Methods and procedure for increasing the authorized capital of a joint-stock company

A joint stock company is a form of organization of a legal entity that operates on the basis of a special agreement and has an authorized capital formed by contributions from members of the community. The main distinguishing feature of a joint stock company is the right to issue shares, which are issued to participants in exchange for their contributions to the capital.

The increase in the authorized capital of a joint stock company is carried out on the basis of the provisions of civil legislation.

There are two ways to increase capital:

- Through additional funds: inclusion of investments by shareholders or third parties.

- At the expense of the property of a legal entity: by bringing the capital of the joint-stock company in accordance with the level of the amount of property that belongs to the legal entity). This method is used to increase the attractiveness of a joint stock company for investors, but there is no actual increase in the amount of property.

It is worth noting that an increase in capital can be carried out no earlier than the community members have fully paid the entire authorized capital declared when registering a legal entity in the constituent documentation.

This requirement means that the increase in capital must show a real increase in the property mass of the legal entity.

The rules for increasing and decreasing capital are designed to protect community members from changes in the proportions of shares in the capital. Unauthorized changes in the proportions of shares may change the structure of the authorized capital.

The following methods are used to increase the authorized capital:

- Placement of new shares of the same par value as before. The rules for the placement of additional shares are regulated by the provisions of the Law “On Joint Stock Companies”. According to the general placement rules, this method should not change the structure of the authorized capital.

- Increasing the par value of shares issued by the community. This issue can only be adopted at a meeting of participants of a legal entity - no one other than the general meeting can make a decision on changing the par value of the issued shares. This method refers to increasing capital at the expense of the property of a legal entity. Since the par value of all shares issued by the community changes, this method does not violate the rights of participants and the capital structure. Choosing this method does not require the payment of additional funds by the participants of the legal entity. The increase is carried out through the exchange of shares of the old par value for shares with a higher par value.

REDUCTION OF AUTHORIZED CAPITAL

A decrease in the authorized capital

can occur by a voluntary decision of the participants, or in cases provided for by law, for example, if the organization has not fully paid the authorized capital within a year after registration, if the amount of the organization’s net assets is less than the specified authorized capital.

The company is obliged, within thirty days from the date of the decision to reduce the authorized capital,

to notify in writing all creditors known to it about its new amount, and also to publish a notice in the press about the decision made.

It should be remembered that as a result of reducing the authorized capital,

the size of the balance should not be lower than the permissible limit.

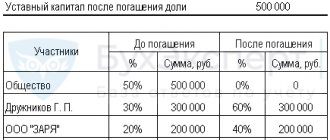

Reducing the authorized capital of an LLC

can be carried out by reducing the value of the shares of all participants in the company, or by redeeming the shares belonging to the company. At the same time, the distribution of shares of the founders remains the same.

Reduce the size of the authorized capital of the joint-stock company

perhaps by reducing the par value of shares and reducing part of the outstanding shares from circulation.

The decision to reduce the authorized capital

must be made at a general meeting. State registration of changes to the charter of a joint-stock company is possible if there is evidence of notification of creditors about the reduction of the authorized capital.

Features of increasing the authorized capital by issuing additional shares

Reduction and increase of the authorized capital of a joint-stock company is carried out in accordance with the norms of legislation - civil law and the Law “On Joint-Stock Companies”.

Regulatory documents set out two ways to increase capital:

- By issuing additional shares of the par value that is currently in effect.

- By increasing the par value of shares by exchanging shares of a smaller value for shares of a larger par value.

All issues regarding the increase and decrease of capital must be resolved at a general meeting of community members.

The method of increasing capital by issuing additional shares should not create a deformation of the authorized capital and shares of each participant. But there are exceptions to this rule - joint stock companies have the legal right to grant the benefit of common shares. Thus, community members who own common stock have greater rights to purchase additional shares than other members of the entity.

Features of this method of increasing capital:

- The decision regarding the increase can be made by the general meeting of founders or the board of directors.

- The number of additional shares is regulated by the framework stated in the constituent documentation of the joint-stock company. The Charter requires the following data: number, par value, types of shares. The decision to issue additional shares can be made by the board of shareholders, simultaneously with amendments to the Charter regarding the number of shares.

- The goals of increasing capital in this way are: attracting additional investments or bringing capital in line with the size of the legal entity’s property.

- It is necessary to accurately determine the number, par value, and methods of placement of additional shares.

The procedure, features and main problems of regulating the increase of capital by issuing additional shares are regulated by law.

In the process of economic activity, the property of a joint-stock company can change both upward and downward. These changes can have both a positive and negative impact on the authorized capital of a joint-stock company as one of the components of the company’s property.

The real property of the company at its disposal is called net assets[11].

The law relates to the amount of net assets the possibility of a joint stock company increasing its authorized capital, as well as the possibility, and in some cases, the need to reduce its authorized capital.

In the event that an increase in the authorized capital of a joint-stock company is caused by objective reasons and is supported financially, it certainly increases the authority of such a company in the business environment and makes the position of the company’s creditors stronger.

The authorized capital of a joint-stock company, under certain conditions and in the manner established by the Federal Law “On Joint-Stock Companies,” can be increased in two ways:

· by increasing the par value of shares;

· through the placement of additional shares (clause 1 of article 100 of the Civil Code of the Russian Federation and clause 1 of article 28 of the Federal Law)[12].

An increase in the authorized capital by any of the above methods is allowed only after it has been fully paid (clause 2 of Article 100 of the Civil Code of the Russian Federation).

The issue by a joint stock company of additional shares is subject to recognition as invalid if it is carried out before full payment of the authorized capital of the company[13].

The same rule prohibits increasing the authorized capital to cover losses incurred by the company.

According to some authors, the ban on increasing the authorized capital to cover losses incurred by the company should be lifted in relation to a closed joint-stock company, in which maintaining the solvency of the company through additional contributions from the shareholders themselves, whose circle is limited, looks quite natural[14].

The Civil Code places the decision on increasing the size of the authorized capital by any of the above methods within the competence of the general meeting of shareholders, without allowing any exceptions (clause 1 of Article 100 of the Civil Code of the Russian Federation).

At the same time, paragraph 2 of Art. 48 of the Federal Law “On Joint-Stock Companies allows” the transfer to the competence of the board of directors (supervisory board) of the company of the issue of increasing the authorized capital of the company by placing additional shares, if such a possibility is provided for in the company’s charter. The same rule is set out in paragraph 2 of Art. 28 Federal Law “On Joint Stock Companies”[15].

The contradiction between the two regulations should be eliminated by setting out paragraph 1 of Art. 100 of the Civil Code of the Russian Federation, taking into account clause 2 of Art. 48 and paragraph 2 of Art. 28 Federal Law “On Joint Stock Companies”.

According to M. G. Iontsev, it would be more correct to give the board of directors (supervisory board) of the company the right to independently decide on the issue of increasing the authorized capital by increasing the par value of shares, since shareholders only benefit from the fact that the par value of their shares increases.

Increasing the authorized capital by issuing additional shares always leads to costs for shareholders who are forced to receive new securities, so the decision on increasing the authorized capital in this way should be left to the competence of the general meeting[16].

According to I.T. Tarasov, an increase in the authorized capital by increasing the nominal price of shares cannot be allowed because this would violate the fundamental principle of limited liability in joint-stock companies[17].

It is hardly possible to agree with such a point of view for the reasons outlined below. An increase in the authorized capital by increasing the par value of shares can only be carried out at the expense of the company’s property, namely:

a) retained earnings based on the results of economic activities for the previous year;

b) capitalization, with the consent of shareholders, of accrued but unpaid dividends;

c) additional funds received by the company from the placement of acquired shares at a price exceeding their nominal value (share premium);

Go to page: 1

Increasing the authorized capital using own funds

The purpose of increasing capital at the expense of a legal entity is a method that is carried out with the aim of equalizing the company’s property and the amount of the authorized capital.

This method is used if it is necessary to attract additional investments, but the actual replenishment of property does not occur.

The increase cannot be carried out before the entire capital has been paid, since the process of increasing capital must show a real addition of property.

In this case, when increasing at the expense of the property of the joint-stock company, it is necessary to take into account the difference between the amounts: reserve fund, authorized capital and net assets. The amount by which the increase is made must not exceed the calculated difference.

Author of the article

WHY MAY THE PROCESS OF REGISTRATION OF CHANGES IN THE AUTHORIZED CAPITAL BE DELAYED?

Registration of changes (increase, decrease) in the authorized capital

must be carried out by the registering authority within

6 working days

, but in reality this process in most cases takes much longer due to the following reasons:

- lack of all necessary documents;

- provision of incorrect information about the organization, presence of errors in documents;

- missing mandatory deadlines for registration and submission of notifications to government agencies;

- submission of documents to an inappropriate authority;

- and, in addition, additional difficulties arise in connection with constant changes in legislation regarding the procedure for registering changes in the authorized capital

.

The process of making changes to the authorized capital

and preparing all the necessary documents requires the work of a competent lawyer who can give professional recommendations on this issue, indicate the presence of restrictions in the organization’s charter and find the most profitable way to implement the

change in the authorized capital

.

Legal brings together highly qualified specialists and provides a wide range of legal services since 1998! You can count on high quality work and short deadlines. Registration of changes in the authorized capital will take 2 days to prepare documents and 5 working days to submit documents to the registration authority.

simplified tax system

Regardless of the chosen object of taxation, organizations applying the simplification do not take into account the difference between the par value of new shares received in exchange for the original ones when calculating the single tax (clause 1 of Article 346.16 of the Tax Code of the Russian Federation).

Organizations that pay a single tax on the difference between income and expenses, the amount of state duty paid for registering the issue of shares, a report on the results of the issue and making changes to the charter, can be included in expenses (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation). This must be done at the time of payment to the budget (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

Combination of OSNO and UTII

Since the payment of the state duty paid for registering the issue of shares, a report on the results of the issue and making changes to the charter is simultaneously related to the organization’s activities on the general taxation system and to activities subject to UTII, the amount of the fee must be distributed (clause 9 of article 274, clause 7 Article 346.26 of the Tax Code of the Russian Federation). For more information about this, see How to take into account expenses for income tax when combining OSNO with UTII.

Income tax expenses include only the amount of state duty related to the organization’s activities on the general taxation system (subclause 1, clause 1, article 264, subclause 3, clause 1, article 265 of the Tax Code of the Russian Federation).

Registration with the tax office

Changes made to the charter must be registered with the tax office (Article 13, paragraph 1 of Article 14 of the Law of December 26, 1995 No. 208-FZ, Article 17 of the Law of August 8, 2001 No. 129-FZ).

In addition, the issue of new shares with a higher par value and a report on the results of the issue of securities are subject to state registration. The procedure for state registration of changes in the charter, the issue of new shares with a higher par value and the report on the results of the issue of securities is similar to the procedure that is applied when registering an additional issue of shares (clauses 3.3, 5.1–5.7, 8.1–8.3, 18.1 of the regulations on the standards of the Bank of Russia dated August 11, 2014 No. 428-P).

Amendments to the charter

When increasing the authorized capital, changes must be made to the company's charter. The decision to make changes is made by:

- general meeting of shareholders (as a general rule);

- board of directors (supervisory board), if such powers are granted to it by the charter;

- sole founder (shareholder) (if the organization has only one founder (shareholder)).

In the first case, draw up the minutes of the general meeting of shareholders. The second contains the minutes of the meeting of the board of directors (supervisory board). In the third - the decision of the sole founder (shareholder).

This is stated in paragraph 2 of Article 12, paragraph 3 of Article 47, Article 63, paragraph 4 of Article 68 of the Law of December 26, 1995 No. 208-FZ.

If the decision to change the charter is made by the general meeting of shareholders, at least 3/4 of the votes of shareholders - owners of voting shares participating in the general meeting must be cast for the change (Clause 4 of Article 49 of the Law of December 26, 1995 No. 208-FZ ). When this decision is made by the board of directors, a majority vote of its members is sufficient, unless the company’s charter establishes other rules (clause 3 of article 68 of the Law of December 26, 1995 No. 208-FZ).

Income tax

An increase in the par value of shares does not affect the calculation of income tax. The difference between the par value of new shares received in exchange for the original ones is not taken into account when calculating income tax (Clause 31, Article 270 of the Tax Code of the Russian Federation).

If such a difference has arisen for a shareholder - a foreign organization that does not operate in Russia through a permanent establishment, there is no need to withhold income tax from it. In this case, the company is not a tax agent in relation to its shareholder - a foreign organization. Since such amounts are excluded from the taxable income of shareholder organizations (subclause 15, clause 1, article 251 of the Tax Code of the Russian Federation).

The amount of state duty paid for registration of the issue of shares, a report on the results of the issue and amendments to the charter can be attributed to:

- for other expenses (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia for Moscow dated June 26, 2006 No. 20-12/56686);

- for non-operating expenses - as costs associated with the issue of shares (subclause 3, clause 1, article 265 of the Tax Code of the Russian Federation).

The organization has the right to independently decide which expenses include the amount of state duty (clause 4 of Article 252 of the Tax Code of the Russian Federation).

When using the accrual method, take into account the amount of the state duty at the time of its accrual (subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation). With the cash method - as it is paid to the budget (subclause 3, clause 3, article 273 of the Tax Code of the Russian Federation).

Personal income tax and insurance premiums

As a result of increasing the authorized capital of the organization, the nominal value of the shares will also increase.

Personal income tax must be withheld from the amount of the difference between the original and new par value of shares of individuals. This procedure follows from paragraph 1, paragraph 3 of paragraph 5 of Article 28 of the Law of December 26, 1995 No. 208-FZ and is confirmed in letters of the Ministry of Finance of Russia dated May 21, 2014 No. 03-04-05/24185 and dated January 12, 2006 No. 03-05-01-04/2.

An exception will be the case when the increase in the authorized capital occurs due to the revaluation of fixed assets. There is no need to withhold personal income tax from such shareholder income (Clause 19, Article 217 of the Tax Code of the Russian Federation).

When the nominal value changes, the following is not charged:

- contributions for compulsory pension, social and health insurance (Part 1, Article 7 of Law No. 212-FZ of July 24, 2009);

- contributions for insurance against accidents and occupational diseases (clause 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

This is due to the fact that such payments do not relate to remuneration received for the performance of duties under employment and civil law contracts.