Labor of foreign citizens in Russia (residents and non-residents)

Within the framework of the country's tax code, a tax resident is a person who has stayed within the territorial borders of the state for at least 183 days during the last year. Acquiring this status obliges a person to transfer to budget funds amounts equivalent to the amount of taxes levied on Russians. Consequently, from a legal point of view, non-residents and persons residing in the Russian Federation on a temporary basis are equal in tax obligations.

Penalties for violation of deadlines and non-payment of taxes

A great way to make money on the Internet, including for beginners. With our partners, the “Workle” service, everything will work out: - work on the Internet on an official basis (conclusion of an agreement) - 2-NDFL certificate to confirm income (on request) - corporate online training for each vacancy - earnings with reliable partners throughout Russia - opportunity for career and professional growth - choice of your own work schedule on the Internet - loyalty program and motivation system (competitions, promotions)

The need to pay tax obligations in full and on time does not differentiate between nationalities. In the understanding of the Tax Code of the Russian Federation, there are only objects of taxation and taxpayers - residents or non-residents. This means that the degree and magnitude of liability for failure to pay taxes or deadlines applies to everyone who receives income in Russia or owns the relevant property.

Part of the mandatory actions for foreigners is taken on by their tax agent. He reports for the income paid and taxes withheld from them, and, accordingly, pays fines for any violations in this area.

Those cases when a non-resident must himself declare his obligations and transfer them to the treasury imply the imposition of financial, administrative or criminal liability on him. Moreover, even an attempt to leave the Russian Federation before the deadline for filing reports and paying taxes will not help to avoid it.

The fact is that Russia has concluded quite a few international agreements regarding mutual assistance in administrative and fiscal matters, as well as in matters of avoiding double taxation.

Employment contract with a foreign specialist

Legal confirmation of legal work activity is a contract. Moreover, every foreigner has the right to demand from the employer that the contract does not have a time frame, despite the fact that migration structures believe that as soon as the validity period of the patent can be considered expired, the contract will also lose its legal force.

Reference! The Labor Code of the Russian Federation regulates only the temporary removal of an employee from a position until the documents are extended and put in order.

Labor activity of foreigners: legal basis

The first law that any foreigner who wants to visit the Russian Federation needs to read contains the rules for crossing the Russian border (114-FZ dated August 15, 1996). It states that when entering without a visa, a future labor migrant must indicate his intention in a special section of the migration card. A foreigner entering under a visa regime is required to obtain a special work visa and invitation.

The following mandatory reading law No. 115-FZ of July 25, 2002 tells foreigners about their status in the Russian Federation, including the specifics of working in the Russian national economy.

How to properly accept a foreign specialist into a team and ensure further mutually effective cooperation is described in the article on the work activities of foreign citizens in the Russian Federation.

Personal income tax rate for foreigners

The total amount of bets on earned funds is equivalent to 30%. This is according to the law. But in practice everything is somewhat different:

- 13% is transferred from total income;

- certain categories of persons will contribute the same amount to the budget from their salaries, and an additional 15% from their dividends and compensations;

- if a person is the founder of a business company in Russia, then his dividends will be reduced by 15%, and other income items will be reduced by 30%.

Note! If within 12 months a person, due to current circumstances, changes his status and is no longer a resident, then his PFDL will be considered under a preferential scheme.

If the payer works on the basis of temporary residence permit

The regulations do not contain clear recommendations in this regard. It is recommended to apply general rules and refer to the rate specified in Article 224 of the Tax Code - standard tax of 13%. For employees working for a temporary residence permit, the calculation system should be used, as for other Russian citizens.

Highly qualified specialists

This concept is determined by the level of the employee’s monthly income. He can be considered highly qualified if a person earns at least 85 thousand rubles per month. 13% tax deductions will be deducted from his total profit. Moreover, if he is entitled to compensation, he must pay 30% of it.

Citizens of EAEU member countries

People who have citizenship of states that are permanent members of the economic Eurasian Union are protected by international treaties, within the framework of which they cannot be deducted from them into the tax budget an amount greater than what citizens of the Russian Federation pay. Therefore, it is the same 13%.

Amount of deductions from the salaries of persons with a patent

Those who carry out their labor activities under a patent transfer tax fees as follows. Once the patent is issued, an advance payment must be made. This value is fixed. Then you need to contact the fiscal authorities and obtain permission from them to change the advance tax assessment downward. The law allows no more than 10 days to make such a decision, after which the amount of contributions to the budget will be reduced by exactly the amount of the advance already made.

This video describes in detail how personal income tax is calculated for persons working under a patent:

How much will a non-resident give to the budget?

A foreigner with a visa will be able to work in the Russian Federation only with permission, and at the same time he will lose 30% of his income every month until the threshold of his stay in the country exceeds 183 days. The reduction rate works only for beneficiaries and persons with special status.

Personal income tax for non-resident shift workers

Working on a rotational basis does not reset the period during which the foreigner lived in the Russian Federation. At the same time, for the period when he is outside the state, the countdown will be automatically suspended. After the required number of days is calculated, the rate will be changed from 30% to the standard 13%.

Income tax for refugees

A person can consider himself a refugee only if he has official confirmation of this. This is proven by a special document, which states that he was forced to move by an emergency situation in his homeland. The migrant’s income will also be deducted 13%.

Tax rates for non-residents

The procedure for taxation of non-residents is established by Article 224 of the Tax Code of the Russian Federation. The rate is 30% of the income. For residents this rate is 13%. However, there are exceptions:

- Highly qualified employees. These are workers with a specific specialty. This category includes persons participating in the Skolkovo project. In this case, the salaries of specialists will be taxed at a rate of 13%. If an employee receives other forms of income from the company, they will be taxed at a rate of 30%.

- Foreign persons working on the basis of a patent. Since 2015, residents of countries with which Russia has a visa-free regime are not required to obtain a work permit. They need to apply for a patent. If applicable, income tax is paid in advance. If a person has a patent, he pays tax at a rate of 13%. The patent is valid for a limited time. The validity period is specified in the certificate from the Federal Tax Service.

- Foreign citizens with refugee status. In this case, the rate will also drop to 13%.

- Persons arriving from the EAEU countries. These citizens also receive benefits: simplified employment and preferential rates.

The list of exceptions also includes these employees:

- Participants in the resettlement program in the Russian Federation who were previously residents.

- People who have been given temporary asylum.

- Members of the crews of ships belonging to the ports of the Russian Federation.

In 2021, individuals do not have to pay personal income tax on funds received from foreign sources.

ATTENTION! The rate on income from shared ownership of a company for non-residents will be 15%.

Calculation example

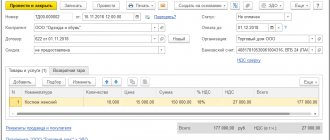

Let's look at a specific example of how the system for calculating personal income tax with foreign citizens works. Let’s say a person transfers 1,000 rubles every month as an advance payment, and this amount is fixed and adjusted by regional coefficients, the value of which may change.

This year it amounted to 2.319, while the deflator for the same period of time stopped at 1.623.

Based on these values, a foreign citizen must pay:

1,000 x 2.319 x 1.623 = 3,763.74 rubles.

KBK

BCCs for foreign migrants are assigned taking into account the following categories:

- from profit;

- patent work;

- when calculating the rate at 13%

- at a rate of 30%;

- in order to avoid double taxation at non-resident rates.

From this video you will learn how personal income tax is correctly calculated and withheld from foreign citizens who work in the Russian Federation:

Compensation payments

This category includes incentive income accruals. They are an integral part of earnings and cannot be separated from it when calculating the amount that must be transferred as a tax deduction.

It should be understood that compensation cannot be remuneration for conscientious work and is therefore taxed at the highest rate.

Can a non-resident count on a tax deduction?

If a person has non-resident status, tax deductions in relation to him are not accepted. This limitation is established by Article 210 of the Tax Code of the Russian Federation, paragraph 1 of Article 220 and paragraph 3 of Article 224 of the Tax Code of the Russian Federation. In addition, non-residents cannot use the method of reducing the income received from the sale of property by the purchase price of this property. These persons are not entitled to the benefits established by subparagraph 2 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation. That is, they cannot deduct expenses from income. This restriction was established in a number of letters from the Ministry of Finance. This is explained by the fact that a decrease in income for expenses is, in fact, a tax deduction, and it is not available to non-residents.

How to return overpaid personal income tax

The first thing you need to do is prepare a package of documents. There are no clear requirements in this regard; everything is considered individually. In this case, all copies of payment documents are submitted in full. A person should understand that fees must be transferred to the tax office where the employer’s enterprise is registered.

The migrant submits a personal petition with a request to return the overpaid funds for the past reporting period. Tax officials will study the document and make a decision.

Refugees from Ukraine: hiring, personal income tax, contributions and benefits

— maternity benefit; — a one-time benefit for women registered in medical institutions in the early stages of pregnancy; — one-time benefit for the birth of a child; — monthly child care allowance, etc.

Since Ukrainian refugees and Ukrainians who have received temporary asylum can be hired without permits, it turns out that in terms of employment they are practically equal to Russians (subclauses 11 and 12 of clause 4 of article 13 of Law No. 115-FZ). Consequently, there is no need to notify the employment service and the territorial branch of the Federal Migration Service of Russia about the conclusion and termination of labor relations with them (clause 9 of Article 13.1 of Law No. 115-FZ).

We recommend reading: We bought a garage but couldn’t register it because it was seized, what to do?

Hiring a citizen of Ukraine in 2021

- When inviting patent applicants to work, the employer is first of all obliged to verify the availability of an issued patent, as well as the compliance of the positions or area of work specified in the patent with the vacancy. In addition, a patent is issued and is valid exclusively on the territory of one subject of the Russian Federation, and if it is necessary to change the position of an employee or move to the territory of another part of the country, it is also necessary to replace the patent.

- In addition to the patent itself, the employer is also obliged to check that the applicant has a migration card and documents confirming the availability of medical insurance or medical support from an accredited medical institution. It is prohibited to employ Ukrainians who do not have a residence permit or temporary residence permit without insurance.

We recommend reading: Retirement compensation for 11 months worked

Many employers, accountants and HR specialists are interested in how the hiring of a citizen of Ukraine should be carried out in 2021. Considering the high level of employer responsibility for violation of labor and migration laws, any mistake can become critical for the enterprise. It should be understood that the procedure for hiring Ukrainians with a temporary residence permit (temporary residence permit), refugees and migrants, with a residence permit or patent is different, which should also be taken into account by the person responsible for personnel appointments.