Participants of the company are obliged, by decision of the general meeting of participants of the company, to make contributions to the property of the company. These contributions do not change the size and nominal value of the shares of company participants in the authorized capital of the company (clause 7 of the LLC Law). According to the letter of the Ministry of Finance of the Russian Federation dated April 13, 2005 No. 07-05-06/107, the contribution to the property of a limited liability company is subject to reflection in accounting as a debit to property accounting accounts and a credit to the additional capital account.

The Tax Code regulates the procedure for taxation of income received by the company in the form of property, property rights contributed by participants and shareholders, including to the additional capital of the company. So, according to subclause 3.4. Clause 1 of Article 251 of the Tax Code of the Russian Federation, when determining the tax base, income in the form of property, property rights that are transferred to a business company or partnership in order to increase net assets, including through the formation of additional capital, is not taken into account. This rule also applies to cases of increase in the net assets of a business company or partnership with a simultaneous decrease or termination of the obligations of the business company or partnership to the relevant shareholders or participants.

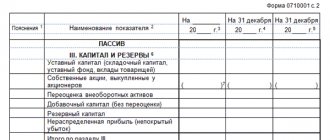

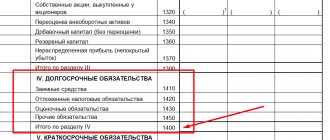

Accounting

To reflect in accounting transactions related to the use of additional capital, use account 83 “Additional capital”. If you have shortcomings in your knowledge of accounting, read the article debit and credit for dummies. Using simple examples, we examined the principles of debit, credit and their balances in simple words.

When paying the founders (participants, shareholders) funds in excess of the amount of reduction in the authorized capital of the organization, make the following entries in the accounting records:

Debit 83 Credit 75-1

– additional capital funds are distributed among the founders (participants, shareholders) of the organization;

Debit 75-1 Credit 51 (52, 50)

– funds of the organization’s additional capital are transferred to the founders (participants, shareholders).

For more information on accounting for transactions related to the use of additional capital for various purposes, see:

- How to reflect the revaluation of fixed assets in accounting;

- How to reflect in accounting an increase in the authorized capital of an LLC at the expense of its own property;

- How to reflect in accounting an increase in the authorized capital of a joint-stock company due to additional placement of shares;

- How to reflect in accounting an increase in the authorized capital of a joint-stock company due to the conversion of shares.

Situation: can additional capital be used to cover losses from previous years?

The answer to this question depends on how the additional capital was formed.

The legislation does not contain a direct indication of the possibility of using additional capital to pay off losses, as well as a direct prohibition on this.

As a rule, the additional capital of an organization is formed from additional property received by the company. An exception is cases of revaluation of fixed assets and intangible assets. The fact is that the revaluation amounts do not reflect the value of the actual property received, since they were formed “virtually” according to accounting rules.

The owner of property created from the contributions of the founders, as well as produced and acquired by the company in the course of its activities, is the company itself (Clause 1, Article 66 of the Civil Code of the Russian Federation). That is, the organization can dispose of it at its own discretion.

Thus, the organization has the right, by decision of the founders (participants), to allocate funds from additional capital to repay received losses. The exception is the amount of additional capital that was formed as a result of the additional valuation of property. This amount can only be used to depreciate the fixed asset or intangible asset in the future. It cannot be used to cover losses (paragraph 6, paragraph 15 of PBU 6/01, paragraph 2, paragraph 21 of PBU 14/2007, letter of the Ministry of Finance of Russia dated July 21, 2000 No. 04-02-05/2).

Confirms the possibility of using additional capital to cover losses and that the list of options for using additional capital given in the Instructions for the chart of accounts is open. At the same time, the openness of this list is indicated by the fact that the last paragraph of the list ends with the words “etc.”

In accounting, reflect the use of additional capital funds to cover losses of previous years by posting:

Debit 83 Credit 84

– additional capital funds are aimed at covering losses of previous years.

An example of using additional capital to cover losses of previous years. Additional capital was formed from the share premium of the organization

As of December 31, 2014, Alfa CJSC recorded additional capital in the amount of RUB 300,000. It was formed through the placement of company shares at a price above their par value (i.e., at the expense of share premium).

Based on the results of activities for 2014, the organization received a loss in the amount of 360,000 rubles. In 2015, it was decided to use the full amount of additional capital to pay off the loss.

In 2015, Alpha’s accountant made an accounting entry:

Debit 83 Credit 84 – 300,000 rub. – additional capital generated from share premium was used to cover the 2014 loss.

The amount of the organization's uncovered loss for 2014 amounted to 60,000 rubles. (360,000 rub. – 300,000 rub.).

Share premium from the sale of shares and shares

The formation of additional capital at the expense of share premium occurs as follows. Share premium is the difference between the selling price and the par value of shares. This difference may result from:

- formation of the authorized capital of a joint-stock company upon its establishment;

- increasing the authorized capital of a joint-stock company through additional issue of shares.

In the first case, the difference is formed if the amount of money actually contributed by shareholders when paying for the shares (or the value of the property received as payment for the shares) is greater than the par value of the shares at their initial placement.

In the second case, the difference will arise if the actual price of shares additionally placed when increasing the authorized capital exceeds their nominal value.

The share premium of a joint-stock company is attributed to the organization's additional capital (clause 68 of the Regulations on Accounting and Reporting).

Similar income can arise in an LLC. This is possible if the participant’s contribution to the authorized capital exceeds the nominal value of the share paid by him. In this case, the amount of such excess is attributed to the organization’s additional capital (letter of the Ministry of Finance of Russia dated August 9, 2004 No. 07-05-12/18, clause 68 of the Regulations on Accounting and Reporting).

BASIC

The use of additional capital of an organization does not affect the calculation of income tax. This is due to the following.

The write-off of additional capital as a result of the depreciation of fixed assets is not taken into account when calculating the tax base for income tax, since the results of the revaluation are not reflected in tax accounting (paragraph 6, clause 1, article 257 of the Tax Code of the Russian Federation). For more information about this, see How to reflect the revaluation of fixed assets in accounting.

A similar procedure applies in the case of write-off of additional capital as a result of a write-down of the organization’s intangible assets. The amount of markdowns does not affect the calculation of income tax, since the Tax Code of the Russian Federation does not provide for the very possibility of revaluing intangible assets (Article 257 of the Tax Code of the Russian Federation).

If additional capital funds are used to increase the authorized capital of an organization, the tax base for income tax also does not change. In this case, the organization does not incur any expenses and does not receive income.

The distribution of additional capital between the founders (participants, shareholders) of the organization does not affect the calculation of income tax. Such an operation is not related to activities aimed at generating income. Therefore, amounts paid to founders (participants, shareholders) when reducing the authorized capital are not recognized as expenses of the organization. This conclusion follows from the provisions of paragraph 49 of Article 270, paragraph 1 of Article 252 of the Tax Code of the Russian Federation and is confirmed by arbitration practice (see, for example, the decision of the Supreme Arbitration Court of the Russian Federation dated January 29, 2007 No. 15395/06, the resolution of the Federal Antimonopoly Service of the North-Western District dated September 18 2006 No. A05-17306/2005-33).

Alternative measures

It is possible that after writing off the loss, the financial picture will improve. However, there are several legal ways to pay income to the founder if there is no profit.

"Surcharge"

If the founder is an employee of his own company, he can receive his income in the form of an increased (compared to the usual “rates”) salary (do not forget to draw up a staffing table).

The amount of the “surcharge” will reduce income tax. From the point of view of salary taxes, it needs to be subject to all of them in full. This will also reduce taxes.

The founder-employee will have to pay personal income tax at a rate of 13% (it is the same for salary and dividends). Of course, from paying income to the founder in the form of additional wages, the company will suffer significant losses in the form of “real” money.

"Present"

You can choose the option with a gift. Whom to reward and in what amount is a matter for the company. The main thing is that it is not often and in accordance with a written gift agreement. Remember: giving money is not prohibited. The amount of the gift cannot be included as expenses, but insurance premiums do not need to be charged. The main thing is to check whether the issuance of gifts is provided for in the employment or collective agreement. If provided, then they are part of the remuneration. This means that insurance premiums will have to be calculated, even if there is a written gift agreement.

As for personal income tax on a gift, it will have to be withheld from an amount exceeding 4,000 rubles - in accordance with the general procedure. In general, be careful - there are quite a lot of nuances associated with the “gift issue”.

Gifts can be presented on the occasion of a specific event (birthday, wedding, New Year, other public or professional holiday) or for no reason.

According to the gift agreement, the donor (clause 1 of Article 572 of the Civil Code of the Russian Federation):

- transfers or undertakes to transfer ownership of an item (including money and gift certificates) to the donee free of charge;

- transfers free of charge or undertakes to transfer to the donee a property right (claim) to himself or to a third party

- releases or undertakes to release the donee from a property obligation to himself or to a third party.

To avoid the need to charge and pay insurance premiums on the value of the gift, the fact of its transfer must be properly documented. The agreement for the donation of movable property must be concluded in writing in the case where the donor is a legal entity and the value of the gift exceeds 3,000 rubles (clause 2 of Article 574 of the Civil Code of the Russian Federation).

Companies can give gifts only to individuals, for example, employees (including former employees), clients, and employees of counterparties.

If a gift agreement is concluded when transferring a gift, you will not have to pay contributions on its value (letter of the Ministry of Finance of Russia dated December 4, 2017 No. 03-15-06/80448, letter of the Ministry of Labor of Russia dated September 22, 2015 No. 17-3/B-473). In this case, the object of taxation by insurance premiums does not arise regardless of the value of the gift.

Payments made under civil law contracts, the subject of which is the transfer of ownership or other proprietary rights to property, are not subject to insurance premiums. Such agreements include a gift agreement (Article 572 of the Civil Code of the Russian Federation). Therefore, gifts formalized by a gift agreement are not included in the base subject to insurance contributions (Part 4 of Article 420 of the Tax Code of the Russian Federation).

note

If the available sources to repay the uncovered loss of the reporting year are not enough, the uncovered loss is left on the balance sheet. However, an organization that has suffered a loss at the end of the year should pay special attention to the value of its net assets.

Officials also note that the donation agreement for movable property must be made in writing in the case where the donor is a legal entity and the value of the gift exceeds 3,000 rubles (Clause 2 of Article 574 of the Civil Code of the Russian Federation). Does this mean that if the value of the gift is less than 3,000 rubles, such an agreement can be concluded orally and insurance premiums do not need to be charged on its value?

We will find the answer in letters from the Ministry of Health and Social Development of Russia dated March 5, 2010 No. 473-19 and the Pension Fund of the Russian Federation dated September 29, 2010 No. 30-21/10260. It says that the object of taxation by insurance premiums does not arise if the gift agreement is concluded in writing, regardless of the value of the gift.

In addition, if the issuance of gifts is provided for in the employment or collective agreement, then they are part of the remuneration. This means that the cost of gifts must be included in the calculation base for calculating insurance premiums.

The courts do not have a uniform approach to the situation.

Loan day

Now consider the option of an interest-free or low-interest loan from the company. This method has its negative sides. Firstly, the recipient’s income will be savings on interest - the so-called material benefit. It is determined on the last day of each calendar month and is subject to personal income tax at a rate of 35%.

If an employee receives a loan from an organization, then a material benefit arises provided that he pays interest for the use of funds at a rate that is lower than 2/3 of the refinancing rate (key rate) of the Bank of Russia (for loans issued in rubles) or 9% per annum (for loans issued in foreign currency). The rate of personal income tax levied on amounts of material benefits at preferential interest, as already mentioned, is 35%.

The tax is imposed on the difference between the amount of interest calculated based on 2/3 of the refinancing rate (key rate) of the Bank of Russia (for ruble loans) on the date of actual receipt of income or 9% per annum (for foreign currency loans), and the amount of interest that a person must pay on loan according to the agreement. The date of actual receipt of income in the form of material benefits from savings on interest is determined as the last day of each month during the period for which borrowed (credit) funds were provided (subclause 7, clause 1, article 223 of the Tax Code of the Russian Federation). Let us recall that previously, until January 1, 2021, income in the form of material benefits on loans was determined on the day of payment of interest on the borrowed funds received.

Please note: the company must withhold and pay tax on income from material benefits.

To determine the amount of material benefit, the accountant must:

- calculate the amount of interest on borrowed funds based on 2/3 of the refinancing rate (key rate) of the Bank of Russia (for loans issued in rubles) on the date of actual receipt of income or 9% per annum (for loans issued in foreign currency);

- deduct from the amount of interest determined based on 2/3 of the refinancing rate (key rate) of the Bank of Russia (for loans issued in rubles) on the date of actual receipt of income or 9% per annum (for loans issued in foreign currency), the amount of interest that should repay the employee's loan.

The amount of interest is calculated based on 2/3 of the refinancing rate (key rate) of the Bank of Russia (for loans issued in rubles) on the date of actual receipt of income according to the formula.

Formula for calculating the amount of interest on loans in rubles

The amount of interest is calculated based on 9% per annum (for loans issued in foreign currency) according to the formula.

simplified tax system

Regardless of the chosen object of taxation, organizations that apply the simplification do not take into account the use of additional capital when calculating the single tax.

The tax base of simplified organizations that pay a single tax on income is not affected by the use of the organization’s additional capital, since in this case the organization does not receive any income (Clause 1 of Article 346.14, Article 346.15 of the Tax Code of the Russian Federation).

The tax base of simplified organizations that pay a single tax on the difference between income and expenses is not reduced by the amounts of additional capital used. This is due to the following.

The use of additional capital as a result of the depreciation of fixed assets is not taken into account when calculating the single tax, since the results of the revaluation are not reflected in tax accounting. For more information about this, see How to reflect the revaluation of fixed assets in accounting.

A similar procedure applies when writing off additional capital as a result of a write-down of the organization’s intangible assets. The results of such a markdown do not affect the calculation of the single tax, since the amounts of markdown of intangible assets are not included in expenses that reduce the tax base (Article 346.16 of the Tax Code of the Russian Federation).

If additional capital funds are used to increase the authorized capital of an organization, the tax base for the single tax also does not change. In this case, the organization does not incur any expenses and does not receive income.

The distribution of additional capital between the founders (participants, shareholders) of the organization does not affect the calculation of the single tax during simplification. Such an operation is not related to activities aimed at generating income. Therefore, amounts paid to founders (participants, shareholders) when reducing the authorized capital are not taken into account when calculating the single tax. This conclusion follows from the provisions of paragraph 1 of paragraph 2 of Article 346.16, paragraph 49 of Article 270, paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Exchange differences when recalculating the value of assets

The formation of additional capital occurs due to differences that arise as a result of the conversion of the value of the assets and liabilities of the organization, expressed in foreign currency, used to conduct activities outside of Russia, into rubles. The resulting exchange rate differences are reflected in accounting as of the date of preparation of the financial statements.

Positive exchange rate differences on assets and negative exchange differences on liabilities are reflected in accounting by posting:

Debit 01 (04, 08, 10, 52, 60, 62, 76) Credit 83

– the exchange rate difference associated with activities abroad is credited to the organization’s additional capital.

If, as a result of the recalculation of assets, a negative exchange rate difference is formed for assets and a positive one for liabilities, then the following entry is made in accounting:

Debit 83 Credit 01 (04, 08, 10, 52, 60, 62, 76)

– the exchange rate difference associated with activities abroad is credited to the organization’s additional capital.

If the organization ceases operations outside of Russia, part of the additional capital corresponding to the amount of exchange rate differences related to the discontinued activities should be recorded as other income or expenses.

Positive exchange differences previously accounted for as part of additional capital are reflected as other income by posting:

Debit 83 Credit 91-1

– positive exchange rate differences on activities terminated abroad are reflected.

Negative exchange differences previously accounted for as part of additional capital are reflected as other expenses by posting:

Debit 91-2 Credit 83

– negative exchange rate differences on activities terminated abroad are reflected.

This procedure is established by paragraph 19 of PBU 3/2006 and the Instructions for the chart of accounts.