When liquidating their enterprise, many entrepreneurs are often concerned about the question of how to close an individual entrepreneur in the Pension Fund of Russia. We hasten to reassure you that this procedure occurs as usual, regardless of the size of the entrepreneur’s debt.

As a rule, difficulties should not arise when liquidating a business. There is a difference when closing the status of an individual entrepreneur for those who entered into employment contracts and those who worked independently (without hired workers or entered into only civil contracts). You can read more about the differences later in this article.

How to calculate the amount

Many problems arise if the closure of an individual entrepreneur does not occur at the end of the year. Then the amount is calculated in proportion to the calendar months until the closing date. If one month is incomplete, then individual days during which the activity was carried out are counted. Insurance premiums are paid for all days when the function of the individual entrepreneur along with the status was preserved.

If the amount of profit for an incomplete tax period exceeds 300 thousand rubles, an additional contribution to the Pension Fund of 1% is charged. The transfer does not take place at the end of the period, but for a maximum of 15 days. For amounts less than 300 thousand rubles, there is no contribution at all.

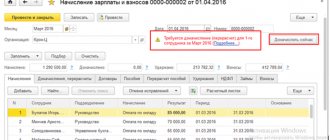

For example, an employee worked the full month of February with a salary of 60 thousand rubles. Contributions for it are calculated as follows:

- Social Insurance Fund: the amount is multiplied by 0.2%.

- Compulsory medical insurance: multiplied by 5.1%.

- In the case of the Social Insurance Fund, the multiplication coefficient is 2.9%.

- OPS - 60 thousand multiplied by 22%.

The resulting numbers are added to each other to determine the total.

When the activity is stopped

The obligation to pay insurance premiums arises from the moment of acquiring the status of an individual entrepreneur and until the moment of exclusion from the Unified State Register of Individual Entrepreneurs in connection with the termination of the activities of an individual as an individual entrepreneur.

This means that if an individual entrepreneur has ceased operations, but has not submitted documents to the Federal Tax Service for exclusion from the Unified State Register of Individual Entrepreneurs, then insurance premiums must be paid regardless of the fact of receiving income.

If an individual entrepreneur is deregistered before the end of the year, then you must pay contributions for yourself to compulsory health insurance and compulsory medical insurance in proportion to the number of calendar months, including the month of termination of registration as an individual entrepreneur. At the same time, for an incomplete month of activity, the amount of contributions is determined in proportion to the number of calendar days of this month up to the date of state registration of termination of the individual entrepreneur status (clause 5 of Article 430 of the Tax Code of the Russian Federation).

In accordance with paragraph 5 of Article 432 of the Tax Code, in the event of termination of activity, payment of insurance premiums is carried out no later than 15 calendar days from the date of deregistration as an individual entrepreneur.

Payment deadlines

UTII, simplified tax system and patent are special regimes that are used in most cases. The procedure for settlements with regulatory authorities varies depending on how exactly a particular market participant operates.

- No later than 5 days after cancellation, 3NDFL is transferred when using OSN. Payment is made within a 15-day period. No later than the 25th day of the month following the closure of the individual entrepreneur, a VAT declaration is submitted. The fee is transferred in full at once, or divided into three parts.

- The 25th day of the month after liquidation is the payment time in the case of the simplified tax system. The declaration must be submitted before the deadline. The situation is radically different when it comes to a patent. In this case, there is no obligation to submit a declaration. You just need to pay for the validity period before it ends. The tax will be recalculated if an application to terminate the activities of an individual entrepreneur is submitted at a time when the document is still valid.

- The 25th day of the next month after closing applies to those working on UTII. The entrepreneur must submit a declaration by the 20th of the same month.

Attention! It is recommended to retain tax documentation for 4 years after liquidation. Receipts for contributions are kept for 6 years.

When should fees be paid?

If the entity ceases to conduct business in the middle of the calendar year, then the date of payment is affected by the date of entering information about the liquidation of the individual entrepreneur. The payment period is 15 calendar days from the date of occurrence of this event. For example, in the case under consideration, the date of entering information into the register is May 15. Therefore, fees must be paid by May 30, 2021. But it's a day off. Therefore, we are guided by the rules for transferring to the first working day. Thus, contributions must be paid by May 31, 2021. If an entrepreneur ceases his activities at the end of the calendar year, then the deadlines for paying contributions automatically change. Based on the Tax Code, it is necessary to do so before April 30 of the next year. For example, when closing an individual entrepreneur at the end of 2021, you must pay contributions by April 30, 2022. Another plus is that a benefit is provided for individual entrepreneurs without employees - they do not need to generate reports and submit them to the relevant authorities. It is also important that entrepreneurs no longer need to independently contact the Pension Fund and inform them about the liquidation of the individual entrepreneur. This is done automatically by the tax office. It is enough to submit an application to the Federal Tax Service using the form. And within a few days you will receive a corresponding letter with an entry made in the Unified State Register of Individual Entrepreneurs. You can now submit an application through your taxpayer’s personal account, by email and in person.

Service for students

If you find an error, please select a piece of text and press Ctrl+Enter.

What to consider when adjusting the “simplified” tax on insurance premiums when closing an individual entrepreneur

This usually applies to individual entrepreneurs who use OSNO with the object of taxation in the form of income. In this case, you have the right to reduce the total amount of fees. If there are employees, this reduction reaches a maximum of 50%. If they are not there, then the reduction occurs by the full amount.

The moment of transfer of money most often occurs after an entry has appeared in the Unified State Register of Entrepreneurs confirming the termination of activities.

That is, an individual already pays, not within the current tax system. This means that payments that were made after this point cannot be taken into account.

When closing, an organization may face debts not only to the pension fund, but also to other organizations, private and public. Tax debt is a situation that many people face. The organization can be closed only after all relevant payments have been transferred. In connection with this issue, additional expenses often arise.

Therefore, it remains a mandatory requirement to provide a tax return for the entire period while business activity was carried out. This is done even if the activity itself was actually absent.

In this case, in the column for income and expenses of the company, they simply put zeros. A report is needed only for the latest tax period, if previously documents were submitted on time. The issue can be resolved a maximum of 5 days after liquidation, if the issue was not resolved within another time frame for one reason or another.

The property of a former entrepreneur can be used as payment for debts if he currently lacks finances.

What else should an individual entrepreneur do during the liquidation of a business with debts to the Pension Fund of Russia?

During the liquidation procedure, a business entity must not forget about the following important points:

- Submit tax returns (on the FSN website you can find out the deadlines for filing a tax return in 2021 for individual entrepreneurs).

- Submit reports to all extra-budgetary funds (where he is registered as a payer of insurance fees).

- Remove the cash register from state registration.

- Close bank and card accounts (notify regulatory authorities of the action taken within 3 days).

- Pay off debts to creditors.

- Sell equipment for small businesses at home (if it was used in commercial activities).

What else should you do after closing?

There are a number of additional measures related to the fact of closure of business activities:

- Submitting a declaration for the last reporting period. Even with zero indicators, the document remains mandatory.

- Deregistration of cash register equipment. The procedure for resolving the issue may differ depending on the territory in which everything occurs. It is better to clarify the requirements in advance with representatives of regulatory authorities.

- Closing a current account. It is optimal when this is done after receiving all the necessary documents. From January 1, 2021, it was prohibited to terminate activities without written notification to the tax office. Violation of the rules leads to quite serious fines.

Important! The pension fund does not require notifications. Information is transmitted to services through interdepartmental interaction. After liquidation, most reports are kept for 3 years. If necessary, additional checks are organized during this time and requests are sent.

What fees must be paid:

1. Contributions to compulsory pension insurance - OPS; 2. For compulsory health insurance - compulsory medical insurance. For each of these types of contributions, there are limits and certain calculation algorithms: • OPS: if the income for the year does not exceed 300,000 rubles, then the entrepreneur pays a fixed amount - 32,448 rubles; if the income is more than the specified amount, then it is necessary to pay 32,448 rubles within the framework of 300,000 rubles and an additional 1% of the amount exceeding this limit. • Compulsory medical insurance: the amount of health insurance is paid in a fixed amount and does not depend on the amount of income. For 2021, its value is 8426 rubles. To better understand the algorithm for calculating contributions, consider an example. Example 1. An entrepreneur works without hired employees. He decides to close his business. The corresponding entry in the register on the liquidation of individual entrepreneurs will be made on May 15, 2021. It is necessary to determine how much a person must pay to the state so that he is not considered a debtor. Calculation: 1. First, the amount of contributions for compulsory pension insurance - OPS is calculated. The contribution for the calendar year 2021 will be 32,448 rubles. But the entrepreneur does not work the whole year, but only the first 4 months - from January to April, as well as another 15 days of May. We get: 32248/12 *4 + 32248/12/30*15 = 10749.33+1343.67 = 12093 rubles. 2. Compulsory medical insurance premiums are calculated in the same way: 8426 rubles (fixed value)/12*4 + 8426/12/30*15 = 2808.67 + 280.87 = 3089.54 rubles. 3. We determine the total aggregate amount of insurance premiums from January 1, 2021 to May 15 (liquidation date): 12093 + 3089.54 = 15182.54 rubles. It is important to understand: 15182.54 rubles is the minimum amount for an individual entrepreneur who has decided to close his business. This calculation is relevant if the amount of income received is less than 300,000 rubles. If the amount of income received, even for the first 4.5 months, is more than this amount, then the amount of the contribution will be calculated completely differently. Example 2 (similar to the previous one): an entrepreneur decides to close the individual entrepreneur on May 15, 2021. From the beginning of the year until the corresponding entry was made in the register, the company received income in the amount of 500,00 rubles. It is necessary to determine how much the subject must pay to the budget. Calculation: 1. Let's start the calculation from the end. The amount of income does not affect health insurance premiums. Therefore, we use the base value – 8426 rubles. Based on this, we get a similar calculation: 8426 rubles/12*4 + 8426/12/30*15 = 2808.67 + 280.87=3089.54 rubles. 2. We determine the amount of contributions for compulsory pension insurance: within the limit - up to 300,000 rubles: 32248/12 *4 + 32248/12/30*15 = 10749.33+1343.67 = 12093 rubles. over the established limit: (500,000 – 300,000)*1%/100/12*4 + (500,000 – 300,000)*1%100/12/30*15 = 666.67+83.33 = 750 rub. 3. The total amount of contributions is: 3089.54+12093.00+750 = 15932.54 rubles. Thus, in this case, upon liquidation, the entrepreneur will be forced to pay 15,932.54 rubles. Important information: regardless of the amount of income received, the maximum amount of insurance premiums at the end of 2021 for compulsory insurance cannot be more than 259,584 rubles (the limit is calculated using the formula = 8 * the established indicator of insurance premiums for the year or 8 * 32,448 rubles)

How to close an individual entrepreneur in 2021 with debt and write it off

The only legal way to liquidate an unprofitable individual entrepreneur without paying debts is to initiate bankruptcy proceedings. According to Law No. 127-FZ, you can submit an application to the Arbitration Court for assignment of insolvent status if 2 or more required conditions are met:

- tax debt is more than 10,000 rubles;

- more than 10% of obligations to regulatory authorities are not paid within the deadlines established by law;

- the last payment on a bank loan was made more than 3 months ago;

- the amount of the entrepreneur’s debt obligations exceeds the market price of real estate or property that is owned by him;

- the financial forecast shows a negative trend and debt repayment in the next 3 months is impossible;

- repayment of debt to one of the creditors excludes the possibility of repaying the remaining obligations.

The bankruptcy procedure involves debt restructuring. If the issue cannot be resolved with creditors, the court will order bankruptcy proceedings to sell the property. If an individual who has the status of an entrepreneur does not have property or the money received from its sale is not enough to cover all debt obligations, they are written off at zero.