Labor Code of the Russian Federation

As enshrined in the Labor Code of the Russian Federation, the need for professional training and retraining of personnel for their own needs is determined by the employer himself. And if the forms of professional training, retraining and advanced training of employees, the list of required professions and specialties are determined by the employer independently, then the advanced training of employees is primarily dictated by the norms of federal laws and other regulatory legal acts of the Russian Federation. For example, according to the Customs Code of the Russian Federation, customs clearance specialists are required to undergo training every two years under federal advanced training programs (clause 3 of Article 147 of the Customs Code of the Russian Federation), or, for example, advanced training for railway transport workers. Workers whose production activities are directly related to the movement of trains and shunting work on public railway tracks, and who are responsible for loading, placing, securing cargo in wagons, containers and unloading cargo (clause 4 of Art. 25 of the Federal Law of January 10, 2003 N 17-FZ “On Railway Transport in the Russian Federation”).

EXAMPLE FROM JUDICIAL PRACTICE

In accordance with Art. 198 of the Labor Code of the Russian Federation, an apprenticeship agreement for off-the-job training was concluded between I. and LNG LLC. In accordance with the apprenticeship agreement, the organization maintained I.’s average salary for the period of training. Having violated the student agreement, I. worked only three months after training instead of two years, because he was fired for systematic violation of labor discipline. Consequently, he violated his obligations under the contract. LNG LLC filed a lawsuit against I. for reimbursement of training costs. But the court rejected the claim. The cassation court found the decision illegal. According to Part 2 of Art. 207 of the Labor Code of the Russian Federation, at the request of the employer, the student is obliged to return the scholarship received during the apprenticeship and other training costs (determination of the Nizhny Novgorod Regional Court dated 06/07/2011 in case No. 33-5712/2011).

GOOD TO KNOW

To qualify for the position of “chief accountant” (clause 3.2 of the Standard, approved by order of the Ministry of Labor of Russia dated December 22, 2014 No. 1061n), it is necessary to have a higher or secondary vocational education, additional professional programs (advanced training, professional retraining) and practical experience related to with accounting, preparation of accounting (financial) statements or auditing activities - at least five years out of the last seven (if you have a higher education - at least three years out of the last five).

Tax Code of the Russian Federation

As noted in the published Letter, expenses for professional training, retraining and other training are taken into account by the taxpayer as part of other expenses associated with production and sales (clause 23, clause 1, article 264 of the Tax Code of the Russian Federation). Moreover, such expenses must meet the requirements set out in paragraph 3 of Art. 264 Tax Code of the Russian Federation. First of all, we point out that according to Art. 264 of the Tax Code of the Russian Federation is allowed to take into account the costs of training for basic and additional professional educational programs, professional training and retraining of workers (hereinafter referred to as training). One of the main requirements is presented to the educational institution in which training is conducted. A Russian educational institution must have the appropriate license , and a foreign one must have the appropriate status . Training is carried out on a contractual basis with Russian or foreign educational institutions. Please note: no paragraphs. 23 clause 1, nor clause 3 of Art. 264 of the Tax Code of the Russian Federation does not contain direct indications that an agreement with an educational institution must be concluded by the employer. Therefore, the existence of an agreement is mandatory, and who concluded it - the employer or the student himself - is not important. It is allowed to take into account in other costs of production and sales the costs of the above training, which are completed by employees working for the taxpayer under an employment contract .

Or the training is carried out by persons not working in the organization who have entered into an obligation with the company providing for, after completion of this training, that person to work for the taxpayer for at least one year. Thus, an employer (organization or entrepreneur) can take into account the costs of training both its own employees and potential employees who undertake to work for him after training. There are also restrictions on including some costs associated with training in the cost structure. Thus, expenses associated with organizing entertainment, recreation or treatment, maintaining educational institutions, as well as performing free work for them or providing them with free services are not recognized as educational expenses (Clause 3 of Article 264 of the Tax Code of the Russian Federation). Closely related to this issue are the general requirements for expense recognition.

Guarantees and compensation

Employers are required to provide employees with certain guarantees depending on the type of training. For example, having sent an employee to professional basic or additional training outside of work, he is retained in his position and paid an average salary. If the employee studies in another area, the employer pays his expenses as for a business trip (Articles 177, 187, 196 of the Labor Code of the Russian Federation).

The list of guarantees and compensations for employees who combine work with study can be found in Articles 173–176, 187 of the Labor Code of the Russian Federation. Among them:

- payment for additional study leave;

- payment of travel expenses to and from the place of study;

- maintaining average earnings for the period of release from work in connection with training.

Situation: is it possible to withhold from a dismissed employee the amount spent on his training?

Yes, you can.

To do this, before paying for an employee’s training, you need to conclude an appropriate agreement with him (Article 197 of the Labor Code of the Russian Federation). This agreement should stipulate that the employee must work for a certain period after completion of training. If such a condition is specified in the employment contract (paragraph 5, part 4, article 57 of the Labor Code of the Russian Federation), there is no need to conclude an additional agreement.

If an employee quits without fulfilling the conditions stipulated by the agreement or employment contract, he must compensate the organization’s expenses for his training (Article 249 of the Labor Code of the Russian Federation).

Situation: should an organization pay an employee for advanced training days if they fall on a weekend?

No, you shouldn't. There is no such obligation in labor legislation.

After all, the Labor Code of the Russian Federation provides guarantees if an employee is sent for training outside of work (Article 187 of the Labor Code of the Russian Federation). And in the situation under consideration, the advanced training courses took place on the weekend. It turns out that the employee studies without interruption from work (but at the same time on his days off). This means that the provisions of Article 187 of the Labor Code of the Russian Federation cannot be applied.

Based on this, the employee is not entitled to either average earnings or compensation for expenses.

In addition, advanced training is not a labor function of an employee, and training time is not considered working time (Article 91 of the Labor Code of the Russian Federation). Therefore, the employer is not obliged to pay for the employee’s training time on weekends (Article 153 of the Labor Code of the Russian Federation).

Let us add that cases when advanced training falls on an employee’s weekend are very rare. Such situations should be avoided. But, if this is not possible, the solution to this issue must be reflected in the order. Include other days of rest. Otherwise, employees will refuse advanced training on weekends.

How to track employee training costs

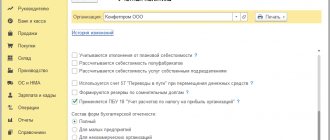

Accounting Regulations “Organization Expenses” PBU 10/99, approved by order of the Ministry of Finance of the Russian Federation No. 33n. dated May 6, 1999 (specifically clauses 5, 6, 6.1, 7), classifies the enterprise’s expenses for employee training (in any form) as expenses for ordinary activities. Their amount must be reflected in the training contract.

Clause 16 of PBU 10/99 lists the following criteria under which a company’s expenses, including employee training costs, can be recognized in accounting:

- The basis for the expense is a contract, legal act or business customs.

- The amount is clearly defined.

- An expense is part of a transaction that clearly results in a reduction in the economic benefits of the enterprise (this is typical in cases where the company actually transfers its asset to someone or there is complete certainty that the asset will be transferred).

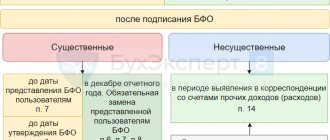

Expenses associated with training and retraining of company employees meet all these conditions and therefore can be counted in the period corresponding to the provision of educational services, namely, the date of signing the act of completion of work (regardless of when the payment for training was actually transferred) – see clause 18 of PBU 10/99.

The company's expenses for employee training are reflected in accounting:

- In the debit of account 60 (“Settlements with suppliers and contractors”).

- In the correspondence for account 50 (“Cashier”).

- On account 51 (“Current Account”), if the company pays for employee training by bank transfer.

- On account 71 (“Settlements with accountable persons”), if the payment was made in cash.

These costs are reflected in the form of accounts receivable if an advance payment was transferred to an educational institution for an employee’s training (see paragraphs 3, 16 of PBU 10/99). But this is no longer an expense, unlike the above cases. Data on prepayment must be present in the credit of account 50 (“Cash”), 51 or 71 (depending on whether the prepayment is made by cash or non-cash payment), as well as in the debit of account 60 (“Settlements with suppliers and contractors”) and analytical account 60-va (“Calculations for issued advances and prepayments”).

As soon as the document of acceptance and transfer of educational services has been received, expenses for employee training should be reflected in the debit of expense accounts 20, 25, 26, 44, in the credit of account 60 and, at the same time, offset the amount of the prepayment in the invoice for the provision of services, making an internal entry in analytical accounting on account 60 (debit 60, credit 60).

In more complex situations, when the company incurs the costs of training citizens with whom an employment contract has not been signed - children of full-time employees, etc. - these amounts are classified as other expenses (which is regulated by clauses 2, 11 of PBU 10/99 ). They must be entered in the debit of account 91 (“Other income and expenses”), subaccount 91.2 (“Other expenses”), as well as in correspondence with the credit of account 60.

Read the material on the topic: How to hire an employee

What documents are needed to justify expenses?

The contents of the documents should show how the costs of advanced training are related to the company’s activities, and what benefits employee training will bring to the company.

Among them may be personnel training (retraining) plans approved by the director, which provide for the goals of advanced training and the timing of sending certain employees for training.

It is good if the opportunity to improve the employee’s qualifications is reflected in his employment contract, and the results of advanced training are reflected in the additional agreement to him on the assignment of new qualifications, changes in responsibilities and a salary increase.

Before sending them to training, issue an order from the manager to send employees to courses. In it, indicate that employees study in connection with production needs and at the initiative of the company in order to:

- introduction of new equipment;

- expansion of production;

- improving business processes, etc. (see above).

Documents that confirm the employee’s training in the interests of the company will be:

- an agreement on the provision of educational services concluded between an organization and an educational institution;

- curriculum with advanced training courses;

- act on the provision of educational services;

- document (diploma, certificate, attestation, certificate, etc.) issued to the employee upon completion of training.

Documenting

By sending an employee for training, the employer enters into an agreement with an educational institution (an organization engaged in educational activities). Sample forms of contracts for the provision of educational services are given in orders of the Ministry of Education and Science of Russia dated December 9, 2013 No. 1315 and dated November 21, 2013 No. 1267.

Situation: what documents can confirm the provision of educational services to an employee of an organization for accounting purposes?

The legislation does not contain a list of documents that can be used to confirm that an educational service was provided. In accounting there is only a requirement that each fact of economic life must be documented in a primary accounting document (Part 1, Article 9 of the Law of December 6, 2011 No. 402-FZ).

The fact of provision of educational services can be confirmed, for example, by a bilateral act. This document must be signed by the employer and the educational institution (organization carrying out educational activities) upon completion of the employee’s training or at another time established by the contract.

The main thing is that the supporting document contains all the mandatory details specified in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

In addition to these documents, you can attach a copy of your educational document (for example, a copy of a diploma, certificate or academic transcript). Their educational institutions issue them in most cases (Article 60 of the Law of December 29, 2012 No. 273-FZ).

Why improve staff qualifications?

Advanced training is the updating of an employee’s knowledge and skills in an existing specialty.

What is it for?

Firstly, qualified employees cope better with their duties and do it quickly and efficiently. Therefore, the quality of the product or service provided improves. The chain can be continued: the number of clients grows, profits increase, etc.

Secondly, the company's expenses are reduced. There is no need to involve third-party specialists. In addition, the amount of losses due to errors made due to lack of knowledge is reduced.

Thirdly, employee training demonstrates care on the part of the company, the microclimate improves, and staff turnover is reduced.

As you can see, all this is directly related to the company's production activities. And this is one of the conditions for recognizing expenses.

Read in the berator “Practical Encyclopedia of an Accountant”

Expenses that reduce profits

Whom to train and in what form is decided by the company. It depends on the goals set - to increase brand awareness, increase competitiveness, increase labor productivity, improve the quality of services, introduce new technologies, etc.