The absence of profit or actual business activity does not relieve the individual entrepreneur from the obligation to submit tax reports on time. The only difference in the described situation is that reporting in this situation is commonly called zero. However, it must be submitted, and this should be done on time, and all necessary documents must meet the requirements that the state imposes on them.

- 2.1 How to submit zero reporting for individual entrepreneurs yourself

- 3.1 Video: tips for successfully submitting zero reporting on insurance premiums

Brief information about the tax regimes of individual entrepreneurs

Before understanding the procedure and deadlines for submitting zero reports, let us briefly recall what taxation systems generally exist for individual entrepreneurs. Moreover, from 2021 there are certain changes in this topic.

The main tax system, on which all entrepreneurs without exception can work, is called the basic or general (OSNO). It is used by default; to switch to it you do not need to write an application or somehow communicate your choice.

At the same time, OSNO is a system with the highest tax burden and complex reporting. It is no coincidence that most individual entrepreneurs choose preferential tax regimes that allow them to pay less taxes. To switch to them, you must submit the appropriate notification or application on time.

Another difference between preferential regimes and OSNO is the minimum or even complete absence of reporting.

- Simplified taxation system. One declaration is submitted per year; during the year you must keep a book of income and expenses.

- Unified agricultural tax. One annual declaration and book of income and expenses.

- Patent taxation system. There are no declarations; only income is taken into account in the book.

- Tax on professional income. There are no declarations, no accounting books. The tax is calculated by the Federal Tax Service based on the income data declared in your personal account.

Until 2021, another preferential regime was in force for individual entrepreneurs - UTII. However, a zero report for imputation was, in principle, not provided for, because the tax calculation was carried out on the basis of the estimated, and not the actual income of the individual entrepreneur.

As you can see, two of the four preferential regimes do not require filing declarations; they are required only for OSNO, simplified taxation system and unified agricultural tax. However, zero reporting of individual entrepreneurs is not only tax returns. If an entrepreneur has employees, in some cases he must submit zero reporting for them.

Please note: an individual entrepreneur without employees is required to pay insurance premiums for himself, even if he does not conduct business. At the same time, no reporting of contributions is established for yourself; just keep receipts for their payment.

Next, we will figure out how and when to submit zero reporting for individual entrepreneurs in the form of declarations and some employer reports. As for financial statements, individual entrepreneurs do not maintain or submit them.

Declaration of the simplified tax system

A zero report for this taxation system is submitted in the same form as a regular declaration that has indicators.

The title page is filled in, and then, depending on the object of taxation:

- for “Income” – sections 1.1 and 1.2;

- for “Income minus expenses” – sections 1.2 and 2.2.

In the appropriate fields you must indicate the OKTMO code and tax rate. The remaining cells are filled with dashes. A sample zero declaration under the simplified tax system can be found here.

Zero declarations on OSNO

The main tax system has several different taxes, in particular VAT and personal income tax. Therefore, zero reporting for individual entrepreneurs on OSNO includes two declarations.

Entrust reporting to specialists

VAT declaration

The main inconvenience of the VAT return is the mandatory submission in electronic form. That is, even if the individual entrepreneur did not start his activities on OSNO, he needs to obtain an electronic signature and submit this declaration via the Internet. And since this is not so simple, you have to turn to an accountant or paid services for help.

Another disadvantage is that, unlike declarations under preferential regimes, VAT reporting is submitted every quarter. The declaration form was approved by order of the Federal Tax Service of Russia dated October 29, 2014 N ММВ-7-3/ [email protected] (as amended on August 19, 2020).

Declaration 3-NDFL

This declaration reflects the income of individuals, even if they are registered as individual entrepreneurs. The declaration form changes annually; in 2021, the form approved by order of the Federal Tax Service of Russia dated August 28, 2020 N ED-7-11/ [email protected] . If there is no income, the title page, as well as sections 1 and 2, are filled out.

Individual entrepreneurs do not submit declarations for transport tax and property, although they pay these taxes simply upon the fact of owning a car or real estate. Payment is made based on notifications from the Federal Tax Service.

What does zero reporting include?

The need to submit zero reporting for individual entrepreneurs is due to the fact that it is on the basis of these documents, drawn up by the entrepreneur himself, that the state, represented by the inspections of the Federal Tax Service (FTS), determines whether he has correctly calculated and paid the tax.

The recipient of zero reporting is the tax office

Entrepreneurs often think that if they have no profit and the base on which the tax is determined is zero, then they have nothing to report. However, it is not.

Zero reporting usually means tax reporting . An entrepreneur must report to the Federal Tax Service on taxes and insurance contributions. And it is also necessary to submit calculations to the Pension Fund (PFR), Social Insurance Fund (SIF), and in some cases, statistical authorities. But these forms have their own specifics, as a result of which there is no need to talk about zero reporting in relation to them:

- An entrepreneur is required to make payments for himself to the Pension Fund and submit reports on them, regardless of the financial result, and the amount of payments for businessmen with an income from zero to 300,000 rubles per year is fixed;

- obligations to make contributions to the Pension Fund and the Social Insurance Fund for hired workers and to report on this are determined solely by the availability of personnel, and if there is none, there is nothing to report on.

In turn, the set of documents that includes the tax reporting of an entrepreneur is determined by the taxation system he applies.

Today, the following tax system options are available to individual entrepreneurs:

- general (OSNO);

- simplified (USN);

- unified tax on imputed income (UTII);

- single agricultural tax (USAT);

- patent.

Zero reporting is usually submitted by individual entrepreneurs to OSNO and simplified tax system

A complete set of reports may include:

- declarations on taxes paid in accordance with the chosen taxation system;

- book of income and expenses.

The income and expense accounting book is filled out by all entrepreneurs, except UTII payers. In 2021, KUDiR can be maintained electronically and does not need to be certified by the tax office. But be prepared to present the KUDiR in printed form at the first request of the tax office. It is not necessary to certify the paper version with the IP seal.

In a narrow sense, tax reporting in general and zero reporting in particular means only documents that are subject to submission to the Federal Tax Service inspection within the prescribed period, that is, tax returns. But it is also necessary to keep a book of income and expenses.

In 2021, entrepreneurs using OSNO and simplified tax systems are recommended to maintain KUDiR

Zero reporting forms

There are no separate forms for zero reporting of individual entrepreneurs in 2021. Most often, a standard declaration form is used for the corresponding type of tax, but the columns allocated to indicate income reflect their absence.

To submit zero reporting, a standard tax return form is used.

However, if the entrepreneur:

- is recognized as a taxpayer for one or more taxes;

- does not carry out operations that result in the movement of funds in his bank accounts (at the organization’s cash desk);

- and has no objects of taxation for these taxes...

... then he can submit a single (simplified) tax return for these taxes.

With the book of income and expenses for those who must fill it out, the situation is similar: it also reflects the lack of income.

The Tax Code of the Russian Federation does not contain the concept of zero reporting at all. And in everyday life, this phrase means a declaration with zero income indicators.

Zero reporting on OSNO

An individual entrepreneur using the general taxation system must submit two documents to the tax office:

- declaration on payment of personal income tax form 3-NDFL;

- value added tax (VAT) declaration.

If the reporting is submitted as zero, only the title page is filled out in both declarations. In section 1, the following are indicated in the appropriate columns OKTMO and KBK: 18210301000011000110 for VAT and 18210102020011000110 for personal income tax. The remaining lines must be filled with dashes.

The VAT return is submitted quarterly by the 25th day of the first month of the new quarter. Form 3-NDFL - once a year until April 30 of the following year.

Zero reporting under simplified tax system

With a simplified taxation system, tax reporting subject to submission to the Federal Tax Service is limited to a single tax declaration in connection with the application of the simplified tax system. It is submitted once a year - until April 30 of the following year.

The procedure for filling out a zero declaration is the same as for individual entrepreneurs on the general system:

- the title page is filled out;

- OKTMO is entered in section 1.1 and the taxpayer attribute and the rate for the object in section 1.2 for those paying 6% of income;

- those paying 15% of the difference between income and expenses indicate OKTMO in section 1.2 and the tax rate in the corresponding paragraphs of section 2.2;

- dashes are placed in all other columns.

Zero reporting for UTII and patent

A feature of these tax regimes is that zero reporting is impossible in principle. After all, the specificity of UTII and patents is that entrepreneurs using these taxation systems transfer UTII or the cost of the patent to the budget, regardless of their financial results.

An individual entrepreneur with a patent does not have to submit any tax returns. His obligations in this regard are limited to timely payment of the cost of the patent and maintaining a ledger of income and expenses. With its help, tax authorities will be able, if necessary, to check whether the income of such an entrepreneur has not exceeded the maximum barrier, after which the right to use the patent is lost.

As for UTII payers, they are required to submit a declaration every quarter before the 20th day of the first month of the next quarter and transfer tax to the budget by the 25th. Including for reporting periods in which they had no profits or did not operate.

Let us emphasize: even if no activity was actually carried out and real income for the period was zero, the single tax is paid based on the potential income received (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Accordingly, it is impossible to submit a zero declaration and not pay UTII (Letters of the Ministry of Finance dated September 14, 2009 No. 03–11–06/3/233, dated July 2, 2012 No. 03–11–11/196).

Photo gallery: UTII declaration for individual entrepreneurs

Sheet 1 of the UTII declaration is the title page; the full name of the entrepreneur and address are indicated on it

UTII declaration: sheet 2 contains the amount of imputed tax broken down by OKATO codes

UTII declaration: sheet 3 shows the calculation of tax amounts for certain types of activities

UTII declaration: sheet 4 shows the amount of insurance contributions by which the amount of tax payable is reduced

Single simplified declaration

There is another option, how to submit zero reporting in the absence of activity. This is the so-called single simplified declaration. The form was approved by a long-standing order of the Ministry of Finance of the Russian Federation dated July 10, 2007 N 62n, and its changes are expected.

However, with the EUD, everything is not so simple. Firstly, it can be surrendered if the entrepreneur not only does not conduct business, but also does not carry out any operations on the cash register or current account. But in many cases, the bank charges payment for cash settlement services, even if the individual entrepreneur does not work. Or, suppose an entrepreneur has issued a lease, but has not yet started the business. In this case, rental payments are processed and documented, which means that in this case it is impossible to hand over the EUD.

Secondly, the EUD cannot be submitted instead of the zero 3-NDFL, so individual entrepreneurs using OSNO can only replace it with a single simplified VAT return. Thirdly, the deadlines for submitting the EUD are not very convenient. For example, a zero declaration under the simplified tax system is submitted before April 30, but if an entrepreneur decides to report under the simplified taxation system under the EUD, then it must be submitted much earlier - no later than January 20.

Thus, a single simplified declaration has practical value only for those individual entrepreneurs who do not want to submit a zero VAT return electronically. You will still have to submit the zero 3-NDFL. You can also replace it with a single simplified declaration under the simplified tax system or unified agricultural tax, but for this you need to meet a shorter deadline - no later than January 20 for the past year.

How and where to submit tax reports

In 2018, the recipient of individual entrepreneurs’ tax returns, including zero ones, remains the Federal Tax Service inspectorate at the entrepreneur’s place of residence.

The place of residence of an individual entrepreneur means the address where he is registered, or, as they say in the old fashioned way, registered. An entrepreneur can actually live and conduct business anywhere, but must send reports to the tax office at his place of registration, even if he has registration at his place of residence somewhere else.

To prepare and submit reports, including zero reports, businessmen often use the services of a specialized organization, which will have to be paid for. Online accounting services (for example, “Elba”, “My Business”, “Deal 24”, etc.) will help you generate declarations, or you can solve this problem entirely on your own.

How to submit zero reporting for individual entrepreneurs yourself

There are three options:

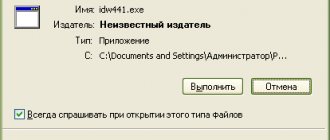

- personally take the documents to the tax office;

- send them there by mail;

- submit via the Internet.

It is necessary to take into account that starting from January 1, 2014, VAT payers (including those who are tax agents) can submit tax returns only electronically via telecommunication channels. The Federal Tax Service has not accepted paper payments for three years now.

When visiting the Federal Tax Service in person, you will need to have a second copy or photocopy of each document submitted. The inspectorate staff will mark them with acceptance.

Instead of an entrepreneur, his authorized representative can submit documents to the Federal Tax Service. To do this, you need to issue a notarized power of attorney for such a person, a copy of which is submitted to the tax office along with the declaration, and reflect the fact of submission of reports by the authorized person in the appropriate section of the title page.

By mail, documents are sent by registered mail with a description of the contents and notification of delivery.

To independently submit documents via the Internet, an entrepreneur will need an electronic digital signature (EDS), which is used to certify each of them, and an individual entrepreneur’s personal account on the government services portal or the website of the Federal Tax Service of Russia.

A “flash drive” with an electronic digital signature relieves entrepreneurs of many problems associated with submitting reports to the Federal Tax Service

Employer reporting

In most cases, if an individual entrepreneur does not operate, then he does not have employees registered under employment or civil law contracts. But it also happens that employees are sent on long unpaid leave, that is, they are not paid. In this case, the zero forms of 6-NFDL are not submitted.

As for DAM reports, an entrepreneur must submit a zero report if he officially has employees, even if he does not pay them wages. In addition, there are reports SZV-M, SZV-TD and SZV-Stazh, which are submitted if there are contracts with employees.

Deadlines for submitting zero reports

Submission of zero reporting by individual entrepreneurs occurs within the same time frame as reports with indicators. There are no exceptions here, so we recommend checking the table.

Submission of zero reporting for individual entrepreneurs: deadlines

| Reporting type | Deadline |

| Declaration of the simplified tax system | April 30 for the previous year |

| Declaration of Unified Agricultural Tax | March 31 for the previous year |

| Declaration 3-NDFL | April 30 for the previous year |

| VAT declaration | 25th day after the reporting quarter |

| Single simplified declaration | 20th day after the reporting quarter |

| RSV | 30th day after the reporting quarter |

| SZV-M | 15th day after the reporting month |

| SZV-Experience | March 1 of the previous year |

| SZV-TD | In the presence of personnel events |

| 4-FSS | 20th day after the reporting quarter |

So, we figured out when it is necessary to submit zero reporting for individual entrepreneurs, as well as what it consists of. If you have difficulties filling out zero declarations and reports, we recommend that you contact us for a free consultation.

Zero reporting on insurance premiums

Individual entrepreneurs submit all reports on insurance premiums only if they have employees. If there are no employees throughout the year, then there is no need to submit zero reporting.

The reporting of individual entrepreneurs to the Pension Fund consists of three forms - SZV-M, SZV-TD and SZV-STAZH. They are applied to employees. If the individual entrepreneur has employees, he submits these forms. If there are no employees, it doesn’t rent. There can be no zero reports.

Businessmen and their employees submit a zero calculation for insurance premiums to the Federal Tax Service if the individual entrepreneur’s employees did not receive money during the reporting period. In the zero calculation you need to add the title page, section 1, subsections 1.1 and 1.2 of Appendix No. 1 to Section 1, Appendix No. 2 to Section 1, Section 3.

If you have employees and no payments, you must submit a zero form 4-FSS to the Social Insurance Fund. You must submit 4-FSS with zero values before the 25th day of the first month of the 1st, 2nd, 3rd, and 4th quarters. Zero 4-FSS includes the title page, tables 1, 2 and 5.

Submit zero reporting through Kontur.Extern

Send a request