Foreign worker with a patent: we reduce personal income tax by a fixed advance payment

On August 21, 2021, Lotos LLC received a notification from the Federal Tax Service, allowing in 2021 to reduce personal income tax on the income of R.K. Zakirova. On August 31, 2021, he was accrued the remainder of his salary for August (minus the previously paid advance) in the amount of 17,500 rubles. (RUB 35,000 / 2).

/ condition / Citizen of Tajikistan R.K. On July 13, Zakirov was hired by Lotos LLC (Lyubertsy, Moscow Region) with a salary of 35,000 rubles. per month. Upon employment, among other documents, he presented a patent issued on 07/06/2021 and a receipt for payment of fixed advance payments for personal income tax in the amount. He also wrote an application for offset of the tax paid.

Table indicating fixed payments for each region of the Russian Federation

The table is very voluminous. It consists of eight Federal Districts and their constituent regions, Autonomous Districts, cities, territories and other constituent entities of the Russian Federation. This table can be viewed by following the link.

How to calculate the cost using the formula

Calculating the cost of a patent for a month or a year is very simple.

To do this you need to know such parameters as:

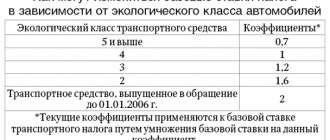

- Base rate (BS). It is approved in the amount of 1200 rubles.

- Deflator coefficient (CD) of personal income tax for the calculated year. In 2021 it is 1.623.

- Regional coefficient (RC). It is established and approved by each region of the Russian Federation independently, taking into account the needs of the subject’s market for labor resources. If it has not been approved, then its value is equal to one. Changes annually.

Knowing all these parameters, we calculate the monthly payment:

- MP=RK*KD*BS

For greater clarity, consider an example:

- Let's say a foreigner works in Sochi. The RK there is 1.786. All other parameters are unchanged.

- MP=1200*1.623*1.786=3478.00 rub.

- For the year, this figure will be 3478.00*12 = 41736.00 rubles.

How to fill out 6 personal income tax if there are foreigners on a patent and return personal income tax

Here accountants have the following questions: can these “advances” be offset in 2021, and if not, does a foreigner have the right to a refund of excessively withheld personal income tax through his inspectorate at the place of registration? Let us say right away that you can begin to reduce the personal income tax accrued to a migrant only after receiving a corresponding notification from your Federal Tax Service. 6 tbsp. 227.1 Tax Code of the Russian Federation. As follows from the notification form approved. By Order of the Federal Tax Service dated March 17, 2021 No. ММВ-7-11/[email protected], it confirms the employer’s right to reduce the calculated amount of tax in a particular year. Since an application for offset of the value of the patent was not submitted in 2021, accordingly, a “permissive” notification from the Federal Tax Service for 2021 was not received. Set off the amount of “advances” paid for the period of validity of the patent falling in 2021 in 2021 The employer cannot, even if he receives a notification from the inspectorate for the current year 2021.

- Kyrgyzstan became the 5th country party to the Treaty on the EAEU, No. 17

- Foreigners who have been granted temporary asylum in the Russian Federation: what about contributions to the Federal Compulsory Medical Insurance Fund, No. 17

- Responsibility for a migrant’s work outside his specialty is now directly provided for in the Code of Administrative Offenses of the Russian Federation, No. 15

- Once upon a time there lived an illegal migrant on the premises of a company: what does this entail, No. 13

- Personal income tax rates and contributions on payments to foreign employees, No. 12

- Can a migrant with a patent perform traveling work, No. 12

- Memo to the FMS notification on the hiring and dismissal of visa-free migrants, No. 11

- Is paying wages to a foreign worker from the cash register a violation?, No. 7

- Master class on employment of foreigners from the EAEU, No. 5

- “Working” patent for visa-free migrants, No. 2

- Rules for hiring and dismissing workers from abroad, No. 1

- 2021

We recommend reading: FSS number by reg number on the FSS website

Changes to the document

Since its introduction in 2021, it has undergone significant changes:

- Tied to a specific territory. A foreigner can only work in a designated territory. If he wants to work on several at once, then to do this he must obtain the appropriate number of patents (1, 2, 3). In case of violation of this clause, he will be punished with a fine (5000 - 7000 rubles) and deported from Russia and included in the list of those prohibited from entry for a period of 3 - 10 years.

- The activities that he can perform are indicated. If, after filing a patent, the foreigner has mastered a new type of activity and wants to engage in it. He needs to include it in the patent by contacting the authority that issued it (the Main Directorate of the Ministry of Internal Affairs). In case of violation of this clause, he will be punished with a fine (5000 - 7000 rubles) and deported from Russia and included in the list of those prohibited from entry for a period of 3 - 10 years.

- The tax paid when registering a patent changes annually, as the regional deflator coefficient changes.

- There are restrictions on the permissible number of foreigners in various economic activities:

- agricultural activity – 50%. With the exception of Khabarovsk, Krasnodar, Stavropol territories and Lipetsk, Astrakhan, Rostov, Voronezh, Saratov and Volgograd regions. In the listed territories and regions, there is a labor shortage due to harvesting.;

- passenger transportation – 30%;

- activities related to transportation and work on freight transport – 30%;

- sales of tobacco products – 15%;

- sales of alcohol-containing products in specialized stores – 15%, etc.

- Bans are being introduced on the involvement of foreigners in various fields.

Thus, in St. Petersburg and the Leningrad region it is not allowed to accept foreigners into such areas of activity as:

- office work at the enterprise;

- sale of timber and building materials;

- production of food products (for children);

- accounting, etc.

When purchasing a patent, a foreigner must take into account the above-mentioned features of the regions of the Russian Federation.

Read whether emigration to Spain is possible. How does the entry and exit of foreign citizens into the Russian Federation proceed? The answer is here.

Personal income tax on a patent for a foreigner and all the features of its calculation

For visa-free foreigners with a work permit, it is possible to offset advance payments against personal income tax. This is done through the employer at the request of the employee or by personal application after the expiration of the tax period. To apply independently, additional documents are required - a 2-NDFL certificate and a 3-NDFL declaration. In any case, the employee himself must contact the tax office at his place of work and receive a notification about the legality of such a deduction.

For many accountants, filling out paperwork for foreign employees is a difficult task. This process becomes habitual only if such workers are hired frequently. If we add to these difficulties the need to reflect deductions, the process becomes even more complicated.

How to get

Foreigners who wish to become holders of a patent to work in the Russian Federation must:

- cross the border of the Russian Federation using a foreign passport;

- In the migrant’s card when crossing the border, indicate “purpose” - work;

- take out insurance;

- register. All foreigners are required to do this within 7 days. Exception - citizens of Tajikistan - 15 days;

- apply for a patent (30 days are given for this).

Documents for obtaining a patent:

- application filled out in blue pen;

- passport and its copy with translation. The copy must be certified by a notary;

- migration card;

- voluntary health insurance policy;

- certificate from a medical institution. A foreigner must undergo a medical examination to ensure that he is free of diseases, HIV, etc.;

- confirm the absence of a criminal record;

- present temporary registration;

- confirm registration;

- provide photographs (4 pcs.);

- confirm personal income tax payment;

- confirm successful completion of the Russian language exam. This exam is not taken by representatives of Belarus or school graduates from neighboring countries;

- collect the entire package of required documents and contact the Main Directorate of the Ministry of Internal Affairs of Russia or the state. services. Registration can be done through an intermediary. In this case, beware of fake patents. Many companies simply make money this way. As a result, you will have no money and no patent. Be careful!

The competent authorities check the entire package of documents and if everything is in order, they issue a patent within 10 days. Otherwise there will be a refusal.

After a patent is issued to an employee, he must get a job within two months and confirm this fact - provide a copy of the contract. Otherwise, the patent will be revoked.

By working without a patent, a foreigner exposes himself to risk. If, in the event of an inspection, his place of work is established, he faces a fine (5,000 - 7,000 rubles) and deportation from the Russian Federation. The Main Directorate of the Ministry of Internal Affairs of the Russian Federation can ban entry for up to 10 years.

How to correctly reflect an advance in form 6-NDFL (nuances)

- The date of actual receipt of income (line 100) is 08/31/2021;

- Tax withholding date (line 110) is 09/05/2021;

- The tax payment deadline (line 130) is 09/06/2021;

- The amount of income actually received (line 130) is 738,000 rubles;

- The amount of tax withheld (line 140) is RUB 95,940.

Thus, an advance is an element of an employee’s income that is subject to personal income tax and, as a result, has every reason to be included in personal income tax reports, one of which is form 6-NDFL. You will find out whether the advance is reflected in 6-NDFL in the next section.

We withhold personal income tax from a foreigner for a patent

If a foreigner paid a lump sum for a patent, the validity period of which relates to different tax periods, a notification must be received for each year. Tax can be reduced only by the amount of fixed payments that relate to a specific tax period. For example, a foreigner paid for a patent whose validity period is from November 1, 2021 to October 31, 2021. To offset the full amount of fixed payments, the tax agent must have two notices - one separately for 2021 and one for 2021. At the same time, in 2021, the amount of personal income tax withheld from a foreigner’s income can be reduced by fixed payments that fall in January–October 2021.

We recommend reading: Popular problems in land surveying

After employing a foreigner and concluding an employment contract with him, personal income tax on his income is calculated and withheld by the employer - tax agent. The tax rate is 13 percent regardless of whether the foreigner is a resident (paragraph 3, paragraph 3, article 224 of the Tax Code of the Russian Federation). In this case, the personal income tax amounts previously transferred by the foreigner as a fixed advance payment are required to be counted by the tax agent against personal income tax on the income that he pays to the foreigner after hiring. In this case, the place of payment of fixed payments does not matter. A foreigner can pay for them both at the place of employment and at the place of his residence. In any case, the tax agent must accept these amounts for offset (letter of the Federal Tax Service of Russia dated March 16, 2021 No. BS-3-11/1096).

Foreign worker with a patent: we reduce personal income tax by a fixed advance payment

Its form was approved by the order of the Ministry of Finance of the Russian Federation “On approval of the application form for confirmation of the right to reduce the calculated amount of personal income tax by the amount of fixed advance payments paid by the taxpayer.” The act was issued on November 13, 2021 under the number ММВ-7-11/ Necessary conditions In essence, a tax agent is any legal entity operating within the Russian state that receives profit in the course of conducting production activities. His functional responsibilities include withholding personal income tax from the employee for the purpose of transferring it to the federal budget. The norm is provided for by the instructions of Articles 226-227.1 of the Tax Code of the Russian Federation. The procedure for collecting tax and returning it is regulated by the standards of Article 231 of the Tax Code of the Russian Federation. The employer must deduct it based on the advance payments paid by a citizen of another country.

Foreigners have the right, in cases provided for by the Legislative Framework of the Russian Federation, to compensate the NFL under a patent. What are the features of the procedure and what amount of compensation can a foreign taxpayer expect?

Personal income tax offset on a patent for the entire year or from the date of receipt of the notification

STEP 3.

Wait until the inspection

receives

“permit”

notification of approval.

By order of the Federal Tax Service dated March 17, 2021 No. ММВ-7-11/. It will be sent to you within 10 working days from the date of receipt by the Federal Tax Service of the said application, provided that clause 6 of Art. 227.1, paragraph 6 of Art. 6.1 Tax Code of the Russian Federation:

What follows is a long process of coordinating databases between tax and migration authorities on registering a migrant and calculating the period of his stay in the Russian Federation. They also check the honesty of the employee himself: whether he has made a similar demand to anyone else at his place of work as a part-time employee. Then the tax authorities prepare a personal notice for the employer with information about which period can be recalculated. So, before returning the overpaid personal income tax on a patent to a foreigner for the previous tax period, you need to carefully study the data received from the tax office.

How to return personal income tax on a patent to a foreigner for the previous tax period

Thus, if a foreigner worked for different employers during the year, he can choose which of them to apply for a tax reduction. The tax agent who has received this application, as well as the above notification from the tax office, will be able to reduce personal income tax by all fixed advances paid for the period of validity of the patent in relation to the corresponding tax period.

The new procedure applies to foreign citizens working under a patent not only for individuals, but also for organizations, individual entrepreneurs or individuals engaged in private practice. In relation to previously issued patents until their expiration, the previous procedure for paying personal income tax remains unchanged.

What is a patent

A patent is a permit confirming the right to work on the territory of the Russian Federation by a foreign citizen who arrived from a state with which Russia has visa-free relations (FZ-115 dated January 1, 2015).

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Adult citizens (over 18 years of age) are entitled to receive it.

It is required when working (Article 227.1 of the Tax Code of the Russian Federation):

- for individuals (work on subsidiary farms, for the personal purposes of the employer without receiving economic benefit);

- at enterprises, individual entrepreneurs and individuals practicing private activities (notaries, lawyers, etc.).

A patent is mandatory for temporarily staying citizens. Not required for citizens living in the countries of Belarus, Armenia, Kazakhstan and Kyrgyzstan and persons prescribed in Federal Law-115, clause 4, article 13 of 01/01/2015. But Azerbaijanis, Ukrainians, Abkhazians and Uzbeks are obliged to receive it.

A patent is issued in the form of a unified strict reporting form. Has protection in the form of a hologram, contains a barcode, number and series.

Patents vary in color. Red ones are issued for working with individuals. persons, and blue ones are legal. individuals and individual entrepreneurs. You cannot work with a legal entity with a red patent. individuals and individual entrepreneurs and vice versa.

The patent must contain information about its owner (full name, year of birth, passport data, citizenship, Taxpayer Identification Number), photo, and also indicate the type of activity that he can engage in. The region of validity of the patent, the date of issue and by whom it was issued must be specified. A foreigner does not have the right to work in a region that is not named in the patent.

How to fill out 6 personal income tax if there are foreigners on a patent and return personal income tax

Now about what amount is accepted for reduction. If the amount of fixed advance payments paid during the validity period of the patent in relation to the corresponding tax period exceeds the amount of tax calculated at the end of this tax period based on the income actually received by the taxpayer, the amount of such excess is not the amount of overpaid tax and is not subject to refund or credit to the taxpayer.

However, the tax office may refuse, in which case the offset will naturally be unavailable and personal income tax will have to be withheld from the migrant’s labor income in full. A refusal is possible if p. In other words, when a foreigner is simultaneously employed in several places, he will have to choose which of the employers will seek credit. It will not be possible to do this for all places of work. Letter from the Federal Tax Service from the place where the foreigner transferred money for this or that patent does not matter. Letter from the Federal Tax Service from Accordingly, the amount of advance payments attributable to the period of validity of the patent in the declared year is always taken into account. Regardless of when the employer received the notification Letter from the Federal Tax Service from Therefore, if the document is late and you have unduly withheld personal income tax from the foreigner’s labor income, you should return the overpayment to him by reducing the tax for both this person and his colleagues. To do this, the migrant writes an application in which he indicates his bank account.

Rules for calculating and withholding personal income tax for foreigners who arrived in Russia on a visa-free basis

Since 2015, foreign citizens who arrived in Russia from countries that do not require a visa can carry out employment activities only on the basis of a patent issued in accordance with Federal Law dated July 25, 2002 N 115-FZ “On the legal status of foreign citizens in the Russian Federation.” Federation".

According to Art. 13.3 of Federal Law No. 115-FZ of July 25, 2002, a patent is issued to foreign citizens who arrived in the Russian Federation in a manner that does not require a visa, with the exception of certain categories of foreign citizens.

The following can operate without a patent:

- foreigners who have obtained a work permit as highly qualified specialists (HQS);

- foreigners who arrived from member countries of the Eurasian Economic Union (EAEU), in particular citizens of: Belarus, Kazakhstan, Kyrgyzstan and Armenia;

- foreigners who have received refugee status;

- foreigners who have received temporary asylum in the Russian Federation.

A patent is a document confirming the right of a foreign citizen who arrived in the Russian Federation in a manner that does not require a visa to temporarily carry out labor activities on the territory of a constituent entity of the Russian Federation.

A patent is issued to a foreign citizen for a period of one to twelve months, with the possibility of repeated extension for a period of one month, but not more than 12 months from the date of issue of the patent, by paying fixed advance payments by the migrant.

According to paragraphs 2 and 3 of Art. 227.1 of the Tax Code of the Russian Federation establishes that fixed advance payments for personal income tax are paid by a foreigner for each month of validity of the patent in the amount of 1,200 rubles. taking into account indexation by the deflator coefficient established for the corresponding calendar year, as well as by the coefficient reflecting the regional characteristics of the labor market, established for the corresponding calendar year by the law of the subject of the Russian Federation.

In 2021, the deflator coefficient according to Order of the Ministry of Economic Development of Russia dated October 20, 2015 N 772 was 1.514, and the regional coefficient in Moscow was 2.3118 (Moscow Law dated November 26, 2014 N 55).

Thus, the cost of a patent per month (fixed advance payment for personal income tax) in Moscow is 4,200.00 rubles. (1200 x 1.514 x 2.3118).

A foreigner can pay a fixed advance payment either monthly or several months in advance, but not longer than the period for which the patent is issued (maximum period 12 months).

When concluding a contractual relationship with a foreigner who has issued a patent in the prescribed manner, the employing organization acts as a tax agent for personal income tax. That is, the tax agent must calculate the total amount of personal income tax on the income of taxpayers - foreign citizens (using a tax rate of 13% - clause 3 of Article 224 of the Tax Code of the Russian Federation) regardless of the status of their recipient - resident or non-resident.

It turns out that for the same tax period, a foreign employee pays personal income tax twice, the first time in advance in the form of a fixed advance payment for each month the patent is valid, and then, in fact, the tax agent withholds from the accrued remuneration and transfers it to the personal income tax budget.

In order to avoid double taxation in accordance with clause 2 of Article 226 and clause 6 of Article 227.1 of the Tax Code of the Russian Federation, on the basis of a written application of a foreigner and a receipt for payment of fixed advance payments, the tax agent reduces the calculated personal income tax by the amount of advance payments paid for personal income tax. To reduce the calculated personal income tax, only the application of a foreigner and the fact of payment of advance payments by the migrant is not enough. The tax agent must contact the tax authority for confirmation of the right to take into account the advance payments made when withholding personal income tax.

The supporting document is the Notice of confirmation of the right to reduce the calculated amount of personal income tax by the amount of fixed advance payments paid by the taxpayer (migrant), which is sent to one tax agent in the tax period within 10 working days from the date the tax authority receives the application from him. The Notification form was approved by Order of the Federal Tax Service of Russia dated March 17, 2015 N ММВ-7-11/ [email protected]

Without Notification, the employer, who is a tax agent, does not have the right to take into account the advance payments paid by the migrant and, as usual, withholds personal income tax from payments to the benefit of the foreign employee at a rate of 13%.

If the calculated amount of personal income tax for the month of the corresponding tax period is less than the amount of the fixed advance payment paid, then the difference can be deducted in the next month (Letter of the Federal Tax Service of Russia dated September 23, 2015 N BS-4-11 / [email protected] ).

For example:

A foreigner got a job with an employer who has been located in Moscow since February 1, 2021, and immediately wrote an application to reduce the calculated personal income tax by the personal income tax paid in advance of 4,200.00 rubles. At the end of February, the tax agent received from the tax authority a Notice of the right to take into account fixed advance payments.

For February, the foreigner was accrued 30,000.00 rubles, the calculated personal income tax amounted to 3,900.00 rubles. (30,000.00 x 13%), which must be reduced by the advance payment of 4,200.00 rubles, but not more than by the calculated personal income tax of 3,900.00 rubles. The difference between the fixed payment paid and the calculated personal income tax is 300.00 rubles (4200 – 3900).

In March, a foreigner was accrued 40,000.00 rubles, the calculated personal income tax will be 5,200.00 rubles (40,000.00 x 13%), which must be reduced by the advance payment for March of 4,200.00 rubles. and the difference from February is 300.00 rubles. Personal income tax payable to the budget will be 700.00 rubles. (5200.00 – 4200.00 – 300.00).

If the amount of fixed advance payments paid during the period of validity of the patent, in relation to the corresponding tax period, exceeds the amount of tax calculated at the end of this tax period based on the income actually received by the taxpayer, the amount of such excess is not the amount of overpaid tax and is not subject to refund or credit to the taxpayer (clause 7 of article 227.1 of the Tax Code).

Personal income tax for foreign workers for employment, who do not need to obtain a patent and pay fixed advance payments, is 13%, regardless of resident status or not. Such foreigners include:

- highly qualified specialists (paragraph 4, paragraph 3, article 224 of the Tax Code of the Russian Federation);

- refugees and persons who have received temporary asylum (paragraph 7, paragraph 3, article 224 of the Tax Code of the Russian Federation);

- foreigners arriving from the EAEU countries (Belarus, Kazakhstan, Kyrgyzstan and Armenia) clause 1 of Art. 7 Tax Code of the Russian Federation; Art. 73 of the Treaty on the Eurasian Economic Union dated May 29, 2014.

For other visa-free foreigners, the personal income tax calculated by the tax agent at a rate of 13% is reduced by the amount paid by the migrant himself in fixed advance payments.

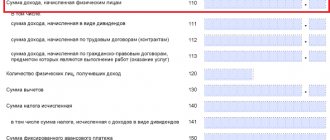

Based on the results of the tax period (calendar year), the tax agent, no later than April 1 of the year following the tax period, provides information about each taxpayer to the tax authority in form 2-NDFL, about income and the amount of tax calculated, withheld and transferred to the budget. The same form reflects the amount of fixed advance payments accepted to reduce the amount of calculated personal income tax.

Author of the article: Tatyana V. Tarasova – leading expert consultant and lecturer.

February 2021

Read more on the topic “Personal income tax and insurance premiums in 2021”

Yours sincerely,

"Pravovest Audit"

8 (495) 231 — 23 — 21 (multichannel)

We are always happy to help you! Contact the professionals!

Personal income tax for a patent

For the latter and most other subjects of the Federation, the choice remains between the post office and queues at the migration authorities. Our recommendations are as follows: all notifications on the conclusion and termination of employment contracts with foreign workers arriving from EAEU member states who have a temporary residence permit, residence permit, refugee status or certificate of temporary asylum or the status of a participant in the program for the resettlement of compatriots, as well as notifications on termination of employment contracts with foreign citizens carrying out labor activities under a patent - send to the migration authorities by mail in a valuable letter with an inventory and notification of delivery.

We recommend reading: Supplement to the pension for the husband of an officer’s widow after 80 years in 2021

The provisions of Chapter 23 of the Tax Code of the Russian Federation do not regulate the procedure for the actions of a tax agent upon receipt of a Notification after the end of the corresponding tax period, but before the submission of personal income tax reporting to the tax authority for the specified period. The letter of the Federal Tax Service of Russia dated September 23, 2021 N BS-4-11/ [email protected] states that after receiving a Notification from the tax authority, the tax agent, when reducing the calculated personal income tax, has the right to take into account the amounts of previously paid fixed advance payments for the period of validity of the patent, regardless of date of receipt of the Notification.

Personal income tax offset on a patent for the entire year or from the date of receipt of the notification

Foreign citizens who arrived in Russia in a manner that does not require a visa and who have reached the age of 18 can work on the basis of a patent. During the validity period of the patent, they must pay fixed advance payments for personal income tax (clause 2 of article 227.1 of the Tax Code of the Russian Federation).

In order for a tax agent to reduce the calculated amount of tax by paid fixed advance payments, he will need to receive a notification from the tax office giving him the right to do so. To receive a notification you must have:

Migrant workers on patent: we analyze individual personal income tax situations

- in this situation, should the employer recalculate personal income tax in connection with the migrant’s change of status and reflect this in the 2-personal income tax certificate submitted at the end of 2021;

- Is it necessary to submit two 2-NDFL certificates for this foreigner with different taxpayer statuses and different tax rates;

- what taxpayer status code (1, 2 or 6) and what personal income tax rate (30% or 13%) should be indicated in the certificate?

Here is what a specialist from the Ministry of Finance answered us about this.

Let us say right away that you can begin to reduce the personal income tax accrued to a migrant only after receiving the appropriate notification from your Federal Tax Service 7. As follows from the notification form 10, it confirms the employer’s right to reduce the calculated amount of tax in a particular year. Since an application for offset of the value of the patent was not submitted in 2021, accordingly, a “permissive” notification from the Federal Tax Service for 2021 was not received. Set off the amount of “advances” paid for the period of validity of the patent falling in 2021 in 2021 The employer cannot, even if he receives a notification from the inspectorate for the current year 2021. After all, it will only be valid for fixed payments paid for the period of validity of the patent relating to 2021, since the personal income tax reduction is made during the tax period 11.

Personal income tax of a foreigner: procedure for offsetting advance payments under a patent

x

Check Also

What to do if a pedestrian is hit by a car The answer to the question of what to do if you are hit by a car, you need to know in advance, imagine the algorithm of actions in your head and do everything to avoid getting hit...

MTPL reform 2021: the essence of innovations and the latest news The MTPL reform proposed by the Ministry of Finance, which will come into force in 2018, has already created a lot of heated discussions and disputes. U...

Discounts for compulsory motor insurance: how to get, find out, check and other questions Alas, a significant part of motorists do not even try to understand how to find out the discount coefficient for compulsory motor liability insurance, accepting any amount named by an employee of the auto insurance company, ...

New state license plates in Russia are planned to be introduced in the near future: large-scale reform New state license plates in Russia for all vehicles can be introduced as early as 2021. What changes...

Cancellation of evacuation: going through the throes of a long-suffering bill On September 1, 2021, new rules for paying for the storage of cars towed to an impound lot came into force, but the cancellation of evacuation from under prohibitory signs, ...

Rights and responsibilities of a traffic police inspector 2021: new regulations In order to be protected on the road and reasonably defend your own view of what happened, it is important for every motorist to know the rights and responsibilities of an inspector...

The Law on Compulsory Motor Liability Insurance with the latest amendments 40 Federal Laws: new edition 2018 -2018 On January 1, 2021, Law No. 214 “On Changes to Compulsory Motor Liability Insurance” came into force - according to this regulatory ...

If you didn't miss the ambulance: fine and rules Social networks are buzzing, discussing those who didn't miss the ambulance. Each new case of “blocking” of doctors rushing to a call convinces them to turn a blind eye...

Car loan subsidy program: how to participate? Current government programs and new projects will turn even more Russians into car owners, especially since Sberbank is offering car loans with government subsidies in 2021...

Retesting for a license after deprivation: rules, documents, law Citizens deprived of their driving license for a serious traffic violation in 2021 are forced to ask the question: is a retest for a license after deprivation necessary? "Troubles in...

Perpetual car registration: what is it? Pros and cons Very often those wishing to purchase a vehicle on the secondary market are faced with the concept of eternal registration of a car - what kind of status is this, why...

Spikes sign 2021: mandatory or not, size and fine Until 2018, drivers of cars with winter tires rarely cared about having the “Spikes” sign on their cars...

Parking in a space for the disabled: fine, rules, effect of the sign Until recently, the legislation of the Russian Federation was quite friendly towards motorists who occupied parking spaces for the disabled - however...

Parking in a space for the disabled: fine, rules, effect of the sign Until recently, the legislation of the Russian Federation was quite friendly towards motorists who occupied parking spaces for the disabled - however...

Registration of a car with the traffic police in 2021: what has changed, procedure, documents Registration of a car with the traffic police in 2021 has become a simpler procedure. Lawmakers have finally met halfway to domestic motorists and eliminated...

Medical examination for driving license: which doctors are required? In 2021, the procedure for a medical examination for a license has been significantly simplified - and the list of doctors to whom a driver must see has become shorter. A complete list of which doctors...

Medical examination for driving license: which doctors are required? In 2021, the procedure for a medical examination for a license has been significantly simplified - and the list of doctors to whom a driver must see has become shorter. A complete list of which doctors...

It is planned to reduce the allowance for the military. The military is planning to significantly reduce their allowance in the near future. But this is connected not only with the crisis that has broken out, but also with a number of other reasons, the main one...

Cancellation of state duty when replacing documents in Crimea Not long ago, the Ministry of Finance of the Russian Federation submitted to the Government Commission on Legislative Activities Bill No. 756755-6 “On Amendments to Article 333.35...

Loans will be banned at the proposal of the leader of A Just Russia There is a possibility that loans will be banned in the near future, Izvestia reports. This is due to the fact that on June 9, the leader of the “A Just Russia” faction received...

Russians expect a record increase in housing and communal services tariffs in 2021. A rise in prices today will not surprise anyone, and yet Russians should be mentally prepared for the next increase in housing and communal services tariffs in 2018. IN …

6-NDFL with foreign workers under a patent

In Letter dated May 17, 2021 N BS-4-11/ [email protected], the Federal Tax Service of Russia reported how to fill out Form 6-NDFL on income in the form of salary of a foreign employee working on a patent, when the amount of personal income tax from the salary is reduced by the amount of fixed advance payments .

example: a foreigner with a patent pays advance payments for personal income tax. The salary for September will be included in line 020. The salary was paid and personal income tax was withheld in October. But personal income tax is calculated with offset of paid advances on September 30, 2021. Will line 050 include paid advances for January-September or January-August?

When do you need to apply for a personal income tax reduction on a patent?

General concepts about taxation To check the validity period of a foreign worker’s patent, the employer must check in advance whether the specified person has made fixed advance payments.

During the tax period, the amount of personal income tax is allowed to be reduced only in one organization (individual entrepreneur), which must have a corresponding tax notice. The company reduces the tax upon the application of the employee and papers confirming the payment of advances for the patent. The tax office will issue a notification to the company if it has not been issued previously and the Federal Tax Service has information from the migration service about the existence of an employment agreement between the employee and the enterprise and the issuance of a patent to the worker. The notification is issued to the applicant within 10 days from the date of submission of the application. If the amount of the patent exceeds the withheld personal income tax, then the difference is not considered overpaid and is not subject to reimbursement.

Offset of advances on patents for personal income tax for previous periods for foreigners in 6 personal income tax in 2021

To do this, you should contact the Federal Tax Service with an application in the established form to receive a Notification of the fixed payments already made by the migrant worker under the patent. Letter No. BS-4-11/2622 of the Federal Tax Service dated February 19, 2021 defines the procedure for offsetting the advance cost of a work patent for foreigners when calculating personal income tax at the place of work. In connection with the new edition of Articles 226 of the Tax Code of the Russian Federation and 227.1 of the Tax Code of the Russian Federation.

Continuing my topic https://forum.klerk.ru/showthread.php?t=209954 in connection with changes in legislation that have come into force, I decided to move everything I collected on the Internet to a new topic. From January 1, 2021, foreign workers from “visa-free” countries temporarily staying in Russia will be required to obtain patents to work for legal entities or individual entrepreneurs. not a work permit.

How to reflect the offset of advance personal income tax payments on a patent from foreigners?

Refund of personal income tax to foreigners working under patents in 1C 8.3

Personal income tax for foreign workers on a patent is calculated, but at the same time, advance payments for personal income tax paid by the foreign worker themselves are offset (clause 2 of article 226 of the Tax Code of the Russian Federation, article 227.1 of the Tax Code of the Russian Federation). While the advance payment is being offset against personal income tax, tax is not accrued in the accounting department, i.e. no wiring Dt 70 Kt 68.01.

Let's consider the return of personal income tax to foreigners working under patents in 1C 8.3 using the example of payroll for February 2021. The employee worked this month in full.

Step 1. Entering information about taxpayer status and Notifications for advance payments for patents

Salaries and personnel – Personnel records – Employees – Income tax field.

Section Taxpayer Status - field Status: Non-resident, employed on the basis of a patent.

Section Notification for advance payments on patents - tax period, number, date of notification and code of the Federal Tax Service that issued it.

A notification can also be registered at Step 2. But it is more convenient to perform this operation at Step 1, then further information about the notification will be filled in automatically.

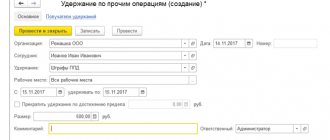

Step 2. Registration of the paid fixed advance payment for personal income tax

Salaries and personnel – Personal income tax – All documents on personal income tax – Create button – Advance payment on personal income tax – Post and close.

Notification details can be entered at this stage. Fill out the document as shown below:

Step 3. Payroll and offset of advance payment for personal income tax

Salary and personnel – All accruals – Payroll – Fill button.

Details of the calculation can be viewed by clicking on the link with the personal income tax amount of 5,850.00 in the personal income tax column or in the personal income tax register. A link to this register will also be available if you follow the link with the personal income tax amount of 5,850.00.

Postings

Control

SALT count 70

Calculation of the amount to be paid

In subsequent months, deductions will be made in the same way when calculating wages.

If at the end of the year there is an overpayment of personal income tax advances paid in the current year (the employee paid more personal income tax on a patent than was accrued to him), then this amount is not subject to return or offset (clause 7 of article 227.1 of the Tax Code of the Russian Federation).

In our example, the entire amount of the advance payment for personal income tax will be taken into account if the employee works the entire period up to December 31, 2018 inclusive.

Step 4. Checking personal income tax registers

Salary and personnel – Salary – Salary reports – Tax accounting register for personal income tax.

- Advance payments are taken into account (Article 227.1 of the Tax Code of the Russian Federation).

- The amount of advance payments has been offset.

Reimbursement of personal income tax to a foreign worker under a patent: specifics of the procedure

A labor patent is a specialized permit that allows foreign guests to officially find employment in the Russian Federation. Having issued the document, a foreign guest has the right to work as an employee for private individuals and legal entities.

The calculation is as follows: for example, an employee’s salary is 22 thousand rubles, then the citizen will be able to return 3 thousand rubles. If the salary is less than 22 thousand rubles, then the foreigner will return 13% of the amount withheld by the employer.

How to fill out 6 personal income taxes for an employer who has foreigners on patent

Since the organization received a full package of documents for tax reduction in June, advance payments paid during the validity period of the patent will be reflected in the half-year report. The deadline for transferring personal income tax coincides with the day of payment of wages. Salaries for May are paid on June 10, after receiving the notification, which means that no tax will be withheld from it. For months for which tax has already been paid, the employee will be given a refund. The salary for June will be transferred to the employee in July and will be included in the report for 9 months.

Venera LLC employed a citizen of Uzbekistan in March 2021. A foreigner works on the territory of the Russian Federation in the city of Moscow on the basis of a patent dated March 10, 2021. The document is valid for 11 months. The fee for the patent was 46,200 rubles, of which 42,021 rubles. refer to 2021. The notification from the tax office was received on June 2.