In our country, it has developed according to business rules that an invoice is a document on the basis of which a company pays suppliers for materials, goods, work or services.

Often managers do not allow payments to be made without an invoice. In some accounting departments, having an original invoice with live signatures and a stamp for each payment is a matter of honor. Invoices are filed in chronological order in separate folders or attached to the executed payment order and bank statement.

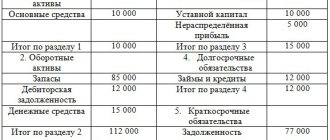

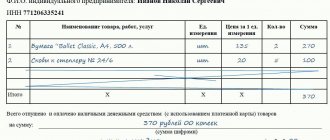

Example of an invoice for payment

Unpaid invoices are stored in a separate folder; those that are endorsed by the manager with the note “pay” are paid by the accountant. Something like this is how organizations usually handle invoices for payment, but are they needed at all and what does the law say?

How to issue an invoice for payment: sample and general information about the issue

The main part of commodity-money transactions in our time is formalized through an agreement or invoice. But these documents themselves do not constitute payment obligations.

It turns out that if you don’t know how to properly open an account, conducting a transaction in our time is extremely problematic.

At the same time, we note that in our time such papers are not so much a document as evidence of an electronic agreement, since all currency transactions (including purchase and sale) are one way or another recorded by the fiscal authorities.

Yes, there are all sorts of gray schemes and even a black market, but we will remain within the legal framework.

Essentially, the invoice only notifies one of the parties that payment is due.

After the payment is made, the invoice turns into a check - the endorsed document confirms payment obligations. If something happens, you can then go to court about this.

An important point: issuing an invoice is not a mandatory step from the point of view of legislation, therefore the state does not regulate its format, procedure for drawing up and content. All this is regulated by the business itself. For this reason, the classic version of this paper looks quite simple.

Before you issue an invoice, you need to make sure that the following information is included:

- Bank details of the service/goods provider (and full details - this is important for correct payment).

- Serial number (thanks to this, you can find out what kind of transaction we are talking about if several similar purchases were made).

- Date (the second criterion by which a specific transaction can be determined).

- Description of the subject of the agreement (detailed).

- Description of the amount (perhaps in our case this is the most important point).

- Place for signature and seal (based on payment results, there must be signatures of responsible persons there).

*How to issue an invoice – sample

Why does the invoice look like this?

In order to fully understand all the nuances of how to correctly issue an invoice for payment, you need to understand why each of its elements looks the way it does and not otherwise.

This is not “brought down” to us from above - it is the result of the activities of the business itself, and business, logically, should not burden itself with unnecessary bureaucratic red tape.

In this form, as in the example, the invoice represents an offer - it is an acknowledgment that the parties have concluded an agreement and carried out the transaction.

This is an important nuance, since such paper actually replaces the contract after the conclusion of the transaction. More precisely, it complements it. For example, in the same court - even if you did not save the text of the agreement, the paid invoice is proof of the transaction and preserves all the obligations of the parties.

Speaking of obligations, the document must indicate all the important aspects of the transaction.

Thus, special attention is paid to the item - price (for 1 piece), cost (for the entire delivery) and the total quantity of goods must be indicated.

By issuing it, the supplier confirms the fact of sending the goods, and the buyer confirms the fact of sending the money. Equally important, the invoice records the period during which the offer is valid.

Another point that cannot be ignored: the invoice must contain an indication of the tax burden.

For example, VAT – value added tax – is almost mandatory for such transactions.

In other words, you can pay for the transaction in another way, but this is how the supplier’s details are recorded - knowing where the money goes is important from the point of view of financial security.

Another important point is that the text of the contract must indicate the method of payment - will it be a regular invoice or something else. This is also important from the point of view of mutual trust between the signatories of the agreement.

PS. Conclusion on the section - an invoice is not required, but it is highly advisable to issue one because this is the easiest way to insure yourself against the risks of falling for an unscrupulous business partner.

Registration and accounting details for correct invoicing

The first thing you need to understand in this context is that such a document is not an accounting document.

You cannot accept goods or services directly using this paper - it only confirms the fact of payment and the volume of goods.

For this reason, the account does not fall under Law No. 402-FZ “On Accounting” (https://www.consultant.ru/document/cons_doc_LAW_122855)

What does this tell us?

Firstly, if the format of the document is not regulated by law, then there is no need to comply with it to the fullest extent.

Secondly, there will be no sanctions from regulatory authorities for violations.

However, there is one remark here: the account is the result of the practical developments of the business. If it does not correspond to the generally accepted model, then it will not be paid for - do you need it?

Stage No. 1. What items should the invoice contain?

- The most important thing that such a document should contain is the supplier’s details.

The first thing that is indicated in this context is the name of the company indicating the form of ownership or full name.

Examples: LLC “Pisaka” for a legal entity, or “Individual entrepreneur Kurolapov Ivan Ivanovich” for an individual entrepreneur. Abbreviations in this column are not allowed.

The next point is to indicate the address of the company or individual entrepreneur.

You can specify both a legal and actual address. The legal entity indicates the INN and KPP, and the individual entrepreneur only the INN.

Based on this, the period during which the account will be valid will be determined.

These points are also very important in case of litigation.

Next comes the subject of the agreement - what exactly you are selling/buying.

The name of the service or product must be complete and accurate (as in other accompanying documents).

Only the most general abbreviations are allowed - “pieces”, “quantity”.

In the previous column or table, you must indicate the quantity, if the case requires it (not everything can be measured quantitatively).

The price for one unit of goods, as well as the total cost of delivery or service, is also indicated.

Below is the amount of VAT or other taxes, if necessary, and only then comes the total amount of the transaction.

Stage No. 2. We indicate information about the buyer and other nuances

An important point is that all Russian accounts must be denominated in rubles, even if the settlement itself was carried out in euros or dollars. This is already a requirement of accounting - if the account doesn’t care, then there are no other documents and tax reporting, this can give rise to problems with the Federal Tax Service and banks (after all, the bill still needs to be paid).

By the way, when transferring currency, only the official rate from the Bank of Russia at the time of drawing up the invoice is used (another reason why it is so important to indicate the date).

We previously wrote about the supplier of services and goods, but the invoice must also contain information about the buyer: company name/individual name in the same format as similar data on the supplier.

An important nuance is that the “payer” line may not indicate the same person or company that is already recorded as “Customer”. This means that almost anyone can pay the invoice, but the delivery will be made to the specified customer.

The registration of the invoice ends with a signature.

In the case of an individual entrepreneur, there must be only one signature - himself, but if we are talking about a legal entity, then the document must be endorsed twice - by the head/director of the company and the chief accountant.

By the way, you can authorize other people to sign such documents - for this you need to draw up a power of attorney, and be sure to indicate it when drawing up an invoice according to the following example: “Manager I.I. Petrov, by power of attorney No. 2 dated 02.16.17.”

The signature of a third party - the one who controls the transaction - is also optional.

At the end of the entire signing process, the legal entity affixes its seal to the invoice.

This is not required from individual entrepreneurs. It is also not required that signatures be handwritten - facsimile prints are allowed (but only if this is specified in the contract).

Stage No. 3. We transfer the invoice to the counterparty

Since the law does not regulate invoices, there are no strict requirements for how the invoice itself will be sent - it can be delivered in person, sent by fax or email.

The latter option is becoming increasingly popular.

In this case, you will actually be signing a copy, but according to the law, the copy is equal in legal force to the original document.

However, here the signature shifts the emphasis somewhat. If previously confirmation was the fact of a person’s signature, now it is not the fact of signature that is important, but the fact of receipt by email.

In other words, your signature becomes “electronic”: if you signed it, then you received it. Therefore, you entered your login and password for your email.

PS. It is the login-password pair that now confirms the authenticity of the signature.

Because of these nuances, many still demand the original invoice, because if something happens, you can claim that your email was hacked and you didn’t sign anything.

Do you have doubts about your business partner? Then it's better to play it safe.

The original or electronic invoice is valid for the period specified in your contract. The deadlines may also be indicated on the invoice itself.

*Example of invoice indicating deadlines.

You can extend the validity of an account only by mutual agreement if errors were found in it - for example, in the details. In other cases, the terms cannot be changed, since the account is precisely the means of recording mutual obligations.

Once again, briefly about what the invoice should be.

Detailed instructions in this video:

Let's summarize how to issue an invoice for payment

So, we found out: what kind of document this is, how to issue an invoice for payment

how its work is regulated by law, how modern technologies are used in this case, etc.

Now it’s up to you to decide whether to use accounts in your practice or focus on other ways of recording transactions and obligations on them.

Let us note, however, that it is not for nothing that this format has become the most popular - try it too, maybe you’ll like it?

Useful article? Don't miss new ones! Enter your email and receive new articles by email

Very often, relations between individual entrepreneurs and organizations are formalized by an invoice for payment. One of the parties issues an invoice to the client, he pays it, and then receives the paid goods or services. Today’s article is for those who do not know what an invoice is and how to issue it.

I would like to immediately note that issuing invoices and maintaining reports is very convenient in a special service.

Let's start with the fact that an invoice is a document that the seller issues to the buyer. The invoice contains the following basic information:

- Information about the seller - who issued the invoice;

- Information about the buyer - to whom this invoice was issued;

- List of goods or services, their quantity - what the buyer pays for;

- Prices for goods or services, total amount - how much the buyer must pay;

- Seller's bank account details - where the buyer should pay.

Essentially, the invoicing process goes like this:

- A potential client contacts the seller because he wants to purchase his goods/services;

- The seller, based on the client’s request, draws up an invoice for payment and sends it to the buyer;

- The buyer pays the specified amount to the bank account of the seller;

- The seller verifies receipt of payment and delivers goods/services to the buyer.

In what situations is an invoice issued?

Before the start of any cooperation, counterparties, as a rule, enter into agreements that stipulate payment terms, amounts and other terms of transactions.

In addition, our legislation does not require transactions without contracts. If the terms of the contract do not stipulate that the seller must issue an invoice for payment, there is no need to do this. In this case, the buyer must pay for the service or product only on the basis of an agreement.

But there are situations when you can’t do without an account. In the event that the terms of the contract do not specify the amount that the buyer must transfer, the seller must issue an invoice without fail.

This may be the case, for example, when paying for communication services: in contracts of this kind, the amount, as a rule, is not specified in advance. An invoice is issued when an organization carries out transactions subject to VAT, and in other cases established by law.

Such an invoice should be issued to the customer (or buyer):

- an organization exempt from VAT (Article 145 of the Tax Code of the Russian Federation);

- an organization that sells goods or services under an agency agreement on its own behalf, subject to the application of the general taxation system, clause 1 of Art. 169 Tax Code of the Russian Federation;

- an organization that has received an advance/partial payment towards the upcoming sale of goods from the customer (Article 168 of the Tax Code of the Russian Federation).

When should you issue an invoice?

Here are a few situations:

- There is a valid agreement between the counterparties, but it does not contain specific amounts of goods/services, their volume and delivery/performance dates. The agreement is concluded for a long period and contains general provisions for cooperation between the two parties. As needed for goods/services, the client sends a request to the seller, and the seller issues an invoice to him according to each specific request;

- There are no contractual relations between the parties, and the supply of goods or provision of services must be carried out as quickly as possible. In this situation, the seller issues an invoice for payment, and the contract is drawn up later.

- An invoice for payment is also issued in the case of a one-time supply or service, when there is no point in the parties signing an agreement.

Thus, an invoice for payment is a document that serves as the basis for the buyer to pay the seller in order to receive goods or services from him. Please note that we are talking about non-cash payment, so the seller must have a bank account.

The invoice for payment does not have a unified form; you can develop it yourself. The invoice must contain the following mandatory details:

- Name of the legal entity (if it is an organization) or individual entrepreneur;

- Seller’s TIN (for legal entities you must also indicate the checkpoint);

- Bank details, current account number, personal account number, correspondent account, bank name and BIC;

- List of goods/services;

- The total amount of the invoice, including VAT.

And there you can also fill in Excel format, screenshots of which we will provide below.

Pay special attention to the allocation of VAT in the invoice! If you are a legal entity or individual entrepreneur using the general regime, then the VAT rate must be specified in the invoice form and its amount must be highlighted. If you use the simplified tax system, then VAT is not allocated, the total amount is indicated in the invoice and the note “Without VAT” is added.

Example of creating an invoice without VAT:

Example of a VAT invoice:

The account, as we have already noted, can be developed independently. It can be done in Excel or Word and the created file can be used as a template. The invoice can be issued either on the seller's letterhead or without it. To automatically generate invoices for payment, you can also use accounting programs or electronic services.

The invoice must have a serial number. Their new numbering begins at the beginning of each year. You can simply number them in order (No. 1, 2, 3, 4...), or you can use special numbering, although it will still be sequential (No. TT/16-1, TT/16-2...).

In the invoice, you can specify additional conditions for the provision of services or delivery of goods, for example, the deadlines for their implementation.

The manager and chief accountant put their signatures on the account. If the invoice is issued by an individual entrepreneur, then only the individual entrepreneur must sign. It is advisable to put a stamp.

Next it is sent to the buyer for payment. The original invoice can be sent by mail or courier; to speed up the process, a copy of the invoice is sent to the buyer by email or fax. If the buyer agrees with the conditions specified in the invoice, then he pays it.

Issue an invoice for payment from an LLC - such a task can arise both for a novice specialist and for an experienced accountant. In our article we will look at what an invoice is and also look at a sample of it.

What is an invoice?

An invoice is a document on the basis of which a company or individual entrepreneur pays for goods, services, or work. The account can either be paid in advance or postpaid. An invoice is not a mandatory document for making payments between business entities.

The form for issuing an invoice for payment for an LLC is not regulated by law, nor is the procedure for issuing it. In this regard, sellers have the right to develop the form themselves and use their own template or issue invoices in free form.

Nevertheless, according to the rules of business turnover, almost every sale and purchase transaction is accompanied by an invoice. When issuing an invoice, the seller seems to remind the buyer: “I am expecting payment for such and such an amount for such and such an item.”

The particular importance of an invoice is that it can serve as an offer when no contract is concluded. In accordance with Art. 435 of the Civil Code of the Russian Federation, an invoice is an offer if it specifies the essential terms of the transaction. When the buyer pays the invoice, he thereby accepts it, i.e., agrees to the terms of the purchase. An invoice issued as an offer, after payment, will be a document that indicates the conclusion of a transaction between the seller and the buyer, even when an agreement was not concluded between them (clause 3 of Article 434 of the Civil Code of the Russian Federation).

Do I need an invoice and the manager’s signature on it for payment under the contract?

Necessity of account

The need to issue an invoice, as well as the requirements for its form, list of details and completion, are not established by current legislation.

In practice, an invoice is issued in such cases.

1.

An invoice replaces a contract. Usually these are purchases for a small amount up to 100,000, when there is no agreement signed by both parties. In this case, payment of the invoice is the institution’s acceptance (consent) to the terms of the transaction specified by the supplier in this invoice. After payment, the contract is considered to be concluded. This follows from paragraphs 1 and 3 of Article 434, Article 435, paragraph 3 of Article 438 of the Civil Code of the Russian Federation, letters of the Ministry of Economic Development of Russia dated November 30, 2015 No. D28I-3446, dated August 3, 2015 No. D28I-2300.

2.

Registration of an invoice is mandatory according to the terms of the agreement. For example, when special calculations are prescribed in it. In addition, the invoice is often issued in advance (for example, when the exact amount is not specified in the contract, only a percentage of the remuneration amount).

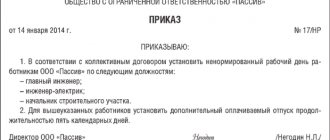

Thus, the invoice is not a mandatory document established by law. This position is also supported by the courts. For example, the Resolution of the Federal Antimonopoly Service of the Volga District dated November 7, 2013 in case No. A65-3808/2013 states that the obligation to issue an invoice is not spelled out in the laws and there is no unified form of the document, since the invoice is a custom of business transactions. Also, Russian legislation does not require invoices to be certified with handwritten signatures and seals.

Signature on the account (visa) and seal of the institution

A visa on the account of the manager (or other employee) and the seal of the institution are not needed - there are no such rules in the current legislation. They are placed only when provided for by the institution’s internal control rules. It is explained this way.

The institution's obligation to pay for the contract arises upon its conclusion and fulfillment by the supplier of obligations, and not at all on the invoice. But even if the invoice is specified in the contract as a mandatory document, the manager is not obliged to endorse it. Even without a visa, the manager confirms his consent to payment twice.

- the first time is when he signs a contract. That is, the signature of the manager who acts on behalf of the institution confirms the institution’s obligation to pay the contract on the terms specified in it (clause 1 of Article 160 of the Civil Code of the Russian Federation);

- the second time - when he signs a payment document for payment of the contract. After all, payment orders, applications for cash expenses and other documents are signed by the manager (with a written or electronic signature).

Thus, the endorsement of an account is not established by current legislation and does not affect the acceptance or fulfillment of obligations. Moreover, if the institution does not pay for the contract, citing the fact that the manager did not issue a visa, this threatens sanctions under the contract and civil law. That is, the institution is obliged to pay for the contract, regardless of the presence of a visa in the account of the manager or other employee.

But an institution can independently establish in the rules of its internal financial control that the manager (another employee) endorses the accounts. Let us recall that institutions are required to carry out such control in accordance with paragraph 6 of the Instruction, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n. In this case, the manager (responsible employee) must issue a visa after specific preliminary control measures, which are prescribed in the control regulations. For example, after reconciling the invoice with the terms of the contract and details.

Mandatory details of the form used for the invoice for payment

So, there is no unified form for the invoice form for payment. Also, such a document is not subject to the requirements of paragraph 2 of Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ on the content of mandatory details. In addition, the mere fact of issuing an invoice is not yet a financial event, since the invoice may be overbilled or not paid. However, in order for the buyer to be able to pay the invoice correctly, it must indicate:

- name and TIN of the supplier;

- supplier payment details;

- name and tax identification number of the buyer.

Without specifying these details, the buyer simply will not be able to make a payment.

The seller can also indicate additional details in the invoice. We'll talk about this later.

Invoice for payment - is it necessary or not?

No legislative document obliges the supplier to issue an invoice for payment. There is no unified form for it, and the order of its display is not regulated anywhere. An invoice is not a primary document, but there are times when an invoice is required to be drawn up, these are:

- if there is no agreement, the invoice after its payment is a document confirming the conclusion of a transaction between the two parties;

- if invoicing is specified in the contract;

- if this arises from the specifics of the concluded transaction, for example, communication services, payment for electricity, etc.

An invoice is a convenient reminder to the client that it is time to pay. An accountant, when paying an invoice, takes payment details from it, and not from the contract.

Additional account details. Invoice with or without VAT

Additionally, you can indicate in the invoice:

- Number and date - these details will help the seller not to get confused in the calculations and correctly identify the payment.

- The basis of payment is the name of the goods (works, services), quantity, price and value. The basis for payment is indicated so that the buyer, before paying, knows what he is paying for, how much of the product he is buying and at what price.

- VAT rate and amount. In accordance with paragraph 4 of Art. 168 of the Tax Code of the Russian Federation in settlement documents, the amount of VAT by taxpayers must be indicated on a separate line. Typically this information is located at the end of the tabular part of the invoice. Accordingly, VAT evaders or persons enjoying tax benefits indicate in their invoices: “Without VAT.”

- Seller's address and telephone number.

- Other details.

For convenience and attracting customers, the seller can indicate in the invoice his address, telephone number or other information (working hours of the delivery department, entrance diagram).

You can also specify the expiration date on the invoice. The timing is important especially for invoices issued in foreign currencies or dependent on their exchange rates. Often at the bottom of the invoice you will see: “Invoice is valid for 10 days.” This means that if the buyer pays the invoice after this time, the seller may refuse to supply the goods or provide the service (perform the work), because for some reason the price may have changed or there is no product left in stock.

Without the signature of the manager and accountant, as well as a seal, the invoice will be valid if the company policy provides for such an invoice form.

Invoice form

So, there is no unified account form, which means the organization independently develops it and consolidates it in its accounting policies. Most often, and this is the most convenient option, the form of the account is determined by the accounting program used by the organization or entrepreneur.

The invoice contains the following details:

- Date of preparation,

- Serial number,

- Payment details of the recipient of funds,

- Payer and buyer data,

- The number and date of the contract on the basis of which the invoice is issued is indicated.

- Positions and signatures of authorized persons.

- Name of goods, works, services,

- Quantity, unit of measurement, price and amount.

- Total amount to be paid.

- The amount of VAT is indicated separately or, if the goods, works, services are not subject to tax, it should be written “Without VAT” or “VAT not subject to tax.”

The invoice can be supplemented with any necessary information.

Is the account primary or not?

Many people argue and mistakenly claim that the invoice must contain the signature of the manager and the company’s seal, since the invoice is the primary document.

Let's figure out together whether the account is primary or not. With the adoption of the law “On amendments to certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business companies” dated 04/06/2015 No. 82-FZ, the seal ceased to be mandatory for use.

Many large companies do not make payments even under concluded contracts without receiving an invoice. The fact is that it is more convenient for the department responsible for payment under contracts and non-contractual deliveries to pay by invoice: the invoice always contains the seller’s valid payment details; The original invoice is attached to the payment application or stored together with payment orders.

That is, in fact, we recognize that an invoice is a primary document. But that's not true. For the supply of goods, services provided and work performed, a primary document is already issued - a delivery note, act, etc., which documents the validity of the transaction and the fact of execution of the contract, and therefore the emergence of an obligation to pay for the goods (works, services). Payment for a transaction can also be made on the basis of an invoice, deed or agreement.

Don't know your rights?

Purpose of the document

The document Invoice to the buyer is not primary and does not generate transactions. Despite this, this document is intended not only for preparing and generating a printed form of an invoice for payment: in the future, it allows you to significantly simplify document flow in 1C, as well as analyze the fulfillment of obligations by each party to the transaction.

Creating an Account for a buyer in 1C will help:

- track payment and shipment of goods;

- quickly and automatically process payment and shipment documents: Provision of production services ;

- Payment by payment card;

- Receipt to the current account;

- Cash receipt;

- Sales (deed, invoice);

- Check.

An invoice is a secondary document

So, the invoice is not a primary, but a secondary document, which serves rather to correctly fill out the seller’s payment details. In addition, each fact of the economic life of a legal entity or individual is documented as a primary document. And the invoice is not a recording of such a fact, but a reminder or desire of the seller to receive payment for his goods, work or service based on the fact of delivery.

An invoice can also play the role of a commercial offer to a potential client. Payment of the invoice in this case will serve as an agreement to this offer. If the buyer does not agree with the terms of the upcoming transaction, then he can simply ignore the invoice, and sending a letter of refusal in this case is not provided.

In addition, based on the invoice, neither party to the transaction makes any accounting entries.

Sample invoice for payment

A sample invoice without VAT for an LLC will be a little simpler than an invoice with a allocated VAT amount. Therefore, we will look at the VAT invoice.

From the point of view of compliance with document flow standards, filling out an invoice should not cause any particular difficulties after familiarizing yourself with our sample.

The first column of the tabular part of the invoice indicates the serial number of the product, work or service, and the second column indicates the name. It is better to give the name without abbreviations, in accordance with the delivery note or the certificate of completion of work. If payment is made under an agreement, then it is better to indicate in the name the name of the agreement or the number and date of the primary document if there is a post-payment.

The third and fourth columns indicate the units of measurement (pieces, sets, linear meters, etc.) and quantity.

The penultimate column contains the price, and the last column contains the total cost.

If errors were made when preparing the invoice or the price or quantity changed, it is better not to correct them, but to issue the invoice again.

An invoice for payment. Filling procedure. We create an account in 1s 8.3.

Analyzing the questions and problems of users of the 1C 8.3 program, we came to the conclusion that the topic of drawing up documents using the 1C program is quite popular and in demand. Therefore, our article is about how to issue one of the most common documents - an invoice in 1C 8.3. I hope you find it interesting and useful.

Let's start with the concept and meaning of counting.

This is a document that the seller issues to the buyer to pay for the last purchased goods or to transfer an advance (prepayment) against future deliveries. Thus, the invoice must necessarily indicate the seller’s payment details so that the buyer can transfer funds, namely:

- number and date; — name of the organization or individual entrepreneur; — INN/KPP; — bank details (bank name, BIC, correspondent account, company account number); — name of goods, (services), their quantity, cost, currency, unit of measurement; — amount to be paid and VAT amount.

Note! An invoice is not a primary document, because its issuance is not a business transaction, but only an offer from the seller to the buyer. In principle, if the parties enter into an agreement between themselves, then it is not necessary to issue an invoice.

When an account is needed.

But when there is no separate agreement, then when concluding a transaction, the invoice can act as an offer, which sets out all the main terms of the agreement. Payment by the buyer of the offer will be confirmation of acceptance of the terms of the contract.

What is an invoice agreement?

Increasingly, in business activities we encounter the concept of an invoice agreement, which, in fact, is an analogue of an offer. The invoice agreement confirms the fact of the transaction and the preliminary agreement on its implementation. In addition to the details required for the invoice, it specifies the terms of the agreement: validity period, terms of payment and delivery, responsibility of the parties, etc. The invoice agreement requires the signature of both parties, therefore it is drawn up in two copies. By the way, many companies issue invoice agreements in one copy with the seal and signature of only the supplier. True, in this case, the clause will be mandatory that if the customer pays, the invoice agreement is considered concluded and the customer agrees with all its terms.

Do I need to keep invoices?

Accountants have a lot of questions about storing accounts. The fact is that this is not stated anywhere in the legislative framework. An invoice is not a primary document, so there are no storage requirements for it. However, if this was a one-time payment and the invoice was indicated as the basis, especially if it was an advance payment and the primary documents have not yet been received, then in controversial situations the invoice will serve as the basis for resolving the problem between the supplier and the buyer. I would advise you to keep the document until all work under the contract under which it was tendered has been completed. As for the storage of invoice agreements, they must remain in the company’s archives for five years, in accordance with the general rules for storing accounting documents.

Creating an account in 1C 8.3.

Now let’s move on directly to generating an invoice for payment to customers in the program. Go to the “Purchases and Sales”

and select the item

“Customer Accounts”

.

Click the “Create”

We fill out the “header” of the open document.

- The invoice creation date is set by default, but if necessary, it can be adjusted.

- The "Organization" field is filled in automatically.

- You can select the “Counterparty” from the corresponding “Buyers” menu, or enter a new one if it is not in the database.

- The number of the agreement on the basis of which the invoice is inserted and the type of agreement are indicated - in this case the value will be “with the buyer”.

Using the “VAT...” link located on the right side of the header, you can adjust the type of prices and how VAT is included in the price.

Now let's start filling out the tabular part.

5. “Products and Services”

, button

“Add”

, then from the product group you need to select a product (service), enter the quantity of the product and the cost.

6. Save the completed document and use the “Submit” button.

This is what a printed invoice looks like...

The invoice is signed by authorized persons and issued to the buyer.

In this article, we showed how to correctly generate only one of many necessary documents in the 1C program. But in order to be sure that all business documents are reflected and entered into the program correctly, and to boldly solve current work situations, it is necessary to constantly improve. That's why I suggest you take the test

, which will show how well versed you are in the field of accounting, and if your knowledge is not enough, then the course

“Accounting and Taxation 2021 for Beginners + 1C8.3.

The workshop will definitely help correct these “gaps”.

Matasova Tatyana Valerievna expert on tax and accounting issues

Methods for filling out an invoice

The invoice can be printed on company letterhead.

There are several ways to fill out an invoice:

- Find the form on the Internet, print it out and fill it out by hand.

This method will look unpresentable if your buyer is a large company and you expect to continue mutually beneficial cooperation. However, this option occurs in hard-to-reach areas or with small volumes of trade with legal entities.

- Take the proposed sample of an invoice for payment from the LLC and then use it as a template, filling it out electronically. This option is acceptable when trade is of a unique nature and the accounting program cannot always be quickly adjusted to a specific type of business.

- Use an accounting or other accounting program, such as 1C.

It is very convenient when issuing an invoice using the program to “sew” a company logo or brand name into the invoice form. Or you can use the invoice as an element of advertising, adding the necessary information there.

The second and third methods are more convenient to use and will allow you to avoid errors when filling out.

You can send or transfer an invoice:

- through Russian Post;

- courier service;

- by fax;

- by email;

- using EDI (electronic document management).

As we understand, the last three methods will allow the buyer to receive an invoice faster, and therefore reduce the time required for approval and payment.

Invoice for payment from an individual entrepreneur or LLC

Today there is no form approving the type of account or suggesting its standard . It is not even considered an accounting document. An invoice is issued and issued for payment electronically or in paper form. Be sure to indicate the following:

- details of an individual entrepreneur or legal entity (identification code, name of the organization, its legal form and legal address);

- details of the servicing bank (name, address, current and correspondent accounts, BIC);

- codes (OKPO, OKONH).

Blank form and example of filling out an invoice for payment

After the individual entrepreneur has indicated his and the buyer’s details, the invoice number and the date of its formation are entered and the presence or absence of VAT is indicated. At the end of the individual entrepreneur’s document, you must indicate your last name, initials and sign. It is not necessary to put a stamp.

Most often, an invoice is created in a standard office program, Excel or Word: there you need to create a template into which data will be entered in the future.

It’s even better to use a special program that generates invoices. In addition, it will automatically keep records of all completed transactions, significantly simplifying accounting reporting. It will also allow you to track the payment of bills, eliminating the occurrence of errors, for example, transferring money to another account.

The following video shows issuing an invoice in the 1C 8.2 program:

Issuing an invoice to an individual

Why might you need to issue an invoice to an individual? Nowadays, individuals - non-entrepreneurs - are increasingly using non-cash forms of payment. Because it is not always possible, for example, to pay for a purchase on the website with a bank card. And through a special banking application you can pay your bill without coming to the seller’s office or store. In this case, the account will be no different from the usual account used by the company in its work.

If an individual acts as a seller of goods, works or services, then the buyer - a legal entity or individual entrepreneur - may require an invoice for payment. This situation is possible in cases where a company rents an apartment for its employees from an individual or, for example, buys a piece of furniture from a private craftsman. Most often, an agreement is drawn up with an individual, which specifies all the required details, including payment information. But if the buyer asks for an invoice, then you can also use our sample by inserting your details and buyer data.

In our article, we reviewed the mandatory and additional account details. The proposed sample will help the accountant in his work when preparing this document. Along the way, we talked about the account for an individual. And our thoughts about whether the invoice is a primary or secondary document dotted the i’s in the discussion of this document.