Home — Articles

Some organizations, after submitting their reports, receive a message from the tax authorities (notification Appendix No. 1 to the Order of the Federal Tax Service of Russia dated May 31, 2007 N MM-3-06 / [email protected] ) with a requirement to provide explanations (Subclause 4, clause 1, Article 31, clause. 1 Article 82, paragraph 3 Article 88 of the Tax Code of the Russian Federation) on the reasons for the discrepancy between the amounts of the indicators “Income from sales” and “Non-sales income” in the income tax return (Approved by Order of the Federal Tax Service of Russia dated December 15, 2010 N ММВ-7-3 / [email protected] ) with the tax base summarized by quarter in VAT returns (Approved by Order of the Ministry of Finance of Russia dated October 15, 2009 N 104n). Should these indicators coincide and how to prepare a response to the tax authorities?

Discrepancies between profit and VAT, accounting and profit reporting

Details Category: Selections from magazines for an accountant: 11/23/2015 00:00

| The accounting department of Zebra Toys LLC expresses gratitude to the Head of the Corporate Department, Sergey Mordvin, and everyone for their help and development of the report “Analysis of discrepancies in VAT and Income Tax revenue.” Before the appearance of this report, a large amount of time was spent on checking the correctness of discrepancies between VAT and Income Tax revenues. Now this task has been simplified to a minimum, which frees up time for other work, which is especially valuable during the reporting period. Sincerely, Chief accountant of Zebra Toys LLC Osipova Yulia Igorevna | |

The processing is very cool! It helps a lot in my work and saves a lot of time. I use it quarterly for reporting. If there is a discrepancy between the tax bases for income tax and VAT, you can check it before submitting your reports and, if necessary, correct it. Previously, in order to check the compliance of the bases, it was necessary to raise the income tax for VAT for all periods of the current year, write down the numbers somewhere, add them up, and then only check them with the income tax income tax. And if you wrote it down incorrectly or someone was distracted at that moment, then the result will be incorrect. Now everything is done very quickly, you can say with one click of a button. The report shows exactly where the discrepancies are and it is very easy to find and check them. Accordingly, the response to the request of the Federal Tax Service is made quickly. Thanks to the developer! I recommend it to all accountants who work for OSNO! Shinkareva Galina NikolaevnaChief accountant of the working group 1C:Accounting services |

With warmth, Sergey Mordvin

In practice, tax authorities are not limited to comparing indicators within one declaration. They also compare the data provided by the company in its VAT and income tax reports. The goal is the same - to identify the underestimation of one or another tax.

for VAT - from column 3 on line 010 of section 3 of the declarations (in order for the data to be comparable with income tax reporting, the inspectors summarize these indicators for all periods from the beginning of the year); for income tax - proceeds from sales from line 010 of Appendix 1 to Sheet 02 plus non-operating income (line 100 of the same Appendix).

However, even here equality should not always be observed. First of all, there are transactions that are subject to VAT, but no income arises from them for income tax purposes. A typical example is that your company donated goods to another organization for free. You must charge VAT on the cost of such products.

The difference between the income tax base and VAT

Taxpayers submitted reports for 2015 and for the first quarter of 2016. And immediately for these two periods, requests from inspectorates began to pour in demanding clarification of the indicators reflected in the accounting and tax reporting. Inspectors also require the share of VAT deductions to be justified.

Many companies carefully explain everything that interests fiscal officials. However, is it really necessary to write detailed explanations in response to a request? Perhaps, even without them, there is a logical explanation for the notorious “discrepancies” in reporting. Individual indicators in declarations should not coincide at all. This means that there are no discrepancies and there is nothing to explain. Tax officials should be well aware of this.

The company that turned to me for help also received requests from fiscal officials demanding clarification of the indicators reflected in the reporting. The organization had many branches, so the number of requests coming from different inspections grew alarmingly. In this regard, there is a need to systematize all requests and requirements received.

The company's management decided to optimize the work of the accounting department. This was necessary in order to avoid copying unnecessary documents and writing unnecessary explanations. After all, everything took up a lot of working time. The management came to the conclusion that it was necessary to develop a unified approach to the formation of explanations for unlawful requests.

The company received a requirement to provide explanations in the form approved in Appendix No. 1 to the order of the Federal Tax Service of Russia dated 05/08/15 No. ММВ-7-2/ The reason for sending the request was a desk audit. The fiscal authorities requested clarification on the indicators reflected in individual lines of the balance sheet (Appendix No. 1 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n). And they also demanded to attach documents confirming the reasons for the decrease in the “Financial Investments” indicator in the balance sheet asset.

But the Tax Code does not allow desk audits of financial statements! Controllers have the right to request documents and explanations on issues related to the calculation and payment of taxes (subclause 1, clause 1, article 31, articles 88, 93 of the Tax Code of the Russian Federation). And financial statements are necessary for users of these statements to make economic decisions (Part 1, Article 13 of Federal Law No. 402-FZ dated December 6, 2011).

In addition, the tax authorities monitor compliance with tax legislation (the regulations on the Federal Tax Service, approved by Decree of the Government of the Russian Federation dated September 30, 2004 No. 506), the Ministry of Finance of Russia is responsible for accounting reporting (Part 1 of Article 22 of the Federal Law dated December 6, 2011 No. 402-FZ, Decree Government of the Russian Federation dated June 30, 2004 No. 329).

Therefore, in the request, the inspectorate may refer to a desk audit of a specific declaration and its indicators. And inspectors do not have the right to demand explanations and documents regarding financial statements. However, it is still worth responding to such a request from the inspectorate. A competent refusal to provide explanations will protect the company from receiving a report on the discovery of facts indicating tax violations (Article 101.

4 of the Tax Code of the Russian Federation), as well as from the need to further challenge this act. With my help, the organization prepared a letter refusing to comply with the inspection’s requirement. In response to a request for clarification, the company indicated that tax legislation does not provide for chambers in relation to accounting statements. At the same time, fiscal officials do not have the authority to control it.

Almost every company received a requirement to provide explanations as part of a desk audit regarding VAT. Fiscal officials are often asked to explain the reasons for the discrepancies between the indicators that make up the revenue in the annual income tax return and the size of the tax bases reflected in the VAT returns for all four quarters of the reporting year. What documents are on the camera for personal income tax? It is illegal to demand {amp}gt;{amp}gt;{amp}gt;

In my case, the company received such a requirement as part of a desk audit of the VAT return for the fourth quarter of 2015. In addition, inspectors demanded to explain why the share of VAT deductions exceeds 89 percent. This is the permissible share of deductions used by companies to independently assess the risks of inclusion in the inspection plan (Appendix No. 2 to the order of the Federal Tax Service of Russia dated May 30.

07 No. MM-3-06/hereinafter - Concept). In the third quarter of 2015, the share of deductions was 93 percent, in the fourth quarter of 2015 - 92 percent. The desk audit was carried out for the fourth quarter of 2015 - inspectors could only demand clarification for this period. In the letter, the company reminded fiscal officials that the tax period for VAT is a quarter (Article 163 of the Tax Code of the Russian Federation).

However, difficulties arose in preparing the answer. It turned out that it is difficult to explain the specific reason for the discrepancies in the declarations. The fact is that the concept of “income” for profit tax purposes (Articles 248–251 of the Tax Code of the Russian Federation) and the concept of “tax base” for VAT purposes are not identical. Consequently, revenue for the purposes of calculating income tax and the tax base for VAT purposes may be different.

The company carried out both transactions subject to VAT and transactions not subject to taxation (Article 149 of the Tax Code of the Russian Federation). Discrepancies in indicators can arise not only due to these nuances, but also due to the use of completely legal optimization methods. This, in particular, issuing invoices at a later date.

This method is often used at the end of the year, when the company closes large contracts. She may receive significant revenue, and the amount of VAT payable will also increase. To this amount are added advances from buyers, from which it is also necessary to calculate VAT (clause 1 of Article 167 of the Tax Code of the Russian Federation). In this case, for goods (advances) shipped (received) in the last days of the reporting year, invoices are issued at the beginning next year.

After all, the supplier must issue an invoice to the buyer within five days from the date of shipment or receipt of an advance payment (clause 3 of Article 168 of the Tax Code of the Russian Federation). This means that it is possible to postpone the payment of VAT from January 25, 2021 to April 25, 2021 (Clause 1 of Article 174 of the Tax Code of the Russian Federation). Of course, the last thing the organization wanted to do was explain such reasons for discrepancies in the controversial declarations.

Therefore, the society decided to refuse this part of the requirement. The fact is that inspectors most often require clarification in connection with errors or contradictions in declarations (clause 3 of Article 88 of the Tax Code of the Russian Federation). And the company asked the tax authorities to indicate what these errors or contradictions were. We also asked the inspectors to provide a link to the regulatory legal act, which states that revenue for the purposes of calculating income tax must be equal to the VAT tax base. In the letter, the company emphasized that Chapters 21 and 25 of the Tax Code of the Russian Federation established different procedures for the formation of these indicators.

One of the most pressing issues when running your own business is making mandatory payments to budgets. If you decide to organize your business using the general taxation system, you will be faced with the obligation to pay taxes, incl. on the profit of organizations and on added value. Let's understand these concepts.

Payers can be identified already from the name - these are organizations. For entrepreneurs, it is replaced by personal income tax.

Let's try to understand the basic concepts using the simplest example.

Let's say Romashka LLC produces and sells office furniture. Vasilek LLC and Morkovkin Individual Entrepreneur are buying it. The company purchases materials for production from Sorokin and Lyutik LLC.

After the furniture is sold, Romashka receives a profit, which in turn is taxed. In order to calculate it, you need to subtract from the amount received from customers all expenses incurred during the production of furniture. Those.

The resulting amount is called the taxable base.

By the way, there are income and expenses that are not taken into account when calculating profit. Their list is defined in Article 251 and Article 270 of the Tax Code of the Russian Federation.

Next, the resulting amount must be multiplied by the tax rate, which in general cases is 20% (including in our example), but there are other rates; they can be found out from Article 284 of the Tax Code.

The next key concepts are tax and reporting periods. At the end of the first of them, the taxable base is determined; based on the results of the second, reporting must be submitted. In this case, the tax period is a calendar year, and each quarter is considered reporting.

The payment period depends on the period for which it is calculated and the applicable procedure for calculating advance payments. For example, our “Romashka” does not pay monthly advance payments, which means that the deadline for paying quarterly advances falls on April 28, July 28 and October 28. The annual tax will be due by March 28 of the following year. The deadlines are determined on the basis of Article 287 of the Tax Code of the Russian Federation. Declarations must be submitted within the same time frame.

It is paid by both organizations and individual entrepreneurs.

So, our Romashka LLC made a table, calculated the costs of its production and determined its price, taking into account the built-in profit. Then this price increases by 20% (this is the total VAT rate from January 1, 2019; there are also cases when rates of 0% and 10% are applied in accordance with Article 164 of the Tax Code of the Russian Federation).

Next, Romashka LLC must pay the VAT received as part of the cost of the goods to the budget. But do not forget that for the production of furniture the organization purchased materials from Sorokin Individual Entrepreneur (located on the simplified tax system) and from Lyutik LLC (located on the general system).

This means that as part of the price for the goods received from Buttercup, Romashka paid VAT and can now reduce its VAT payable by the amount of VAT paid as part of the price to the supplier. This is called applying a tax deduction.

Where do discrepancies in income tax and VAT returns come from?

But this is rather an exception. In most cases, these indicators will not be equal. Firstly, there will always be transactions that lead to the appearance of income included in the income tax base, but do not form an object of taxation for VAT (Clause 1 of Article 146 of the Tax Code of the Russian Federation). For example:— receipt of property during the liquidation of decommissioned fixed assets (Clause 13 of Article 250 of the Tax Code of the Russian Federation);

- identification of surpluses during inventory (Clause 20 of Article 250 of the Tax Code of the Russian Federation); - receipt of income in the form of positive amount and exchange rate differences (Clause 2, 11 of Article 250 of the Tax Code of the Russian Federation); - restoration of reserves (Clause 7 of Article 250 of the Tax Code of the Russian Federation); — write-off of accounts payable after the expiration of the limitation period (Clause 18 of Article 250 of the Tax Code of the Russian Federation);

- sale of works, services, the place of sale of which is not recognized as the territory of the Russian Federation (Articles 147, 148, paragraph 1, paragraph 1, Article 248, paragraph 1, Article 249 of the Tax Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated January 29, 2010 N 03-07- 08/21). By the way, this implementation can be seen in the VAT return in section. 7 on line 010, column 2 with codes 1010811 and (or) 1010812 (Clause 44.

3 Procedure for filling out the value added tax declaration, approved. By Order of the Ministry of Finance of Russia dated October 15, 2009 N 104n (hereinafter referred to as the Procedure); Appendix No. 1 to the Procedure); - receiving interest on loans issued or even interest accrued on the balance of money in a bank account (Clause 6 of Article 250 of the Tax Code of the Russian Federation). After all, the latter are accrued monthly to almost all organizations if there is a certain amount of money in the account.

This amount is included in the income tax return, but not in the VAT return. Secondly, it may be the other way around - some transactions are subject to VAT, but do not create “profitable” income. For example, the gratuitous transfer of goods (work, services) (Subclause 1, clause 1, Article 146, clause 2, Article 154 of the Tax Code of the Russian Federation) or the transfer of goods (performance of work, provision of services) for one’s own needs (Subclause 2, clause 1, Art. 146, clause 1 of article 159 of the Tax Code of the Russian Federation).

In these cases, it is not necessary to reflect income for profit tax purposes, because the transfer of ownership of goods (works, services), including free of charge, is recognized as a sale only when it is expressly stipulated in the Tax Code (Clause 1, Article 39, Art. 41 Tax Code of the Russian Federation). Therefore, such transactions are not reflected in the income tax return, but are shown on line 010 (or 030) of column 3 of section.

3 VAT declarations (Clause 38.1 of the Procedure). And if you are an exporter of goods, then the declarations cannot coincide at all. After all, export revenue is reflected in the “profit” and “VAT” declarations in different periods: - for income tax - in the period of sale of goods (work, services) (Clause 1 of Article 249, paragraph 3 of Article 271 of the Tax Code of the Russian Federation);

Questions arise from regulatory authorities if the values of two indicators do not coincide - the amount of income from the “profitable” declaration and the summed value of the VAT tax base for the same reporting period. The following declaration lines are involved in equality:

- 010-100 Appendix 1 to Sheet 02 of the profit declaration form - the values in these columns are summed up and together form the income base;

- line 010 from Section 3 of the VAT return form, taking into account all amounts for the reporting interval.

When checking, tax authorities proceed from the position that these indicators must be identical. In practice, discrepancies between income in the VAT return and profit are common. The reasons for this may be:

- the presence of transactions, the value of which affects the tax base in relation to income tax, but are not grounds for increasing the VAT base;

- carrying out transactions for which there is an increase in the base for calculating VAT obligations, but these proceeds cannot be offset for income tax.

Examples of situations where transactions are reflected in the profit base without including VAT in the calculation:

- amounts of dividend payments received;

- income, the source of which was exchange rate differences;

- surpluses received based on the results of the inventory;

- accounts payable written off due to the expiration of the statute of limitations for them.

An example of a situation where a VAT liability arises, but there are no grounds for increasing the income tax base is the gratuitous transfer of assets.

If discrepancies in data within one reporting form are identified during a desk audit, or when comparing similar indicators in several documents, the tax authority has the right to request written explanations from the taxpayer. The business entity receives a notification from the Federal Tax Service. The procedure for responding to such requests is regulated by clause 3 of Art. 88 Tax Code of the Russian Federation.

It is recommended to send an explanation to the tax office about discrepancies in writing, formulating the answer arbitrarily. Methods for transmitting an explanatory note:

- personally to the inspector;

- to the office of the tax authority;

- by mail.

In the first two cases, it is necessary to ensure that the document bears an acceptance mark indicating the current date.

Every accountant has more than once been faced with a requirement from the tax inspectorate to explain the discrepancies in the indicators of the income tax declaration (“Sales income” “Non-operating income”) and the VAT tax base for the year.

Are such discrepancies a mistake? How can I explain to the tax authorities their reason? In this article we will try to give a decent answer to these questions.

The answer is very simple - the tax office does this, which means we, accountants, need to do this too =) Tax officers compare VAT and profit declarations in order to find income that the company forgot to impose VAT on.

In the simplest case (if we are analyzing the 1st quarter of the reporting period and we have no accounting difficulties), to reconcile we just need to carefully look at both declarations and check lines 010 020 (Sheet 02) in Profit and line 010 (Section 3) in the declaration according to VAT.

And this is quite easy to do. Difficulties begin if we need to compare indicators over 9 months or over a year. Profit is easy to calculate - it is indicated in the declarations on an accrual basis. But with VAT there is already a problem - reporting is quarterly, which means we need to take all declarations from the beginning of the year and summarize their indicators.

Now let’s add some more truths of life:

- refunds to suppliers (increase the VAT base, but no profit)

- customer returns (reduce income in profit, but not in VAT)

- VAT-free income

- different periods of income recognition for export sales All this leads to the fact that understanding the discrepancies between VAT and profit becomes a very difficult task, requiring a deep dive into accounting, drawing up additional tables and additional checks.

Specialists have a lot of experience in finding VAT and profit differences using Excel tables and “working weekends,” but we are tired of searching everything by hand.

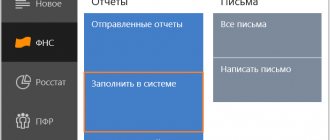

We used all our knowledge and experience and developed a special report that allows you to automatically check the convergence of the VAT and Profit bases and take into account common discrepancies. And we are ready to share our findings.

This is exactly how much our jeans will be sold for in our store to the end consumer. And it is from this amount that our tax liability will be deducted - that is, the tax that we must pay to the budget. From 200 thousand rubles, according to the formula or calculator, it turns out that VAT is equal to 36,000 rubles. This is our tax liability.

But! After all, we also have documents that confirm our tax credit of 18,000 rubles (that is, the fact that we have already paid 18 thousand in the form of value added tax). This means that we can subtract 18 thousand already paid from 36 thousand. In total, we will get 18 thousand rubles, which we will pay after selling all 10 pairs of jeans (let’s say this happened in one reporting period).

From 200 thousand rubles, 18,000 went to the budget in the form of tax.

That is, this is income from activities. This income is subject to income tax. VAT is not taken into account in the calculation of income tax, all indicators - income and expenses are taken in “pure” form - without VAT. To simplify, revenue is, for example, what was received at the store’s cash register, but you understand that this not profit. The store needs to buy goods, pay rent, taxes and salaries, and what remains is profit.

Reply from 2 replies[guru]Hi! Here is a selection of topics with answers to your question: How does VAT on revenue differ from income tax? and how is revenue different from profit? How does VAT on revenue differ from income tax? and how is revenue different from profit? tags: Profit VAT What is the difference between the simplified tax system and the OSNO? Please explain what is the difference between the simplified tax system and the regular tax system?

Section 3

The VAT declaration form and the procedure for filling it out were approved by Federal Tax Service order No. MMV-7-3 dated October 29, 2014/ [email protected] From the report for the 4th quarter of 2020, it is necessary to use its updated form - as amended by Federal Tax Service order No. ED- dated August 19, 2020 7-3/ [email protected]

You will find a sample of filling out a new VAT return in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Section 3 of the VAT return indicates the amounts related to activities subject to VAT at rates of 10 and 20% (paragraph 2, clause 38.1 of the filling procedure).

In the figure below you can clearly see how section 3 of the VAT return should reflect the amounts indicated in our example.

Discrepancies in profit and VAT declarations

In other words, discrepancies in revenue figures in accordance with income tax and VAT returns can be fully explained by accounting requirements. And the task of the organization is to correctly present all this in explanations.

Explanations must be submitted within 5 working days following the day the request was received from the tax authorities (clause 3 of Article 88 of the Tax Code of the Russian Federation). It should not be ignored, since this may become an additional argument for inspectors to order an on-site inspection of the organization (clause 9 of Appendix No. 2 to Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/).

Explanations of reasons for discrepancies (form)

Explanations to the tax office regarding discrepancies in VAT and profit returns must be provided within five working days without fail and in writing.

Let's look at ways to write explanatory notes on income tax and VAT.

Note to accountants! Revenue in the income tax return does not always coincide with the tax base reflected in the VAT return. In addition, the expenses displayed in the income statement almost never coincide with the financial statements.

Get 267 video lessons on 1C for free:

- Code “1” indicates that a declaration for the previous period was not provided. The information contained in the declaration is not included in the counterparty’s reporting;

- Code “2” – discrepancies were identified in the accounting logs;

- Code “3” – discrepancies regarding the actions of intermediaries have been identified;

- Code “4” – other questions.

After studying the presented requirement, you can begin writing an explanation.

To date, there is no legislative regulation for the preparation of an “explanatory” form. Drawing up an explanation to the tax office about discrepancies in the declaration is carried out in any form. The main condition is to provide a clear answer to the question asked, and the history of the origin of inaccuracies in the declaration. In practice, two clarification options are used:

- The identified error is reflected in the explanatory note, but always with reference to the correct data;

- The presence of an error is refuted, explanations and relevant data are provided that confirm the inclusion of this information in the declaration. An example of this situation could be discrepancies in reconciliation between the enterprise and its counterparties.

Frequently asked question: VAT discrepancies associated with the discovery of an error in VAT calculation between the company data and the supplier. The occurrence of these discrepancies may be due to a number of reasons:

- The supplier's declaration does not contain information about the shipment of goods;

- The supplier of the goods is an intermediary.

The current legislation stipulates that when issuing an invoice on behalf of its customer, the intermediary is exempt from charging VAT; this function must be performed by the direct supplier.

Thus, the presence of shortcomings may be due to the lack of appropriate actions on the part of the principal, failure to provide them with accounting logs or incorrect provision of them.

In this case, it is necessary to additionally provide supporting documents: a letter from the counterparty, a commission agreement.

After examining the error code stated in the tax request, it is necessary to provide a reasoned answer, which will be supported by relevant digital data.

These explanations must be submitted to the Federal Tax Service within 5 working days from the day following the day you received a message (notification) from the tax authorities with a requirement to submit them (Clause 2, 6, Article 6.1, paragraph 3, Article 88 of the Tax Code of the Russian Federation). Submit It is better to give explanations in writing (in any form) and personally to the tax inspector (he needs to mark their receipt) or to the office of the Federal Tax Service, rather than verbally or by mail.

To the Head of the Federal Tax Service of Russia No. 21. Moscow from Rosa LLC, TIN 7721025156, KPP 772101001, OGRN 1107712345674 Tel. (495) 111-22-33 Contact person: Ch. accountant Zinnia L.V.

In response to the request dated 08/05/2011 N 2357 for the provision of explanations, we report the following. The discrepancies between the indicators in the income tax returns for the first half of 2011 and the VAT returns for the first and second quarters of 2011 are explained by the different taxation procedures for certain transactions for the sale of goods (works, services) for the purposes of calculating income tax and VAT.

In particular, in the second quarter of 2011, our organization donated goods. Based on paragraphs. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, the cost of goods transferred free of charge is recognized as an object of taxation for VAT. Therefore, it is reflected in the VAT return in the amount of 155,000 rubles. And for the purposes of calculating income tax, the cost of goods transferred free of charge is not income in accordance with Art. Art.

General Director of LLC "Rosa" ————— Vasilkov V.P. August 10, 2011

However, in practice it is observed extremely rarely. After all, if an organization, for example, received dividends during the year, then for profit tax purposes they had to be taken into account (clause 1 of Article 250 of the Tax Code of the Russian Federation), but did not need to be included in the VAT base. The following are taken into account in the same way:

- income in the form of exchange rate and amount differences (clause 2 of Article 250 of the Tax Code of the Russian Federation);

- surpluses identified during the inventory (clause 20 of article 250 of the Tax Code of the Russian Federation);

- write-off of accounts payable after the expiration of the limitation period (clause 18 of Article 250 of the Tax Code of the Russian Federation), etc.

At the same time, for example, the gratuitous transfer of goods (work, services) is subject to VAT, but does not generate income for profit tax purposes (clause 1, clause 1, article 146, clause 2, article 154 of the Tax Code of the Russian Federation).

In other words, discrepancies in revenue figures in accordance with income tax and VAT returns can be fully explained by accounting requirements. And the task of the organization is to correctly present all this in explanations.

If your company is on a simplified basis Companies on a simplified basis report only on year-end results.

When checking companies' tax reporting, inspectors usually monitor how their indicators compare with each other. And if discrepancies are identified, they demand to explain the reason or to make corrections to the declaration. The right to do this is given to auditors by paragraph 3 of Article 88 of the Tax Code of the Russian Federation.

We do not recommend ignoring letters from the inspectorate with such requests. Firstly, it is possible that the tax authorities actually found some kind of error in the declaration. Secondly, inspectors may include a company in their on-site inspection plan that does not respond to their demands. This is provided for in paragraph 9 of Appendix No. 2 to the order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/

In this article, we will look at examples of how to respond to typical requests from tax authorities if they have informed you of discrepancies in reporting and are asking for an explanation.

View more:

How to fill out a VAT return when maintaining separate accounting

To make it easier to navigate the explanations, let’s fill out a VAT return based on a specific example.

Example

TransExpert LLC is engaged in various types of transportation:

- passenger:

- public transport - not subject to VAT (subclause 7, clause 2, article 149 of the Tax Code of the Russian Federation);

- by air transport within Russia (with the exception of Crimea, Sevastopol, and from 10/01/2018 - also the Kaliningrad region and the Far Eastern Federal District) - VAT rate of 10% (subclause 6, clause 2, article 164 of the Tax Code of the Russian Federation.

- cargo:

- international class - VAT rate 0% (subclause 2.1, clause 1, article 164 of the Tax Code of the Russian Federation);

- domestic class - VAT rate of 20% (clause 3 of Article 164 of the Tax Code of the Russian Federation).

For the reporting quarter, according to separate VAT accounting data, the following values were displayed:

| Kind of activity | Revenue from sales of services (excluding VAT), rub. | Expenses associated with the sale of services (including VAT), rub. | Expenses associated with the sale of services for which VAT is not claimed by the seller, rub. | ||

| Expenses excluding VAT | VAT | ||||

| 1 | 2 | 3 | 4 | ||

| Public passenger transport (not taxed) | A | 375 920,00 | 248 060,00 | 49 612,00 | 10 540,00 |

| Air passenger transport (10%) | B | 895 540,00 | 684 670,00 | 136 934,00 | 15 940,00 |

| International freight transport (0%) | IN | 984 930,00 | 712 340,00 | 142 468,00 | 25 720,00 |

| Domestic freight transport (20%) | G | 995 610,00 | 594 090,00 | 118 818,00 | 20 670,00 |

| Total | 3 052 000,00 | 2 239 160,00 | 447 832,00 | 72 870,00 | |

Read about the rules by which separate VAT accounting should be carried out in the Ready-made solution from ConsultantPlus. To do everything right, get trial access to the system and study the material for free.

What are the VAT requirements?

After calculating data for 12 months, the company concluded that the share of deductions exceeds 89 percent. To find out what affects this indicator, we examined VAT returns in detail.

It turned out that the inspection included in the calculation the entire VAT, taking into account advances, both accrued for payment to the budget and declared for deduction. However, the Federal Tax Service of Russia believes that the share of VAT deductions should be calculated without taking into account accruals and deductions for advances (letter No. AS-4-2/12722 dated July 17, 2013). By recalculating the share of deductions, you can see how much the result will change if you take into account in the formula only the indicators of VAT accrued and presented on completed transactions and operations.

In our case, the recalculation gave an adjustment in the right direction. Without taking into account advance VAT, the share of deductions decreased by 2 percent and the deviation in the fourth quarter of 2015 was only 1 percent. Having recalculated the share of deductions due to VAT amounts from advances issued and received, the company came to the conclusion that prepayment amounts are the main reason influencing the level of the share of deductions.

Income tax requirements are often no less mysterious and even more time-consuming to explain than VAT. The company received a request as part of a desk audit of the income tax return for 2015 with a request to explain the discrepancies between the expenses reflected in the statement of financial results (Appendix No. 1 to the order of the Ministry of Finance of Russia dated 02.07.

The approach to writing explanations on such issues depends on the desire and scrupulousness of the chief accountant. If the amount of expenses in tax accounting is less than in accounting, then we can limit ourselves to a short answer that the difference was formed due to expenses that are not accepted for tax purposes. The company itself decides whether to attach documents or not. After all, the inspectorate can demand documents in a camera room only in a limited number of cases.

The company explained that the increase in expenses occurred at the end of 2015 due to the creation of a reserve for doubtful debts in tax accounting. Because of this, a difference arose between accounting and tax accounting and the tax base for income tax did not increase significantly.

Results

Separate VAT accounting involves keeping records of transactions related to the sale of goods and services in the context of 3 groups: subject to VAT at a rate of 10 and 20%; taxable at a zero rate and non-taxable. When filling out a VAT return, amounts for the specified groups of transactions must be reflected in certain sections. In particular, amounts for activities taxed at a rate of 10 and 20% are reflected in section 3. Amounts for activities taxed at a rate of 0% are indicated in sections 4–6. And amounts for activities not subject to VAT are entered in section 7.

The deductible tax on the export of non-commodity goods and sales of precious metals to funds (banks) carried out from 07/01/2016 is reflected only in section 3; it does not need to be included in sections 4-6.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

VAT deductions from advances issued exceed the recovered tax

Let's start with the VAT return. In line 150 of section 3 of these statements, buyers reflect tax deductions on prepayments transferred to suppliers. However, as you remember, having subsequently received goods (work, services) from the counterparty, these deductions must be restored. In the declaration, these amounts are shown on line 110 of section 3.

Carefully! Controllers usually check whether the company has restored the tax previously accepted for deduction from the prepayment.

Tax officials typically monitor whether a company has fully recovered its prepayment deductions. To do this, they compare the data on lines 150 and 110. Having discovered that the indicator on line 110 (that is, the amount of tax recovered) is less, the auditors will probably inform the company about this. And they will demand to either correct the reporting or explain the reason for the discrepancy with the data in line 150. How to respond to such a request?

Can tax authorities require a company to explain discrepancies between its income tax return and financial statements?

Yes, controllers may request such clarifications. The Tax Code of the Russian Federation allows this.

How long does it take to provide tax authorities with explanations regarding discrepancies in reporting?

The explanations requested by them must be provided to the controllers within five working days. This is stated in paragraph 3 of Article 88 of the Tax Code of the Russian Federation.

Do auditors have the right to request any documents from the company if they find discrepancies in reporting?

No. Tax officials only have the right to require the company to provide explanations or make corrections to the declaration.

Tax officials want us to decipher the structure of non-operating expenses. Is this legal?

Yes, if they really identified errors or contradictions (letter of the Ministry of Finance of Russia dated July 25, 2012 No. 03-02-08/65).

First of all, we advise you to check whether you have recovered the tax on all advances that the supplier covered with shipments this quarter. If not and you forgot about some amount, then draw up an updated declaration now and hand it over to the inspectors. Before doing this, pay additional taxes and penalties.

But let’s say that you indicated everything correctly in the reporting. And the data in lines 150 and 110 do not necessarily have to be equal to each other. Let's say the company transferred an advance to the seller in the third quarter. And he will deliver the goods only in the next tax period. In this case, the amount of VAT deduction from this prepayment will lead to the difference between the indicators. This needs to be explained to the tax authorities. An example of an explanation letter is provided below.

We add that you can attach supporting documents to the letter. For example, a purchase book or a sales book for the corresponding period. It is better to convey the explanations directly to the inspectorate in person. After all, if you send them by mail, they may reach the tax authorities with a delay, or even get lost altogether.

And by the way. You don’t have to deduct tax on prepayments at all. Because this is the buyer's right, not an obligation. Officials agree with this. An example of this is the letter of the Ministry of Finance of Russia dated April 9, 2009 No. 03-07-11/103. Then these amounts will not have to be restored in the quarter when the company receives goods from the supplier. And this will not cause discrepancies in reporting.

Let's start with the VAT return. In line 150 of section 3 of these statements, buyers reflect tax deductions on prepayments transferred to suppliers. However, as you remember, having subsequently received goods (work, services) from the counterparty, these deductions must be restored. In the declaration, these amounts are shown on line 110 of section 3.

Taxpayer income is divided into two categories: capital income and labor income. In Finland, the total tax burden is 43.8% of GDP in the form of direct taxes, in particular personal income, which is 16.7% of the total tax. The share of indirect taxes is 14.5%, and social contributions, mainly paid by employers, are 12.7%.

Carefully! Controllers usually check whether the company has restored the tax previously accepted for deduction from the prepayment.

Tax officials typically monitor whether a company has fully recovered its prepayment deductions. To do this, they compare the string data and . Having discovered that the indicator of line 110 (that is, the amount of the restored tax) is less, the auditors will probably inform the company about this. And they will demand to either correct the reporting or explain the reason for the discrepancy with the data in line 150. How to respond to such a request?

Section 4

Section 4 reflects amounts for activities taxed at a 0% rate. This section is filled out in the quarter when a package of documents has already been fully collected confirming the fact that the zero rate was applied justifiably (paragraph 1, clause 9, article 167 of the Tax Code of the Russian Federation). For our example, the list of necessary supporting documents is presented in clause 3.1 of Art. 165 Tax Code of the Russian Federation.

IMPORTANT! The period for collecting documents should not exceed 180 days starting from the day when the customs control stamp appears on the transportation documents (clause 9 of Article 165 of the Tax Code of the Russian Federation). When filling out declarations for periods starting from the 3rd quarter of 2021, in lines 030 and 050, there is no need to reflect deductible tax on transactions related to the export sale of non-commodity goods and the sale of precious metals to funds and banks. Information on them should be reflected in lines 120-190 of section 3.

If, at the end of the next period, documents confirming the zero rate have not been collected, and the period for collecting documents has not yet exceeded 180 days, then the amounts for transactions taxed at a 0% rate are not indicated anywhere in the VAT declaration.

Let us assume that, following our example, the provision of international services for the transportation of goods and the collection of a full package of documents giving the right to apply a zero VAT rate were carried out in the same period. Then section 4 will be filled in as follows:

Read more about confirming your right to a zero VAT rate in this material .

Separate VAT accounting must also be carried out during a long production cycle. ConsultantPlus experts tell you in detail how to do this. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Question test on the topics of the issue

- 1 Tax officials sent a message to the company that the amount of expenses in the income tax return differs from similar figures in the financial statements. In this situation, do controllers have the right to demand that contracts with counterparties and other documents be presented to them?

- A. Yes, I have the right.

B. No, you have no right.

The correct answer is B. If tax authorities have identified errors or contradictions in a company's reporting, they can only ask it for clarification. Or demand that the necessary corrections be made to the declaration. This is stated in paragraph 3 of Article 88 of the Tax Code of the Russian Federation.

The next question in the article “Frequent mistakes, eradicating which you will make your balance sheet perfect.”

- How to calculate store profitability