With foreign buyers and suppliers, settlements most often occur in foreign currency. A regular current account is not suitable for this, but a foreign currency account is used. Today we will tell you about working with foreign currency accounts from the tax side.

When you contact a bank to open a foreign currency account, the bank always opens a transit foreign currency account for it. Thus, it turns out that you have two foreign currency accounts - transit and current. Initially, all proceeds in foreign currency will go to the transit account; it is intended for the bank to carry out currency control. After which, income from the transit account is transferred to the current foreign exchange account or the currency is sold.

Expenses in foreign currency should be treated more carefully

According to the general rules, expenses for calculating tax are written off on the last date:

- date of payment to the supplier;

- date of receipt of specific goods/materials or works/services from the supplier;

- the date of shipment of the goods to the final buyer, if goods were purchased for resale.

If you paid for the order to a foreign counterparty in foreign currency, then in order to account for the expense in the simplified tax system, the amount must be converted into rubles at the Bank of Russia exchange rate established on one of these dates.

For example, if you ordered software development abroad, then the amount of expenses in foreign currency must be recalculated into rubles at the exchange rate of the Central Bank of the Russian Federation on the date of payment or on the date of signing the act - depending on which was later.

If you purchased goods abroad, then the costs must be converted into rubles on the later of the dates - the date of payment or the date of sale.

Expenses for the purchase of fixed assets are written off according to special rules: in equal quarterly installments for one year and are taken into account on the last day of the quarter. If you purchased a fixed asset from a foreign supplier, then this expense must be written off quarterly and recalculated into rubles at the exchange rate of the Central Bank of the Russian Federation established for the last day of the quarter.

Submit reports in three clicks

Elba is suitable for individual entrepreneurs and LLCs. The service will prepare a tax return, calculate the tax and reduce it by insurance premiums.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Exchange differences and simplified system

All businesses face foreign exchange transactions in one way or another. Someone buys foreign currency to pay a foreign partner, someone receives it by exporting goods, someone opens a foreign currency bank account. And since income and expenses are accounted for in rubles at the rate of the Central Bank of the Russian Federation, which is constantly changing, differences arise. Now we’ll find out what to do with them.

We have already repeatedly discussed in the magazine the accounting of exchange rate differences. The topic is complex and always raises questions. We will try to help readers again. What differences are reflected by “simplified”

Let us highlight the main thing: exchange rate differences are relevant only to currency payments. If the contract includes a currency, and payment is made in rubles, not exchange rate differences, but amount differences are formed. According to paragraph 3 of Article 346.17 of the Tax Code of the Russian Federation, they are not taken into account when “simplified”.

What is taken into account?

Income. In accordance with Article 346.15 of the Tax Code of the Russian Federation, the tax base includes income from sales and non-operating income, which are named in Articles 249 and 250 of the Tax Code of the Russian Federation. Not reflected - those specified in Article 251 of the Tax Code of the Russian Federation. In paragraph 2 of Article 250 of the Tax Code of the Russian Federation, non-operating income is classified as non-operating income in the form of positive or negative exchange rate differences arising due to deviation of the rate of sale or purchase of currency from that established by the Central Bank of the Russian Federation, and in its paragraph 11 it is added that non-operating income is positive exchange rate differences received when revaluing property (except for securities) and claims denominated in foreign currency. We are talking about a procedure carried out due to a change in the official exchange rate established by the Central Bank of the Russian Federation. Thus, there are two cases when exchange rate differences are included in income under the simplified system.

Expenses. Let's look at the list of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. Subclause 34 identifies expenses caused by negative exchange rate differences. Here, too, we mean the exchange rate difference that arises when revaluing property and claims, the value of which is expressed in foreign currency, if the revaluation is due to a change in the exchange rate of the Central Bank of the Russian Federation. Please note that exchange rate differences associated with the sale or purchase of currency at a rate higher or lower than the Central Bank of the Russian Federation are not taken into account in expenses under the simplified system.

So, income is included in the tax base when exchange rate differences are formed of two types, expenses - one. Well, this once again shows how unfair the legislation is to “simplistic” people.

Readers are probably interested in knowing what will happen if exchange rate differences are not included in income. It seemed, as in any case of identifying unaccounted income, tax authorities have the right to resort to sanctions under Article 122 of the Tax Code of the Russian Federation, provided for incomplete payment of tax. Nevertheless, let's think about it. How can “simplified people” determine income in the form of exchange rate differences? After all, they are not required to keep accounting records in full (clause 3 of article 4 of the Federal Law of November 21, 1996 No. 129-FZ). It is enough to take into account fixed assets and intangible assets. But this does not require any revaluation of currency values and liabilities. There are also no regulations in this regard in Chapter 26.2 of the Tax Code of the Russian Federation. In their explanations, tax officials recommend following the procedure contained in paragraph 8 of Article 271 of the Tax Code of the Russian Federation (see, for example, letter of the Federal Tax Service of Russia for Moscow dated April 23, 2007 No. 18-11/3/ [email protected] ). However, it is addressed to income tax payers, and those using the accrual method. And for “simplified” people, the income accounting method can only be cash (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). There are also no references to Article 271 in Chapter 26.2 of the Tax Code of the Russian Federation. So the exchange rate difference is supposed to be taken into account, but how to identify it is not indicated anywhere. Of course, this is a clear miscalculation in the legislation, and in such cases the law is always interpreted in favor of taxpayers (Clause 7, Article 3 of the Tax Code of the Russian Federation). Therefore, tax authorities have no right to punish those who use the simplified system for exchange rate differences not taken into account in income under Article 122 of the Tax Code of the Russian Federation. If they do agree to this, we recommend going to court. In this matter, the courts usually side with taxpayers.

For those who are ready to recognize exchange rate differences, we invite you to look with us at when to track them.

See, for example, resolutions of the Federal Antimonopoly Service of the Volga-Vyatka District dated 02.02.2006 No. A29-4905/2005a and the Federal Antimonopoly Service of the Northwestern District dated 07.13.2005 No. A21-3645/04-C1

Availability of currency values

Let's say you apply a simplified taxation system and have a foreign currency account in a bank. To understand whether exchange rate differences have arisen or not, a revaluation is needed, as the Tax Code indicates.

Question one: how often to do it? The exchange rate set by the Central Bank of the Russian Federation changes almost daily. Does this mean constantly making entries in the Income and Expense Book? This is possible, but, fortunately, it is not necessary. “Simplers” determine the tax base and tax not every day, but for the reporting (tax) period. Therefore, a revaluation of property with a value in foreign currency carried out on the last day of the reporting or tax period is sufficient. Official bodies advise the same. True, in the letter of the Ministry of Finance of Russia dated October 5, 2007 No. 03-11-04/2/248, it is recommended to reflect positive exchange rate differences as education progresses. But if the “simplifier” does this at the end of the reporting (tax) period, there will be no violation.

See, for example, letters from the Ministry of Finance of Russia dated 05/06/2008 No. 03-11-04/2/81 and the Federal Tax Service of Russia for Moscow dated 01/25/2008 No. 18-11/3/ [email protected]

When reflecting transactions with property, the value of which is determined in foreign currency (for example, when moving on a foreign currency account), a revaluation of balances is also required. As a result of its implementation, income or expenses in the form of exchange rate differences must be taken into account.

Question two: how to perform a revaluation? It’s easier for “simplified” people who keep full accounting records - they act in accordance with PBU 3/2006 (approved by order of the Ministry of Finance of Russia dated November 27, 2006 No. 154n). By the way, in accordance with paragraph 3 of PBU 3/2006, exchange rate refers to the difference between the ruble estimates of an asset (liability), the value of which is expressed in foreign currency, on the date of payment or the current report and, accordingly, on the date of inclusion in accounting records in the reporting period or the previous report . It also follows from this definition that revaluation must be carried out on the last day of each reporting period. How exactly? Compare bank balances with those formed on account 52 “Currency account”. If the latter are less, accrue a positive exchange rate difference, if more, a negative one. Exchange differences are charged to financial results and included in other income or expenses. The resulting differences can be transferred to the Income and Expense Accounting Book.

On a note.

Targeted revenues in foreign currency and their revaluation Targeted revenues received by non-profit organizations for maintenance and statutory activities, in accordance with paragraph 2 of Article 251 and Article 346.15 of the Tax Code of the Russian Federation, under the simplified system, are not included in the tax base. However, if it is a foreign currency, then the positive exchange rate differences identified during the revaluation will have to be taken into account as non-operating income on the basis of paragraph 11 of Article 250 of the Tax Code of the Russian Federation, since there are no longer any reservations in it. The same is stated in the letter of the Ministry of Finance of Russia dated October 5, 2007 No. 03-11-04/2/249

Example 1

CJSC Velton applies the simplified tax system with the object of taxation being income minus expenses and keeps accounting records in full. The organization has two foreign currency accounts - in dollars and euros. As of June 30, 2008, bank balances amounted to $10,780 and €22,500, and account 52 contained RUB 253,498.17. (subaccount 1 “Account in dollars”) and 834,021 rubles. (sub-account 2 “Euro account”). The exchange rates of the Central Bank of the Russian Federation on this day were equal to 23.3534 rubles/dollars. and 37.1516 rubles/euro (conditional figures).

We will calculate and reflect exchange rate differences in accounting and tax accounting.

Let's determine what balances should be on the subaccounts of account 52 by June 30, 2008. On subaccount 52-1 - 251,749.65 rubles. ($10,780 # #23.3534 rub.), on subaccount 52-2 - 835,911 rub. (22,500 euros # #37.1516 rubles). Both do not match those shown on the bank statements, so exchange rate differences must be calculated. In subaccount 52-1 we will reflect the negative difference amounting to 1748.52 rubles. (RUB 253,498.17 - RUB 251,749.65), on subaccount 52-2 - a positive difference in the amount of RUB 1,890. (RUB 835,911 – – RUB 834,021).

Accounting entries are shown in table. 1.

We will enter the found exchange rate differences into tax accounting. It is given in table. 2.

Table 1. Accounting entries of CJSC Velton related to the accrual of exchange rate differences for the second quarter of 2008

| No. | Contents of operation | date | Debit | Credit | Amount, rub. | Document |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | Negative exchange rate difference accrued on dollar account | 30.06.2008 | 91-2 | 52-1 | 1748,52 | Accounting information |

| 2 | A positive exchange rate difference has been accrued on the account in euros | 30.06.2008 | 52-2 | 91-1 | 1890 | Accounting information |

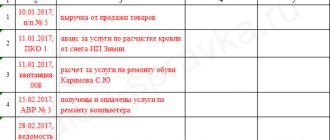

Table 2. Fragment of filling out the Income and Expense Book of CJSC Velton for the second quarter of 2008

| No. | Expenses taken into account when calculating the tax base | Income taken into account when calculating the tax base | Date and number of the primary document | Contents of operation |

| 1 | 2 | 3 | 4 | 5 |

| … | … | … | … | … |

| 138 | Accounting certificate No. 51 dated 06/30/2008 | Negative exchange rate difference on the foreign currency account in dollars is reflected | — | 1748,51 |

| 139 | Accounting certificate No. 51 dated 06/30/2008 | A positive exchange rate difference is reflected in the currency account in euros | 1890 | — |

| … | … | … | … | … |

It is clear when calculating exchange rate differences when accounting is carried out in full.

And when he is not there? If during the quarter there was a movement of funds in foreign currency accounts, it is difficult to understand at the end of the quarter the rates on the days of receipt or withdrawal of amounts. Therefore, we recommend creating special registers for recording transactions on foreign currency accounts (an option is suggested in the figure on p. 16). …liabilities in foreign currency

The rules for accounting for debts and property denominated in foreign currency are the same. Let us clarify just a few points.

Let's say an organization takes out a foreign currency loan or loan. When to reassess? Firstly, quarterly until full settlement with the creditor (lender). Secondly, when paying off debt. Should interest be revalued? It all depends on when to pay them. If, as usual, on the day of accrual there will be no exchange rate differences at all, if later, then the exchange rate may change and revaluation will not be necessary.

Example 2

Trezor LLC applies the simplified tax system and maintains accounting records in full. On May 19, 2008, a foreign currency loan was taken out in the amount of 18,000 euros for a period of 2 months at 12% per annum. According to the loan agreement, interest is accrued and must be paid in foreign currency on the 19th month.

On June 19, the company paid interest for 31 days of using the loan, amounting to 183.45 euros (18,000 euros #12% : 365 days # #31 days), and on July 19 - for the remaining 30 days in the amount of 177.53 euros (18,000 euro#12% : 365 days#30 days), and also calculated the principal debt.

The exchange rate of the Central Bank of the Russian Federation was as follows: May 19 - 36.7823 rubles/euro, June 19 - 36.8411 rubles/euro; June 30 - 37.0115 rubles/euro, July 19 - 36.9715 rubles/euro (values are arbitrary).

We will reflect transactions related to the loan in the accounting and tax records of the company.

Revaluation of debt must be carried out on the last day of the reporting period and on the days of foreign exchange transactions. In this case, it is June 30 (end of the second quarter) and July 19 (loan repayment day). Interest was paid on the accrual days, so there will be no exchange rate differences.

The organization's accounting is presented in table. 3 on p. 17.

A loan received is not reflected in taxable income (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation), as is a loan returned in expenses. Exchange rate differences and interest remain. On June 30, 2008, the company has the right to attribute to expenses a negative exchange rate difference equal to 4,125.60 rubles. and arising from the revaluation of the debt, and on the day the loan is repaid, a positive one should be included in the tax base - 720.00 rubles. Interest paid for the use of borrowed funds under the simplified system can be recognized as expenses (subclause 9, clause 1, Article 346.16 of the Tax Code of the Russian Federation), but taking into account the established standards (Article 269 of the Tax Code of the Russian Federation).

Expenses take into account interest paid on debt obligations, accrued at a rate not exceeding by more than 20% the average rate on debt obligations issued on comparable terms. If there were no such obligations in the past quarter, interest on obligations in foreign currency is reflected in amounts not exceeding those calculated based on 15% per annum. We do not have information about other loans in foreign currency, so we will assume that the organization did not receive them. Consequently, the interest paid for using the loan can be taken into account within 15%. For a loan taken, the rate is lower (12%), which means that we will include the entire amount transferred for interest in the tax base. Tax accounting of Trezor LLC is shown in table. 4.

The link to Article 269 is in paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation

Table 3. Accounting entries of Trezor LLC related to a foreign currency loan

| No. | Contents of operation | date | Debit | Credit | Amount, rub. | Document |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | Credit credited to bank account | 19.05.2008 | 52 | 66 | 662 081,4 (18,000 euros x 36.7823 rubles/euro) | Bank statement |

| 2 | Interest accrued for using the loan | 19.06.2008 | 91-2 | 66 | 6758,5 (183.45 euros x 36.8411 rubles/euro) | Accounting information |

| 3 | Interest paid for using the loan | 19.06.2008 | 66 | 52 | 6758,5 | Payment order |

| 4 | Negative exchange rate differences on liabilities are reflected | 30.06.2008 | 91-2 | 66 | 4125,6 (18,000 euros x 37.0115 rubles/euro – 662,081.4 rubles) | Accounting information |

| 5 | Interest accrued for using the loan | 19.07.2008 | 91-2 | 66 | 6563,55 (177.53 euros x 36.9715 rubles/euro) | Accounting information |

| 6 | Interest paid for using the loan | 19.07.2008 | 66 | 52 | 6563,55 | Payment order |

| 7 | Principal debt returned | 19.07.2008 | 66 | 52 | 665 487 (18,000 euros x 36.9715 rubles/euro) | Payment order |

| 8 | Positive exchange rate differences on liabilities are reflected | 19.07.2008 | 66 | 91-1 | 720 [(37.0115 rub./euro – 36.9715 rub./euro) x 18,000 euro] | Accounting information |

Table 4. Fragment of filling out the Income and Expense Book of Trezor LLC

| № p/p | Date and number of the primary document | Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base |

| 1 | 2 | 3 | 4 | 5 |

| … | … | … | … | … |

| 214 | Payment order No. 191 dated June 19, 2008 | Interest paid for using the loan | — | 6758,5 |

| … | … | … | … | … |

| 238 | Accounting certificate No. 12 dated June 30, 2008 | Negative exchange rate difference on the obligation is reflected | — | 4125,6 |

| … | … | … | … | … |

| 281 | Payment order No. 228 dated July 19, 2008 | Interest paid for using the loan | — | 6563,55 |

| 282 | Accounting certificate No. 18 dated July 19, 2008 | Positive exchange rate difference on the obligation is reflected | 720 | — |

| … | … | … | … | … |

...foreign exchange earnings

For those who receive earnings in foreign currency, there are two types of exchange rate differences.

1. From the sale of currency. Let us recall that the tax base under the simplified system includes only positive differences associated with the purchase and sale of currency at a rate that does not coincide with the rate of the Central Bank of the Russian Federation (clause 2 of Article 250 of the Tax Code of the Russian Federation). An unexpected opinion was expressed in a letter from the Ministry of Finance of Russia dated 06/07/2007 No. 03-11-04/2/162. Since income expressed in foreign currency is accounted for in rubles at the exchange rate of the Central Bank of the Russian Federation on the day the money is credited to the bank account, neither income nor expenses in the form of exchange rate differences are generated when selling currency. Obviously, this meant the absence of exchange rate differences from revaluation, since it itself does not occur. Of course, there will be non-operating income when selling currency at a rate higher than the Central Bank of the Russian Federation (other explanations from the same Ministry of Finance and tax authorities confirm this). If the currency is sold at a rate lower than that established by the Central Bank of the Russian Federation, there will be non-operating expenses, but, unfortunately, only income tax payers have the right to take them into account. In the list of costs attributed by the “simplified people” to expenses, negative exchange rate differences from the purchase and sale of currency at their exchange rate are not indicated. By the way, commissions charged by banks for the sale of currency on behalf of a client under a simplified system can be recognized as expenses on the basis of subclause 9 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation.

2. From currency revaluation. If the “simplified” people do not want to immediately sell foreign currency earnings, their income and expenses are taken into account like all owners of foreign currency accounts. Revaluation is carried out on the last day of the reporting (tax) period and for transactions on a foreign currency account, reflecting positive or negative exchange rate differences in the tax base in accordance with paragraph 11 of Article 250 or subparagraph 34 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

See, for example, letters from the Ministry of Finance of Russia dated 10/05/2007 No. 03-11-04/2/249 and the Federal Tax Service of Russia for Moscow dated 10/06/2006 No. 18-12/3/ [email protected] and dated 06/07/2006 No. 18-11/3/ [email protected]

Example 3

Rox LLC applies the simplified tax system with the object of taxation being income minus expenses and maintains accounting records in full. On June 25, 2008, the company received 15,000 euros as an advance from a foreign buyer. On July 1, 5,000 euros were sold through the bank at the rate of 36.96 rubles/euro and, after deducting a commission equal to 2,300 rubles, 184,800 rubles were credited to the current account. Let's assume that the exchange rate of the Central Bank of the Russian Federation on June 25 was 36.9811 rubles/euro, on June 30 - 36.8692 rubles/euro, on July 1 - 37.0123 rubles/euro.

We will show transactions related to currency in the accounting and tax accounting of the company.

First of all, it is necessary to revaluate the currency at the end of the reporting period, since the euro exchange rate was not constant. The fall in the exchange rate of the Central Bank of the Russian Federation by June 30 led to a negative exchange rate difference, which amounted to 1,678.5 rubles. [15,000 euros#(36.9811 rubles – – 36.8692 rubles)]. It should be reflected in both accounting and tax accounting (subclause 34, clause 1, article 346.16 of the Tax Code of the Russian Federation).

The company sold the currency on July 1 at a reduced rate, which again resulted in a negative exchange rate difference. However, it will be reflected only in accounting - in paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation there is no such type of expense. But the commission paid to the bank can be taken into account both in accounting and for tax purposes.

In addition, we will re-evaluate and calculate the exchange rate difference from the sale of currency. By July 1, the euro exchange rate of the Central Bank of the Russian Federation increased, and the revaluation will give a positive exchange rate difference of 2146.5 rubles. [15,000 euros#(37.0123 rubles – 36.8692 rubles)]. It must be included in tax accounting as non-operating income, and in accounting as other income. Accounting entries are presented in table. 5, Book of expenses and income - in table. 6.

Table 5. Accounting entries of Rox LLC related to foreign exchange transactions

| No. | Contents of operation | date | Debit | Credit | Amount, rub. | Document |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 | An advance in foreign currency was received into the account | 25.06.2008 | 52 | 62-2 | 554,716.5 (15,000 euros x 36.9811 rubles/euro) | Bank statement |

| 2 | The negative exchange rate difference identified during revaluation is reflected | 30.06.2008 | 91-2 | 52 | 1678,5 | Accounting information |

| 3 | Currency transferred to the bank for sale | 01.07.2008 | 57 | 52 | 185,061.5 (5000 euros x 37.0123 rubles/euro) | Order to sell currency |

| 4 | Positive exchange rate difference reflected | 01.07.2008 | 52 | 91-1 | 2146,5 | Accounting information |

| 5 | Money from the sale of currency is credited to the current account | 01.07.2008 | 51 | 91-1 | 184,800 (5000 euros x 36.96 rubles/euro) | Accounting information |

| 6 | The sale of currency is reflected | 01.07.200 | 91-2 | 57 | 185 061,5 | Accounting information |

| 7 | Bank commission withheld | 8 | 91-2 | 51 | 2300 | Memorial Order |

| 8 | Negative exchange rate difference from currency sales is reflected | 01.07.2008 01.07.2008 | 99 | 91-9 | 261,5 (RUB 185,061.5 – – 184,800 rub.) | Accounting information |

Table 6. Fragment of filling out the Income and Expense Book of Roks LLC

| № p/p | Date and number of the primary document | Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base |

| 1 | 2 | 3 | 4 | 5 |

| … | … | … | … | … |

| 189 | Extract from foreign exchange account No. 293 from 06/25/2008 | Advance received in foreign currency | 554 716,5 | — |

| … | … | … | … | … |

| 206 | Accounting certificate No. 34 dated June 30, 2008 | Reflected negative exchange rate difference on a foreign currency account | — | 1678,5 |

| … | … | … | … | … |

| 234 | Accounting information | Reflected positive | 2146,5 | — |

| 235 | No. 35 dated 07/01/2008 Memorial Order No. 2236 from 07/01/2008 | exchange rate difference on a foreign currency account Bank commission withheld | — | 2300 |

| … | … | … | … | … |

…purchased currency

How to reflect the purchase of currency in tax accounting was discussed quite recently, so let’s note the most important things.

Expenses for purchasing foreign currency at a rate higher than that established by the Central Bank of the Russian Federation are not taken into account under the simplified system. Well, if you are lucky enough to purchase currency at a lower rate, do not rush to rejoice either - the positive difference will have to be attributed to non-operating income (clause 2 of Article 250 of the Tax Code of the Russian Federation). The only thing is that in both cases it is allowed to recognize a bank commission as an expense (subclause 9, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Revaluation, if the currency is not spent on the day it was purchased, is carried out according to the general rules: on the last day of the quarter and on the day when there were movements on the foreign exchange account.