About refunds

For questions regarding the payment and return of insurance premiums for compulsory pension insurance and insurance premiums for compulsory health insurance, the Ministry of Finance recommends contacting the Ministry of Labor (Letter No. 03-04-05/4-419 dated 05/08/2013).

However, the latter is in no hurry to comment on the designated topic. Therefore, the accountant has no choice but to study arbitration practice; but the author proposes to start with the norms of legislation, which in controversial situations are still primary. So, the procedure for offset and return of amounts of overpaid insurance premiums, penalties and fines is established in Art. 26 of the Law on Insurance Contributions. The offset or return of the amount of overpaid insurance premiums is carried out by the body that controls the payment of contributions at the place of registration of the contribution payer, without charging interest. If officials of extra-budgetary funds become aware of overpayment of contributions, then they are obliged to inform the policyholder about this, and not to hush up the facts. With the mutual consent of the parties, it is possible to conduct a joint reconciliation of calculations for insurance premiums in order to clarify the fact and amount of the overpayment. It should be taken into account that it is easier to offset insurance premiums than to return them, since the control body carries out the first procedure independently, and this is beneficial for the extra-budgetary fund.

To obtain a refund, the fee payer must take the initiative by submitting a written application in the prescribed form to the control body. The return period is no more than a month, and if the policyholder has arrears of penalties and fines to be collected, the return is made only after the amount of overpaid insurance premiums is offset against the debt. It is not allowed to offset contributions overpaid to the budget of one extra-budgetary fund against upcoming payments of insurance premiums, repayment of arrears on them, arrears of penalties and fines to the budget of another state extra-budgetary fund.

It is not always possible to refund overpaid fees. In particular, this operation is not performed if information about overpaid insurance premiums is presented as part of individual (personalized) accounting information and is taken into account (posted) by the Pension Fund on the individual personal accounts of insured persons in accordance with the legislation on personalized accounting. Obviously, this limitation applies to that part of the contributions that go to pension insurance and are taken into account in accordance with the Federal Law of 01.04.1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system.” In the described situation, the overpayment can only be offset against future payments.

Postings for accrual of penalties for taxes and insurance premiums

If the established procedure is violated, government bodies may collect arrears and penalties from the company. When penalties are calculated on Pension Fund insurance premiums Refusal to transfer funds is fraught with punishment - penalties and fines established by regulatory authorities. P = 5,000.00 * 2 days. * 11% * 1/300 = 3.67 rub. Accounting certificate 69-1, 69-3 51 5,000.00 Payment of debt on insurance contributions to the Social Insurance Fund and the Compulsory Medical Insurance Fund Payment order 69-1, 69-3 51 3.67 Accrued penalty paid to the budget Accounting certificate, payment order 99-2 68 -4 (68-2, 68-1) 475.17 A penalty was accrued for non-payment of tax in the amount of RUB 78,540.00. The delay was 22 days. To calculate the amount of the penalty, the formula is used: P = C*D*CP*1/300, where C is the amount of contributions payable; D - number of calendar days of delay; SR - refinancing rate. Amounts that the company was unable to transfer for good reason are excluded from the calculations.

Such situations include:

- suspension by court decision of all banking operations of the company;

- seizure of property belonging to the enterprise.

The amount of the fine determined by the formula is transferred in full on the same day as the overdue money. Fines of the Federal Tax Service and the Pension Fund of Russia Fines according to the Labor Code Fines in the Pension Fund of the Russian Federation Key Rate.

. Fines and Penalties for Taxes Accrual of Penalty Postings from October 1, 2017 From October 1, 2021, the rules for calculating penalties are changing. From this date, a new version of paragraph 4 of Article 75 of the Tax Code of the Russian Federation is in force. According to the new rule, the interest rate for calculating penalties will be doubled, i.e.

In particular, this account may reflect...

- 44 - Sales expensesAccount 44 “Sales expenses” is intended to summarize information on expenses associated with the sale of products, goods, works and services.

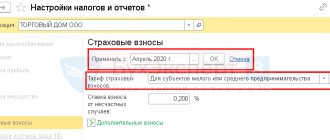

- the bulk of contributions (for compulsory health insurance, compulsory medical insurance, compulsory health insurance for disability and maternity) began to be subject to the Tax Code of the Russian Federation and the requirements that apply to tax payments;

- contributions for injuries remained under the provisions of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ.

- sending a collection order to the payer’s bank;

- recovery from property.

- reducing the possibility of obtaining investment income from investing pension savings;

- reduction in the amount of pension savings when indexing them.

But additional assessments of insurance premiums for these amounts and sanctions against employers are still being carried out (Resolution of the Arbitration Court for the East Siberian District No. F02-11-29/2016 dated May 16, 2016). At one of the enterprises in Moscow, additional insurance premiums were charged for the costs of paying for the gym and trips to the resort.

The Social Insurance Fund considered these benefits to be unreasonable expenses.

Since 2021, insurance premiums have been divided in relation to the legislative norms establishing the rules for working with them:

However, the requirements for their payment have remained unchanged: insurance premiums must be paid by the payer on time and in full. If due to any circumstances they are not paid or not paid in full, not only the arrears are collected from the payer, but also a sanction for late payment, which is called a penalty.

Please note that arrears in contributions cannot be repaid using overpayments incurred before 2021. A return of the overpayment to the current account is possible only after the arrears have been repaid.

For more details, see “Offsetting overpayments on contributions for periods before 2017 is not possible.”

The basis for payment of penalties (if they are not paid voluntarily) are the requirements presented to the payer by the body supervising the relevant contributions (IFTS or Social Insurance Fund). Thus, penalties are the estimated amount that must be paid by a payer who has violated the deadline for paying contributions. They are calculated as a percentage for each day of delay, starting from the day following the payment deadline, which is established by law.

You can calculate penalties using our calculator.

Read about the specifics of calculating penalties from October 1, 2017 in the material “Increased penalties are not always paid.”

Read about the proposed changes in the calculation of penalties in the article “Tax Penalties: Changes in Payment.”

If the payer has neglected the opportunity to voluntarily fulfill the requirement to pay penalties, they are collected using the following methods:

To learn about which accounts penalties can be collected, read the article “From which accounts can tax authorities collect penalties?”

In addition, if the terms and completeness of payment of insurance premiums are violated, we are talking not only about sanctions, but also about a violation of the pension rights of the insured persons.

The negative consequences of non-payment of contributions are:

Read about the consequences of non-payment of insurance premiums due to their failure to be reflected in the calculation in the article “What is the liability for non-payment of insurance premiums?”

Clause 7 of PBU 1/2008 states that the enterprise itself has the opportunity to choose the method of reflecting expenses in accounting, if it is not expressly established by law. PBU 10/99 does not specifically specify the reflection of penalties for taxes and fees; it only indicates penalties for violation of the terms of contracts.

Dt 26 (44) Kt 69.

Read more about the latest point of view of the Ministry of Finance in the material “Tax Penalties and Fines - What is the Accounting Account?”

In earlier recommendations, the Ministry of Finance proposed using account 99 to reflect penalties (letter dated February 15, 2006 No. 07-05-06/31).

In the instructions for using the chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, account 99 is used to reflect tax sanctions. Penalties do not apply to tax sanctions, but the instructions say that account 99 can also be used to reflect penalties for violation of deadlines for paying contributions in correspondence with account 69.

Dt 91 Kt 69.

The amount of the listed penalties is reflected by the posting: Dt 69 Kt 51.

We also emphasize that the amount of penalties on contributions is not involved in calculating the income tax base (clause 2 of Article 270 of the Tax Code of the Russian Federation), therefore, in relation to them, permanent differences arise between accounting and tax accounting (clause 4 of PBU 18/02). These differences correspond to permanent tax liabilities accrued by posting: Dt 99 Kt 68.

About submitting a “clarification”

In connection with overpayment of insurance premiums (when applying a general tariff instead of a reduced one), the payer becomes obligated to submit updated reports to the control body.

The rules for making changes to the calculation of accrued and paid insurance premiums are prescribed in Art. 17 of the Law on Insurance Contributions. The adjusted calculation is not considered to be submitted in violation of the established deadline (“penalty calculation”) if the mistakes made did not lead to an underestimation of the amount of insurance premiums (in a situation where the pharmacy, instead of applying reduced rates, calculated and paid premiums at the general rate, the amount was not underestimated) . The updated calculation of accrued and paid insurance premiums is presented in the form that was in effect during the billing period for which the corresponding changes are made. When submitting an updated calculation of insurance premiums in connection with the use of a general tariff instead of a reduced one, the procedure for filling out the calculation is the same as usual, with the exception of a number of nuances. One of the nuances is associated not so much with filling out the “clarification”, but with the reflection of data on calculations of contributions in subsequent reporting. It raises questions about filling out the lines that indicate the balances of insurance premiums at the beginning and end of the reporting period, as well as where the amount of paid premiums is entered. How to fill out these lines if the regulatory authority has returned the overpayment? Indeed, in the current form for calculating insurance premiums there is no line for this operation. In this case, there are two ways: either increase any of the settlement balances (initial or final, depending on the period) to refund the overpayment, or reduce the paid insurance premiums by the amount of the refund of the overpayment. In both cases, negative values may appear in the calculation lines, which, according to officials, should not be alarmed, since the calculation is structured in such a way that it may contain negative numbers along with positive ones (Letter of the Pension Fund of the Russian Federation dated October 11, 2012 No. 30-21/14846 ).

Let us note that in the reporting forms of individual (personalized) accounting this should not be the case, since the amounts of paid insurance premiums (separately for the insurance, separately for the funded part of the labor pension) must be less than the amount of accrued insurance contributions or equal to it (respectively). This is stated in the Letter of the Pension Fund of the Russian Federation dated May 23, 2011 No. 08-25/5577, dedicated to the algorithm for checking the amounts of insurance premiums on the individual personal account of the insured person. It turns out that the amounts of overpaid insurance premiums are not reflected in individual (personalized) accounting forms, that is, there is no need to submit corrective information to the Pension Fund for the return of the overpayment; the most that can be done is to offset the overpayment based on the updated calculation of insurance premiums. We repeat, the above applies to contributions transferred to compulsory pension insurance and posted to individual personal accounts of insured persons. Contributions to other types of social insurance (to the Social Insurance Fund, Compulsory Medical Insurance) can be returned provided that an application for refund is submitted and a “clarification” is submitted.

For your information

Regarding contributions to the Social Insurance Fund, the calculation of 4-FSS is subject to clarification (the form was approved by Order of the Ministry of Labor of the Russian Federation dated March 19, 2013 No. 107n), and on the title page you need to put the adjustment number in the field provided for this.

And one more thing: for payers of insurance premiums at reduced rates, sections are provided in the calculation of insurance premiums, the completion of which confirms this right. For pharmacies applying a reduced tariff due to clause 10, part 1, art. 58 of the Law on Insurance Contributions, no such separate table (section) has been introduced in the calculation of insurance premiums.

Liability for failure to submit reports on insurance accruals and other violations

Erroneous actions when preparing reports, failure to meet deadlines for submission, evasion of contributions from legal entities and private individuals can have serious consequences. Depending on the degree of violation, the obligated person is subject to administrative liability, fined or charged a fine.

| Major violations | Sanctions | Base |

| Failure to submit reports in accordance with the required deadlines | A fine of 5% of the amount of the insurance payment that must be made for each month (from 1000 rubles, but not more than 30% of the amount); counting starts from the date when it was necessary to pay | Tax Code of the Russian Federation, Article 119, paragraph 1 |

| Reducing the tax base for calculating insurance payments | Fine 20% of the unpaid amount, but not more than 40,000 rubles. | Tax Code of the Russian Federation, art. 120, paragraph 3 |

| Non-payment, partial payment of contributions due to a decrease in the tax base for their calculation, erroneous calculation of contributions, other illegal actions not related to tax offenses | Fine 20% of the unpaid amount of insurance premiums, 40% for an intentional act | Tax Code of the Russian Federation, art. 122, paragraph 1 |

These sanctions apply to violators in 2021.

Example 1. Additional insurance charges and penalties based on an audit report in accounting

In 2021, Domino LLC underwent a desk audit by the Pension Fund of Russia, which resulted in an understatement of the taxable base for calculating insurance payments. The inspector drew up an act in which he ordered additional contributions to be calculated. In addition, the obligated person was fined for violating payment deadlines.

The accounting department of Domino LLC showed the additional insurance accrual with the entry DT 91 CT 69, penalties - DT 91 CT 69, and the offset - DT 69, CT 69 (76).

Example 2. Penalty for late insurance payments: display in accounting

Dolina LLC did not accrue insurance premiums to the Pension Fund in a timely manner. As a result, due to the delay, the company's penalties increased by the end of the reporting period. The management decided to cover the debt through the discovered overpayment of Pension Fund contributions. The accounting department of Dolina LLC made the following entries:

- DT 99 CT 69 (collection “Payments for penalties of the Pension Fund”) - penalties for late insurance payments;

- DT 69 (collection “Payments for Penal Fund Penalties”) CT 69 (collection “Insurance Contributions to the Pension Fund”) - covering penalties by overpayment of Pension Fund contributions.

The accounted overpayment completely covered the penalty.

About judicial practice

The organization submits to the territorial body of the Pension Fund of the Russian Federation at the place of registration as a payer of insurance premiums an application for the return of overpaid contributions.

The inspector considers the application taking into account the information available in the personalized accounting forms and declaration of insurance premiums. Based on the results of the review, the official decides to return overpaid insurance premiums, but sometimes not in favor of the policyholder. Thus, in the Resolution of the FAS ZSO dated May 30, 2013 in case No. A46-25881/2012, the Pension Fund of the Russian Federation refused to return the overpaid amounts, citing the refusal by the absence of an overpayment, which followed from the statement (form ADV-11). Meanwhile, the legislation does not establish priority for the information reflected in the statement in form ADV-11 over the information included in the calculation of insurance premiums. There is also no such reason for refusing to return overpaid insurance premiums as a discrepancy between the data available in the statement (form ADV-11) and in the calculation, or the lack of a certificate about the status of settlements with the budget. Simply put, when resolving the issue of the presence or absence of excessive payment of insurance premiums, personalized information does not have any priority compared to the calculation and payment documents, and also does not confirm or refute the information reflected in the calculation of insurance premiums and following from payment documents .

Sometimes another person transfers these contributions for the payer of insurance premiums. Any organization or entrepreneur can face a lack of funds. In this case, you need to know that today there are no mandatory requirements for the method of transferring insurance contributions for compulsory pension insurance, as well as a ban on the participation of other persons in fulfilling the obligation to pay insurance premiums (Resolution of the Federal Antimonopoly Service of the Federal Antimonopoly Service dated May 17, 2013 in the case No. A03-11003/2012).

There are deadlines for claiming the right to a refund of overpaid insurance premiums:

– no more than a month for the payer of insurance premiums to submit an application to the body monitoring the payment of insurance premiums;

– no more than three years for filing a claim in court from the day when the person learned or should have learned about the fact of excessive collection (payment) of insurance premiums.

If these deadlines are not violated, the control body does not have the right to refuse to return the overpayment (decrees of the FAS ZSO dated 03/22/2013 in case No. A27-17234/2011, FAS MO dated 03/06/2013 in case No. A40-68316/12-99-395) .

And one more thing: in the period from 2002 to 2009, the authority to calculate the amount of overpayment to be returned and make a decision on return was granted to the Pension Fund of Russia, while the execution of such decisions was entrusted to the chief administrator of the budget revenues of the Pension Fund - the Federal Tax Service ( see Resolution of the Eleventh Arbitration Court of Appeal dated January 31, 2013 in case No. A72-6511/2012). Therefore, contributions for these periods were returned only on the basis of an agreed decision of the Pension Fund and the Federal Tax Service. If this was not done, both the Pension Fund (Resolution of the Federal Antimonopoly Service dated May 28, 2013 in case No. A72-5990/2012) and the Federal Tax Service (Resolution of the Federal Antimonopoly Service of Ukraine dated January 31, 2013 No. F09-14095) had to answer for the unlawful non-refund of insurance premiums. /12 in case No. A60-50182/11).

On reflecting the recalculation of contributions in accounting

For accounting purposes, any inaccuracy that requires clarification must be properly qualified.

If this is an error, the procedure for making corrections is one, and if it is obtaining new, previously inaccessible information, then another. As the reader guessed, the author uses the terms PBU 22/2010 “Correcting Errors in Accounting and Reporting” and refers to the methodology contained in this standard. For the purposes of its application, an error is considered to be the failure to reflect the facts of economic activity in the accounting records or financial statements of an organization or their incorrect reflection. At the same time, inaccuracies or omissions identified as a result of obtaining new information that was not previously available to the accountant are not considered errors. I don’t want to admit that the use of a general tariff instead of a reduced one is a mistake, but nevertheless it is so. After all, the fact that the accountant learned about the possibility of applying reduced tariffs from letters from authorized bodies, court decisions and articles by journal experts does not mean that new information was received that was not available at the time of reflection (non-reflection) of such facts of economic activity. Although an overestimated calculation of insurance premiums most likely does not indicate an error in the accounting methodology, but rather miscalculations in compliance with the legislation on insurance premiums. This can be regarded as an inaccuracy in calculations or as an incorrect use of information available at the date of signing the financial statements. One thing is obvious: the amount of insurance premiums to be accrued, and with it the amount of expenses (financial result), must be adjusted taking into account the previously unapplied reduced tariff. But first, let us recall that preferential insurance rates in the Pension Fund and the Social Insurance Fund for pharmacy organizations licensed for pharmaceutical activities and using UTII in relation to payments and rewards made to individuals in connection with the implementation of pharmaceutical activities have been introduced since 2012 (Federal Law dated 03.12. 2011 No. 379-FZ). Therefore, the accountant has the right to recalculate contributions for 2012 and for those interim reporting periods that took place in 2013. Excessively accrued and transferred insurance premiums in 2012 are an error of previous years, while overpayment in 2013 is an error of the current period.

When half of the year is already behind us, we can state that the financial statements for last year have already been compiled, signed and approved; they can no longer be corrected in the fall, and there is no need to prepare revised financial statements. Let everything remain as it is in 2012; adjustments must be made to the 2013 accounting. Let us remind you that an error identified after approval of the statements is corrected either in correspondence with account 84 “Retained earnings (uncovered loss)” (for a significant error), or in correspondence with account 91 “Other income and expenses” (for a minor error) (see clause 1, clause 9 and clause 14 of PBU 22/2010).

The question arises: is overpayment of insurance premiums a significant mistake? The answer depends on the amount of the overpayment and its share in retained earnings (uncovered loss) - will it influence the decisions of the owners or can it be included in the calculation of the current financial result? The author would venture to suggest that based on the results of the entire 2012, the error in overpayment of contributions may be significant, but based on the results of the interim reporting periods of 2013 - not. Another option is when the errors of both periods are insignificant or, on the contrary, are recognized as significant. Let's look at these situations using examples.

Example 1

The pharmacy overpaid insurance premiums at the general rate for 2012 (RUB 110,000) and one reporting period in 2013 (RUB 30,000). All this was revealed in 2013 after the approval of the statements for 2012. Insurance contributions to extra-budgetary funds are included in sales expenses and reflected in account 44. The error relating to 2012 was recognized as significant, but that relating to 2013 was not. .

We start with the overpayment for 2012. During this period in accounting, it is necessary to reduce the amount of accrued insurance premiums (Debit 69 Credit 84) to the amount that would be obtained if insurance premiums were accrued at a reduced rate.

Next, let's look at the overpayment for 2013. Excessively accrued contributions are reversed to the amount that would show the calculation of insurance premiums not at the general rate, but at a reduced rate (Debit 44 Credit 69 - reversal) in the month of 2013 when the accountant learned that he , by not applying the reduced tariff, I was mistaken.

The following entries will be made in the pharmacy accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| For excess accrued and paid contributions for 2012. | |||

| Excessively accrued contributions in the month the error was discovered in 2013 were reduced. | 69 | 84 | 110 000 |

| For excess accrued and paid contributions for 2013. | |||

| Excessively accrued insurance premiums in the month the error was discovered, 2013, were reversed. | 44 | 69 | (30 000) |

The presented correspondence is suitable for a situation where errors in overpayment of insurance premiums for both periods are recognized by the accountant as significant.

Example 2

Let's change the conditions of the previous example. Overpayment of insurance premiums for 2013 and 2012. recognized as an insignificant error in relation to the pharmacy’s financial reporting indicators.

In this case, the corresponding account for correcting the overpayment of contributions for 2012 is account 91 “Other income and expenses,” and for the error in 2013, the same rules apply as in the previous example, that is, corrections are made by reversal entries.

The following entries will be made in the pharmacy accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| For excess accrued and paid contributions for 2012. | |||

| Excessively accrued contributions in the month the error was discovered in 2013 were reduced. | 69 | 91 | 110 000 |

| For excess accrued and paid contributions for 2013. | |||

| Excessively accrued insurance premiums in the month the error was discovered, 2013, were reversed. | 44 | 69 | (30 000) |

Let’s add that all transactions must be confirmed by documents (accountant’s certificates).

Recalculation of contributions for previous years is not reflected in the RSV

For example, when calculating the base for one of the past periods for which reports have already been submitted to the Pension Fund, you did not take into account any payment subject to contributions.

As a result, contributions based on the results of that “erroneous” period were accrued to the funds in an incomplete amount. Now the policyholder must add additional premiums from the unaccounted amount, pay them and submit the updated RSV-1 to his Pension Fund branch (Part 1, Article 17 of Law No. 212-FZ of July 24, 2009). Moreover, the procedure should be exactly this - first payment of fees, then submission of clarification. This way you can avoid a fine (clause 1, part 4, article 17, part 1, article 47 of Law No. 212-FZ of July 24, 2009). Submitting an update and an alternative option The policyholder can submit updated information on contributions in two ways:

- or submit exactly the updated RSV-1 for the “erroneous” period and in full.

If any errors occur during the operation of the program, you should contact your system administrator. In most cases, the reluctance of the program to work as required is caused by the actions of the accountant himself. In case of violation of the current legislation regarding contributions to extra-budgetary funds, the following sanctions are imposed on violators: The payment procedure is violated. Arrears are collected. The procedure for payment for social insurance for disability is violated. The procedure for payment for social insurance for disability is violated. Understatement of the base used for calculating contributions. Collection of a fine (20% of amount) Failure to submit required documents within the deadline RUB 200.

The individual entrepreneur prepares and submits reports to the Pension Fund on a quarterly basis. The sequence of actions for additional accruals is as follows: first, contributions are transferred, then proper reporting is submitted (updated RSV-1, etc.). If he doesn’t have employees, then he doesn’t need to report to anyone.

1.1 to pr.1 to r.1; sub.1.2 to pr.1, appendix 2 to r.1) and 3. BCCs are written for each type of insurance (section 1 of the form). A number of new BCCs have been approved for 2021 (in accordance with Order of the Ministry of Finance No. 230n dated December 7, 2016 .).

Insurance premiums are often not paid, and some individuals have been doing this for many years in a row. This should not be done, as this may lead to the imposition of penalties on the employer.

In addition, subsequent additional payments of insurance premiums for previous years to the budget will still need to be carried out, this is inevitable. Even if the transfer of the corresponding amounts in favor of the funds is carried out on time and without violations, it is imperative to first understand the following important points:

- when generating a report for past periods – what exactly to take into account;

- relating to inspection reports;

- process of reflection in financial statements (posting);

- work in the 1C program.

It is especially important to correctly display reporting in accounting programs.

Summoning for questioning to the tax office: tips to ensure everything goes smoothly. Would a SIMPLE taxpayer win in this situation?? I think this is the “only” one... The Pension Fund of Russia lost the case of a fine from the tax inspectorate for failure to submit the SZV-M. One of the recipes for fighting poverty: you need to transfer some from the consumer basket to the consumer goods... How they will reduce poverty Just today I was watching TV at breakfast.

But the court is on the side of the taxpayers, if you really are a thief, compliance with these recommendations, nerves of iron and the ability to bluff will be very...

- Additional accrual of insurance premiums for previous periods

- Recalculation of contributions for previous years is not reflected in the RSV

- Contributions as of January 1: arrears and overpayments

- Bad request

- Accounting for additional charges of insurance premiums

- Reflection of receivables for insurance premiums for the previous period.

- Accounting in 1C for arrears in the Pension Fund for the past period in 2021

How are additional insurance premiums calculated for past periods in 2021? Important: This can be done in one of the following ways:

- Submit the full corrected version of RSV-1 for the period where the error was made.

- Show additional accruals in sections 1 (line 120) and 4 for the current period (used when an error is detected after the first day of the third month following the expired reporting period).

Sample RSV-1 From January 1, 2017. After transferring information about it to the Federal Tax Service, will the Federal Tax Service be able to count it against upcoming contributions payments? — Neither the Tax Code of the Russian Federation nor the Law of 07/03/2016 No. 250-FZ contains direct provisions that tax authorities can offset overpaid amounts of insurance premiums for periods before 01/01.

2017 towards upcoming payments. For now, such an overpayment can only be returned. The policyholder must submit a refund application to the Pension Fund or Social Insurance Fund. The Fund will make a decision and send it to the Federal Tax Service for execution. — The policyholder has arrears in premiums as of 01/01/2017. In 2017, he submitted an updated calculation for 2021, the amount of contributions payable became less.

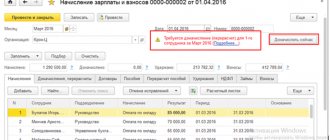

Therefore, if any inaccuracies were made when reflecting additional charges, then such precedents do not threaten the taxpayer with anything terrible. Working in the 1C program Sometimes some difficulties arise due to the need to reflect additional accruals in the special accounting program 1C ZUP - salary and management. Data entry in accordance with the drawn up inspection report is carried out for each employee, this operation looks like this:

- open the application;

- we find an employee whose income should be subject to additional accrual;

- open the menu in the “accrual” section;

- A new window will appear - click on the “tax” tab;

- click on “Taxable, income code”;

- select the type of deductions (name of the extra-budgetary fund).

Thus, all necessary data is entered into the 1C program.

In this case, it is necessary to make transfers on all grounds. Thus, if an individual entrepreneur conducts private practice and has entered into employment contracts with individuals, then he is obliged to make transfers both for himself and for his employees. It must be remembered that the employer is obliged to generate quarterly reports, which are subsequently transferred to the Pension Fund of Russia. Moreover, if the total number of employees is more than 50 people, then this must be done only electronically.

At the same time, individual entrepreneurs carrying out work without employees should not submit any reports. Legal grounds The very existence of various extra-budgetary funds, as well as the mandatory transfer of contributions to them, is enshrined at the legislative level.

If the fact of the existence of debt is not confirmed, submit to the tax authority an information letter from the funds about the absence of debt for reporting periods before 01/01/2017.

For what period should contributions be taken into account? As for the tax period in which the specified additionally accrued insurance premiums can be included in expenses for the purposes of calculating income tax, the Russian Ministry of Finance proposes to do this on the date of accrual of contributions. In this case, officials refer to subparagraph 1 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation: the date of incurring other expenses in the form of taxes (advance payments for taxes), fees and other obligatory payments is the date of accrual of taxes (fees). The fact that insurance premiums are calculated for past periods, according to officials, does not matter.

In our opinion, we can agree with this position if we take into account the provisions of Article 54 of the Tax Code of the Russian Federation. After all, additional assessment of insurance premiums means that in previous tax (reporting) periods the taxpayer underestimated the amount of expenses accepted when calculating income tax. That is, he overpaid the tax.

Since not all operations can be performed with the current date. Some difficulties may arise when making additional charges in 1C 8.2, since there are some peculiarities in performing this operation. What period to take into account? The tax period for contributions to extra-budgetary funds is recognized as one calendar year. The reporting periods are:

- one block;

- half year;

- 9 months.

About amendments to reporting

If an overpayment relating to 2012 is detected, the accountant will no longer be able to make corrections to the approved statements for this period.

It is not subject to revision, replacement or re-presentation to users (clause 10 of PBU 22/2010). A significant error of the previous reporting year, identified after approval of the reporting for this year, is corrected by recalculating comparative indicators for the reporting periods reflected in the organization’s financial statements for the current reporting year (clause 2, clause 9 of PBU 22/2010). In fact, this means that due to a significant error in 2012, the indicators of retained earnings (uncovered loss) will have to be clarified. Let us recall that currently comparative information in the balance sheet is presented for three periods: the current (in the example, this is 2013), the previous one (2012) and the previous previous one (2011). In this case, data on retained earnings (uncovered loss), reflected in the capital of the balance sheet of the current period, must correspond to the balance of account 84 as of the reporting date, which shows the correctness of the retrospective recalculation of financial statements. Due to an insignificant error, there is no need to recalculate comparative indicators; it is enough to reflect the adjustment in the net profit (loss) of the current reporting period.

If an overpayment relating to 2013 is discovered, it must be reflected in the interim reporting for the period when this deficiency was discovered and a decision was made to recalculate insurance premiums at reduced rates. Obviously, there is no need to prepare revised reports for the previous interim period, and not only because this is not provided for by PBU 22/2010 . The fact is that interim reporting is prepared for internal users, who can at any time request data about the operation they are interested in from the accountant.