Decoding KBK 18210801000011000110 in 2021

How does an overpayment occur? There are many ways in which a real overpayment can occur. These may be: the excess of the total amount of tax paid in advance payments over its amount reflected in the declaration for the tax period: profit, property, transport, land, excise taxes, simplified tax system; filing a declaration for VAT refund; submission of an updated calculation declaration with a reduction in the total amount after payment of tax according to the previous reporting option; recalculation towards a decrease in personal income tax withheld from an individual; erroneous payment of a larger amount of tax or contribution; recalculation to reduce the amount of paid penalties after submitting two clarifications, the first of which increases, and the second reduces the amount of the accrued payment; a court decision, the conclusion of which is a statement of the fact of excessive payment of tax payments; changes in legislation, as a result of which the tax contribution begins to be considered overpaid.

How is overpayment detected? Typically, the taxpayer knows about the existence of an overpayment based on his own accounting data, provided that they are correct.

As a rule, an overpayment occurs either at the time of filing the declaration or when the tax is actually paid. If the overpayment is obvious to the Federal Tax Service, it must promptly, within 10 working days from the date of discovery, inform the taxpayer about this or invite him to reconcile the clause. Since the year, personal income tax reporting has become mandatory and quarterly. The fact of overpayment of taxes can be established by the court if: the existence of an overpayment became indisputable only after the publication of letters from the Ministry of Finance of Russia, a resolution of the Federal Antimonopoly Service of the Volga Region from How to draw up an application for a refund offset?

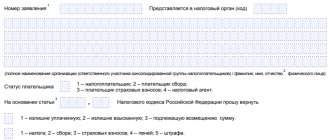

Applications for credit and refund have approved forms. You can download application forms for refunds and offsets of taxes, fees, fines and penalties on our website.

Find a sample form for filling out a return application here. There are several ways to submit an application. Format for electronic applications approved. How is the application deadline determined? The deadline for filing an application, according to paragraph. However, for a number of cases this approach is not applicable. For example, when: The tax is paid in advance payments, and its total amount for the tax period is determined only according to the declaration data, the period must be counted from the date of submission of the declaration for the tax non-reporting period, the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation from Overpayment was the result of the transfer of tax amounts in several payment documents.

In this case, the period can be determined in two ways: for each payment separately, the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation from For the amount claimed for reimbursement, an application for which was not submitted by the taxpayer before the decision of the Federal Tax Service on the return of money. What is the procedure for offsetting the refund? Having considered the taxpayer’s application, the Federal Tax Service, within 10 working days from the date of its receipt, makes a decision on the appropriate action of paragraphs. The positive results of this decision will be: offset of the overpayment made on the date of the offset decision; refund of the overpayment no later than 1 month from the date of receipt of the application for refund p.

In addition, the deadline for making a decision on the refund of overpaid tax depends on whether the fact of overpayment is confirmed based on the results of a desk tax audit. The relevant provisions are provided for in clause. In the case of a desk tax audit, the period for making a decision on a tax refund is calculated not from the day the taxpayer submits an application for a refund, but in the following order: after 10 days from the day following the day of completion of the desk audit of the declaration that reflects the amount of tax to be refunded, or from the day on which such an audit should have been completed due to the deadlines specified in paragraph.

These provisions apply if no violations of the legislation on taxes and fees are revealed during a desk tax audit. These provisions apply if, during the audit, the tax authority drew up a tax audit report and made a corresponding decision.

In some cases, there may be peculiarities in the rules for counting deadlines. For example, if the overpayment is indicated in the 3-NDFL declaration and at the same time an application for return is submitted, then the countdown of the return period will begin not from the date of filing the application, but from the date of actual completion of the desk audit of the declaration or after the expiration of such an audit, a letter from the Federal Tax Service of Russia from Settlement of the discovered The Federal Tax Service can make overpayments on its own, but this does not deprive the taxpayer of the right to submit an application based on his own point of view on repaying the existing arrears.

What is the basic rule of return contained in clause? An overpayment in the presence of arrears on other payments to the same budget can be returned only after such arrears are closed by offset from the amount of the existing overpayment in clause.

This offset will be made by the Federal Tax Service itself. The presence of such arrears is not an obstacle for the taxpayer to send to the Federal Tax Service an application for the return of an overpayment, a letter from the Ministry of Finance of Russia from the Arrears existing on other payments can also reduce the amount of the overpayment, which the payer wants to offset against future tax payments according to the possibility , provided by clause. There is one exception to the rule on carrying out a set-off to repay the arrears of the Federal Tax Service before returning the overpayment to the taxpayer: it does not apply if bankruptcy proceedings have been opened against the taxpayer, the resolution of the Federal Antimonopoly Service of the East Siberian District dated What are the features of the return of personal income tax?

The return of personal income tax amounts that are withheld at the place of work, as a rule, occurs in a special procedure. It is carried out by the employer at the request of the employee, and such a return, if necessary, is also made to an already dismissed employee. If the employer refuses to return the overpayment, it can be recovered through the court.

The tax refund deadline month will be counted from the day the verification of the 3-NDFL declaration is completed, regardless of the date the taxpayer submits an application for a refund of the letter from the Ministry of Finance of Russia dated If the Federal Tax Service Inspectorate violates the refund deadline established by clause. Their amount is calculated according to the refinancing rate of the Central Bank of the Russian Federation, which is equal to key rate corresponding to the days of violation, based on the fact that the length of a year is considered equal to days, and the length of a month is 30 days, letter from the Federal Tax Service of Russia from In this regard, the Ministry of Finance letter from Who returns the overpayment when moving to another Federal Tax Service?

Is it possible to return an overpayment that is more than 3 years old? Article 78 of the Tax Code of the Russian Federation is devoted to the procedure for out-of-court settlement of issues of overpayment to the budget, when the fact of its existence is established quite easily and corresponds to the limitation period calculated from the date officially recognized by the Federal Tax Service as the day from which such a calculation is possible. However, quite often situations arise when the taxpayer learns about the existence of an overpayment late.

In this case, he can take advantage of the possibility of calculating the statute of limitations from the day when he became aware of the violation of his rights.

The collection of all evidence confirming the reality of the late receipt of information about the presence of an overpayment will fall on the taxpayer. Is the 3-year period interrupted by a reconciliation report with the Federal Tax Service? One of these actions is the signing of a reconciliation report. What happens to the unrefunded overpayment after the 3-year period? If the 3-year period allotted by Art.

Budget classification - what is it and why?

The Federal Tax Service of Russia is the administrator of state duties for actions performed by tax authorities, as well as courts and magistrates.

Let's try to figure out what these mysterious codes are, why they are needed, how they are formed and why they change regularly. We will also tell you what to do if you find an error in the specified code, and what you risk in this case, and most importantly, how to prevent this risk and not end up with accrued fines and penalties for paying taxes and fees on time.

In the first case, KBK 18210501011011000110 is used to pay the tax, in the second - 18210501021011000110. Just like for income tax, the specified KBK are used when paying arrears and making recalculations.

Overpaid tax

Article Offset or refund of amounts of overpaid taxes, fees, insurance premiums, penalties, fines, as amended. Federal Law No. The amount of overpaid tax is subject to offset against the taxpayer's upcoming payments for this or other taxes, repayment of arrears for other taxes, arrears of penalties and fines for tax offenses, or refund to the taxpayer in the manner prescribed by this article.

The offset of the amounts of overpaid federal taxes and fees, regional and local taxes is carried out for the corresponding types of taxes and fees, as well as for penalties accrued on the corresponding taxes and fees. The amount of overpaid insurance premiums is subject to offset against the relevant budget of the state extra-budgetary fund of the Russian Federation, to which this amount was credited, against the payer's upcoming payments for this contribution, debt on relevant penalties and fines for tax offenses, or the return of insurance premiums to the payer in the manner prescribed this article.

A credit or refund of the amount of overpaid tax is carried out by the tax authority without charging interest on this amount, unless otherwise established by this article. The tax authority is obliged to inform the taxpayer about each fact of excessive payment of tax that has become known to the tax authority and the amount of overpaid tax within 10 days from the date of discovery of such a fact.

If facts are discovered indicating a possible excessive payment of tax, at the proposal of the tax authority or taxpayer, a joint reconciliation of calculations for taxes, fees, insurance premiums, penalties and fines may be carried out.

Federal Laws Offsetting the amount of overpaid tax against the taxpayer's upcoming payments for this or other taxes is carried out on the basis of a written application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels or submitted through the taxpayer's personal account by decision of the tax authority.

The offset of the amount of overpaid tax against the repayment of arrears on other taxes, arrears of penalties and or fines subject to payment or collection in cases provided for by this Code is carried out by the tax authorities independently no more than three years from the date of payment of the specified amount of tax. The provision provided for in this paragraph does not prevent the taxpayer from submitting to the tax authority a written application, an application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels or submitted through the taxpayer’s personal account for the offset of the amount of overpaid tax to pay off the arrears of debt on penalties, fines.

In this case, the decision of the tax authority to set off the amount of overpaid tax to pay off the arrears and arrears of penalties and fines is made within 10 days from the date of receipt of the specified application of the taxpayer or from the date of signing by the tax authority and this taxpayer of the act of joint reconciliation of the taxes paid by him, if such a joint reconciliation was carried out.

The amount of overpaid tax is subject to refund upon a written application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels or submitted through the taxpayer’s personal account within one month from the date the tax authority received such an application.

A refund of the amount of overpaid insurance contributions for compulsory pension insurance is not made if, according to a message from the territorial management body of the Pension Fund of the Russian Federation, information on the amount of overpaid insurance contributions for compulsory pension insurance is presented by the payer of insurance contributions as part of individual personalized accounting information and is taken into account on individual personal accounts of insured persons in accordance with the legislation of the Russian Federation on individual personalized accounting in the compulsory pension insurance system.

An application for offset or refund of the amount of overpaid tax may be submitted within three years from the date of payment of the specified amount, unless otherwise provided by the legislation of the Russian Federation on taxes and fees or as a result of a mutual agreement procedure in accordance with an international treaty of the Russian Federation on taxation issues.

Unless otherwise provided by this article, the decision to return the amount of overpaid tax is made by the tax authority within 10 days from the date of receipt of the taxpayer’s application for the return of the amount of overpaid tax or from the date of signing by the tax authority and this taxpayer of a joint reconciliation report of the taxes paid by him, if such joint reconciliation was carried out.

In the case of a desk tax audit, the deadlines established by paragraph two of clause 4, paragraph three of clause 5 and paragraph one of clause 8 of this article begin to be calculated after 10 days from the day following the day of completion of the desk tax audit for the corresponding tax reporting period or from the day , when such an inspection must be completed within the period established by paragraph 2 of Article 88 of this Code.

In case of detection of a violation of the legislation on taxes and fees during a desk tax audit, the deadlines established by paragraph two of paragraph 4, paragraph three of paragraph 5 and paragraph one of paragraph 8 of this article begin to be calculated from the day following the day of entry into force of the decision made under the results of such verification.

The tax authority is obliged to inform the taxpayer about the decision taken to offset the refund of amounts of overpaid tax or the decision to refuse to offset the refund within five days from the date of adoption of the corresponding decision. Amounts of overpaid corporate income tax for a consolidated group of taxpayers are subject to offset and return to the responsible participant of this group in the manner established by this article.

If the refund of the amount of overpaid tax is carried out in violation of the deadline established by paragraph 6 of this article, and taking into account the specifics provided for in clause 8. The territorial body of the Federal Treasury that carried out the refund of the amount of overpaid tax notifies the tax authority of the date of return and the amount of the refunded taxpayer's funds.

If the interest provided for in paragraph 10 of this article is not paid to the taxpayer in full, the tax authority makes a decision to return the remaining amount of interest, calculated based on the date of actual refund to the taxpayer of the amounts of overpaid tax, within three days from the date of receipt of the notification from the territorial body of the Federal Treasury on the date of return and the amount of funds returned to the taxpayer.

Before the expiration of the period established by the first paragraph of this paragraph, an order for the return of the remaining amount of interest, issued on the basis of a decision of the tax authority to return this amount, must be sent by the tax authority to the territorial body of the Federal Treasury for the refund.

Credit or refund of the amount of overpaid tax and payment of accrued interest are made in the currency of the Russian Federation.

Amounts of funds paid to compensate for damage caused to the budget system of the Russian Federation as a result of crimes provided for in articles - The rules established by this article also apply to the offset or return of amounts of overpaid advance payments, fees, insurance premiums, penalties and fines and apply to tax agents, payers of fees, payers of insurance premiums and the responsible participant in a consolidated group of taxpayers.

The rules established by this article also apply in relation to the offset or refund of the amount of value added tax subject to reimbursement by decision of the tax authority, in the case provided for in paragraph The fact of indicating a person as a nominal owner of property in a special declaration submitted in accordance with the Federal Law " On the voluntary declaration by individuals of assets and deposit accounts in banks and on amendments to certain legislative acts of the Russian Federation,” and the transfer of such property to its actual owner do not in themselves constitute grounds for recognizing the amounts of taxes, fees, penalties and fines paid as overpaid nominal owner in respect of such property.

The rules established by this article also apply to amounts of overpaid value added tax that are subject to refund or credit to foreign organizations - taxpayers and tax agents specified in paragraph 3 of the article. Refund of the amount of overpaid value added tax to such organizations is carried out to an account opened in jar.

The rules for the return of amounts of overpaid taxes established by this article also apply to the return of amounts of previously withheld corporate income tax that are subject to return to a foreign organization in the cases provided for in paragraph 2 of article of this Code, taking into account the specifics established by this paragraph. The decision to return the amount of previously withheld corporate income tax is made by the tax authority within six months from the date of receipt from a foreign organization of an application for the return of previously withheld tax and other documents specified in paragraph 2 of Article of this Code.

The rules established by Art. 78 of the Tax Code of the Russian Federation, also apply to the return of amounts of overpaid advance payments, fees, insurance premiums, penalties and fines and apply to tax agents, payers of fees, payers of insurance premiums and a responsible participant in a consolidated group of taxpayers. The decision to return the overpaid amount of state duty to the payer is made by the body (official) carrying out the actions for which the state duty was paid (collected).

KBK for paying taxes for organizations and individual entrepreneurs in special modes

In July 1998, the Budget Code of the Russian Federation in Federal Law No. 145 first introduced the term “KBK”, used as a means of grouping the budget.

In the list of the codifier system under consideration, there are many different code names. Below we will consider the decoding of KBK 182 10100 110 with a detailed analysis of the digital designations included in its composition.

Penalties can vary greatly depending on the specific tax violation. For example, if a company has not paid a tax or fee, it will have to pay a fine of 20% of the amount of debt to the budget or 40% if the body administering payments proves that the company deliberately failed to fulfill its obligations to the budget.

When paying penalties and fines for periods before 01/01/2017, it is necessary to use KBK, respectively, 18210202010062100160 and 18210202010063000160. The same payments for periods after 01/01/2017 will be made using KBK 18210202010062110160 and 18210202010063010160.

Until 2021, the BCC had its own minimum tax that must be paid when applying the simplified tax system “income minus expenses” if the total amount of tax calculated in the usual manner for the tax period (year) turned out to be less than 1% of the tax base.

Even though these CBCs have existed for a long time, and accountants have been using them for many years, mistakes still happen. My accountant mistakenly entered the wrong KBK for the transfer of personal income tax, and of course, then an arrears arose. We contacted the fiscal authorities with a written statement, but decided that it would be better to make a new payment.

If the payment purpose code is specified incorrectly, the payment will be transferred to the budget, but it will not be distributed correctly there, which means that the state will not actually receive it. The result may be the same as if the money had not been transferred at all: the tax office will count the arrears under a certain item. At the same time, if the BCC is simply mixed up, there may be an overpayment under another item.

More details about the codes for paying taxes in simplified terms are described in the article “KBK according to the simplified tax system for 2021 and 2021.”

In fact, it duplicates the information indicated in the “Base of payment” field, as well as partially in the “Recipient” and “Recipient’s current account” fields.

Let's look at various cases that occur due to errors in the CBC and analyze what an entrepreneur should do.

- The inspectorate assessed penalties for non-payment of taxes . If there was a beneficial request from the payer to offset the amount paid, then you should additionally ask the tax office to recalculate the accrued penalties. If the tax office refuses to do this, going to court will most likely allow for a recalculation (there is a rich case law with similar precedents).

- The BCC does not correspond to the payment specified in the assignment . If the error is “within one tax”, for example, the KBK is indicated on the USN-6, and the payment basis is indicated on the USN-15, then the tax office usually easily makes a re-offset. If the KBK does not completely correspond to the basis of the payment, for example, a businessman was going to pay personal income tax, but indicated the KBK belonging to the VAT, the tax office often refuses to clarify, but the court is almost always on the side of the taxpayer.

- Due to an error in the KBK, insurance premiums were unpaid . If the funds do not reach the required treasury account, this is almost inevitably fraught with fines and penalties. The entrepreneur should repeat the payment as quickly as possible with the correct details in order to reduce the amount of possible penalties. Then the money paid by mistake must be returned (you can also count it against future payments). To do this, an application is sent to the authority to whose account the money was transferred erroneously. Failure to comply with a request for a refund or re-credit is a reason to go to court.

- The funds entered the planned fund, but under the wrong heading . For example, the payment slip indicated the KBK for the funded portion of the pension, but they intended to pay for the insurance portion. In such cases, contributions are still considered to have been made on time, and you must proceed in the same way as under the usual procedure. The court can help with any problems with a fund that refuses to make a recalculation, and an illegal demand for payment of arrears and the accrual of penalties.

A separate BCC must be used when transferring contributions to the Pension Fund for employees. It is used by legal entities and individual entrepreneurs who hire workers (not only under an employment contract, but also under civil law contracts) and pay other income to individuals.

You can see the finished payment using KBK 18210101011011000110 in the window below, this document can be downloaded for free.

KBK 18210801000011000110 transcript

What happens to the amount of overpaid taxes based on Art. This occurs as a result of a decision of the tax authority or the taxpayer, after he/she contacts the tax authority with a corresponding application. The procedure for crediting or returning is established by Art. The essence of law enforcement Art. What exactly led to the money being written off from the account does not matter.

This could be a technical error in calculations, a misinterpretation by the tax inspector of the rules and regulations of laws and regulations, an erroneous decision by the judiciary, or something similar that was discovered after the payment was made. The legality of the above interpretation is also indicated by judicial practice, in particular, the Resolution of the Federal Antimonopoly Service of the Ural District dated January 23.

The taxpayer may contact the tax authorities with an application indicating a specific option for using the overpayment in the form of a credit for the payment of a certain tax in a future period.

This requirement is satisfied regardless of which tax payment is due first. However, based on paragraph. Both options are quite logical. If the payer had no obligation to pay, then these funds remain his property, so he himself has the right to decide how to dispose of them. But if there is a debt for some types of tax, then the inspector receives the right to dispose of the payer’s property, but within the framework of legally forcing him to fulfill his obligations to pay taxes.

It must be remembered that in the Russian Federation there are three types of taxes - federal, regional and municipal. Credit due to overpayment can only take place within the framework of one type of tax. Thus, VAT is always a federal tax, as stated in paragraph. However, it remains possible to submit an application to the tax authority for a refund of the overpaid amount of VAT, as evidenced by the Letter of the Ministry of Finance of the Russian Federation dated Of course, after the refund of the overpayment, the taxpayer can immediately transfer it to repay the arrears on corporate property tax.

Taxes paid to the budget of other states in the general case are not taxes established by the Tax Code of the Russian Federation. However, it contains Art. If any of them contains a condition on the inadmissibility of double taxation of a certain transaction or creates other types of exceptions, then an overpayment may arise on this basis.

Another point of view can be seen in the letter of the Ministry of Finance of the Russian Federation from For example, the Ministry of Finance cannot change the procedure for treating indirect taxes or taxes that arise from the operation of railways and related to the use of property of joint ventures. Tax authorities must notify taxpayers that an overpayment of a particular tax has been detected. They are given a period of 10 days to do this from the date of discovery of the fact of the overpaid amount.

It instructs not only to send letters, but to create a special information resource dedicated to the return or offset of overpayments. Before the actual execution of the offset or refund of funds, the tax authorities conduct a reconciliation of calculations for all payments by the taxpayer. Although p. The question of the timing and the ruling of the Supreme Court of the Russian Federation in the case of overpayment of taxes is 10 years old. The taxpayer is given three years to apply for a refund or offset.

However, courts of all levels, including the highest, came to the conclusion that the company had missed the three-year deadline for filing a claim with the court for the return of the overpaid tax. Despite the fact that the company’s lawyers tried to prove that the period should be counted from the moment the fact of overpayment was discovered, the RF Supreme Court considered that a different interpretation of the laws by the applicant is not a basis for reconsidering the case.

18210909010010000110 kbk decoding 2021 what tax

When choosing the simplified taxation system for income minus expenses, a commercial structure has a number of advantages. This primarily affects the maintenance of documentation and the tax itself, which is reduced. The usual rate for this tax regime is 15%, but at the regional level it can be reduced to 5%.

Trade tax paid within the boundaries of intra-city municipalities of federal cities.

KBK 18210602010022100110, transcript 2021 is a 20-digit code used to pay penalties assessed to an organization by the tax authority in case of late payment of property tax not included in the Unified Gas Supply System. Payment of penalties occurs by filling out a payment document using the same form 0401060, which is also used for paying taxes.

KBK 2021 — 182 1 0800 110

How are these percentages calculated? Expert consultation, Question: Regarding item. How is interest calculated in case of violation of the deadlines for the return of overpaid taxes? Are there any grounds for which interest is not accrued for each calendar day of violation of the deadline for the return of overpaid tax, for example, due to a lack of funds in the budget?

Answer: In accordance with paragraphs. The procedure for the return of overpaid taxes is regulated in Art. According to clause. Based on clause. In accordance with clause. By virtue of clause. Order of the Ministry of Finance of Russia dated In the opinion of the Ministry of Finance of Russia, set out in the Letter from. Untimely return of the amount of overpaid tax to the taxpayer due to lack of funds in the budget is the basis for calculating interest amounts for untimely refund of overpaid taxes.

Thus, the above allows us to conclude that there are no grounds for which interest for each calendar day of violation of the deadline for the return of overpaid tax is not accrued. Gorshkov and taxation

Letter from the Russian Ministry of Finance from

Refund of overpaid taxes, fees, insurance premiums, penalties, fines

Malyshev, having familiarized himself with the petition for interim measures in the form of a ban on any registration actions in relation to the debtor’s property and the documents attached to the application, established the following circumstances. By a court ruling dated January 16, the application was left without movement. By a court ruling dated May 14, the application was accepted for court proceedings. Chita, Central administrative district, st. Shilova, 6a, room. Chita, microdistrict Kashtaksky, d.

Chita, st. Shilova, Irkutsk, st. Akademicheskaya, d. This BCC corresponds to budget revenues in the form of payments for state fees collected for consideration of applications in courts of general jurisdiction, magistrates' courts, that is, not in connection with the consideration of a case in an arbitration court.

At the same time, in accordance with Article 50 of the Budget Code of the Russian Federation, the state duty on cases considered by arbitration courts is paid to the federal budget. Order of the Ministry of Finance of Russia from The correct budget classification code for payment of the state fee for consideration of a case by an arbitration court is the code According to the explanations set out in paragraph 2 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated On the official website of the Arbitration Court of the Trans-Baikal Territory, the details of the deposit account of the Arbitration Court of the Trans-Baikal Territory are indicated.

In what part of the payment is the KBK indicated?

Budget classification codes are approved in the regulations of the main federal department that is responsible for taxes and fees - the Ministry of Finance of the Russian Federation. For 2021, the procedure for the formation and application of BCCs, their structure and principles of appointment were approved by order of the Ministry of Finance of the Russian Federation dated 06.06.2021 No. 85n. And the lists of codes related to the federal budget and extra-budgetary funds are by order of the Ministry of Finance dated November 29, 2021 No. 207n.

Until 2021, the BCC had its own minimum tax that must be paid when applying the simplified tax system “income minus expenses” if the total amount of tax calculated in the usual manner for the tax period (year) turned out to be less than 1% of the tax base. From 2021, for the minimum tax, the BCC is set to the same as for the regular simplified tax system “income minus expenses,” i.e. 18210501021011000110.

One of the common special regimes is the single tax on imputed income or UTII. The fee is paid not from the profit earned, but from the income that the company will receive approximately. But the use of the UTII mode is allowed only for certain types of work. KBK 18210502010020000110 is used when paying a single tax on imputed income for certain types of activities.

Legal entities and individual entrepreneurs can accrue the simplified tax system according to two schemes: from the tax base “income” or from the base defined as “income minus expenses”. In the first case, KBK 18210501011011000110 is used to pay the tax, in the second - 18210501021011000110. Just like for income tax, the specified KBK are used when paying arrears and making recalculations.

KBK 18210801000011000110

Excessive payment or excessive collection of taxes The provisions of the Tax Code do not contain definitions of excessive payment and excessive collection of taxes, which often leads to disputes between taxpayers and tax authorities. Such disputes arise due to the fact that the Tax Code provides for different procedures for calculating interest due to the taxpayer on overpaid and overcollected amounts of tax payments. So, in accordance with clause. In this case, interest on the amount of over-collected tax is accrued from the day following the day of collection until the day of the actual refund. When returning overpaid taxes, interest is calculated in accordance with paragraph. So which taxes are considered overcharged and which are considered overpaid? It does not matter how taxes were transferred to the budget - independently or by collecting tax arrears from the tax inspectorate.

KBK code 1 08 01 in Russia. Current data for the year.

Budget Classification Codes (BCC) for 2021

So, in accordance with the provisions of Art. 227 this tax is paid by individual entrepreneurs working under the general taxation system. Art. 227.1 of the Tax Code of the Russian Federation regulates the payment of personal income tax by certain categories of foreign citizens.

In addition to codes for standard contribution amounts, KBC have been developed for the payment of fines and penalties. Some payers violate tax laws and pay monetary penalties for violating the Tax Code of the Russian Federation.

According to the law, an error in the KBK is not a reason for which the payment will not be considered transferred. The payment order contains additional information indicating the purpose of the payment and its recipient, therefore, if it is indicated correctly, there is and cannot be a reason for penalties against the entrepreneur; other decisions can be challenged in court.

This means that KBK 18210501011010000110 stands for a tax on total income, administered by the Federal Tax Service and credited to the federal budget. In other words, this is a tax under the simplified tax system with the object “income” or arrears on it.

Budget classification codes are approved in the regulations of the main federal department that is responsible for taxes and fees - the Ministry of Finance of the Russian Federation. For 2021, the procedure for the formation and application of BCCs, their structure and principles of appointment were approved by order of the Ministry of Finance of the Russian Federation dated 06.06.2019 No. 85n.

Since 2021, in connection with the repeal of Law No. 212-FZ of July 24, 2009, payments to the Pension Fund of the Russian Federation are supervised by the tax authorities. This circumstance led to a change in the BCC for payments intended for funds. Contributions made by individual entrepreneurs for themselves were no exception.

This is good when there are few payments and you can form a template, but what if it’s a large enterprise? Every day we have 20-30 payments made to different contractors, so you can get completely confused with the templates.

The Federal Tax Service of Russia carries out its functions both independently and through territorial tax authorities.

Art. 78 Tax Code of the Russian Federation (2019 - 2020): questions and answers

ConsultantPlus: note. The amount of overpaid tax is subject to refund upon a written application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels or submitted through the taxpayer’s personal account within one month from the date the tax authority received such an application. Federal Laws Refund to a taxpayer of the amount of overpaid tax if he has arrears on other taxes of the corresponding type or arrears on the corresponding penalties, as well as fines subject to collection in cases provided for by this Code, is made only after offsetting the amount of overpaid tax to repay the arrears debt. For legal regulation before changes are made, see Refund of the amount of overpaid insurance contributions for compulsory pension insurance is not made if, according to the territorial management body of the Pension Fund of the Russian Federation, information on the amount of overpaid insurance contributions for compulsory pension insurance is submitted by the payer of insurance contributions as part of information of individual personalized accounting and are recorded on individual personal accounts of insured persons in accordance with the legislation of the Russian Federation on individual personalized accounting in the compulsory pension insurance system.

The amount of overpaid tax is subject to refund upon a written application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels or submitted through the taxpayer’s personal account within one month from the date the tax authority received such an application. Refund to the taxpayer of the amount of overpaid tax if he has arrears on other taxes of the corresponding type or debt on the corresponding penalties, as well as fines subject to collection in cases provided for by this Code, is made only after offsetting the amount of overpaid tax to pay off the arrears of debt.

About the refund of overpaid tax

What tax payment is hidden behind this transcript. The procedure for applying this budget classification code. Legal entities and individuals regularly encounter budget classification codes, abbreviated KBK, when it is necessary to make a particular payment to the budget. These may be taxes, contributions, duties, interest on them, as well as fines, penalties, surcharges and other payments. Let's take the KBK - it stands for payment of state fees by a legal entity during legal proceedings in an arbitration court.

KBK 18210801000011050110 transcript

In the article, we will look at KBK 18210501012010000110: what tax entrepreneurs will be able to list under it, what codes to indicate when paying fines and penalties, and the relevance of these codes in 2021 and 2019.

Code 182 1 0500 110 KBK (decoding 2018) - what is the tax? This is a general designation for simplified tax. When making a payment, it is necessary to specify the intended purpose of the amount by changing two digits of the code (under serial numbers 14 and 15).

What tax does KBK 18210301000011000110 correspond to in 2021 - 2021? We are talking about VAT on goods sold in the Russian Federation. It is for him that this KBK was installed.

A table will appear; the 1st column will contain the income item, and a little to the right - the corresponding budget classification code. The basis for maintaining any accounting and tax records is the correct completion of all submitted forms. And BCC are the most important details of any official document.

What tax does KBK 18210301000011000110 correspond to in 2021 - 2021? We are talking about VAT on goods sold in the Russian Federation. It is for him that this KBK was installed.

Form: Payment document (notification) of an individual for the payment of taxes, fees and other payments to the budget system of the Russian Federation (payment of state duty) (fragment).

Attention taxpayers! From 01/01/2011, the BCC for taxes related to special tax regimes was changed.

This is the cry from the heart of the vast majority of entrepreneurs: how much easier it would be if these codes were uniform and established once and for all. But the Ministry of Finance makes certain changes to the BCC almost every year. Entrepreneurs and accountants do not always have the opportunity to timely monitor innovations and correct the specified BACs, this is especially evident during reporting periods.

The codes indicated for penalties and fines will also be divided by period. If their payment is made for the period before 01/01/2017, then for penalties the code 18210202090072100160 is used, and for a fine - code 18310202090073000160. If penalties or fines relate to periods after 01/01/2017, then the code 182102020900721 is used, respectively 10160 and 18310202090073010160.

For 2021 - by order No. 99n dated 06/08/2020. That is, if you need to find out which tax KBK 18210301000012100110 (or any other) corresponds to in 2021, then order No. 99n dated 06/08/2020 will be the primary source.