The Labor Code allows workers to hold multiple positions or have multiple employers. But if we are talking about a hired manager, then certain restrictions are established in relation to him. Can the CEO work part-time? This question can be answered positively only if a number of conditions are met.

Free accounting services from 1C

What is the difference between part-time and combination

To understand whether a director can work part-time, you need to understand two different personnel concepts.

The combination is characterized by the following characteristics:

- all work is performed by only one employer;

- information about combining positions is included in the main contract with the employee, a separate employment contract is not concluded;

- additional job functions are performed during regular working hours;

- combining positions does not require special consent from the employer;

- an entry about the combination is not made in the work book;

- For performing several job functions, the employee receives an additional payment to the basic salary.

In practice, they usually combine positions that can be called related. For example, the chief accountant combines his position with the responsibilities of a personnel employee. In this case, there is an expansion of service areas and an increase in the volume of work, but it is impossible to predict in advance what it will be. If there is no staff turnover in the organization, then there will be no need to overwork.

In this case, the combination is beneficial to the employer, who does not need to hire a human resources specialist. But when the need for such an employee arises, the issue will be entrusted to the chief accountant, who will successfully cope with it.

But part-time work is recognized as a separate labor activity, which may not be related to the main job at all.

Let us list the features of part-time work:

- you can work part-time in another organization, and not just with your main employer;

- additional working time is allocated to perform duties, which should not exceed four hours a day;

- a separate employment contract is concluded for part-time work;

- At the request of the employee, a corresponding entry is made in the work book.

If a part-time job occurs with one employer, then it is called internal, if with different employers, it is called external. And when we are talking about the head of a company, then for external part-time work he must obtain the consent of his main employer.

This norm is fixed in Article 276 of the Labor Code of the Russian Federation: “The head of an organization can work part-time for another employer only with the permission of the authorized body of the legal entity or the owner of the organization’s property, or a person (body) authorized by the owner.”

Can an organization operate without a leader?

The head of the organization (general director, director) is the sole executive body and manages the current activities of the company (if a collegial executive body is formed in the company, together with it). Only in relation to the manager does the law establish that he has the right to act on behalf of the company without a power of attorney. In other words, the leader is precisely the body through which society acquires civil rights and assumes civic responsibilities. Confirmation: clause 1 of Art. 53 Civil Code of the Russian Federation, paragraphs. 1 clause 3 art. 40 Federal Law No. 14-FZ of February 8, 1998, para. 3 p. 2 art. 69 of Federal Law No. 208-FZ of December 26, 1995

At the same time, the legislation does not formally provide for the period during which it is necessary to appoint a general director (director) to the position of: – upon state registration of a newly created organization; – upon dismissal (change) of a manager. There is also no obligation to assign the powers of a manager to a member of the company.

At the same time, information about a person who has the right to act on behalf of a legal entity without a power of attorney (about the general director, director) is contained in the Unified State Register of Legal Entities. And if, during the state registration of a newly created organization, the applicant can be not only the head (but also, for example, the founder), which does not force the organization to appoint him, then when making other changes that are subject to registration in the Unified State Register of Legal Entities (including information about the change manager), it is impossible to do without the appointment of a new manager (because in the general case it is he who is the applicant for such registration).

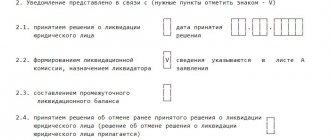

For example, if information about the last name, first name, patronymic and position of a person who has the right to act on behalf of an organization without a power of attorney changes, it becomes necessary to notify the tax office in the prescribed manner in order to make (register) these changes in the Unified State Register of Legal Entities. To do this, you need to submit an application for a change of manager to the tax office, which is drawn up according to the unified form No. P14001, approved. By Order of the Federal Tax Service of Russia No. ММВ-7-6/25 dated January 25, 2012 (see Sample filling when changing the general director). It must be signed not by the previous, but by the new head of the organization or another authorized person who has the right to be an applicant (letter of the Federal Tax Service of Russia No. GV-6-14/846 dated August 23, 2006). That is, the legislation does not provide for the possibility of entering into the Unified State Register of Legal Entities information about the termination of the powers of the head of the company without simultaneously entering information about the person newly appointed to this position. Therefore, before the election of a new director, it is impossible to make changes to the information contained in the Unified State Register of Legal Entities about the head of the organization.

It follows that formally the organization has the right to conduct its activities without a leader. However, the absence of a person authorized to act on behalf of the company without a power of attorney actually deprives him of the opportunity to conduct current activities, in particular: – the organization will not be able to fulfill the obligations of a taxpayer to submit tax reports. At the same time, tax and administrative liability is provided for failure to submit it; – in case of untimely changes to the information in the Unified State Register of Legal Entities (the presence of false information), the organization may face negative consequences (up to and including liquidation).

Confirmation: Art. 185, 312, paragraph 2 of Art. 720 of the Civil Code of the Russian Federation, clause, art. 29, paragraph 5, art. 80 of the Tax Code of the Russian Federation.

Problem-free option

For the full functioning and conduct of business activities, it is advisable for the founders (participants) to approve and accept a person who will act as the head of the organization.In addition, conducting business without employees (including an appointed general director) may lead to claims from regulatory authorities (in particular, the tax inspectorate).

Why does the Labor Code of the Russian Federation require obtaining consent for part-time work?

So, we found out whether the CEO can work part-time. Yes, if it is properly executed and the consent of the owners of the company in which he already works is obtained.

Consent is required because the head of the organization is the main official whose activities directly affect the success of the business. And if he works in several companies at once, a conflict of commercial interests may arise between them.

The fact that a part-time general director sometimes acts to the detriment of his main employer is known from judicial practice. The most common cases are concluding deals for the supply of goods or services at inflated prices with companies where he works.

In addition, the effectiveness of any employee depends, first of all, on the length of time that he can devote to performing his duties. It is no coincidence that the workload of a part-time worker is limited, because working 12 hours every day (8 at the main job and 4 part-time) is very difficult. Of course, this depletes the resources of any person and it can lead to professional burnout.

The owners of the company have the right to even establish in the charter a ban on the manager working somewhere part-time, thereby reducing their efficiency.

Why, then, does the Labor Code not provide for a complete ban on dual-time directors? The point is that sometimes it is necessary for business.

If we are talking about the simultaneous management of friendly organizations (affiliated, dependent, subsidiaries), then having a part-time director will be in the interests of the main employer. Therefore, business owners decide in each specific situation whether the director can work part-time in another company or not. Moreover, their consent is required for any position with a new employer, and not just a managerial one.

The requirement to obtain consent for external part-time work does not apply only to the director who is the sole founder of the LLC. The Labor Code does not classify this category as employees at all.

Connect online accounting from 1C First month - free

How to obtain consent

The law does not establish how consent for a part-time job by the general director should be formalized. But since Article 276 of the Labor Code of the Russian Federation stipulates that consent must be given by the owners of the organization’s property, this may be the protocol of the general meeting of participants.

The agenda includes the question of whether it is possible to allow the general director to enter into an employment contract to perform part-time work in another organization. If the participant is the only one in the company, his resolution on the director’s application to allow him to do additional work is sufficient. But no matter how the consent is formalized, it should be clear from it in which organization the manager will work and what position he plans to occupy.

But what to do in a situation where they want to appoint a person as a director in an LLC who already holds some kind of non-managerial position in another company? The Labor Code of the Russian Federation does not talk about this, but the question will definitely come up when drawing up an employment contract with the future director.

There cannot be two main places of work. If the candidate for director’s job with the previous employer is the main one, and he does not want to give it up, then the new employer simply may not conclude a part-time employment contract with him. Moreover, the option when an employee performs management functions as a part-time job is not prohibited. It’s just that the parties to the labor relationship should be aware that the future director will work with double workload.

Can a founder (not a director) be an employee of the company?

To answer the question, the following documents and regulations were used:

- Constitution of the Russian Federation;

- Labor Code of the Russian Federation (LC RF);

- Civil Code of the Russian Federation (Civil Code of the Russian Federation);

- Code of the Russian Federation on Administrative Offenses (COAP RF);

- Federal Law of 08.08.2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs”;

- Federal Law of December 6, 2011 No. 402-FZ “On Accounting”;

- Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation”;

- Resolution of the Supreme Court of the Russian Federation dated February 28, 2006 No. 59-ad06-1;

- Resolution of the Federal Arbitration Court of the Northwestern District dated February 18, 2009 in case No. A56-7625/2008;

- Resolution of the Federal Arbitration Court of the North-Western District dated December 20, 2010 in case No. A21-13642/2009;

- By the decision of the Third Arbitration Court of Appeal dated January 21, 2011 in case No. A33-7629/2010.

Based on the information provided, we consider it necessary to report the following.

The issue of state registration of a limited liability company upon creation is regulated by the norms of the Civil Code of the Russian Federation and the Federal Law of 08.08.2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs”, and issues of labor relations and other legal relations related to labor, — Labor Code of the Russian Federation.

As follows from the provisions of Articles 48, 52, 53, 56, 57, 59, 61 of the Civil Code of the Russian Federation and Articles 5, 9, 20, 23 of the Federal Law of 08.08.2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” ” and others, the terms “participant” and “founder” are equivalent for the legislator in the event that the person (persons) who participated in the establishment of the company acts as a participant in the legal entity. If a person acquired shares in a legal entity after its state registration, such a person cannot be called a founder and is a participant.

The most common case of labor participation of founders (participants) in their own LLC is their involvement as the sole executive body (president, director, general director, manager, etc.) or chief accountant. In small organizations, the responsibility for maintaining accounting records is often assumed by the sole executive body, which is permitted by Part 2 of Art. 19 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

The law establishes that the property of the founders of a limited liability company and the property of the company are divided. The founders (participants) of the company are not liable for the obligations of the company, and the company is not liable for the obligations of the participants, which follows from Art. 87 Civil Code of the Russian Federation.

In accordance with Article 37 of the Constitution of the Russian Federation, everyone has the right to independently choose in which work activity to apply their strength. Forced labor is prohibited. Work must be paid. The employment contract, in accordance with Art. 56 of the Labor Code of the Russian Federation recognizes an agreement between an employee (individual) and an employer, according to which the employer is obliged to provide the employee with the opportunity to perform any labor function and pay for the employee’s work, and the employee must perform this function personally and has the right to remuneration for his work. The employee must comply with the employer's labor regulations.

On behalf of the employer (limited liability company), employment contracts are concluded by the sole executive body of the organization as a person authorized to enter into external relations on behalf of the company without a power of attorney, which is confirmed by judicial practice, for example, the decision of the Third Arbitration Court of Appeal dated January 21, 2011 in the case No. A33-7629/2010, by decision of the Federal Arbitration Court of the North-Western District dated February 18, 2009 in case No. A56-7625/2008. An exception is made only for the sole executive body of the company; in some cases, an employment contract may not be concluded with him.

According to Art. 67 of the Labor Code of the Russian Federation, an employment contract must be drawn up in writing no later than three days from the date of the employee’s actual admission to work, which is also confirmed by the opinion set forth in the resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2 “On the application by the courts of the Russian Federation Labor Code of the Russian Federation".

Failure to conclude an employment contract through the fault of the organization entails administrative liability under Art. 5.27. Code of Administrative Offenses of the Russian Federation (resolution of the Supreme Court of the Russian Federation dated February 28, 2006 No. 59-ad06-1).

Summary

The property of a limited liability company is separated from the property of its founders. Citizens have the right to independently choose whether to work or not to work in an organization of which they are founders. Naturally, this applies only to individual founders. Founders - foreign citizens, in order to work for the organization they founded, in established cases, are required to obtain a document giving the right to work on the territory of the Russian Federation.

Labor legislation specifies that any employment relationship must be formalized by an employment contract, which is concluded in writing no later than three days from the date of the employee’s actual admission to work. Exceptions are possible only in a number of cases of registration of work in the company by its sole executive body. At the same time, the sole executive body still has an employment relationship with the company.

The current legislation does not contain any exceptions regarding the formalization of relations between founders and a limited liability company. Thus, the labor relationship between the founding employee of the company and the limited liability company must be formalized by an employment contract in writing. For an LLC’s evasion from concluding employment contracts, administrative liability is provided in the form of a fine and disqualification (if the offense is repeated). Employment contracts on behalf of a limited liability company are signed by the sole executive body of the company (president, manager, director, etc.)

At the same time, a different form of relations between the founder and the established company is possible. But this requires a different content of the relationship between these persons. The relationship between the parties should not be an employment relationship. The conditions that allow a relationship to be classified as labor are set out in Art. 56 Labor Code of the Russian Federation. Another option for cooperation between an organization and a founder is civil law relations, i.e. conclusion of a civil contract, relations under which are not regulated by labor legislation (Article 11 of the Labor Code of the Russian Federation). In other words, it is necessary that the actually existing relations do not repeat the relations of the parties in connection with the conclusion of an employment contract, only under a different “sign”. Thus, the court may not recognize the existing relationship as an employment relationship in cases where it does not follow from the concluded contract that the employee undertakes to obey the internal labor regulations of the employer, if the contract was concluded for the performance of one-time work and it does not follow from the contract that the organization provides an individual with a workplace , tools and materials for work (i.e. the contract is executed by the dependent of an individual). This conclusion follows, for example, from the decision of the Federal Arbitration Court of the North-Western District dated December 20, 2010 in case No. A21-13642/2009.

Would you like to receive legal advice on your matter? Call now!