approval of Methodological Recommendations for the development of state regulatory requirements for labor protection.”

Will consolidated checklists be used during joint inspections of Rostrud and Rospotrebnadzor?

When conducting joint scheduled inspections, consolidated checklists (checklists) developed and approved by several state control (supervision) bodies may be used.

For example, during a joint scheduled inspection of Rostrud and Rospotrebnadzor, a consolidated checklist may be approved regarding the verification of the provision of personal protective equipment for workers whose activities are associated with a high risk of contracting infectious diseases. We remind you that the employer is obliged to provide employees belonging to occupational risk groups with special clothing and repellents[10].

There are currently no approved summary checklists.

How can an employer find out if he is included in the Rostrud inspection plan for 2021?

By law, information about planned control activities must be publicly available. Employers can find out about upcoming control by the State Tax Inspectorate in 2 ways.

Firstly, the schedule of inspections of the labor inspectorate for 2021 must be published on its regional Internet portals by December 1, 2017. This is the requirement of Part 5 of Art. 9 of Law 294-FZ and clause 40 of the Administrative Regulations. As a rule, the plan is posted as a file in Excel format.

Secondly, information about scheduled inspections by all supervisory authorities is included in a single consolidated plan for inspections of business entities (Part 7, Article 9 of Law 294-FZ). It is being prepared by the Prosecutor General's Office of the Russian Federation. You can find out whether labor inspection inspections are planned for a particular employer for 2018 (as well as inspections by other bodies) using a special service on the department’s website. To use it, it is enough to enter at least the TIN or OGRN/OGRNIP of the enterprise.

Please note that you can only find out in advance the calendar month of the inspection and its duration, and not the specific start date. The employer learns about the start and end dates of the control upon receipt of a copy of the State Labor Inspectorate’s order to conduct the inspection, which must be handed to him at least 3 working days before the control activities (Part 12, Article 9 of Law 294-FZ).

What to do if someone comes to you

The basis for any inspection is an order from the head of the inspection. The GIT inspection in 2021 is no exception.

Therefore, when visiting your office, inspectors must present their official identification and a regulatory document that specifies the basis for the inspection.

In addition, the planned audit of the State Tax Inspectorate must be coordinated with the prosecutor's office.

The list of all possible grounds is specified in Article 360 of the Labor Code of the Russian Federation, including:

- complaints from former and current employees;

- demands of the prosecutor and a number of others.

Next, the auditors will request the necessary documents and information.

Please note that inspectors have the right to request information that relates exclusively to the subject of their inspection. They have no right to demand anything more - a direct prohibition is stated in Article 15 of the said Federal Law.

New principles for preparing a plan for GIT inspections in 2018

When forming scheduled inspections for 2021, labor inspectorates were guided by the so-called risk-based approach (Article 8.1 of Law 294-FZ). It means that all economic entities are assigned:

- hazard class (depends on the severity of possible negative consequences from non-compliance with mandatory legal requirements);

- risk category (depends both on the severity of the consequences of non-compliance with the above requirements and on the likelihood of their non-compliance by the enterprise).

The classification of an enterprise into a risk category or hazard class in general is regulated by the Rules, approved. by Decree of the Government of the Russian Federation dated August 17, 2016 No. 806. But in relation to each area of state supervision there are its own criteria for assigning a particular class/category. In the field of supervision over compliance with labor legislation, employers are assigned risk categories (clause 17 of the Regulations on the FGN for Labor).

The formula for determining the employer's risk category is established in Appendix No. 1 to the Regulations on the Federal State Tax Fund for Labor. It directly depends on the indicator of potential harm to legally protected values in the world of work (these include the life and health of workers, timely payment of wages, etc.).

This indicator is fixed and is determined depending on the field of activity of the enterprise in Appendix No. 2 to the Regulations on the FGN for labor. Thus, the highest risk category will be for enterprises in the mining sector.

The risk category affects the frequency of scheduled inspections of GIT.

What documents does the labor inspectorate study?

Order of Rostrud No. 160 dated June 13, 2019 contains a list of documents that employers can request from State Labor Inspectorate. Among them:

- local regulations regulated by labor law in establishing labor relations;

- documents establishing the legal form of the employer;

- staffing schedule;

- taking into account the recommendations of the trade union body;

- statements from company employees;

- orders and recording the fact of familiarization with them by employees of the organization;

- documents describing the rights and obligations of the parties to the labor relationship;

- documents on the conclusion, amendment, termination of an employment contract;

- income and expense book for accounting of work records;

- agreements on full financial liability, orders on personnel, on the termination of employment contracts, on the dismissal of employees;

- documents confirming the protection of personal data of employees;

- documents confirming compliance with working time and rest requirements;

- orders for granting vacations, written consents of employees to carry out professional activities on weekends and holidays;

- agreements on dividing vacation into parts, settlement in case of termination of an employment contract, documents on payment of compensation for vacation that was not used by the employee;

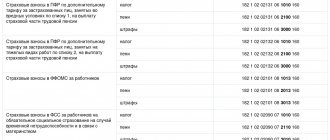

- documents confirming compliance with wage requirements, in particular the payment of wages;

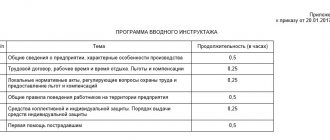

- documents confirming compliance with mandatory requirements regarding the organization of labor protection: provision of personal protective equipment, medical support, and labor protection guarantees for a number of categories of employees, labor protection training, etc.

- documents that certify that the employee has a disability, as well as the validity period of the supporting documents.

In addition, the State Tax Inspectorate may request from government bodies:

- information about the absence of debt on insurance premiums and fines;

- an extract from the Unified State Register of Real Estate rights;

- information from financial statements;

- average number of employees for the previous year;

- information from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs;

- the amount of taxes paid for the current year;

- information about criminal records and facts of criminal prosecution.

Frequency of Rostrud inspections in 2018

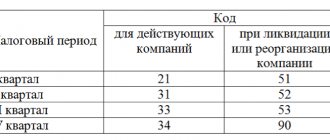

Previously, the frequency of planned monitoring of gastrointestinal tracts was determined according to the general norm of Part 2 of Art. 9 of Law 294-FZ - no more than once every 3 years. Now it depends on the risk category of the employer (clause 20 of the Regulations on the Federal State Tax Fund for Labor):

- high - once every 2 years;

- significant - once every 3 years;

- average - once every 5 years;

- moderate - once every 6 years;

- low - no checks are carried out.

The basis for including an enterprise in the inspection plan is the expiration of the specified period from the date (part 8 of article 9 of Law 294-FZ, clause 35 of the Administrative Regulations):

- enterprise registration;

- carrying out the last scheduled inspection;

- the beginning of an activity, which must be notified to Rostrud (in accordance with clause 5.1 of the Rules, approved by Decree of the Government of the Russian Federation of July 16, 2009 No. 584, such activities include care with accommodation and social services without accommodation).

The specified list of grounds is exhaustive. Carrying out an inspection without a reason entails the invalidity of its results (clause 1, part 2, article 20 of Law 294-FZ).

Attention: scammers!

The State Labor Inspectorate in the Kaluga Region and colleagues from other regions officially warn that scammers are coming to employers on behalf of Rostrud employees. People who introduce themselves as State Inspectorate employees offer various kinds of paid services to prepare for supposedly upcoming unscheduled inspections. It is difficult to say how good the specialists are who offer such assistance.

Rostrud reminds that the list of enterprises for which inspections are planned is freely available. When visiting a company, inspectors are required to present an official ID and an inspection order, which must be signed by the head of the territorial body and certified with a seal. Inspectors do not provide any paid services, the department emphasizes. If you notice that control rules are being violated (for example, there were no reports of an unscheduled visit), be vigilant, it is possible that scammers have come to the organization. In such cases, feel free to contact law enforcement agencies.

Deadlines for scheduled inspections by the labor inspectorate

According to Art. 13 of Law 294-FZ, the maximum period for both on-site and documentary scheduled inspections is 20 working days. There are restrictions on on-site control of the following entities:

- small enterprise - no more than 50 hours per year;

- micro-enterprise - no more than 15 hours per year.

Documentary checks of these entities are carried out without these restrictions.

The on-site inspection may be extended for another 20 working days (or 50 and 15 hours, respectively) in exceptional cases. We are talking about the need to conduct lengthy examinations, investigations, etc. Documentary checks are not extended.

In relation to the small businesses mentioned above, inspections may be suspended for a period of no more than 10 working days and only if it is necessary to obtain documents in the manner of interdepartmental cooperation.

If an enterprise that has separate divisions in several regions is being inspected, the inspection deadlines are set individually for each of them. But the total duration of inspections cannot be more than 60 working days.

Let us remind you that until the end of 2021, small businesses are exempt from Rostrud inspections (Article 26.1 of Law 294-FZ). The exceptions are companies:

- for which the law provides for special control periods (in the field of heat supply, healthcare, energy, etc. - Part 9 of Article 9 of Law 294-FZ);

- who, based on the results of inspections carried out over the previous 3 years, were held accountable for a gross violation of the law or suffered penalties such as disqualification, suspension of activities, revocation or suspension of a license.

Fines for non-compliance with legislation

The detected violations are of a heterogeneous nature. You need to understand that for non-compliance with labor legislation, the employer will have to bear responsibility according to the Code of Administrative Offenses of the Russian Federation. Evasion from concluding an employment contract with an employee entails a fine (Part 4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- for officials - up to 20,000 rubles;

- for legal entities - up to 100,000 rubles.

Delaying wages or setting a salary to an employee in an amount less than the minimum wage entails a warning or a fine (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- for officials - up to 20,000 rubles;

- for an enterprise - up to 50,000 rubles.

In order to avoid administrative liability, we recommend that you comply with labor laws and avoid violations in the field of labor relations, and also seek help from SRG-ECO specialists .

Can the GIT inspection schedule for 2018 be changed?

Not all enterprises whose next inspection deadline has come are included in the inspection plan. But if the inspection was never planned, the enterprise cannot be included in it for a year.

The list of cases in which the plan is subject to adjustment is exhaustive and is established in clause 7 of the Rules for the Preparation of Plans and clause 41 of the Administrative Regulations. An inspection may be excluded from the plan if it is impossible to carry out due to:

- liquidation of an organization, termination of the activities of an individual entrepreneur;

- circumstances of force majeure.

Other changes may be made for reasons such as:

- changes in the location or address of the organization/entrepreneur;

- change of organization name, full name entrepreneur;

- reorganization of a legal entity.

These changes do not entail exclusion of the inspection from the plan or shift in deadlines.

Small businesses who believe that they were included in the inspection plan unreasonably (in violation of Article 26.1 of Law 294-FZ) have the right to submit an application to exclude themselves from the inspection plan. A positive result of consideration of the application is the basis for excluding the corresponding inspection from the plan.

Registration of results

At the end of the inspection activities, the inspectors draw up a report. It is drawn up in two copies and drawn up immediately after the completion of the inspection. Nobody knows what the legislation includes in the term “directly”, but demand this document from the inspectors immediately after all activities are completed and, if it is not provided, file a complaint with the State Tax Inspectorate itself and the prosecutor’s office.

Read more: Should you argue with the labor inspectorate?