Entrepreneurs using the simplified tax system do not pay VAT and do not indicate it in their documents. But sometimes large clients using the general taxation system come and ask for a VAT invoice. If they buy without VAT, they cannot claim the tax as a deduction and save.

On the contrary, it is not profitable for you to issue an invoice with VAT - you will have to pay this tax to the budget. But if you refuse a client, he will go to another supplier. Therefore, in large transactions, entrepreneurs using the simplified tax system sometimes make exceptions.

Let's figure out what to do if you have issued a VAT invoice: how to calculate and pay tax and what reporting to submit.

Responsibilities of a VAT payer

Under this phrase the provisions of Ch. 21 of the Tax Code of the Russian Federation imply a set of the following mandatory actions of the taxpayer.

| Responsibilities of a VAT payer | Decoding |

| Issue an invoice to the buyer in the form given in Appendix 1 to Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 | When selling goods (work, services), property rights, in addition to their price (tariff), the seller must present for payment to the buyer a certain amount of indirect tax (Article 168 of the Tax Code of the Russian Federation), which is calculated for each type of goods (work, services), property rights as a percentage of the prices (tariffs) agreed upon by the parties corresponding to the tax rate (clause 1 of Article 166 of the Tax Code of the Russian Federation) |

| Maintain invoice journals, sales and purchase books | The seller is obliged to register issued invoices in the sales book (and received ones in the purchase book) and the log of received and issued invoices (clauses 3 and 3.1 of Article 169 of the Tax Code of the Russian Federation) |

| Declaring VAT | The seller is obliged to submit VAT returns to the tax authority within the prescribed period (no later than the 25th day of the month following the expired quarter) in the manner prescribed by Art. 174 of the Tax Code of the Russian Federation: in electronic form via TKS channels |

When a “simplified” person is recognized as a VAT payer

In general, organizations or entrepreneurs using the simplified tax system are not recognized as VAT payers (clause 3 of article 346.11 of the Tax Code of the Russian Federation). This means that when carrying out transactions for the sale of goods (works, services), property rights, they should not present for payment to counterparties the corresponding amount of VAT reflected as a separate line in the invoice, maintain the above-mentioned tax registers, or declare this indirect tax.

At the same time, the Tax Code defines a number of situations when the “simplified” person is assigned the specified duties of a VAT payer, these are:

- import into the territory of the Russian Federation and other territories under its jurisdiction of goods not specified in Art. 150 Tax Code of the Russian Federation;

- carrying out transactions under a simple or investment partnership agreement, concession agreement or property trust management agreement as a participant in the partnership, concessionaire or trustee (Article 174.1 of the Tax Code of the Russian Federation);

- carrying out transactions in which he is recognized as a tax agent.

Invoice of an intermediary under the simplified tax system: an exceptional case

And yet, in some cases, buyers can safely claim a VAT deduction based on an invoice received from a “simplified” company. This applies to situations where the “special regime agent” is an intermediary (commission agent, agent) selling goods on his own behalf. Then the intermediary under the simplified tax system draws up an invoice based on legal norms, and the buyer should not have problems applying the deduction. This conclusion was made by the Ministry of Finance in a letter dated June 25, 2014 No. 03-07-RZ/30534.

This also applies to “simplers” who are participants in a simple partnership agreement or a trustee, since, due to the requirements of the Tax Code, they are required to issue an invoice (clause 2 of article 174.1, clause 2 of article 346.11 and clause 2.1 of art. 346.26 Tax Code of the Russian Federation).

Consequences of issuing a simplified invoice

In paragraph 3 of Art. 169 of the Tax Code of the Russian Federation directly states that only VAT payers are required to prepare invoices. Consequently, organizations and individual entrepreneurs using the simplified tax system should not create them when selling goods (works, services), property rights.

For your information

The “simplified” cannot take into account the amount of VAT paid in the tax base:

- nor as part of expenses (if the single tax is calculated from the difference between income and expenses), since according to paragraphs. 22 clause 1 art. 346.16 of the Tax Code of the Russian Federation, the amounts of VAT paid to the budget on the basis of clause 5 of Art. 173 of the Tax Code of the Russian Federation, are not subject to inclusion in expenses;

- neither as part of income, since according to paragraph 1 of Art. 248, paragraph 1, art. 346.15 of the Tax Code of the Russian Federation, when determining income, the amounts of taxes that are presented to the buyer are excluded from them.

At the same time, tax legislation does not formally prohibit a “simplified” person from issuing an invoice with the VAT amount highlighted on a separate line and presenting it to the buyer. This means that persons who are not payers of this tax, due to certain circumstances, have the right to independently decide whether to present the buyer of goods (works, services) with an indirect tax for payment or not. But they will have to answer for such “independence”.

Issuing invoices under the simplified tax system

At the same time, the Tax Code does not prohibit the issuance of invoices under the simplified tax system with VAT allocated in it. Moreover, the Code defines the consequences of issuing a simplified invoice.

Despite numerous explanations from regulatory authorities, the issuance of invoices indicating the amount of VAT by companies using the simplified tax system is not so rare. This is mainly done at the insistent request of buyers who ask the “simplified people” to send them VAT invoices in order to save on taxes. And this, in turn, leads to additional responsibilities for the “simplified” person and can create difficulties.

Use the online calculator to calculate VAT

Obligation to pay tax to the budget

Registration by a “simplified” invoice with an allocated tax by virtue of clause 5 of Art. 173 of the Tax Code of the Russian Federation entails the obligation to pay tax to the budget based on the results of the tax period, based on the corresponding sale of goods (work, services) for the expired tax period, no later than the 25th day of the month following this period (clause 4 of Article 174 of the Tax Code of the Russian Federation ) (see also letter of the Ministry of Finance of Russia dated 02/09/2018 No. 03-07-14/7897).

Thus, the basis for the emergence of an obligation to pay VAT is precisely the fact that the “simplified” person has issued an invoice with the allocated amount of tax. Accordingly, if an invoice is not issued, then this obligation does not arise for the “simplified” person even if there is VAT indicated as a separate line in the transaction agreement and payment documents for payment for it (see letters of the Ministry of Finance of Russia dated June 22, 2018 No. 03-07 -11/42820, dated 02/15/2018 No. 03-07-14/9470).

This means that neither the fact of payment of tax by the buyer, nor the method of settlements between counterparties, according to financiers, are of decisive importance for the emergence of such an obligation for simplified taxation system payers. By the way, the Federal Tax Service also allows for the possibility of a “simplified” person not issuing an invoice to the customer with VAT reflected in a separate line within the framework of a state (municipal) contract for the supply of goods (works, services), concluded in accordance with Law No. 44-FZ (see letter dated 08.11 .2016 No.SD-4-3/ [email protected] ). True, judges do not always support this approach.

Let us emphasize: if organizations and individual entrepreneurs using the simplified tax system do not pay the VAT presented in the invoice themselves, they will have to do this based on the results of a tax audit, and with penalties and fines. It is unlikely that the “simplified people” will be able to challenge the fiscal sanctions in this case (including in court) (see, for example, Resolution of the Supreme Court of the Russian Federation of September 4, 2017 No. F01-3550/2017 in case No. A11-12604/2015).

note

The emergence of an obligation for a “simplified” person to transfer VAT to the budget does not mean acquiring the status of a VAT payer, therefore he does not have the right to apply tax deductions. Clause 1 of Art. 171 of the Tax Code of the Russian Federation establishes that this right applies exclusively to VAT payers (and not to persons who paid the tax on their own initiative).

Consequently, even if all formal conditions are met (presence of primary documents and an invoice with the allocation of tax, acceptance of values for registration, separate accounting), the “simplified” cannot deduct the “input” tax. Otherwise, he faces additional tax and fines (see Resolution of the AS PO dated September 18, 2018 in case No. A72-14193/2017).

Duty to declare tax

In addition to the obligation to pay VAT to the budget, the “simplifiers” in the analyzed situation also have the obligation to declare this tax.

According to paragraph 5 of Art. 174 of the Tax Code of the Russian Federation, “simplified” persons are required to submit a VAT return to the Federal Tax Service no later than the 25th day of the month following the expired quarter in which the invoice was issued. Moreover, along with VAT payers, they are required to submit a declaration in electronic form through TKS channels.

The declaration must include (see clauses 3, 17, 34.3, 51 - 51.5 of the Procedure for filling out the declaration, letter of the Federal Tax Service of Russia dated September 15, 2016 No. ED-4-15/17338):

- title page;

- section 1, line 030 of which reflects the amount of tax payable to the budget for the tax period, based on all invoices issued for this period (the amount of VAT indicated in this line does not participate in the calculation of indicators on lines 040 and 050);

- section 12, which is filled out for each invoice issued by the “simplified” invoice with allocated VAT (that is, it contains as many sheets as invoices were presented to customers).

Let's summarize what has been said. If the seller (executor) issues an invoice to the buyer using the simplified tax system with the allocated amount of VAT, then he is obliged to:

- pay tax to the budget, without subsequently having the right to accept this amount as a deduction;

- declare tax electronically.

“Simplified” employees are not required to register issued invoices in the journal of issued and received invoices. This follows from clause 3.1 of Art. 169 of the Tax Code of the Russian Federation and the rules for maintaining this journal.

As we can see, there is no obvious benefit from issuing an invoice with a dedicated VAT for organizations and individual entrepreneurs using the simplified tax system. Rather, on the contrary: the consequences - paying tax to the budget and declaring it - are clearly negative for him. In addition, for failure to fulfill these duties, he may be held accountable on the basis of Art. 122 and 119 of the Tax Code of the Russian Federation.

Can a “simplified” issue an invoice with o?

As stated in paragraph 5 of Art. 168 Tax Code of the Russian Federation and paragraphs. “g” clause 2 of the Rules for filling out an invoice, persons released in accordance with Art. 145 of the Tax Code of the Russian Federation from the performance of duties as a VAT payer, invoices are drawn up without highlighting VAT: they make an appropriate inscription or put a stamp “Without tax (VAT)”.

Can a “simplified” person issue such an invoice? We believe not.

By virtue of paragraphs. 2 p. 2 art. 18 of the Tax Code of the Russian Federation The simplified tax system refers to special tax regimes, therefore, organizations and individual entrepreneurs that have switched to this special regime are not covered by the general system of VAT benefits established by Art. 145 Tax Code of the Russian Federation. Consequently, provided for in paragraph 5 of Art. 168 Tax Code of the Russian Federation and paragraphs. “g” clause 2 of the Rules for filling out an invoice, they cannot use the preference to issue an invoice indicating “Without tax (VAT)” (see, for example, Resolution of the AS VSO dated 04/12/2018 No. Ф02-1385/2018 on the case No. A19-13739/2017).

Can an individual entrepreneur issue invoices without VAT on USN?

Who may not issue an invoice? Depending on the taxation procedure chosen by the individual entrepreneur, payment of VAT may not be provided for; therefore, the question objectively arises about the need to issue invoices to those who are exempt from the “quitrent”. According to the Tax Code of the Russian Federation, tax is not paid:

- working in retail trade;

- employed in public catering;

- providing services for cash only;

- operating in the securities market and selling shares and bonds;

- selling goods to consumers who use preferential tax regimes.

Details are provided in Articles 168 and 169 of the Tax Code, which reflect nuances depending on the chosen taxation system. Under the special regime, tax is not paid, which is reflected in the reporting provided.

- home

- For individual entrepreneurs

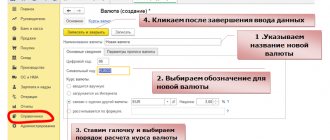

Companies that apply such a special tax regime as the simplified tax system are exempt from VAT and do not have to issue invoices. However, some simplifiers still have to do this, for example, when they work with counterparties who present such terms of cooperation. How to correctly issue an invoice under the simplified tax system with VAT and without VAT in 2021 will be discussed in detail in the article.

Invoice under the simplified tax system All organizations and individual entrepreneurs using the simplified system are not VAT payers, which means they do not need to issue an invoice. However, if certain situations arise, such a document will be needed. If you nevertheless decide to charge VAT, then here’s another piece of advice: in transactions where you are expected to receive an advance, do not issue an invoice for the advance, do it only after shipment. It is also better to discuss this situation in advance. Otherwise, you will have to report and pay VAT twice: first on the advance invoice, and then on the shipping invoice. The rule here is: you have issued a document with VAT, which means you have transferred the tax. As a result, you will pay the tax twice, since you will not be able to deduct VAT on the prepayment received, because you are not a VAT payer. And also, due to the fact that issuing a VAT invoice to a client is a non-standard situation before the simplification, it is recommended to store these documents for 4 years: the tax office may require them to present it during an audit. VAT Fourthly, the paper must be certified by the signature of the seller, and in the electronic form, also by the electronic signature. A sample of filling out an invoice is attached to this article. Is a zero provided? As mentioned earlier, when drawing up an individual entrepreneur or LLC on a simplified invoice, further preparation of a declaration and payment of VAT to the treasury is required. At the same time, many entrepreneurs are wondering whether it is possible to issue invoices on a voluntary basis, but not pay value added tax? It turned out that this situation is quite real. To do this, you just need to create and present a zero invoice to the buyer. A zero invoice is a document that requires the indication “Without VAT” in the column of the “Tax rate” table. It is important to remember that 0% should be entered in the table. Such a rate will still require the preparation of a declaration.

If the price of the agreement (contract) is formed taking into account VAT

As mentioned earlier, the authorities admit the possibility that “simplified” companies may not issue invoices for transactions whose price structure is formed taking into account the indirect tax. Meanwhile, the advantage of this position of officials is offset by additional risks for the “simplistic” people.

Firstly, the amount of indirect tax that is not shown as a separate line in the shipping documents can be recovered by the buyer from the “simplified” seller as unjust enrichment.

For example, AS CO, in Resolution No. F10-614/2016 dated March 31, 2016 in case No. A09-2920/2015, collected from the seller using the simplified tax system the amount of VAT that was not indicated as a separate line in the shipping documents. In this case, the seller took into account the entire payment received from the buyer as part of income, unilaterally reclassifying the amount of tax as part of the contract price. But such requalification is illegal (see also Resolution of the Supreme Court of the Russian Federation of August 29, 2018 No. F02-3658/2018, F02-3670/2018 in case No. A69-1555/2017).

Secondly, the customer can oblige (in court) the contractor applying the simplified tax system to issue an invoice with the allocated tax amount if the price of the government contract is formed taking into account VAT. After all, adjusting the terms of the contract (in particular, excluding VAT from its price) unilaterally contradicts the provisions of Law No. 44FZ.

Let us turn to the Resolution of the Third Arbitration Court of Appeal dated July 20, 2018 No. 03AP-2349/18 in case No. A74-17656/2017. The judges concluded that concluding a contract with a price based on VAT entails the supplier's obligation to issue an invoice with the tax amount allocated. The arbitrators emphasized: when concluding a contract on the terms that are provided for in the auction documentation and do not imply the right of the contractor to pay the contract price without VAT if he applies a special regime, the contractor of such a government contract must understand that he is obliged to determine the price taking into account VAT and pay it to the budget when implementing the specified in the goods contract.

VAT deduction under the simplified tax system

It is worth noting that if a company’s supplier uses the simplified tax system, it will be very difficult to obtain a VAT deduction. Regulatory authorities have long held this position: if an invoice is received from a “simplified” person, then it cannot be used for VAT reimbursement. Another similar conclusion was made in the letter of the Ministry of Finance dated October 5, 2015 No. 03-07-11/56700. The department came to such conclusions earlier in letters dated May 16, 2011 No. 03-07-11/126, Federal Tax Service of Russia for Moscow dated April 5, 2010 No. 16-15/035198 and others.