Quite often, tenants are faced with the need to equip their rented premises. This can be either a cosmetic renovation or a fairly serious redevelopment of the premises. Those. the tenant needs to make inseparable improvements to the leased property.

Improvements to the leased property that cannot be separated from it without causing harm are considered inseparable (clause 2 of Article 623 of the Civil Code of the Russian Federation). In this case, improvements are understood as capital works that increase (change) the quality characteristics of the rental property

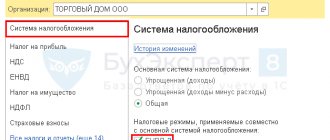

Accountants know that the specifics of accounting for financial investments in leased properties depend primarily on the conditions included in the lease agreement. The correctness of determining the tax base for income tax and VAT depends on these conditions.

But until now, accountants have not particularly bothered about property tax, believing that this tax is paid by the lessor, because he is the owner of the leased property. This, of course, is true, but only until the tenant has made inseparable improvements to the leased property.

The Federal Tax Service of Russia recalled this in its letter to the Federal Tax Service of Russia dated August 15, 2019 N AS-4-21/ [email protected] “On clarifications (recommendations) on the issues of determining the procedure for paying and submitting tax reporting on the property tax of organizations in relation to capital investments in in the form of inseparable improvements to the leased property.”

Transfer of Inseparable Improvements

In accordance with Article 623 of the Civil Code, all improvements to the leased property that can be separated from it are the property of the lessee. But if the improvements made cannot be separated without damage to the property, for example, renovation of the premises, then in the event of termination of the lease agreement, the tenant has the right to receive compensation for their cost. Both of these provisions apply unless otherwise provided in the lease agreement. From the foregoing, we can conclude that inseparable improvements to the leased property made by the tenant are the property of the lessor.

Let's consider a situation where the lease agreement stipulates that upon its expiration, the tenant transfers the property to the lessor under a transfer and acceptance certificate. This procedure for returning rental property is common practice. In this case, taking into account the above, the inseparable improvements made by the tenant, together with the property, must be transferred to the tenant under the acceptance certificate.

In accordance with paragraph 1 of Article 39 of the Tax Code, the transfer of inseparable improvements by the user of the property to its owner is recognized as a sale. Thus, this operation falls under VAT on the basis of paragraph 1 of Article 146 and paragraph 2 of Article 154 of the Tax Code. These conclusions are confirmed by judicial practice, for example, the resolution of the FAS of the Volga District dated June 26, 2012 in case No. A65-12909/2011, the resolution of the FAS of the Ural District dated July 1, 2010 No. F09-4941/10-S2 in case No. A07-20648/2009 .

Conclusion: if during the rental period the tenant made inseparable improvements to the property, for example, renovation of the premises, then, upon receiving these improvements, the owner of the premises is obliged to charge VAT on them.

Property tax on permanent improvements

Capital investments made by the lessee in the leased fixed assets (the cost of improvements to the leased property) are taken into account by the lessee as part of fixed assets until their disposal in accordance with the lease agreement.

If the tenant organization has made capital investments in a leased real estate property, the tax base of which is determined in accordance with Article 378.2 of the Tax Code of the Russian Federation , based on the cadastral value, then the tax base in relation to capital investments in the leased real estate object recorded on the balance sheet of the tenant is determined in accordance with paragraph 1 of Article 375 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of Russia dated September 3, 2014 No. 03-05-05-01/44118). According to the Ministry of Finance of the Russian Federation, all capital investments of a tenant in a rented building are taxed at the average annual cost .

The question of whether capital investments in leased premises are movable or immovable property for property tax purposes must be decided on a case-by-case basis, taking into account the actual circumstances.

As a general rule, the classification of a particular capital investment as real estate depends on whether the rights to this object are subject to state registration in accordance with Article 131 of the Civil Code of the Russian Federation and the Federal Law of July 21, 1997 No. 122-FZ “On State Registration of Rights to Real Estate and transactions with him."

In Letters dated 04/11/2013 No. 03-05-05-01/11960, dated 02/25/2013 No. 03-05-05-01/5322, the Russian Ministry of Finance noted that when considering the issue of classifying objects as movable and immovable property, it is necessary to take into account the provisions of the Federal Law of December 30, 2009 No. 384-FZ “Technical Regulations on the Safety of Buildings and Structures”, as well as OKOF.

According to representatives of the Ministry of Finance of the Russian Federation, capital investments made by a tenant in a leased property, accepted by the tenant for registration as fixed assets on January 1, 2013, are not movable property and are subject to taxation until their disposal.

The Federal Tax Service of Russia in Letter dated March 28, 2018 No. BS-4-21/ [email protected] recommends using the explanations given in Letter of the Ministry of Industry and Trade of Russia dated March 23, 2018 No. OV-17590-12. It states, in particular, that the Ministry of Industry and Trade of Russia, as the federal executive body responsible for the implementation of industrial policy, considers the classification of equipment, machinery and other fixed assets of industrial production as real estate unjustified .

Inseparable improvements are accounted for as separate inventory items of movable property (for example, fire and security alarms, etc.) if:

- capital investments in a leased property can be used outside this property,

- dismantling of inseparable improvements does not cause disproportionate damage to the purpose of the object and (or) their functional purpose is not an integral part of the functioning of the object.

Want to know more?

Contact the professionals

Read more

Redemption of rental property

But what about VAT in a situation where, during the period of validity of the lease agreement, the parties entered into a purchase and sale agreement, and the former tenant became the owner of the property? In this case, on the basis of Articles 425 and 450 of the Civil Code of the Russian Federation, the lease agreement is not considered terminated - there was only a termination of obligations under it by novation. In this case, the original obligation that existed between the parties is replaced by another obligation (Article 414 of the Civil Code of the Russian Federation). In the case under consideration, lease obligations were replaced by obligations under a purchase and sale agreement.

Since the property that was rented became the property of the tenant, it was not transferred back to the lessor under the acceptance certificate. Accordingly, inseparable improvements that were carried out by the former tenant were not transferred. And since they were not transmitted, then their implementation did not take place.

This point of view is confirmed in judicial practice. Thus, in the ruling of the Supreme Arbitration Court of the Russian Federation dated December 9, 2010 No. VAS-14603/10, which was issued in a similar case, the court indicated the following. Once the premises in which an inseparable improvement was carried out became the property of the former tenant under a purchase and sale agreement, then the fact of the implementation of these inseparable improvements, which is subject to VAT, is absent. As a result, the court declared the inspectorate’s decision on the need to levy VAT on this transaction invalid.

In addition, there is a resolution of the Plenum of the Supreme Arbitration Court No. 33 of May 30, 2014, paragraph 26 of which states the following. If capital investments (in our case, inseparable improvements) were not compensated to the tenant and were not made against the rent, the tenant can deduct the tax amounts presented to him on these costs. In this situation, he acts as a person who acquired goods, works or services in the course of his activities.

Thus, for the purposes of VAT, it should be considered that the tenant’s compensated costs for inseparable improvements to the property are transferred to the lessor along with this property, and uncompensated costs and those not made as part of the rent are not subject to transfer to the lessor.

Summary

The tax authority writes that these clarifications (recommendations) are of a purely informational and explanatory nature, do not contain generally binding legal norms, do not specify regulatory requirements and do not prevent one from being guided by legal norms in an understanding that differs from the interpretation set out in these clarifications (recommendations).

But it goes on to say that;

- these clarifications (recommendations) were agreed upon by the Department of Tax and Customs Policy of the Ministry of Finance of Russia (letter dated August 14, 2019 N 03-05-04-01/61497).

- The Federal Tax Service of Russia for the constituent entities of the Russian Federation is instructed to promptly bring this information to employees of tax authorities who administer the taxation of property of organizations (including the acceptance of tax reporting and its verification) and work with taxpayers, in order to be able to apply the specified clarifications (recommendations) from the moment of publication of this letter.

Conclusion

Since the purchase of the leased property took place during the validity period of the lease agreement, we come to the conclusion that the uncompensated inseparable improvements were not transferred to the lessor. That is, in accordance with Article 39 of the Tax Code of the Russian Federation, there was no sale, and accordingly there is no object of VAT taxation.

Taking into account the above provisions of the law and judicial practice, we can draw the following conclusion. If the property was purchased by the tenant during the validity period of the lease agreement, then VAT should not be charged on inseparable improvements made by him earlier, but not transferred to the lessor.

Main conclusions

- About the object of taxation

According to paragraph 1 of Article 374 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), objects of taxation for Russian organizations are real estate that is taken into account on the balance sheet as fixed assets in the manner established for accounting, unless otherwise provided by Articles 378, 378.1 and 378.2 of the Code.

Inseparable capital investments in a leased property are an integral part of this property. Consequently, inseparable capital investments accounted for by a Russian tenant organization as fixed assets are subject to taxation by virtue of paragraph 1 of Article 374 of the Code until they are removed from the tenant’s fixed assets.

- On payment of tax in relation to inseparable capital investments located outside the location of the tenant or its separate division

In accordance with Article 385 of the Code, an organization that takes into account on its balance sheet real estate objects located outside the location of the organization or its separate division that has a separate balance sheet, pays tax (advance tax payments) to the budget at the location of each of these real estate objects in an amount determined as the product of the tax rate in force in the territory of the corresponding constituent entity of the Russian Federation on which these real estate objects are located, and the tax base (one fourth of the average value of the property), determined for the tax (reporting) period in accordance with Article 376 of the Code, in relation to each object real estate, taking into account the features established by Article 378.2 of the Code.

Consequently, the amount of tax calculated in relation to inseparable capital investments located outside the location of the tenant or its separate division is subject to payment to the budget according to the OKTMO code corresponding to the territory of the municipality at the location of the leased property with inseparable capital investments.

- About submission of tax reporting on tax

Article 386 of the Code defines the following places for taxpayers to submit tax reporting on taxes (tax calculations for advance tax payments and tax returns, hereinafter referred to as tax reporting):

- to the tax authority at the location of the real estate objects and (or) at the location of the property included in the Unified Gas Supply System (paragraph one of paragraph 1 of Article 386 of the Code);

- to the tax authority at the location of the Russian organization (the place of registration with the tax authorities of the permanent representative office of the foreign organization) - in relation to property located in the territorial sea of the Russian Federation, on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and (or) beyond outside the territory of the Russian Federation (for Russian organizations) (paragraph two of paragraph 1 of Article 386 of the Code);

- to the tax authority at the place of registration as the largest taxpayers - for taxpayers classified in accordance with Article 83 of the Code as the largest (paragraph three of paragraph 1 of Article 386 of the Code).

To submit tax reporting at the location of real estate with inseparable capital investments, it is necessary to understand that the fact of lease is not an independent basis for registration with the tax authorities at the location of the leased property.

Thus, tax reporting can be submitted to the tax authority at the place of registration of inseparable capital investments on the balance sheet, that is, at the location (recording) of the tenant or at the location (recording) of its separate division, which has a separate balance sheet, if inseparable capital investments are taken into account on balance sheet as fixed assets of this separate division.

This letter also defines the procedure for filling out a property tax return in relation to inseparable capital investments.

The letter also contains a detailed description of the procedure for filling out tax reporting lines in relation to inseparable capital investments in a leased property.

Inseparable improvements and property tax from 2021

Whether or not to pay property tax on permanent improvements to rental property in 2021 depends on the property in which the capital investment was made.

If this is real estate, then the tax must continue to be paid. This also applies to objects taxed at cadastral value. An exception is property in respect of which any preferences are provided. They also apply to its improvements.

If capital investments are made in movable property, there is no need to pay tax on them.

This was indicated by the Ministry of Finance in letter dated 01/09/2019 No. 03-05-05-01/52.

Inseparable improvements to leased real estate: recommendations of the Federal Tax Service

If your capital investments are subject to taxation, follow these recommendations from the Federal Tax Service (letter dated August 15, 2019 No. AS-4-21/ [email protected] ).

- Pay tax before the permanent improvements are disposed of from your fixed assets (for example, before a capital investment lease is returned to the lessor).

- Submit the declaration to the location of your organization, and if capital investments are taken into account on the balance sheet of the unit, to the OP inspection. There is no need to register with the inspectorate at the location of the property with capital investments, because it is rented.

- But the tax needs to be transferred to where the object is located. That is, in the payment slip you must indicate OKTMO of the municipality where the leased property with inseparable capital investments is located. It must be included in the declaration.

Inseparable improvements: how to fill out section 2.1 of the property tax return

When filling out section 2.1 on permanent improvements to leased real estate, please indicate:

On line 010 - code number of the property:

- 3 - if the property has an inventory number and is assigned an address indicating the municipality;

- 4 - if there is an inventory number, but the address indicating the municipality has not been assigned.

On line 020 - inventory number of inseparable capital investments;

On line 030 - the address of the rented property, if it includes an indication of the municipality (to be filled in only if line 010 contains code 3).

On line 040 - code of the leased property in accordance with the All-Russian Classifier of Fixed Assets.

On line 050 - the residual value of inseparable capital investments as of December 31 of the tax period.

How to differentiate between movable and immovable property, see here.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.