In 2015, the calculation of insurance contributions to the Pension Fund and the Compulsory Medical Insurance Fund (form RSV-1) must be submitted quarterly in paper form by the 15th day, and electronically by the 20th day of the second calendar month following the reporting period.

The last dates for submitting paper reports in 2015 are:

- May 15, 2015 for the 1st quarter of 2015;

- August 17, 2015 for the first half of 2015;

- November 16, 2015 for 9 months of 2915;

- February 15, 2021 - report for 2015;

And when submitting reports electronically:

- May 20, 2015 for the 1st quarter of 2015;

- August 20, 2015 for the first half of 2015;

- November 20, 2015 for 9 months of 2915;

- February 22, 2021 - report for 2015;

How to fill out RSV-1?

The RSV-1 form itself and how to fill it out are described in the officially approved resolution of the Pension Fund Board of January 16, 2014 No. 2p.

This document was amended on June 4, 2015, in accordance with the resolution of the Pension Fund Board of June 4, 2015 No. 194 p.

The innovations are associated with changes in the procedure for calculating contributions. Thus, since the beginning of 2015, the number of companies that have the right to apply reduced rates for insurance premiums has decreased. In addition, the maximum base for contributions to the Health Insurance Fund was abolished.

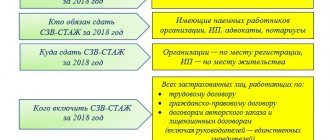

Companies and individual entrepreneurs must submit a report in form RSV-1 if they have employees. If the policyholder did not pay wages, then he needs to generate and submit a zero calculation.

RSV-2

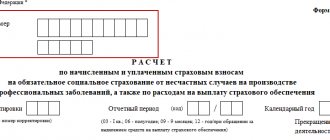

RSV-2 - Calculation of accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and insurance contributions for compulsory medical insurance to the Federal Compulsory Medical Insurance Fund by the heads of peasant (farm) farms.

The new form was approved by Order of the Ministry of Labor and Social Protection of the Russian Federation dated May 7, 2014 N 294n “On approval of the form of calculation for accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and for compulsory medical insurance to the Federal Compulsory Medical Insurance Fund heads of peasant (farm) farms” (Registered with the Ministry of Justice of Russia on May 28, 2014 No. 32467).

Submitted to the Pension Fund by the heads of peasant (farm) households no later than March 1 of the calendar year following the expired billing period.

- For 2014, the calculation must be submitted by March 1, 2015.

The calculation is presented on paper or in electronic form, in accordance with the legislation of the Russian Federation.

Deadlines for submitting the report according to the RSV-1 form

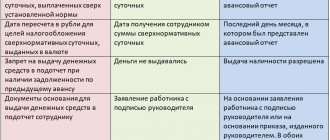

Insurance premiums are paid by period: in the first quarter, for half a year, for nine months and for a year. Paper RSV-1 reports must be submitted within one and a half months after the reporting period ends, and electronic reports must be submitted within one month and 20 days. Submit it later and the report will not be accepted. However, if the deadline falls on a non-working day, it is automatically moved to the next working day.

Where to submit RSV-1 for 2021

The electronic RSV-1 report form is required to be submitted by payers whose average number of employees for 2021 is 25 people or more. All other payers can provide reporting in one of the ways, at their own discretion: either in paper form or electronically.

The report for 2021, as before, should be submitted to the relevant territorial divisions of the Pension Fund at the location of the enterprise or at the place of residence of the entrepreneur. It should be borne in mind that this is the last time funds will accept reports of this type. From January 1, 2021, the functions of administering insurance pension payments are transferred to the tax authorities, which will subsequently accept reports. At the same time, primary and updated reporting for reporting periods up to 2017 will continue to be provided to the Pension Fund.

In what order should I fill out RSV-1?

Form RSV-1 is a title page followed by six standard sections.

All organizations, without exception, need to fill out the title page and the first two sections. The remaining sections need to be completed and submitted only if there is data for them. Sections 1 and 2 contain general information about the earnings of the organization’s employees, contribution rates, accrued and paid contributions for pension and health insurance.

Section 3 – filled out by companies with reduced insurance premium rates. In this section, they confirm their right to apply a reduced tariff.

Section 4 - it contains data on recalculations for previous reporting periods.

Section 5 - it contains information on payments and other remuneration accrued for activities carried out in the student team under labor and civil law contracts.

Section 6 – individual information about employees is described here. For each employee or working under a GPC agreement, a separate page is filled out containing information about earnings, accrued insurance contributions to the Pension Fund, as well as insurance experience for the last three months of the reporting period.

Still have questions? Watch the webinar on reporting for the 1st quarter of 2016.

If you fill out the wrong form

As 2021 begins, there may be some confusion when using the contribution reporting form. And it is possible that some accountants will fill out the calculation of insurance premiums for 2021 using a new form approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. However, keep in mind that the tax office will not accept the calculation of contributions for 2021 on the new form. The fact is that the Federal Tax Service simply does not have the authority to accept and verify calculations for 2021. And the new form of unified calculation is applied only from reporting for the 1st quarter of 2017.

Accordingly, another situation is possible: the accountant will submit to the Pension Fund a calculation of insurance premiums using a new form approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. The Fund, in turn, will also refuse to accept the settlement. Therefore, it is important to take into account the calculation of insurance premiums for 2021:

- must be submitted using the “previous” form RSV-1, approved by order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551;

- RSV-1 for 2021 is submitted exclusively to the Pension Fund of Russia (despite the fact that since 2021, insurance premiums are controlled by tax authorities).

Why are monthly reports submitted to the Pension Fund?

According to Federal Law No. 385-FZ dated December 29, 2015, indexation of pensions of working pensioners is suspended from January 1, 2016. If a pensioner stops working, then the insurance pension and a fixed payment to it are paid taking into account indexation and other adjustments that occurred during the period of work.

The Pension Fund website explains that monthly reporting to the Pension Fund since 2016 is a necessary innovation that will help implement the law. With the help of such reporting, it will be possible to determine whether the pensioner continues to work. The procedure will relieve people of retirement age from the need to visit the territorial offices of the Pension Fund of the Russian Federation to submit an application for the resumption of indexation of the insurance pension. In order for the Pension Fund to automatically detect the fact that a pensioner is working, the employer himself will have to submit the necessary information.

It is important to note that monthly reporting to the Pension Fund from 2021 does not replace quarterly reporting, but is additional. That is, no one can cancel the submission of quarterly unified reporting (in the RSV-1 form).

Monthly reporting to the Pension Fund: who should submit and how

The innovation will affect all employers. They will have to provide information about every insured person working for them, even about those who work under civil contracts.

The reporting deadline is no later than the 10th day of the month following the reporting period. Policyholders need to submit simplified reporting, which includes information about the working insured person: last name, first name and patronymic, SNILS, INN.

The law, according to which monthly reporting is introduced to the Pension Fund of Russia, comes into force on April 1, 2021. Therefore, the first reports must be submitted for April 2021. It must be received by the Pension Fund no later than May 10, 2021.

Companies with an average number of employees for 2015 of more than 25 people must submit reports in electronic form. Everyone else has the right to choose how it is more convenient for them to submit monthly reports - electronically or on paper.

Penalty for late delivery

Penalties are provided for late submission of the RSV-1 form. The minimum fine is 1000 rubles, and the maximum is 30% of the amount of insurance payments accrued over the last 3 months. For each month of delay, the amount of the fine is 5% of the amount of insurance amounts payable. In this case, an incomplete month is rounded up to one whole month.

- Form RSV-1 - sample filling in 2021

Filling out the RSV-1 report: title page

Filling out RSV-1, like many other reporting forms, can begin with the title page. It indicates:

- information about the insured (registration number in the Pension Fund of the Russian Federation, name/full name of the individual entrepreneur, INN, KPP, OKVED code for the type of activity engaged in by the organization or individual entrepreneur, contact telephone number);

- code of the period for which the calculation was made, as well as the calendar year to which this period relates;

- the number of insured persons for whom information is provided in the calculation, i.e. sections 6 of the RSV-1 are completed;

- average number.

Be sure to also date and sign the title page. By the way, you will need to put “autographs” and dates in the same way on all pages of the calculation you prepared (clause 3 of the Procedure for filling out the RSV-1).

How to fill out RSV-1 for 9 months of 2015 and when should it be submitted to the Pension Fund?

the RSV-1 form for 9 months of 2015 is established by Resolution of the Board of the Pension Fund of the Russian Federation dated January 16, 2014 No. 2p.

The following are required to be filled out: title page, sections I, II, VI of RSV-1 .

- On the title page you must indicate:

- The number and type of correction, for the initial submission - number “000”, for subsequent submissions, respectively, “001”, “002”, “003”, etc. The type changes from 1 to 3, for example, if the correction is related to clarification of the listed amounts of insurance premiums are indicated “1”, clarification of accrued contributions for compulsory health insurance – “2”, for compulsory medical insurance – “3”.

- Reporting period – “9”, calendar year – 2015.

- A dash is entered in the “Cessation of activity” field if the activity is ongoing. Otherwise, you must enter “L”.

- “Number of insured” is taken from section VI of the RSV-1 .

- Next, fill out section II, when entering data into which you need to pay attention to the following points:

- All employers are required to fill out subsection 2.1, which indicates the tariff code and the amount of calculated contributions for compulsory health insurance and compulsory medical insurance, and it is necessary to indicate the values for both 9 months of 2015 and for July, August, September (III quarter of 2015). If the payer's tariff code had different meanings, it is necessary to reflect information about each on a separate sheet of subsection 2.1.

- If the payer has employees who work in hazardous working conditions or in difficult industries, it is necessary to fill out subsections 2.2. and 2.3. If the policyholder carried out a special assessment - 2.4.

- Section I reflects the summary values of the completed sections. In this case, it is important to reflect in line 100 of the section the indicator of line 150 of RSV-1 for 2014.

- In Section VI, it is necessary to show all employees (their full name and SNILS) who received payments in the period from January to September 2015, reflecting in detail for each the amount of payments, accrued contributions, possible adjustments, as well as other additional information.

When other sections need to be completed:

- Section III of RSV-1 is filled out by categories of payers who apply reduced tariffs. For example, subsection 3.3 is filled out by organizations or individual entrepreneurs engaged in activities in the field of information technology, and subsection 3.5 is filled out by simplifiers with a preferential type of activity.

- Section IV should be completed when errors are found:

- Pension Fund bodies conducting desk or on-site inspections; as a result of which the Pension Fund made additional assessments of the amount of insurance contributions;

- by the policyholder himself, representing RSV-1 .

- Section V of the RSV-1 is filled out only by those employers who make non-taxable payments to students working in student teams. But the following conditions must be met:

- Full-time education;

- the educational institution provides higher or secondary vocational education;

- the student team is mentioned in the register of federal or regional significance;

- There is a contract between the employer and the student - a labor contract or civil contract.

After all the data has been entered into the RSV-1 , we recommend checking the report using specialized software tools presented on the Pension Fund website.

How to do this is described in detail in our material “The Pension Fund has updated the program for checking statements.”

RSV-1 form can be sent to the Pension Fund in 2 ways:

- Electronic.

You can learn about changes since 2015 in this type of report submission from the material “Some policyholders have a chance to avoid a fine for failure to comply with the electronic method of submitting reports to funds”.

Read our publication about what is important to pay attention to when sending via TKS.

- On paper: hand in in person to the Pension Fund or by mail.

For information about which postal services you can use, read the article “Paper reporting to the Pension Fund can be sent by mail. And not only by Russian Post" .

Our material “The Ministry of Labor told when you need to switch to electronic reporting” will help you decide on the option to send RSV-1.

The deadlines for submitting the RSV-1 form are indicated here.

However, we note that the date of submission of RSV-1 depends on the format of the report.

Let's consider the deadlines for submitting RSV-1:

| Period | Submission deadline | |

| electronic | on paper | |

| 9 months 2015 | November 20, 2015 | November 16, 2015 |

| 2015 | February 22, 2021 | February 15, 2021 |

| 1st quarter 2021 | May 20, 2021 | May 16, 2021 |

| 6 months 2021 | August 22, 2021 | August 15, 2021 |

| 9 months of 2021 | November 21, 2021 | November 15, 2021 |

| 2016 | February 20, 2021 | February 15, 2021 |

Payment of insurance premiums is made on a monthly basis until the 15th day of each subsequent month for the previous one.