The Recommendations for audit organizations, individual auditors, and auditors on conducting an audit of the annual financial statements of organizations for 2014, given in the appendix to the Letter of the Ministry of Finance of Russia dated 02/06/2015 No. 07-04-06/5027 (hereinafter referred to as the Recommendations of the Ministry of Finance), specify in which In order, the transferring and receiving parties should take into account the funds intended to increase the authorized capital. Since operations to increase the authorized capital concern a wide range of enterprises, we will analyze in detail the explanations given by specialists from the Ministry of Finance.

The Recommendations of the Ministry of Finance consider two mirror situations:

- accounting for funds transferred by an enterprise as a contribution to the authorized capital of another enterprise until the moment of state registration of the relevant changes in the constituent documents;

- accounting for funds received by an enterprise in connection with an increase in its authorized capital until the moment of state registration of the relevant changes in the constituent documents.

Incorporation of funds transferred to increase the authorized capital

Without taking into account the Recommendations of the Ministry of Finance

Until today, the author has taken the position that an enterprise that has contributed funds to pay for shares (shares) registers financial investments when acquiring ownership of these financial investments, which, in turn, arises from the moment of state registration of the transaction. Accordingly, until the receipt of ownership rights, the funds transferred in payment for shares (shares) are included in other receivables.

In the accounting records it looks like this:

Debit 76 “Settlements with various debtors and creditors” Credit 51 “Settlement accounts” - funds were transferred in payment for the acquired shares (shares);

Debit 58-1 “Shares and shares” Credit 76 “Settlements with various debtors and creditors” - shares (shares) are capitalized.

This position is due to the following:

- in cases where the alienation of property is subject to state registration, the acquirer’s ownership rights arise from the moment of such registration, unless otherwise established by law ( clause 2 of Article 223 of the Civil Code of the Russian Federation );

- changes and additions to the company's charter are subject to state registration and become valid for third parties from the moment of their state registration ( clause 2 of article 14 of the Law on JSC [1], clause 2.1 of article 19 of the Law on LLC [2] ).

The LLC Law directly say when a participant has the right to shares when increasing the authorized capital . With regard to secondary turnover, in which already placed shares are transferred, there are similar explanations. Despite the fact that the transfer between third parties of already placed shares (shares) is beyond the scope of this article, in this case it is appropriate to pay attention to this. According to paragraph 12 of Art. 21 of the Law on LLC, a share or part of a share in the authorized capital of an LLC passes to its acquirer from the moment of notarization of a transaction aimed at alienating a share or part of a share in the authorized capital of an LLC, or in cases that do not require notarization, from the moment of making relevant changes to the Unified State Register of Legal Entities based on legal documents.

When increasing the authorized capital, notarization of the transaction is not required; therefore, drawing an analogy, it can be argued that ownership of the share arises from the moment of state registration of changes to the constituent documents. The transfer of ownership of shares[3] occurs from the moment of making a credit entry on the personal account of the acquirer in the register of securities owners or from the moment of making a credit entry on the acquirer’s securities account in the depositary (clause 2 of article 149 of the Civil Code of the Russian Federation , article 29 of the Law on securities market [4]).

Let us allow ourselves a small digression about the legal significance of state registration. State registration is not some technical moment of the transaction, it is an action during which ownership rights arise for the acquirer. The recording of financial investments by enterprises after state registration of a transaction is not due to the fact that accountants prefer to register an object when all procedures have been completed and no violations have been identified, but because at this moment ownership rights arise. According to the author, when explanations focus on the fact of state registration and are silent that at this moment the ownership right is transferred, this leads to the fact that the understanding of what is happening is erased.

Taking into account the Recommendations of the Ministry of Finance

In the Recommendations of the Ministry of Finance (section “Disclosure of information on investments in the authorized capitals of other organizations”) the Ministry of Finance (with reference to clause 2 of PBU 19/02 “Accounting for financial investments” [5]) concludes: information on the amount of funds transferred by the enterprise to A contribution account to the authorized capital of another enterprise, prior to state registration of the relevant changes in the constituent documents, is reflected in the balance sheet as financial investments.

Let us present in full the contents of clause 2 of PBU 19/02 : for the purposes of this provision, in order to accept assets for accounting as financial investments, the following conditions must be simultaneously met:

- the presence of properly executed documents confirming the existence of the organization’s right to financial investments and to receive funds or other assets arising from this right;

- transition to organizing financial risks associated with financial investments (risk of price changes, risk of debtor insolvency, liquidity risk, etc.);

- the ability to bring economic benefits (income) to the organization in the future in the form of interest, dividends or an increase in their value (in the form of the difference between the sale (redemption) price of a financial investment and its purchase value as a result of its exchange, use in repaying the organization’s obligations, an increase in the current market value and so on.).

From the Recommendations of the Ministry of Finance it clearly follows that properly executed documents confirming the existence of the right to financial investments mean not only documents that have undergone state registration, but also are documents evidencing payment for them sufficient for registering a financial investment? Since the Ministry of Finance does not mention any other aspects of the transaction in its letter, then, perhaps, yes. Although many may not agree with this interpretation, since the Recommendations of the Ministry of Finance do not directly state that payment is the moment when a financial investment arises, it is absolutely clear that this moment occurs before obtaining ownership of the financial investment.

Solving a similar problem in relation to real estate, the Ministry of Finance explained that the basis for recording an object for accounting is the actual receipt of the object[6]. An enterprise receiving a piece of real estate, the ownership of which is subject to state registration, must take it into account at the time of actual receipt , regardless of the fact of state registration of ownership rights.

The question arises, how is the actual transfer of shares and shares to participants (shareholders) when increasing the authorized capital? (We are more familiar with discussions about the moment of transfer of property from a shareholder (participant), which consists of transferring money to a current account or transferring property under a transfer and acceptance certificate.)

The LLC Law does not regulate the moment of actual transfer of a share in the event of an increase in the authorized capital, but it can be assumed that the actual transfer occurs with the adoption of a decision on approving the results of making additional contributions by LLC participants and on introducing changes to the LLC charter related to increasing the size of the LLC’s authorized capital ( paragraph 3, paragraph 1, article 19 of the LLC Law ).

When increasing the authorized capital of a JSC, the transfer occurs on the basis of the transfer order of the issuer of shares ( clause 7.3 of the Regulations on maintaining the register of owners of registered securities [7]). The legal nature of the transfer order was examined, in particular, in the Resolution of the Federal Antimonopoly Service of Ukraine dated March 13, 2014 No. F09-5058/13 in case No. A60-26251/2011 [8]. The court came to the conclusion that the transfer order not only contains an appeal to the registration authority to transfer ownership of uncertificated securities, but is also directly an act (action) of transferring uncertificated securities from the seller to the acquirer of such securities. Therefore, within the meaning of Art. 153 of the Civil Code of the Russian Federation, the transfer order actually meets the criteria of a transaction, which recognizes, in particular, the action of a legal entity aimed at establishing, changing or terminating civil rights and obligations, and which can be challenged. If we draw analogies, we can say that the transfer order plays the same role for shares as the act of acceptance and transfer for real estate.

Let's summarize. Since the Explanations of the Ministry of Finance do not stipulate in any way the moment of actual receipt by a participant (shareholder) of shares (shares), most likely, the department considers it possible to take into account funds as part of financial investments from the moment of their payment, that is, both before the transfer of ownership and before actual receipt. Let us remind you: the procedure for increasing the authorized capital is such that the transfer of shares (shares) and the ownership of them always arises later than payment (more on this below).

Types of securities

According to Art. 142 of the Civil Code of the Russian Federation, a security is a document certifying property rights, the exercise or transfer of which is possible only upon presentation.

The circulation of securities means their purchase and sale and other actions leading to a change in the owner of the securities.

Any enterprise, joint-stock companies (JSC) and credit institutions have the right to issue securities.

Securities include shares of joint stock companies, bonds, certificates of deposit, bills, etc. The issue and circulation of securities are regulated by the legislation of the Russian Federation.

A share is a security confirming the contribution of funds by its owner to the authorized capital of a joint-stock company, giving the right to receive income from its activities, distribution of the remaining property upon liquidation of the company and to participate in the management of this company.

The promotion has no validity period and exists as long as the JSC operates. Shares can be registered or bearer; ordinary and privileged.

Registered shares contain the name of the owner and are recorded in the share registration book, indicating in it information about each registered share, the time of acquisition and the number of shares of individual shareholders.

For bearer shares, only their total number is recorded in the book; they do not contain the name of the owner.

Ordinary shares give the right to participate in the management of the joint-stock company and to receive dividends in the amount determined by the meeting of shareholders at the end of the reporting period.

Preferred shares provide the owner with a preferential right to receive dividends in the form of a firm fixed percentage, but do not give him the right to vote in the joint-stock company.

A bond is a security that confirms an obligation to compensate its holder for its nominal value with payment of a fixed interest.

The holder of the bond is a creditor of the joint-stock company or enterprise that issued the bonds.

Bonds can be issued registered or bearer, interest-bearing or interest-free, freely circulating or with a limited circulation.

The joint-stock company issues bonds only after full payment of all issued shares in the amount of no more than 25% of the authorized capital.

Interest on bonds is paid either periodically during the period for which they are issued or in a lump sum upon the maturity of the bond.

A bill of exchange is a security that certifies the unconditional obligation of the drawer to pay, upon maturity, a certain amount to the holder of the bill (the owner of the bill).

A bill of exchange is not only a convenient form of payment, but also a type of commercial loan, since payment of a bill does not occur immediately, but after a certain time, during which the amount of the bill is at the disposal of the drawer.

A bill of exchange is a unilateral monetary debt obligation in which only the drawer undertakes to pay the amount specified in it

Securities are a means of financing, lending, redistributing financial resources, and investing cash savings.

According to the nature of the object issuing securities, they are:

- government;

- non-state;

- securities of foreign issuers.

Depending on the nature of the operations and transactions hidden behind the issue of securities, as well as the purposes of their issue, they are divided into:

- stock, or monetary. These include stocks and bonds and securities derived from them that are traded on stock exchanges;

- commercial (capital), servicing the process of trade turnover and certain property transactions (bills, checks, mortgages, etc.).

Capital securities are issued for the purpose of forming or increasing the capital of an enterprise necessary for the development of production.

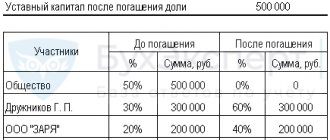

Incorporation of funds received to increase the authorized capital

Without taking into account the Recommendations of the Ministry of Finance

The traditional approach is that an enterprise has the right to increase the balance of account 80 “Authorized capital” only after state registration of the corresponding changes to the constituent documents. This is justified as follows:

- the balance in account 80 “Authorized capital” must correspond to the amount of the authorized capital recorded in the constituent documents of the organization ( Instructions for using the Chart of Accounts [9]);

- changes and additions to the company's charter are subject to state registration and become valid for third parties from the moment of their state registration ( clause 2 of article 14 of the Law on JSC , clause 2.1 of article 19 of the Law on LLC ).

Funds received in payment from shareholders (participants) until the registration of changes to the charter are listed in attracted sources in account 75 “Settlements with founders” and do not increase the value of the enterprise’s net assets. In particular, attention is indirectly drawn to this point in the Letter of the Ministry of Finance of Russia dated 04/09/2007 No. 07‑05‑06/86 .

It should be noted that when increasing the authorized capital, accounts payable always arise to the participants (founders). The reason is that changes to the charter will not be registered until the authorized capital is paid in full ( paragraph 6 , paragraph 1, article 34 of the Law on JSC , paragraph 1, article 17 of the Law on LLC ). This is the difference between increasing the authorized capital and forming the authorized capital when creating an enterprise, when it is allowed to make full payment within a certain time after the state registration of the company ( clause 1, article 34 of the Law on JSC , clause 1, article 16 of the Law on LLC ).

The procedure for increasing the authorized capital from the moment the decision is made to the state registration of the corresponding changes to the constituent documents can take a very long period. For example, for an LLC, in case of increasing the authorized capital due to the contribution of existing participants, this period reaches four months:

- two months to pay contributions after making a decision to increase the authorized capital ( paragraph 2, paragraph 1, article 19 of the Law on LLC );

- a month to make a decision on approving the results of making additional contributions by the company’s participants and on making changes to the company’s charter ( paragraph 3, clause 1, article 19 of the LLC Law );

- month to submit documents for state registration of changes to the charter ( clause 2.1 of article 19 of the LLC Law ).

When increasing the authorized capital through the contribution of third parties (new participants), the procedure may take longer, since in this case six months are allotted for payment of shares ( paragraph 5, paragraph 2, article 19 of the LLC Law ). The issue of shares of a joint-stock company may take even longer, since the period for placement of shares is determined by the issuer itself ( clause 2.7.4 of the Standards for issuing securities and registering securities prospectuses [10]).

From an analysis of the duration of the stages of the procedure for increasing the authorized capital, we can conclude that the longest time period is occupied by the payment of shares (shares) to participants (shareholders). Taking into account the Recommendations of the Ministry of Finance

In the Recommendations of the Ministry of Finance (section “Disclosure of information about received investments in connection with an increase in the authorized capital of a business company”), officials (with reference to PBU 9/99 “Income of the organization” [11]) indicate that contributions of participants (owners of property) are not income economic society. Taking this into account, financiers continue, and also based on the Instructions for the use of the Chart of Accounts in the accounting of a business company, the value of funds and other property received from shareholders or participants in connection with an increase in the size of the authorized capital of the company (before registering the corresponding changes in the constituent documents) is shown separately article in the “Capital and Reserves” section of the balance sheet.

Apparently, the Ministry of Finance does not consider it necessary for funds transferred to the authorized capital to be included in attracted sources until the moment of state registration. in the Instructions for using the Chart of Accounts does not allow them to be capitalized as funds are received from participants (shareholders) to account 80 “Authorized capital” . Based on the above, the author proposes from the moment of payment of shares (shares) to take into account the received deposits in account 75 “Settlements with founders”, but in the reporting to include these contributions in the section “Capital and reserves”, and from the moment of making changes to the constituent documents, without waiting their state registration, credited to account 80 “Authorized capital”.

Valuation of securities

The following types of valuation of securities are distinguished: Nominal value - the amount indicated on the form of the security (CB). The total value of all shares at par value reflects the amount of the organization's authorized capital.

Exchange (market) value is the price determined as the result of the quotation of securities on the secondary market, i.e., reflects the real value based on supply and demand in a certain time interval.

Issue price is the selling price of a security during its initial placement. It may not coincide with the nominal value. The difference between the sale price and the nominal value constitutes the organization's share premium.

The book value of shares is determined according to the balance sheet by dividing the own sources of property by the number of issued shares, i.e., the value at which the securities are reflected in the balance sheet.

Book value is the cost at which securities are reflected in the accounting accounts.

Liquidation value is the value of the property being sold by a liquidated organization in actual prices paid per share or bond.

In accordance with the Regulations on Accounting and Reporting, financial investments are taken into account in the amount of actual costs for investors.

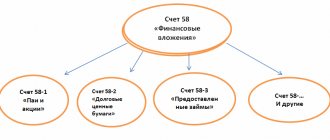

Accounting for the costs of purchasing bonds

Bonds are classified as debt securities and are accounted for in account 58, subaccount 2 “Debt securities”. An organization's costs for purchasing bonds and other similar securities often do not equal their face value. In these cases, there is a difference between actual costs (sales value) and nominal value. This difference must be amortized so that by the time the bond matures, the actual value equals the face value.

According to the Regulations on Accounting and Reporting, the difference between the amount of actual costs for the acquisition of bonds and their nominal value during their circulation period is applied evenly (monthly) to other income (expenses).

If the actual value of the bonds is greater than their nominal value, then the difference is charged to expenses by posting: D-t 91 K-t 58/2, and if the acquisition cost is less than their nominal value, then it is charged to the organization’s income: D-t 58/2 K-t 91. Thus, by the time of maturity, the actual value of the bonds reaches the nominal value.

Example.

CJSC Luch purchased bonds for 40,000 rubles, their nominal value was 34,000 rubles. The maturity of the bond is 2 years. The annual percentage of income is 30%.

In accounting, these transactions will be reflected in the following entries:

1) when registering D-t 58/2 K-t 76 - 40,000 rubles;

2) payment of bonds D-t 76 K-t 51 - 40,000 rubles;

3) the difference between the actual and nominal value will be: 40,000 - 34,000 = 6,000 rubles.

This difference must be repaid in 2 years. The amount of monthly depreciation will be: 6,000 rubles. : 2 : 12 = 250 rub. A monthly entry is made for the amount of depreciation: D-t 91 K-t 58/2 - 250 rubles;

4) for the amount of accrued annual income: D-t 76 K-t 91—RUB 10,200. (34,000 x 30%);

5) Receipt of income to the current account: D-t 51 K-t 76 - 10,200 rubles.