Supporting documents for the advance report

A company employee becomes an accountable person when he receives money from the cash register to carry out official assignments. The most common types of errands are going on a business trip or purchasing some items for the office. Regardless of what expenses the employee incurred - travel expenses (travel to and from the destination, accommodation, meals), general business expenses, etc., he is obliged to confirm this by providing an advance report with all the necessary documents to the company’s accounting department.

Documents for the expense report must contain basic details (date, registration number, etc.), as well as information about expenses for goods or services. In addition to the popular cash receipt, the following can also be used as supporting documents:

- Strict reporting form (SRF) - it can be a plane or train ticket, a boarding pass, a subscription to attend courses or trainings, etc.

- Receipt cash order (PKO) - it is filled out by an accountant or the head of the company.

- A sales receipt - unlike a cash receipt, it is filled out by the seller (by hand or electronically); it is also not a fiscal document - it is not always issued by an officially registered cash register.

Note that the disadvantage of all paper documents is the quality of their printing and the possibility of loss. However, today digitalization is doing a great job of combating all this, both of the documents themselves (read about the innovations from July 1, 2021 in the material Report from July 1, 2019) and the format for preparing the advance report.

For example, in the Hamilton Expense Report application, an employee can fill out an expense report online in a couple of minutes from any mobile device, attaching a photo of all paper checks or their electronic versions. The manager confirms the electronic advance report in one click, endorsing it with an electronic digital signature. All expense postings are generated automatically - the accountant will only have to make payments to the employee when necessary.

In what cases is it permissible to issue an advance report without a cash receipt?

A document confirming payment for goods, works and services actually received must contain a number of mandatory elements: number and date of issue, information about the organization, content of the business transaction.

Such primary accounting documents confirming the fact of the calculation include:

- sales receipt;

- cash receipt order (hereinafter referred to as PKO);

- strict reporting form (hereinafter referred to as SSR).

Let's consider the reflection of each of these supporting documents when filling out an advance report without a cash receipt .

In accordance with the provisions of Art. 2 of the Law “On the use of cash register systems when making cash payments and (or) settlements using payment cards” dated May 22, 2003 No. 54-FZ, individual entrepreneurs or organizations whose activities fall under UTII or a patent (for individual entrepreneurs) have the right not to use cash registers, and issue sales receipts to your customers instead of cash registers. Consequently, a sales receipt issued by the accounting department of such a business entity is considered a primary document suitable for confirming expenses for accounting and tax purposes.

Let us note that the norms of Russian legislation have not approved any mandatory form of “tovarnik”. However, the mandatory details that must be filled in when issuing a sales receipt include:

- date of preparation and document number;

- name of the organization or full name of the individual entrepreneur who issued the check;

- individual tax number of an organization or individual entrepreneur;

- the name of the paid goods, works, services, their price and quantity;

- total amount of the check in rubles;

- position, initials and signature of the accounting employee who prepared the document.

In cases where the seller does not have the opportunity to draw up a correct cash receipt order or strict reporting form (we will talk about the features of these documents in the following sections), the seller can be asked to issue a sales receipt. Let us note this peculiarity: the “tovarnik” is issued precisely at the request of the buyer, because in principle its issuance is not the responsibility of the seller.

If the sales receipt is drawn up correctly, it can be attached to the advance report as a document confirming the fact of payment for the relevant goods (work, service). The accounting department is obliged to accept and post an advance report with a sales receipt without a cash receipt .

Advance report without receipt

The laws regulating the procedure for drawing up reports on advance funds do not contain information that cash receipts must be attached to this document. But in the official form (form AO-1) there are cells in which it is necessary to record information about receipts and other documents confirming expenses. In these cells you must enter their number and date, and also decipher the contents of the costs, indicating the total amount.

It follows from this that accounting can conduct an advance report without checks only when one of the alternative supporting documents is attached to it. Why is that?

First, supporting documents are strictly necessary for accounting purposes.

Secondly, the company can accept reporting funds issued to an employee for professional expenses to reduce the tax base - in order to reduce the amount of payments, it is necessary to provide the tax authority with a list of documents established by law that indicate the expenses incurred by the employee.

Thirdly, the employee will need these documents to confirm to the employer the fact of expenses for completing an official task or purchasing goods for the needs of the company.

Let's consider options for preparing expense reports without checks, but using other supporting documents.

How to properly prepare an advance report? Sample and rules

An employee of an organization can go out to purchase the necessary goods (works, services) at his own expense. In this case, there is no need to fill out an advance report. How to correctly complete the above steps?

We recommend reading: Benefits for labor veterans aged 80 in the Sverdlovsk region in 2021

A business trip is a trip by an employee to perform his job duties outside the company's location. It never comes without expenses that are subject to compensation to the employee in accordance with current legislation.

BSO instead of a check

You can supplement the advance report with an air or train ticket, food voucher and other types of strict reporting forms. The peculiarity of the BSO is that it is drawn up only when services are provided—the form is not provided when selling goods.

The only condition for using a strict reporting form in an advance report without a check is that the attached document must fully comply with the requirements of paragraph 3 of Resolution No. 359 of May 6, 2008, namely contain the following details:

- name (for example, “Passenger ticket”, “Baggage receipt”, etc.);

- series and number;

- name of the organization providing the service, its legal address and Taxpayer Identification Number;

- decoding of the service provided;

- date of payment for the service;

- Full name, position, signature of the representative of the organization;

- seal, if available.

The legally established form of this document includes two sections: main and detachable. After filling out, the employee receives a tear-off part, which he attaches to the expense report without sales and cash receipts, and on the basis of which he fills in the corresponding columns in it. If the BSO spine is not detachable, for example, in a transport ticket, then both parts of the form are attached to the report.

The accountable person must ensure that the rules for filling out the strict reporting form are followed and that the required details are present in it, because only a correctly completed BSO is a full-fledged replacement for a cash receipt.

What details should be in checks and BSO brought by the accountant from July 1

- name of the buyer/client;

- INN of the buyer/client;

- information about the country of origin of the goods - when making payments for the goods;

- excise tax amount – when selling excisable goods;

- registration number of the customs declaration - when making payments for goods imported by the seller from outside the Russian Federation (Federal Law of July 3, 2021 No. 192-FZ “On Amendments to Certain Legislative Acts of the Russian Federation”).

From July 1, 2021, a cash receipt or a strict reporting form generated when making payments using cash or bank cards must contain new details in addition to the previous ones (Clause 1, Article 4.7 of the Federal Law of May 22, 2021 No. 54-FZ “On the use of cash register equipment when making payments in the Russian Federation”):

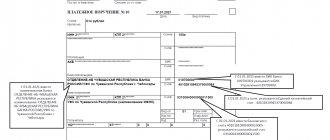

PKO instead of a check

A cash receipt order records the receipt of funds into the company's cash desk. This document also consists of two parts - the main and detachable ones, and, by analogy with the BSO, is needed by an employee when submitting an expense report.

Unlike the BSO, this document is used not only when providing services, but also when recording the sale and purchase transaction of various goods.

Requirements for PKO for reporting:

- basic details: number, date, name of organization, etc.;

- seal of the company that sold the product or provided the service;

- the amount of a product or service in numerical format with an explanation in words.

Before attaching a cash receipt order to an advance report, you must ensure that the details are available and that it complies with the KO-1 form established by the State Statistics Committee.

***

To summarize, let's say that a cash receipt is not the only document that an employee can attach to an expense report in order to report on funds issued for business expenses. The function of a cash receipt can also be performed by a sales receipt, a receipt stub of a cash receipt order or a BSO stub.

Similar articles

- How to check the authenticity of a cash receipt?

- Do I need a cash receipt for the tax office?

- Fine for failure to issue a cash receipt in 2017

- Where is the cash receipt number?

- Cashier's check when paying by credit card

Sales receipt instead of cash receipt

Individual entrepreneurs, as well as enterprises using UTII (Unified Tax on Imputed Income), have the right to use sales receipts.

The legislation does not establish a strict form for its execution - it must contain the number, date, name of the selling company or full name of the entrepreneur, as well as a listing of goods or services with quantity, cost and total amount.

Unstamped sales receipts can be attached to the advance report only if they contain all the listed details.

Check yourself: what mandatory details should be on a cash receipt from 2021

- Name of the organization.

- Address of the retail outlet.

- Name and serial number of the document for the shift, type of operation (receipt, return of receipt, expense, return of expense).

- Full name and position of the employee making the purchase.

- List of goods, works, services.

- Unit price including discounts and total purchase amount.

- Rate and allocated amount of VAT per unit and total cost (if applicable).

- Type of payment (cash or non-cash) and payment amount.

- A site where you can check the authenticity of a document and the fiscal indicator (QR code) specified in it.

- Cash register data (registration number of the cash register, serial number of the fiscal drive, fiscal sign of the document - QR code).

- Serial number of the fiscal document.

- TIN of the organization or individual entrepreneur.

- Seller taxation system.

- Shift number.

- Date and time of the operation; fiscal sign of the message (if the information is stored in a fiscal storage device or transmitted by the OFD).

In some cases, specifically provided for in paragraph 7 of Art. 7 Federal Law N 290-FZ (which introduces changes to online cash registers in 54-FZ), sellers after July 1, 2021 may not use a cash register and issue only a sales receipt.

Mandatory details of cash receipt and BSO in 2021

Let us note that at the moment there is a draft resolution of the Government of the Russian Federation, according to which the deadline for mandatory labeling in terms of withdrawal from circulation should be shifted to July 1, and the acceptance of UTD to a later date.

As for sellers who do not pay VAT, they may not indicate the tax rate and amount on the cash receipt. In this case, they can issue one of two documents: an electronic cash receipt, without indicating the name of the VAT rate (tag 1199) “VAT not subject to”; cash receipt in printed form with the value “-” or “VAT not subject to.” But the details “settlement amount for the check without VAT” will have to be indicated in any case. Since it is mandatory for all cash register receipts and BSO (clause 4 of the notes to Table 20 of Appendix No. 2 to the order of the Federal Tax Service of Russia dated March 21, 2021 No. ММВ-7-20 / [email protected] ).