Business lawyer > Accounting > Remuneration > Summarized accounting of working time, what is it: subtleties of implementation in work

Some companies and organizations do not have a standardized work week, which lasts five working days. Under such circumstances, a work schedule is introduced for the company's employees. But the duration of their shift can be more or less than eight hours. Labor time during the week can sometimes last more than 40 hours, and sometimes less. Such cases are usually regulated by introducing summarized working time recording into work, for the maintenance of which there are no rules clearly prescribed by law.

The procedure for introducing summarized accounting

According to Art. 104 of the Labor Code of the Russian Federation, the procedure for introducing summarized recording of working time is established by the internal labor regulations (hereinafter referred to as PVTR).

The PVTR regulates the working hours, rest periods, incentive and penalty measures applied to employees, as well as other issues of regulating labor relations with a given employer.

Summarized recording of working time at an enterprise can be introduced by order (instruction) of the employer, taking into account the opinion of the elected body of the primary trade union organization (if the enterprise has a trade union).

Summarized working time tracking can be introduced throughout the organization or for specific employees. The condition of summarized accounting must be included in the employment contract.

According to Art. 74 of the Labor Code of the Russian Federation, if the terms of the employment contract determined by the parties, related to changes in organizational or technological working conditions, cannot be preserved, they can be changed at the initiative of the employer, with the exception of changes in the employee’s labor function.

That is, if the PVTR did not initially provide for summarized recording of working time, appropriate changes must be made when applying it.

Don't have time to read the article?

Get an initial consultation from several companies for free

: fill out an application and the system will select suitable companies!

86 companies are connected to this service

Start selection in a few clicks >

The definition of working hours is given in Art. 100 of the Labor Code (Labor Code of the Russian Federation). This article provides points that must be included in an employment contract. And the obligation to record hours worked is assigned to the employer in Art. 91 Labor Code of the Russian Federation.

How to make changes to PVTR

According to Part 1 of Art. 190 of the Labor Code of the Russian Federation PVTR are approved by the employer taking into account the opinion of the representative body of employees. Therefore, when making any changes to the PVTR, this procedure must be followed.

For your information

If the organization does not have a trade union, then employees at a general meeting (conference) can entrust the representation of their interests to a representative (representative body) elected from among the employees (Article 31 of the Labor Code of the Russian Federation).

Before making a decision to amend the PVTR, the employer must send a draft containing the main provisions regarding changes to the local regulatory act, accompanied by justifications to the representative (representative body). The representative, no later than five working days from the date of receipt of the draft PVTR, sends the employer a reasoned opinion on the draft in writing.

If the representative body or representative does not agree with the draft PVTR or proposals have been received to improve the project, the employer may agree with the representative’s opinion or disagree.

Within three days after receiving a reasoned opinion, the employer holds an additional meeting with a representative or representative body in order to reach agreement.

If the parties do not agree, a protocol of disagreement is drawn up. After this, the employer has the right to adopt a local regulation.

In turn, the representative body has the right to appeal the text of the rules approved by the employer in the state labor inspectorate or in court.

How to make changes to an employment contract

If before the introduction of summarized accounting, the employee was on a different regime, for example, a 5-day work week with two days off, then an additional agreement is drawn up to the employment contract, which reflects the conditions for the use of summarized recording of working time. In the section “Working hours” of the additional agreement to the employment contract, it is advisable to indicate the following points:

1. The employee is provided with a summarized recording of working time.

2. The procedure for introducing summarized recording of working time is established by the Internal Labor Regulations.

3. The accounting period is a month.

4. The standard working time for the accounting period is established based on a 40-hour work week with two days off.

5. The date and time the employee goes to work, the duration of work, the end time of work, and days off are determined in the work schedule.

6. Work schedules are brought to the attention of the employee no later than 1 month before they come into effect.

7. A break for rest and food (45 minutes) is provided every 4 hours of work.

8. The hourly rate for calculating wages for salaried employees is calculated by dividing the official salary by the average annual standard number of hours and remains unchanged during the current year.

Note!

The employer is obliged to notify employees of changes in the terms of the employment contract (in our case, the transition to summarized recording of working hours) in writing no later than 2 months in advance (Part 2 of Article 74 of the Labor Code of the Russian Federation) - for example, issue an order to amend the PVTR with employee list application.

If the employee refuses the working conditions in the new regime, i.e. in new organizational conditions, then the employment contract is terminated in accordance with clause 7, part 1, art. 77 Labor Code of the Russian Federation.

When switching to summarized recording of working hours, the employer is obliged to develop a work schedule that contains information about the standard working hours, the number of days off and working days, the boundaries and duration of the working day, as well as the combination of working periods with rest periods.

Registration of work schedules and time sheets for summarized accounting

The work schedule can be introduced by order of the head of the organization. The law does not establish a special procedure providing for the form and time frame for familiarizing employees with the work schedule. Therefore, the employer can independently determine the procedure for familiarizing himself with the work schedule, while providing for reasonable deadlines.

We remind you that the Labor Code of the Russian Federation generally defines normal working hours as a 40-hour working week (Article 90 of the Labor Code of the Russian Federation). The duration of work duties during the accounting period should be no more than a normal week, multiplied by the number of weeks in the accepted accounting period.

When drawing up a work schedule, the length of the accounting period is taken into account, which should not exceed a year.

Depending on the specifics of the company’s work, work schedules with different working hours and combinations of rest periods may be established for different positions.

As an example, consider the work modes of communication (railway) specialists (Table 1).

When drawing up a work schedule, the following are taken into account:

1. Standard working hours. The number of working hours according to the schedule for the accounting period should not be greater than the number of working hours according to the production calendar for the same period.

2. One shift cannot last longer than 12 hours.

3. It is prohibited to work two shifts in a row.

4. Weekly uninterrupted rest must be at least 42 hours.

5. Break for rest and food - from half an hour to two hours.

6. The duration of night shifts should be reduced by one hour without further work.

7. On the day before a holiday, the duration of the shift is reduced by 1 hour.

8. Annual leave of 28 calendar days is taken into account.

9. The work schedule should not contain conditions for overtime work.

To correctly draw up a work schedule, you first need to determine the number of people per workplace.

How many employees are needed per workplace can be calculated as follows:

(Number of calendar days in the accounting period) × (Duration of the working day in hours) / (Normal for the accounting period according to the production calendar - Number of working days coming for vacation).

Example 1

The trading organization's operating hours are from 10:00 to 20:00, seven days a week. Normal working hours are no more than 40 hours per week. The accounting period is quarter. It accounts for 480 hours (40 hours × 4 weeks × 3 months) of working time.

Vacation lasting 28 calendar days. It accounts for 160 working hours (4 weeks × 40 hours).

Let's determine how many employees are needed per workplace to avoid overtime:

90 days × 10 hours / (480 hours – 160 hours) = 2.8 people, i.e. 3 employees are needed for 1 workplace.

The employer is obliged to take into account the working time of employees personally, separately recording the actually worked hours of each person in the time sheet. The time sheet is compiled in one copy by an authorized employee and submitted to the accounting department. A completed and signed time sheet is the basis for settlements with employees and the calculation of wages for the time actually worked.

Severance pay

If there is a reduction in staff at a company or the organization ceases to exist, the employee is fired with severance pay. This also applies to employees who worked under the summed working time system. The amount of severance pay should not be less than monthly earnings.

The legislation also establishes that after dismissal and until new employment, he must retain earnings in the amount of average monthly earnings. But this period cannot last longer than 2, or in special cases established by the employment service itself, 3 months.

In this case, it is relevant to use the average earnings per hour of work.

Average earnings are calculated by multiplying earnings per hour by the number of days worked. But since the person no longer works in production, he is not included in the schedule, which means it is impossible to count the hours worked. In this case, you need to take the time that the former employee of the company should have worked according to the production calendar.

Payment for night hours with total accounting

Night hours (from 22:00 to 6:00) must be taken into account separately and paid at an increased rate (Article 154 of the Labor Code of the Russian Federation). The minimum bonus for night work is 20% of the hourly tariff rate (official salary), calculated for each hour of night work.

The number of night hours worked is determined by the working time sheet (form T-12 or T-13). To reflect the hours worked at night on the timesheet, use the letter code “H” or the numeric “02” indicating the number of hours worked at night.

Example 4

The company has established a summarized recording of working hours for all employees. The billing period is one month. The working hours for individual employees (security guards, dispatchers, storekeepers) are every three days.

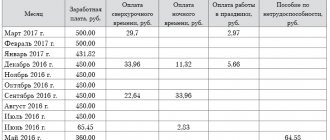

The working time sheet for April is presented in table. 4.

Let's calculate the salary of dispatcher V. G. Sokolov for April according to the work time sheet.

From the timesheet data it follows that in April the dispatcher worked 7 shifts of 24 hours each. The total time was 168 hours (7 shifts × 24 hours), including 56 hours of night work.

Work within normal limits. We pay extra for night work.

The hourly tariff rate for this specialist is 300 rubles. Night time surcharge - 20% of the hourly tariff rate.

Wages for April will be equal to:

168 hours × 300 rub. + (56 hours × 300 rub. × 20%) = 53,760 rub.

For your information

If during the accounting period both overtime and night work took place, then both overtime work and night hours are subject to payment at an increased rate, since this work is performed under conditions deviating from normal ones.

Payment for holidays with total accounting

According to Art. 153 of the Labor Code of the Russian Federation, work on a day off or a non-working holiday is paid at least double the amount.

Note!

When accounting for working hours in total, work on weekends and holidays is included in the monthly working time standard.

In order to correctly process wages on holidays and weekends, you need to determine whether the holiday is a working day according to the employee’s schedule or whether he should rest on this day. If this is a scheduled working day for an employee and he worked this day, as indicated by the mark “I” on the time sheet, then the additional payment for this day should be made in a single amount, since there are no special deviations for summarized accounting in Art. 153 of the Labor Code of the Russian Federation no.

That is, an employee, subject to a full work schedule, will receive wages calculated based on the hourly tariff rate or salary and an additional payment in the amount of a single rate for a holiday.

If a holiday is not a working day according to the schedule, but it is reflected in the timesheet as “RV” - the duration of work on weekends and non-working days, then the additional payment for this day should be made in double the amount in the current month.

In this case, the employee will receive wages calculated at the salary or hourly rate, and an additional payment in the amount of double the rate for a holiday.

Note!

When calculating overtime hours at the end of the accounting period, work performed on holidays in excess of the norm should not be taken into account, since it has already been paid in double amount (clause 4 of Explanation No. 13/P-21 “On compensation for work on holidays”).

Overtime in case of dismissal

Special attention can be paid to the issue of overtime payment in cases where an employee quits for some reason before the end of the accounting period. There are also two ways to solve this problem.

Calculation of severance

If you follow the law, processing calculations must be carried out at the end of the accounting period.

If you carry out calculations using the first approach, then there is no need to pay overtime, since overtime can only be determined (by law) at the end of the accounting period. As a result, the employment agreement was terminated before the end of this period, and it is simply impossible to pay overtime.

If you follow the second approach, then any employees who work under a summarized labor accounting system have the full right to receive additional payment for overtime hours. To receive funds for overtime work, you simply need to calculate it.

The second approach turns out to be more objective. This can be seen in the following aspects:

- If an employee worked the entire accounting period and only then quit, then he has the right to demand payment for overtime work. The period has ended, and the employer can count the overtime from the norm.

- But Article 99 of the Labor Code also does not prohibit counting overtime until the end of a certain period when the employee quits his job.

- But the law stipulates that overtime work can be compensated on another day. Therefore, it is possible to fully calculate the number of hours worked only at the end of the accounting period.

- But if a person quits, then overtime can no longer be compensated for by other days, and failure to pay legally earned money cannot be the right step on the part of the employer.

- Application of the first part of Article 99 of the Labor Code is possible only if the employee has worked until the end of the period.

An employee’s overtime work can be determined according to the following scheme:

- carry out the calculation of the standard working time from the beginning of the accounting period until his dismissal from his position

- calculate actual hours worked

- if an employee worked more than the standard time, he needs to make an additional payment for overtime

Every person deserves a decent assessment of his work. Therefore, the employer must understand that everyone is obliged to pay for overtime work performed. And there is no need to hide behind some legal norms, which everyone tries to interpret differently.

Violation of labor activity is provided for in labor protection legislation. In this case, the violator will face administrative punishment in the form of a fine. Its size can be set from 1 thousand to 5 thousand rubles for individuals and from twenty-nine thousand rubles for legal entities. In addition, the court may impose a penalty in the form of stopping the company’s activities for up to 3 months.

If you look, in practice such working conditions are not established for all employees of the enterprise. Therefore, such a work schedule must be specified in the employment contract. In addition, the rules for summarized recording of working time and the sequence of their determination should be included in the internal regulations of the organization.

Top

Write your question in the form below