Video surveillance as an additional service is paid for by the owners according to the methodology adopted at OSS

The turning point in the case occurred in the Court of Cassation, where the management organization appealed. She indicated that the minimum list of works for the proper maintenance of the common property of the house does not include video surveillance services. Therefore, the owners have the right to determine the payment for it otherwise than in proportion to the share in the right of common ownership of the common property. This is within the powers of the general meeting of owners, which decided to pay for services at the rate per apartment.

The MA insisted that those adopted in accordance with Art. 46 of the RF Housing Code, decisions of the general meeting of owners are binding, and the company does not have the right to change them unilaterally. Consequently, she cannot make a recalculation, as required by the State Housing Registration Authority. The Court of Cassation finally heard these arguments and sided with the organization managing the house, noting that:

- Services for protecting the property of an apartment building do not relate to utility services, as well as to the costs of maintaining and repairing residential premises, but are additional (Articles 30, 46, 154 of the RF Housing Code, RF PP No. 491, RF PP No. 290).

- Making a decision to provide additional services to the owners of an apartment building falls within the competence of the general meeting of owners of premises in such a building.

- The method chosen and approved at the OSS for determining the fee for the maintenance of a video surveillance system in public areas - a fixed payment for each room in the house - does not contradict current legislation.

The Court of Cassation recognized the right of owners to independently determine the methodology for calculating fees for additional services, and such a methodology may not be based on the principle of proportionality to the share of each owner in the common property. The demands of the GZHN body were declared illegal, and the order was cancelled.

The supervisory agency filed a complaint with the RF Armed Forces, but the court refused to consider it, indicating that the previous authority made the correct conclusions. The GZHN body tried to refer to judicial practice, in which the fee for video surveillance was recognized as part of the fee for the maintenance of residential premises. But the Supreme Court of the Russian Federation indicated that the presence of such a judicial position does not indicate a violation by the court of uniformity in the interpretation and application of the law, because decisions in each case are made taking into account the circumstances of a particular dispute.

On the work required for the management authority to maintain the common property of the house

1094845

Depreciation

The cost of an asset is repaid by calculating depreciation (clause 17 of PBU 6/01).

The annual amount of depreciation charges using the linear method of calculating depreciation is calculated based on the initial cost of the fixed asset and the depreciation rate calculated based on the useful life of this object (clauses 18, 19 of PBU 6/01).

The useful life of an asset is established when it is accepted for accounting based on the expected period of its use (clause 20 of PBU 6/01).

At the same time, for accounting purposes, when establishing the useful life of an object of fixed assets (FA), the organization can be guided by the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation of 01.01.2002 N 1 (paragraph 2 of clause 1 of the Decree of the Government of the Russian Federation N 1).

Thus, in accounting, an organization has the right to set the useful life of an item of fixed assets, the same as in tax accounting.

Depreciation charges for equipment are recognized in accounting as expenses for ordinary activities in the reporting period to which they relate (clauses 5, 8, 16, 18 of the Accounting Regulations PBU 10/99 “Organization Expenses”, approved by Order of the Ministry of Finance Russia dated 05/06/1999 N 33n).

Thus, the amount of accrued depreciation on equipment is included monthly in expenses for ordinary activities.

Depreciation begins on the 1st day of the month following the month in which this object was accepted for accounting, and is carried out until the cost of this object is fully repaid or this object is written off from accounting (clause 21 of PBU 6/01).

Remember

Judicial practice on the installation and maintenance of video surveillance systems shows that even the RF Armed Forces do not have a unified position on the issue of whether this is part of the services for the proper maintenance of the owners’ common property or an additional service. And accordingly, there was no general consensus on how the management company should charge owners for such work.

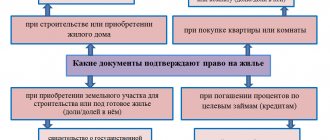

In order to defend in court the right to calculate fees for the maintenance of video surveillance systems, regardless of the area of the premises and the owner’s share in the common property, the management organization must prove that:

- This decision was made by the owners at the general meeting, and the OSS protocol was not challenged in court.

- Services for video surveillance and maintenance of such systems are not included in the minimum list of works and services for the proper maintenance of the common property of premises owners in apartment buildings, and therefore are additional. The issue of determining the amount of payment for them is within the competence of the OSS, and the management organization only carries out the will of the owners.

How do owners of houses under your management pay for such a service? Share in the comments.

What is a video surveillance system?

A video surveillance system, as a rule, includes components such as indoor and outdoor video cameras, video recorders, switches, hard drives, monitors, uninterruptible power supplies, as well as consumables, such as cables, holders, cable channels, socket blocks. However, in some cases, the composition and design of a video surveillance system can be much more complex.

It is precisely because of the different list of components in each specific case that officials of the institution have to make a decision on one or another option for accounting for the installed system. Let us recall that such a responsibility is assigned to the members of the commission for the receipt and disposal of assets in accordance with clause 34 of the Instructions, approved. By Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n (hereinafter referred to as Instruction No. 157n).

In order to make the right decision, the commission for the receipt and disposal of assets must include employees with special technical knowledge. Also, specialists in the relevant field can be invited to work on the commission voluntarily or for a fee.

KVR and KOSGU in 2021 for budgetary institutions

- 100 - income;

- 200 - expenses;

- 300 — receipt of non-financial assets (NA);

- 400—retirement of equipment;

- 500 — receipt of financial assets (FA);

- 600—FA retirement;

- 700 - increase in liabilities;

- 800 - reduction of obligations.

Since KVR is a larger grouping than KOSGU, to simplify the application of the corresponding codes, the Ministry of Finance has approved a correspondence table. A comparison of CVR codes and KOSGU codes for 2021 for budgetary institutions and public sector organizations is presented in a table. The document contains the latest changes that should apply in 2021.

Selection of KOSGU cost items for repair work

Please tell me, if the situation arises that there are already funds in the personal account according to KOSGU 226, but it is necessary to carry out repair work on the heating system and the new premises, how can this be done using KOSGU 226, if it is not possible to return the funds from the personal account and move Are there 225 of them at KOSGU? Is it possible to dismantle the old heating system according to KOSGU 226 and install a new heating system also according to KOSGU 226?

Please tell me how to repair the heating system of a rented premises - is this KOSGU 225? And if you purchase radiators separately - KOSGU 340, and installation work according to KOSGU 225? Replacing a boiler is also 225? What repair work can be carried out according to KOSGU 226?

Completion, retrofitting, reconstruction and modernization of OS

This position is confirmed by the All-Russian Classifier of Fixed Assets OK 013-94 (OKOF). It provides that the buildings include communications inside it necessary for operation, including a heating system, ventilation devices for general sanitary purposes, etc.

Thus, the costs of capital investments associated with reconstruction (modernization, etc.) are preliminarily collected on account 08 “Investments in non-current assets” in a separate subaccount (for example 9 “Reconstruction, modernization and additional equipment of fixed assets”). Upon completion of all work, they are written off to increase the value of the fixed asset that has undergone modification (that is, to the debit of account 01 “Fixed assets”).

Income tax

In tax accounting, property with an initial cost of more than 100,000 rubles is recognized as a fixed asset. (Clause 1 of Article 257 of the Tax Code of the Russian Federation).

In this case, the initial cost of the video surveillance system is 90,000 rubles. (84,000 rub. - 14,000 rub. 24,000 rub. - 4,000 rub.).

Therefore, property worth up to 100,000 rubles. inclusive from the point of view of tax accounting is not a fixed asset.

Thus, for tax accounting purposes, property worth 100,000 rubles. and less is not a fixed asset and is not depreciated. This conclusion follows from paragraph 1 of Art. 256, paragraph 1, art. 257 Tax Code of the Russian Federation.

In this regard, property worth up to 100,000 rubles. inclusive, can be taken into account as part of material costs.

At the same time, there are two options for writing off such an asset (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation):

- the property is written off as expenses in full at the time of commissioning;

- property is written off as expenses over several reporting periods, taking into account the period of its use.

The organization decides which of these options to choose independently.

The selected option must be reflected in the accounting policy (Letter of the Ministry of Finance of Russia dated 03/06/2019 N 03-03-07/14527).

Accounting entries for fixed assets in budgetary organizations

Fixed assets are recorded in accounting registers at their original cost. It includes the costs of purchasing and constructing facilities, consulting services, delivery and other costs required to bring the facility into a state of readiness for operation, taking into account the VAT charged. Accounting in budget accounting accounts is carried out in rubles and kopecks.

Budgetary organizations are institutions financed from budgetary funds. Accounting in such organizations is carried out on the basis of a special chart of accounts for budgetary institutions with their own entries, which is approved by Order No. 174n of the Ministry of Finance of the Russian Federation dated December 16, 2021. In all budgetary institutions, fixed assets, according to Instruction No. 25n, are accounted for in account No. 010100000 - Basic facilities.

We recommend reading: Can Bailiffs Describe the Property of a Common-law Wife for the Debts of the Husband

Business registration

A standard step for starting any entrepreneurial activity is registering a business with government agencies. The most convenient organizational and legal forms of action for a businessman in the field of video surveillance are LLC or individual entrepreneur.

In any case, and especially if you choose an individual entrepreneur, it is worth taking specialized courses and receiving a certificate. But remember that already at this stage you will have to pay about 15 thousand rubles.

The registration of a legal entity or individual entrepreneur is a mandatory procedure, although you have to pay your hard-earned money for the state fee. Otherwise, you risk being fined for illegal actions. And the fine will cost much more than the fee and certificate combined.

Purchasing materials in 2021: which KOSGU to apply

2. Subarticle 347 of KOSGU was introduced to separate the costs of paying for contracts for the acquisition (manufacturing) of all types of materials, including building materials, for the purposes of capital investments. That is, it is designed to separate capital expenditures in terms of the acquisition of material reserves.

At the same time, it should be clearly understood that the key word for applying subsection 347 of KOSGU is the word “purpose”. That is, the same material reserves, depending on the purpose of their acquisition, may fall under both subarticle 347 of KOSGU and other subarticles of article 340 of KOSGU. If the goal is to form capital investments in fixed assets, intangible or non-produced assets, then subsection 347 of KOSGU is applied. At the same time, in order to justify the decision made on the allocation of expenses, it is advisable to confirm the goal with relevant documents (for example, construction estimates, estimates for repairs, reconstruction, and other similar documents).