Algorithm of operation of ASK VAT-2

- The program compares the VAT charged by the seller (according to his sales book) and the VAT accepted for deduction by the buyer (according to his purchase book).

- If these data do not match, the program finds out what is wrong: whether the seller reflected the sale and how lawfully the buyer declared tax deductions.

- Everything happens without the participation of an inspector: the tax office automatically sends requests for explanations to the buyer and seller.

- You have five days to respond, and then the local inspectorate begins an inspection.

- As a result, taxpayers either correct payment errors themselves or receive notification of additional assessments.

Scheme of operation of ASK NDS-2

RESULT:

By introducing PC ASK VAT-2, tax authorities actually automated the classic “counter check”, for greater efficiency, also introducing the necessary amendments to the Tax Code, which began to work from the beginning of 2015. The use of new Big Data technologies makes it possible to automatically compare the data of counterparties, quickly identify and suppress the illegal activities of fraudulent companies that do not fulfill their tax obligations. Now the Federal Tax Service, having identified inconsistencies in the reporting of the buyer and seller, can request invoices and primary documentation from companies. And a company that has not confirmed receipt of tax demands or notifications may have its accounts blocked by tax authorities.

What are the results used for?

1. To determine which companies are claiming VAT refunds, you need to pay special attention. Previously, in order to identify “dubious” VAT refund applications, it was necessary to sift through a lot of documents, but the ASK VAT-2 RMS does everything very quickly and in an automated mode.

2. If there are discrepancies in the tax returns of the “chain” of suppliers and buyers, then the ASK VAT-2 RMS is used to determine what caused these discrepancies. Tax officials begin to look for a beneficiary in the chain - a company that somehow makes illegal tax profits. And then there will be a desk audit, and then there will be an almost 100% probability of additional tax charges.

It should also be noted that when a “gap” is discovered in some chain - that is, someone did not reflect something in the declaration, some numbers did not match, then the Federal Tax Service begins to “shake” the entire chain. And first of all, they are interested in the fact that they can be charged more taxes and actually collect them.

ASK VAT-2: find out about your potential VAT risks and ways to reduce them!

All information is accumulated in the Big data

, which is used to process data from PC ASK NDS-2.

Thus, all VAT reports (and therefore all invoices) now fall into the all-Russian database (data center of the Federal Tax Service of Russia in Dubna). The program is aimed at comparing data on each operation along the goods movement chain. Big Data

is a system for processing huge amounts of data, formed in the late 2000s, as an alternative to the traditional database management system (DBMS).

Defining Characteristics of Big Data:

- data volume,

- data processing speed,

- variety of simultaneous processing of various types of data.

Since 2013, big data as an academic subject has been studied in emerging university programs in data science, computational science and engineering.

Algorithm of operation of ASK VAT-2

- The program compares the VAT charged by the seller (according to his sales book) and the VAT accepted for deduction by the buyer (according to his purchase book).

- If these data do not match, the program finds out what is wrong: whether the seller reflected the sale and how lawfully the buyer declared tax deductions.

- Everything happens without the participation of an inspector: the tax office automatically sends requests for explanations to the buyer and seller.

- You have five days to respond, and then the local inspectorate begins an inspection.

- As a result, taxpayers either correct payment errors themselves or receive notification of additional assessments.

Scheme of operation of ASK NDS-2

RESULT:

By introducing the PC ASK VAT-2, tax officials actually automated the classic “counter check”, for greater efficiency, also introducing the necessary amendments to the Tax Code, which began to work from the beginning of 2015. The use of new Big Data technologies makes it possible to automatically compare the data of counterparties, quickly identify and suppress the illegal activities of fraudulent companies that do not fulfill their tax obligations. Now the Federal Tax Service, having identified inconsistencies in the reporting of the buyer and seller, can request invoices and primary documentation from companies. And a company that has not confirmed receipt of tax demands or notifications may have its accounts blocked by tax authorities.

How tax authorities and ASK VAT-2 work

- You submit a VAT return.

- The system independently analyzes data for each operation along the chain of movement of goods and identifies tax gaps in transactions for which there is a deduction, but VAT has not been paid.

- Unscrupulous VAT payers are automatically detected, and a tree of connections with other participants in the trade turnover is built.

- The totality of the data obtained allows tax authorities to identify the beneficiary of VAT tax deductions. It can be absolutely any organization or individual entrepreneur claiming a tax deduction - after all, the right to deductions is given to those who buy goods (work or services) from their counterparties who present the tax amount (clause 2 of Article 171 of the Tax Code of the Russian Federation).

What does "tax gap" mean?

This is when your counterparty:

- Or submitted a zero VAT return.

- Or he didn’t pass it at all.

- Or you submitted the declaration, but did not reflect the invoice issued to you in the sales book (or distorted the data).

Thus, often all the headaches from ASK VAT-2 are caused by erroneous actions/inactions of our counterparties or the existence of relationships they have with shell companies.

- If contradictions are identified in the VAT declaration, the system automatically generates a request for explanations.

- This is followed by other tax control measures. Let's say a tax gap has been identified. To identify the recipient of an unjustified tax benefit, inspectors can use an expanded list of tax control measures already within the chamber: requesting a voluminous list of documents, inspecting premises, territories, interviewing employees, etc. ...

- Conscientious taxpayers are also under attack. Most audits after identifying tax gaps end unfavorably. Claims from inspectors regarding violations of third parties can be made specifically against bona fide companies and, more likely, against those who have property. Even in cases where you yourself interact with a bona fide counterparty, but there are “gray” or “black” companies in the chain.

- The number of tax audits initiated thanks to the VAT-2 ASK is growing and, as judicial practice shows, most of these audits resulted in a victory for the tax authorities in the form of additional assessments or denials of deductions.

- Tax authorities continue to improve the tax administration of VAT. ASK NDS-3

is coming .

Taxpayers submit electronic VAT returns

, containing indicators of the purchase book and sales book. In 2015, the Federal Tax Service launched the ASK VAT-2 PC to control declarations.

| Copyright © Moscow Accountant's Quick Reference Guide: KSBuh website |

How is the amount of VAT that is subject to reimbursement (refund) to the taxpayer from the budget formed?

The peculiarity of VAT is that, at the end of the quarter, the taxpayer determines the difference between the tax received from buyers (i.e., calculated on taxable transactions) and the tax transferred to its suppliers (tax deduction for VAT).

If the amount of VAT tax deductions exceeds the total amount of tax calculated for taxable transactions, then the resulting difference is subject to reimbursement (refund) to the taxpayer from the budget after a desk tax audit of the VAT return filed by him.

Why does the tax office use ASK VAT-3?

As noted above, ASK VAT-3 is a new service of the Federal Tax Service

, used in test mode from February 1, 2021. The new version of the program allows you to track cash flows in the accounts of both organizations and individuals.

Please note that starting from 2021, banks have also included VAT-3 in their ASK work, so the tax service receives information from taxpayers’ bank accounts. From a practical point of view, this means that the search for interdependent organizations and associated civilians has ceased to be a problem for the Federal Tax Service.

How does the control system for VAT refunds from the budget work?

The system automates tax procedures and allows you to save invoices, tax returns of VAT payers, information about transactions, creating a tax history of companies.

This helps tax authorities separate bona fide taxpayers from unscrupulous ones, thereby reducing the number of attempts to illegally recover VAT from the budget.

The system, based on extended VAT returns, accurately determines tax gaps in the chain of relationships between taxpayers and counterparties and does not allow unlawful deductions for value added tax.

All tax returns undergo a desk tax audit within three months.

At the same time, tax authorities have the right to request documents not only for declarations in which tax refunds are claimed. For all VAT returns, tax authorities have the right to request invoices, primary and other documents in cases where discrepancies are identified between the information of the taxpayer and his counterparties, indicating an understatement of VAT payable to the budget or an overstatement of VAT reimbursement from the budget when a VAT tax gap is formed.

In case of a discrepancy, a letter is immediately sent asking for clarification of the reason for the discrepancy.

What's happening?

Why are additional charges growing? Are businessmen violating tax laws more often? Maybe you are right. Wanting to “save on taxes” against the backdrop of the crisis of recent years, some of them, quite possibly, could have decided to do this. In addition, one should not ignore this point: tax legislation, in particular regarding VAT, has recently been improved and changed. Surely some entrepreneurs simply lose sight of these changes. But most likely, the lion's share of increased additional charges was formed due to more efficient work of the tax authorities. Entrepreneurs not only began to violate more often, but inspectors began to identify these violations more often.

How tax authorities control the payment of VAT

Now the tax office uses more than 20 information systems, with the help of which it checks the activities of taxpayers. Among them are AIS "Tax-3", PIK "One-Day", PIK "Invoices", "VNP-Otbor", PIK "Income", PIK "Customs", PIK "Schemes", PP "VAT Control" (formerly ASK “VAT-2”) and others, allowing inspectors to identify schemes of illegal tax evasion.

PC "VAT Control" (formerly ASK "VAT-2") monitors the chain of movement of goods subject to value added tax (VAT), from creation or crossing the Russian border to sale to the final consumer.

The system detects the following discrepancies:

1. Discrepancy of the “gap” type:

- failure to submit tax returns by organizations;

- submission by organizations of a declaration with a “zero indicator”;

- absence of transactions in the counterparty’s tax return;

- significant data distortion.

2. Discrepancy of the type “VAT”:

- the excess of the amount of VAT accepted for deduction by the taxpayer - the buyer, in comparison with the amount of VAT calculated by the counterparty - the seller from sales transactions.

If the buyer’s invoice reflected in the purchase book is not in the seller’s sales book, then a “gap” occurs, i.e. the system has established that the VAT refunded by the buyer (accepted for deduction) by the seller has not been paid to the budget (not calculated and not reflected for payment).

Thus, if the data on the same transaction (invoice) does not match, the system automatically generates claims against the seller and buyer for a gap, which indicates either an overstatement of tax deductions by the buyer or an understatement of the amount of tax payable by the seller. Requirements are set automatically by the system, and the inspector does not take any part in this.

"VNP-Selection" (AIS subsystem "Tax-3")

Using the VNP-Otbor information complex, inspectors compare data on the company’s activities (profitability, profitability) with information on the activities of companies of similar scale and localization and compare the indicators of the tax period under study with data from previous years. The VNP-Selection system assigns points to taxpayers, and if a company has many inconsistencies, it recommends it for a tax audit. At the same time, the solvency of the taxpayer (availability of property) and its owners is analyzed.

PC "VAI"

The VAI (Visual Analysis of Information) software package is used by tax authorities to present data about companies, their owners and payments made by companies in graphical form.

PIK “Income”, PIK “One-Day”, PIK “Customs”, PIK “Schemes”, etc.

These software and information systems collect data on desk audits that have already been carried out, the results of comparisons of peer companies in the region, and explanations given by company employees in past periods.

All information about taxpayers is collected in data processing centers (DPC). In May 2015, the first data center was opened in Dubna, Moscow Region. In December 2015, the Federal Tax Service launched a second Data Processing Center in Gorodets. Data centers in Dubna and Gorodets automatically generate a “single tax file” about each taxpayer in Russia. Taxable transaction data is collected and processed by robots and stored in the cloud. Human participation is minimized. All VAT reports (and therefore all invoices) are included in the all-Russian database.

In its control activities, the tax office uses technology that is based on the creation of a so-called “optimal model” of a representative of any industry or type of activity that corresponds to a kind of standard with average indicators. This is the result of a lot of analytical work.

Such indicators are determined as a result of processing information on a particular type of activity. For example, it is clearly determined that for this type of activity today the rate of return is 12 percent. Based on this, they find out what tax payments for corporate income tax should go to the budget? Or, accordingly, at what turnover of revenue for this type of activity should the budget receive the corresponding data on value added tax, based on the value added norm for the type of activity?

Again, this is somewhere close to profitability. Based on this, the corresponding standards for VAT refunds are determined, because, as is known, today almost 99 percent of audits give a result in which the tax authorities know exactly how much VAT should be refunded, and not as much as is requested in tax returns.

This is very serious work as a result of the introduction of VAT-2, and now ASK VAT-3.

Comparison with these indicators allows you to identify risky links and unwind chains of connections very deeply. That is, if earlier they talked about fly-by-night companies that hid operations behind two or three links, now it reaches 15 or more levels.

How tax control becomes total with the help of digital

General Director magazine, No. 4, April 2019

The Federal Tax Service is one of the most technologically advanced departments in Russia. However, for some reason, many businessmen are still surprised that tax control is becoming total, and fiscal authorities can find out everything about us in real time.

We can say that the tax service has become a role model for business. The economy is stagnating, business and consumer incomes are not growing, but tax collection sets records every year. The growth in fees in 2021 was 114 percent. In 2017, the dynamics were approximately the same. Is the business growing at double the rate?

Digital transformation has brought such success to the Federal Tax Service. However, the department is not going to stop there and continues to improve business control systems. I’ll tell you how companies and entrepreneurs will be controlled in 5–10 years.

Three main technologies for controlling business today

The Federal Tax Service successfully uses and develops three main control systems.

ASK VAT-2. Using this system, tax authorities monitor the entire process of creating added value in real time. The system automatically compares declarations, finds breaks in the VAT chain, and compiles a risk profile for each taxpayer.

The system demonstrates phenomenal efficiency. Over three years, the average Russian tax gap for VAT has decreased nine times: from 9 percent at the beginning of 2021 to 1 percent at the end of 2018. As a result, it has become almost impossible not to pay VAT or engage in illegal reimbursement from the budget.

Companies have taken up the optimization of other taxes, but in three to five years there will be no such opportunity left.

The number of VAT-related violations has decreased by 9 times

ASK VAT-2 is part of a broader automated information system (AIS) “Tax-3”. This system also includes data on registration of legal entities and individual entrepreneurs, bank accounts of legal entities and individuals, IP addresses from telecom operators. Plus information from customs, which allows you to control imports within the EAEU.

Soon, the fiscal authorities will apply the principles of ASK VAT-2 to other types of taxes and the entire Tax-3 system. The Federal Tax Service does not say how this will work, either officially or in private conversations.

Online cash registers. With their help, wholesale and retail sales are analyzed. In the short term, they will help ensure 100 percent cash control.

Our sources at the Federal Tax Service say that the department is considering the issue of abandoning almost all reporting for retail trade. And the tax base for the taxpayer will be formed not by tax periods, but in real time.

National information system for labeling and traceability of goods. Labeling is a means of identification to trace the entire path of a product from the manufacturer or from the border to the final consumer. The system drives counterfeit and falsification products out of the market, and also stops gray schemes. Thanks to this, the state will be able to manage supplies and quickly remove low-quality batches of goods from circulation.

Labeling of fur products, alcohol, and medicines is now mandatory. This year the list of products will expand. They will start marking: cigarettes, shoes, perfume, tires, cameras, bed linen, outerwear.

In addition, preparations are underway to launch a pilot project for labeling beer, mineral water, tea, and finished dairy products. A unified product labeling system should be operational by 2024.

consult

Total control in the future

According to our information, at the end of 2021, the Federal Tax Service combined data flows from the Tax-3 AIS, online cash registers, labeling and traceability systems for goods into a single information mega-system based on Big Data. This is a whole network of large information centers for collecting, processing and analyzing a huge amount of data. We know of three such data centers: mainly in the Moscow region (Dubna) and additional reserve ones in the Volgograd and Nizhny Novgorod regions. Artificial intelligence, machine learning, machine-to-machine data exchange and other advanced technologies are used.

The megasystem will not be limited to only the listed components. Data from all registry offices and archives, that is, information about the entire population, will also be transferred there. It is already possible to upload there all network analytics, data from social networks, computers and phones, which we openly disclose.

While the system is operating in pilot mode, the data is not systematized and not properly compared. But this is a question for the next three to five years. And in the next year or two, the Federal Tax Service will test and debug the work of its data centers.

Already in the United States, artificial intelligence predicts the time and location of a possible crime. In Russia, digital technologies will reveal information about tax obligations and offenses.

As a result, tax obligations will be fulfilled completely automatically. Today we are setting up automatic payments for housing and communal services, and in three to five years taxes will be automatically debited from companies’ current accounts. Penalties, fines and arrears for violations too. And if you don’t agree, then you’ll have to prove it offline, to make it more difficult.

Such changes are not fantasy - we have already gone through similar things in our relations with the traffic police. The traffic cops were reduced, but the number of video cameras that record violations was increased. As a result, it is no longer possible to “excuse” yourself with bribes; you have to pay exorbitant fines to the budget. The work of the Federal Tax Service is being restructured in a similar way.

There are also positive aspects to such changes. Businesses will have easy and quick access to government support and government services, including receiving tax deductions and refunds. The same applies to banking and other services. The volume of reporting will be significantly reduced.

Surely a series of internal tax amnesties will be a bonus - as is now being done to return assets from abroad to Russia.

What does the Federal Tax Service say?

In December 2021, the head of the Federal Tax Service Mikhail Mishustin announced the next stage of development of the tax service. After complete digitalization, an “adaptive platform” for tax administration will be created. The platform will work only with digital data sources and operate in real time. This will be a transition to a new form of interaction with the tax authorities.

The first stage of digitalization of the Federal Tax Service was expressed in the creation of websites, web portals and personal electronic services. The second stage, which is being implemented now, is mobile applications and individual proactive services. The process will take several more years.

According to the head of the Federal Tax Service, tax services must be integrated into the business environment. All tax obligations will be fulfilled automatically, and the economy will become transparent. The Federal Tax Service believes that the boundary of the transition to “new transparency” will be the practical implementation of the Internet of Things (IoT) in the economy in 2025–2035.

In 10–15 years, the Federal Tax Service sees itself as a service department that constantly interacts closely with “digital processes” within the taxpayer company. The correctness of tax payments will be checked in the same mode.

The Federal Tax Service reported that it seeks to move to a more trusting relationship with taxpayers, reduce the administrative burden on business, and reduce the number and duration of inspections. Now their number is decreasing due to the use of analytical methods. In 2021, thanks to “analytical systems” alone, the budget received an additional 345 billion rubles. Tax control is shifting towards risk-based models and prevention of violations.

An example of partnerships with taxpayers is the introduction of such a type of control as tax monitoring. This is a replacement of traditional checks with online interaction, when the company provides the Federal Tax Service with remote access to its information systems.

Tax monitoring participants can choose the method of interaction with the Federal Tax Service depending on their own technical equipment.

The Federal Tax Service provides the following data on tax monitoring participants:

- 36% provide access to the organization’s accounting system;

- 25% provide access to an analytical data mart, where the organization publishes information for the tax authority;

- 39% exchange information via telecommunications channels.

consult

Will criminal schemes remain in the future?

In 10 years, all old schemes for tax evasion and money laundering will disappear. Given the trends, we will stop using cash altogether.

Gray salaries will disappear. Monitoring receipts to the employee’s account will raise questions for the company in case of any suspicious payments. The disappearance of cash will affect the informal sector.

The nominal managers will be identified immediately, as well as the real beneficiaries. Analysis of data from electronic sources will make the search for real beneficiaries instantaneous.

It will be impossible to withdraw money without taxes. Offshore zones will disappear or become transparent. Every internal and external operation of the company will be visible to tax authorities in real time, so schemes with loans, overvaluation and other accounting fraud will also disappear. A large number of intermediate operations will lose efficiency, since artificial intelligence will be able to process them instantly.

But we can assume that new models of income laundering will replace the old ones. It is likely that cryptocurrencies or other types of currencies will be used.

Cashers will be replaced by hackers, and money withdrawal schemes will be replaced by hacking systems. Just as some people now use proxies to bypass website blocking, in the future the emphasis will be on bypassing control systems. Technical progress is not only on the side of the Federal Tax Service. The services of shadow programmers will appear on the market, and currency transactions will be carried out through an analogue of the current darknet.

There will be new laws and loopholes in them. It is unlikely that in the next 20 years legislation will become perfect and corruption will disappear. Changes in laws will not only block old options for withdrawing money, but also create new ones.

Still have questions about these and other topics?

Contact us, we will help:

consult

Risk-based approach to controlling VAT refunds

All VAT returns that claim reimbursement from the value added tax budget are automatically assigned their own risk level: high, medium or low:

- high level of risk – taxpayers in whose work there have been recorded violations, the level of fulfillment of their tax obligations is low, and therefore the likelihood of on-site inspections is especially high.

- medium risk level – this group includes taxpayers who partially fail to fulfill their tax obligations;

- low level of risk of tax offenses – taxpayers fulfilling their obligations to accrue and pay taxes.

Declarations assigned a high and medium tax risk receive “special attention” from the tax office, which conducts a desk tax audit.

The introduction of a new automated risk-based approach to monitoring VAT refunds using the ASK VAT system was one of the factors that made it possible to achieve an increase in VAT revenues.

The system identifies discrepancies in declarations

ASK VAT-2 allows tax authorities to compare information from purchase books and sales books along the chain from the supplier to the final buyer. The program verifies counterparties, invoices and tax amounts indicated on them. The system can detect several types of discrepancies.

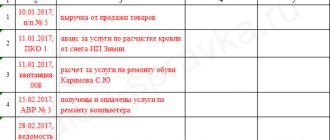

Discrepancies of the type “VAT”. The program identifies these discrepancies when the tax is indicated in the declarations, but there are errors in them. The list of such errors is known to many accountants. These are discrepancies in the transaction code, incorrect invoice number or date, as well as discrepancies in the amount of VAT payable by the seller and deductible by the buyer.

Some accountants agree with the requirements of inspectors and submit updated declarations. However, if there are technical errors that do not affect the amount of tax, it is sufficient to provide an explanation. They must be accompanied by invoices and other documents. In this case, providing clarification is the right, and not the obligation of the taxpayer (paragraph 2, paragraph 1, article 81 of the Tax Code of the Russian Federation). This includes typos in invoice numbers and dates and incorrect transaction codes. If the company does not match the amount of VAT declared for deduction on the invoice from the supplier, then the most common case is the presentation of VAT for deduction in a later period. For example, the supplier reflected the invoice in the first quarter of 2021, and the buyer accepted VAT for deduction in the second quarter of 2016.

Discrepancies of the “gap” type. We are talking about the so-called tax gap. When comparing data from the purchase and sales books, it turns out that the counterparty whose invoice is stated in the declaration is simply not in the Unified State Register of Legal Entities. Either he does not submit tax reports, or he submits them with zero indicators. With this type of gap, the taxpayer receives an invoice, the amount of tax for which is not reflected in the counterparty’s declaration. If the company is a supplier and VAT is declared for payment, then, most likely, this will not cause suspicion, since VAT has been paid to the budget. But if the company is a buyer and has declared this VAT to be deducted, then the inspectorate will most likely immediately formulate a requirement to submit documents (clause 8.1 of Article 88 of the Tax Code of the Russian Federation).

However, if the company has submitted the entire package of documents, then it is not yet possible to refuse deductions based on discrepancies identified according to the AKS VAT-2 data. A sign of a deduction is the presence of an invoice (Article 169 of the Tax Code of the Russian Federation). And if the inspectors intend to refuse deductions, then they are obliged to carry out tax control measures. These measures must prove the fictitiousness of one-day transactions or the presence of other unjustified tax benefits.

In judicial practice, there are interesting cases of losses for tax authorities when they refused to allow companies to make deductions on invoices of counterparties that were not included in the Unified State Register of Legal Entities. In one of the cases, the accountant of a company excluded from the Unified State Register of Legal Entities continued to issue invoices for two years on behalf of a non-existent company (decision of the Moscow City Court of June 20, 2013 No. A40-18764/13).

The tax authority denied deductions. The company redid the invoices and submitted them to the court. The arbitrators indicated that the organization did not suspect that the invoices were invalid and could not verify this fact. The court canceled the additional assessments. At the same time, the company could check the status of the counterparty using publicly available services on the website of the Federal Tax Service of Russia. Therefore, such court decisions are rather isolated and cannot be relied upon.

Taxpayers are faced with a tax gap when ASK VAT-2 cannot compare invoices for advances issued and when offsetting these advances. This is due to the fact that the company that paid the counterparty an advance prepares the invoice itself. Even if you have the correct transaction code, ASK VAT-2 often generates a requirement indicating the absence of a “twin” invoice. In this case, it is enough to provide written explanations and attach documents to them.

The purpose of introducing ASK VAT-2 is to combat fly-by-night scams

ASK VAT-2 helps tax authorities identify an unscrupulous link in the trade chain - a fly-by-night. The stage at which the tax has not reached the budget. This is necessary to find the ultimate beneficiary who receives unjustified benefits from tax gaps. The risk management system “SUR ASK NDS-2” is responsible for searching for beneficiaries. Its main tasks are described in the letter of the Federal Tax Service of Russia dated 06/03/16 No. ED-4-15 / [email protected] “On the assessment of RMS risk indicators.” Taxpayers may fall into low, medium and high risk groups. Companies with low tax risk have material and labor resources, conduct real activities, and pay taxes. They have on-site inspections.

Organizations with persistent signs of ephemeral activity are classified as high-risk. They have no assets or personnel, pay little taxes with high turnover, and use third parties to make payments. Inspectors mark the company's risk group in the program using color indicators. Tax authorities use the results of “SUR ASK VAT-2” when deciding on VAT refunds and planning on-site audits.

For the effective use of ASK VAT-2, inspectors received expanded powers at their desks. They use almost the same list of control measures as during on-site inspections. Inspectors may require the company to provide:

- documents due to discrepancies in operations (clause 8.1 of Article 88, Article 93 of the Tax Code of the Russian Federation, Appendix No. 15 to the order of the Federal Tax Service of Russia dated 05/08/15 No. ММВ-7-2 / [email protected] );

- explanations (clause 3 of Article 88 of the Tax Code of the Russian Federation, Appendix No. 1 to the order of the Federal Tax Service of Russia dated 05/08/15 No. ММВ-7-2 / [email protected] ).

If the organization has received a request, it is necessary to send a receipt of receipt of the electronic document via telecommunication channels within six working days. Otherwise, the inspectorate may block bank accounts (subclause 1.1, clause 3, article 76 of the Tax Code of the Russian Federation).

Taxpayers send a response to the request for the submission of documents to the inspectorate within 10 working days from the date of receipt of the request (clause 8.1 of Article 88, Article 93 of the Tax Code of the Russian Federation). And written explanations - within five working days (clause 3 of article 88 of the Tax Code of the Russian Federation).

Companies rarely ignore document submission requirements. This is fraught with a fine (Article 126 of the Tax Code of the Russian Federation) and denial of deductions on formal grounds.

It is better to provide explanations too. Otherwise, the inspector will draw up a desk inspection report (clause 5 of Article 88 of the Tax Code of the Russian Federation). Then you will have to recoup additional charges by filing objections or in court.

However, confirmation of the right to deduction during a camera meeting does not guarantee that the company will not be assigned an on-site inspection (Article 89 of the Tax Code of the Russian Federation). The duration of a desk inspection is limited to three months, so inspectors often do not have time to collect evidence that can stand up in court. The courts believe that inspectors have the right to order an on-site inspection of a period that has already been inspected off-site. Taxpayers are not exempt from liability for detected offenses (resolution of the Federal Antimonopoly Service of the West Siberian District dated June 24, 2011 No. A75-8783/2010).

Tax officials can also schedule an on-site audit after tax control activities, which will be carried out by the pre-audit analysis department. The maximum period for an on-site inspection is 15 months. Subject to extension (up to six months) and suspension (six or nine months). In such an impressive period of time, inspectors will definitely collect the necessary evidence.

How to protect yourself from combining ASK VAT-2 with the customs service base? Interview on Business FM

The automatic report data of this program can initiate a criminal case (if the amount of violations exceeds the amount established by law).

Lately, tax officials have gotten the hang of sending information to the Department of Economic Crimes immediately after a camera meeting ─ we are gradually being accustomed to the idea that conducting any tax audit automatically means an inspection by the security forces and criminal prosecution. Moreover, it will not be possible to accuse the tax authorities of illegal actions (Article 4 of the “Agreement on interaction between the Ministry of Internal Affairs of the Russian Federation and the Federal Tax Service” dated October 13, 2010 N ММВ-27-4/11, Letter of the Federal Tax Service of the Russian Federation dated April 22, 2015 N PA-4-6/6929 ).

The number of tax audits initiated thanks to the VAT-2 ASK is growing and, as judicial practice shows, most of these audits resulted in a victory for the tax authorities in the form of additional assessments or denials of deductions.

Don't want to become another "victim"?

More details about the event program can be found here

Please confirm your participation by registering using the link

Judicial practice on ASK VAT-2 has not yet been formed

The argument about “tax gaps” in the ASK VAT-2 database is new for judicial practice. So far it is rare. There are several reasons for this.

Firstly, ASK VAT-2 is an internal database of the tax authorities; there is no public access to it. The courts do not recognize information from internal information resources as proper evidence (resolution of the Moscow District Court of December 28, 2015 No. F05-18124/2015). The company may learn about the fiscal conclusions made on the basis of internal information no earlier than negative tax consequences occur.

Second, the tax gap itself does not prove that the tax benefit is unreasonable. This gap is only a mathematical result of the control ratios of the numbers in the two declarations. If the numbers are different, this is just a reason to check.

Nevertheless, information from the ASK VAT-2 has already begun to appear in judicial practice. And not only in disputes related to VAT deductions.

For example, in the resolution of the Volga Region Autonomous District Court dated June 24, 2016 No. F06-9933/2016, the company challenged the tax authority’s refusal to register the liquidation of a legal entity in the Unified State Register of Legal Entities*. The company compiled a liquidation balance sheet and submitted it to the inspectorate. However, the inspection, based on the results of two chamber VAT declarations, denied the company deductions for an impressive amount and handed over inspection reports.

After the cameral decisions come into force, the tax authority could post the VAT debt on a personal account and become a creditor of the company. In addition, at the time of filing the liquidation application, the company had not submitted another VAT return. As a result, the inspectorate recognized the company's balance sheet as unreliable and refused state registration of the changes. In the decision of the appellate instance, the judges indicated that the tax authority, with the help of the VAT-2 ASK, established the existence of a tax gap in the form of an unlawfully declared VAT deduction (resolution of the Twelfth AAS dated April 15, 2016 No. 12AP-2681/2016).

The tax authorities issued demands for the presentation of documents. The company ignored the demands and did not provide documents. The head of the company also avoided appearing for questioning.

The company believed that at the time of filing the liquidation balance sheet, the tax authority did not have a decision on desk audits. Therefore, the amount of VAT payable was unknown to him. However, the court took into account the fact of opposition and evasion of society from submitting documents. And I came to the conclusion that the application for liquidation was filed to avoid additional charges due to inspections.

The court decided that the company knowingly provided false information, and the liquidation procedure cannot be considered complied with. The legality of additional accruals based on desk audits was not the subject of the dispute. Therefore, regarding the unreliability of the balance sheet, the court supported the inspection.

The unusual case was considered by the Nineteenth AAS (resolution dated August 31, 2016 No. A14-16854/2015). The evidence found in the ASC VAT-2 was stated by one of the parties in a civil dispute. It was between two legal entities regarding the falsification of the manager’s signature in an agreement.

The company went to court with a demand to collect from the counterparty the debt under the supply agreement for 12 tons of fishmeal. However, the buyer unexpectedly declared in court that the manager’s signature on the contract was fake. This means that the deal was not concluded and there are no grounds for compensating the seller for losses.

As evidence of the reality of the shipment, the supplier presented a contract, an invoice for goods acceptance, emails to the buyer and replies to them. In addition, the seller submitted a letter from the inspectorate stating that, based on the results of desk audits of the declarations of both companies, the tax authority found an invoice for the supply of fishmeal in both the seller’s declaration and the buyer’s declaration. The tax authorities found the invoice by cross-comparing declarations in the ASK VAT-2 system.

The tax authorities confirmed that the buyer claimed a deduction due to the fact that the seller reflected the transaction in the declaration and paid VAT on it to the budget. The court concluded that the buyer concealed information about the delivery from the court and did not allege falsification of evidence. In connection with this, the court decided to recover the entire amount of debt and a penalty from the negligent buyer.

Tax gap for VAT

The tax gap is the difference between the amount of taxes that theoretically should be paid by the taxpayer(s) and the amount of taxes actually paid.

Discrepancies are identified automatically after receiving declarations from taxpayers for the next reporting period.

The purpose of searching for such gaps is to detect shell companies and assign taxpayers to the appropriate “risk groups.”

The VAT ASC reveals the following discrepancies:

1. Discrepancy of the “gap” type:

- failure to submit tax returns by organizations;

- submission by organizations of a declaration with a “zero indicator”;

- absence of transactions in the counterparty’s tax return;

- significant data distortion.

2. Discrepancy of the type “VAT”:

- the excess of the amount of VAT accepted for deduction by the taxpayer - the buyer, in comparison with the amount of VAT calculated by the counterparty - the seller from sales transactions.

So, if the buyer’s invoice reflected in the purchase book is not in the seller’s sales book, then a “gap” arises, i.e. the system has established that the VAT refunded by the buyer (accepted for deduction) by the seller has not been paid to the budget (not calculated and not reflected for payment).

Thus, if the data on the same transaction (invoice) does not match, the system automatically generates automatic claims to the seller and buyer for a gap, which indicates either an overstatement of tax deductions by the buyer or an understatement of the amount of tax payable by the seller. Automatic requirements are set automatically by the system, and the inspector does not take any part in this.

They began to add more

This year there has been a sharp increase in the amounts of additional charges that inspectors make after conducting inspections. As a result of my visits to the taxpayer, the number of which, remember, decreased by 10%, the total amount of charges increased by almost a third! In the first half of 2015, more than 140 billion rubles were accrued, and for the same period in 2016 – more than 184 billion rubles .

An even more impressive increase was shown by the amount of additional charges based on the results of desk audits. As of July 1, 2015, inspectors accrued about 33 billion rubles to taxpayers, and for the same period of this year - already more than 62 billion rubles. Thus, additional charges for desk audits increased by more than 85% in just a year!

Complex tax gaps for VAT and in-depth desk audit

If a gap occurs based on the results of processing the auto-requests sent by the system, the problem is not eliminated, then so-called “complex discrepancies” arise. That is, the system establishes that at the place of the gap on the part of the buyer and the seller there are transitors - otherwise “technical . Complex discrepancies established by the VAT ASK system are centrally sent by the Interregional Inspectorate for Desk Control to the inspectorate where the gap arose in order to identify beneficiary organizations/beneficiaries in the formal supply chain.

When conducting an in-depth desk audit, the tax authorities determine who, if a gap occurs in the supply chain, is the transitor and who is the beneficiary, taking into account the information:

- about the leader and founders, including the definition of the attribute “mass leader/founder”;

- about the average number of employees;

- about the upcoming exclusion of the organization from the Unified State Register of Legal Entities as an inactive legal entity;

- about the presence in the Unified State Register of Legal Entities of information about the unreliability of information about the director, founder, and registration address;

- on the availability and content of interrogation protocols of managers and founders;

- about disqualified persons;

- on the availability of current accounts and their number, information on the suspension of transactions on bank accounts;

- about the addresses of registration (registration), registration at the place of “mass registration”;

- about the assets of the organization and whether a declaration on the property tax of organizations is provided;

- about the tax burden and the share of tax deductions;

- about the date of registration (age of organizations);

- on comparison of the tax base in declarations and the turnover of funds in current accounts;

- about the presence of arrears in taxes and obligatory payments;

- about turnover on the current account of organizations and purpose, the presence of operations characteristic of real organizations;

- on methods of submitting declarations, information about digital signature;

- and so on. depending on the depth of control.

How to automate accounting in trade

To ensure the transparency of your business for tax authorities, use accounting automation solutions (for example, 1C or Kontur). If you have a product accounting program connected, you can set up data exchange. For example, the LiteBox commodity accounting service integrates with 1C and the Kontur.Elba program via file exchange or via API.

Data exchange allows you to simplify the work of an accountant: synchronize reference books of items and counterparties, transactions with accounts. Reports in the accounting program are generated based on commodity accounting data. For example, after acceptance of goods, unloading in 1C occurs in the context of item, quantity, and name of supplier. Further postings are carried out in 1C in the required unified form.

Automation of accounting and commodity accounting helps the accountant quickly obtain data on inventory balances, cash flow and suppliers, and upload data into Excel. As a result, maintaining accounting records becomes more convenient and simpler, and the risk of errors and tax audits is reduced.

What does this mean for business?

The rules of the game are getting tougher, and in order to stay afloat, you need to adapt in time. Given the more efficient work of the Federal Tax Service, today it becomes more profitable to play fair, as well as ensure that records are kept in accordance with established requirements. After all, if tax violations are detected, you will have to pay not only the additional assessed amount, but also penalties and fines. But you definitely shouldn’t count on the fact that a gray VAT scheme or disregard for accounting and tax accounting rules will go unnoticed!