Provisions for doubtful debts under the simplified tax system

In accounting, creating a reserve for doubtful debts is an obligation, including for small businesses.

Why is a provision for doubtful debts created?

- To reflect in the reporting the reliable amount of receivables, that is, the amount of debt that is likely to be repaid;

- To fulfill the requirement of prudence, that is, there is a greater willingness to reflect expenses in accounting than possible income.

The creation of a reserve for doubtful debts and vacations does not affect the “simplified” approach to tax accounting, since there is no cash expense and the reserve is created on an accrual basis. There is no cash flow under the accrual method, while the “simplified” ones record expenses and income using the cash method.

Creating a reserve for doubtful debts in 1C 8.3

Necessary actions to create a reserve for doubtful debts:

- Conducting a debt inventory. In 1C 8.3 it is drawn up in the document “Act of Inventory of Settlements”:

- Identification of doubtful debts based on inventory results;

- Determining the amount of reserve for each doubtful debt;

- Formation of a reserve for doubtful debts in accounting. accounting is documented by posting Dt 91.02 Kt 63. In 1C 8.3 it is entered by the document “Operation (BU and NU)”;

- The write-off of bad debts from the reserve for doubtful debts is documented by posting Dt 63 Kt 62.01. in 1C 8.3 it is entered by the document “Operation (BU and NU)”.

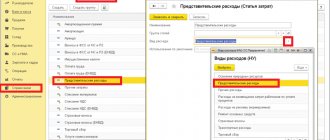

In the 1C 8.3 program, a reserve is created in the Accounting Policy settings: section Main - Accounting Policy, on the Reserves tab. If you check the “In accounting” checkbox, then in 1C 8.3 reserves will be formed according to the rules of Tax Code Part 25, so it is not recommended to check the box:

Provisions for doubtful debts in 1C 8.3 in accounting can be created by entries entered manually, as follows: Operations – Operations entered manually, where we create the entry Dt 91.02 Kt 63:

The most important thing is that in this case the reserve is created on account credit 63 and this does not affect tax accounting according to the simplified tax system.

Further, when the debt is recognized as uncollectible, it must be written off. If the reserve was created for accounts receivable, then the debt is written off through account 63 also with manual entries:

Writing off bad debts in 1C 8.3 is always done manually, even if you create reserves.

The features of the simplified tax system, the capabilities of the 1C 8.3 program when applying the simplified tax system and how to avoid errors in accounting under the simplified tax system are discussed in more detail in our course “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z, simplified tax system”, where you can figure out and understand how the legal requirements of the simplified tax system should be reflected in the 1C 8.3 Accounting program.

Support and assistance

Receive articles by email

To automate the creation of a reserve, you should set up an accounting policy.

Let's go to "Main" - "Accounting Policies".

Rice. 1. “Main” tab

Let's check the box for the formation of reserves. The program will track “delays” in accounting, using the interval method prescribed in the Tax Code. Don't forget to save the changes. Such innovations should be introduced only from the beginning of the year.

Rice. 2. Accounting policies

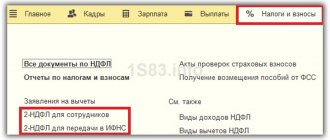

Next, let’s go to the “Main” section - “Taxes and reports”.

Rice. 3. Taxes and reports

In the “Income Tax” section, we confirm with a tick our decision to create a reserve in tax accounting. Here we will also use the interval method, but within the limit.

Rice. 4. Confirmation of the decision to create a reserve

Next, it is necessary to specify the criteria for the insolvency of debtors. To do this, in the “Administration” section, select “Accounting Settings”.

Rice. 5. Accounting parameters

Click on the hyperlink “Payment terms for buyers”.

Rice. 6. Terms of payment by buyers through the “Administration” section

Similar settings can be made in the “Sales” section. The user can independently choose the path to the document for configuration that is convenient for him.

Rice. 7. Terms of payment by buyers through the “Sales” section

We set the number of days after which the debt will be overdue and a report will be made to recognize it as doubtful. In our example, we will enter 10 days.

Rice. 8. Setting the deadline for payment of debt by buyers

But if for any of the counterparties the payment term differs from the main one established by us earlier, then it is necessary to specify an individual term in the contract.

In the “Directories” section, select “Contracts” and double-click the mouse to “fail” into the counterparty we need.

Rice. 9. Contracts

We go to the “Calculations” subsection, here we are interested in the “Payment Deadline” item.

It is important to remember that if the organization has security for the debt or confidence that it will be paid, then you can specify a period, for example, 555 days. In this case, the reserve will not be accrued during this period.

Rice. 10. Setting an individual payment term from the counterparty

The setup is complete. Now let's see how the reservation occurs.

Let’s use the report for the manager “Buyers’ debt by debt terms.”

Rice. 11. Report “Buyers’ debt by debt terms”

As of February 28, the debt was overdue. Note that Buyer B’s debt was not reflected as overdue, since according to the agreement the payment deadline was set at 03/01/2021. Buyer A is subject to a general setting of 10 days.

Columns with “overdue” intervals do not take into account program settings and report from the moment of shipment.

It is worth noting the fact that the organization presented in this example belongs to small businesses and does not apply PBU 18/02.

So, as of February 28, 2021, we identified an overdue debt. Let us remind you that if the debt period is more than 45 days, then we create a reserve. We set the payment period to 10 days, add 45, it turns out that on the 55th day there will be a need to create a reserve.

Rice. 12. Debt of the counterparty

The reserve is created automatically by the “Month Closing” operation.

Rice. 13. Creation of a reserve

Let's close February and look at the transactions generated by the program.

Rice. 14. View generated transactions

We see that the program has created a reserve. Note that the reserve is formed by 50% of the amount in accounting and 10% of revenue in tax accounting. Further, if revenue increases, the tax accounting amount will be automatically adjusted.

Rice. 15. View the generated reserve

Next, let's move on to the closure of April (in March, the program did not accrue reserves - the debt period was less than 90 days).

Let’s open the “References and calculations” tab and go to the “Reserves for doubtful debts” tab.

Rice. 16. Tab “References-calculations”

Please note that in this document, data on accounting and tax accounting are generated separately. If you generate a document with data on two types of accounting at once, the report will turn out to be quite cumbersome and difficult for novice accountants to read. Therefore, for clarity, we will generate our own report for each type of accounting.

Rice. 17. Report for each type of accounting

In the accounting certificate we see that a reserve has been created in full for the debt of buyer A, because the period exceeded 90 days. For buyer B, the program also accrued a reserve, but in the amount of 50%.

Rice. 18. Help for buyers

We remember about the limit in tax accounting. The program calculates this indicator independently.

Rice. 19. Automatic limit calculation

Let's create a balance sheet for account 63. In the settings, check the boxes: BU, NU.

Rice. 20. Balance sheet for account 63

The program's reserves are formed correctly.

Rice. 21. Formed reserves

Let's see how the work done is reflected in the reporting.

Go to “Reports” - “Regulated reports”.

Rice. 22. Regulated reports

We create simplified financial statements, since the organization presented in the example is a small enterprise.

We see that the reserve reduced accounts receivable and was reflected in the line “Financial and other current assets”.

Rice. 23. Simplified accounting statements

Having decrypted this string, we can analyze the recordings made by the program.

Rice. 24. Analysis of records made by the program

In the following report, the reserve is reflected in the item “Other expenses”.

Rice. 25. Reflection of the reserve in the item “Other expenses”

Decoding the line confirms the correct reflection of accounting data in the reporting.

Rice. 26. Checking the reflection of accounting data in reporting

In the declaration for personal income, the reserve is shown in line 200 of Appendix 2 of Sheet 02.

Rice. 27. Declaration on NNP

We decipher the line by clicking on the appropriate button.

Rice. 28. Decoding the string

If the debtor repays partially or fully the debt for which a reserve was created in the organization, then the accountant on the date of receipt of payment from the counterparty should restore that part of the reserve that relates to this debt. The instructions show the steps required for this in the 1C program.

How to restore the reserve for doubtful debts in the 1C program?