Note! tax regime has been abolished since 2021 . Payers of UTII need to choose another taxation option.

Free consultation on

UTII taxes is a preferential tax regime for small businesses, which will be terminated from January 2021. The Ministry of Finance believes that budget revenues from imputation are too insignificant compared to other tax regimes.

But while UTII is still in effect, organizations and individual entrepreneurs can take advantage of the benefits of this taxation system. After all, taxes here are not imposed on real, but on estimated (imputed) business income.

What is taken into account when calculating tax on imputed income

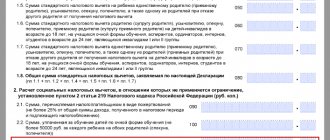

To calculate what the UTII tax will be for 2021 by type of activity, you need to know what is taken into account when determining imputed income. Since real revenue from sales and provision of services is not taken into account, other indicators are used here:

- basic yield (BR);

- physical indicator (PF);

- coefficients K1 and K2.

The first two indicators for UTII are established by the Tax Code of the Russian Federation and remain unchanged. But the coefficients are a variable value, and the amount of tax paid on UTII depends on their size.

News

Review from 05/12/2020

Decisions of the Krasnoyarsk City Council of Deputies dated April 28, 2020 No. B-97 and dated April 28, 2020 No. B-98

The procedure for calculating rent for land and for municipal non-residential facilities in the city of Krasnoyarsk has been changed

In order to support entrepreneurship in connection with the spread of the new coronavirus infection, the procedure for calculating the amount of rent for the period from April 1 to June 30, 2021 for small and medium-sized businesses and socially oriented non-profit organizations (except for government agencies) for non-residential facilities, for with the exception of objects leased based on the results of bidding, and the amount of rent for small and medium-sized businesses for a land plot that is in municipal ownership and leased without bidding.

The amount of rent paid by tenants during the period from April 1 to April 30, 2021 is subject to recalculation without the tenant filing a corresponding application, and, if any, the overpayment is subject to offset against upcoming payments.

Decision of the Krasnoyarsk City Council of Deputies dated April 28, 2020 No. B-99.

In the city of Krasnoyarsk, reduced rates of the single tax on imputed income have been established for certain types of activities

In the city of Krasnoyarsk, for the 2nd quarter of 2021, the UTII rate of 7.5 percent of the amount of imputed income is established for taxpayers engaged in business activities in the provision of household services, motor transport services for the transportation of passengers and goods, carried out by organizations and individual entrepreneurs with no more than 20 vehicles , public catering services provided through public catering facilities with a hall area of no more than 150 sq. m. or without a visitor service hall, distribution of outdoor advertising using advertising structures and placement of advertising using the external and internal surfaces of vehicles, provision of temporary accommodation and accommodation services in an area of no more than 500 sq. m. m., for the transfer for temporary possession and (or) use of retail spaces and land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities.

And the amount of 11.25 percent of the amount of imputed income is established for taxpayers engaged in retail trade carried out through shops and pavilions with a sales floor area of no more than 150 square meters for each trade facility, and through objects of a stationary retail chain that does not have sales floors, as well as objects of a non-stationary trading network.

Law of the Krasnoyarsk Territory No. 9-3861 dated April 24, 2020 “On amendments to the annex to the Regional Law “On the patent taxation system in the Krasnoyarsk Territory”

The amount of annual income potentially available to an individual entrepreneur has been reduced, especially if there are hired workers, for the following activities: repair and tailoring of garments, shoes, hairdressing and beauty services, dry cleaning and laundry services, production and repair of metal haberdashery, repair and maintenance household and electronic equipment, furniture repair, photo studio services, maintenance and repair of vehicles, machinery and equipment, provision of motor transport services for the transportation of goods and transportation of passengers by road, services for training the population in courses and tutoring, supervision and care services, production of folk arts and crafts, services of jewelers, designers, sports instructors, paid toilet services, rental services, catering services and a number of other activities.

Law of the Krasnoyarsk Territory No. 9-3857 dated April 24, 2020 “On amendments to Articles 2 and 5 of the Territory Law “On Organizational Property Tax”.

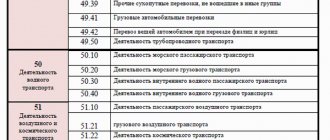

According to the changes made, the corporate property tax rate is set at 0% for the tax period 2021 for organizations included in the unified register of small and medium-sized businesses carrying out a certain type of economic activity in accordance with the All-Russian Classifier of Types of Economic Activities, according to the approved list.

The zero rate is applied if the following conditions are simultaneously met during the tax period: revenue from the sale of goods (work, services) when carrying out the specified types of economic activities for the tax period of 2021 amounted to at least 70% of the income from the sale of goods (work, services); the amount of monthly wages and (or) other payments due to an employee of the organization is not lower than the minimum wage, with the addition of the regional and northern coefficient in case of full employment, for other employees - not lower than the amount calculated in accordance with the requirements of the Labor Code Code of the Russian Federation.

Also, organizations included in the unified register of small and medium-sized businesses, the main type of economic activity of which, in accordance with the All-Russian Classifier of Economic Activities, is “Rental and management of own or leased non-residential real estate” (subgroup 68.20.2 of section L), have the right to reduce the amount corporate property tax for 2021, by the amount of rent reduction under lease agreements for buildings and non-residential premises, subject to certain conditions.

Law of the Krasnoyarsk Territory No. 9-3853 dated April 24, 2020 “On the establishment of tax rates in the territory of the Krasnoyarsk Territory when applying a simplified taxation system for certain categories of taxpayers in 2021.”

In the territory of the Krasnoyarsk Territory, in the tax period of 2021, reduced tax rates are established when applying a simplified taxation system: in the amount of 1% if the object of taxation is income, 5% if the object of taxation is income reduced by the amount of expenses. To apply this rate, organizations and individual entrepreneurs must meet the following criteria:

— income from one of the forty established types of economic activity for the tax period of 2020 amounted to at least 70% of the total amount of income taken into account when determining the object of taxation in accordance with Article 346.15 of the Tax Code of the Russian Federation;

- the amount of wages and (or) other payments due to an employee of the organization in each month of the tax period is, in relation to a full-time employee, not lower than the minimum wage, with the regional and northern coefficients applied to him, in relation to other employees - not lower than the size calculated in accordance with the requirements of the Labor Code of the Russian Federation.

Reduced tax rates are applied when taxpayers carry out certain types of economic activities in accordance with the All-Russian Classifier of Types of Economic Activities.

Prepared based on materials from SPS Consultant Plus. No ConsultantPlus? Order the full version of the document!

Coefficient K1

First, let's talk about the correction factor K1. This indicator is intended to take into account inflation, i.e. rising prices for goods and services.

K1 in Russia changes annually; it is approved by order of the Ministry of Economic Development. The correction coefficient is valid in all regions and municipalities of the Russian Federation.

K1 UTII 2021 was approved by order of the Ministry of Economic Development dated December 10, 2019 No. 793 and its value is 2.005.

For comparison: in 2021 K1 was equal to 1.915, in 2021 - 1.868, and in 2021 - 1.798. That is, this indicator shows a steady, although not very significant increase. Which is natural, since the coefficient reflects the constant increase in the cost of goods and services.

Please note: for the first time, the Ministry approved deflator coefficients for 2021 by order No. 684 dated October 21, 2019. The K1 coefficient for UTII was set at 2.009. However, the coefficients were later reduced by a separate order.

Accounting is:

| Universal Serving businesses of all forms of ownership and taxation regimes | Reliable We provide services under a contract that specifies rights, obligations, terms and responsibilities. | Professionally Services are provided by accountants with specialized education and extensive experience. |

| Individual approach Taking into account the scale and characteristics of your business, individual approach to the client | Comprehensively A full range of accounting and reporting services in one place | Full complex Profitable The services of our accountants will cost you less than maintaining your own specialist or staff |

K2 coefficient

The second coefficient for calculating UTII tax has a completely different function. With its help, municipalities can reduce the calculated imputed income, and therefore the tax on it. This allows the development of certain types of businesses in the region.

The K2 value in 2021 is from 0.005 to 1 . Unlike K1, this indicator differs not only in municipalities, but also in the types of activities that are allowed for UTII.

You can find out the specific value of K2 in 2021 for imputation in the regulatory legal act of the locality at the place of activity. We talked about how to do this here.

Prepare a UTII declaration for only 149 rubles

UTII rate 2021

As a general rule, the single tax rate on imputed income is set at 15% (clause 1 of Article 346.31 of the Tax Code of the Russian Federation).

However, in the regions, depending on the type of business activity, as well as on the category of taxpayer, the UTII rate can be reduced from 15% to 7.5% by regulatory legal acts of local government bodies (clause 2 of Article 346.31 of the Tax Code of the Russian Federation). If local authorities have not approved regulations on the application of a reduced tax rate in a given region, then UTII taxpayers apply a general rate of 15% (clause 1 of Article 346.31 of the Tax Code of the Russian Federation).

Increasing UTII from 2021: calculation example

There is a high probability that the bill of the Russian Ministry of Finance will be adopted. Let's try using examples to calculate UTII from 2021 taking into account the new coefficient and compare the indicators with 2021. So, the general formula for calculating UTII in 2021 remains the same:

Let us give examples of calculations adjusted for K1.

An example of calculating UTII in 2021

Tsvetochek LLC is engaged in retail trade through its own store with a sales area of 80 sq. m. m. In the city where trade is carried out, the use of UTII is allowed. The tax rate for retail is 15%. Alpha LLC conducted imputed activities in January, February and March. The calculation will be based on the following indicators:

- in 2021, the new value of the deflator coefficient K1 is 1.891;

- The regional authorities set the value of the correction coefficient K2 at 0.7.

- the basic profitability for retail trade in the presence of trading floors is 1800 rubles/sq.m. m.

Imputed income for February–March 2021 (that is, for the 1st quarter) will be:

571,838 rubles. = 1800 rub./sq. m × (80 sq. m + 80 sq. m + 80 sq. m) × 0.7 × 1,891.

UTII for the first quarter of 2021 with the new value of the K1 coefficient will be:

RUB 85,776 = RUB 571,838 × 15%

Comparison of calculation with 2021

Let’s assume that the bill to increase the coefficients for “imputation” is not adopted and in 2021 the K1 coefficient remains at the same level – 1.798. In this case, under the same conditions, the amount of UTII payable for the 1st quarter of 2021 will be less. In this case, the basic profitability indicator will be equal to 543,715 rubles. = 1800 rub./sq. m × (80 sq. m + 80 sq. m + 80 sq. m) × 0.7 × 1,798.

The amount of tax payable will be 81,557 rubles = 543,715 rubles. × 15%

Thus, if the new coefficient for UTII is approved, then with similar indicators, the amount of tax for the 1st quarter of 2021 will increase by 4219 rubles. (RUB 85,776 – RUB 81,557). In percentage terms, the increase in 2021 will be 5.2 percent.