What is Basic Yield

The concept of “basic profitability” is characteristic from 2021 only for the patent tax system.

Previously, it was used to calculate imputed tax for UTII. IMPORTANT! UTII has been abolished throughout Russia since 2021. See here for details.

Basic profitability is a conventionally accepted amount of profitability that characterizes the commercial activities of enterprises and individual entrepreneurs in certain conditions. Basic yield is used as the main indicator (base) for calculating tax under this special tax regime.

Under the patent taxation system, the base profitability is the potential revenue for the year (Article 346.48 of the Tax Code of the Russian Federation). The potentially possible level of income is the object of taxation (Article 346.47 of the Tax Code of the Russian Federation). The maximum amount of basic income under the patent tax regime is limited. Every year it is recalculated taking into account the deflator coefficient (discussed in more detail below).

Authorities at the regional level set their own basic income levels for local individual entrepreneurs (clause 7 of Article 346.43 of the Tax Code of the Russian Federation). They are enshrined in the laws of the constituent entities of the Russian Federation.

In 2021, regional authorities can set the basic profitability for calculating the cost of a patent, taking into account recalculation to a deflator coefficient of 1.637. But in some situations, the Tax Code of the Russian Federation gives them the right to increase this figure by a certain number of times (subclause 4, clause 8, Article 346.43 of the Tax Code of the Russian Federation):

- An increase in the level of potential revenue by 3 times is possible for commercial activities, the types of which are specified in subparagraph. 9–11, 32, 33, 38, 42 and 43 p. 2 art. 346.43 Tax Code of the Russian Federation. These include maintenance of vehicles and equipment, transportation of goods and passengers using automobile and water transport, licensed medical activities (including pharmaceuticals), services related to rituals and funerals.

- Regional authorities have the right to increase by 5 times the maximum possible income for individual entrepreneurs who work in millionaire cities.

- And finally, the largest increase in potential revenue, 10 times, is typical for the types of commercial activities that are given in subsection. 19, as well as sub. 45–47 paragraph 2 art. 346.43 Tax Code of the Russian Federation. These are services for renting out your own space and land plots and catering services (with the area of the hall for serving visitors no more than 50 sq. m), as well as retail trade using stationary ones (with the area of the premises for trading no more than 50 sq. m ) and non-stationary objects.

Let us remind you that increasing the basic yield several times is the right of the region, but not the obligation.

ATTENTION! Officials propose increasing the limits for PSN and making it available to SMEs. See here for details.

The conditions for the transition to the PSN and its further use are valid at the time of writing, experts told ConsultantPlus. Get free demo access to K+ and go to the Ready-made solution to learn all the nuances of using the special mode.

List of regional laws on PSN as of May 2017

| Region | Regional law |

| Altai region | Law of the Altai Territory of October 30, 2012 No. 78-ZS |

| Amur region | Law of the Amur Region of October 9, 2012 No. 93-OZ |

| Arhangelsk region | Law of the Arkhangelsk Region of November 19, 2012 No. 574-35-OZ |

| Astrakhan region | Law of the Astrakhan region of November 8, 2012 No. 76/2012-OZ |

| Belgorod region | Law of the Belgorod Region of November 6, 2012 No. 145 |

| Bryansk region | Law of the Bryansk region of November 2, 2012 No. 73-Z |

| Vladimir region | Law of the Vladimir Region of November 12, 2012 No. 140-OZ |

| Volgograd region | Law of the Volgograd region of November 29, 2012 No. 165-OD |

| Vologda Region | Law of the Vologda Region of November 29, 2012 No. 2900-OZ |

| Voronezh region | Law of the Voronezh region of November 28, 2012 No. 127-OZ |

| Moscow city | Moscow City Law of October 31, 2012 No. 53 |

| City of Saint Petersburg | Law of St. Petersburg of October 30, 2013 No. 551-98 |

| Jewish Autonomous Region | Law of the Jewish Autonomous Region of September 27, 2012 No. 130-OZ |

| Transbaikal region | Law of the Trans-Baikal Territory of November 1, 2012 No. 735-ZZK |

| Ivanovo region | Law of the Ivanovo region of November 29, 2012 No. 99-OZ |

| Irkutsk region | Law of the Irkutsk region of November 29, 2012 No. 124-OZ |

| Kabardino-Balkarian Republic | Law of the Kabardino-Balkarian Republic of November 29, 2012 No. 86-RZ |

| Kaliningrad region | Law of the Kaliningrad Region of October 22, 2012 No. 154 |

| Kaluga region | Law of the Kaluga Region of October 25, 2012 No. 328-OZ |

| Kamchatka Krai | Law of the Kamchatka Territory of October 5, 2012 No. 121 |

| Karachay-Cherkess Republic | Law of the Karachay-Cherkess Republic of November 27, 2012 No. 91-RZ |

| Kemerovo region | Law of the Kemerovo region of November 2, 2012 No. 101-OZ |

| Kirov region | Law of the Kirov region of November 29, 2012 No. 221-ZO |

| Kostroma region | Law of the Kostroma Region of November 30, 2012 No. 304-5-ZKO |

| Krasnodar region | Law of the Krasnodar Territory of November 16, 2012 No. 2601-KZ |

| Krasnoyarsk region | Law of the Krasnoyarsk Territory of November 27, 2012 No. 3-756 |

| Kurgan region | Law of the Kurgan region of November 28, 2012 No. 65 |

| Kursk region | Law of the Kursk region of November 23, 2012 No. 104-ZKO |

| Leningrad region | Law of the Leningrad Region of November 7, 2012 No. 80-OZ |

| Lipetsk region | Law of the Lipetsk Region of November 8, 2012 No. 80-OZ |

| Magadan Region | Law of the Magadan Region of October 29, 2012 No. 1539-OZ |

| Moscow region | Law of the Moscow Region of November 6, 2012 No. 164/2012-OZ |

| Murmansk region | Law of the Murmansk region of November 12, 2012 No. 1537-01-ZMO |

| Nenets Autonomous Okrug | Law of the Nenets Autonomous Okrug of November 27, 2012 No. 103-OZ |

| Nizhny Novgorod Region | Law of the Nizhny Novgorod Region of November 21, 2012 No. 148-Z |

| Novgorod region | Law of the Novgorod Region of October 31, 2012 No. 149-OZ |

| Novosibirsk region | Law of the Novosibirsk Region of October 16, 2003 No. 142-OZ |

| Omsk region | Law of the Omsk Region of November 29, 2012 No. 1488-OZ |

| Orenburg region | Law of the Orenburg Region of November 14, 2012 No. 1156/343-V-OZ |

| Oryol Region | Law of the Oryol region of November 2, 2012 No. 1423-OZ |

| Penza region | Law of the Penza region of November 28, 2012 No. 2299-ZPO |

| Perm region | Law of the Perm Region of August 30, 2001 No. 1685-296 |

| Primorsky Krai | Law of Primorsky Territory of November 13, 2012 No. 122-KZ |

| Pskov region | Law of the Pskov Region of October 5, 2012 No. 1199-OZ |

| Republic of Adygea | Law of the Republic of Adygea dated November 26, 2012 No. 139 |

| Altai Republic | Law of the Altai Republic of November 16, 2012 No. 58-RZ |

| Republic of Bashkortostan | Law of the Republic of Bashkortostan dated October 29, 2012 No. 592-Z |

| The Republic of Buryatia | Law of the Republic of Buryatia dated November 26, 2002 No. 145-III |

| The Republic of Dagestan | Law of the Republic of Dagestan of November 29, 2012 No. 79 |

| The Republic of Ingushetia | Law of the Republic of Ingushetia dated November 29, 2012 No. 35-RZ |

| Republic of Kalmykia | Law of the Republic of Kalmykia dated March 1, 2013 No. 412-IV-Z |

| Republic of Karelia | Law of the Republic of Karelia dated December 30, 1999 No. 384-ZRK |

| Komi Republic | Law of the Komi Republic of November 29, 2012 No. 87-RZ |

| Republic of Crimea | Law of the Republic of Crimea dated June 6, 2014 No. 19-ZRK |

| Mari El Republic | Law of the Republic of Mari El dated October 27, 2011 No. 59-Z |

| The Republic of Mordovia | Law of the Republic of Mordovia of November 20, 2012 No. 78-Z |

| Republic of North Ossetia–Alania | Law of the Republic of North Ossetia – Alania dated December 13, 2012 No. 46-RZ |

| Republic of Tatarstan | Law of the Republic of Tatarstan dated September 29, 2012 No. 65-ZRT |

| Tyva Republic | Law of the Republic of Tuva dated November 24, 2014 No. 5-ZRT |

| The Republic of Khakassia | Law of the Republic of Khakassia dated October 5, 2012 No. 90-ЗРХ |

| Rostov region | Law of the Rostov region of May 10, 2012 No. 843-ZS |

| Ryazan Oblast | Law of the Ryazan region of November 8, 2012 No. 82-OZ |

| Samara Region | Law of the Samara Region of November 27, 2012 No. 117-GD |

| Saratov region | Law of the Saratov Region of November 13, 2012 No. 167-ZSO |

| Sakhalin region | Law of the Sakhalin Region of October 12, 2012 No. 93-ZO |

| Sverdlovsk region | Law of the Sverdlovsk region of November 21, 2012 No. 87-OZ |

| City of Sevastopol | Law of the city of Sevastopol dated August 14, 2014 No. 57-ZS |

| Smolensk region | Law of the Smolensk region of November 19, 2012 No. 90-Z |

| Stavropol region | Law of the Stavropol Territory of October 15, 2012 No. 96-KZ |

| Tambov Region | Law of the Tambov region of October 30, 2012 No. 204-З |

| Tver region | Law of the Tver Region of November 29, 2012 No. 110-ZO |

| Tomsk region | Law of the Tomsk Region of November 9, 2012 No. 199-OZ |

| Tula region | Law of the Tula region of November 14, 2012 No. 1833-ZTO |

| Tyumen region | Law of the Tyumen region of November 27, 2012 No. 96 |

| Udmurt republic | Law of the Udmurt Republic of November 28, 2012 No. 63-RZ |

| Ulyanovsk region | Law of the Ulyanovsk region of October 2, 2012 No. 129-ZO |

| Khabarovsk region | Law of the Khabarovsk Territory of November 10, 2005 No. 308 |

| Khanty-Mansiysk Autonomous Okrug - Yugra | Law of the Khanty-Mansiysk Autonomous Okrug - Ugra dated November 9, 2012 No. 122-OZ |

| Chelyabinsk region | Law of the Chelyabinsk Region of October 25, 2012 No. 396-ZO |

| Chechen Republic | Law of the Chechen Republic of November 26, 2012 No. 32-RZ |

| Chuvash Republic | Law of the Chuvash Republic of July 23, 2001 No. 38 |

| Chukotka Autonomous Okrug | Law of the Chukotka Autonomous Okrug of October 8, 2012 No. 71-OZ |

| Yamalo-Nenets Autonomous Okrug | Law of the Yamalo-Nenets Autonomous Okrug of September 28, 2012 No. 83-ZAO |

| Yaroslavl region | Law of the Yaroslavl region of November 8, 2012 No. 47-Z |

The influence of the deflator coefficient on the basic yield

A coefficient is a specific numerical value that has a wide range of applications. It is used in economics when calculating shares and percentages, and also shows the growth dynamics of a certain object or phenomenon.

In tax practice, the deflator coefficient has found application as a way to adjust the amount of profitability for tax purposes. Why is this recalculation necessary? In conditions of market relations and an unstable economic situation, the price level in the country is constantly changing. This phenomenon is known as inflation. The deflator coefficient helps to bring the size of the basic yield into line with price increases, that is, to index it. It is calculated annually at the federal level for special tax regimes:

- simplified tax system;

- patent tax system (PTS).

The upper limit of the basic profitability for the patent tax system is 1,000,000 rubles. The deflator coefficient is determined for the new calendar year as the product of the deflator coefficient of the previous year and a coefficient that reflects the increase in prices also in the previous year. Every year the calculated value of the deflator coefficient is multiplied by 1,000,000 rubles. Thus, the size of the basic yield for the current calendar year is obtained, taking into account the inflation process.

Local authorities cannot set the level of basic profitability in the region above this value, except for the cases prescribed in subparagraph. 4 paragraph 8 art. 346.43 of the Tax Code of the Russian Federation (increase in potential revenue by 3, 5 or 10 times).

We determine the basic profitability under the patent tax system

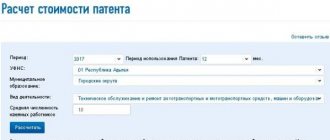

Let's imagine that an individual entrepreneur decides to switch to a patent tax regime. His main question will be: how to determine the value of a patent? He doesn’t have to worry about calculating the amount of tax (the cost of a patent). This will be done for him by specialists from the tax office, to which he submitted an application to switch to a patent tax system. But he can clarify the basic profitability, which is the basis for calculating the patent tax, in 2 ways:

- directly to the tax authorities.

- in legislative acts adopted by regional authorities.

At the same time, regional authorities have the right not to change the amount of basic profitability adopted in the previous year, for example, to leave the amount of potential revenue in 2021 at the 2020 level.

Tax legislation provides local authorities with the opportunity to set the amount of basic profitability depending on the following factors (subclause 3, clause 8, article 346.43 of the Tax Code of the Russian Federation):

- From the number of hired workers. In this case, all personnel are taken into account, regardless of the types of activities and taxation regimes of an individual entrepreneur. For example, if the number of employees is up to 5 people, then the basic profitability is set at 500,000 rubles, if there are from 6 to 10 people - 700,000 rubles. etc.

- The number of vehicles, their carrying capacity and places to board them.

- Number of premises (objects).

- Territorial validity of a patent - the cost of a patent can vary significantly depending on the territory of its validity. At the same time, tax legislation does not prohibit payers from acquiring patents in different regions and for different types of activities.

If you are just planning to switch to PSN, we recommend that you familiarize yourself with the conditions for using the special mode. A typical situation from ConsultantPlus will help you understand the conditions and nuances of using PSN. If you do not have access, sign up for a temporary free demo access to the K+ legal reference system.

Application of CCT and BSO

As a general rule, with PSN, you can not use cash register equipment for cash payments, issuing a document with the required details at the request of the client (buyer).

However, this rule does not always apply. In particular, from March 31, 2017, individual entrepreneurs on PSN are required to use cash registers when selling alcoholic products (beer also refers to alcohol). No exceptions have been made for anyone.

When providing services to the public, instead of using CCP, a strict reporting form (SRF) is issued. In this case, the BSO is issued not at the client’s request, but to all clients paying in cash. The Ministry of Finance repeatedly reminded about this in its letters (No. 03-11-06/2/1651 dated 01/20/2016, No. 03-01-15/33694 dated 08/19/2013). The Supreme Court shares the same point of view (resolution No. 307-AD16-8841 of October 31, 2016).

An example of calculating the cost of a patent with basic profitability

In order to understand how tax inspectorates calculate the amount of the patent payment, let's look at a simple example. All data in it is conditional. Let us remind you that the size of the basic yield varies depending on the region of the country.

Example

Individual entrepreneur F.S. Bogdanov has a small shoe workshop and independently repairs, paints and sews shoes. Regional laws of the N. region of the Russian Federation for this type of activity establish the base income of 300,000 rubles.

The tax rate under the patent regime is 6% (Article 346.50 of the Tax Code of the Russian Federation). In paragraph 2 of Art. 346.50 of the Tax Code of the Russian Federation stipulates that only regional authorities of the Republic of Crimea and the city of Sevastopol can reduce it to 4% (for 2017–2021).

Let’s assume that individual entrepreneur F.S. Bogdanov does not operate in these regions. Then the annual tax amount will be equal to: 300,000 rubles. x 6% = 18,000 rub.

The cost of a patent per month will be 18,000 rubles. / 12 months = 1,500 rub. Accordingly, if individual entrepreneur F.S. Bogdanov acquires a patent for 2 months, then he will pay 3,000 rubles, for 5 months - 7,500 rubles. etc. But such a calculation is made for no more than 1 year.

There is no need to submit a tax return under the patent regime.

In order to obtain a patent, an individual entrepreneur only needs to submit an application to the tax office and meet certain conditions (carry out the required type of activity, have no more than 15 employees and annual revenue of up to 60 million rubles). To control the amount of his income, an entrepreneur is required to keep a book of income, that is, carry out tax accounting.

What is the benefit of a patent?

PSN simplifies tax accounting and helps you save a little on taxes and contributions for employees:

- on a patent, you only keep a book of income accounting (separately for each patent);

- pay simple payments for the patent (if the patent term is less than 6 months, pay the full amount within 25 days after the start of validity; if the patent term is more than 6 months, a third of the amount within 25 days after the start of validity, the remaining amount - no later than 30 days before expiration patent or no later than December 31 for an annual patent);

- pay contributions for employees at a reduced rate of 20% in the Pension Fund, and in the FFOMS and Social Insurance Fund - at a rate of 0%.

Also, on PSN you do not submit tax reports, although you are required to keep a ledger for each patent.

However, you are not exempt from property and transport taxes.

Important! Calculate the amounts of mandatory payments to assess the profitability of this tax regime. Check the conditions for PSN in your region. Local authorities have the right to reduce PSN rates to 0% and increase the maximum potential income up to 10 times.

Results

Basic profitability is the main indicator and basis for calculating tax under the patent tax system. The higher this value, the greater the amount of tax that an individual entrepreneur must pay to the budget for the right to use a patent.

An entrepreneur can find out about the basic profitability and types of activities covered by a patent in his region directly from the tax office or from the legislative acts of the region. Tax calculations for obtaining a patent are carried out by tax authorities. The entrepreneur can only pay it without delay. In this case, you do not need to submit a tax return; it is enough to keep simple tax records in the income book in order to control the actual revenue received on an accrual basis from the beginning of the year.

The amount of potential income is set by regional authorities by adopting relevant laws, but not more than the maximum value adopted at the federal level, taking into account the annual deflator coefficient. In some cases, local authorities have the right to increase the level of basic profitability by a certain number of times - 3, 5 or 10 (subclause 4, clause 8, article 346.43 of the Tax Code of the Russian Federation).

The cost of a patent for the same type of activity may vary significantly across the territory of its coverage, depending on the region of the Russian Federation.

At the same time, tax legislation does not prohibit payers from acquiring patents in different regions and for different types of activities. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How long is a patent valid?

The patent is valid for a calendar year. An individual entrepreneur can take out one or more patents for a period of 1 month to a year. You can obtain a patent at any time of the year, with a couple of reservations:

- if you failed to pay for a patent and lost it, you can only renew it from the beginning of the next calendar year;

- in December you can only count on a monthly patent, and only if you apply for it from December 1st.

If you run a business based on a patent or combine modes, work in the Kontur.Accounting web service. Here you can easily fill out all the documents, and the system itself will calculate taxes and prepare payments for online banking, remind you of payment deadlines and generate reports for sending via the Internet. All newcomers work in the service for free for two weeks.