In what cases is it necessary to recalculate insurance premiums for previous periods?

Typically, updated data is submitted to regulatory authorities if the amount is more or less than the specified standards due to errors made when drawing up the document. Here are some examples of reasons for submitting updated information:

- During the preliminary calculation, there is no information that the employee’s profession is hazardous, which requires the application of additional tariffs. Because of this, there was an underpayment of insurance premiums.

- The right to apply preferential tariffs has been lost by the unit. The accounting department received the information with some delay. As a result, after recalculation the amount will increase.

- The premium from the calculation base is not included during the initial setup of computer programs.

- An employee was transferred from one department to another, and both have different tariffs and payment ratios.

- Incorrect completion of the third section, late transfer of personal data.

It is also useful to read: Is sick leave subject to insurance contributions?

“Past” mistakes regarding contributions to the Social Insurance Fund - everything can be corrected

Author: interviewed by A.V. Khoroshavkina

Errors are not always noticed immediately. We receive questions from readers about how to correct past mistakes related to the payment of insurance premiums to the Social Insurance Fund. We turned to the head of the Fund’s specialized department for advice.

FROM AUTHENTIC SOURCES

Ermolaeva Natalya Nikolaevna, head of the department for methodological support of budget accounting and reporting of the Financial Department of the Federal Social Insurance Fund of the Russian Federation

Graduated from the All-Russian Correspondence Institute of Finance and Economics

Worked as chief accountant of the organization

He has been working at the Social Insurance Fund since 1994.

A.V. Khoroshavkina:

Natalya Nikolaevna, how to correct the mistakes that led to underpayment of contributions to compulsory social insurance in case of temporary disability and in connection with maternity in 2010?

N.N. Ermolaeva:

If the base for insurance premiums in case of temporary disability and in connection with maternity for 2010 turned out to be underestimated, insurance premiums for this year must be additionally calculated and transferred to the Social Insurance Fund. In addition, a fine must be paid, but the organization is exempt from the fine <1>. An updated calculation of 4-FSS for 2010 should also be drawn up according to the form in force that year <2>. The Foundation's specialists will use this report during control activities. All data in it, including the balance at the end of the period, must be indicated correctly.

It is necessary to recall that Table 1 “Calculations for accrued and paid insurance premiums...” of FSS Form-4 is filled out on the basis of accounting entries <3>. Balances as of January 1, 2011, according to accounting data, were formed and reflected in the report for the first quarter of 2011. These balances (lines 1 and 12 of table 1) do not change during the billing period <4>. Therefore, the balances at the beginning of 2011 can no longer be changed now that you have discovered the error (for example, in November 2011).

It is clear that taking into account the additional accrual of insurance premiums, settlements with the Fund will change. But this is not scary, and the amount of additionally accrued contributions for 2010 must be reflected in the current period (in the report for 2011) in line 4 “Accrued insurance premiums by the policyholder for past billing periods” of Table 1 of Section I of Form-4 of the Social Insurance Fund. That is, at the end of the current period, all data will be entered correctly.

A.V. Khoroshavkina:

What if an error was discovered for the past reporting period of the current year (for example, in November 2011 an error was found for April 2011)?

N.N. Ermolaeva:

It is necessary to draw up an updated calculation for the first half of 2011. The error is reflected in the reporting period when it was identified. If an accountant finds an error for April in November, he will also make an accounting entry for additional accrual of insurance premiums for April in November. Consequently, in the report for 2011 this correction will be reflected in November 2011.

A.V. Khoroshavkina:

How to correct a mistake if an accountant discovered that he underpaid contributions for compulsory social insurance against industrial accidents and occupational diseases in 2009? Do I need to pay additional contributions and submit to the Social Insurance Fund an updated calculation in Form 4-FSS for 2009 or reflect additional contributions in the calculation for the current year?

N.N. Ermolaeva:

Law No. 125-FZ does not provide for the possibility of submitting an updated calculation of insurance premiums <5>. If you have discovered an underpayment of insurance premiums for past years, I recommend that you reflect this in Form-4 of the Social Insurance Fund in Table 7 on line 5, “Added contributions by the policyholder for past billing periods,” for the period in which the underpayment was identified <6>. Nevertheless, it is necessary to accrue and pay penalties for the amount of the underpayment <7>.

A.V. Khoroshavkina:

There may also be an error when the employee was paid temporary disability benefits in a smaller amount than required. What should an accountant do when he discovers an error? Is he required to submit an updated calculation and does this depend on whether an error was discovered for the previous reporting period or for the billing period?

N.N. Ermolaeva:

The employee benefit, of course, must be paid extra. And this is reflected in the calculation in the period when you paid him additional benefits. You are required to submit an updated calculation to the Fund only when an error is discovered that leads to an underestimation of insurance premiums. If, as in this case, the error did not lead to an underestimation of contributions, the accountant may, but is not required to, provide an updated calculation <8>.

——————————-

<1> clause 1 part 4 art. 17 Federal Law of July 24, 2009 N 212-FZ

<2> approved By Order of the Ministry of Health and Social Development of Russia dated November 6, 2009 N 871n

<3> clause 5.2 The procedure for filling out the calculation form... approved. By Order of the Ministry of Health and Social Development of Russia dated February 28, 2011 N 156n (hereinafter referred to as the Procedure)

<4> pp. 5.3, 5.12 Order

<5> Art. 24 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

<6> clause 17.6 of the Procedure

<7> clause 1 art. 22.1 of the Federal Law of July 24, 1998 N 125-FZ

<8> part 2 tbsp. 17 Federal Law of July 24, 2009 N 212-FZ

First published in the magazine "Glavnaya Ledger" N23, 2011

How to make a conversion in 1C ZUP

Let's consider one of the practical examples for clarity. There are conditions that can be described as follows.

Example:

The employee works as a storekeeper, her standard salary is 10 thousand rubles. The warehouse itself is classified as a division for which a preferential rate for insurance premiums is applied under the name “Residents of a technology-innovative special economic zone.” First, we submitted the calculations for the first half of 2021, then we found out that since February 2021, the right to preferential treatment has been lost.

Specific recommendations

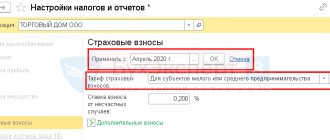

Previously, tariff code 05 was used when calculating insurance premiums using programs. For 2021, at this tariff, 13% is allocated to the Pension Fund. The Social Insurance Fund needs 2.9%, the Federal Compulsory Medical Insurance Fund – 5.1%. Previously, the calculation of contributions for the specified employee was based on the information given above.

The amount of insurance deductions for the month was, taking into account the tariff:

- 290 rubles to the Social Insurance Fund.

- 510 rubles for FFOMS.

- 1,300 rubles for the Pension Fund.

The calculation for the 1st quarter of 2021 reflects exactly these amounts. When this information was discovered, the need arose to draw up an updated Calculation. This means that insurance premiums are recalculated at new rates.

The “Preferential rate of insurance premiums” field in the “Divisions” card is completely cleared. Then choose the standard tariff established for the organization. Usually information about it is located in the “Organizations” card. The Tab that interests users is called “Accounting Policy and Other Settings”, then follow the link to the Accounting Policy and look at the type of tariff.

According to the previously established tariff, the previously specified company must transfer:

- FFOMS 5.1%.

- 2.9% for Social Insurance Fund.

- 22% for the Pension Fund.

The tariff code should change, in addition, the Pension Fund received less than 9%.

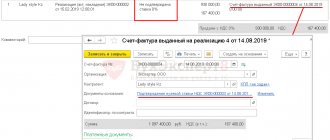

The procedure for accounting for income must be reviewed in order to make adjustments in accordance with all the rules. To do this, use a document called “Recalculation of insurance premiums” from the “Taxes and Contributions” menu. All employee incomes are specified manually on the “Income Information” tab.

Insurance premiums are recalculated automatically on the corresponding tab.

With a monthly salary of 10 thousand rubles, after recalculation, the amount of contributions became as follows:

- 290 and 510 rubles, respectively, for the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

- 2,200 rubles for the Pension Fund.

Calculations with clarifications are being prepared for the 1st quarter. During the corrected periods, new documents are created using the 1C program. The cover page must contain information regarding the revision number. An example is when changes affect all employees of the Section, therefore adjustments are required for everyone.

In the adjusted calculation, the third Sections are formed for each employee. If only one of them is needed, then the information is adjusted accordingly. The remaining sections are completely filled with new data, regardless of the current situation.

How benefits are reflected in the RSV

When filling out the DAM form, benefits should be reflected in Appendix 2 to Section 1 :

- line 080 reflects the amount of compensation received by the policyholder from the Fund;

- on line 090 - the difference between the amount of benefits paid to insured persons and the amount of accrued contributions.

The Tax Service explained exactly how the amount of contributions is reflected in line 090 in a letter dated 08/23/17 No. BS-4-11 / [email protected] The calculation is made using the following formula (indicators are taken from the corresponding lines of Appendix 2 to Section 1):

Amount in line 090 = Line 060 - Line 070 + Line 080

The result is interpreted as follows:

- If it is positive , it means that the policyholder has a debt. In the column “Total from the beginning of the billing period” of line 090 the calculated value is indicated, and in the column “Characteristic” - 1.

- If the result is negative , then the Fund is in debt. In the column “Total since the beginning of the billing period” the value without the “-” sign , and in the column “Sign” - 2.

Updated calculation and right of representation

If the Policyholder has discovered errors due to which the amount differs from the standards, then he has the right to provide updated information. In such situations, there are no additional legal requirements for completed documents. All recalculations are carried out in the next period . But the organization has the right to clarify the documents even six months in advance.

Attention! You should not make hasty conclusions and take actions before the end of the reporting period. After all, it also happens that later different results overlap each other, so there is no need to change anything radically.

How to check

If you have doubts about the correctness of filling out the DAM, it is recommended to reconcile the calculations with the budget . This is the most reliable method that will give a 100% guarantee that there will be no errors.

You can also check the balance of social insurance settlements using a calculation certificate (Appendix 1 to the letter of the Federal Social Insurance Fund of Russia dated December 7, 2016 No. 02-09-11/04-03-27029). Such a certificate, along with other documents, is submitted to the Fund by those policyholders who want to receive compensation.

The document contains fields that reflect the debts owed by the policyholder and the Fund at the beginning and end of the reporting period. Thus, the mentioned calculation certificate reflects the real state of settlements with the Social Insurance Fund.

In conclusion, let us mention that when checking, inspectors are not guided by the contents of line 090 of Appendix 2 to Section 1. The document from which they receive data on mutual settlements is the Budget Payment Card . Reconciliation of the policyholder is carried out precisely on the basis of this card, and not at all according to data from the DAM.

What else needs to be considered

Sometimes there is no obligation to submit an Update, but the policyholder has no other option to provide important information to regulatory authorities.

For example , when a negative amount is formed. Such a report cannot be submitted to the tax authorities; new papers must be generated.

Or if an employee works in a hazardous workplace. But then he was transferred to regular work, and the information arrived with a delay. Then the accruals cannot compensate for the amount. Reports also need to be developed.