Any organizations or entrepreneurs that pay wages and other remuneration to individuals are tax agents.

When paying employees salaries, the tax agent is obliged to calculate the amount of tax, withhold it and transfer it to the budget. According to paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, income tax, that is, personal income tax, is withheld from the income of employees upon their actual payment. But at the time of payment of the advance, this tax is not paid.

The income of an individual for calculating income tax can be expressed in any form: monetary, tangible and intangible.

What you need to know about personal income tax

Since 2021, there have been some changes in the payment of personal income tax. And they will affect those companies that employ employees with high salaries.

Previously, personal income tax was calculated based on the actual income of employees for the month; a flat rate of 13% for residents of the Russian Federation “worked.” From January 1, 2021, the PFDL rate was introduced and became progressive. This means that the amount withheld will depend on the amount of income (Federal Law No. 372-FZ dated November 23, 2020).

If the annual salary exceeds 5 million rubles, then it is subject to personal income tax of 15%. At the same time, the increased rate does not apply to all income, but only to the part that goes beyond 5 million rubles.

For non-residents of the Russian Federation, personal income tax continues to apply in the amount of 30%.

Tax reduction

To reduce tax, the Tax Code provides for special deductions:

- standard (applied when there are children of a certain age);

- social (applies to the provision of documents for treatment or education);

- property (applied when purchasing housing).

The above deductions are issued to the Federal Tax Service or the employer. A deduction for children is provided upon application from the employer accompanied by the necessary documents.

The employer submits reports 2-NDFL (annually) and 6-NDFL (quarterly) to the tax office. Despite the fact that from 2021 the 2-NFDL is canceled, for 2021 it will have to be taken by March 1. The rules for filling out the form are described in Order of the Federal Tax Service of the Russian Federation dated October 2, 2018 N ММВ-7-11/ [email protected]

Read about the procedure for filling out form 6-NDFL in Order of the Federal Tax Service of the Russian Federation dated October 14, 2015 N ММВ-7-11/ [email protected]

Reporting

To the Pension Fund:

- SZV-M - monthly, within 15 days after the end of the month;

- Report on insurance experience SZV-STAZH - annually no later than March 1 of the following year (until March 2, 2021 for 2019).

Note! Starting from 2021, a new report will have to be submitted to the Pension Fund due to the introduction of electronic work books. Its form has not yet been approved.

To the Federal Tax Service:

Calculation of insurance premiums (for compulsory medical insurance, compulsory medical insurance and VniM) - quarterly no later than the 30th day of the next month.

For 2021 - no later than January 30, 2020.

In 2021:

- I quarter — April 30, 2021;

- I pl. — July 31, 2021;

- 9 months — October 30, 2021;

- year. — February 1, 2021.

From 2021, a report in the DAM form for 10 or more people is submitted only electronically.

Reporting to the Social Insurance Fund:

Calculation of accrued and paid insurance premiums for injuries (Form 4-FSS).

Due dates:

- on paper - no later than the 20th day of the month following the reporting quarter;

- in electronic form - no later than the 25th day of the month following the reporting quarter.

Payroll taxes for employees in 2021

Personal income tax at a rate of 13% is paid by resident taxpayers whose salary does not exceed 5 million rubles. in year. Personal income tax at a rate of 15% is calculated on salaries over 5 million rubles. Non-resident employees pay 30% personal income tax.

Insurance contributions to extra-budgetary funds are calculated and transferred according to the following tariffs, the tariffs are fixed in Art. 425 Tax Code of the Russian Federation:

- to the Pension Fund of Russia (PFR) - 22%

- to the Social Insurance Fund (FSS) - 2.9%

- to the Federal Compulsory Medical Insurance Fund (FFOMS) - 5.1%

- for accident insurance - from 0.2 to 8.5% (the rate depends on the class of professional risk)

In work with difficult working conditions, in underground work, in hot shops, female tractor drivers, drivers of locomotive crews (categories of workers are specified in Article 30 of the Federal Law of December 28, 2013 No. 400-FZ) are provided with additional insurance premium rates (Article 428 Tax Code of the Russian Federation).

Insurance premium calculator

To independently calculate contributions, including for partial years, use the free contribution calculator.

Pay attention to the KBK for insurance contributions to extra-budgetary funds of the Russian Federation for 2021.

What has changed due to direct payments?

From January 1, 2021, the remaining regions switched to direct payments, and now employers are freed from the need to reserve funds for payments and withdraw them from circulation.

The employer assigns and pays temporary disability benefits at his own expense for the first three days, and for the subsequent days of incapacity the regional branch of the Social Insurance Fund is “responsible”, that is, it pays benefits for the remaining period from the fund’s budget.

Where and when to transfer contributions

All contributions, except NS and PZ, are transferred to the tax office, where the individual entrepreneur is registered at his place of residence, regardless of where the activity is carried out. NS and PZ contributions are paid to the Social Insurance Fund, where the individual entrepreneur is registered as an employer.

Contributions to the budget must be calculated and paid no later than the 15th day of the month following the billing month. If the last day for payment of insurance premiums falls on a holiday (weekend), then the final date for payment is considered to be the next working day.

Mandatory contributions for individual entrepreneurs in 2021

Under any tax regime, an individual entrepreneur is required to make systematic deductions for himself. An individual entrepreneur does not have an employer, he is not paid a salary, so fixed payments are calculated from income. The amount of contributions to the funds depends on the amount of income received.

Back in 2021, the insurance burden of individual entrepreneurs was decoupled from the minimum wage, after which the amount of contributions became fixed. Federal Law No. 322-FZ of October 15, 2020 specifies the amounts of insurance contributions for compulsory pension insurance (OPI) and compulsory health insurance (CHI) until 2023.

As a general rule, individual entrepreneurs are required to pay insurance contributions to extra-budgetary funds:

- for your own pension and health insurance;

- for social insurance of employees, if the entrepreneur has them.

Also, individual entrepreneurs can voluntarily pay social insurance contributions for themselves if they want to receive benefits from the Social Insurance Fund (for example, maternity benefits, child benefits, temporary disability benefits). To do this, you need to register with the Social Insurance Fund yourself. We wrote about how to do this in the article “Sick leave for individual entrepreneurs without employees.”

The amount of insurance contributions that an individual entrepreneur must transfer to the Social Insurance Fund if he enters into voluntary legal relations with him for social insurance will be 4,4516 rubles in 2021.

The cost of the insurance year is calculated using the formula: 12,792 (minimum wage) * 2.9% (insurance rate) * 12

Accounting and tax accounting, employee settlements, reporting to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat, currency accounting - all in one service.

To learn more

In accordance with paragraph 1 of Art. 430 of the Tax Code of the Russian Federation, insurance premiums for compulsory health insurance are calculated as follows:

- if the income of an individual entrepreneur falls within the limits of 300,000 rubles, then the fixed amount is 32,448 rubles;

- if the income of an individual entrepreneur exceeds 300,000 rubles, then the fixed amount is 32,448 rubles. + 1% of the amount of income exceeding the limit of 300,000 rubles, but not more than an eightfold increase in the fixed payment - 8 * 32,448 rubles.

The maximum contribution amount for mandatory pension insurance in 2021 is set at RUB 1,465,000. (Resolution of the Government of the Russian Federation dated November 26, 2020 No. 1935).

Insurance premiums for compulsory medical insurance for individual entrepreneurs in 2021 amount to 8,426 rubles.

How can an individual entrepreneur become an employer?

You just need to sign an employment contract. There is no need to register it anywhere. If the individual entrepreneur did not have employees before and is not registered with the Social Insurance Fund, you need to register there and get a registration number. You will need it for reporting. The period for registration is 30 days from the date of the employment contract (there is no need to register when concluding a GPC agreement). In addition, the Social Insurance Fund will establish a contribution rate for work-related injuries based on the main type of activity declared in the Unified State Register of Individual Entrepreneurs.

How much should you pay per employee per month?

Having studied all the taxes, let's calculate how much you need to pay per employee per month.

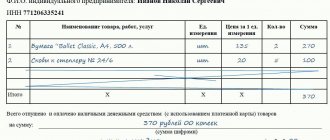

If the salary under the employment contract is 20,000 rubles. per month (before taxes), then for the year it will be 240,000 rubles.

Let's calculate personal income tax: 20,000 x 13% = 2,600 rubles.

The employee receives 17,400 rubles. (20,000 - 2,600).

Every month, under the same conditions, you will need to pay fees:

- for compulsory medical insurance: 20,000 x 5.1% = 1,020 rubles.

- for OPS: 20,000 x 22% = 4,400 rubles.

- on OSS: 20,000 x 2.9% = 580 rubles.

- “for injuries”: 20,000 x 0.2% = 40 rubles.

The total amount is 6,040 rubles. per month and 72,480 rubles. in year.

Total: costs per employee will be 26,040 rubles. per month or 312,480 rubles. in year.

In addition to wages, it is also necessary to take into account the employer’s costs for equipping each employee’s workplace. Until recently, it was believed that those who transfer employees to remote work save significantly. However, Federal Law No. 407-FZ dated December 8, 2020 amended the Labor Code and it became clear that remote work imposes separate obligations on employers.

In particular, the employer, at his own expense, is obliged to provide the employee performing his work functions from home with the equipment he needs for full-time work, software and hardware, and information security tools. Options are possible when an employee uses his own technology, equipment and programs, but then the employer must compensate him for the costs.

Read the article: Eight changes in working with employees in 2021

Dangerous Economy

Many entrepreneurs are looking for various opportunities to minimize employee costs. And salaries in envelopes are being replaced by new options for reducing the amount of payments from the payroll. But each of them carries certain risks.

Conclusion of GPC agreements

This option for minimizing costs is interesting to the employer because there is no need to provide the employee with guarantees and compensation provided for by the Labor Code. The employer is not obliged to pay benefits; it is not spent on creating working conditions. The only thing he needs from an employee is the result of his work.

However, in most cases, payments under GPC agreements are still subject to insurance premiums. In this case, personal income tax is paid in any case, since the company acts as a tax agent when paying income to individuals.

In paragraph 4 of Art. 420 of the Tax Code of the Russian Federation specifies cases when payments under GPC agreements are not subject to contributions. We are talking about situations where the subject of contracts is the transfer of ownership or other proprietary rights to property (property rights). This also includes agreements related to the transfer of property (property rights) for use, with the exception of copyright contracts, agreements on the alienation of the exclusive right to the results of intellectual activity specified in paragraphs. 1-12 p. 1 tbsp. 1225 of the Civil Code of the Russian Federation, publishing license agreements, license agreements on granting the right to use the results of intellectual activity specified in paragraphs. 1-12 p. 1 tbsp. 1225 of the Civil Code of the Russian Federation.

The essence of the risk is that GPC agreements, which actually regulate labor relations, can be reclassified as labor ones (Article 19.1 of the Labor Code of the Russian Federation). There are a number of signs that courts pay attention to when recognizing a relationship as an employment relationship.

The consequence of recharacterization of the contract is the accrual of arrears, fines, penalties, liability for violation of labor protection legislation, etc.

Registration of employees as individual entrepreneurs

This is another option to minimize employee costs. For example, if you take an individual entrepreneur using the simplified tax system “income”, then the amount of payment of the actual salary will be 6%, you also need to take into account contributions to compulsory pension insurance - 32,448 rubles. and contributions for compulsory medical insurance - 8,426 rubles. If the income of an individual entrepreneur exceeds 300,000 rubles. per year, then plus 1% of the excess amount is paid.

In order to save money, employers even compensate the necessary amounts within 6%, which is also beneficial for individual entrepreneurs - in fact, the entrepreneur receives the full amount. In this case, the individual entrepreneur is deprived of all guarantees provided for by the Labor Code.

An agreement with an individual entrepreneur, as in the previous case, can be recognized as an employment contract if it contains signs that the individual entrepreneur is in fact involved in the production process, performs the same duties every day along with full-time employees, has a workplace in the company’s office and uses its equipment. The tax office takes into account the totality of signs and testimony of witnesses. If it turns out that the company really “hid” the employment relationship in contracts with individual entrepreneurs, then additional taxes will follow.

“Transfer” of employees to self-employed

This scheme became known as soon as the professional income tax came into force, which allowed people who work for themselves to become officially self-employed.

From January 1, 2021, all regions, without exception, joined the experiment with a tax on professional income. Those who have registered as self-employed pay a tax of 4% on income from transactions with individuals and 6% on income from transactions with individual entrepreneurs and legal entities. Some employers have decided to transfer some of their employees to professional income tax payers, that is, to fire them and re-register relations with them using GPC agreements.

Employers have realized that the benefit from this is quite large: they cease to be tax agents for personal income tax in relation to an employee who has become self-employed, and get rid of the obligation to pay insurance premiums. Accordingly, they are also not required to comply with any guarantees under the Labor Code. Self-employed employees remain without severance pay, paid leave and benefits in case of temporary disability.

However, it is worth considering that in addition to obvious signs that may indicate the real status of a “self-employed” (for example, the daily presence of a former employee in the office and his use of a specific workplace), there are also provisions of the law itself on the self-employed. They indicate that an employer can, within the framework of a GPC agreement, cooperate with a former employee who has become self-employed only under one condition - if at least two years have passed since the dismissal of this employee from the company.

How to calculate contributions

The basis for calculating contributions is all income accrued in favor of individuals (without deduction of personal income tax!). What is not subject to contributions is listed in Article 422 of the Tax Code. Here are some of the most common incomes that are not subject to contributions: sick leave, daily allowance, financial assistance (there is a non-taxable limit), severance pay.

Contributions are considered as a cumulative total throughout the year for each person separately. Comparison with the maximum base is also carried out for each specific employee.

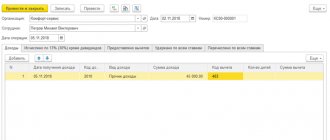

Example: an individual entrepreneur hired an employee on July 1, 2019 with a salary of 30,000 rubles. The employee worked full time for the entire month of July. Individual entrepreneurs apply basic contribution rates and deduct 0.3% for “injuries.” We calculate contributions:

The base for calculating contributions is 30,000 rubles:

- on OPS: 30,000×22% = 6,600

- for social insurance: 30,000×2.9% = 870

- on medical insurance: 30,000×5.1% = 1,530

- for “injuries”: 30,000×0.3% = 90

The total amount of insurance premiums for an employee for July is 9,090 rubles.