Amount of minimum wage in Russia

Editorial

Promdevelop editorial team

Questions that are related to the general characteristics and concepts of the minimum wage, its minimum size in the current year and comparison of the minimum wage by region can be found out after reading this article. Now let's look at each aspect separately.

Minimum wage from January 1, 2021 in the Russian Federation

The minimum wage in the Russian Federation will not be increased from January 1, 2021. Deputies of the State Duma did not increase the minimum wage from January 1 next year. At the same time, most accountants are accustomed to the fact that increases in the minimum wage occur at the beginning of the year.

From January 1, 2021, the minimum wage was increased, and its value, in accordance with Article 1 of the Federal Law of December 14, 2015 No. 376-FZ, amounted to 6,204 rubles. In 2021, from January 1, there will be no increase in the minimum wage.

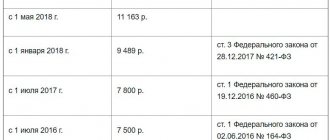

The previous increase in the minimum wage, in accordance with Article 1 of Federal Law No. 164-FZ dated June 2, 2016, to 7,500 rubles occurred in July 2021. This also led to changes in the size of benefits.

From January 1, 2021, due to the fact that the minimum wage remains at the level of 7,500 rubles, the amount of benefits will not change.

What is the minimum wage?

This value is established on a national scale and this issue is regulated within the framework of federal law. It represents the minimum wage that is paid to an employee per day, hour or month. The employer does not have the right to pay his employee less than the established value.

This amount increases every year and is indexed taking into account existing inflation. There have been cases when this size increased several times over the course of a year. This right is reserved by the state and, at the first opportunity, the minimum wage of employees is increased.

In our country, the minimum wage is the minimum established at the level of current legislation. It is used to regulate wages and is involved in the process of calculating the amount of temporary disability benefits. This amount is used to determine the amount of taxes, duties, and other fees. Even any kind of fine is calculated based on this amount.

Employers must pay their employees wages that are equal to or greater than the specified minimum. Many entrepreneurs and organizations conduct double-entry bookkeeping, officially paying employees the “minimum wage” and disbursing the rest unofficially. This allows them to significantly reduce taxes. But it is worth remembering that this kind of fraud is illegal and criminally punishable.

Minimum wage from January 1, 2021 and wages

In accordance with Article 133 of the Labor Code of the Russian Federation, the minimum wage is the minimum wage that an individual entrepreneur or organization must pay to employees for a full working month worked by them. In this case, the employee may receive an amount less than the minimum wage (for example, due to the deduction of alimony or personal income tax).

Thus, starting from January 1, 2021, the employer will not be able to pay the employee less than 7,500 rubles.

In accordance with the provisions of Article 129 of the Labor Code of the Russian Federation, the total salary, which includes:

- remuneration for work;

- compensation payments (including additional payments and allowances);

- incentive payments (bonuses).

That is, from January 1, 2021, the total amount of the above payments cannot be less than the minimum wage - 7,500 rubles.

Minimum wage for calculating fines

To determine the amount of taxes and fines, the amount of which depended on the established minimum wage, the so-called basic minimum wage amount was previously used. Since January 1, 2001, its size has not changed and remained equal to 100 rubles. (Article 5 of Law No. 82-FZ).

Important! At the moment, the dependence of the amounts of administrative, criminal and tax fines on the minimum wage has been completely abolished, and the legislation regulates their amounts in fixed amounts (see the Law “On Amendments...” dated June 22, 2007 No. 116-FZ).

For example, fines in the Code of the Russian Federation on Administrative Offenses, the Criminal Code or the Tax Code are no longer calculated in terms of the minimum wage for a particular offense, but are expressed in a specific amount or percentage of the amount. For example, the fine for non-payment of taxes without guilt is 20% of the amount of unpaid tax (see paragraph 1 of Article 122 of the Tax Code of the Russian Federation).

Employer's responsibility for wages below the minimum wage

Please note that if, from January 1, 2021, an employee’s salary is less than the minimum wage—7,500 rubles—then the employer may be held liable in the form of fines. The legislation of the Russian Federation provides for the following fines:

- for an organization (upon initial identification) - from 30,000 to 50,000 rubles;

- for an organization (for secondary detection) - from 50,000 to 70,000 rubles;

- for the director or chief accountant of the organization (upon initial detection) - a warning or a fine from 1,000 to 5,000 rubles;

- for the director or chief accountant of the organization (in case of secondary detection) - a fine of 10,000 to 20,000 rubles.

According to the provisions of Article 5.27 of the Code of Administrative Offenses of the Russian Federation, the director or chief accountant of an enterprise can be disqualified for a period of one to three years.

Official website of the City District Administration - Kamyshin city

The administration of the urban district - the city of Kamyshin informs employees and employers of the city about the change from 07/01/2017 to the minimum wage in the Russian Federation.Federal Law of the Russian Federation dated December 19, 2016 No. 460-FZ amended Article 1 of Federal Law dated June 19, 2000 No. 82-FZ “On the minimum wage”. According to the changes, starting from July 1, 2017, the minimum wage (minimum wage) in the Russian Federation is 7,800 rubles per month. These changes come into force on July 1, 2021.

The Labor Code of the Russian Federation defines the minimum wage as the level of monthly wage established by law, which must be paid to each employee who has worked the standard working hours fully determined for this period and has fulfilled his or her job duties (labor standards). This means that it represents the minimum remuneration for work, below which no one can pay it. At the same time, for an employee who has worked for less than a full month (standard hours), the minimum wage is determined in proportion to the time worked in a given month.

We recommend:

— heads of government agencies; - heads of public organizations (associations), non-profit organizations (these include: consumer cooperatives (including garage cooperatives, credit consumer cooperatives (citizens, first and second level), agricultural consumer cooperatives (processing, marketing (trading), servicing, supply , horticultural, market gardening, livestock farming), housing savings cooperatives, religious organizations/associations (religious organizations (local and centralized), religious groups), horticultural, gardening or dacha non-profit associations, chamber of commerce and industry, territorial public self-governments, housing construction cooperatives , Cossack society, condominiums (homeowners' associations), political parties, public funds, public institutions, public amateur bodies, trade unions, organizations created by societies for the disabled, etc.); - employers of the non-budgetary sector of the economy who submitted to the Committee on Labor and Employment Volgograd region motivated written refusal to join the regional Agreement C-272/15 dated July 5, 2016 on the minimum wage in the Volgograd region

bring the minimum amount of wages paid to employees in accordance with the above Federal Law, i.e. at least 7,800 rubles per month.

In organizations financed from the federal budget, the minimum wage is provided from the federal budget; in organizations financed from the budgets of constituent entities of the Russian Federation - at the expense of funds from the budgets of constituent entities of the Russian Federation; in organizations financed from local budgets - at the expense of local budgets, in non-budgetary organizations - at the expense of their own funds. Chairman of the Economic Development Committee of the City District Administration - city Kamyshin D.A. Rezvov

This might also be useful:

- Taxes are urgent: you must pay before December 1

- Property tax and assessment quality

- From 2021, income limits for switching to the simplified tax system will be increased

- UST in 2021

- What will the minimum wage be in 2021?

- Tax calendar for 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Formula for calculating individual entrepreneur contributions to the Pension Fund and the Compulsory Medical Insurance Fund

You must immediately understand that insurance premiums of individual entrepreneurs are not taxes - they are payment for the entrepreneur’s pension (contribution to the Pension Fund) and free medical care (contribution to the Compulsory Medical Insurance Fund).

- The formula for calculating the contribution of individual entrepreneurs to the Pension Fund = minimum wage * 12 * 26% + 1%

(of the amount over 300,000 money turnover) where: minimum wage - minimum wage, 12 - number of months in a year, 26% - pension fund rate, 1% — pension fund rate when the individual entrepreneur’s turnover exceeds 300,000 rubles; - The formula for calculating the contribution of individual entrepreneurs to the Compulsory Medical Insurance Fund = minimum wage * 12 * 5.1%

where: minimum wage is the minimum wage, 12 is the number of months, 5.1% is the rate of the compulsory health insurance fund.

What is the minimum wage used for?

According to Art.

3 of Federal Law No. 82-FZ The minimum wage is used to regulate wages and determine the amount of benefits for temporary disability, pregnancy and childbirth, as well as for other purposes of compulsory social insurance. The use of minimum wage for other purposes is not permitted. At the same time, Art. 4 and 5 of Federal Law No. 82-FZ, establishing transitional provisions for the application of the minimum wage. Until changes are made to the relevant federal laws, from January 1, 2001, a base amount of 100 rubles is used in the following cases:

- when determining the amount of scholarships, benefits and other mandatory social payments, depending on the minimum wage;

- when calculating taxes, fees, fines and other payments made in accordance with the legislation of the Russian Federation depending on the minimum wage;

- when calculating payments for civil obligations established depending on the minimum wage.

Let us explain the rules regarding the transition period.

As explained by the Constitutional Court in Resolution No. 11-P of November 27, 2008, the minimum wage institution, by its constitutional and legal nature, is intended to establish the minimum amount of money that should be guaranteed to an employee as remuneration for performing work duties, taking into account the subsistence level. Meanwhile, at a certain stage of development of the Russian Federation, this institution was given a broader meaning: the minimum wage was used in various branches of legislation as a criterion for calculating social benefits, payments for civil obligations, tax rates and fees, state duties, fines, etc. which was due to the need to index the amounts of these payments in the context of a constant increase in the inflation rate. The minimum wage itself was periodically increased by the legislator, but without a strict link to the subsistence level.

With the change in the economic situation, the legislator took steps to abandon this practice, stipulating that the minimum wage is used exclusively to regulate wages and determine the amount of benefits for temporary disability, pregnancy and childbirth, as well as for other purposes of compulsory social insurance and that its use for other purposes are not allowed (Determination of the Constitutional Court of the Russian Federation dated January 17, 2012 No. 171-О-О).

As a clear example of the refusal to use the minimum wage as a “non-core” value, we can cite the Code of Administrative Offenses of the Russian Federation. The Code of Administrative Offenses of the Russian Federation widely used the minimum wage to calculate an administrative fine, but in the current version there is no mention of the minimum wage. In 2007, in connection with the general trend of abandoning the widespread use of the minimum wage as a criterion for determining the size of a fine and other payments actually not related to wages, changes were made according to which the administrative fine began to be established as a general rule as a fixed amount expressed in rubles. For example, in Art. 15.5 “Violation of the deadlines for submitting a tax return” of the Code of Administrative Offenses of the Russian Federation for violation of the deadlines for submitting a tax return to the tax authority at the place of registration provided for by the legislation on taxes and fees, an administrative fine was imposed on officials in the amount of three to five minimum wages. Today the fine ranges from 300 to 500 rubles.

Similar changes are being made to other legislative acts regulating economic activities.

We also note that in the current tax legislation, the minimum wage is not used as a base value for calculating taxes, fees, penalties, and fines.

It follows from the established legislative norms that the main purpose of the minimum wage is to regulate wages and establish minimum amounts of payments for compulsory social insurance.

Regulation of wages

A widely used system of remuneration is that a salary and allowances or bonuses are established. The question often arises of what to compare with the minimum wage: salary or the full amount of wages for the month, taking into account allowances or bonuses?

Let us recall that in Art. 133 of the Labor Code of the Russian Federation, which regulates the establishment of the minimum wage, we are talking about the employee’s monthly wage, and not about the salary. The concepts of wages and salary are given in Art. 129 Labor Code of the Russian Federation.

Wages (employee remuneration) - remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

Salary (official salary) is a fixed amount of remuneration for an employee for the performance of labor (official) duties of a certain complexity for a calendar month without taking into account compensation, incentives and social payments.

Accordingly, the salary may be less than the minimum wage, but in general the salary, taking into account allowances or bonuses, must be no less than the minimum wage.

The courts also come to a similar conclusion: labor legislation allows the establishment of salaries (tariff rates) as components of workers’ wages in an amount less than the minimum wage, provided that their wages, without including the regional coefficient and percentage bonus for continuous work experience, will be no less than that determined by federal law Minimum wage (Review of judicial practice of the RF Armed Forces for the third quarter of 2013, approved by the Presidium of the RF Armed Forces on 02/05/2014).

Note that if an employee works part-time or part-time, the legislator does not guarantee that the monthly wage will not be lower than the minimum, since in this case remuneration is made in proportion to the time worked or depending on output (Letter of the Federal Tax Service of the Russian Federation dated 08/31/2010 No. ШС-37-3/ [email protected] ).

For the payment of wages for a period of more than two months in an amount below the minimum wage established by federal law, made out of selfish or other personal interest by the head of the organization, the employer - an individual, the head of a branch, representative office or other separate structural unit of the organization, criminal liability is provided in accordance with paragraph .2 tbsp. 145.1 of the Criminal Code of the Russian Federation - imprisonment for up to three years.

At the same time, remuneration for work performed in the regions of the Far North and equivalent areas is carried out using regional coefficients and percentage increases in wages (Articles 148, 315, 316 and 317 of the Labor Code of the Russian Federation). What to compare with the minimum wage in this case: the amount of wages taking into account the “northern” coefficients or without them?

In accordance with current legislation, an employee working in special climatic conditions is guaranteed not only the minimum wage, but also an increased wage, which is ensured by a regional coefficient and a percentage increase. Therefore, his salary should be determined in an amount not less than the minimum wage, after which a regional coefficient and an allowance for work experience in the northern regions should be added to it.

The courts also come to the same conclusion (Review of the Supreme Court of the Russian Federation of the practice of consideration by courts of cases related to the implementation of labor activities by citizens in the regions of the Far North and equivalent areas, approved by the Presidium of the Supreme Court of the Russian Federation on February 26, 2014).

Compulsory social insurance payments

The second application of the minimum wage established by Federal Law No. 82-FZ is the determination of the amount of benefits for temporary disability, pregnancy and childbirth, as well as for other purposes of compulsory social insurance.

Legal relations in the system of compulsory social insurance in case of temporary disability and in connection with maternity are regulated by Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Federal Law No. 255-FZ ). In some cases, the minimum wage is used to calculate established benefits.

Temporary disability benefits to an insured person with an insurance period of less than six months are paid in an amount not exceeding the minimum wage for a full calendar month, and in regions and localities in which regional coefficients are applied to wages in a certain manner - in an amount not exceeding The minimum wage taking into account these coefficients (clause 6, article 7 of Federal Law No. 255-FZ).

In addition, temporary disability benefits may be reduced to the minimum wage if there are grounds provided for in paragraph 1 of Art. 8 of Federal Law No. 255-FZ.

The minimum wage will pay maternity benefits to an insured woman with an insurance period of less than six months (in regions and localities in which regional coefficients are applied to wages in accordance with the established procedure, in an amount not exceeding the minimum wage taking into account these coefficients) (clause 3 Article 11 of Federal Law No. 255-FZ).

In addition, according to clause 1.1 of Art. 14 of Federal Law No. 255-FZ, if the insured person had no earnings during the prescribed periods, and also if the average earnings calculated for such periods, calculated for a full calendar month, are lower than the minimum wage established on the day the insured event occurred, the average earnings based on in which benefits for temporary disability, maternity and childbirth, and monthly child care benefits are calculated are assumed to be equal to the minimum wage determined on the day of the insured event. If the insured person at the time of the occurrence of the insured event works part-time (part-time, part-time), then the indicated average earnings are determined in proportion to the length of the insured person’s working hours. Moreover, in all cases, the calculated monthly child care benefit cannot be less than the minimum amount of the monthly child care benefit established by Federal Law No. 81-FZ of May 19, 1995 “On state benefits for citizens with children.”

In this situation, a comparison of the average monthly earnings of the insured person, determined for the billing period, with the minimum wage is made through the average daily earnings.

The average daily earnings are calculated in accordance with clauses 3 and 3.1 of Art. 14 of Federal Law No. 255-FZ and clauses 15.1, 15.2 and 15.3 of the Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth, monthly child care benefits for citizens subject to compulsory social insurance in case of temporary disability and in connection with maternity, approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

Next, you need to compare the average daily earnings, calculated from the employee’s actual earnings, with the average daily earnings, calculated on the basis of the minimum wage, taking into account the duration of working hours, and choose the larger of these two values (Letter of the Federal Social Insurance Fund of the Russian Federation dated November 16, 2015 No. 02‑09‑14/ 15-19990).

Quarterly increase to the cost of living

The minimum wage (minimum wage) in Moscow takes on a new meaning based on the results of each quarter. The fact is that the minimum wage in Moscow depends on the subsistence level of the working population. If the cost of living increases, then from the first day of the month following the month of increase, the minimum wage also increases. This is provided for in paragraphs 3.1.1 and 3.1.2 of the Moscow Government Decree No. 858-PP dated December 15, 2015 “On the draft Moscow tripartite agreement for 2016-2018 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations.”

In accordance with the Decree of the Moscow Government dated June 13, 2017 No. 355-PP (effective from June 26), the cost of living of the working population for the first quarter of 2021 amounted to 17,642 rubles. Accordingly, from July 1, wages in Moscow cannot be lower than the specified value.

In this regard, according to the decree of the Moscow government dated 06/13/17 No. 355-PP and the tripartite agreement between the Moscow government, the Moscow Association of Trade Unions and the Moscow Association of Employers dated 12/15/15 No. 858-PP, the minimum wage from July 1 will increase from 17,561 rubles to 17,642 rubles. The total increase is 81 rubles.

When the cost of living becomes lower, the minimum wage in Moscow remains at the same level. This is provided for in paragraph 3.1.1 of the Moscow tripartite agreement for 2016-2018 between the Moscow Government, Moscow trade union associations and Moscow employer associations dated December 24. 2015 No. 77-848.

Since the 4th quarter of 2021, the cost of living has decreased from 17,561 rubles. up to 17,487 rubles, and from the 1st quarter of 2021 - up to 17,219 rubles. However, the minimum wage in Moscow remained at 17,561 rubles. throughout the first half of 2021.

Minimum Moscow salary from July 1: what does it include

From July 1, 2021, no less than the Moscow minimum wage (17,642 rubles) must be the totality of all payments established to the employee that make up his salary (Article 129 of the Labor Code of the Russian Federation). That is, not only salary, but also compensation with bonuses. The minimum salary must include all types of bonuses and additional payments to employees, except for additional payments:

- for working in harmful and dangerous working conditions

- for overtime work;

- for night work;

- for working on weekends or holidays;

- for combining professions.

With the new Moscow minimum wage from July 1, 2021, compare the amount before deduction of personal income tax. That is, if the employee worked the full working time for July. This means that he will receive at least 15,348.54 rubles in his hands. (RUB 17,642 – RUB 17,642 x 13%). This is fine.

If the salary in Moscow to be calculated for July, August or September 2017 is lower than the minimum wage (17,642 rubles), then the employee must be paid extra. And from July 1, 2021. You can set the surcharge in two ways:

- increase salary;

- establish in a local act (for example, a separate order or Regulation on remuneration) an additional payment up to the minimum wage. That is, it should be directly stated that employees are given an additional payment up to the regional minimum wage. Then there will be no need to review salaries or change employment contracts.

Salary commission

Article 133.1 of the Labor Code of the Russian Federation gives the Moscow authorities the right to invite representatives of an employer who has refused to adopt the new minimum wage from July 1, 2021, for consultations. That is, abandoning the Moscow minimum wage threatens a collision with administrative resources.

Please note that in 2021, the Federal Tax Service continues the practice of salary commissions. Moreover, the Federal Tax Service has the right to transfer information about employers who pay low wages to labor inspectorates (letter dated April 21, 2021 No. ED-4-15/7708).

The purpose of salary commissions is to identify “gray” salaries and personal income tax debts. An employer can be invited to a salary commission:

- due to personal income tax debts;

- if personal income tax payments have decreased by 10 percent or more;

- if the salary is below the regional subsistence level, the minimum wage or the industry average.

Loading …