In accordance with current legislation, each vehicle owner must pay the appropriate transport tax, which is calculated depending on the type of vehicle, its capacity and cost. Many car owners encounter certain difficulties when calculating such a tax on a car, because it is necessary to take into account various increasing and decreasing factors. We will tell you in more detail how to correctly calculate car tax in 2021.

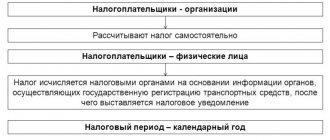

Transport tax in accordance with current legislation is paid by the owner of the vehicle. Tax authorities receive all the necessary data from the traffic police, which allows them to correctly calculate the amount of such tax in each specific case, after which car owners are sent a notice by mail to pay the tax. It should be said that such a calculation is carried out taking into account many additional correction factors, so many car owners reasonably have difficulties with correctly determining the amount of tax for each specific vehicle.

Main changes in the transport tax in 2020

When it comes to the fact that duty rates will remain at the same level. Some categories may expect their pay to be reduced for certain reasons. This mainly applies to owners of heavy vehicles weighing more than 12 tons. After all, they already pay a lot for causing harm to public roads. You can even limit yourself to these amounts.

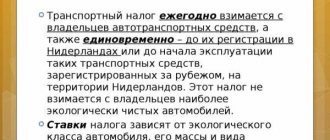

There are rumors that owners of cars with environmentally friendly engines will also fall under the preferential category. For now, this is all at the discussion level, but most likely such a decision will soon be approved. Many even European countries are prone to such moments and encourage owners of cars that use electric energy rather than gasoline or diesel fuel.

And, of course, there are established penalties if the car owner does not report on time that he has a car for use. Previously, you had to wait for the right moment and the relevant papers, and only then go to the bank and make a payment. Now, for this, a fine is established in the amount of 1/5 of the amount of tax that will be charged on the car. If a person says that he did not know about this, he will still have to pay the fine. Ignorance of the law cannot become a reason for exemption from established liability.

How is tax paid?

The algorithm for calculating and paying taxes is currently enshrined in current legislation. The State Traffic Safety Inspectorate sends information about all vehicles and their owners to the tax office. Relevant tax specialists calculate the amount for each specific car, after which car owners are sent a corresponding notification, to which receipts for paying the tax are attached. The car owner, having received such a receipt, must pay the amount he needs in a timely manner at any bank branch based on the received receipt. In the event that the amount is not paid within a specific period, a penalty begins to apply, which is accrued for each day of delay.

If the car owner does not pay the basic amount of the tax and the overdue amount, he is included in the list of debtors, which significantly complicates the person’s life. A certain encumbrance appears on a specific vehicle. It cannot be sold or re-registered until the tax is paid in full. Among other things, the owner of a vehicle who does not pay taxes and is in the debtor database cannot leave the country, and when transferring data to the court, bailiffs can begin the procedure for inventorying the property.

That is why we do not recommend that you ignore the need to pay such tax. Subsequently, you will still have to pay both the principal amount and the accrued interest penalties. The latter can be quite high, which leads to unnecessary expenses for the car owner.

Benefits when paying transport tax

Not only will all transport tax benefits for certain categories of car owners be maintained at the same level, but also the procedure for their calculation. No one will definitely reduce them, at least this year. It is worth noting that there is no exact list of benefit recipients, since local authorities are empowered to remove or add benefit categories at their discretion.

There is a lot to pay attention to the number of times cars leave the garage. After all, pensioners only rarely travel every day along the streets of a city or other populated area. It often happens that their cars are idle, and the tax must be paid in full. It is in this direction that government officials are working to establish transport tax benefits. But so far all this is to no avail. It would be more rational to increase the cost of fuel and then use it to deduct funds for road repair work. Whoever uses the transport will pay.

Should we expect changes in the coefficient values in 2021?

Please note that there is no of transport tax coefficients for 2017 . Nevertheless, the public is quite rightly inclined to increase their values. The explanation for this is inflationary processes and the corresponding rise in prices.

In this regard, similar consequences should be expected for coefficients.

NOTE! The 2021 tax advance for reporting periods must also be calculated taking into account all the necessary coefficients.

Individual categories

Officials decided to take a differentiated approach for some car owners. This decision will most likely be implemented soon. Most of all it concerns owners of cars with a hybrid engine, as well as with an electric motor. Some consider it advisable to include owners of cars running on gas fuel in this category. Due to the current crisis in the country, the Ministry of Finance is categorically against any decision taken aimed at reducing payments from transport owners.

As soon as the Plato program began to operate, owners of cars weighing more than 12 tons increased their costs for the benefit of the state. Many truckers even protested throughout the country. But even here the authorities decided to find a compromise. They completely abolish the transport tax for this category of citizens, or introduce certain benefits for the transport tax in order to achieve the difference by which the fees were increased earlier.

There are many opinions regarding transport tax reform. There are both supporters and opponents here. In most cases, it is possible to find your own alternative to such a duty in order to reduce aggression from car owners.

Legislative changes for 2021

From 2021, individuals who own vehicles can submit an application for benefits to the tax service without providing evidence of their existence. The Federal Tax Service will independently send a request to the necessary departments, to which they will need to respond within 7 calendar days. The innovation is due to the fact that individuals are forced to annually confirm their exemption for calculating transport tax. For a certain category of people (disabled people, combat veterans), the annual collection of the necessary certificates poses a certain problem. You can submit an application for benefits through a personal application to the Federal Tax Service, by sending a letter by mail, or by sending an electronic application through the official website of the Federal Tax Service or the State Services portal.

From 2021, the procedure for calculating the increase factor for cars with an average cost of 3 to 5 million Russian rubles is changing. Previously, for cars of this price category, 3 increase factors could be applied: 1.5 for cars less than 1 year old, 1.3 for cars older than 1 year but less than 2 years old, 1.1 for cars older than 2 but less than 3 years old. Now, for all cars of the specified price category and under 3 years of age, a single increase factor is applied - 1.1. This change is due to accelerated inflation in the country and rising prices. If in 2015 the list of cars subject to the luxury tax law included less than 200 vehicles, then in 2017 this figure increased to 708 units. Reducing the coefficient is a way to find a compromise between the claims of drivers whose cars have risen in price and are subject to the law, and the urgent need to replenish the state budget.

Alternative to transport tax

The very first option, which acts as an alternative to the transport tax, is to increase the excise tax on fuel, gasoline or diesel. The load will immediately become less for those who practically never use their car. But the amount of payment will become large for those constantly moving on the roads.

Most regional governors are against such a decision. They believe that as soon as gasoline prices begin to rise, protests from motorists will appear. This will lead to the reform becoming ineffective. But they don’t think that due to the absence of a transport tax, everything will fall into place.

Another option is to abolish the tax altogether for owners of vehicles with environmentally friendly engines running on electricity. But here you can forget about justice in society. After all, many citizens with low income will not be able to afford to purchase such transport. They will have to pay the full tax, which will be significantly increased.

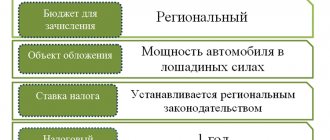

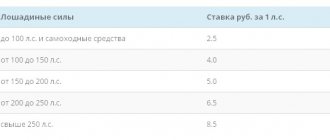

Setting tax rates

Tax rates that should be taken as a basis when calculating the amount of transport tax are indicated in Article 361 of the Tax Code of the Russian Federation. The same article states that local authorities have the right to set their own rates, which will differ by no more than 10 times less or more from the rates established in the Tax Code. This means that regional authorities have the right to make annual changes to the determination of tax rates or leave them unchanged. Please refer to local regulations to determine possible changes.

Online calculator for calculating transport tax from 2020

You should be able to correctly and know how to calculate transport tax. There are several options for this. If a person owns a business class or executive class car, then there are increasing coefficients that are commonly called luxury tax. The increased coefficient also applies to luxury vehicles.

In a standard calculation, the tax rate must be multiplied by horsepower:

TN=NS*LS.

If the car has been owned for less than a year, that is, it was recently purchased, then in addition to this there is a price

When do you need to pay taxes?

Many car owners have certain difficulties determining the time when they need to pay the tax and for what period such payment is made. For 2021, the last payment date for individuals is December 1, 2021. At the same time, legal entities must pay for the vehicles they use by February 5, 2021.

In this case, the tax is paid even if the owner did not operate the vehicle during the specified period; it was always under repair. You can get rid of the need to pay such transport tax only by selling it or recycling it in accordance with current legislation.

Benefits for paying transport tax in the regions of Russia

Let's take a more specific look at what benefits are available for paying transport tax in the regions.

Benefits for paying transport tax in the Republic of Bashkortostan

The grounds, procedure for calculation and benefits for paying transport tax are enshrined in the Law of the Republic of Bashkortostan dated November 27, 2002 No. 365-z “On Transport Tax”.

In the Republic of Bashkortostan the following categories of benefits for payment of transport tax have been established.

Regardless of the power of the cars, Heroes of the Soviet Union, Heroes of the Russian Federation, Heroes of Socialist Labor, Full Knights of the Order of Glory, Full Knights of the Order of Labor Glory are exempt from paying the tax.

Disabled people of groups 1, 2, 3, Labor veterans, Veterans of the Great Patriotic War, Chernobyl survivors, Veterans of military operations on the territory of the USSR, on the territory of the Russian Federation and the territories of other states, Veterans of military service, Veterans of public service can take advantage of tax benefits only for motorized wheelchairs , motorcycles, scooters and passenger cars with an engine power of up to 150 horsepower inclusive, as well as for trucks, from the date of manufacture of which more than 10 years have passed, with an engine power of up to 250 horsepower inclusive (for owners of two or more vehicles, a benefit is provided optionally for one vehicle of each type).

An additional benefit established in the Republic of Bashkortostan is available to owners of cars with installed gas equipment. Such citizens pay 80% of the tax rate per vehicle using natural gas as a motor fuel. If an individual owns more than 1 vehicle with gas equipment, the benefit is provided only for one vehicle of the person’s choice.

Benefits for paying transport tax in the Rostov region

Payment of transport tax in the Rostov region is provided for by the Law of the Rostov Region dated May 10, 2012 No. 843-ZS “On regional taxes and some taxation issues in the Rostov Region”, according to which it is established that residents of the Rostov Region are required to pay transport tax no later than February 10 of the year, following the tax period.

Regional beneficiaries for the payment of transport tax in the Rostov region are:

1. Heroes of the Soviet Union, Heroes of the Russian Federation, Heroes of Socialist Labor, citizens who are full holders of the Order of Glory, as well as public associations (organizations) created by them and consisting of them.

2. Veterans of the Great Patriotic War (participant in the war), combat veterans who have the right of ownership of passenger cars with an engine power of up to 150 horsepower (up to 110.33 kW), inclusive.

3. Citizens who have been granted ownership of a motor vehicle (minibus). Let us recall that in the Rostov region, the right to receive a minibus is given to low-income large families with an average per capita income, the amount of which does not exceed the subsistence level in the region per capita, who have lived in the Rostov region for at least 5 years and are raising eight or more minor children with dignity. .

4. Chernobyl victims, and citizens subject to the Law of the Russian Federation of May 15, 1991 No. 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant.”

5. Disabled people who own motorcycles, scooters or cars with an engine power of up to 100 horsepower (up to 73.55 kW) inclusive.

Prospects for innovation

The possibilities of modifying the transport tax are currently being discussed. There are 2 options available. The first is to abolish the transport tax and simultaneously increase fuel prices. The more often the driver uses the vehicle, the higher the tax amount, which seems fair. In addition, the existing procedure for calculating the amount of tax is largely based on engine power, expressed in horsepower. And the greater the engine power, the more fuel it will consume. But the Federal Tax Service stated that this innovation is not yet possible, since an increase in excise taxes on fuel will lead to an inevitable increase in prices for consumer goods.

The second alternative to a transport tax is an environmental tax, used in many Western countries. The bottom line is that a vehicle that emits more harmful gases into the atmosphere will be subject to more tax. This innovation will encourage drivers to purchase new, more environmentally friendly vehicles. But so far this proposal remains without approval from the State Duma.

Meaning

The quantitative ratio of entire months of ownership of a vehicle by a company to the number of months in a certain reporting or tax period is called the Q coefficient.

This indicator is calculated in ten thousandths. For example, 0.7933.

In the transport tax return it is indicated in Section 2 on line 160:

Also see “Increasing coefficients for transport tax”.