Features of filling out 6-NDFL for 2021

It should be noted that Form 6-NDFL, compiled at the end of the year, is called the report for the 4th quarter only for simplicity. The calculation is compiled on a cumulative basis from the beginning of the year, so it is more correct to talk not about the report for the 4th quarter of 2021, but about the annual Calculation of 6-NDFL for 2021.

Form 6-NDFL for the 4th quarter of 2021 has not changed, as has the composition of the form submitted to the tax office:

- Title page (Page 001)

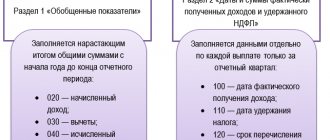

- Section 1 “Generalized indicators”

- Section 2 “Dates and amounts of income actually received and withheld personal income tax”

Let us remind you that in Section 2 of the annual Calculation, personal income tax amounts withheld in the 1st, 2nd or 3rd quarter are not shown. They will be reflected only in Section 1 of form 6-NDFL.

General requirements for filling out form 6-NDFL can be found in our consultation.

Deadlines and assigned responsibilities

The legislation states that this reporting form must be submitted to the tax authorities before the last day of the month that follows the reporting quarter. And the report for the year must be submitted before the beginning of April next year.

In 2021, the deadlines for submitting the report are as follows:

- 1st quarter – until May 4, 2021:

- 2nd quarter – until August 1, 2021;

- 6-NDFL for the 3rd quarter – until October thirty-first, 2016;

- 4th quarter – until April 3, 2021.

In some cases, report submission deadlines have been postponed due to holidays or weekends.

It is important not to delay submitting the form, as there is a penalty for late submission. It is one thousand rubles for each overdue month. Read more about fines for late submission of 6 personal income taxes in the article.

Deadline for submitting 6-NDFL for 2021

If interim Calculations in Form 6-NDFL are submitted no later than the last day of the month following the corresponding quarter, then for the annual Calculation this period is extended. Form 6-NDFL for the year must be submitted no later than April 1 (paragraph 3, paragraph 2, article 230 of the Tax Code of the Russian Federation).

It should be taken into account that if the last day of the deadline for submitting the Calculation falls on a weekend or a non-working holiday, the Calculation can be submitted on the next working day following such a day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Since 04/01/2017 is a Saturday, Form 6-NDFL for 2016 must be submitted no later than 04/03/2017.

Sanctions for violations

For violations of the deadline and form for filing 6-NDFL, tax and administrative liability is provided. All sanctions are collected in the following table.

Table 1. Possible sanctions for violating the procedure and deadline for filing 6-NDFL

| Violation | Sanction | Regulatory Standard |

| Form not submitted | 1 thousand rubles for each month (full and part-time) | clause 1.2 art. 126 Tax Code of the Russian Federation |

| The calculation was not received by the Federal Tax Service within 10 days after the deadline for submission | Blocking the current account | clause 3.2 art. 76 Tax Code of the Russian Federation |

| Error in calculation (if identified by the tax authority before the agent corrected it) | 500 rubles | Art. 126.1 Tax Code of the Russian Federation |

| Failure to comply with the form (submission on paper instead of sending via TKS)* | 200 rubles | Art. 119.1 Tax Code of the Russian Federation |

| Submission deadline violation | 300-500 rubles per official | Part 1 Art. 15.6 Code of Administrative Offenses of the Russian Federation |

* Note. Tax agents submitting calculations in respect of 25 or more insured persons must submit it electronically using the TKS. Everyone else can choose the form at their discretion.

Company officials are held administratively liable. For example, a fine for late filing of 6-NDFL will be imposed on the chief accountant if his job description states that he is responsible for the timely filing of reports.

6-NDFL for the 4th quarter: example of filling

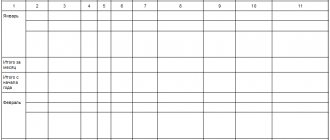

Let us present in the table the data for preparing the Calculation according to Form 6-NDFL. To do this, we will supplement the information on the accrued income of employees for 9 months, used to fill out form 6-NDFL for 9 months of 2016, with information on income from the 4th quarter of 2016.

Let us also assume that wages for December 2021 were paid in full ahead of schedule on December 29, 2016. However, personal income tax will not be withheld from the December salary in December, since at the time of payment of funds the income has not yet been received.

In this case, personal income tax will need to be withheld for the next payment of funds to employees. Let’s assume this will be the advance payment date for January 2021 – 01/16/2017.

In addition, for vacation pay paid on December 21, 2016, the deadline for transferring personal income tax is January 9, 2017, since December 31, 2016 falls on a day off (Saturday).

Consequently, the amounts of advance payment and salary for December, personal income tax withheld on January 16, 2017, as well as information on vacation pay issued on December 21, 2016, will be shown in Section 2 only for the 1st quarter of 2021 (Letters of the Federal Tax Service of Russia dated November 2, 2016 N BS-4- 11/ [email protected] , dated 10/24/2016 N BS-4-11/ [email protected] ).

At the same time, in Section 1, the amounts of advance payment, salary for December and December vacation pay, as well as calculated tax are indicated, because the tax calculation dates fall in 2021.

You can check the correctness of filling out the 6-NDFL form using control ratios.

Completing Section 2 in the case when income is accrued in one period and paid in another

As a general rule, the tax agent is obliged to transfer the tax amount no later than the day following the day the income is paid.

An exception is made only for temporary disability benefits (including benefits for caring for a sick child) and vacation pay. Personal income tax withheld from these payments must be transferred no later than the last day of the month in which they were paid (clause 6 of Article 226 of the Tax Code of the Russian Federation). Therefore, if, for example, the salary for March 2021 is paid in April, accordingly, personal income tax will be withheld and transferred in April. In this regard, in Section 1, the amount of accrued income will be reflected in Form 6-NDFL for the first quarter, and in Section 2 this operation will be reflected only for direct payment of wages to employees, that is, in the Calculation in Form 6-NDFL for the first half of 2021 ( letter of the Federal Tax Service of Russia dated February 25, 2016 No. BS-4-11/ [email protected] ).

Let's look at what dates should be indicated in this case when filling out 6-NDFL with an example.

EXAMPLE

1. Wages for March were paid to employees on April 5, and personal income tax was transferred on April 6. The operation is reflected in Section 1 of the Calculation in Form 6-NDFL for the 1st quarter, while the tax agent does not reflect the operation in Section 2 for the 1st quarter of 2016. This operation will be reflected when directly paying wages to employees, that is, in the Calculation in Form 6- Personal income tax for the first half of 2021 is as follows:

- line 100 indicates the date 03/31/2016;

- on line 110 - 04/05/2016;

- on line 120 - 04/06/2016;

- on lines 130 and 140 - the corresponding total indicators.

2. Sick leave for March was paid on April 5. The operation in Section 2 of the Calculation Form 6-NDFL for the first half of 2021 will be reflected as follows:

- line 100 indicates 04/05/2016;

- on line 110 - 04/05/2016;

- on line 120 - 04/30/2016;

- on lines 130 and 140 - the corresponding total indicators.

General requirements for filling out 6-NDFL

To reduce the likelihood of errors when filling out 6-NDFL, you must refer to the Instructions for filling out form 6-NDFL, which can be found in the order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] General requirements for filling out form 6 -Personal income tax, in particular, includes:

- Filling Calculation text and number fields from left to right, starting from the leftmost cell

- putting dashes in unfilled cells, while in unfilled cells for total indicators zero is indicated in the leftmost cell, the remaining cells are crossed out

- ban on double-sided printing of Calculations on paper

- using black, purple or blue ink

- When preparing the Calculation on a computer and subsequent printing, dashes can be omitted; in this case, Courier New font should be used with a height of 16 - 18 points

How to correctly fill out form 6-NDFL

If filling out the title page does not cause any particular difficulties, the procedure for filling out Section 1 “Generalized Indicators” may raise questions.

If different tax rates were applied during the year, then lines 010-050 are filled out separately for each tax rate. In this case, the indicators are given in total for all individuals to whose income each specific rate is applied.

Lines 010-090 are filled in cumulatively from the beginning of the year.

Line 010 “Tax rate, %” indicates the tax rate applied in the reporting period.

Lines 020-050 are filled in for each specific rate indicated on line 010.

Line 020 “Amount of accrued income” indicates the amount of accrued income on a cumulative basis from the beginning of the tax period.

If dividends were accrued during the tax period, then the tax agent reflects their amount again on line 025 “Including the amount of accrued income in the form of dividends.”

Line 030 “Amount of tax deductions” reflects the amount of tax deductions that reduces income subject to taxation. This line reflects, in particular, the standard tax deductions provided for in Art. 218 of the Tax Code of the Russian Federation, as well as deductions in the amounts provided for in Art. 217 of the Tax Code of the Russian Federation (for example, deduction from the cost of gifts or material assistance). A complete list of deductions can be found in the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected]

The amount of calculated personal income tax is reflected in line 040 “Amount of calculated tax.”

In line 045 “Including the amount of calculated tax on income in the form of dividends” you need to indicate the amount of personal income tax on dividends previously reflected on line 025.

If an organization or individual entrepreneur employs a foreigner who has a patent and pays personal income tax on his own, then the tax agent can reduce the calculated personal income tax of such employees by the amount of their fixed personal income tax payments. The amount by which the tax agent reduces the calculated personal income tax is reflected on line 050 “Amount of fixed advance payment.”

On line 060 “Number of individuals who received income,” the tax agent must indicate the total number of individuals who received income from him in the tax period. If during the year the same individual was fired and rehired, it is indicated on line 060 only once.

Line 070 “Amount of tax withheld” reflects the amount of personal income tax that was withheld by the tax agent.

Line 080 “Amount of tax not withheld by the tax agent” reflects the amount of personal income tax that the tax agent was unable to withhold from the income of an individual.

On line 090 “Amount of tax returned by the tax agent” you need to show the amount of personal income tax that was returned by the tax agent in accordance with Art. 231 Tax Code of the Russian Federation.

Lines 060-090 are filled out in total for all tax rates and must be filled out on the first page of Section 1.

Procedure for filling out the first section

The first section of the form, called summary indicators, includes two blocks. Filling occurs in the following order:

1 block – generalized information for each line separately:

- 010 – the tax rate is indicated as a percentage;

- 020 – intended to indicate total accrued income;

- 025 – total amount of accrued dividends;

- 030 – the total amount of deductions that make the tax amount smaller;

- 040 – indicate the fully calculated tax;

- 050 – reflect the amount of all advance payments made.

Block 2 – summary information:

- 060 – number of employees who received income during the reporting period;

- 070 – amount of tax withheld for the period;

- 080 – amount of tax that was not withheld;

- 090 – amount of tax refunded (written off by mistake and returned to the employee).

6-NDFL: section 2

How to fill out section 2 6-NDFL? In Section 2 “Dates and amounts of income actually received and personal income tax withheld”, based on its title, the tax agent must reflect:

- dates of actual receipt of income by individuals

- personal income tax withholding dates

- personal income tax payment deadlines

- the amount of income actually received

- amount of personal income tax withheld

The data in Section 2 is generalized. This means that if one individual has the dates of actual receipt of income, the dates when personal income tax must be withheld and transferred to the budget, are the same as for another individual, then data on the amounts of income received and tax withheld on them are reflected in Form 6 - Personal income tax is summarized.

Comments on filling out Section 2 of form 6-NDFL

Line 100 “Date of actual receipt of income” indicates the date when the individual actually received the income reflected in line 130. What is the date of actual receipt of income is indicated in Art. 223 Tax Code of the Russian Federation. For example, for wages, such a date is the last day of the month for which income was accrued.

On line 110 “Date of tax withholding”, the tax agent must show the date when he withholds personal income tax from the income of an individual, which is shown on line 130. Tax is withheld from income when it is actually paid (clause 4 of article 226 of the Tax Code of the Russian Federation).

On line 120 “Tax transfer deadline,” you must indicate the date no later than which personal income tax must be transferred to the budget. Personal income tax is transferred no later than the working day following the day of payment of income (clause 6 of article 226 of the Tax Code of the Russian Federation). When paying benefits for temporary disability and vacation pay, personal income tax is transferred within a special timeframe: no later than the last day of the month in which such payments were made.

On line 130 “Amount of income actually received” you need to show the total amount of income of individuals (including personal income tax) received on the date indicated on line 100.

On line 140 “Amount of withheld tax” you need to reflect the generalized amount of withheld tax on the date indicated on line 110.

Line 080 of form 6-NDFL: filling procedure

If during the reporting period the tax agent calculated personal income tax amounts that cannot be withheld in the current year, then such amounts are reflected on line 080 “Amount of tax not withheld by the tax agent” in form 6-NDFL. The tax agent must notify the individual and his tax office no later than March 1 of the following year about the impossibility of withholding personal income tax and the amount of income from which tax is not withheld (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Control ratios for checking form 6-NDFL

Let's present the main control ratios for form 6-NDFL in the form of a table.

| Ratio | Comments |

| line 020 “Amount of accrued income” ≥ line 030 “Amount of tax deductions” | In form 6-NDFL, the amount of tax deductions (line 030) cannot be more than accrued income (line 020). |

| (line 020 “Amount of accrued income” − line 030 “Amount of tax deductions”) * line 010 “Tax rate, %” / 100 = line 040 “Amount of calculated tax” | If the ratio is not met, then the tax amount is underestimated or overestimated. In this case, it is allowed to deviate the calculated tax from line 040 in both directions by no more than the following amount (in rubles): line 060 “Number of individuals who received income” * number of lines 100 “Date of actual receipt of income” |

| line 040 “Amount of calculated tax” ≥ line 050 “Amount of fixed advance payment” | The amount of fixed advance payments cannot exceed the amount of calculated tax. The tax office will also request clarification if line 050 is completed, but the tax agent was not given notices of the right to reduce personal income tax on the tax of foreigners with a patent |

In addition, the tax agent can compare not only the data of Form 6-NDFL with each other, but also the Calculation indicators with accounting data and tax registers.

So, if the amount of the difference between lines 070 “Amount of tax withheld” and 090 “Amount of tax returned by the tax agent” exceeds the amount of personal income tax paid for this year according to the tax agent, then this may indicate non-payment of personal income tax to the budget. The tax office also checks this data with the Card of settlements with the tax agent's budget. Similarly, the inspectorate can compare the actual date of personal income tax transfer with the card with the date declared by the tax agent on line 120 “Tax transfer deadline” in relation to the tax amount reflected on line 140 “Amount of withheld tax.”

Also, at the end of the year, to check Form 6-NDFL, the tax inspectorate can compare the indicators of Form 6-NDFL with the data on individual income certificates (Form 2-NDFL), and the income tax return (Appendix No. 2).

Changes in personal income tax from 2021. New certificate 6-NDFL.

The coming year 2021 has brought with it a colossal number of tax changes. The amendments affected almost all taxes. Personal income tax is no exception. Let's look at the most significant of them.

What changed.

♦ Starting from 2021, employer companies have the right to transfer personal income tax from employees’ salaries not on the day the income is paid, but a day later. In the case of transferring benefits or vacation pay, tax can be paid on the last day of the month in which the income was paid. For example, “the employee’s vacation pay was paid on March 1, therefore, the accountant will quite rightfully be able to pay personal income tax accrued from vacation pay only on March 31.”

♦ According to the innovations, in order to receive a social deduction for training or treatment, an employee can write a corresponding application and submit it to the employer. According to the new edition of paragraph 2 of Art. 219 of the Tax Code of the Russian Federation, from January 1, 2021, such a responsibility is assigned to the employer. Let me remind you that previously these deductions were provided by the Federal Tax Service.

♦ If the tax agent cannot withhold personal income tax, then he needs to inform the inspectorate about this. Previously, this had to be done within a month after the end of the year, i.e. until January 31st. According to the new rules, information about the impossibility of withholding personal income tax should be provided before March 1, and according to the new form 2NDFL.

♦ A certificate of income for individuals for 2015 can be submitted on paper only if the number of employees of the company is less than 25 people.

♦ Liability for late submission of personal income tax reports has been tightened. If before 2021, for failure to submit to the tax authorities documents and (or) other information prescribed in the Tax Code of the Russian Federation, a tax agent could be fined under Article 126 of the Tax Code of the Russian Federation in the amount of 200 rubles for each missing document, now the fine will be 1000 rubles for each overdue document. month (full and incomplete). In addition, tax authorities are authorized to block the accounts of companies if they do not submit personal income tax reports within ten days after the last day of reporting. Example: “The legislation sets the deadline for submitting the 2NDFL report - April 1, therefore, if inspectors do not see your personal income tax report by April 11, then transactions on the bank accounts of your organization may be suspended until the report is submitted. Only after this the decision to suspend the account must be canceled no later than one day following the day the report is submitted.”

Introduction of quarterly reporting.

And finally, news that, in my opinion, deserves special attention is the introduction of quarterly reporting on personal income tax. This means that in addition to the annual calculation of personal income tax amounts, which we submit in form 2NDFL, it is necessary to submit quarterly generalized information on the income of individuals of your company for the 1st quarter, half a year, 9 months.

Deadlines for delivery.

To avoid fines, reports must be submitted within the deadlines established by paragraph 2 of Article 230 of the Tax Code of the Russian Federation. This is the last day of the month following the end of the corresponding period. Thus, the 1st quarter of 2021 should be reported by May 4, 2016

, because April 30 falls on a day off and the payment is provided on the next working day, in accordance with clause 7 of Art. 6.1 Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated December 21, 2015 No. BS-4-11/22387.

Report form.

The form on which the calculation must be submitted is called 6 personal income tax. Order on the basis of which this form was approved No. ММВ-7-11/450 dated October 14, 2015.

Where to submit and how.

The form is submitted to the Federal Tax Service at the place of registration of the tax agent either on paper, provided that the company employs less than 25 people, or electronically through an electronic document management operator.

How to fill out 6-NDFL.

Now let’s learn how to correctly prepare and fill out the calculation of 6 personal income taxes. To make it more clear and visual, let’s do this with a specific example. “For the 1st quarter, Mir LLC paid employees a salary of 120,000 rubles, including 40,000 rubles for January, 40,000 rubles for February, 40,000 rubles for March. The company has 3 employees. Two receive deductions for children of 1,400 rubles. per month. The date of payment of salaries to employees is the 3rd day of each month.”

1. Let’s calculate the amount of tax deduction for 2 employees per month: 1400x2= 2800.

2. For the quarter, respectively: 2800x3=8400.

3. Let’s move on to calculating the amount of accrued personal income tax for the 1st quarter:

Formula for calculating personal income tax

Personal income tax = (Total income - Total amount of deductions) x Personal income tax rate

Personal income tax = (120000-8400)x 13% = 14508.

We have all the data to fill out 6NDFL, let’s get started:

Title page.

The title page does not present any difficulties, because... its completion is similar to other tax reports. You just need to enter the necessary information in the fields:

Correction number.

If you are submitting a primary report, then enter “000”.

Presentation period. 21

- quarter;

31

- half a year;

33

- 9 months;

34

- year.

In our case, we set the code “21”. Taxable period

.

“2016” - as you understand, the year for which the calculation is submitted is indicated. Below we enter the code of the tax authority

and

the location code of the tax agent.

For example, “212”, as in our example, means the place of registration of a Russian organization.

The line below is the name of the company or individual entrepreneur

, as well as the

OKTMO

, which can be taken from the Unified State Register of Legal Entities extract or from the statistics information letter when registering a company, and

a contact telephone number

.

Let's move on to the bottom of the Title Page. Depending on the category of the signatory, we enter “1” - tax agent

or

“2” - representative of the tax agent.

Full name of the manager or authorized person, signature and date of submission of the report. It is worth remembering that if the payment is submitted by an authorized person, then at the bottom of the sheet after the signature and date, the documents on the basis of which this person is considered authorized must be indicated!

Now let's proceed directly to the calculation itself. I would like to draw your attention to the peculiarity of the calculation of 6NDFL is that general indicators for the organization are submitted, and not specifically for each employee, as in 2NDFL.

Section 1.

Line 010

– tax rate. We choose a rate - in our case it will be 13%.

Line 020

– in fact, this is the income accrued by the organization (120,000 rubles)

Line 030

– tax deductions. According to our example, they amounted to 8,400 rubles.

Line 040

– it must indicate the amount of calculated personal income tax, which is calculated according to the formula specified above. It is equal to 14508 rubles.

Lines 025 and 045

on dividends, if necessary.

Line 050

– it is relevant only if there have been advance payments offset against personal income tax on the income of foreigners working under patents.

Line 060

– you need to record the number of employees who received income. Following our example, we have 3 of them.

Line 070

– in the column we enter the tax withheld from employees when transferring wages.

If the tax amount was partially not withheld or returned by the tax agent, in this case you will need to fill out lines 080 and 090.

Section 2.

Unlike section 1,

it is completed

for the last 3 months

of the reporting period.

Line 100

- record the date when employees actually received income. According to paragraph 2 of Art. 223 of the Tax Code of the Russian Federation is the last day of the month for calculating salaries.

Line 110

– the date when the tax was withheld. According to the law, this is the date of direct payment of income (clause 4 of Article 226 of the Tax Code of the Russian Federation).

Line 120

— the deadline for tax payment specified in clause 6 of Art. should be entered here. 226 Tax Code of the Russian Federation. This rule is stated in the letter of the Federal Tax Service of Russia dated January 20, 2021 No. BS-4-11/546.

Line 130

– display the amount of accrued income without tax withholding as of the date recorded in

line 100

.

As we previously thought, it is equal to 40,000 rubles.

Line 140

– and here we just indicate the amount of tax withheld as of the date on

line 110

.

(Personal income tax = (40000-2800) x 13% = 4836 rubles

- calculation using the formula in the example).

I would like to draw your attention to the moments of filling out lines 100,110,120

during the so-called “transition” period.

This is when wages are accrued in one reporting period, and taxes are withheld and transferred in another. For example, for March 2021 or further for June 2021. In this case, you should be guided by the letter of the Federal Tax Service of Russia dated February 25, 2021 No. BS-4-11/3058. It says that this operation should be included in the report for the 1st quarter in section 1

, and in

section 2

the tax agent has the right

not to display

.

But in the reporting for the half-year, this information must be indicated without fail in section 2. That is, in the reporting for the half-year, initially in line 100

it will be necessary to indicate the date of actual receipt of income for March

03/31/2016

, in

line 110

- the date of tax withholding for March, in our case it will be 04/03/2016, and in line 120 - the deadline for transferring the tax, namely

04/04/2016

.

At the end of our article, I would like to advise you to read the letter of the Federal Tax Service of Russia dated January 20, 2021 No. BS-4-11 / [email protected] , which sets out the control ratios for tax authorities to check the new Form 6 of personal income tax. By using them, you can find out for yourself whether the report has been compiled correctly.

The most detailed information about the procedure for generating reports related to the remuneration of employees, such as 2NDFL, Pension Fund, Social Insurance Fund, as well as an explanation of all the nuances relating to the calculation of employee salaries can be obtained by enrolling in the course “Payroll and HR Accounting + 1C ZUP 8.2” .

Matasova Tatyana Valerievna expert on tax and accounting issues

New control ratios for form 6-NDFL

Since the approval of Form 6-NDFL, the Federal Tax Service has repeatedly approved control ratios, replacing those previously issued. Thus, for the first time, control ratios were issued in accordance with the letter of the Federal Tax Service of Russia dated December 28, 2015 No. BS-4-11 / [email protected] Less than a month later, the Federal Tax Service of Russia issues another letter on control ratios in form 6-NDFL dated January 20, 2016 No. BS -4-11/ [email protected] In June 2021, the control ratios sent by the Federal Tax Service of Russia by letter dated March 10, 2016 No. BS-4-11/ [email protected]

Based on materials from: glavkniga.ru

Changes to OKVED from 01/01/2017

Payment of sick leave in 2021

03.02.2017 13:01