The main document when calculating the budget for VAT is the invoice. In accordance with Article 169 of the Tax Code, this document is the basis for the buyer to accept tax deduction on values purchased from the seller. According to the norms of Ch. 21 of the Tax Code of the Russian Federation, the absence of a signature on the invoice, its readable transcript, or signing by an unauthorized person does not serve as sufficient grounds to withdraw a tax deduction. This circumstance is considered in conjunction only with other factors.

However, the current Government Decree No. 1137 of December 26, 2011 (last amended on February 1, 2018) requires the correct completion of all issued invoices. According to tax audits, tax inspectors carefully study signatures on invoices and require confirmation of authority to sign documents. Moreover, the buyers themselves, according to the letter of the Federal Tax Service No. ШС-37-3/8664 dated 08/09/2010, do not have the right to request from the counterparty a document confirming the authority of the signatory and to compare the signature. But tax inspectors have such a right.

Product purchased from a retail store

As a rule, goods in retail stores are purchased by company employees, who are given cash from the cash register for this purpose on account.

In these cases, you risk losing your VAT deduction on your purchase, because the store itself may not be a VAT payer. And these are those who:

- switched to a simplified taxation system (clause 2 of Article 346.11 of the Tax Code of the Russian Federation);

- use their right to be exempt from VAT (Article 145 of the Tax Code of the Russian Federation).

If the company that owns the store is a VAT payer, the purchase amount includes VAT.

Signatures in the UPD

- In the form of an invoice, as part of the transfer document, space is provided for the signature of the head of the company (or a person authorized by him) or an entrepreneur with a transcript (full name), as well as the chief accountant or other authorized person.

- Line 10 provides space for the signature of the person who shipped (transferred) the goods (service, results of work, rights) indicating his position and full name.

- In line 13, signatures in the UPD are placed by persons who are authorized to draw up the UPD as a primary document on the part of the seller (contractor, performer).

- Line 15 provides space for the signature of the person who is responsible for receiving (accepting) goods, services, work results, rights.

- Line 18 provides space for the signature of the person responsible for the correct execution of the transaction on the part of the buyer, the customer.

What mandatory signatures should always be in the UPD? Should all signatures be in the UPD in the specified places? The answers to these questions can be found in the recommendations that the tax authorities provided in the appendices to Letter No. ММВ-20-3/96 dated October 21, 2021. This letter approved the official form of the universal transfer document and communicated the rules for filling out the UTD. Signatures according to these recommendations may not be filled out all and not always.

If there is no invoice

If for a purchase made in a retail store there is only a cash register receipt and no invoice, then VAT deduction cannot be applied on one cash receipt. Without an invoice, VAT deduction is not possible. The Ministry of Finance is adamant on this issue.

Without an invoice, a deduction is possible only when paying travel expenses for travel services to and from the place of business travel, as well as for the rental of residential premises. In this case, the basis for the deduction will be strict reporting forms issued for the posted worker, with the VAT amount highlighted as a separate line.

But the store will issue an invoice and delivery note if the company representative has a power of attorney to purchase goods.

How to format it correctly?

Sample order on the right to sign primary documents

Article 9 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ establishes that every fact of the economic life of an organization must be documented in a primary accounting document (agreement, invoice, invoice, cash order, act, etc.). At the same time, the Ministry of Finance of Russia, commenting on the provisions of this law in the Information dated 04.12.

In the current legislation there is no rule that imperatively establishes a method for vesting employees with such powers, therefore, in this matter, one should focus on the established customs of document flow, according to which the authority to sign can be transferred:

- by approving the relevant order;

- using a power of attorney to sign the primary document.

The principle of distinguishing between these two approaches is that the effect of the order applies only to the employees of the organization, while the power of attorney applies to any persons specified in the paper. The preparation of these documents is regulated by different sources of law - in the first case, this is the Labor Code of the Russian Federation, and in the second, the Civil Code.

The choice between two regulatory sources depends on the goals pursued by the manager: if it is assumed that it will be necessary to sign internal corporate documentation, then the optimal solution is to issue an order. If you plan to sign and transfer papers outside the company (for example, cover letters for the shipment of goods or invoices), then it is preferable to choose a power of attorney.

For security purposes and protection of trade secrets, many are afraid to transfer such serious powers to third parties who are not employees of the company, so the practice of orders is the most common. However, in cases where the manager intends to entrust an employee with a number of small tasks and is not ready to give him the right to sign in a global sense, then he can also issue a power of attorney for him.

We suggest you read: Re-register a child in another apartment

However, in both acts it is necessary to indicate:

- personal data of the authorized person;

- names of papers that it can sign.

Also, in both cases, the head of the company should certify a sample signature of the authorized person, which should be placed in a separate column of the form.

Any option is suitable, but it is necessary to specify which documents the employee can endorse. It happens that the accounting department issues a power of attorney to sign a delivery note one-time - to receive a specific batch of goods or products. Usually we are talking about granting powers to a person who performs such tasks occasionally.

The director must approve the list of persons authorized to sign primary documents by order.

https://www.youtube.com/watch?v=ytpressen-GB

Responsibility for the execution of a business transaction and the accuracy of the data lies with the person who endorsed the primary document, and not with the person who keeps the accounting records.

Terms of office also differ. Thus, a power of attorney is limited to the period specified in it. Local acts are valid until the employment relationship with the employee is terminated or until it is canceled or a new version is adopted. You can specify the duration of powers in the document itself, for example, set a one-year period. Often powers are assigned for the period of absence of an employee; the period in this case is determined by the period of replacement.

Agreement, invoice, delivery note, invoice are the most common official documents of primary accounting. The list is open: the administration can expand it by establishing other forms in the accounting policy.

The primary document first of all confirms the fact of a business transaction. And it also serves as the basis for recording transactions in accounts. Issued upon completion of the fact or after the completion of the transaction.

Requirements for a power of attorney

The buyer can use any form of power of attorney, but it must meet the requirements of the Civil Code of the Russian Federation (Articles 185–187 of the Civil Code of the Russian Federation). This:

- mandatory written form;

- presence of an issue date (without an issue date, the power of attorney is considered invalid);

- presence of the signature of the manager or the signature of another authorized person (who, in turn, must also have a power of attorney);

- who issued the power of attorney: full name of the legal entity (full name of the individual entrepreneur), TIN (OGRN);

- to whom the power of attorney was issued - full name, passport details;

- powers of the representative (functions that are assigned to him and the list of documents that he is authorized to sign);

- validity period of the power of attorney (if the validity period of the power of attorney is not specified, then by default it is considered issued for one year).

In addition, the power of attorney must contain the signatures of the principal and the person entrusted with receiving the goods.

Any power of attorney on behalf of the company, including one drawn up in any form, must be drawn up in writing (preferably on company letterhead) in compliance with these requirements.

The buyer must present the power of attorney to the seller before the goods are released. At the same time, he shows the original passport; the data in the power of attorney and in the passport must match. The original power of attorney remains with the supplier.

What to write in the order

Formulations are at the discretion of the administration. Typically, a sample order for the right to sign documents contains general phrases, and a power of attorney details the rights. If we are talking about the endorsement of contracts, representation of the interests of a budgetary organization in third-party institutions, government bodies, then it is advisable to issue a power of attorney. Counterparties always insist on confirmation of the representative’s authority, requiring a power of attorney.

We suggest you read: The difference between apartments and apartments

When approving personnel documents, no reference is made to the details, but when approving contracts, on the contrary, the date and number of the authorizing act are indicated.

Power of attorney in form M-2

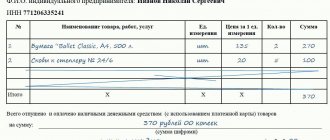

Of the unified forms, the power of attorney in form M-2 (approved by Resolution of the State Statistics Committee of the Russian Federation of October 30, 1997 No. 71a) fully meets the requirements of the Civil Code of the Russian Federation. This is a document on the basis of which an employee authorized by the organization receives goods and other material assets from the supplier, including in a retail store. In addition, it serves as an accounting document.

Form M-2 is issued for one-time receipt of goods. A separate power of attorney is issued for each supplier.

A company that issues such powers of attorney to its reporting employees maintains a special accounting journal. The power of attorney number is assigned in order, according to the journal.

Form M-2 consists of two parts: tear-off and main.

The detachable part of the form remains with the accountant. It states:

- number, date of preparation and validity period of the power of attorney;

- Full name and position of the employee to whom it was issued;

- name of the seller organization (supplier) where the power of attorney must be presented;

- number and date of the document confirming the execution of the order.

The main part of the form is handed over to the seller.

It states:

- name of the principal company, address, bank details;

- number, date of issue and validity period of the power of attorney;

- Full name, position and passport details of the employee who will receive the goods;

- the name of the selling company (supplier) and information about the document on the basis of which the goods are issued (agreement, invoice, application, etc.).

The form is signed by the employee who receives the goods and materials, the head of the trustor company and the chief accountant (a stamp is placed if available). Corrections in the power of attorney are not allowed.

Read in the berator “Practical Encyclopedia of an Accountant”

Receipt of inventory from suppliers

Sample order on the right to sign invoices

An invoice is proof of the completed shipment of goods or provision of services. The cost is also indicated. Registration is regulated by Article 169 of the Tax Code of the Russian Federation, which allows the following options for signing a paper version:

- manager and chief accountant;

- leader;

- by another person by order;

- person by proxy.

The electronic version is endorsed with an enhanced qualified electronic signature.

Certification of the document

A power of attorney issued by a legal entity is sometimes valid without notarization, but in some cases it is necessary. When re-trusting, the original deed must also be certified by a notary .

Entrepreneurs without the formation of a legal entity can also issue powers of attorney to a citizen or enterprise. At its core, a power of attorney from an individual entrepreneur differs little from the same act from organizations.

An entrepreneur must have his signature certified by a notary. Without a power of attorney, only the entrepreneur himself is free to act.

Power of attorney on behalf of the individual entrepreneur

All of the above also applies to individual entrepreneurs who, for some reason, do not have the opportunity to sign or receive accounting documents on their own, and delegate such powers to their employees. However, if for organizations a power of attorney is a document drawn up within the company, drawn up and signed by the head himself, then an individual entrepreneur can delegate his rights to interact with counterparties and controlling structures only on the basis of a notarized document. A power of attorney to sign accounting documents issued without such certification is not formally valid.

Is it necessary for the customer to sign the invoice?

Considering that the payer, in the situation described in the question, deducts VAT only after payment, the software will provide the opportunity in relation to the received ESHF to indicate a specific date for the right to deduction, i.e. the date on which payment for the purchased goods will be made.

When selling objects under commission agreements, the issuance of the ESCF to buyers is carried out by the commission agent on the basis of the data of the ESCF of the principal, which can be issued by the principal to the commission agent at the end of the reporting month based on the data of the commission agent's report for the specified month.

Is it necessary for the customer to sign the invoice?

No. VG-6-03/404, the opinion was expressed that in certain industries associated with continuous long-term supplies to the same buyer (for example, the provision of services for the transportation of electricity, oil, gas, the provision of telecommunication services, etc.), It is allowed to draw up invoices in accordance with the terms of the supply agreement concluded between the seller and the buyer of goods (services), acts of reconciliation of completed deliveries and issue invoices to customers simultaneously with payment and settlement documents, but not less than once a month and no later than 5 the day of the month following the previous month. But such accounts need to be registered in the month in which the first sales of received goods were made. Responsibility for failure to comply with deadlines The Tax Code of the Russian Federation does not indicate penalties for violating deadlines for issuing invoices.

We recommend reading: Preferential length of service according to List 1 is 3 years 6 months

Although the indication in the invoice of a date that violates the established deadlines for its issuance is not named in the list of reasons that make the deduction impossible (clause 2 of Article 169 of the Tax Code of the Russian Federation), and the courts adhere to the same position (Resolution of the Federal Antimonopoly Service of the Moscow District dated December 23, 2021 No. A40-142945/10-118-831), we recommend that, in order to avoid disputes, you always indicate the correct date on the invoice. On issues arising in connection with the application of Art. 169 of the Tax Code of the Russian Federation, read the article “Art.